Global Wax Emulsion Market Size, Share, Trends & Growth Forecast Report By Material Base (Synthetic, Natural), Type (Polyethylene, Paraffin, Carnauba, Polypropylene and Others), End User Industry (Paints & Coatings, Adhesives & Sealants, Cosmetics, Textiles, and Others), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

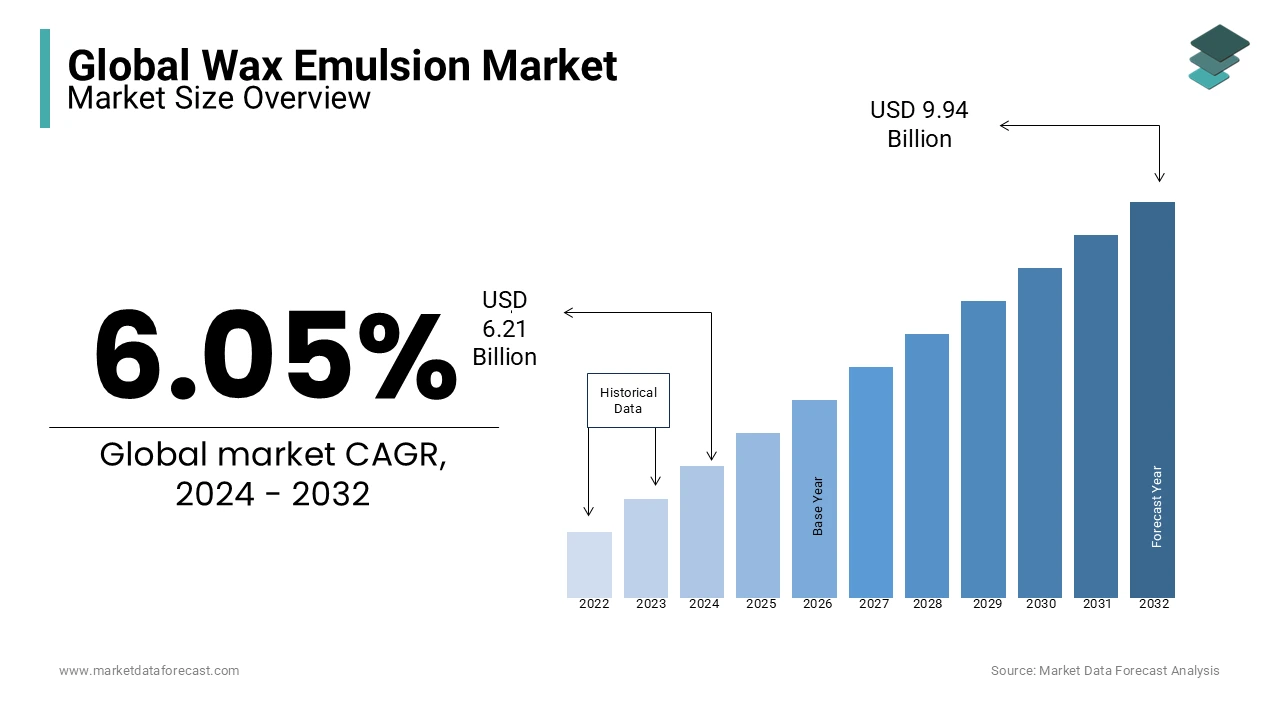

Global Wax Emulsion Market Size (2024 to 2032)

The size of the global wax emulsion market was valued at USD 5.86 billion in 2023. The global market is further estimated to grow from USD 6.21 billion in 2024 to USD 9.94 billion by 2032, growing at a CAGR of 6.05% from 2024 to 2032.

MARKET OVERVIEW

The Asia Pacific region is expected to grow the fastest. Recently, a study was conducted on water absorption & susceptibility of wood flour/polypropylene composites modified with silane–wax emulsions. Composites of wood plastics can act as a water-absorbing material for exterior applications due to the hygroscopicity of wood flour (WF). WF was immersed in silane, wax emulsion, and compound systems to modify it at various concentrations. The modified WF was mixed with polypropylene (PP) to prepare composites at a mass ratio of 6:4 (WF/PP). The test was carried out using Aspergillus Niger. The results showed that silane can enhance adhesion between WF & PP. Recently, a paper was published on novel nanostructured lipid carriers with photoprotective properties made from carnauba wax, beeswax, & kenaf seed oil. Stable kenaf seed oil‐nanostructured lipid carrier (KSO‐NLC) sunscreen can be used against the photoprotective effect. A study was conducted on the characterization of sodium caseinate/Hydroxypropyl methylcellulose concentrated emulsions & the effect of mixing ratio, concentration, and wax addition to the emulsions. Emulsion stability, particle size distribution, microstructure, and rheological properties were tested during the study. The experimental results showed that emulsion stability was improved significantly by increasing Hydroxypropyl methylcellulose (HPMC) concentration (p-value < 0.05). Concentrated emulsions stabilized by caseinate/Hydroxypropyl methylcellulose (HPMC) complex can be useful for application in specific food products such as heavy cream, mayonnaise, oleo gels, and pharmaceutical products.

MARKET DRIVERS & RESTRAINTS

The augmenting demand from end-use verticals like paints and coatings and adhesives and sealants is anticipated to fuel the expansion in the global wax emulsion market. Easy availability and cost-effective workmanship drive call for wax emulsions. The rising call for paints, printing inks, textiles, construction, cosmetics, coatings, floor varnishes, adhesives, sealants, and packaging will drive the global wax emulsion market. The properties of emulsified wax products, such as water resistance, abrasion resistance, anti-lock, chemical stability, and ecological nature, fuel their sales in different regions, which in turn stimulates the world market. The significant expansion of the paint and coating industry worldwide is likely to drive the expansion of the global wax emulsion market, as the process is expanding in paint and coating formulations. The place of solvents is generally considered high in volatile organic matter (VOC). In addition, the wax emulsion finds wide employment in textile manufacturing as an additive to impart softness to yarn, yarn, and possibly fabric; reduce cable breakage rate by providing lubrication; improves resistance when weaving fabrics; and serves as a protective agent for fabrics woven with anti-wrinkle fibers and free finish, among others.

The expansion of the global textile industry due to the escalating purchasing power of consumers and the evolution of lifestyle further stimulates the expansion of the world market for wax emulsions. The absence of a close substitute for the wax emulsion also stimulates the expansion of the product market. In addition, expanding the scope of wax emulsion applications in cosmetics and personal care products should boost players operating in the global wax emulsion market throughout the foreseen period. The escalating call for wax emulsion from various end-use businesses, such as adhesives and sealants, paints and coatings, textiles, cosmetics, and others, due to its strength-like properties. Abrasion, ease of employment, and anti-lock, is an important factor that is predicted to stimulate expansion in the target market. In addition, the escalating employment of paraffin wax emulsion in packaging and food applications, such as special decorative paper and cardboard boxes for transporting food, making cork stoppers, and the like, should stimulate expansion in the potential market in the coming years. In addition, the escalated call for wax emulsion in the wood industry for wood finishing and treatment, as it escalates physical stability and durability, is among other predicted factors for promoting the expansion of the target market.

Dow Chemical Company (United States of America) is one of the big market players in the wax emulsion market. It recently released ECOSURF. It is a series of nonionic surfactants which is of new-generation high-performance, readily biodegradable specialty surfactants that provide performance equal to alkylphenol ethoxylate (APE) surfactants and is better than primary alcohol ethoxylate (PAE) surfactants in several applications including hard surface cleaning, textile manufacturing & any application in which excellent wetting performance is required. Danquinsa GmbH (Germany) produces wax emulsions under the name EMULTROL,which is a mixture of silicone & wax emulsions mostly used for thermoplastic polyurethanes. Sasol Ltd. (South Africa) manufactures wax emulsions under the name of HYDROWAX 112. It is an anionic liquid emulsion used in wood treatment and impregnation.

MARKET OPPORTUNITIES

The escalating call for wax emulsion products, mainly in the construction businesses and developing regions, is helping the wax emulsion market to develop globally. The escalated call for wax emulsions is mainly due to the rise in construction activities in developing and underdeveloped countries and the lack of substitutes for wax emulsions that serve the same purpose. Other properties such as water resistance, abrasion resistance, slip control, lubrication, and anti-lock also drive call for wax emulsion worldwide. The escalating adoption of natural wax emulsion, the development of innovative and profitable products, and the escalating call of various end-use businesses in developing countries are other factors that should create opportunities for manufacturers and should escalate the expansion of the target market.

MARKET CHALLENGES

Rules on the utilization of wax emulsion in coating, packaging, and food applications are predicted to be a challenging factor hindering the expansion of the industry in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.05% |

|

Segments Covered |

By Material Base, Type, End-user, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

The Dow Chemical Company (United States of America), Exxon Mobile Corp. (United States of America), Momentive Performance Materials Inc. (United States of America), Lubrizol Corporation (United States of America), Danquinsa GmbH (Germany), Michelman Inc. (United States of America), Atlanta AG (Germany), BASF SE (Germany), Nippon Seiro Co., Ltd. (Japan), & Sasol Ltd. (South Africa) |

SEGMENTAL ANALYSIS

By Material Base Insights

The synthetic segment had the leading share of the global market in 2023. The synthetic wax emulsions were the most widely employed material for manufacturing. The availability of these products with varied properties makes it suitable for many applications, including paints and coatings, cosmetics, and construction. Expansion in these end-use businesses is predicted to drive expansion in the segment throughout the foreseen period.

By Type Insights

Polyethylene wax emulsion has been the prominent segment because of its affordable prices and easy access. This segment is predicted to experience the fastest expansion throughout the foreseen period. This expansion is mainly attributed to the increase in construction activities in emerging economies and the absence of a close substitute for wax emulsion. Physical attributes such as water repellency, abrasion resistance, slip control, lubrication, and anti-lock also contribute to the expansion of polyethylene as the most preferred material for the wax emulsion.

By End-user Insights

Paints and coatings contributed to the largest market share in 2019. Easy access, physical stability, and other properties have promoted the use of wax emulsions in the paint and coatings sector. However, the textile segment is predicted to grow at the highest rate in the foreseen period. Improving tear resistance, fabric softening, heat absorption, and reduced needle cut are some of the added benefits of using wax emulsion on textiles.

REGIONAL ANALYSIS

The Asia Pacific is the fastest-growing market both in terms of volume & size due to an increase in demand from the growing automobile & construction industries. India, China, Japan, Taiwan, and South Korea are some of the fastest-growing countries in the region. An improved economic condition and availability of cheap labor & raw material in the region have boosted the growth of the market.

KEY MARKET PLAYERS

The Dow Chemical Company (United States of America), Exxon Mobile Corp. (United States of America), Momentive Performance Materials Inc. (United States of America), Lubrizol Corporation (United States of America), Danquinsa GmbH (Germany), Michelman Inc. (United States of America), Atlanta AG (Germany), BASF SE (Germany), Nippon Seiro Co., Ltd. (Japan), Sasol Ltd. (South Africa) are some of the notable companies in the global Wax Emulsion market.

MARKET SEGMENTATION

This research report on the global wax emulsion market has been segmented and sub-segmented based on type, product, and region.

By Material Base

- Natural base wax emulsion

- Synthetic base wax emulsion

By Type

- Polyethylene

- Polypropylene

- Paraffin

- Carnauba

- Beeswax

- Montan

- Microcrystalline

- Fischer Tropsch

- Fatty acid amine

By End-user

- Paints and coatings

- Adhesives and sealants

- Cosmetics

- Textiles

- Automotive

- Leather

- Packaging

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]