Global Whiskey Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Malt Whisky, Wheat Whisky, Rye Whisky, Corn Whisky, Blended Whisky, Others), Premium (Premium, High End Premium, Super Premium), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Whiskey Market Size

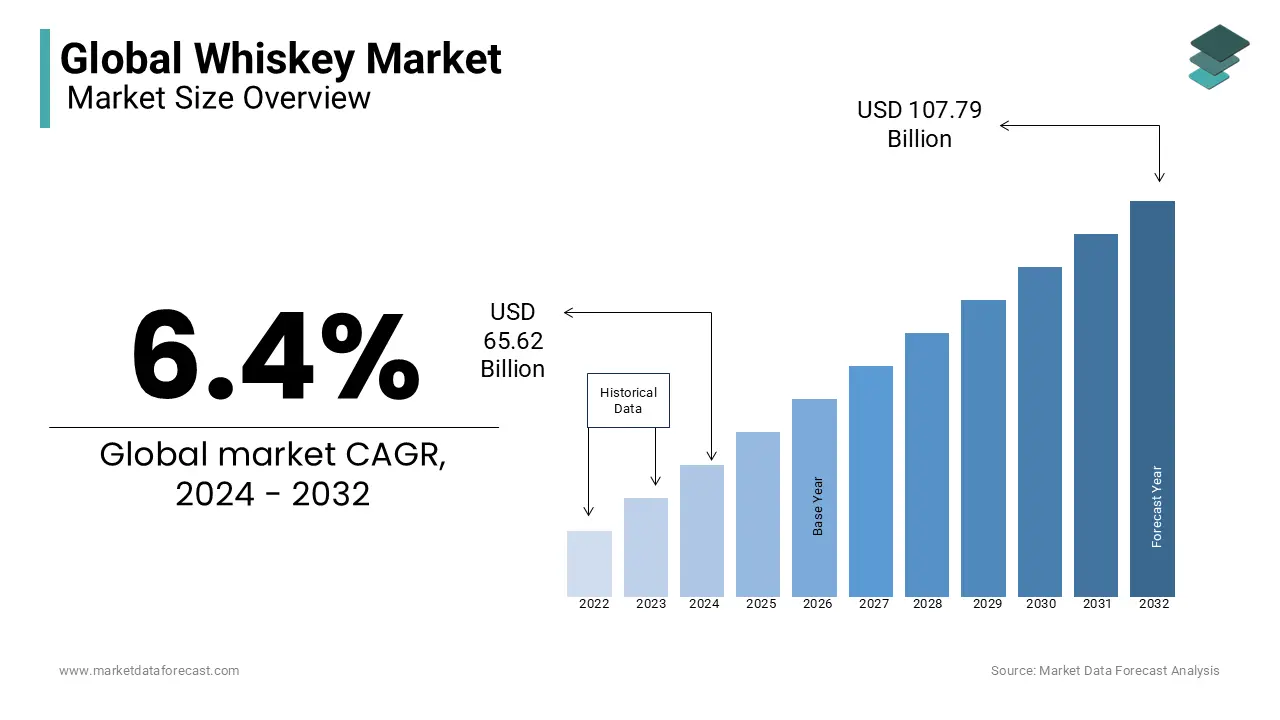

The global whiskey market size was calculated to be USD 65.62 billion in 2024 and is anticipated to be worth USD 114.69 billion by 2033 from USD 69.82 billion In 2025, growing at a CAGR of 6.4% during the forecast period. The market is expected to witness growth due to the increased consumption of products worldwide during the forecast period.

Whiskey is an alcoholic beverage and is made by aging in a wooden box. As the cocktail culture grew, the demand for whiskey increased. Whiskey is an alcoholic drink prepared from fermented grain puree. The grains used include barley, rye, malt barley, malt rye, wheat, and corn. In the United States, there is no need to ripen corn whiskey. Whiskey is grown in grain but is produced in most regions where content and quality may differ. It is an alcoholic beverage made from fermented grain puree. As a general rule, these grains are aged with a white oak wood barrel, giving them a unique flavor. Whiskey is a premium item that is reasonably priced, so consumers drink it more. This factor encourages manufacturing companies to introduce more innovation in their products.

Current Scenario Of The Global Whiskey Market

The whiskey market has registered tremendous growth in the last few years after COVID-19. This is clear from the fact that Uganda and Czechs have the highest alcohol consumption per person with 15.09 and 14.45 liters, respectively. In several countries, most of the adults consume a certain level of alcohol. For instance, throughout Europe over two-thirds drink in the majority of economies. On the Other hand, the frequency of drinking across the Middle East and North America is considerably less than in other regions. Usually, 5 to 10 percent of the adult population in these areas consumed whiskey in the previous year and in some countries, the drinking rate is even zero. In addition, on an average man drink more alcohol than women. For instance, in Czechia women consume 6.9 liters on average but on the other hand men in the country drink 22 liters. In some nations, the difference is even higher. Like in Turkmenistan males consume over five times that of females i.e. 5.26 liters annually for men and 1.03 liters yearly for women.

Apart from this, according to current trends, the Asia Pacific is growing at the fastest pace despite obstructions in its way. It became the biggest purchaser of Scotch whiskey leaving behind Europe. Its sales are thrived in 2023 in the APAC region. And, these figures came when the industry revenues and profits in North America and Europe were significantly slowed down.

MARKET DRIVERS

Lifestyle changes, whiskey consumption habits, high disposable incomes, improved whiskey economy, and increased demand for premium whiskey are majorly boosting the growth of the global whiskey market.

Factors promoting the expansion of the global whiskey market are changes in people's lifestyles and increased disposable income. Increased individual purchasing power has added to increased product consumption. The growing worldwide consumer base has dramatically increased the demand for blended whiskey. The popularity of super-premium drinks is supposed to grow in the coming years, especially in high-end areas. Aspects behind this growth are structured alcohol laws, lower currency taxes, increased demand for processed products, the availability of premium and personalized products, and better consumer choice and access.

Whiskey belongs to the main category, so it must comply with specific regulations. For example, there are regulations related to the sale, production, and distribution of alcoholic beverages across borders. Market participants must follow all of these rules. Therefore, these federal and local laws are affecting the growth of the market. Non-dominated countries like China, Brazil, and India offer opportunities for industry players. This industry boom is driven by a number of factors, such as an increase in disposable income levels, changes in lifestyle, and consumer preferences. The millennial generation, with significant purchasing power, is the leading consumer in the market. This product uses cultures in a distiller to mix flavors, herbs, and grains to improve taste and aroma. The demand for whiskey blends is assumed to grow significantly as the global consumer base increases.

In the coming years, the need for super-premium beverages is expected to increase considerably in developed countries such as the United Kingdom, France, the United States, and Canada. Factors responsible for this growth include "innovation and premium," modernized liquor laws that expand consumer choice and access, limiting hospitality taxes, growth in the "cocktail culture," and a focus on "artisanal" products in developed regions. The demand for various Scottish whiskeys in low-growth emerging markets and the need for low-alcohol and organic whiskey varieties among health-conscious drinkers are the driving forces behind the market. Also, as interest in healthy living grows around the world, people are choosing this variety of whiskey. Government regulations and tax policies influence market growth.

MARKET RESTRAINTS

One of the main factors expected to affect the growth of the global whiskey market is strict regulation and government taxes on alcoholic beverages.

Whiskey is an alcoholic beverage and must comply with various government regulations. It is suspected to hamper the market growth in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.4% |

|

Segments Covered |

By product, premium & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Accolade Wines, Angus Dundee Distillers Plc, Constellation Brands, Inc., Allied Blenders and Distillers Pvt. Ltd., Bacardi Limited, Affymetrix, Inc., Alko, Asahi Brewers, Bruker Corporation, and Danaher Corporation |

SEGMENT ANALYSIS

Global Whiskey Market Analysis By Product

The wheat whiskey segment holds the biggest share of the market and is expected to drive forward during the forecast period. It is majorly produced in the United States and is famous for its uniquely mild and light taste, limited spiciness, and gentle flavor. For instance, A.D. Laws Triticum straight wheat whiskey, Bernheim Original wheat, and Dry Fly Straight Washington Wheat Whiskey. Moreover, the segment growth is also influenced by the steady rise in the cocktails. Whereas the Rye segment is also witnessing growth among the American population. Despite multiple production problems, the suppliers are optimistic about its prospective growth and are looking forward to elevating its market share in the world market. It is generally considered the United State's original spirit and has consistently top-performed segments since 2009. As compared to 2017, its sales skyrocketed to 356 million dollars in 2022 from 175 million dollars in 2017.

The malt whiskey segment is also growing at a higher CAGR in the last few years. Indri which was named the world’s best whiskey is swiftly driving its way forward across India and several other countries. Further, rating agencies have projected that the Indian alcoholic beverages sector’s profit margins and revenues will see a significant increase. Interestingly, it sold over 100000 cases just within 2 years after its introduction.

Global Whiskey Market Analysis By Premium

The premium segment accounts for the maximum share of the whiskey market and is anticipated to propel further in the coming years. This is because of the changing customer choices and growing disposable income of middle-class people. The segment growth rate is also having an upward trajectory due to the evolving standard of living, the desire to maintain their social status, and the rising acceptance of subtle taste, flavors, and workmanship related to high-quality whiskies. In addition, the strengthening position of the Indian whiskey industry is leading and fuelling the Asia Pacific market because of the launch of varied products.

Currently, the consumer pattern is in favor of the premiumization of the products involving whiskey as well. The customers are highly intrigued by their consumption by the high-class people which is especially urging or attracting them towards companies like Diageo. This organization is also witnessing the transition to the premium segment. For example, in March 2023, Pernod Ricard USA revealed the acquisition of a large share in Skrewball which launched the peanut butter version of whiskey for Americans.

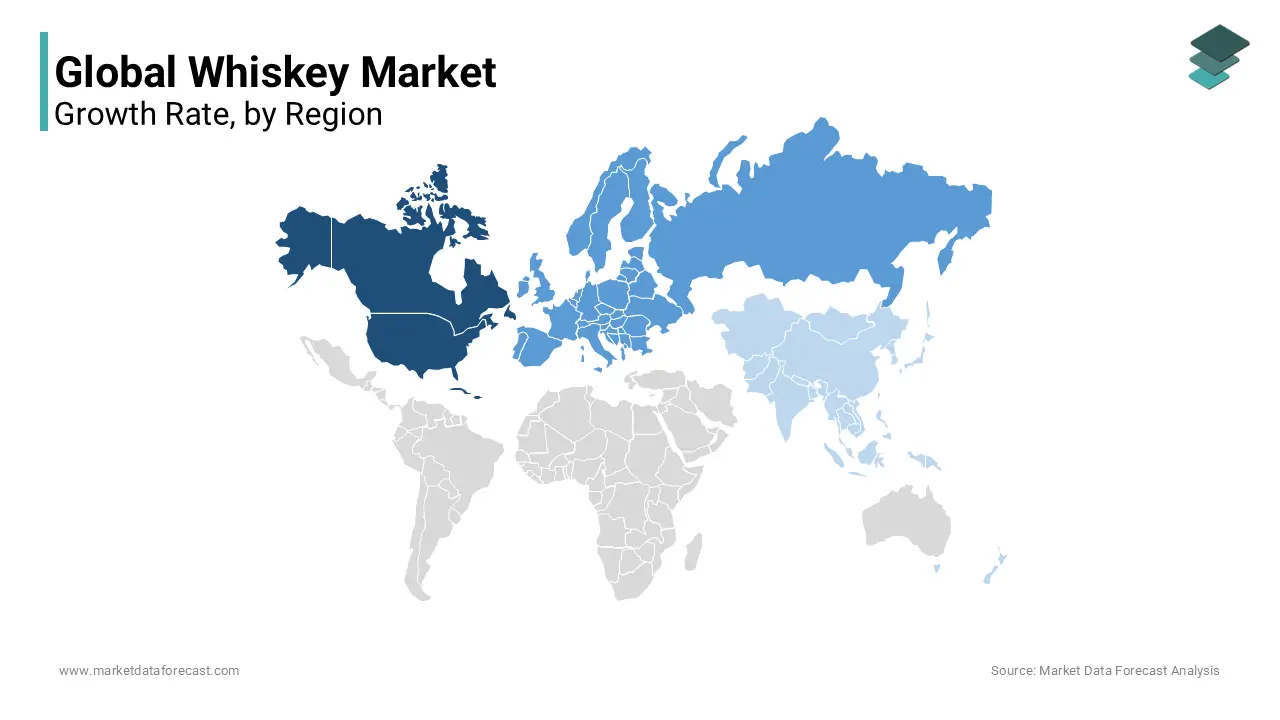

REGIONAL ANALYSIS

The number of manufacturers of premium products in North America has increased dramatically in recent years. The growing demand for commodities has attracted several new companies to the market. Additionally, whiskey production started at the brewery due to a short time frame for approval by federal and state regulatory agencies. As a result, the number of large breweries in the region will increase significantly in the coming years. The breweries are regulated by the American Distillation Institute, the three commercial offices for alcohol and tobacco, and the American Craft Spirit Association. Consumers who have recently reached the Legal Age for Consumption (LDA) play an essential role in driving the industry in North America. Besides the United States, Canada and Mexico are other vital economies in the region's mixed products sector.

Europe was an essential regional market in 2018, with a 34.8% share. Local markets are mainly driven by higher demand from Belgium, Germany, the United Kingdom, France, Spain, and Poland. However, the increase in the elderly population in Western Europe is likely to lead to a relatively slow growth rate compared to developing countries. Europe is the leader in the whiskey market with the highest market share. Germany, Italy, Spain, and France are the leading countries in the region in whiskey production and consumption.

South America represents a tenth of the world market share, and the whiskey market is growing slowly. The Asia Pacific area is estimated to be the fastest-growing market for the production and consumption of whiskey. The local whiskey market is mostly backed by a high adoption rate of Western culture and lifestyle, a large population, and a growing middle-class home. China, Japan, and India are important markets in this region. India is the largest whiskey consumer in the Asia Pacific region.

KEY PLAYERS IN THE GLOBAL WHISKEY MARKET

Major Key Players in the Global Whiskey Market are Accolade Wines, Angus Dundee Distillers Plc, Constellation Brands, Inc., Allied Blenders and Distillers Pvt. Ltd., Bacardi Limited, Affymetrix, Inc., Alko, Asahi Brewers, Bruker Corporation, and Danaher Corporation

RECENT HAPPENINGS IN THE MARKET

- In April 2024, the 2024 edition of a limited Jack Daniel’s Tennessee Whiskey bottle was launched to celebrate its collaboration with McLaren Racing.

- In April 2024, Bacardi unveiled Patrón El Cielo throughout the Indian subcontinent airports at key vendors. This involves Mumbai, Chennai, Delhi, Mumbai in India and Colombo in Sri Lanka.

- In January 2024, Garrard County Distilling Co. opened a big factory just outside Lexington, Kentucky bourbon which commenced the first barrel-filling on the 2nd of this month. It holds the capacity to produce about 150000 barrels or 8.5 million gallons of whiskey annually. This is part of the Atlanta-based Staghorn which has more than 250 million separate distillery initiatives in Lancaster.

- In October 2024, the latest 30 million dollar Bourbon and rye whiskey distillery was started by the Kentucky Distillery Company in Beaver Dam, Kentucky, Ohio County.

DETAILED SEGMENTATION OF GLOBAL WHISKEY MARKET INCLUDED IN THIS REPORT

This research report on the global whiskey market has been segmented and sub-segmented based on product, premium, & region.

By Product

- Malt Whisky

- Wheat Whisky

- Rye Whisky

- Corn Whisky

- Blended Whisky

By Premium

- Premium

- High-End Premium

- Super Premium

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What factors influence the price of whiskey?

Several factors can influence whiskey's price, including its age (older whiskies tend to be more expensive), rarity or limited availability, brand reputation, and quality of the ingredients and production process.

2. What are some emerging trends in the whiskey market?

Some emerging trends in the whiskey market include the rise of craft distilleries, increased interest in experimental and innovative whiskey styles, growing demand for premium and luxury whiskies, and a focus on sustainability and environmental practices in production.

3. Is whiskey a good investment?

Whiskey can be a good investment for collectors and enthusiasts, especially rare or limited-edition bottles from reputable distilleries. However, like any investment, it comes with risks and requires knowledge of the market and industry trends.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com