Global Wireless Infrastructure Monitoring Market Size, Share, Trends, & Growth Forecast Report Segmented By Offering (Hardware and Software & Services), End-User (Civil infrastructure, Aerospace and Defense, Energy, Mining, Industrial Machinery, Automobile, Transportation, Marine Structures and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Wireless Infrastructure Monitoring Market Size

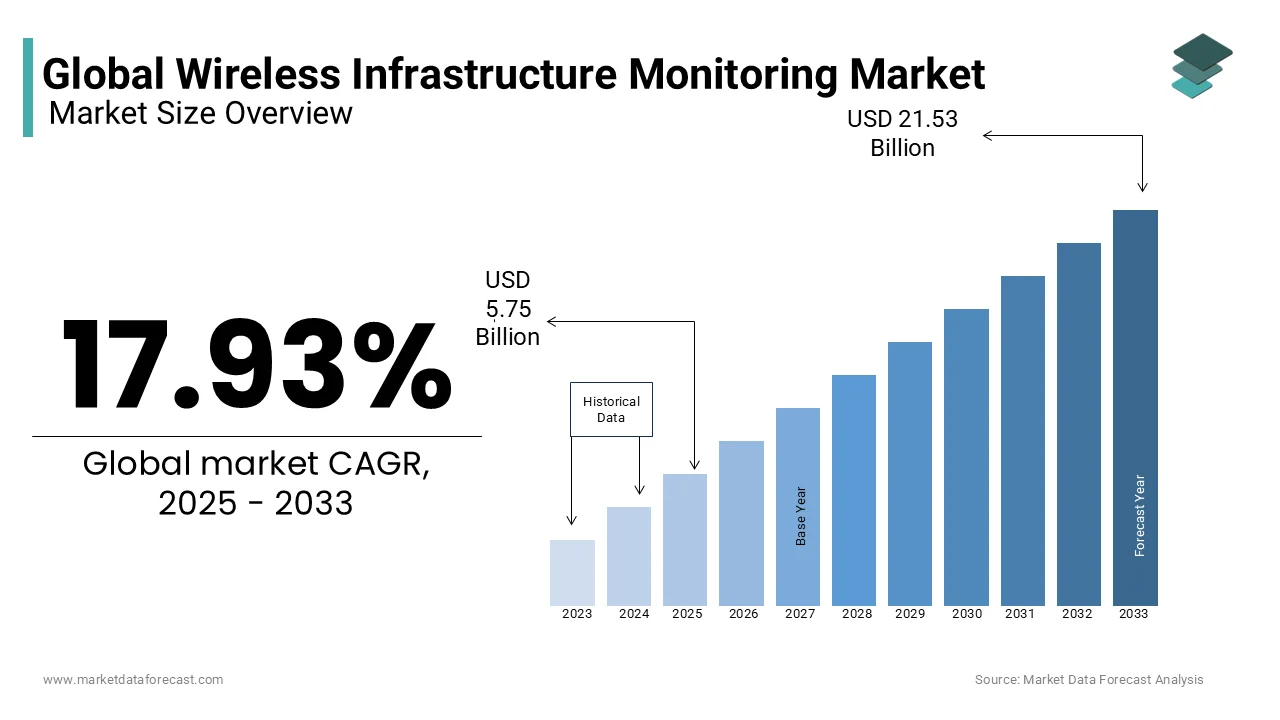

The global wireless infrastructure monitoring market was valued at USD 4.88 billion in 2024. The global market is expected to be worth USD 21.53 billion by 2033 from USD 5.75 billion in 2025, growing at a CAGR of 17.93% during the forecast period.

Wireless infrastructure monitoring equipment is the instrument or device connected to the wireless Internet that is used to anticipate the deterioration of infrastructure, such as buildings, bridges, refineries, etc. to avoid any accidents in the future. They provide the real-time data needed to understand the state of the infrastructure and the competition to further enumerate progress and enable optimal infrastructure management.

MARKET DRIVERS

Strengthening of the Economy

Due to the strengthening of the economy, most countries are under the positive influence of industrialization and are seeing exuberant growth of their convoy of civil infrastructures, such as roads, highways, bridges, industrial warehouses, power plants and zones. mining companies that should promote the wireless Infrastructure monitoring market.

For instance, in 2019, China invested more than USD 125 billion in the construction of a high-speed rail network. China Railway Corporation is expected to open 6,800 km of new lines, including 4,100 km of high-speed infrastructure, 45% more than the total mileage put into service in 2018. At the end of 2018, it was operating 29,000 km of high speed. lines, two-thirds of the world, and had added more than 4,000 km of roads in 2018. This has reduced travel time between major cities and Chinese authorities seeking to expand new lines in some of the country's most remote corners.

Use of Structural Monitoring Equipment

Structural monitoring equipment is used to provide continuous, real-time monitoring of the state of the infrastructure and detect any cracks that may go unnoticed and worsen over time. According to the 2019 IOGP Global Production Report, demand for oil and gas is at its peak, higher than ever, with spectacular growth in Africa, Asia-Pacific, the Middle East and America. This has boosted investment in oil exploration and production to meet demand and supply. Many medium players form a strategic alliance for the development of unconventional resources. For instance, in 2019, Ecopetrol and Occidental Petroleum Corp agreed to form a joint venture for the development of unconventional reservoirs on approximately 97,000 acres of the Permian Basin in the state of Texas, which is one of the most important oil basins. largest and most active in the United States, which accounts for about 30 percent of total United States oil production. Demand for structural monitoring equipment is expected to increase in the oil and gas sector.

Increasing Trend of Smart Cities

In addition, the growth of the global wireless infrastructure monitoring systems market is increasing owing to the current mega trend of smart cities. Growing numbers of people are moving to cities, driving the growing demand for resources and services in these urban centers. By 2025, 35 cities across the world will have a population of over 10 million. Cities already consume 2/3 of the world's energy and most other resources, such as water, housing, energy and energy reliability, air quality and traffic, which will affect the quality of life. As a result, most urban cities are responding to growing demand and are turning to Internet of Things (IoT) technology for the cutting-edge intelligence and flexibility needed to help cities use resources more efficiently. For instance, Intel and the city of San José, California, collaborated on a public-private partnership project that implements Intel's IoT Smart City demonstration platform to create environmental sustainability using technology IoT to measure characteristics such as particles. in air, noise pollution and traffic and provide air quality, noise, transport efficiency, health and energy efficiency.

MARKET RESTRAINTS

High installation and monitoring costs and slow growth in developing countries are primarily hampering the growth of the wireless infrastructure monitoring market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.93% |

|

Segments Covered |

By Product, End Users and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nova Metrix (USA), Geokon (USA), Campbell Scientific (USA), RST Instruments (Canada) and Sisgeo (Italy). Some of the companies that offer software and services include COWI (Denmark), Geocomp (USA), Acellent (USA), SIXENSE (France), and others. |

REGIONAL ANALYSIS

North America and Europe are considered as the dominant regions in the global wireless infrastructure monitoring market that are anticipated to continue their market hold in the coming years. At the same time, the Asia Pacific market is also estimated to develop with a considerable CAGR in the foreseen period.

KEY PLAYERS IN THE MARKET

Some of the major players operating in the global wireless infrastructure monitoring market are Nova Metrix (USA), Geokon (USA), Campbell Scientific (USA), RST Instruments (Canada) and Sisgeo (Italy). Some of the companies that offer software and services include COWI (Denmark), Geocomp (USA), Acellent (USA), and SIXENSE (France), among others. The global wireless infrastructure monitoring system market provides information such as company profiles, product images and specifications, capacity, production, price, cost, revenue, and contact details. The analysis of the demand for raw materials and upstream equipment is also carried out.

RECENT HAPPENINGS IN THE MARKET

-

In June 2020, COWI A/S won two framework agreements for VEAS, the largest wastewater treatment plant in Norway. One covers the construction trades, including construction technology, fire safety, mechanical installations, the outdoor environment, water, sewage, stormwater, planning, the environment, architecture, and HSE.

-

In May 2020, Sisgeo. S.r.l. has collaborated with Worldsensing's leading wireless solution for geotechnical monitoring, so your customers can enjoy automated readings when using Sisgeo's version 3 digital protocol sensors in combination with Worldsensing's Loadsensing. Ensures interoperability with Sisgeo Drill Profile Inclinometers, Inclinometers, Rail Deformation Systems, Strain Gauges, Strain Gauges, Liquid Sedimentation Systems, Load Cells and Strain Gauges. multipoint drilling, among others.

MARKET SEGMENTATION

This research report on the global wireless infrastructure monitoring market has been segmented and sub-segmented based on product, end-user and region.

By Product

- Hardware

- Software

- Services

By End-Users

- Civil Infrastructure

- Aerospace and Defense

- Energy

- Mining

- Industrial Machinery

- Automobile

- Transportation

- Marine Structures

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What is the current size of the global wireless infrastructure monitoring market?

The global wireless infrastructure monitoring market is expected at USD 5.75 bn in 2025.

What factors are driving the growth of the global wireless infrastructure monitoring market?

Key factors driving the growth of the global wireless infrastructure monitoring market include the increasing deployment of wireless networks, the need for real-time monitoring and maintenance, and advancements in IoT and sensor technologies.

Which regions dominate the global wireless infrastructure monitoring market share?

Currently, regions such as North America, Europe, and Asia-Pacific are among the leading contributors to the global wireless infrastructure monitoring market share, driven by extensive wireless network deployments and technological advancements.

Who are the key players in the wireless infrastructure monitoring market?

Companies playing a significant role in the global market include Nova Metrix (USA), Geokon (USA), Campbell Scientific (USA), RST Instruments (Canada) and Sisgeo (Italy). Some of the companies that offer software and services include COWI (Denmark), Geocomp (USA), Acellent (USA), and SIXENSE (France).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]