Global Water Filters Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Filters and Water Softener), Media Type, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Water Filters Market Size

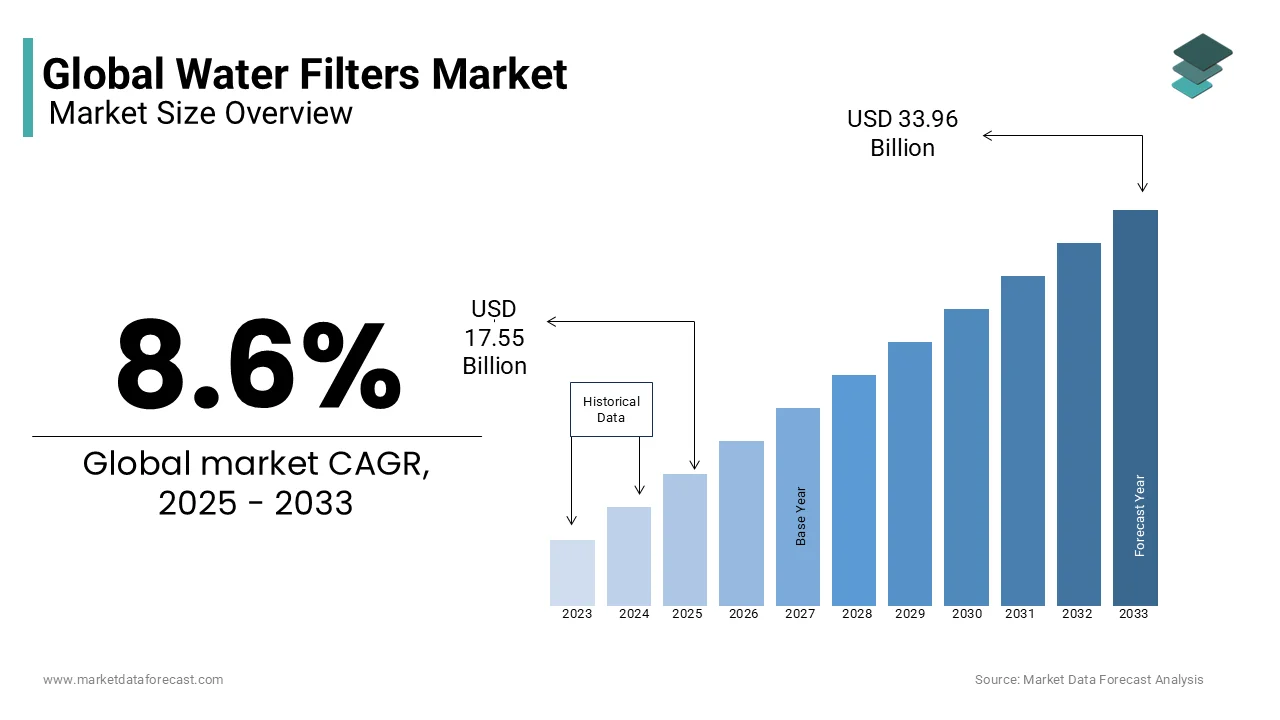

The global water filters market size was valued at USD 16.16 billion in 2024, and the global market size is expected to reach USD 33.96 billion by 2033 from USD 17.55 billion in 2025. The market's promising CAGR for the predicted period is 8.6%.

The water filters market provides systems that remove impurities from water to make it safe for drinking and other uses. These systems use technologies like activated carbon, reverse osmosis, and ultraviolet purification to tackle contaminants such as bacteria, heavy metals, and microplastics. Clean water is vital for health, yet access remains a global issue. The World Health Organization states that over 2 billion people globally drink water contaminated with fecal matter, causing diseases like cholera and diarrhea. This shows the urgent need for effective filtration solutions.

Water pollution has worsened due to industrial waste and agricultural runoff. The United Nations reports that 80% of wastewater worldwide is released untreated into rivers and oceans, contaminating freshwater sources. Harmful chemicals like lead and arsenic are also found in water supplies. In the United States, the Environmental Protection Agency estimates that about 15% of households rely on private wells, which are unregulated and often require filtration systems to ensure safety.

Urbanization and population growth are straining clean water resources. The United Nations projects that by 2025, half of the world’s population will live in water-stressed areas. This growing scarcity emphasizes the importance of water filters in protecting health. As awareness spreads about waterborne diseases and chemical contamination, more households and communities are adopting filtration systems. These trends exhibits the critical role water filters play in addressing one of humanity’s most pressing challenges: ensuring access to safe and clean water.

MARKET DRIVERS

Rising Water Contamination Levels

Water contamination levels are a key driver for water filter adoption. The World Health Organization states that over 2 billion people globally drink water contaminated with fecal matter leading to diseases like diarrhea which causes nearly 485,000 deaths annually. Industrial waste and agricultural runoff worsen the issue. The United Nations reports that 80% of wastewater is discharged untreated into rivers and oceans contaminating freshwater sources. Harmful chemicals like arsenic and lead are also prevalent. For example, according to the Centers for Disease Control and Prevention, 12% of homes in the United States have tap water with detectable lead levels. These alarming statistics emphasize the urgent need for filtration systems to ensure safe drinking water.

Growing Awareness About Health Risks

Awareness about health risks from contaminated water is driving demand for water filters. The Environmental Protection Agency warns that exposure to contaminants like microplastics and heavy metals can cause chronic illnesses including cancer. A study by the National Institutes of Health reveals that 60% of Americans are concerned about water quality in their homes. In developing nations UNICEF reports that waterborne diseases account for 20% of deaths among children under five. This growing awareness has led households to prioritize clean water solutions. Governments and health organizations are promoting education campaigns further encouraging the adoption of filtration systems to protect families from preventable diseases.

MARKET RESTRAINTS

High Cost of Advanced Filtration Systems

The high cost of advanced water filtration systems acts as a restraint especially in low-income regions. The World Bank reports that 70% of households in Sub-Saharan Africa live on less than $2 a day making expensive systems unaffordable. Even in developed nations the Environmental Protection Agency states that installing advanced systems like reverse osmosis can cost up to $2,000 per household. Maintenance costs add to the burden as filters need regular replacement. This financial barrier limits access to clean water for millions. While cheaper alternatives exist they often lack efficiency leaving many reliant on unsafe water sources.

Lack of Infrastructure in Rural Areas

Lack of infrastructure in rural areas restrains the water filters market. The United Nations reports that 80% of people without clean water access live in rural regions where distribution networks are weak. In India the Ministry of Rural Development estimates that 40% of villages lack basic water supply systems. Similarly, in Africa the African Development Bank emphasizes that only 30% of rural households have piped water making it hard to implement filtration solutions. Without proper infrastructure even donated filters cannot reach those in need leaving millions exposed to contaminated water and its associated health risks.

MARKET OPPORTUNITIES

Government Initiatives for Clean Water Access

Government initiatives for clean water access present significant opportunities. The United Nations reports that over 90 countries aim to achieve universal access to safe drinking water by 2030 under the Sustainable Development Goals. In India the Jal Jeevan Mission plans to invest $50 billion to provide piped water to rural households. Similarly in Africa the African Development Bank has allocated $10 billion for water infrastructure projects. These efforts create a favorable environment for adopting filtration systems. As governments focus on improving water quality households will increasingly rely on filters to meet safety standards ensuring access to clean drinking water.

Technological Advancements in Filtration

Technological advancements in filtration systems offer new opportunities. The National Science Foundation stresses innovations like graphene-based filters which remove 99% of contaminants including viruses and heavy metals. These systems are more efficient and durable. In the U.S. the Environmental Protection Agency supports research into affordable solutions for rural areas. Globally the World Health Organization encourages portable filters benefiting disaster-prone regions. With advancements making filters more accessible and effective the market can address challenges like water scarcity and contamination expanding its reach worldwide.

MARKET CHALLENGES

Limited Awareness in Remote Communities

Limited awareness in remote communities poses a challenge. The United Nations reports that 60% of rural populations are unaware of health risks from contaminated water. In South Asia the Asian Development Bank states that 50% of rural households do not know about available filtration solutions. This lack of awareness prevents adoption despite affordable options. Cultural beliefs also discourage modern systems. Without targeted education campaigns these communities remain vulnerable to waterborne diseases. Addressing this requires collaboration between governments and organizations to promote awareness and demonstrate the benefits of clean water solutions.

Environmental Impact of Filter Disposal

The environmental impact of filter disposal is a growing challenge. The Environmental Protection Agency warns that used filters contribute to plastic waste with millions ending up in landfills annually. In Europe the European Environment Agency reports that only 30% of plastic waste is recycled leaving the rest to pollute ecosystems. Many filters contain non-biodegradable materials like activated carbon taking centuries to decompose. Improper disposal releases trapped contaminants back into the environment. This undermines sustainability goals. To address this manufacturers must develop eco-friendly designs while governments enforce stricter recycling regulations to minimize the environmental footprint.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.6% |

|

Segments Covered |

By Technology, Type, Media Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eaton Corporation (US), Suez Water Technologies & Solutions (France), Veolia (France), Dow Water & Process Solutions (US), Evo Qua Water Technologies (US), Mann-Hummel (Germany), Pall Corporation (US), Pentair PLC (UK) and Lydall Industrial Filtration (US) |

SEGMENTAL ANALYSIS

By Type Insights

The Reverse osmosis segment was the best performing category and held a 38.5% market share in 2024 fueled by removing contaminants like lead and bacteria ensuring safe drinking water for millions. The EPA states 95% of U.S. public water systems meet health standards yet consumer demand for added purification persists. WHO reports 829000 yearly deaths from diarrhea due to unsafe water driving adoption of reliable solutions. Its importance lies in tackling health risks effectively as households prioritize quality water. Reverse osmosis stands out for its proven ability to deliver consistent purity addressing widespread concerns about water safety globally.

The UV filters segment grow at the fastest CAGR of 10.5% from 2025 to 2033. Their rise stems from chemical-free pathogen elimination appealing to eco-conscious consumers worldwide. The CDC confirms UV systems kill 99.9% of waterborne bacteria crucial as WHO notes 2 billion people lack safe water access. This boosts demand for UV filters offering fast sustainable purification methods. The UN draws attention to 3.4 million annual deaths from waterborne diseases emphasizing their role in health protection. Their importance grows with increasing focus on green reliable solutions meeting modern needs efficiently.

By Technology Insights

The RO purifiers segment commanded the water filters market and captured a 53.7% market share in 2024. They dominate by removing dissolved impurities like salts providing high-quality water consistently. The EPA reports over 300 contaminants in U.S. tap water pushing reliance on RO technology across households. WHO estimates 1.8 million yearly deaths from water-related illnesses underscoring their critical role in safety. Its leadership comes from meeting consumer needs for pure water amid growing health awareness. RO purifiers remain essential for reducing risks tied to poor water quality effectively worldwide.

On the other hand, the UV purifiers segment show a CAGR of 9.8% during the forecast. They grow fastest by disinfecting water without chemicals aligning with sustainability trends globally. The CDC states UV inactivates 99.99% of viruses vital as UN reports 80% of wastewater goes untreated yearly. This drives demand for UV purifiers as an eco-friendly purification option. WHO notes 485000 yearly diarrheal deaths from unsafe water spotlighting their importance in health safety. Their rapid rise reflects a shift toward efficient green technologies addressing urgent water challenges.

By Media Type Insights

The Multimedia filters segment led the market by possessing a 45.8% market share in 2024. They excel by using layered media to remove diverse impurities ensuring thorough purification effectively. The EPA notes 13% of U.S. households rely on private wells often polluted with sediment. WHO reports 829000 yearly deaths from poor water quality emphasizing their vital role in safety. Its dominance stems from addressing varied contamination needs reliably. Multimedia filters are key for delivering clean water where basic systems fall short consistently.

The Cartridge filters segment grow at the highest CAGR of 6.5% over the forecast period. Their rise is due to compact user-friendly designs ideal for urban households everywhere. The U.S. Census Bureau states 83% of Americans live in cities increasing need for space-saving filters. UN reports 2 billion people lack safe water boosting cartridge demand globally. WHO notes 1.8 million annual water-related deaths underlining their importance in accessible purification. They meet modern lifestyle demands with efficient practical solutions quickly.

By End-User Insights

The Domestic use segment held a 60.8% market share in 2024. It influences as households demand clean water for health amid rising awareness worldwide. The EPA says 10% of U.S. community water systems had violations in 2022 fueling home filter reliance. WHO notes 1.1 billion lack safe water services sheds light on the domestic filters’ key role in safety. Its dominance reflects a focus on personal well-being through quality water. Domestic filtration remains critical for addressing everyday health needs effectively.

The Food and beverages segment expands at a CAGR of 7.4% during the forecast period. Strict quality standards drive this surge requiring pure water for production globally. The FDA oversees 30000 food facilities yearly ensuring compliance with safe water rules. UN states 70% of global water use is industrial pushing demand upward. WHO reports 485000 annual deaths from unsafe water emphasizing its role in food safety. This segment meets regulatory and health needs efficiently.

REGIONAL ANALYSIS

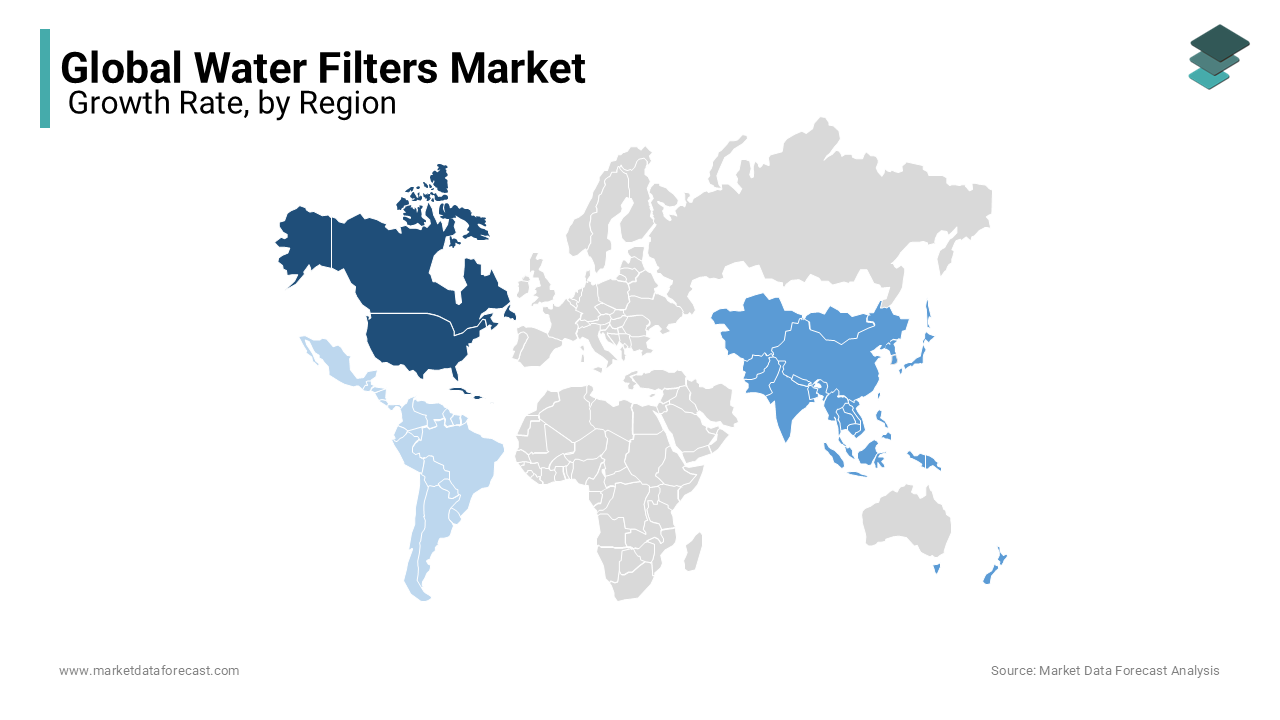

North America held the largest share of the water filters market at 35.5% in 2024. The region's prominence is propelled by high awareness about clean drinking water and strict regulations like the Safe Drinking Water Act enforced by the U.S. Environmental Protection Agency. With over 80% of households using filtered water systems according to the CDC the demand remains strong. The presence of major companies such as 3M and Pentair also boosts innovation. This region’s leadership ensures global standards for water safety are set here making it critical for market growth.

Asia-Pacific is the rapidly growing region with a CAGR of 9.5% from 2025 to 2033. Rapid urbanization and rising pollution levels in countries like India and China are key drivers. Over 60% of the population in these nations lacks access to safe drinking water says UNICEF which increases reliance on filtration systems. Governments are investing heavily in clean water initiatives including $10 billion annually in India alone. Increasing disposable incomes and health awareness further propel growth making this region pivotal for future innovations and adoption trends.

Europe holds a significant share of the water filters market, driven by strict environmental policies under the EU Green Deal. The European Environment Agency states that over 90% of Europe’s population has access to safe drinking water, yet concerns about contaminants like microplastics drive demand for advanced filtration systems. Germany leads with annual investments exceeding $1.5 billion in water purification technologies, as per the Federal Ministry for the Environment. With growing awareness of health and sustainability, Europe is expected to grow. This region’s focus on eco-friendly solutions ensures its role as a key adopter of innovative water filter technologies.

Latin America shows moderate growth in the water filters market, supported by urbanization and government investments. As per the Inter-American Development Bank, Brazil’s $2.7 billion annual spending on water infrastructure projects. Despite progress, UNICEF reports that 25% of the region still lacks access to clean drinking water, boosting demand for filtration systems. Rising disposable incomes and health awareness further fuel adoption. Latin America is poised for steady expansion. This region’s efforts to address water scarcity underline its importance in the global market.

The Middle East and Africa face water scarcity challenges but show potential for growth in the water filters market. Saudi Arabia plans $500 million in desalination projects annually, according to the Saudi Water Authority. The African Development Bank reports that 40% of Sub-Saharan Africans lack clean water access, driving demand for affordable filtration systems. Investments in water infrastructure and international aid are accelerating adoption. While challenges remain, these regions are critical for addressing global water access issues and represent emerging markets for scalable filtration solutions.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Eaton Corporation (US), Suez Water Technologies & Solutions (France), Veolia (France), Dow Water & Process Solutions (US), Evo Qua Water Technologies (US), Mann-Hummel (Germany), Pall Corporation (US), Pentair PLC (UK), Lydall Industrial Filtration (US) are playing dominating role in the global water filters market.

The water filters market is highly competitive with many global and regional players working to gain a strong position. Companies compete by offering advanced filtration technologies better quality and improved efficiency. Innovation is a key factor as businesses invest in research and development to create products that remove more contaminants last longer and provide safer drinking water.

Brand reputation and customer trust play a big role in the market. Established brands like A.O. Smith Eureka Forbes and Pentair have an advantage because customers recognize them for quality and reliability. New players must work harder to build trust by offering better pricing unique features or eco-friendly solutions.

Price competition is also strong. Some companies focus on affordable filters for budget-conscious customers while others offer premium smart water purification systems with high-end features. Online and offline distribution channels are important as well with companies expanding their presence through e-commerce and retail stores.

Sustainability is another competitive factor. Consumers prefer filters that reduce plastic waste save water and use energy-efficient technology. With growing concerns about water contamination and health safety the demand for innovative and effective filtration solutions is increasing making competition tougher and driving continuous improvements in the market.

TOP 3 PLAYERS IN THE MARKET

A.O. Smith Corporation

A.O. Smith Corporation is a leading manufacturer in the water filtration industry, offering residential and commercial water treatment solutions. The company has solidified its position through strategic acquisitions, such as the purchase of Atlantic Filter Corporation in June 2022, which expanded its water treatment product portfolio. A.O. Smith is known for its innovative water purification technologies that cater to a wide range of consumer needs, from household water purifiers to large-scale commercial filtration systems. With a strong global presence, the company significantly contributes to ensuring safe drinking water through advanced filtration solutions that remove contaminants, improve water taste, and enhance overall water quality.

Eureka Forbes

Eureka Forbes is a dominant player in the water purifier market, particularly in Asia, where it has established itself as a trusted brand. The company has consistently expanded its portfolio by introducing cutting-edge water purification technologies, ensuring that consumers have access to safe drinking water. Known for its flagship Aquaguard and Euroclean brands, Eureka Forbes caters to both residential and industrial segments. The company’s filtration systems are designed to tackle various water contamination issues, making them highly effective in regions with poor water quality. Its commitment to innovation and sustainability has enabled it to maintain a strong foothold in the global water filters market.

Pentair PLC

Pentair PLC is a global leader in water filtration and treatment solutions, offering a diverse range of products for residential, commercial, and industrial applications. The company has shown significant growth, with its October 2024 profit estimates rising due to increased demand for its water filters and related services. Pentair’s contribution to the water filters market is substantial, as it focuses on delivering efficient and sustainable water purification solutions that help address global water quality challenges. The company’s filtration systems are widely used in households, food and beverage industries, and municipal water treatment facilities, making clean and safe water more accessible worldwide.

STRATEGIES USED BY THE MARKET PLAYERS

Strategic Acquisitions and Expansions – A.O. Smith Corporation

A.O. Smith Corporation has strengthened its market position through strategic acquisitions and geographic expansion. One key acquisition was the purchase of Atlantic Filter Corporation in 2022, which helped the company enhance its water treatment portfolio and expand its reach in the residential and commercial filtration segments. By acquiring established brands, A.O. Smith has been able to integrate new technologies into its offerings while gaining a larger customer base. Additionally, the company has focused on expanding its manufacturing capabilities to meet the growing global demand for advanced water filtration solutions.

Continuous Innovation and Product Diversification – Eureka Forbes

Eureka Forbes has maintained its competitive edge through continuous innovation and product diversification. The company invests heavily in research and development (R&D) to introduce advanced water purification technologies, such as UV, RO, and smart filtration systems. It has also diversified its product range to cater to different consumer segments, from low-cost purifiers for emerging markets to high-end smart water filters with IoT integration. By continuously upgrading its product offerings, Eureka Forbes ensures that it meets the evolving needs of consumers while maintaining its leadership in the water filtration market.

Sustainability and Eco-friendly Solutions – Pentair PLC

Pentair PLC has focused on sustainability and eco-friendly filtration solutions to strengthen its market position. The company develops energy-efficient water filtration systems that help reduce water wastage and minimize environmental impact. Pentair has also adopted sustainable manufacturing practices, such as using recycled materials and optimizing energy consumption in its production processes. This strategic focus aligns with the growing demand for environmentally responsible water treatment solutions and positions Pentair as a leader in sustainable water filtration technologies.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, the UK and Welsh Governments launched an Independent Commission to review the water sector and its regulation. This initiative aims to attract investment, clean up waterways, expedite infrastructure projects, and restore public confidence in the sector.

- In July 2024, the UK Government announced initial steps to reform the water sector, focusing on reducing sewage pollution, protecting customers, and attracting investment for infrastructure upgrades. Measures include ringfencing funds for vital infrastructure and enhancing customer powers to hold water company executives accountable

MARKET SEGMENTATION

This research report on the global water filters market has been segmented and sub-segmented based on type, technology, media type, end-user and region.

By Type

- Reverse Osmosis

- Ceramic Filters

- Activated Carbon Filters

- UV Filters

- Water Distillation

By Technology

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Filters

- Water Softener

By Media Type

- Single & Dual Phase

- Multimedia

- Cartridge

By End-User

- Municipal

- Industrial

- Oil & Gas

- Chemicals & Petrochemicals

- Food & Beverages

- Pharmaceuticals

- Domestic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What was the size of the global water filters market in 2024?

The global water filters market size was valued at approximately USD 16.16 billion in 2024.

2. What factors are driving the growth of the global water filters market?

Key drivers include rising concerns over water contamination, increasing consumer awareness, advancements in filtration technologies, and the integration of smart monitoring systems.

3. Which regions are significant contributors to the global water filters market?

North America is a major contributor, with significant demand driven by concerns over safe drinking water in the U.S. and Canada.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]