Global Wooden Toys Market Size, Share, Trends and Growth Forecast Report - Segmented By Age group (Infants, Toddlers, Pre-Schoolers and Older Children), Product (Building Blocks, Puzzles, Dolls, Vehicles, Educational Toys and Others), Distribution channel (Physical Stores, Online and Both), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2032)

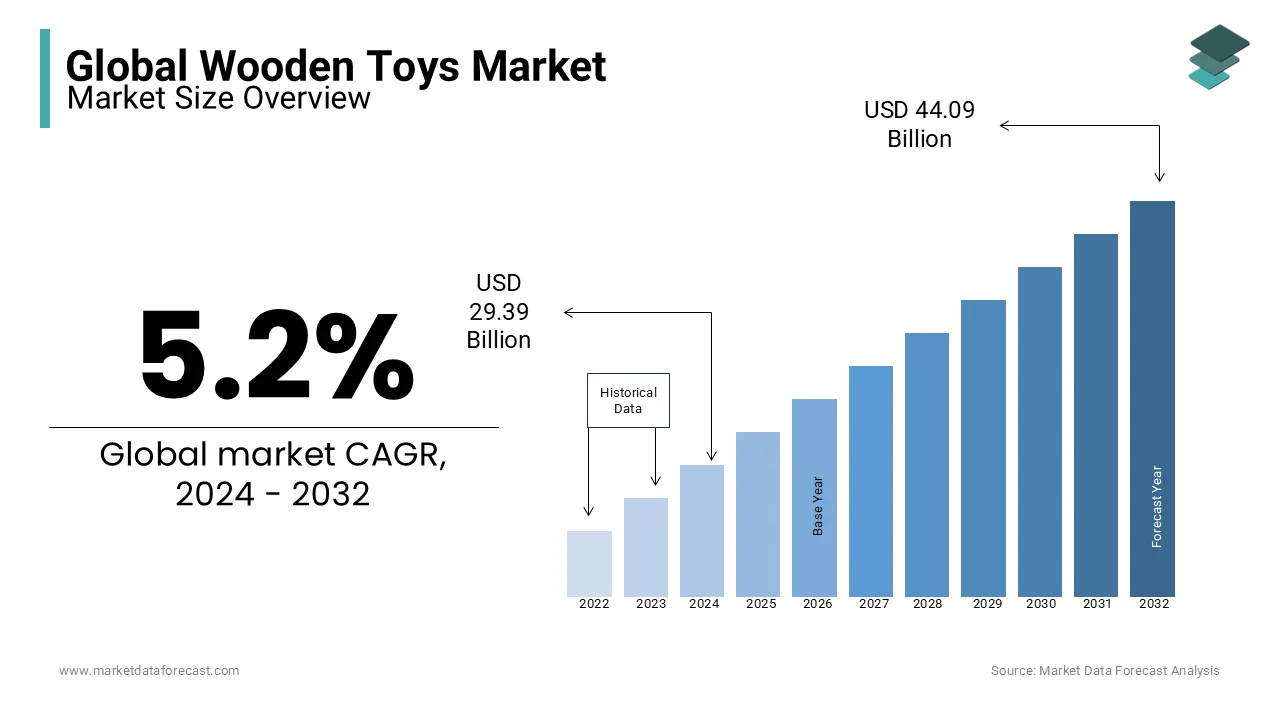

Global Wooden Toys Market Size (2024 to 2032)

The global wooden toys market was valued at USD 27.94 billion in 2023. The market size is expected to grow at a CAGR of 5.2% from 2024 to 2032 and be worth USD 44.09 billion by 2032 from USD 29.39 billion in 2024.

MARKET DRIVERS

The durability and longevity of wooden toys are significant factors driving the market growth.

In a world increasingly concerned with reducing waste and minimizing the environmental impact of consumer goods, the preference for wooden toys is growing gradually. These toys are perfectly renowned for their ability to endure rigorous play and be handed down through generations, making them an economical choice for families. Parents also appreciated the extended lifespan of wooden toys, as they offer lasting value and reduce the need for frequent replacements. As consumers seek products that offer both quality and sustainability, the enduring nature of wooden toys reinforces their appeal and contributes to the market's sustained growth.

The wooden toys market is thriving in response to growing environmental awareness. With consumers' increasing concerns about plastic waste and its environmental consequences, the demand for wooden toys is on the rise. Wooden toys are gaining importance as a sustainable choice due to their natural material composition and biodegradability. Thus, an increase in eco-consciousness has led to a surge in the popularity of wooden toys, as parents and caregivers choose these environmentally friendly options to support their dedication to a more sustainable future for their children.

MARKET RESTRAINTS

Cost and pricing dynamics pose a significant restraint in the wooden toys market. These Wooden toys tend to be pricier than plastic alternatives due to the use of natural materials and skilled craftsmanship. This higher price point can discourage price-sensitive consumers by limiting market trends. Therefore, price-conscious consumers often opt for more affordable plastic toys, which are mass-produced at lower costs. This price differential can impact the market's growth potential, limiting the reach of wooden toys to a niche audience willing to pay a premium for quality and sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.2% |

|

Segments Covered |

By Age group, Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Hape International, Plan Toys, Melissa & Doug, Grimms Spiel und Holz Design, Sevi, Brio, Manhattan Toy, EverEarth, Tegu and Janod |

SEGMENTAL ANALYSIS

Global Wooden Toys Market By Distribution Channel

The online channel holds the leading share of the global market during the forecast period owing to the growth of e-commerce platforms and the convenience of online shopping. The COVID-19 pandemic further accelerated this shift, with more consumers turning to online shopping for safety reasons. Online channels provide vast options, often at competitive prices, and offer the convenience of doorstep delivery.

The physical stores segment is estimated to account for a notable share of the worldwide market in the coming years. Physical stores have traditionally been a significant distribution channel for wooden toys, offering customers a hands-on experience, the ability to see the product's quality, and immediate purchase gratification.

Global Wooden Toys Market By Product

The building blocks segment is predicted to hold the major share of the worldwide market during the forecast period.

Building blocks are a versatile and timeless toy that appeals to a broad age range, from toddlers to older children. They promote creativity, spatial awareness, problem-solving skills, and fine motor development in children. The puzzles segment is estimated to hold a substantial share of the worldwide market during the forecast period. Puzzles are educational and offer both entertainment and cognitive benefits.

The educational toys segment is projected to showcase a CAGR during the forecast period.

Segments such as dolls and vehicles are predicted to witness a healthy CAGR in the coming years. Dolls and vehicles also have their dedicated segments of the market growth, with dolls appealing to children's nurturing instincts and vehicles often attracting those with an interest in motion and storytelling. Educational toys include those that are focused on STEM subjects and which have gained importance as parents increasingly prioritize learning through playing.

Global Wooden Toys market By Age group

The preschool age group has often been one of the more dominating segments. This is because wooden toys like building blocks, puzzles, and educational toys are well-suited to stimulate cognitive and motor skill development in preschool-aged children, making them a popular choice among parents and caregivers.

Infants and toddlers hold the second-largest market share during the forecast period. They are typically provided with a broader range of materials and may have fewer wooden toys. Older children, on the other hand, may lean toward more advanced playthings and digital entertainment options.

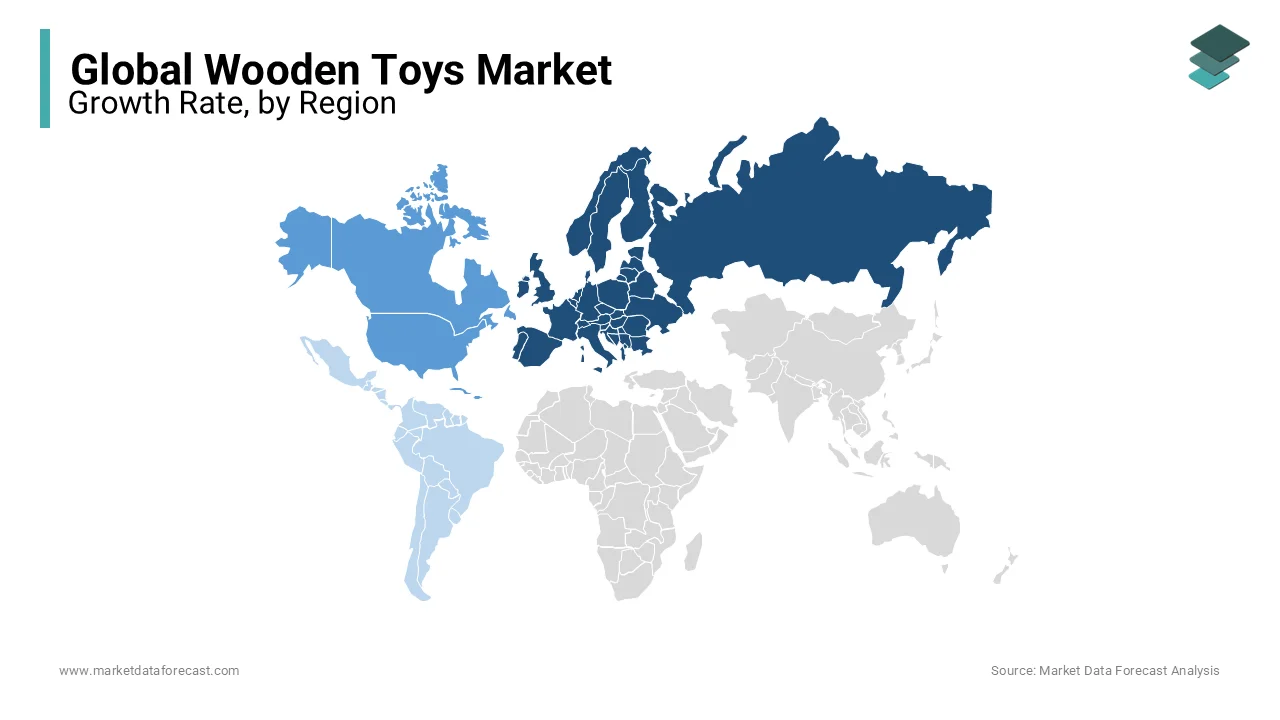

REGIONAL ANALYSIS

Europe holds the largest share of the global market during the forecast period owing to their cultural appreciation for artisanal craftsmanship and eco-consciousness that align well with the qualities of wooden toys. Parents across European countries often prefer these toys for their children due to their environmental friendliness, durability, and aesthetic appeal. The tradition of wooden toy-making in several European countries, coupled with strong consumer awareness of the benefits of these toys, contributes to their prominent position in the market.

North America holds the second largest share of the global market during the forecast period due to the value of traditional and eco-friendly toys such as wooden toys. Parents in North America often prioritize the safety and sustainability of toys for their children, leading to a strong demand for wooden toys known for their durability and non-toxic materials.

The Asia-Pacific region is estimated to witness a promising CAGR during the forecast period owing to the growing interest in wooden toys, driven by shifting consumer preferences towards more sustainable and non-plastic alternatives. Rising environmental concerns and an increasing focus on child safety have led to greater demand for wooden toys in countries like China and India.

In the Middle East and Africa, wooden toys are gradually gaining recognition and market share. The appeal of wooden toys in this region lies in their simplicity, durability, and adherence to cultural preferences for natural materials.

In Latin America, wooden toys are also carving out a niche market, although they may not dominate the segment. The region's appreciation for handcrafted products and a growing awareness of the environmental impact of plastic toys contribute to the appeal of wooden alternatives.

KEY MARKET PLAYERS

Hape International, Plan Toys, Melissa & Doug, Grimms Spiel und Holz Design, Sevi, Brio, Manhattan Toy, EverEarth, Tegu and Janod are some of the major players in the global wooden toys market.

RECENT HAPPENINGS IN THIS MARKET

- In 2021, Hape International continued to focus on sustainability, using eco-friendly materials and production methods for its wooden toys. They also emphasized their commitment to safety.

- In 2021, BRIO integrated digital technology into some of its wooden toys, creating interactive play experiences that combine physical and digital elements.

- In 2019, Plan Toys introduced innovative eco-friendly materials for their wooden toys, such as sustainable rubberwood and organic dyes.

- In 2019, Melissa & Doug expanded its product offerings beyond traditional wooden toys, entering categories like arts and crafts, puzzles, and educational games.

DETAILED SEGMENTATION OF THE GLOBAL WOODEN TOYS MARKET INCLUDED IN THIS REPORT

This research report on the wooden toys market has been segmented & sub-segmented based on the distribution channel, product, age group, and region.

By Distribution Channel

- Physical stores

- Online

- others

By Product

- Building blocks

- Puzzles

- Dolls

- Vehicles

- Educational toys

- Others

By Age group

- Infants

- Toddlers

- Preschoolers

- Older children

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the Wooden Toys Market?

The wooden toys market refers to the industry that produces toys primarily made from wood, which come in various shapes and sizes for children of different age groups.

What is the market size of the Wooden Toys Market?

The wooden toy market was valued at around USD 26.56 billion in 2022 and is expected to reach USD 35.24 billion at a CAGR of 5.2% by the end of 2028.

What are the opportunities in the Wooden Toys Market?

The opportunities in the wooden toys market include the growing demand for sustainable and eco-friendly options, the increasing demand for educational toys, and the aesthetic appeal of wooden toys combined with their durability and longevity.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]