Global Welding Market Size, Share, Trends & Growth Forecast Report By Product Type (Equipment, Consumables) Welding Type ( Arc, Resistance ) Application ( Automotive , Building & Construction ) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Welding Market Size

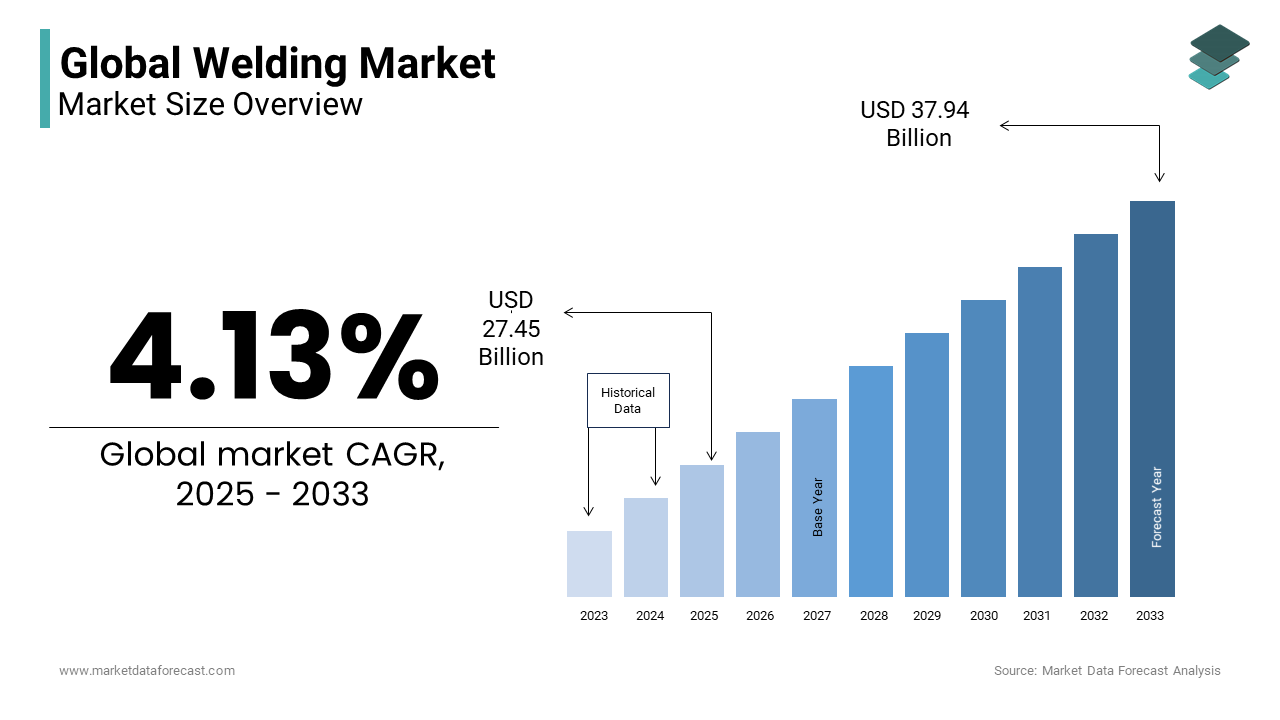

The global welding market size was valued at USD 26.36 billion in 2024. The welding market Size is expected to have 4.13 % CAGR from 2025 to 2033 and be worth USD 37.94 billion by 2033 from USD 27.45 billion in 2025.

The welding is a diverse array of processes and technologies employed to join materials, primarily metals, through the application of heat, pressure, or both. This essential industrial activity is pivotal across various sectors, including construction, automotive, aerospace, and manufacturing, where the integrity and durability of structures and components are paramount. Welding techniques, such as arc welding, gas welding, and resistance welding, have evolved significantly, driven by advancements in technology and the increasing demand for high-quality, efficient joining solutions.

The global welding market is projected to witness substantial growth with the rising demand for infrastructure development and the expansion of manufacturing capabilities. According to the International Federation of Robotics, the global stock of industrial robots reached approximately 3 million units in 2020 with the automation trend in manufacturing, which often relies on sophisticated welding technologies. Furthermore, the American Welding Society estimates that the welding market contributes over $50 billion annually to the U.S. economy, due to its critical role in economic development and job creation.

Moreover, the increasing emphasis on sustainability and the adoption of eco-friendly welding practices are reshaping the market landscape, as industries seek to minimize their environmental footprint while maintaining operational efficiency. This dynamic environment presents both challenges and opportunities for stakeholders within the welding sector, necessitating continuous innovation and adaptation to meet evolving market demands.

MARKET DRIVERS

Growth of the Construction and Infrastructure Sectors

The expansion of the construction and infrastructure sectors is a significant driver of the welding market. The demand for residential, commercial, and industrial buildings continues to rise as urbanization accelerates globally. According to the U.S. Bureau of Labor Statistics, employment in the construction industry is projected to grow by 11% from 2020 to 2030, which translates to approximately 1 million new jobs. This growth necessitates robust welding applications for structural integrity and safety in construction projects. According to the American Society of Civil Engineers, the U.S. requires an estimated $4.5 trillion investment in infrastructure by 2025 to address aging facilities and improve public safety.

Advancements in Welding Technology

Technological advancements in welding processes are another major driver of the market. Innovations such as automated welding systems, laser welding, and hybrid welding techniques are enhancing efficiency, precision, and quality in welding applications. According to the International Federation of Robotics, the global stock of industrial robots reached approximately 3 million units in 2020, with a significant portion dedicated to welding tasks. These advancements not only reduce labor costs but also improve safety and consistency in production. Additionally, the integration of smart technologies, such as IoT and AI, is revolutionizing welding operations by enabling real-time monitoring and predictive maintenance. This shift towards automation and smart welding solutions is expected to propel market growth, as industries increasingly seek to optimize their manufacturing processes and reduce operational downtime.

MARKET RESTRAINTS

Skilled Labor Shortage

One of the primary restraints affecting the welding market is the shortage of skilled labor. The American Welding Society has projected that the welding market will face a shortfall of approximately 400,000 skilled welders by 2024, which poses a significant challenge to meeting the growing demand for welding services. This shortage is largely attributed to an aging workforce and a lack of interest among younger generations in pursuing careers in skilled trades. The U.S. Bureau of Labor Statistics also indicates that the median age of welders is around 55 years due to the urgent need for workforce development initiatives.

Regulatory Compliance and Safety Standards

Another significant restraint in the welding market is the stringent regulatory compliance and safety standards that companies must adhere to. The Occupational Safety and Health Administration (OSHA) enforces regulations that require welding operations to meet specific safety protocols to protect workers from hazards such as fumes, heat, and noise. Compliance with these regulations can be costly and time-consuming, particularly for small and medium-sized enterprises. According to OSHA, the costs associated with workplace injuries and illnesses can exceed $1 billion annually in the U.S. alone. These financial burdens may deter companies from investing in new technologies or expanding their operations, thereby limiting the overall growth potential of the welding market.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Projects

The growing emphasis on renewable energy sources presents a significant opportunity for the welding market. As countries strive to meet climate goals and reduce carbon emissions, investments in renewable energy infrastructure, such as wind and solar power, are surging. The U.S. Energy Information Administration projects that renewable energy will account for 42% of total electricity generation by 2050. This shift necessitates extensive welding applications for the construction of solar panels, wind turbines, and associated infrastructure. The American Wind Energy Association reported that the U.S. wind industry alone supported over 116,000 jobs in 2020, indicating a robust demand for skilled welders in this sector. The welding market stands to benefit significantly from increased demand for specialized welding services as renewable energy projects expand

Adoption of Advanced Manufacturing Techniques

The adoption of advanced manufacturing techniques, such as additive manufacturing and Industry 4.0 technologies, offers substantial opportunities for the welding market. These innovations enable manufacturers to enhance production efficiency, reduce waste, and improve product quality. According to the National Institute of Standards and Technology, the implementation of smart manufacturing technologies could increase productivity by up to 30% in the manufacturing sector. Additionally, the integration of welding with additive manufacturing allows for the creation of complex geometries and customized components, which are increasingly sought after in industries like aerospace and automotive. The demand for innovative welding solutions is expected to rise with the rapid adoption of the technological advancements.

MARKET CHALLENGES

Fluctuating Raw Material Prices

One of the significant challenges facing the welding market is the volatility of raw material prices for metals such as steel and aluminum. According to the World Bank, steel prices have experienced substantial fluctuations, with a notable increase of over 50% from 2020 to 2021 due to supply chain disruptions and rising demand. These price variations can significantly impact the cost structure for welding companies, leading to unpredictable profit margins. According to the U.S. Geological Survey, the prices of aluminum and other essential welding materials are influenced by global market dynamics, including trade policies and geopolitical tensions. Such instability can hinder long-term planning and investment in the welding sector by posing a challenge for businesses striving to maintain competitiveness.

Environmental Regulations and Compliance Costs

The welding market faces increasing pressure from environmental regulations aimed at reducing emissions and promoting sustainable practices. Compliance with these regulations often requires significant investments in technology and processes to minimize environmental impact. The Environmental Protection Agency (EPA) has established stringent standards for air quality and hazardous waste management, which welding companies must adhere to. According to the EPA, the costs associated with compliance can be substantial, with estimates suggesting that businesses may spend up to 3% of their annual revenue on environmental compliance measures. These financial burdens can strain resources for smaller firms, and may deter investment in innovation and growth by posing a challenge to the overall development of the welding market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.13 % |

|

Segments Covered |

By Product Type, Welding Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Lincoln Electric (U.S.),KOBE STEEL, LTD (Japan),ESAB (U.S.),Fronius International GmbH (Austria). |

SEGMENTAL ANALYSIS

By Product Type Insights

The equipment segment was the largest by capturing 60.4% of the total welding market share in 2024. This dominance is primarily due to the essential role that welding equipment plays in various industries, including construction, automotive, and manufacturing. According to the American Welding Society, the demand for advanced welding machines, such as robotic welding systems, is increasing as companies seek to enhance productivity and precision. The integration of automation in welding processes is crucial for meeting the growing need for high-quality welds, thereby amplifying the growth of the market.

The consumables segment is swiftly emerging with an estimated CAGR of 5.5% during the forecast period. This growth is driven by the increasing demand for welding rods, wires, and other consumables that are essential for various welding processes. The rise in infrastructure projects and manufacturing activities globally is fueling the need for consumables, as per the U.S. Bureau of Labor Statistics, which anticipates a 7% increase in manufacturing jobs by 2028. Additionally, the shift towards more sustainable and efficient welding practices is prompting industries to invest in high-performance consumables that further accelerates this segment's growth.

By Welding Type Insights

The arc welding segment was the largest by occupying 55.4% of the total welding market share in 2024. This dominance is attributed to its versatility and widespread application across various industries, including construction, automotive, and shipbuilding. According to the American Welding Society, arc welding processes, such as MIG and TIG welding, are favored for their efficiency and ability to produce high-quality welds. As per the U.S. Bureau of Labor Statistics, the demand for skilled welders proficient in arc welding techniques is expected to grow that further boosts the growth of this segment in the coming years.

The resistance segment is projected to witness a CAGR of 6.2% during the forecast period. This growth is driven by the increasing adoption of resistance welding in the automotive and electronics industries, where precision and speed are critical. The International Federation of Robotics reported that the automotive sector is rapidly integrating robotic resistance welding systems to enhance production efficiency and reduce labor costs. Furthermore, the rising demand for lightweight materials in vehicle manufacturing is propelling the need for advanced resistance welding techniques by making this segment crucial for meeting modern manufacturing requirements and sustainability goals.

By Application Insights

The automotive segment was the largest in the welding market by accounting for 40.2% of the total market share in 2024. This dominance is primarily due to the extensive use of welding in vehicle manufacturing, where it is essential for assembling various components, including frames, body panels, and exhaust systems. According to the International Organization of Motor Vehicle Manufacturers, global vehicle production reached over 77 million units in 2021 with rising prominence for welding in this sector. Additionally, advancements in welding technologies, such as robotic welding, are enhancing production efficiency and quality.

The oil and gas segment is likely to experience a fastest CAGR of 7.4% from 2025 to 2033. This growth is driven by increasing investments in oil and gas exploration and production in emerging markets. The U.S. Energy Information Administration forecasts that global oil demand will rise to 104 million barrels per day by 2026 with the robust infrastructure and pipeline systems that rely heavily on welding. Furthermore, the need for high-quality, durable welds in harsh environments makes advanced welding techniques essential for ensuring safety and efficiency in oil and gas operations, thereby propelling this segment's growth.

REGIONAL ANALYSIS

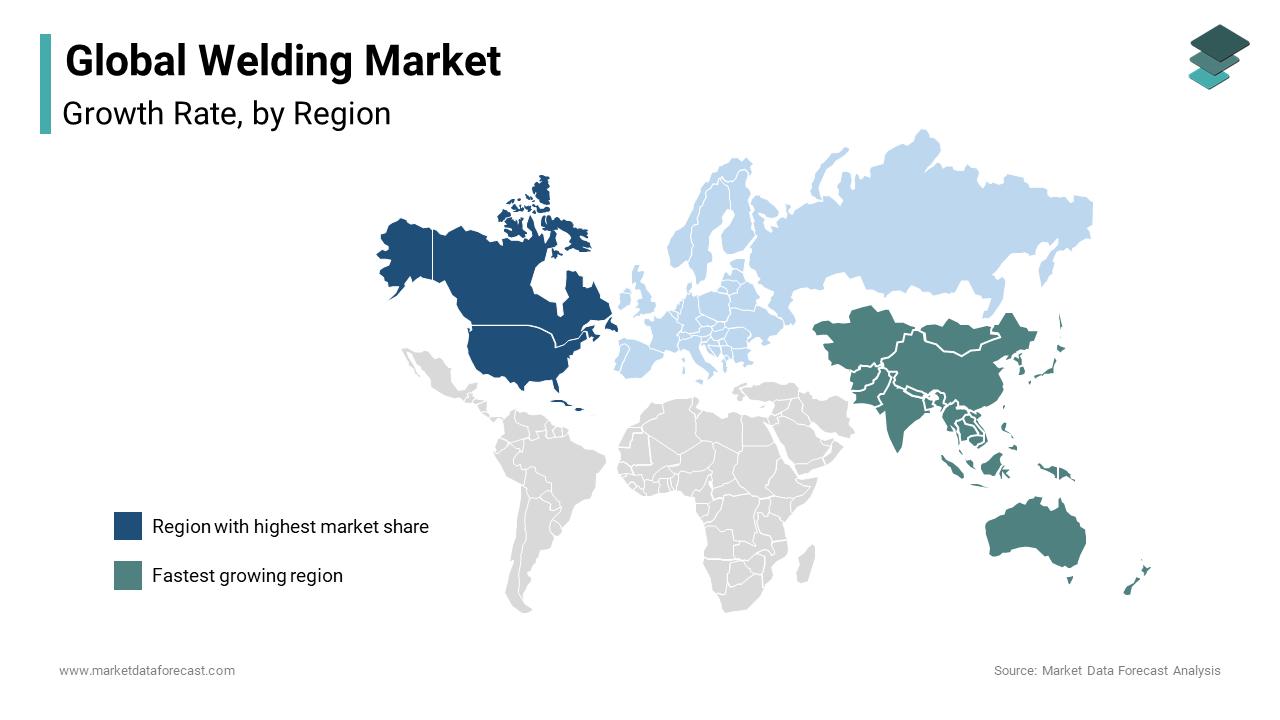

North America welding market held the largest share of 35.6% in 2024 with the robust automotive and aerospace industries, which heavily rely on advanced welding technologies. Additionally, the region's focus on technological advancements, such as automation and robotics in welding processes, further enhances productivity and quality, amplifying the North America's dominant position in the global welding market.

The Asia-Pacific welding market is projected to hit a prominent CAGR of 6.5% from 2025 to 2033. This growth is fueled by rapid industrialization and urbanization in countries like China and India, where significant investments in infrastructure and manufacturing are underway. The International Energy Agency forecasts that Asia-Pacific will account for nearly 60% of global energy demand growth by 2030 with extensive welding applications in energy and construction projects. Furthermore, the increasing adoption of advanced welding technologies in the region is expected to drive market expansion by making it a critical area for future growth.

In Europe, the welding market is expected to grow steadily, driven by stringent regulations promoting safety and quality in manufacturing. The European Commission's initiatives to enhance industrial competitiveness are likely to support this growth. Latin America is anticipated to experience moderate growth, with a focus on infrastructure development, particularly in Brazil and Mexico, as reported by the Inter-American Development Bank. The Middle East and Africa are projected to see increased demand for welding services due to ongoing investments in oil and gas projects, with the African Development Bank estimating a 4% growth in infrastructure spending by 2025.

Top 3 Players in the market

Lincoln Electric (U.S.)

Lincoln Electric is a leading player in the global welding market, renowned for its comprehensive range of welding equipment, consumables, and automation solutions. With a market presence spanning over 100 years, the company has established itself as a pioneer in welding technology. Lincoln Electric's innovative products, such as the Power Wave® series of welding machines and the VRTEX® virtual reality training system, have set industry standards for quality and efficiency. The company’s commitment to research and development ensures that it remains at the forefront of technological advancements, contributing significantly to the overall growth and innovation in the welding sector.

ESAB (U.S.)

ESAB is another major player in the global welding market, recognized for its extensive portfolio of welding and cutting equipment, as well as consumables. The company operates in over 80 countries and serves a diverse range of industries, including construction, automotive, and shipbuilding. ESAB's innovative solutions, such as the Rebel™ series of multi-process welding machines and its advanced welding consumables, have positioned it as a leader in the market. The company's focus on sustainability and efficiency in welding processes aligns with global trends, further enhancing its contribution to the welding market's growth.

KOBE STEEL, LTD (Japan)

KOBE STEEL, LTD is a prominent player in the global welding market, particularly known for its high-quality welding consumables and materials. The company has a strong foothold in the Asia-Pacific region and is recognized for its advanced welding technologies, including flux-cored wires and submerged arc welding products. KOBE STEEL's commitment to quality and innovation has earned it a reputation as a trusted supplier in various industries, including construction, shipbuilding, and energy. The company’s emphasis on research and development ensures that it continues to meet the evolving needs of the welding market, solidifying its position as a key player in the market.

Top strategies used by the key market participants

Lincoln Electric (U.S.)

Lincoln Electric is a leading player in the global welding market, renowned for its comprehensive range of welding equipment, consumables, and automation solutions. With a market presence spanning over 100 years, the company has established itself as a pioneer in welding technology. Lincoln Electric's innovative products, such as the Power Wave® series of welding machines and the VRTEX® virtual reality training system, have set industry standards for quality and efficiency. The company’s commitment to research and development ensures that it remains at the forefront of technological advancements, contributing significantly to the overall growth and innovation in the welding sector.

ESAB (U.S.)

ESAB is another major player in the global welding market, recognized for its extensive portfolio of welding and cutting equipment, as well as consumables. The company operates in over 80 countries and serves a diverse range of industries, including construction, automotive, and shipbuilding. ESAB's innovative solutions, such as the Rebel™ series of multi-process welding machines and its advanced welding consumables, have positioned it as a leader in the market. The company's focus on sustainability and efficiency in welding processes aligns with global trends, further enhancing its contribution to the welding market's growth.

KOBE STEEL, LTD (Japan)

KOBE STEEL, LTD is a prominent player in the global welding market, particularly known for its high-quality welding consumables and materials. The company has a strong foothold in the Asia-Pacific region and is recognized for its advanced welding technologies, including flux-cored wires and submerged arc welding products. KOBE STEEL's commitment to quality and innovation has earned it a reputation as a trusted supplier in various industries, including construction, shipbuilding, and energy. The company’s emphasis on research and development ensures that it continues to meet the evolving needs of the welding market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global welding market are Lincoln Electric (U.S.),KOBE STEEL, LTD (Japan),ESAB (U.S.),Fronius International GmbH (Austria),ZULFI (Saudi Arabia),KISWEL CO., LTD. (South Korea),CS HOLDINGS CO., LTD. (South Korea),RME MIDDLE EAST (UAE),voestalpine BÖHLER Edelstahl GmbH (Austria),capilla GmbH (Germany),Tianjin Golden Bridge Welding Materials Group International Trading Co., Ltd. (China),Miller Electric Mfg. LLC (U.S.)

The welding market is characterized by intense competition among a diverse array of players, ranging from established multinational corporations to emerging local firms. Major companies such as Lincoln Electric, ESAB, and KOBE STEEL dominate the landscape, leveraging their extensive product portfolios, technological innovations, and global reach to maintain market’s dominance. These key players continuously invest in research and development to introduce advanced welding technologies, such as automated and robotic welding systems, which enhance efficiency and precision in various applications.

Moreover, the competition is further intensified by the increasing demand for high-quality welding solutions across multiple industries, including automotive, construction, and energy. As companies strive to differentiate themselves, they often focus on sustainability initiatives, offering eco-friendly products and processes that align with global environmental standards.

Additionally, strategic partnerships and collaborations are common, enabling firms to expand their market presence and access new customer segments. The rise of digitalization and Industry 4.0 technologies is also reshaping the competitive landscape, as companies adopt smart manufacturing practices to optimize operations. Overall, the welding market remains dynamic, with ongoing innovations and competitive strategies driving growth and shaping the future of the market.

RECENT HAPPENINGS IN THE MARKET

In January 2023, Lincoln Electric launched a new line of advanced robotic welding systems. This introduction is expected to enhance productivity and precision in manufacturing environments, catering to the growing demand for automation in the welding market.

In March 2023, ESAB acquired a leading manufacturer of welding consumables to expand its product offerings. This strategic move aims to strengthen ESAB's position in the consumables market by integrating innovative products and technologies, enhancing its competitive edge.

In June 2023, Miller Electric introduced a series of energy-efficient welding machines. These machines are designed to meet the increasing demand for sustainable practices in manufacturing, aligning with global trends toward environmental responsibility and reduced operational costs.

In August 2023, Kemppi developed a new software platform for enhanced welding process management. This platform provides real-time monitoring and analytics for welding operations, allowing manufacturers to optimize their processes and improve quality control, supporting the trend of digitalization in the welding market.

In November 2023, KOBE STEEL invested in a state-of-the-art welding research facility. This investment aims to advance welding technology and develop new materials, contributing to the company's long-term growth strategy.

In February 2024, YesWelder expanded its product line to include multifunctional welding machines. This expansion caters to the diverse needs of welders and positions YesWelder as a versatile player in the market.

In April 2024, Fronius launched a new range of solar-powered welding equipment. This innovative product line reflects the company's commitment to sustainability, designed for environmentally conscious manufacturers looking to reduce their carbon footprint.

In July 2024, Hypertherm introduced a new plasma cutting system with advanced features. This product is aimed at industries requiring high-performance cutting solutions, further solidifying Hypertherm's reputation as a leader in cutting technologies.

In September 2024, ABB enhanced its robotic welding solutions with AI capabilities. This integration allows for smarter automation, enabling robots to learn and adapt to different welding tasks, appealing to manufacturers seeking to streamline operations.

In December 2024, Panasonic partnered with a tech firm to integrate IoT in welding equipment. This collaboration focuses on allowing remote monitoring and predictive maintenance, supporting manufacturers in optimizing their operations and reducing downtime.

MARKET SEGMENTATION

This research report on the Welding Market has been segmented and sub-segmented into the following categories.

By Product Type

- Equipment

- Welders

- Welding Jigs and Fixtures

- Auxiliary Equipment

- Others

- Consumables

- Stick Electrodes

- Solid Wires

- Flux-cored Wires

- SAW Wires & Fluxes

By Welding Type

- Arc

- TIG/GTAW

- MIG/GMAW

- Submerged Arc

- Shielded Metal Arc

- Others (Plasma Arc, Flux Cord)

- Resistance

- Spot

- Seam

- Others (Projection)

- Oxy-Acetylene Gas

- Solid State

- Others (Electron Beam)

By Application

- Automotive

- Building & Construction

- Heavy Engineering

- Railway & Shipbuilding

- Oil & Gas

- Others (Aerospace)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary applications of welding?

Welding is extensively used in industries such as automotive, building & construction, heavy engineering, railway & shipbuilding, and oil & gas.

What factors are driving the growth of the welding market?

Key drivers include rapid industrialization, infrastructure development, and the expansion of automotive and construction sectors.

What challenges does the welding industry face?

The industry faces challenges such as a shortage of skilled welders and health and safety concerns associated with welding processes.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]