Global Yacht Market Size, Share, Trends & Growth Forecast Report By Type (Super Yacht, Sport Yacht, Flybridge Yacht, Long Range Yacht), Length (Up To 20 M, 20 To 50 M, Above 50 M), Propulsion (Motor Sailing), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Yacht Market Size

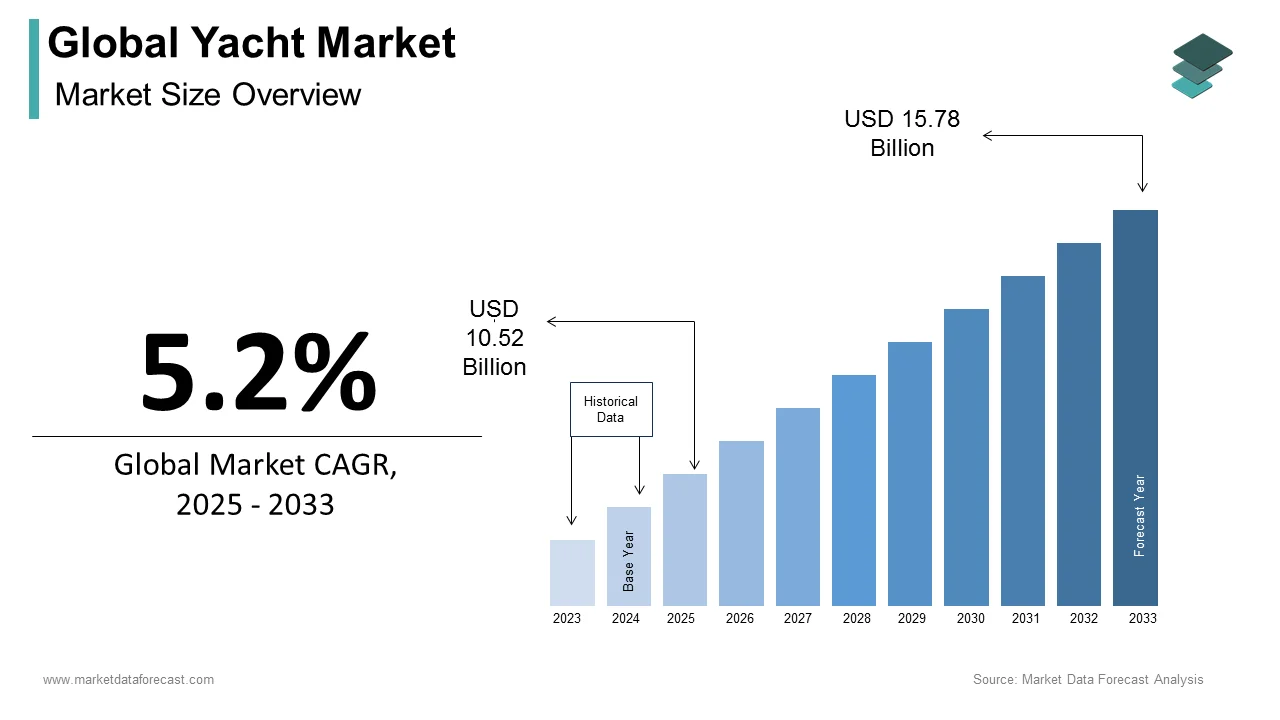

The size of the global yacht market was worth USD 10 billion in 2024. The global market is anticipated to grow at a CAGR of 5.2% from 2025 to 2033 and be worth USD 15.78 billion by 2033 from USD 10.52 billion in 2025.

The yacht is a fascinating intersection of engineering excellence, design innovation, and aspirational living. Yachts range from compact recreational vessels to extravagant superyachts that serve as both functional watercraft and symbols of personal achievement by offering unparalleled opportunities for exploration, entertainment, and relaxation. As of 2023, the allure of yachting has transcended traditional boundaries by attracting a diverse clientele that includes not only seasoned sailors but also first-time buyers seeking unique experiences on the water.

One notable aspect of the yacht ecosystem is the sheer scale of its operational footprint. For instance, the average length of superyachts delivered in recent years exceeds 50 meters, with some flagship models surpassing 100 meters, as reported by Boat International. These vessels often require specialized marinas and docking facilities, leading to the development of over 4,000 marinas globally, according to the International Council of Marine Industry Associations. Furthermore, the environmental impact of yachting has become a focal point, with studies indicating that approximately 2.5 million recreational boats are registered in the United States alone, as per the National Marine Manufacturers Association.

The global boating industry, including yacht manufacturing and maintenance, employs more than 600,000 people worldwide, highlighting its socioeconomic significance. Additionally, technological advancements have made yachts increasingly sophisticated; it is estimated that modern superyachts can incorporate up to 50 kilometers of wiring to support their state-of-the-art navigation, entertainment, and safety systems. These elements collectively paint a vivid picture of the yacht market's intricate and multifaceted nature.

MARKET DRIVERS

Technological Advancements in Yacht Design and Functionality

Innovations in yacht technology have revolutionized the industry by making yachts more efficient, luxurious, and environmentally friendly, thereby attracting a broader clientele. The International Maritime Organization reports that over 60% of newly constructed yachts now incorporate hybrid propulsion systems which reduce fuel consumption and carbon emissions by up to 30%. Additionally, advancements in materials science, such as the use of lightweight composites, have enhanced vessel performance and durability. According to the National Oceanic and Atmospheric Administration, these innovations align with increasing regulatory pressures to minimize the ecological footprint of maritime activities. Furthermore, smart technologies, including automated navigation and integrated entertainment systems have transformed the onboard experience. A study by the European Patent Office reveals that patent filings related to marine technology surged by 25% between 2018 and 2022. These advancements cater to tech-savvy buyers seeking cutting-edge solutions.

Rising Wealth Among High-Net-Worth Individuals

The yacht market is significantly propelled by the growing number of high-net-worth individuals (HNWIs), whose financial capacity enables them to invest in luxury assets like yachts. According to the World Ultra Wealth Report published by Wealth-X, the global population of UHNWIs those with a net worth exceeding $30 million has reached approximately 295,000 in 2022 by marking a steady increase over the past decade. This demographic often views yachts as both status symbols and lifestyle enhancers which is driving demand for custom-built and high-end vessels. Furthermore, the U.S. Department of Commerce highlights that personal consumption expenditures on recreational goods and vehicles, including yachts, have risen by 15% annually in recent years among affluent households. The concentration of wealth in regions such as North America and Europe has particularly bolstered yacht sales, while emerging markets like China and India are also contributing to this trend as their affluent populations expand.

MARKET RESTRAINTS

Stringent Environmental Regulations and Compliance Costs

The yacht market faces significant challenges due to increasingly stringent environmental regulations aimed at reducing maritime emissions and pollution. The International Maritime Organization (IMO) has mandated a global sulfur cap of 0.5% on marine fuels since 2020, compelling yacht manufacturers and owners to adopt cleaner technologies. According to the U.S. Environmental Protection Agency, non-compliance with these regulations can result in fines exceeding $100,000 per incident, creating financial burdens for yacht operators. Additionally, retrofitting older yachts with emission-reducing systems or switching to sustainable fuels can cost upwards of $500,000 per vessel, as reported by the National Oceanic and Atmospheric Administration. These costs deter potential buyers and increase operational expenses, particularly for smaller operators. As regulatory scrutiny intensifies, the industry must balance luxury with sustainability which poses a significant restraint on market growth.

High Maintenance and Operational Costs

The exorbitant costs associated with maintaining and operating yachts act as a major deterrent for prospective buyers and charter companies. The U.S. Department of Commerce estimates that annual maintenance expenses for a mid-sized yacht can range from 10% to 15% of its purchase price which translates to hundreds of thousands of dollars annually. Furthermore, crew salaries, docking fees, and insurance premiums add to the financial burden. For instance, the average annual cost of berthing a superyacht in prime locations like Monaco or Miami exceeds $100,000, according to the Federal Maritime Commission. These high recurring costs make yacht ownership less appealing, especially during economic downturns when discretionary spending declines. As a result, many affluent individuals opt for alternative luxury investments by limiting the expansion of the yacht market despite growing wealth among high-net-worth individuals.

MARKET OPPORTUNITIES

Growing Demand for Sustainable and Eco-Friendly Yachts

The yacht market is poised to benefit from the increasing global emphasis on sustainability, as affluent consumers seek environmentally responsible luxury options. The International Energy Agency highlights that investments in green technologies have surged by over 25% annually since 2020 with hybrid and electric propulsion systems gaining traction in the maritime sector. According to the U.S. Department of Energy, yachts equipped with solar panels and energy-efficient systems can reduce fuel consumption by up to 40% by appealing to eco-conscious buyers. Additionally, the European Environment Agency reports that ports across Europe are incentivizing sustainable practices by offering discounts on docking fees for low-emission vessels. These trends create a lucrative opportunity for manufacturers to innovate and cater to this niche yet expanding market segment.

Expansion of Yacht Tourism and Emerging Markets

The rise of yacht tourism presents a significant opportunity for the yacht market, particularly in emerging economies with untapped coastal potential. The United Nations World Tourism Organization states that marine tourism contributes over $100 billion annually to the global economy, with yacht charters accounting for a growing share of this revenue. Regions like Southeast Asia and the Caribbean are witnessing increased infrastructure development, with governments investing in marinas and coastal facilities to support yacht tourism. For instance, India’s Ministry of Tourism has allocated over $50 million to develop yacht-friendly infrastructure along its coastline, aiming to attract international visitors. Furthermore, the Australian Trade Commission reports that yacht tourism in the Asia-Pacific region is projected to grow by 8% annually through 2025. This expansion into emerging markets not only diversifies the industry’s geographic reach but also opens new revenue streams for manufacturers and service providers.

MARKET CHALLENGES

Economic Volatility and Its Impact on Luxury Spending

The yacht market is highly sensitive to economic fluctuations, as luxury purchases are often the first to be deferred during periods of financial uncertainty. The International Monetary Fund (IMF) has reported that global economic growth slowed to 3.4% in 2022, with projections indicating further deceleration in key markets such as Europe and North America. This economic instability directly affects high-net-worth individuals' discretionary spending, as noted by the U.S. Department of Commerce, which found that luxury goods sales, including yachts, declined by 12% during economic downturns in the past decade. Additionally, rising interest rates have increased financing costs for yacht purchases, with the Federal Reserve reporting an average increase of 2.5 percentage points in loan rates since 2021. These factors create a challenging environment for the yacht industry, as potential buyers delay or reconsider investments in high-value assets.

Limited Infrastructure in Key Regions

A significant challenge for the yacht market is the lack of adequate infrastructure in many regions, hindering accessibility and operational efficiency. The United Nations Conference on Trade and Development (UNCTAD) highlights that only 30% of global coastlines are equipped with marinas and docking facilities capable of accommodating large yachts. Similarly, the U.S. Maritime Administration notes that aging port infrastructure in parts of Asia and South America requires over $10 billion in upgrades to support modern yachts. This gap in infrastructure not only restricts market expansion but also increases operational costs for yacht owners, who must travel longer distances to access suitable facilities, thereby dampening demand in underserved regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Length, Propulsion, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Alexander Marine International (AMI) Co., Ltd., Azimut Benetti Group, Damen Shipyards Group, Feadship, Ferretti SpA, Flensburger Schiffbau Gesellschaft GmbH (FSG), Heesen Group, Princess Yachts Limited, Sanlorenzo SpA, Sunseeker International, Viking Yacht Company, WANDA Group, and Others. |

SEGMENT ANALYSIS

By Type Insights

The super yachts segment dominated the market by holding 35.4% of the global market share in 2024. The dominance of super yachts segment is attributed to their appeal among ultra-high-net-worth individuals who prioritize exclusivity, customization, and cutting-edge technology. According to the U.S. Department of Commerce, super yachts, typically exceeding 24 meters in length, contribute significantly to the luxury maritime sector with annual sales surpassing $8 billion globally. Their importance lies in setting benchmarks for innovation, design, and onboard amenities such as advanced navigation systems and entertainment suites. The segment's ability to cater to affluent buyers seeking both status symbols and functional luxury cements its leadership position in the yacht market.

The long-range yacht segment is attributed to grow with a significant CAGR of 6.2% from 2025 to 2033. The shifting consumer preferences toward self-sufficiency, extended voyages, and eco-friendly designs is majorly driving the expansion of the long-range yacht segment in the global market. The European Maritime Safety Agency (EMSA) highlights that advancements in hybrid propulsion systems and energy-efficient technologies have reduced fuel consumption by up to 25% by making long-range yachts more appealing to environmentally conscious buyers. Furthermore, the Australian Trade Commission notes a 15% increase in demand for expedition-style yachts since 2020 by reflecting a growing appetite for adventure and remote exploration. This segment's alignment with sustainability and versatility underscores its critical role in shaping the future of the yacht market.

By Length Insights

The yachts up to 20 meters segment held the dominant share of 65.6% of the global market share in 2024. The domination of up to 20M segment is attributed to its affordability and versatility, appealing to recreational users and first-time buyers. These yachts are ideal for coastal cruising and day trips, making them accessible to a broader audience. According to the National Marine Manufacturers Association (NMMA), smaller vessels, including those under 20 meters, represent the majority of new yacht purchases due to their lower maintenance costs and operational simplicity. Their importance lies in driving industry volume, as this segment sustains demand for smaller marinas and service providers by ensuring steady revenue streams.

The yachts above 50 meters segment is emerging and is likely to witness a CAGR of 7.8% over the forecast period owing to the increasing wealth among ultra-high-net-worth individuals, who prioritize customization and luxury. The Australian Trade Commission notes that superyacht orders exceeded 150 units annually in recent years which is driven by demand for advanced technologies like hybrid propulsion systems. Additionally, emerging markets such as the Middle East and Asia-Pacific are investing heavily in superyacht infrastructure that further boosts the market growth. This segment’s importance lies in its high profitability, as these yachts often cost tens of millions of dollars which is significantly contributing to the industry's revenue and technological innovation.

By Propulsion Insights

The motor yachts segment had 70.9% of the global market share in 2024. The superior speed, ease of operation, and luxurious amenities of motor yachts is making them ideal for both leisure and long-distance cruising are driving the growth of the motor yachts segment in the global market. The National Marine Manufacturers Association notes that motorized vessels contribute significantly to the $47 billion annual economic impact of the U.S. recreational boating industry with motor yachts being a key driver. The U.S. Department of Commerce highlights that motorized vessels represent over 60% of new boat sales revenue is reflecting their widespread appeal. Advancements in engine technology, such as fuel-efficient turbocharged motors which have further enhanced their attractiveness. This segment's leadership is also driven by its adaptability to various sizes by catering to diverse consumer preferences.

The sailing yachts segment is anticipated to witness a CAGR of 6.8% over the forecast period owing to the increasing demand for eco-friendly and energy-efficient vessels, as sailing yachts rely on wind power, reducing reliance on fossil fuels. The National Oceanic and Atmospheric Administration notes that over 40% of new sailing yacht buyers cite sustainability as a key purchasing factor. Additionally, governments like Australia’s Trade Commission are promoting sailing tourism with a 20% increase in coastal tourism revenue linked to sailing activities. The segment’s emphasis on environmental responsibility and experiential travel aligns with evolving consumer values by driving its rapid expansion.

REGIONAL ANALYSIS

Europe dominated the yacht market globally with 40.7% of the global market share in 2024. This leadership stems from its extensive coastline, well-developed infrastructure, and a strong maritime culture. The Mediterranean region alone contributes significantly to the yacht industry with the European Commission estimating that yacht-related tourism generates over €6 billion annually. Countries like Italy, France, and the Netherlands are renowned for their premium yacht manufacturing and tourism. Europe's dominance is further supported by government initiatives, such as the EU’s Blue Economy Strategy which promotes sustainable maritime activities. With over 4,500 marinas, Europe offers unparalleled accessibility by solidifying its position as the hub of the global yacht market.

The Asia-Pacific region is likely to reach the highest growth rate with a compound annual growth rate (CAGR) of 7.2% during the forecast period. This growth is driven by rising wealth among high-net-worth individuals, particularly in China and India, where the luxury goods market is expanding rapidly. The Australian Trade Commission highlights that yacht tourism in Southeast Asia has grown with the increasing investments in coastal infrastructure. Governments like Thailand and Indonesia are promoting marine tourism with docking fees reduced by up to 30% for eco-friendly vessels. The region’s focus on sustainability and untapped coastal potential positions it as a key driver of future yacht market expansion.

North America remains a cornerstone of the yacht market which is driven by the United States' robust recreational boating culture. The U.S. Department of Commerce estimates that the yacht industry contributes over $40 billion annually to the economy with Florida alone accounting for 20% of global yacht sales. Rising disposable incomes and a well-established marina infrastructure support steady growth.

In Latin America, Brazil is emerging as a key player, with its luxury yacht market growing at 5% annually, according to the Brazilian Maritime Authority. Coastal tourism initiatives in Mexico and the Caribbean are also boosting demand for charter yachts.

The Middle East is rapidly establishing itself as a luxury yacht hub, with Dubai investing heavily in superyacht marinas and maritime tourism. The UAE Ministry of Economy projects a 10% annual increase in yacht-related tourism by 2025, supported by tax incentives and world-class facilities. Meanwhile, Africa's yacht market is nascent but promising. South Africa leads the region, with its maritime sector projected to grow by 6% annually, driven by government investments in coastal infrastructure and marine tourism. These regions collectively represent untapped potential and diverse opportunities for the global yacht market’s future expansion.

KEY MARKET PLAYERS

Some of the notable companies dominating the global yacht market profiled in this report are Alexander Marine International (AMI) Co., Ltd., Azimut Benetti Group, Damen Shipyards Group, Feadship, Ferretti SpA, Flensburger Schiffbau Gesellschaft GmbH (FSG), Heesen Group, Princess Yachts Limited, Sanlorenzo SpA, Sunseeker International, Viking Yacht Company, WANDA Group, and Others.

TOP 3 PLAYERS IN THE MARKET

Azimut Benetti Group

Azimut Benetti Group stands as a global leader in the yacht market, renowned for its diverse portfolio of luxury yachts. The company excels in combining Italian design with advanced technology, offering vessels that cater to a wide range of clientele, from casual sailors to ultra-high-net-worth individuals. Azimut Benetti’s focus on sustainability is evident in its adoption of hybrid propulsion systems and eco-friendly materials, setting a benchmark for the industry. With a strong international presence, the group has established itself as a dominant player in key markets such as Europe, North America, and Asia-Pacific. Its ability to deliver custom-built megayachts under the Benetti brand further cements its reputation as a pioneer in the superyacht segment.

Ferretti SpA

Ferretti SpA is synonymous with luxury and innovation, offering iconic brands like Riva, Pershing, and Ferretti Yachts. The company is celebrated for its commitment to craftsmanship and cutting-edge engineering, ensuring its vessels remain highly desirable in the global market. Ferretti’s emphasis on customization allows clients to create unique yachts tailored to their preferences, enhancing its appeal among affluent buyers. Through strategic collaborations, including partnerships in Asia, Ferretti has successfully expanded its reach into emerging markets. Its dedication to research and development ensures that its yachts consistently incorporate the latest advancements in design and performance, reinforcing its status as an industry leader.

Sanlorenzo SpA

Sanlorenzo SpA is a distinguished name in the superyacht segment, known for its bespoke designs and exclusivity. The company specializes in crafting personalized yachts that reflect the unique tastes of its clients, blending traditional Italian artistry with modern engineering. Sanlorenzo’s commitment to sustainability is reflected in its use of eco-friendly materials and energy-efficient technologies, aligning with the growing demand for environmentally responsible luxury products. With a global footprint and partnerships with high-end brands, Sanlorenzo has established itself as a preferred choice for discerning buyers. Its ability to deliver exceptional quality and exclusivity ensures its continued prominence in the competitive yacht market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Emphasis on Innovation and Customization

Leading companies like Azimut Benetti Group and Sanlorenzo SpA prioritize innovation by investing heavily in research and development. They focus on integrating cutting-edge technologies, such as hybrid propulsion systems and smart navigation tools, to improve performance and sustainability. Customization is another cornerstone of their strategy, allowing clients to personalize every aspect of their yachts, from interior design to onboard amenities. This approach caters to the growing demand for exclusivity and ensures customer loyalty among high-net-worth individuals.

Expansion into Emerging Markets

To tap into new revenue streams, key players are expanding their presence in emerging markets like Asia-Pacific, the Middle East, and Latin America. For instance, Ferretti SpA has partnered with Chinese conglomerates to establish a strong foothold in China, while Sanlorenzo has opened new sales offices in Southeast Asia. These efforts are supported by localized marketing campaigns and collaborations with regional distributors, ensuring alignment with local preferences and regulatory requirements.

Sustainability and Eco-Friendly Solutions

Sustainability has become a critical focus for industry leaders. Companies like Azimut Benetti and Heesen Group are adopting eco-friendly materials, energy-efficient systems, and alternative fuels to reduce the environmental impact of their yachts. This aligns with global environmental regulations and appeals to environmentally conscious buyers, enhancing brand reputation and competitiveness.

Strategic Partnerships and Collaborations

Strategic alliances with luxury brands, technology firms, and maritime organizations have become a key growth driver. For example, partnerships with high-end interior designers or tech companies enable players to offer unique features that differentiate their products. Additionally, collaborations with governments and tourism boards help promote yacht tourism, further boosting demand.

Focus on After-Sales Services and Experiences

Providing exceptional after-sales services, including maintenance, crew training, and concierge services, has become a priority for companies like Princess Yachts Limited and Sunseeker International. These services enhance customer satisfaction and retention. Furthermore, organizing exclusive events, regattas, and yacht shows allows brands to engage directly with clients, reinforcing their prestige and fostering long-term relationships.

COMPETITIVE LANDSCAPE

The yacht market is characterized by intense competition, driven by a mix of established luxury brands and emerging players striving to capture market share in this lucrative industry. The competitive landscape is shaped by innovation, customization, and the ability to cater to the evolving preferences of affluent consumers. Leading companies such as Azimut Benetti Group, Ferretti SpA, and Sanlorenzo SpA dominate the market through their strong brand equity, cutting-edge designs, and global reach. These firms leverage their expertise in crafting bespoke yachts, offering unparalleled levels of personalization that appeal to high-net-worth individuals seeking exclusivity.

However, the market is not without its challenges. Smaller players and niche manufacturers are increasingly entering the fray, targeting specific segments like eco-friendly yachts or compact luxury vessels. This has intensified competition, particularly in regions like Europe and North America, where demand for premium yachts remains robust. Additionally, emerging markets in Asia-Pacific and the Middle East present new battlegrounds, with local players and international brands vying for dominance.

Technological advancements have further raised the stakes, as companies invest heavily in hybrid propulsion systems, smart navigation, and sustainable materials to differentiate themselves. Strategic partnerships, mergers, and collaborations with luxury brands or tech firms are also common tactics to enhance competitiveness. Despite these efforts, smaller firms often struggle to match the scale and resources of industry giants, leading to a fragmented yet dynamic market. Overall, the yacht market’s competitive environment reflects a delicate balance between tradition and innovation, with sustainability and customer experience emerging as key differentiators.

RECENT MARKET DEVELOPMENTS

- In January 2023, Heesen Group delivered "Project Cosmos," its largest hybrid superyacht to date. This delivery is anticipated to allow Heesen to showcase its innovation in eco-friendly technology and solidify its position in the superyacht segment.

- In July 2022, Princess Yachts Limited announced a significant investment in research and development to integrate AI-driven navigation systems into its vessels. This investment is anticipated to allow Princess Yachts to enhance the technological sophistication of its yachts and attract tech-savvy buyers.

- In November 2022, Sunseeker International launched a new line of compact luxury yachts targeting younger buyers and first-time yacht owners. This launch is anticipated to allow Sunseeker to expand its customer base and capture a growing segment of the market.

- In April 2023, Damen Yachting introduced the Xplorer 80, a new range of expedition yachts designed for long-distance cruising, as reported by Powerboat World. This launch is anticipated to allow Damen to appeal to adventure-seeking clientele by offering a robust and versatile yacht capable of exploring remote destinations. The Xplorer 80 combines durability, comfort, and advanced technology, making it ideal for extended voyages.

- In February 2023, Viking Yacht Company acquired a smaller yacht manufacturer to expand its product portfolio. This acquisition is anticipated to allow Viking to strengthen its presence in the sportfishing yacht segment and increase its market share.

- In August 2022, WANDA Group deepened its partnership with Ferretti SpA to promote luxury yacht tourism in China. This partnership is anticipated to allow WANDA and Ferretti to leverage local expertise and resources to boost sales in the Asia-Pacific region.

- In October 2022, Feadship launched a sustainability initiative to reduce carbon emissions across its manufacturing processes. This initiative is anticipated to allow Feadship to align with global environmental standards and enhance its reputation as a leader in sustainable yacht production.

MARKET SEGMENTATION

This research report on the global yacht market has been segmented and sub-segmented based on the type, length, propulsion, and region.

By Type

- Super Yacht

- Sport Yacht

- Flybridge Yacht

- Long Range Yacht

By Length

- Up To 20 M

- 20 To 50 M

- Above 50 M

By Propulsion

- Motor

- Sailing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected growth of the global yacht market?

The yacht market is projected to grow from USD 10.52 billion in 2025 to USD 15.78 billion by 2033, at a CAGR of 5.2%, driven by increasing luxury tourism and sustainable innovations.

2. What factors are driving yacht market growth?

Technological advancements, rising wealth among high-net-worth individuals, and growing interest in yacht tourism.

3. What are the major challenges facing the industry?

Stringent environmental regulations, high operational costs, and economic volatility.

4. How is sustainability shaping the yacht industry?

Hybrid propulsion, solar power, and eco-friendly materials are becoming more popular.

5. What opportunities exist in emerging markets?

Regions like Southeast Asia and the Caribbean are investing in yacht-friendly infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]