Global Water Purifier Market Size, Share, Trends, & Growth Forecast Report - Segmented By Technology (Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Purifiers, Water Softeners and Others), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Water Purifier Market Size

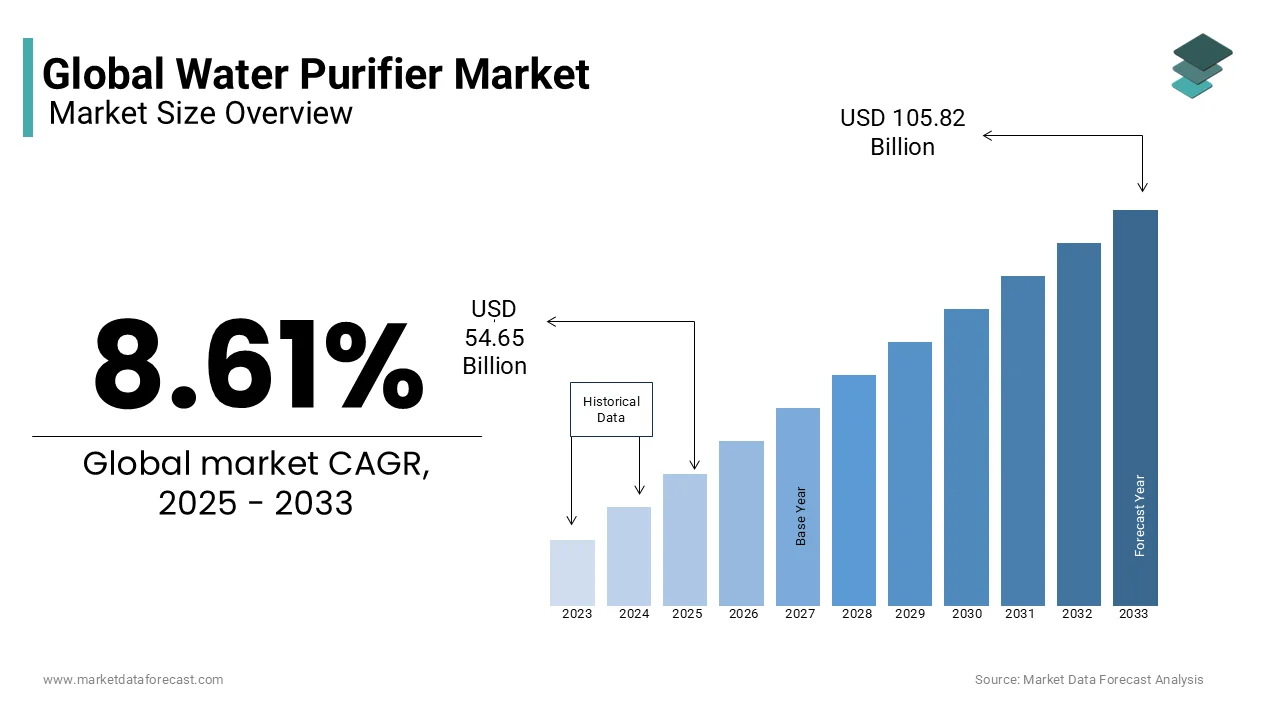

The global water purifier market size was valued at USD 50.32 billion in 2024, and the global market size is expected to reach USD 105.82 billion by 2033 from USD 54.65 billion in 2025. The market's promising CAGR for the predicted period is 8.61%

The water purifier market provides solutions to make water safe for drinking and other uses. Water purifiers remove harmful contaminants like bacteria viruses and chemicals from water. This is important because many people around the world do not have access to clean water. The World Health Organization says that over two billion people use drinking water sources contaminated with feces. This makes water purifiers essential for protecting health especially in areas with poor water quality.

The demand for water purifiers is rising because of increasing pollution and awareness about health. Many cities face problems like industrial waste and pesticides entering water supplies. For example, the United Nations reports that 80 percent of wastewater flows back into the environment without proper treatment. This has led to more households and businesses buying water purifiers. Advanced technologies like UV filtration RO reverse osmosis and activated carbon are becoming popular because they offer better purification.

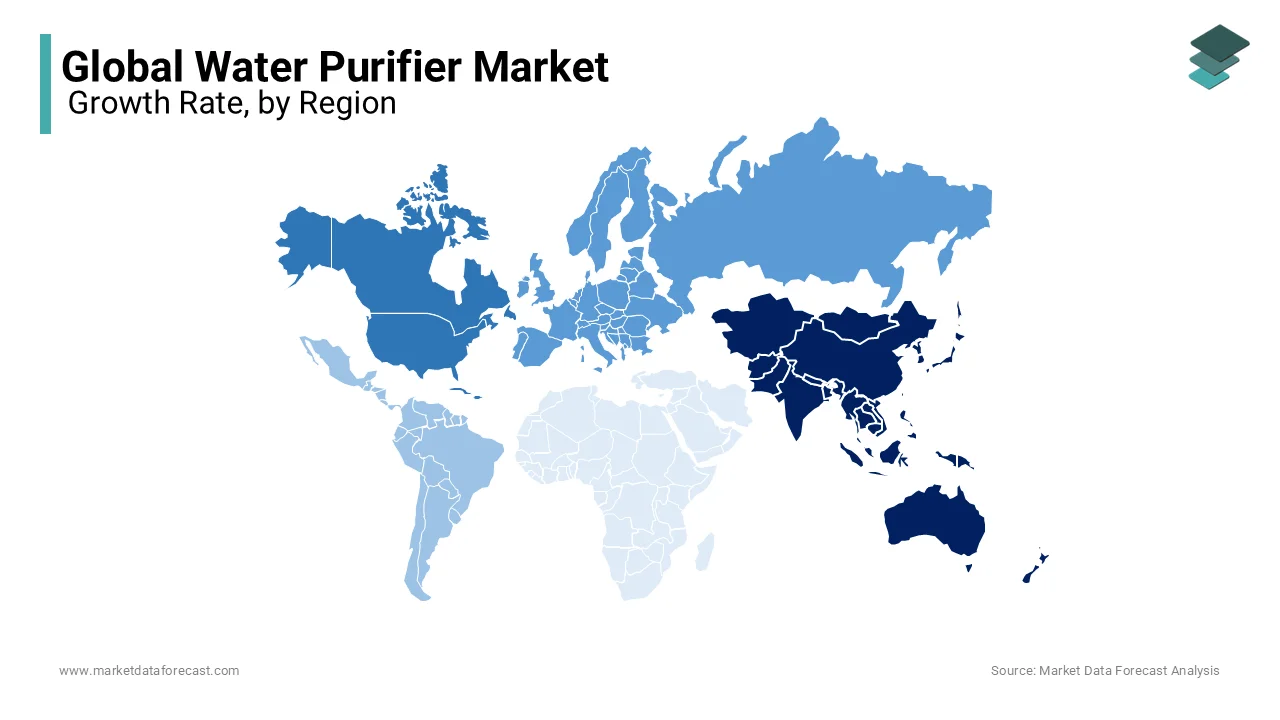

In terms of regions Asia-Pacific is the largest market for water purifiers. This is because countries like India and China face serious water contamination issues. The Food and Agriculture Organization states that agriculture uses 70 percent of freshwater which often gets polluted with fertilizers and pesticides. Urbanization is also driving demand as more people move to cities where clean water supply is a challenge.

The water purifier market is expected to grow further as governments and companies focus on clean water solutions. With rising health awareness and stricter water safety rules this market will play a key role in ensuring safe drinking water for all.

MARKET DRIVERS

Increasing Water Pollution

Rising water pollution fuels the water purifier market as contaminants endanger health. The U.S. EPA reports 50% of U.S. rivers are impaired by pollutants like nitrogen which is affecting aquatic life and drinking sources. The United Nations states 80% of global wastewater is untreated, releasing toxins like mercury, impacting 140 million people yearly per WHO data. This degradation, driven by industrial and agricultural runoff, heightens purification demand. The World Bank notes that 1.8 billion people use fecally contaminated water, pushing reliance on purifiers to mitigate risks like cholera, ensuring safe consumption amid worsening pollution.

Growing Population Pressure

Population growth drives water purifier demand by straining freshwater availability. The United Nations forecasts a 9.7 billion global population by 2050, with 70% urbanized, escalating water use. The U.S. Census Bureau reports U.S. urbanites use 110 gallons daily per person, stressing supply systems. WHO data shows 2.2 billion people lack safe drinking water, a crisis worsened by population surges. The World Bank estimates 40% of global food production depends on stressed water resources, amplifying purification needs. As natural sources dwindle, purifiers become essential for households and industries to secure clean water.

MARKET RESTRAINTS

High Installation and Maintenance Costs

Costly installation and maintenance limit water purifier uptake, especially in poorer regions. The U.S. EPA estimates advanced systems cost $800-$2,000 initially, with $150-$400 yearly upkeep. The World Bank reports 689 million people live below $2.15 daily, rendering these unaffordable. WHO data indicates 2 billion lack basic water services, often due to financial constraints. The United Nations notes 1.4 billion lack electricity access, complicating powered purifier use. High expenses deter adoption where need is greatest, stalling market growth despite rising contamination threats.

Lack of Awareness in Rural Areas

Rural unawareness hampers the water purifier market as risks are underestimated. WHO states 771 million people lack basic water access, mostly rural. The U.S. Census Bureau finds rural U.S. water treatment lags urban by 15%, reflecting awareness gaps. The United Nations reports 43% of rural sub-Saharan Africans lack sanitation education, correlating with low purifier uptake. The World Bank notes 60% of rural developing-world households rely on unimproved water, unaware of health threats like typhoid. This knowledge deficit curbs demand, restricting market expansion in vulnerable regions.

MARKET OPPORTUNITIES

Government Initiatives for Clean Water

Government efforts bolster water purifier market growth through funding and awareness. The U.S. EPA invested $5.8 billion in 2023 for water infrastructure, per federal records. The United Nations targets universal water access by 2030, with $150 billion yearly global investment. WHO estimates $1 in water sanitation yields $4 in health benefits, spurring initiatives like India’s $50 billion Jal Jeevan Mission. The World Bank notes 25 million gained water access in 2022 via such programs, expanding purifier markets by reducing costs and promoting adoption.

Technological Advancements

Innovative technologies enhance water purifier market potential by improving efficiency. The U.S. Department of Energy reports a 25% rise in smart appliance use since 2020, including IoT purifiers. WHO confirms modern UV systems eliminate 99.99% of pathogens, per lab studies. The United Nations states 1.8 million rural homes got electricity in 2023, enabling purifier use. The World Bank notes 10% annual growth in nanotechnology filtration patents, enhancing portability and effectiveness. These advancements attract consumers, broadening market reach with sustainable, high-performance solutions.

MARKET CHALLENGES

Infrastructure Limitations

Poor infrastructure challenges the water purifier market is hindering deployment. The United Nations reports 2.1 billion lack reliable water systems, disrupting supply for purification. The U.S. EPA logs 250,000 annual U.S. water main breaks, delaying access. The World Bank states 41% of sub-Saharan Africa lacks electricity, per 2023 data, limiting powered purifiers. WHO notes 1 billion rural dwellers fetch water over 30 minutes away, reducing purifier feasibility. Weak networks stall market growth where clean water is most critical.

Environmental Impact of Waste

Purifier waste like filters challenges market growth with ecological concerns. The U.S. EPA estimates 14 million tons of U.S. plastic waste yearly, including purifier components. The United Nations reports 9 million tons pollute oceans annually, partly from water treatment. WHO warns microplastics from disposal affect 320 million people via water, per 2022 studies. The World Bank notes 20% of landfill waste in developing nations is recyclable, yet unprocessed. This environmental cost pressures sustainable innovation, raising production complexity and costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.61% |

|

Segments Covered |

By Technology, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kent RO Systems, Aquatech International LLC, LG, Whirlpool, 3M, Eureka Forbes Ltd, Unilever Pure it, Panasonic and Mitsubishi |

SEGMENTAL ANALYSIS

By Technology Insights

The RO Purifiers led the market with a 53.7% share in 2024. They excel by removing 99% of contaminants including lead and bacteria as confirmed by the U.S. EPA. The WHO notes 829,000 annual deaths from waterborne diseases which is emphasizing RO’s role in safe water provision. Urban growth drives demand, with the United Nations projecting 68% of people in cities by 2050. The U.S. Geological Survey estimates 45% of U.S. tap water contains PFAS, reinforcing RO’s necessity. Their advanced filtration ensures health safety, making them the preferred choice globally.

The UV Purifiers segment is the fastest-growing segment with a 9.5% CAGR over the forecast period. They disinfect efficiently as well as neutralizing 99.99% of pathogens without chemicals, per the U.S. EPA. The CDC reports unsafe water causes 485,000 diarrheal deaths yearly is showcases UV’s importance. WHO data shows 2 billion people use contaminated water, boosting demand for eco-friendly solutions. UV systems’ low energy use and smart technology integration appeal to consumers, with the U.S. Department of Energy noting a 15% rise in energy-efficient appliance adoption since 2020. Their growth shows a shift toward sustainable purification which is addressing global health and environmental needs effectively.

By End-User Insights

The Household segment commanded a 58.7% market share in 2024. Rising health concerns drive its dominance, with WHO reporting 1.7 billion annual cases of waterborne diarrhea. The U.S. EPA states 70% of U.S. households use water treatment due to quality issues. Urbanization fuels growth, as the United Nations predicts 68% of the world’s population will be urban by 2050. The U.S. Census Bureau notes 300 gallons of daily water use per average American family, underscoring purification needs. This segment’s dominance reflects its critical role in ensuring safe drinking water at home.

The Industrial segment is rising quickly with a 10.6% CAGR over the forecast period. Strict regulations and water reuse needs propel it, with the U.S. EPA reporting 34 billion gallons of wastewater treated daily in the U.S. The United Nations estimates 80% of global wastewater is untreated, increasing purifier demand in industries like manufacturing. The World Bank records a 3.5% annual rise in industrial output and is amplifying water quality needs. In 2023, the U.S. Department of Commerce noted a 12% increase in industrial water recycling investments. This growth exhibits its importance for compliance and sustainable resource management amid rising industrial activity.

By Distribution Channel Insights

The Retail Stores segment dominated the market by having a 64.8% share in 2024. Consumers favor in-store purchases for tangible evaluation, with the U.S. Census Bureau reporting $1.58 trillion in retail sales for durable goods in 2023. The World Bank estimates 60% of global consumers prefer offline shopping for high-value items like purifiers. The U.S. EPA notes 45% of U.S. tap water has contaminants, driving in-store demand for trusted solutions. Retail’s lead stems from offering hands-on access and expert advice which is vital for addressing water safety concerns effectively in households and businesses.

The Online Stores segment stands as the rapidly expanding with a 12.3% CAGR. E-commerce expansion fuels this segment with the U.S. Census Bureau reporting $870 billion in online sales in 2023, up 7.6% from 2022. WHO’s 829,000 annual water-related deaths sheds light on purification needs, met by online accessibility. The U.S. Department of Commerce reports a 20% rise in online appliance sales since 2021, reflecting shifting preferences. This channel’s importance lies in meeting urgent demand with competitive pricing and broad reach, transforming water purifier access.

REGIONAL ANALYSIS

Asia-Pacific dominated the water purifier market with a 38.9% share in 2024. This comes from a huge population and severe water pollution. The World Health Organization states 1.8 billion people globally lack safe water, with Asia-Pacific most affected. India’s Ministry of Jal Shakti reports 70% of its surface water is contaminated, driving purifier demand. Over 600 million people face high water stress, per the United Nations and is fueling market growth. Rapid urbanization and rising health awareness make Asia-Pacific vital, as millions seek clean water solutions to combat widespread waterborne diseases.

North America’s water purifier market stood as the fastest grow, with a CAGR of 7.5% from 2025-2033. Rising water quality concerns and tech advancements drive this surge. The U.S. Environmental Protection Agency notes 40 million Americans used contaminated water in 2022, boosting purifier use. The U.S. Census Bureau confirms 90% of households used filters in 2023, a record. Government initiatives, like the EPA’s $4 billion clean water plan, accelerate adoption. Health-focused consumers and innovation make North America key, with demand soaring as aging infrastructure fails to ensure safe water.

Europe’s water purifier market will grow steadily in coming years owing to strict regulations and health awareness. Eurostat reports 85% of Europeans have safe water access, yet 20% of groundwater bodies are polluted, per the European Environment Agency. Rising concerns over microplastics and nitrates push purifier use. The EU’s Drinking Water Directive mandates quality, increasing demand. Germany and France lead with 15% annual purifier sales growth, per government data. Europe’s focus on sustainability and advanced filtration tech ensures consistent market expansion as consumers prioritize safe, clean drinking water.

Latin America’s water purifier market will expand as urbanization rises. The World Bank states 82% of its population is urban, straining water systems. The Pan American Health Organization reports 34 million lack safe water, driving demand. Brazil’s Ministry of Health notes 20% of hospitalizations stem from waterborne diseases, spurring purifier adoption. Government investments, like Mexico’s $1 billion water program, boost growth. The region’s middle class grows with 60% seeking clean water solutions, per UN data. Latin America promises steady market gains as infrastructure improves.

The Middle East and Africa’s water purifier market will see moderate growth due to scarcity. UNESCO reports 400 million Africans lack safe water, while the United Nations notes 70% of the Middle East faces water stress. Saudi Arabia’s Vision 2030 aims to purify 90% of water by 2030, per government plans. The WHO estimates 50 million face waterborne diseases yearly, increasing purifier needs. Investments in desalination and filtration rise, with $5 billion pledged by 2025, per World Bank. Growth will be steady, addressing critical water challenges.

KEY MARKET PLAYERS

Companies playing a major role in the global water purifier market include Kent RO Systems, Aquatech International LLC, LG, Whirlpool, 3M, Eureka Forbes Ltd., Unilever Pure it, Panasonic, and Mitsubishi. The major market participants are using new ideas and products and purchasing small-scale suppliers and manufacturers to enhance their stability in the market and remain competitive in the industry.

The water purifier market is highly competitive. This competition is driven by the growing need for clean and safe drinking water around the world. Key players like Pentair, 3M, and Culligan are leading the market, but smaller companies are also trying to make their mark. These companies focus on offering advanced technologies, such as reverse osmosis (RO), ultraviolet (UV) purification, and smart filtration systems, to attract customers.

Moreover, companies use different strategies. One common approach is innovation. They invest in research to create better and more efficient products. For example, smart water purifiers that connect to phones allow users to monitor water quality in real time. Another strategy is expanding into new markets, especially in developing countries where water pollution is a big problem. Companies also buy smaller firms or partner with local businesses to grow faster.

Despite the competition, customer trust plays a big role. People want reliable products that are easy to use and affordable. As a result, companies focus on quality and after-sales services, like filter replacements and maintenance.

TOP 3 PLAYERS IN THE MARKET

Pentair plc

Pentair plc is one of the leading players in the global water purifier market, known for its innovative and sustainable water solutions. The company has established a strong presence across North America, Europe, and Asia-Pacific, driven by its focus on advanced filtration technologies and energy-efficient products. Pentair's growth strategy revolves around expanding its product portfolio through acquisitions and partnerships, such as its acquisition of Pelican Water Systems, which strengthened its position in the residential water treatment segment. The company’s contribution to the global water purifier market includes the development of smart water purification systems that integrate IoT technology, enabling real-time monitoring and optimization of water usage. Pentair’s commitment to sustainability and water conservation has further enhanced its reputation, making it a key driver of innovation in the market. Its emphasis on addressing water scarcity challenges through cutting-edge solutions positions Pentair as a critical player shaping the future of the global water purifier market.

3M Company

3M Company is another major contributor to the global water purifier market, leveraging its expertise in materials science and filtration technologies. The company offers a wide range of water purification solutions, including point-of-use (POU) and point-of-entry (POE) systems, catering to both residential and commercial customers. 3M’s growth in this market is fueled by its ability to develop high-performance filtration systems that remove contaminants such as lead, chlorine, and microorganisms, ensuring safe and clean drinking water. A significant factor contributing to 3M’s success is its focus on R&D, which has led to innovations like the 3M™ High Flow Series and ScaleGard™ Blend systems, designed for industrial and foodservice applications. Additionally, 3M has expanded its market reach through strategic collaborations and investments in emerging markets, particularly in regions facing severe water quality issues. By addressing diverse customer needs with reliable and efficient products, 3M continues to play a pivotal role in advancing the global water purifier market and improving access to clean water worldwide.

Culligan International Company

Culligan International Company is a prominent name in the global water purifier market, renowned for its comprehensive range of water treatment solutions tailored to residential, commercial, and industrial sectors. With a history spanning over eight decades, Culligan has built a robust global footprint, operating in more than 90 countries. The company’s growth is driven by its focus on delivering customized water purification systems, including reverse osmosis (RO), ultraviolet (UV), and ion exchange technologies, to meet specific regional water quality challenges. Culligan’s contributions to the market include pioneering advancements in water softening and filtration systems, which have set industry benchmarks for efficiency and performance. The company also emphasizes sustainability by promoting water conservation and reducing plastic waste through reusable water bottles and filtration systems. Furthermore, Culligan’s expansion into digital platforms, such as its smart home water monitoring solutions, reflects its commitment to staying ahead of technological trends. By combining innovation, reliability, and customer-centric approaches, Culligan has solidified its leadership position in the global water purifier market while continuing to address the growing demand for clean and safe water.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Technological Advancements

One of the most critical strategies adopted by key players in the water purifier market is continuous product innovation and the integration of advanced technologies. Companies like Pentair, 3M, and Culligan are investing heavily in research and development (R&D) to introduce cutting-edge filtration systems that address emerging water quality challenges. For instance, the incorporation of IoT-enabled smart water purifiers allows users to monitor water quality and filter performance in real-time, enhancing convenience and efficiency. Additionally, advancements in reverse osmosis (RO), ultraviolet (UV), and nanotechnology-based purification systems have enabled these companies to offer highly efficient solutions that remove contaminants such as heavy metals, bacteria, and viruses. By focusing on innovation, these players not only differentiate themselves from competitors but also cater to evolving consumer preferences for smarter, more sustainable, and health-focused products.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are another major strategy employed by leading companies to strengthen their position in the water purifier market. For example, Pentair has expanded its portfolio through acquisitions like Pelican Water Systems, which enhanced its offerings in whole-house water filtration and salt-free softening systems. Similarly, 3M has collaborated with regional distributors and technology providers to penetrate untapped markets and enhance its global reach. These strategic moves allow companies to leverage complementary strengths, access new customer segments, and accelerate their growth in emerging economies. Partnerships with local governments and NGOs are also common, enabling companies to address water scarcity issues in underserved regions while building brand credibility. By consolidating resources and expertise, these companies can scale their operations and maintain a competitive edge in an increasingly crowded market.

Expansion into Emerging Markets

Key players in the water purifier market are actively expanding their presence in emerging markets to capitalize on growing demand for clean water solutions. Regions such as Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization, industrialization, and increasing awareness about waterborne diseases, creating significant opportunities for growth. Companies like Culligan and 3M are establishing manufacturing facilities, distribution networks, and service centers in these regions to ensure accessibility and affordability of their products. Additionally, they are tailoring their offerings to meet local water quality challenges, such as high levels of arsenic or fluoride contamination in certain areas. This localization strategy not only helps companies tap into new revenue streams but also strengthens their brand loyalty among consumers. By addressing the unique needs of emerging markets, these players are positioning themselves as global leaders in providing sustainable and scalable water purification solutions.

RECENT HAPPENINGS IN THE MARKET

-

In December 2019, Kent RO Systems said in a report that they are planning to invest more than USD 19 million for the next three years to increase their annual capacity by 0.4 million units by developing a new manufacturing unit to double the revenue.

- In April 2019, Culligan International introduced the ClearLink Connect as well as Drinking Water Connect accessories. Culligan International introduced the ClearLink Connect and Drinking Water Connect accessories in April 2019. Using a smartphone app and Wi-Fi, these innovative accessories may be linked to drinking water systems. This allows the consumer to regularly keep track of both the economic and technical functioning of drinking water systems.

MARKET SEGMENTATION

This research report on the global water purifier market has been segmented and sub-segmented based on technology, end-user, distribution channel, and region.

By Technology

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Purifiers

- Water Softeners

- Others

By End-User

- Industrial

- Commercial

- Household

By Distribution Channel

- Retail Stores

- Direct Sales

- Online Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What is the projected market size of the Global Water Purifier Market?

The market is expected to reach USD 105.82 billion by 2033, growing from USD 54.65 billion in 2025 at a CAGR of 8.61% from 2025 to 2033.

2. What are the key challenges faced by the Global Water Purifier Market?

The market faces challenges such as high initial costs, frequent maintenance requirements, competition from bottled water, and regulatory compliance for water filtration technologies.

3. What factors are driving the demand for water purifiers globally?

The demand is driven by increasing water contamination concerns, health consciousness among consumers, technological advancements in filtration systems, and growing urbanization.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]