Global Wood Plastic Composites Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Polyethylene, Polypropylene, Polyvinylchloride, Others), Application and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Wood Plastic Composites Market Size

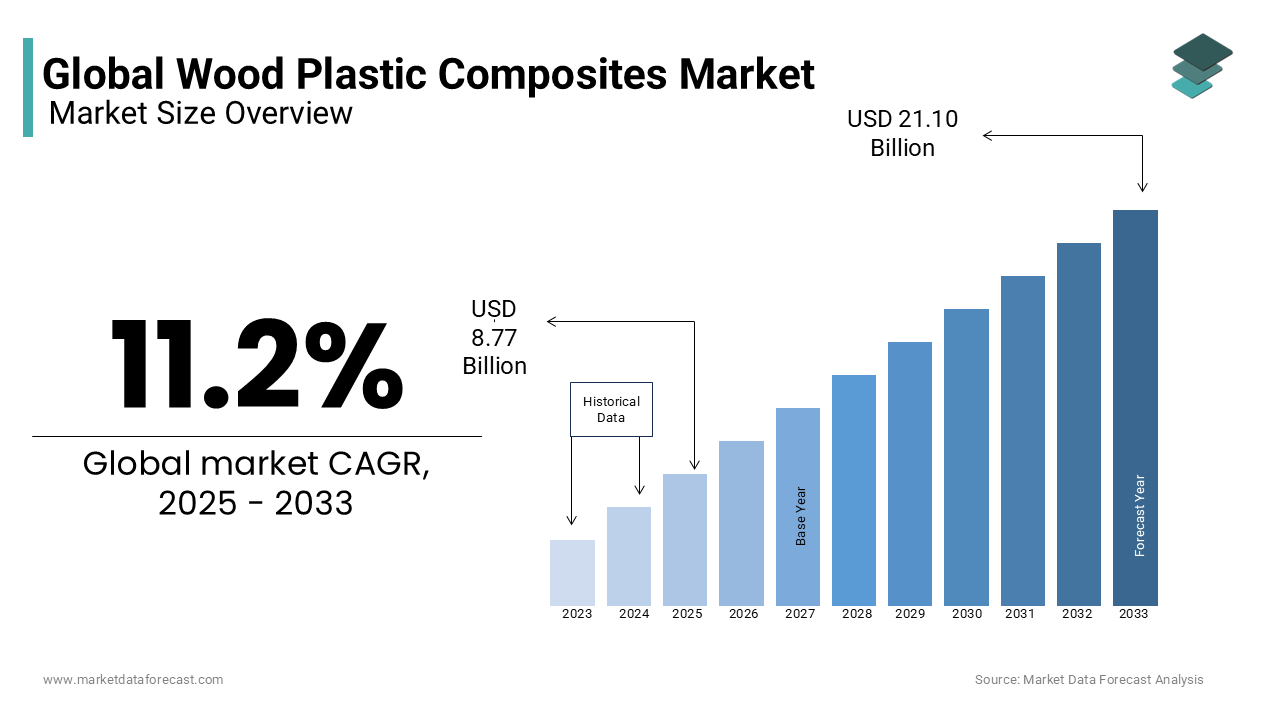

The global wood plastic composites market size was estimated at USD 7.86 billion in 2024 and is projected to reach USD 21.10 billion by 2033 from USD 8.77 billion in 2025, growing at a CAGR of 11.2% from 2025 to 2033.

Wood plastic composites (WPCs) are engineered materials composed of wood fibers or wood flour combined with thermoplastics such as polyethylene, polypropylene, or polyvinyl chloride. This combination results in a product that emulates the appearance of natural wood while offering enhanced durability, moisture resistance, and reduced maintenance requirements. Consequently, WPCs have found extensive applications in sectors like construction, automotive, and consumer goods.

MARKET DRIVERS

Environmental Sustainability

Wood Plastic Composites (WPCs) play a pivotal role in promoting environmental sustainability by incorporating recycled materials. The U.S. Environmental Protection Agency (EPA) reported that in 2018, the United States generated approximately 292.4 million tons of municipal solid waste with plastics accounting for 35.7 million tons or 12.2% of the total waste stream. By utilizing recycled plastics and reclaimed wood fibers in their production, WPCs help divert significant amounts of waste from landfills and thereby reducing environmental pollution. This practice not only mitigates waste accumulation but also decreases the demand for virgin materials, leading to conservation of natural resources and a reduction in greenhouse gas emissions associated with raw material extraction and processing.

Enhanced Durability and Longevity

WPCs are planned to offer superior durability compared to traditional wood products. The U.S. Forest Service's Forest Products Laboratory has reported that WPCs exhibit enhanced resistance to moisture, decay and insect damage which are common issues affecting conventional wood materials. This increased durability translates to longer service life and reduced maintenance requirements for WPC products. For instance, while traditional wood decking may need replacement or significant repairs every 10 to 15 years due to rot or insect damage, WPC decking can last longer with minimal upkeep. This longevity not only provides economic benefits to consumers through reduced maintenance and replacement costs but also lessens the environmental impact associated with frequent material replacement and resource consumption.

MARKET RESTRAINTS

Technical Limitations

Wood Plastic Composites (WPCs) possesses certain technical constraints that may impede their broader application. The U.S. Forest Service's Forest Products Laboratory indicates that WPCs generally have lower strength and stiffness compared to solid wood which can restrict their use in load-bearing structures. Additionally, these are susceptible to moisture absorption and thereby leading to potential fungal decay and a reduction in mechanical properties over time. The Forest Products Laboratory has documented that exposure to moisture can cause WPCs to lose up notable portion of their flexural stiffness after five water soak-freeze-thaw cycles. These factors necessitate careful consideration in applications where mechanical performance and environmental exposure are critical.

Higher Production Costs

The manufacturing process of WPCs is associated with elevated production costs relative to traditional wood materials. The U.S. Department of Energy highlights that the production of composite materials including WPCs is energy-intensive, contributing to increased manufacturing expenses. Furthermore, the incorporation of additives to enhance properties such as UV resistance, color stability, and fungal resistance further escalates production costs. These factors contribute to the higher market price of WPC products which can deter cost-sensitive consumers and limit the material's competitiveness against conventional alternatives.

MARKET OPPORTUNITIES

Government Regulations Promoting Sustainable Materials

Government initiatives aimed at promoting sustainable materials present a potential opportunity for the Wood Plastic Composites (WPC) market. The U.S. Environmental Protection Agency (EPA) has developed the Recycling Infrastructure and Market Opportunities Map to support the National Recycling Strategy and the Bipartisan Infrastructure Law. This interactive tool highlights existing infrastructure and market factors related to post-consumer materials management is facilitating the development of end markets for recyclable materials. Such regulatory frameworks encourage the adoption of recycled content in manufacturing and is positioning WPCs as a favorable alternative in construction and other industries. The emphasis on sustainability and environmental responsibility in policy frameworks is anticipated to drive the adoption of WPCs and thereby expanding market opportunities.

Advancements in Manufacturing Processes

Ongoing advancements in manufacturing processes offer substantial growth prospects for the WPC market. Innovations in production techniques such as improved extrusion and injection molding processes is enhancing the quality and performance of WPC products. The U.S. Department of Agriculture's Forest Products Laboratory has been at the forefront of developing technologies to convert recycled wood fiber and plastics into durable as well as environmentally friendly composites. These technological improvements lead to better material properties, increased durability, and expanded application possibilities. The efficiency and cost-effectiveness of WPC production are expected to improve because manufacturing technologies continue to evolve and is making these composites more competitive with traditional materials and opening new avenues for market expansion.

MARKET CHALLENGES

Moisture Sensitivity and Biological Degradation

Wood Plastic Composites (WPCs) are susceptible to moisture absorption which can lead to biological degradation. The U.S. Forest Service's Forest Products Laboratory has documented that WPCs can absorb moisture and consequently leading to fungal decay and a reduction in mechanical properties over time. This moisture sensitivity poses challenges for WPC applications in environments with high humidity or frequent exposure to water and is potentially limiting their durability and lifespan.

Recycling and End-of-Life Disposal Challenges

The recycling and end-of-life disposal of WPCs present significant challenges. The International Trade Administration notes that composite recycling is at a slower rate globally which is indicating substantial room for improvement. The combination of wood fibers and plastics in WPCs complicates the recycling process because separating these components is technologically challenging and often not economically viable. Consequently, WPCs may contribute to landfill waste at the end of their lifecycle which is raising environmental concerns and potentially negating some of the sustainability benefits associated with their use.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

CertainTeed, LLC., Beologic, Fiberon, FKuR, Guangzhou Kindwood Co. Ltd., JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, RENOLIT SE, TAMKO Building Products LLC, The AZEK Company Inc. (TimberTech) |

SEGMENTAL ANALYSIS

By Product Insights

The polyethylene (PE)-based composites segment commanded the wood plastic composites (WPC) market by accounting for 69.4% of the market share in 2024. The dominance of the polyethylene segment is attributed to PE's favorable properties including its molecular structure and special arrangement of molecules which contribute to its widespread use in producing decking, flooring, lumber, molding strips, furniture materials, wall cladding, hollow boards, and hollow filler profiles. The U.S. Environmental Protection Agency highlights that polyethylene is one of the most commonly recycled plastics, further supporting its extensive application in sustainable building materials.

The polyvinyl chloride (PVC) segment is witnessing rapid growth and is estimated to grow at a CAGR of 9.8% over the forecast period. The inherent properties of PVC such as low maintenance, toughness, rigidity with high impact strength, sound and heat insulation, non-toxicity, and weatherproof characteristics makes it a preferred choice in the construction industry. The U.S. Department of Energy notes that PVC is extensively used in building applications due to its durability and resistance to environmental degradation, contributing to its accelerated adoption in WPC products.

By Application Insights

The building and construction segment dominated the market by representing for a 71.3% share of the global market in 2024. The growth of the building and construction segment is majorly driven by the superior properties of WPC such as moisture and rot resistance which make them ideal for decking, molding, and fencing applications. The U.S. Environmental Protection Agency emphasizes the importance of sustainable materials in construction and WPCs, composed of recycled wood fibers and plastics and align with these sustainability goals. Their durability and low maintenance requirements further enhance their appeal in building applications.

The automotive components segment is estimated to grow at a CAGR of 9.8% over the forecast period owing to the increasing focus of automotive industry on lightweight and sustainable materials to improve fuel efficiency and reduce emissions. According to the U.S. Department of Energy, reducing vehicle weight by 10% can enhance fuel economy by 6% to 8%. WPCs offer a favorable strength-to-weight ratio, making them suitable for interior components such as door panels and seat backs, thereby contributing to vehicle weight reduction and environmental sustainability.

REGIONAL ANALYSIS

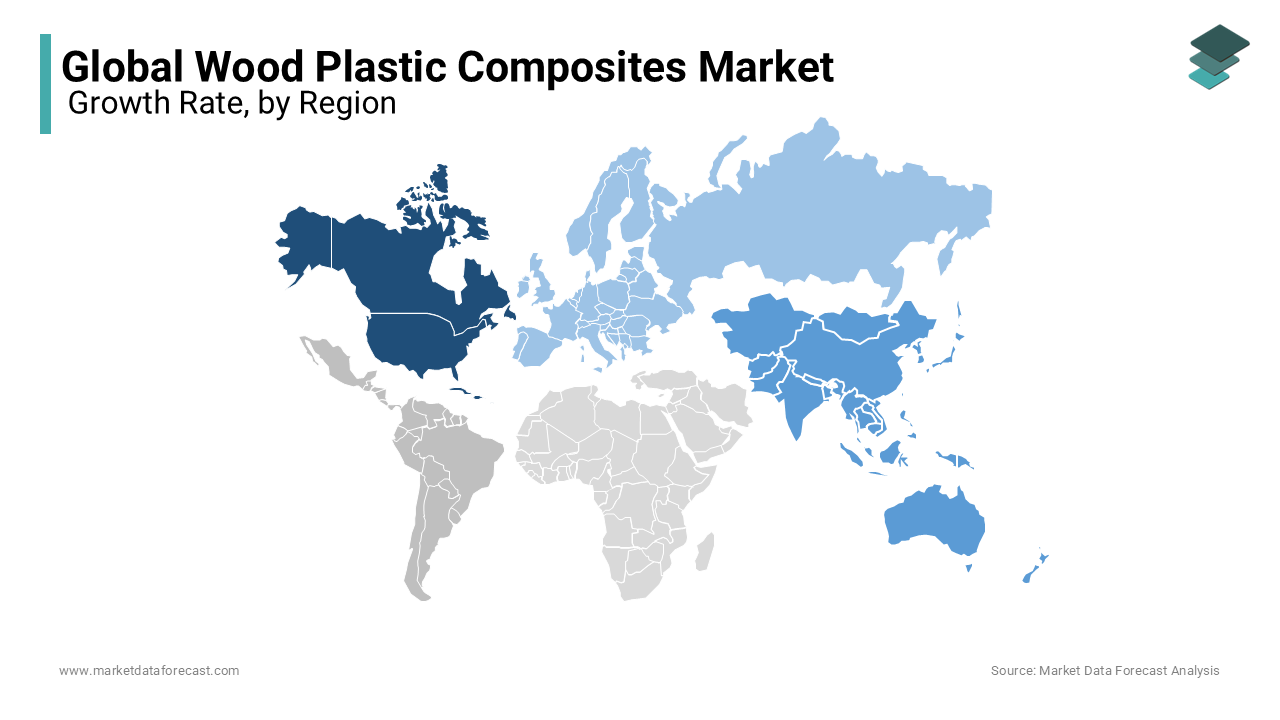

North America dominated the Wood Plastic Composites (WPC) market by accounting for 44.44% of the global market share in 2024. The domination of North America is majorly attributed to the robust construction industry of North America and a growing preference for environmentally friendly products. The U.S. Environmental Protection Agency notes that the United States generated about 292.4 million tons of municipal solid waste in 2018, with plastics comprising 12.2% (35.7 million tons). The emphasis on recycling and sustainable materials has propelled the adoption of WPCs in applications such as decking and fencing, which offer durability and low maintenance.

The Asia-Pacific region is likely to experience the fastest growth in the global WPC market and is estimated to exhibit a CAGR of 12.8% over the forecast period owing to the rapid urbanization and infrastructure development in countries like China and India. The United Nations reports that as of 2018, 55% of the world's population resides in urban areas which is a figure expected to increase and is leading to heightened construction activities. The demand for sustainable and cost-effective building materials in these emerging economies significantly contributes to the WPC market's growth.

Europe is witnessing steady growth in the WPC market and is supported by stringent environmental regulations and a strong emphasis on sustainability. The European Union's directives on recycling and waste management encourage the use of recycled materials and thereby promoting WPC utilization. Countries like Germany and the United Kingdom are leading in the adoption of WPCs and especially in automotive and construction sectors.

Latin America shows potential for growth in the WPC market, with countries like Brazil and Mexico focusing on infrastructure development and sustainable construction practices. The availability of raw materials and increasing awareness of environmental issues contribute to the gradual adoption of WPCs in this region.

The Middle East and Africa region is gradually embracing WPCs, primarily in construction applications. The demand is driven by the need for durable and low-maintenance building materials suitable for harsh climatic conditions. However, market growth is moderated by economic factors and limited awareness of WPC benefits.

Top 3 Players in the market

Trex Company, Inc.

Trex is recognized as the world's largest manufacturer of wood-alternative decking and railing products. Founded in 1996 and headquartered in Winchester, Virginia, Trex specializes in creating high-performance, low-maintenance composite decking materials made from 95% recycled content, including reclaimed wood and plastic film. The company's commitment to sustainability has led to the repurposing of over 400 million pounds of plastic and scrap wood annually, positioning Trex as a leader in eco-friendly building materials. In 2023, Trex reported revenues of approximately $1.1 billion, underscoring its significant impact on the WPC market.

The AZEK Company Inc.

The AZEK Company is a leading manufacturer of low-maintenance, sustainable residential and commercial building products, including composite decking under its TimberTech brand. The company focuses on converting recycled materials into premium products, emphasizing innovation and environmental stewardship. In December 2022, AZEK partnered with ThredUP to recycle plastic films into its TimberTech decking products, highlighting its dedication to sustainability and circular economy practices.

UPM (United Paper Mills)

UPM, headquartered in Helsinki, Finland, is a global leader in the forest-based bioindustry. The company produces a wide range of products, including biocomposites like UPM ProFi, which are used in outdoor applications such as decking and facades. UPM ProFi is known for its durability and high recycled content, aligning with the company's commitment to sustainable development. UPM's extensive experience in wood sourcing and processing has enabled it to contribute significantly to the WPC market by offering innovative and eco-friendly composite solutions.

Top strategies used by the key market participants

Expansion of Product Portfolio & Innovation

Leading companies in the Wood Plastic Composites (WPC) market continuously invest in expanding their product portfolios to meet evolving consumer demands. Trex Company introduced Trex Transcend® Lineage, a high-performance composite decking line with enhanced heat-resistant technology, ensuring durability and longevity. The AZEK Company developed TimberTech Advanced PVC and Composite Decking, offering superior strength and lower environmental impact. Similarly, UPM focuses on its UPM ProFi biocomposites, enhancing moisture resistance and extending the lifespan of its materials. By integrating cutting-edge technology and innovation, these companies maintain a competitive edge and attract a wider customer base.

Sustainability & Recycling Initiatives

Sustainability is a core focus for WPC market leaders as they emphasize environmentally friendly manufacturing processes. Trex Company incorporates 95% recycled materials, utilizing reclaimed wood and plastic waste to prevent landfill accumulation. Each year, the company diverts over 400 million pounds of plastic film from waste streams, reinforcing its eco-friendly reputation. The AZEK Company has launched a circular economy program, collecting and repurposing PVC waste into its TimberTech decking products, reducing dependency on virgin raw materials. Meanwhile, UPM is at the forefront of bio-based composites, ensuring lower carbon emissions in production. These sustainability efforts not only comply with stringent environmental regulations but also attract eco-conscious consumers and investors.

Geographic Expansion & Market Penetration

To strengthen their market presence, WPC manufacturers are aggressively expanding into new regions. Trex Company has ramped up production capacity in Virginia and Nevada, ensuring a steady supply for the growing North American market. The AZEK Company is extending its footprint in Europe and Asia, leveraging the increasing demand for sustainable construction materials in emerging economies. Likewise, UPM has expanded into key markets such as Germany, the United States, and China, reinforcing its position as a global leader in biocomposites. By penetrating international markets, these companies diversify revenue streams and capitalize on rising WPC demand worldwide.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

CertainTeed, LLC., Beologic, Fiberon, FKuR, Guangzhou Kindwood Co. Ltd., JELU-WERK J. Ehrler GmbH & Co. KG, PolyPlank AB, RENOLIT SE, TAMKO Building Products LLC, The AZEK Company Inc. (TimberTech) are some of the key market players.

The Wood Plastic Composites (WPC) market is highly competitive, driven by increasing demand for sustainable, durable, and low-maintenance construction materials. The market consists of several major players, including Trex Company, The AZEK Company, and UPM, alongside regional manufacturers and emerging startups. Competition is fueled by continuous product innovation, sustainability initiatives, and geographic expansion as companies strive to differentiate themselves.

Leading manufacturers focus on advanced material technology, integrating recycled plastics and bio-based materials to enhance product performance and environmental sustainability. Companies like Trex and AZEK dominate the North American market, while UPM and other European firms strengthen their foothold in international markets. The rise of smaller manufacturers, particularly in Asia-Pacific, further intensifies competition, with price sensitivity playing a crucial role in market share distribution.

In addition to price and product quality, brand reputation and distribution networks significantly impact competitive positioning. Established brands leverage their market credibility, extensive sales channels, and strategic partnerships to maintain dominance. Meanwhile, mergers and acquisitions help large players expand their capabilities and regional presence. As demand for eco-friendly building materials rises, competition is expected to intensify, pushing companies toward greater innovation, sustainable practices, and cost-effective manufacturing strategies.

RECENT MARKET DEVELOPMENTS

- In December 2024, KPS Capital Partners announced a definitive agreement to acquire INEOS Composites from INEOS Enterprises Holdings II Ltd for approximately €1.7 billion. INEOS Composites is a leading global manufacturer of unsaturated polyester resins, vinyl ester resins, and gelcoats used in plastic composites across various applications, including building materials, recreation, transportation, and wind energy. The transaction is expected to close in the first half of 2025, subject to regulatory approvals.

- In December 2024, KPS Capital Partners agreed to acquire the Engineered Materials business, known as Crane Composites, from Crane Company for an enterprise value of $227 million. Crane Composites is a leading designer and manufacturer of high-quality fiberglass reinforced plastic composite products, serving markets such as building products, recreational vehicles, and transportation. This transaction is anticipated to be completed in the first quarter of 2025.

MARKET SEGMENTATION

This research report on the wood plastic composites market is segmented and sub-segmented into the following categories.

By Product

-

Polyethylene

-

Polypropylene

-

Polyvinylchloride

-

Others

By Application

-

Building And Construction

-

Automotive Components

-

Industrial And Consumer Goods

-

Others

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What challenges are hindering the growth of the wood plastic composites market?

The market faces challenges such as high production costs, limited performance under extreme conditions, and competition from traditional materials like wood and plastics.

What are the emerging trends in the WPC market?

Emerging trends include a stronger focus on recycling and sustainability, with manufacturers incorporating more recycled wood fibers and plastics, as well as exploring biodegradable WPCs.

What are the main types of Wood Plastic Composites?

The market is primarily segmented into polyethylene-based (PE-WPCs), polyvinyl chloride-based (PVC-WPCs), and polypropylene-based (PP-WPCs), with PE-WPCs leading due to their cost-effectiveness.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]