Global Water Pumps Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Centrifugal Pump, Reciprocating Pump, and Rotary Pump), Application (Oil and Gas and Refining, Chemical, Water and Wastewater, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Water Pumps Market Size

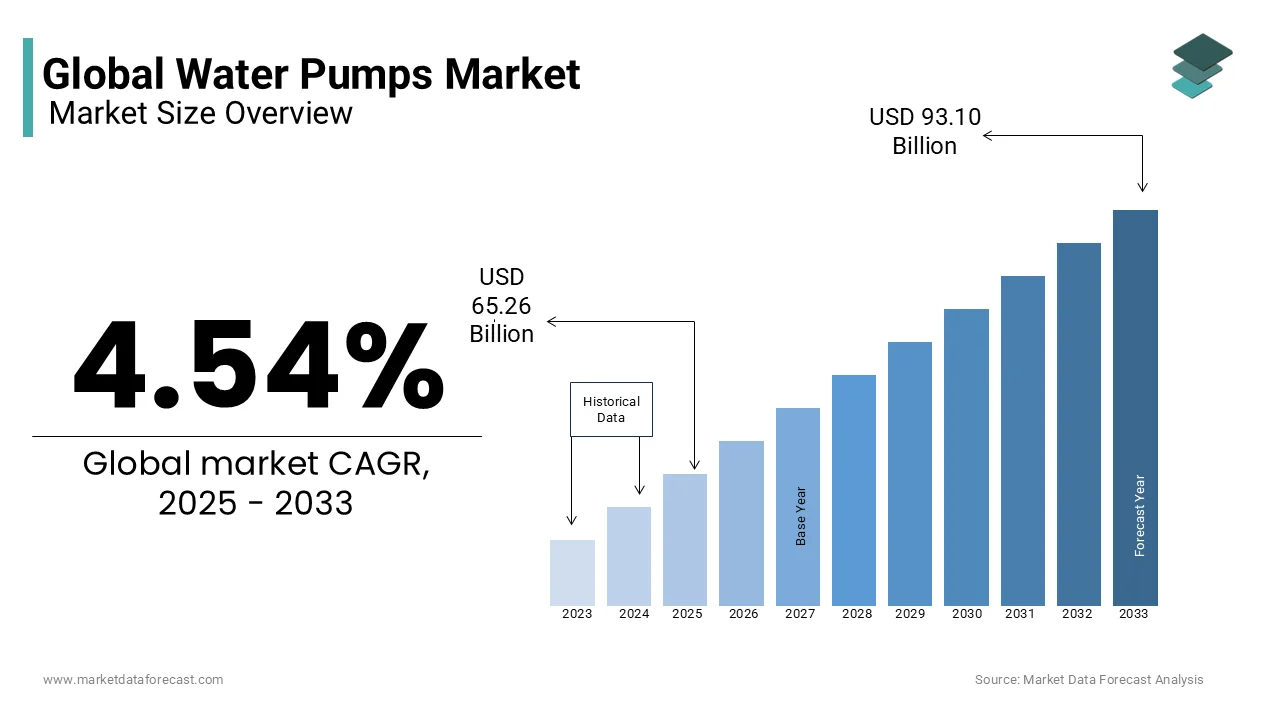

The global water pumps market was worth USD 62.43 billion in 2024. The global market is projected to reach USD 93.10 billion by 2033 from USD 65.26 billion in 2025, rising at a CAGR of 4.54% from 2025 to 2033.

The global water pumps involves efficient water management across residential, commercial, industrial, and agricultural sectors. These pumps are mechanical devices designed to transfer water from one location to another, supporting applications such as irrigation, wastewater treatment, desalination, flood control, and industrial processes. In an era defined by escalating water scarcity, urbanization, and climate change, the demand for advanced, energy-efficient, and sustainable water pump solutions has surged. The World Health Organization estimates that over two billion people globally lack access to safely managed drinking water services, spotlighting the critical need for robust water distribution systems. This pressing issue has positioned the water pumps market as a key player in addressing global water security challenges.

The market is characterized by rapid technological advancements, including IoT-enabled smart pumps, energy-efficient designs, and renewable energy integration which are transforming traditional pumping systems. According to the U.S. Department of Energy, water-related energy consumption accounts for approximately 4% of global electricity usage, underscoring the importance of developing energy-efficient solutions. Additionally, the rising adoption of desalination technologies has created significant demand for specialized pumps. The International Desalination Association reports that desalination plants now supply water to over 300 million people worldwide, driving growth in high-pressure and corrosion-resistant pump applications.

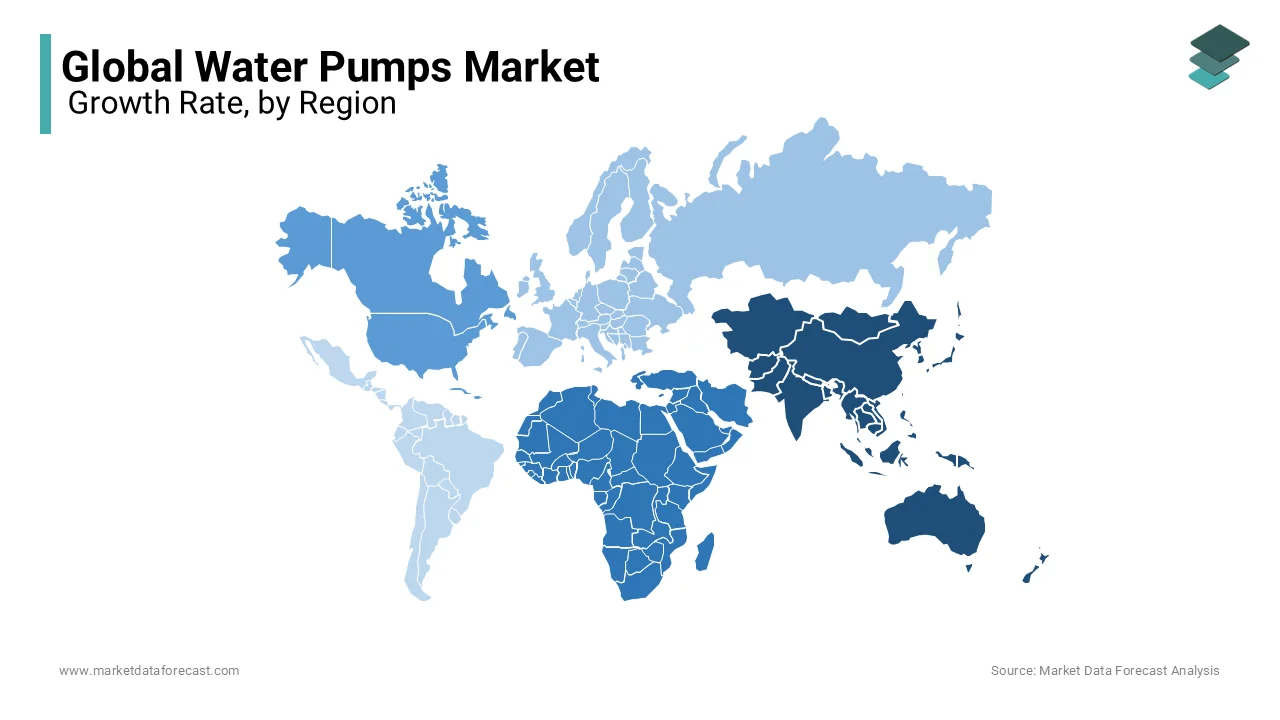

Geographically, the Asia-Pacific region leads the market due to rapid urbanization and industrialization, while regions like the Middle East and Africa exhibit strong growth potential driven by water scarcity and infrastructure development. Collectively, these factors underscore the water pumps market's pivotal role in addressing global water challenges while fostering economic and environmental sustainability.

MARKET DRIVERS

Escalating Global Water Scarcity

Water scarcity boosts water pump demand as populations struggle for access. The United Nations estimates 2.2 billion people lack safely managed drinking water, necessitating efficient pumping systems. The World Health Organization forecasts that by 2025, 1.8 billion people will face absolute water scarcity, driving investments in extraction technologies. In the U.S., the Environmental Protection Agency reports 40 out of 50 states expect water shortages by 2030 due to climate change. This pressing need accelerates pump deployments for moving water from dwindling sources to urban and agricultural areas, bolstering market growth as governments and industries prioritize sustainable water solutions.

Rising Industrialization and Infrastructure Development

Industrial growth and infrastructure projects fuel water pump demand for water management. The U.S. Census Bureau recorded $1.92 trillion in construction spending in 2023, draws attention on the projects needing pumps for supply and drainage. The United Nations Industrial Development Organization notes industrial water use constitutes 22% of global consumption, with Asia’s manufacturing growing 6.8% yearly. The U.S. Department of Energy states industrial facilities used 31.8 billion gallons of water daily in 2022, relying on pumps for processing and cooling. This surge in industrial and infrastructural activity drives consistent market expansion as pumps become integral to operational efficiency.

MARKET RESTRAINTS

High Energy Consumption Costs

Energy-heavy water pumps face adoption barriers due to escalating costs. The U.S. Energy Information Administration reports industrial electricity prices hit 7.54 cents per kilowatt-hour in 2023, up 5.2% from 2022, burdening pump users. The International Energy Agency estimates pumping systems account for 20% of global electricity use, deterring uptake in budget-constrained regions. The U.S. Department of Agriculture states irrigation pumps consume 13% of farm energy, with rising costs impacting profitability. This energy dependency restricts market growth as operators seek cheaper alternatives despite water management needs.

Stringent Environmental Regulations

Tough environmental laws limit the water pumps market by raising compliance costs. The U.S. Environmental Protection Agency aims to cut water system energy use by 15% by 2030, pushing manufacturers to redesign pumps. The United Nations Environment Programme states 80% of global wastewater is untreated, prompting strict rules like the EU’s Water Framework Directive. The U.S. Department of the Interior allocated $1.66 billion in 2023 for water efficiency projects, increasing production expenses as firms adapt to eco-standards. These regulations slow market growth by complicating pump design and deployment.

MARKET OPPORTUNITIES

Adoption of Renewable Energy-Powered Pumps

Renewable energy integration opens growth paths for water pumps, supporting sustainability. The International Renewable Energy Agency reports global solar capacity hit 1,052 gigawatts in 2023, powering solar pumps widely. The U.S. Department of Energy notes renewables generated 21% of U.S. electricity in 2022, aiding off-grid pump solutions. India’s Ministry of New and Renewable Energy states 500,000 solar pumps were installed by 2023, saving 2.5 billion liters of diesel yearly. This trend enhances market prospects as regions embrace green pump technologies.

Expansion of Wastewater Treatment Infrastructure

Rising wastewater treatment needs boost pump demand for infrastructure upgrades. The U.S. Environmental Protection Agency estimates a $271 billion investment is required over 20 years to improve wastewater systems, relying on pumps. The World Bank reports only 56% of urban wastewater is treated globally, with 3.2 billion people lacking sanitation in 2022. The U.S. Bureau of Reclamation invested $1 billion in 2023 for water recycling, heavily utilizing pumps. This focus on sanitation and pollution control expands market opportunities as treatment facilities grow.

MARKET CHALLENGES

Aging Water Infrastructure

Old water systems hinder the water pumps market by reducing efficiency. The American Society of Civil Engineers reports U.S. water infrastructure loses 6 billion gallons daily to leaks, earning a C- grade in 2021. The World Bank estimates global water loss at 32 billion cubic meters annually due to aging pipes, undermining pump performance. The U.S. Environmental Protection Agency projects a $743 billion need by 2040 to update systems, straining funds and delaying pump integration. This outdated infrastructure limits market progress significantly.

Skilled Labor Shortages

A shortage of skilled workers slows water pump deployment and upkeep. The U.S. Bureau of Labor Statistics notes a 7% drop in skilled trade workers from 2010 to 2020, with 41% over 45 nearing retirement. The International Labour Organization projects a need for 60 million skilled workers by 2030 to support infrastructure. The U.S. Department of Labor reported an 80,000-plumber shortage in 2023, critical for pump systems, raising costs and delays. This labor gap challenges market scalability severely.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.54% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Gardner Denver, Torishima Pump Mfg. Co., Ltd., General Electric Company, The Weir Group Plc, Weatherford International Ltd., ITT Inc., PROCON Products, KSB Group, Kirloskar Brothers Limited, and Sulzer Ltd. |

SEGMENT ANALYSIS

By Type Insights

The Centrifugal pumps segment dominated the water pumps market by holding 65.7% of the global market share in 2024 due to their versatility and efficiency in handling large volumes of water. For instance, centrifugal pumps are widely used in irrigation systems, which account for nearly 70% of global freshwater withdrawals , as stated by the United Nations Food and Agriculture Organization (FAO). These pumps are cost-effective, easy to maintain, and capable of operating in both low- and high-pressure environments, making them ideal for applications like agriculture, municipal water supply, and wastewater management. Their widespread adoption ensures their continued dominance in the market.

On the other hand, the Rotary pumps segment is projected to grow at the fastest rate with a CAGR of 7.8% from 2025 to 2033. This growth is driven by increasing demand in industries such as oil and gas, where rotary pumps are essential for transferring viscous fluids like crude oil. The U.S. Energy Information Administration (EIA) reports that global crude oil production reached 84 million barrels per day in 2023 , displaying the need for reliable pumping solutions. Additionally, rotary pumps are gaining traction in pharmaceuticals and food processing due to their precision in handling delicate fluids. Their compact design, low maintenance requirements, and ability to handle high-viscosity materials make them increasingly popular in niche industrial applications.

By Application Insights

The water and wastewater segment captured the biggest share of the market at 40% in 2023 , according to data from the World Health Organization (WHO) . This dominance is attributed to rising urbanization and the need for clean water access. WHO estimates that over 2 billion people globally lack access to safe drinking water , underscoring the critical role of water pumps in treatment plants. Furthermore, the U.S. Environmental Protection Agency (EPA) states that wastewater treatment facilities consume about 3% of total U.S. electricity usage , emphasizing the importance of efficient pumping systems. This segment’s significance lies in its contribution to public health infrastructure and environmental sustainability.

The oil and gas and refining segment is expected to grow at the highest rate with a CAGR of 8.2% during the forecast period. This expansion is influenced by rising energy demands and increased exploration activities. The IEA notes that global energy consumption grew by 2.3% in 2023 , driven by emerging economies like India and China. Additionally, the American Petroleum Institute states that the U.S. alone accounts for 18% of global oil production , creating significant demand for high-pressure pumps in refineries. The segment’s importance lies in supporting energy security and enabling efficient resource extraction and processing.

REGIONAL ANALYSIS

Asia-Pacific was the largest region in the water pumps market and held 40.1% of the global market share in 2024. This dominance is driven by rapid urbanization, particularly in China and India. The United Nations Department of Economic and Social Affairs (UN DESA) states that the region accounts for 60% of global urban population growth , increasing demand for water supply systems. Agriculture also plays a key role, consuming 70% of freshwater withdrawals , according to the Food and Agriculture Organization (FAO) . Investments in smart irrigation and wastewater management further boost pump adoption. Asia-Pacific’s prominence shows its critical role in addressing water scarcity and infrastructure challenges.

The Middle East and Africa are projected to grow at the fastest rate with a CAGR of 9.5% from 2025 to 2033. This growth is fueled by rising investments in desalination plants, where the Middle East holds 50% of global capacity , according to the International Desalination Association (IDA). Additionally, the World Health Organization (WHO) estimates that over 40% of Africans lack access to clean water , driving demand for affordable water solutions. Governments and private players are increasingly adopting renewable energy-powered pumps for sustainability. These factors make the region pivotal for future market expansion and addressing water accessibility challenges effectively.

North America is a mature market for water pumps, driven by aging infrastructure and stringent environmental regulations. The U.S. Environmental Protection Agency (EPA) estimates that $472 billion is needed to repair and upgrade water infrastructure by 2030, creating significant demand for advanced pumping systems. Additionally, the region is focusing on energy-efficient solutions, with the Department of Energy (DOE) promoting smart water technologies to reduce energy consumption. Urbanization and industrial growth in the U.S. and Canada further drive adoption. North America’s emphasis on sustainability and innovation ensures steady demand for water pumps in residential, commercial, and industrial applications.

Europe faces growing water stress, with the European Environment Agency (EEA) reporting that 11% of the population is affected by water scarcity. This has increased the adoption of water pumps for efficient water management and wastewater treatment. Stringent environmental regulations, such as the EU Water Framework Directive, mandate sustainable water practices, boosting demand for eco-friendly pumps. Investments in renewable energy-powered systems and smart irrigation are also rising. Europe’s focus on reducing carbon footprints and improving water infrastructure ensures consistent growth in pump adoption across municipal, agricultural, and industrial sectors.

Latin America holds immense potential for water pump adoption due to rapid urbanization and agricultural expansion. As per the Inter-American Development Bank (IDB), the region accounts for 31% of global freshwater resources , yet inefficient water management remains a challenge. Governments are investing in modern irrigation systems and desalination plants to address water accessibility issues. For example, Brazil and Mexico are adopting solar-powered pumps to support rural agriculture. Rising industrial activities and infrastructure development further drive demand. Latin America’s focus on improving water efficiency positions it as a key contributor to the global water pumps market.

TOP 3 PLAYERS IN THE MARKET

Grundfos

Grundfos is one of the largest and most innovative manufacturers of water pumps globally, holding a notable portion of the global water pumps market. With a revenue of approximately $4.5 billion in 2022, Grundfos has established a strong presence in Europe, North America, and Asia-Pacific. The company focuses on sustainability and energy efficiency, committing to achieving carbon neutrality by 2030. In June 2023, Grundfos announced a $120 million investment to expand its manufacturing facilities in India, targeting urban water supply and wastewater management. Grundfos has also pioneered IoT-enabled smart pumps through its iSOLUTIONS platform, offering real-time monitoring, predictive maintenance, and remote control capabilities. Its contributions to the global water pumps market include addressing water scarcity, promoting energy-efficient solutions, and advancing smart water management technologies. Grundfos’ products are widely used in agriculture, desalination, wastewater treatment, and building services, making it a cornerstone of global water infrastructure.

Xylem Inc.

Xylem Inc. is a leading provider of water technology solutions, including water pumps, treatment systems, and analytics platforms, with a market share of approximately 10-15%. Generating $6.2 billion in revenue in 2022, Xylem has a strong presence in North America, Europe, and Asia. The company has pursued aggressive growth strategies, such as acquiring Fluid Handling Systems, a U.S.-based startup specializing in AI-driven pump optimization software, for $180 million in March 2023. This acquisition strengthened Xylem’s position in digital water solutions. Xylem’s Decision Intelligence platform leverages AI, IoT, and predictive analytics to optimize water usage and reduce operational costs for municipalities and industries. Xylem is also committed to sustainability, supporting initiatives like "Watermark" to provide clean water access to underserved communities. Its contributions to the global water pumps market include advancing digital water technologies, improving flood control and desalination processes, and promoting sustainable water management practices.

Flowserve Corporation

Flowserve Corporation is a dominant player in the industrial segment of the water pumps market, particularly in high-pressure and heavy-duty applications, holding approximately 8-12% of the global market. With a revenue of $4.2 billion in 2022, Flowserve serves industries such as oil and gas, power generation, and chemical processing. The company specializes in designing and manufacturing high-pressure pumps for demanding environments, such as refineries, desalination plants, and power plants. In July 2023, Flowserve invested $100 million in R&D to develop next-generation pumps with improved energy efficiency and reliability. Flowserve has also expanded its footprint in emerging markets by collaborating with local engineering firms and governments, particularly in the Middle East for large-scale desalination projects. The company is committed to sustainability, aiming to achieve net-zero emissions by 2050. Flowserve’s contributions to the global water pumps market include providing reliable solutions for industrial applications, supporting desalination and water recycling efforts, and driving energy efficiency in critical sectors.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancements

Key players in the water filters market, such as Brita , Pentair , and 3M , have heavily invested in product innovation and technological advancements to strengthen their market position. These companies focus on developing cutting-edge filtration technologies that address emerging consumer needs, such as removing microplastics, heavy metals, and pharmaceutical residues from water. For instance, Brita has introduced advanced pitcher filters with activated carbon and ion-exchange resins to enhance contaminant removal efficiency. Similarly, Pentair has developed smart water filtration systems integrated with IoT capabilities, allowing users to monitor water quality and filter performance in real-time. By continuously innovating and incorporating advanced materials and digital technologies, these companies not only differentiate themselves from competitors but also cater to the growing demand for high-performance and sustainable water filtration solutions.

Expansion into Emerging Markets

To tap into untapped growth opportunities, key players like Eureka Forbes , Hindustan Unilever (Pureit) , and Culligan have aggressively expanded their presence in emerging markets such as India, China, Africa, and Southeast Asia. These regions face significant challenges related to water scarcity and contamination, creating a high demand for affordable and efficient water filters. Eureka Forbes, for example, has established a robust distribution network across rural and semi-urban areas in India, offering cost-effective purification systems tailored to local water conditions. Similarly, Pureit has launched compact, low-cost water purifiers designed for households with limited access to clean water. By focusing on affordability, accessibility, and localized solutions, these companies have successfully strengthened their foothold in emerging markets while contributing to global efforts to improve water safety.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations have been a cornerstone strategy for companies like 3M , Pentair , and Aqua-Pure to expand their product portfolios and enhance market reach. These players often collaborate with technology firms, research institutions, and government agencies to co-develop innovative filtration solutions. For instance, 3M has partnered with municipal authorities in several countries to provide large-scale water filtration systems for public infrastructure projects. Pentair has collaborated with startups specializing in AI and IoT to integrate smart monitoring features into its filtration systems. Such partnerships enable companies to leverage external expertise, reduce R&D costs, and accelerate time-to-market for new products. By aligning with complementary stakeholders, these companies enhance their competitive edge and solidify their reputation as leaders in the water filtration industry.

COMPETITIVE LANDSCAPE

The water pumps market is highly competitive with many companies trying to be at the forefront. Key players like Grundfos Xylem and Flowserve are at the forefront due to their focus on innovation and quality. These companies invest heavily in research and development to create advanced products such as energy-efficient pumps smart IoT-enabled systems and solutions for tough industrial environments. This helps them stay ahead of smaller competitors who often struggle to match their technology.

Emerging markets in Asia Africa and South America are becoming important battlegrounds for companies. Many firms are expanding their presence there by offering affordable and reliable pumps tailored to local needs. At the same time they face competition from regional manufacturers who understand the local market better and can offer cheaper options.

Sustainability is another major factor shaping competition. Companies that develop eco-friendly pumps using renewable energy or recyclable materials attract more customers. Governments and industries also prefer suppliers who align with global environmental goals.

KEY MARKET PLAYERS

The major players in the global water pumps market include Gardner Denver, Torishima Pump Mfg. Co., Ltd., General Electric Company, The Weir Group Plc, Weatherford International Ltd., ITT Inc., PROCON Products, KSB Group, Kirloskar Brothers Limited, and Sulzer Ltd.

RECENT MARKET DEVELOPMENTS

- In September 2024, the UK government announced significant reforms in the water sector to enhance regulatory oversight and attract global investment. These reforms aim to upgrade aging sewage and pipeline infrastructure, improving efficiency and reliability in water services.

- In September 2024, the Water (Special Measures) Bill was introduced in the House of Lords. This legislation is designed to hold underperforming water companies accountable and enforce stricter service and infrastructure management regulations.

MARKET SEGMENTATION

This research report on the global water pumps market is segmented and sub-segmented into the following categories.

By Type

- Centrifugal Pump

- Reciprocating Pump

- Rotary Pump

By Application

- Oil and Gas and Refining

- Chemical

- Water and Wastewater

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the water pumps market?

The market's expansion is propelled by increasing demand for efficient water management in agriculture, construction, and municipal services, alongside rapid urbanization and industrialization.

What are the primary types of water pumps available?

The two main types are centrifugal pumps, which move large volumes at low to moderate pressures, and positive displacement pumps, ideal for high-pressure applications.

How is technology influencing the water pumps market?

Technological advancements, such as IoT integration and smart controls, are enhancing pump efficiency and reducing operational costs, driving market growth.

What opportunities exist for growth in the water pumps market?

Opportunities lie in the adoption of advanced technologies, such as smart pumps and renewable energy-powered systems, to enhance efficiency and sustainability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com