Global Water and Wastewater Pipes Market Size, Share, Trends & Growth Research Report - Segmented By Material Type (Plastic Pipe, Metal Pipe, Concrete Pipe, Clay Pipe), By Application (Municipal, Industrial, Agriculture), & Region - Industry Forecast From 2024 to 2032

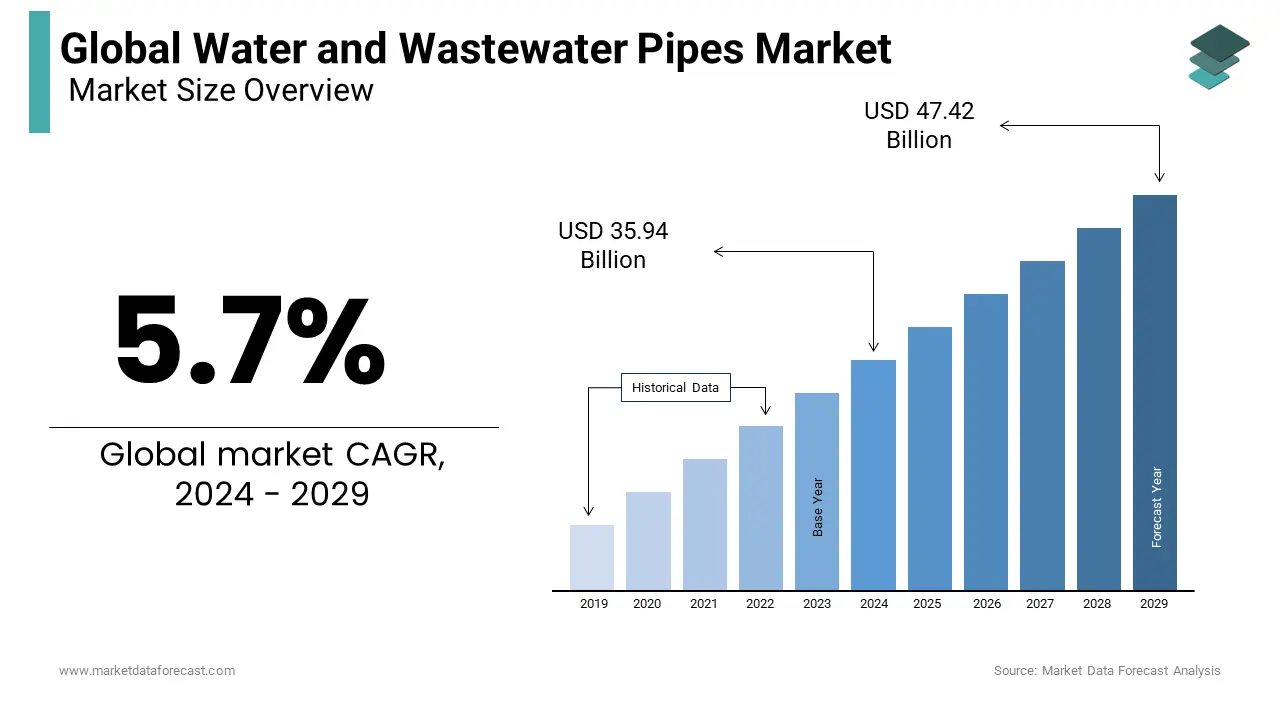

Global Water and Wastewater Pipes Market Size (2024 to 2032)

The global water and wastewater pipes market was worth USD 34 billion in 2023 and is anticipated to reach USD 56 billion by 2032 from USD 35.94 billion in 2024, registering a CAGR of 5.7% from 2024 to 2032.

Current Scenario of the Global Water and Wastewater Pipes Market

Presently, the water and wastewater pipes market is gaining momentum and is witnessing a year-on-year rise in development and financial efforts. Governments worldwide and prominent companies are actively engaged in community outreach and education programs to create awareness among societies. Likewise, the World Bank assisted programs and initiatives that made water available to water or sanitation to about 30 million people in fiscal year 2023. Also, in the same year, its new water projects attained their highest level of funding in the last five years, i.e., overall, 4.65 billion dollars. Apart from this, water service firms and organizations can employ live surveillance and incorporate Internet of Things (IoT) systems or equipment into their facilities to handle water distribution problems.

MARKET DRIVERS

The aging infrastructure, increased urbanization, population growth and extensive use of plastic-based pipes drive the growth of the water and wastewater pipes market.

Older water systems in urban regions continue to deteriorate as towns and metropolises seek to grow and modernize. These aged pipe networks also lead to various health problems and are suffering from inefficiency, contamination, and leakages, which fail to meet the heightening demand. According to a study of water usage patterns by Americans, it is anticipated that as far as 50 percent of water is lost because of overflow, evaporation, and wind. At the same time, irrigation techniques and systems worsen these issues. Hence, this population growth and intense efforts for sustainable development are surging the sale of water pipes.

An increase in the number of water conservation projects due to groundwater depletion and pollution is further boosting the water and wastewater pipes market growth.

The world’s major cities and countries are developing unique or personalized water management methods to address this concern. For instance, Saudi Arabia innovated desalination techniques and became the largest producer of desalinated water globally. Likewise, Boston City obliges all the big buildings to comply with an Energy Star certification and lower power usage that needs water. Additionally, the market is also moving forward with the expanding construction industry. Construction is a key propellant for the economic progress of the North American, Asian and Middle Eastern nations. Also, governments in the region are quickly ramping up construction projects to cope with the rising demand.

MARKET RESTRAINTS

The lack of or delay in upgrading the aging infrastructure in North America is inhibiting the global market growth

Low-quality controls and manufacturing standards in the Asia Pacific and the stringent regulatory environment in Europe are some of the main factors hindering the water and wastewater pipes market growth. As per a study, around 2.6 billion dollars are spent on yearly repair expenses in the United States and Canada as they face 260000 water main breaks annually. 11.1 per 100 miles per year is the average break rate. Further, the estimated cost of a single repair of a water main break is 10000 dollars including direct and indirect expenses. Whereas in Europe, policies regarding water scarcity, supply and other matters have not been reformed for a long time to address the issues. But, the changes or amendments are complicated and politically tough to bring.

MARKET OPPORTUNITIES

Rising demand for sewage and wastewater treatment in water-scarce areas presents potential opportunities for the market players.

Developing economies in the Asia Pacific and Latin America like India, Brazil, Indonesia, Mexico, China, etc. Also, the upgrade of the old water distribution and wastewater treatment system in the United States and key European economies, including France, Spain, Poland, Belgium, and Germany. Apart from this, the market is expected to grow further due to the rising popularity of polypropylene is expected to further expand the water and wastewater market. It is forming the future of the pipe market owing to its special features and its adaptability to current requirements for sustainability and effectiveness. This material’s robustness, flexibility, and affordability are gradually favored over standard substitutes like metal and PVC.

MARKET CHALLENGES

The biggest hurdle for the water and wastewater pipes market is modernization or improving them in ways which go in line with the objectives of current urban progress.

Advancements should equalize the requirement for technological incorporation with the necessity of a dependable water supply. This ongoing labored effort depicts a vital barrier for future-ready and strong cities. Also, authorities and professionals have estimated that approximately 60 percent of the global population will live in urban regions by 2023, which will further exert pressure on the infrastructure. Another factor hampering the market expansion is the financial challenges of consumers. In several areas, people are finding it difficult to pay off their water bills owing to economic problems, particularly in financially underprivileged regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.7% |

|

Segments Covered |

By Material Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Future Pipe Industries, Aliaxis Group SA/NV, Tyman plc., Orbia, Mexichem S.A.B. de C.V., Sekisui Chemical, ThyssenKrupp AG, JM EAGLE, INC., China Lesso Group Holdings Limited, AMERICAN (American Cast Iron Pipe Company), Tenaris S.A, NIPPON STEEL CORPORATION, CEMEX SAB de CV, GF Piping Systems, JM EAGLE, INC., Saint-Gobain Group, and Others. |

SEGMENT ANALYSIS

Global Water and Wastewater Pipes Market Analysis By Material Type

The plastic pipe segment is quickly striving towards becoming the biggest category of the water and wastewater pipes market because of its comprehensive utilization in sewerage and water distribution systems. Moreover, the high endurance, corrosion resistance and versatility of plastic pipes make them a preferred option for various uses. Its capability to withstand harsh conditions is also a factor that is expected to strengthen the segment’s market share. The lightweight and cost-effective nature of plastic water and wastewater pipes also contributes to its expansion and greater demand.

At the same time, consumption for concrete and clay water pipes is also likely to elevate throughout the forecast period. The rising application of concrete pipes for water and wastewater in drainage systems, gutters, and processing plant channeling is adding to the segment’s notable growth rate.

Global Water and Wastewater Pipes Market Analysis By Application

The municipal application segment holds a significant portion of the water and wastewater pipes market share. The rising urban population worldwide requires the growth of these management infrastructures in towns and metropolises, which is believed to influence consumption in municipal usage in the coming years. Moreover, the degradation of aged water administration and distribution networks resulted in the enforcement of upgraded measures by municipalities, hence boosting pipe sales. In addition, the rapid pace of industrialization globally to meet the surging demands of an ever-growing population is also fuelling the demand for pipes for water and handling wastewater in industrial space throughout the estimation period. Besides this, developing nations like China, India and Indonesia are predicted to witness elevated demand for water and wastewater pipes for commercial applications in the longer period.

REGIONAL ANALYSIS

North America held the major share of the worldwide market in 2023.

North America is a prominent regional segment in the global market and is leading the way in technological advancements, driving the water and wastewater pipes market. Greater cognizance of water quality and the presence of a strong distribution network and management infrastructure in North American economies is propelling market growth. Moreover, the United States and Canada are generating maximum demand for water and wastewater pipes in the future. The existence of prominent water and wastewater pipe producers and distributors in this region also adds to its large market share. Further, there is a higher emphasis on handling and processing wastewater in this area which offers potential opportunities for pipe companies going forward.

Asia-Pacific is predicted to witness rapid growth during the forecast period.

Asia Pacific is the fastest-growing market and will experience tremendous demand for different sorts of pipes for water supply and wastewater management. A significant influx of investments in building and improving existing facilities and a swift rise in population are the main factors pushing forward this region to emerge as the most lucrative industry globally. More importantly, its inclination towards urbanization, digitalization and industrialization is also anticipated to boost the regional sales of water and wastewater pipes. Also, Indonesia and India are projected to be the major marketplaces for pipe vendors and manufacturers in the coming years. Additionally, the access to low-cost manpower and input materials in the APAC region will position it as one of the biggest industries for producers wanting to get better returns on investments in the future.

Europe captured a substantial share of the worldwide market in 2023.

Europe is another potential water and wastewater market as it faces a high number of droughts and wildfires in summer, especially in the southern part of the region. It is estimated that in the future, a blend of inadequate policymaking, vested interests and frequent climate change seems in place to make the condition even worse.

KEY PLAYERS IN THE GLOBAL WATER AND WASTEWATER PIPES MARKET

Companies playing a prominent role in the global water and wastewater pipes market include Future Pipe Industries, Aliaxis Group SA/NV, Tyman plc., Orbia, Mexichem S.A.B. de C.V., Sekisui Chemical, ThyssenKrupp AG, JM EAGLE, INC., China Lesso Group Holdings Limited, AMERICAN (American Cast Iron Pipe Company), Tenaris S.A, NIPPON STEEL CORPORATION, CEMEX SAB de CV, GF Piping Systems, JM EAGLE, INC., Saint-Gobain Group, and Others.

RECENT HAPPENINGS IN THE GLOBAL WATER AND WASTEWATER PIPES MARKET

- In January 2024, a factory in Texas, United States, became the first pipe-producing facility to obtain the Leadership in Energy and Environmental Design (LEED) certification. This demonstrates the company’s dedication to sustainability.

DETAILED SEGMENTATION OF THE GLOBAL WATER AND WASTEWATER PIPES MARKET INCLUDED IN THIS REPORT

This global market research report on water and wastewater pipes has been segmented and sub-segmented based on material type, application, and region.

By Material Type

- Plastic Pipe

- Metal Pipe

- Concrete Pipe

- Clay Pipe

By Application

- Municipal

- Industrial

- Agriculture

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary materials used in water and wastewater pipes?

Common materials include PVC, HDPE, ductile iron, concrete, and steel. Each material has unique properties that make it suitable for specific applications, such as durability, corrosion resistance, or cost-effectiveness.

What are the major drivers for growth in the water and wastewater pipes market?

The key drivers include increasing global population, urban expansion, aging infrastructure replacement, and the rising need for efficient water management systems to address water scarcity and pollution.

What role does technology play in the water and wastewater pipes market?

Technological advancements, such as smart piping systems with sensors for monitoring leaks and water quality, are revolutionizing the industry by improving efficiency and reducing maintenance costs.

What is the role of government policies in shaping the water and wastewater pipes market?

Government initiatives, such as funding for infrastructure projects, policies promoting water conservation, and stricter regulations on wastewater management, significantly influence market growth and direction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]