Global Washing Machine Market Size, Share, Trends, & Growth Forecast Report Segmented By Product Type (Fully Automatic (Front Load, Top Load), Semi- Automatic, Dryer), Capacity, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Washing Machine Market Size

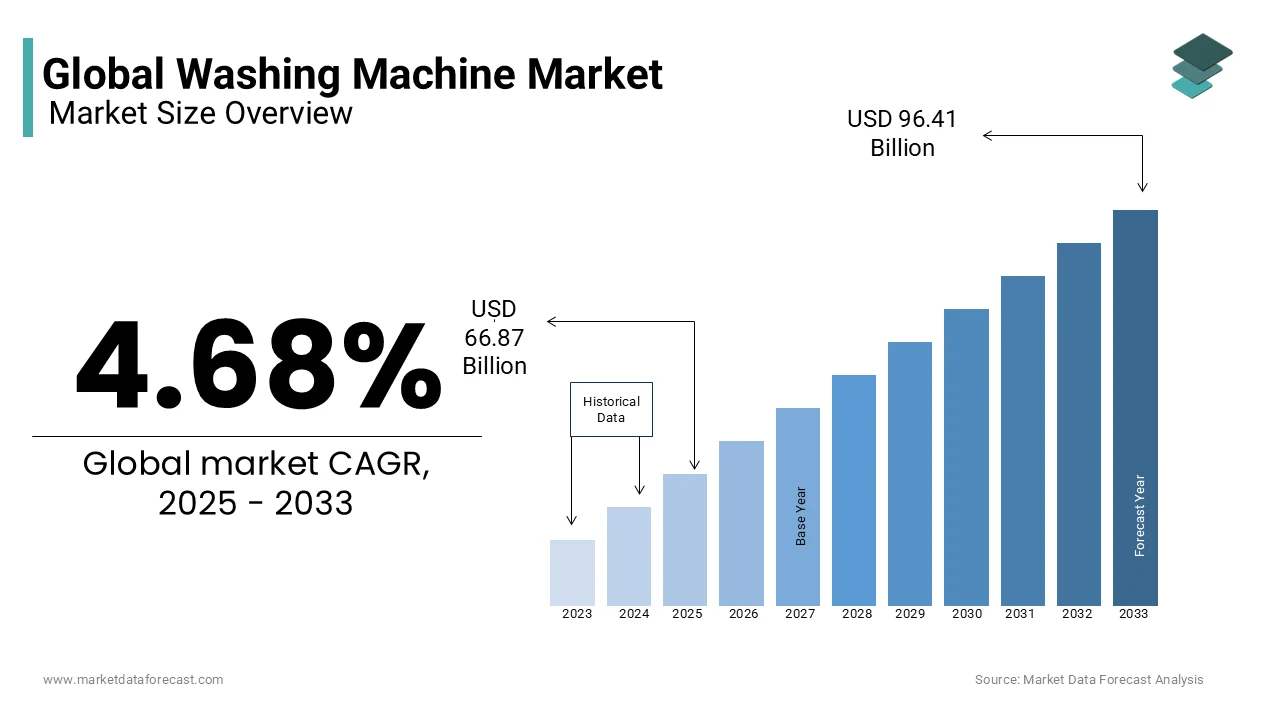

The global washing machine market size was valued at USD 63.88 billion in 2024 and is expected to reach USD 96.41 billion by 2033 from USD 66.87 billion in 2025. The market is projected to grow at a CAGR of 4.68%.

The washing machines market is focused on designing manufacturing and distributing appliances that clean clothes and fabrics. These machines come in various types including fully automatic semi-automatic and dryers. Fully automatic models are further categorized into top load and front load designs. Over the years these appliances have evolved to include advanced features such as energy efficiency water-saving technologies and smart connectivity.

It play a significant role in improving quality of life. The World Health Organization emphasizes that access to clean clothing is directly linked to better hygiene and reduced health risks particularly in densely populated urban areas. In addition, the United Nations Department of Economic and Social Affairs reports that 56 percent of the global population now lives in urban settings where convenience and time-saving appliances like washing machines are highly valued. Furthermore the U.S. Environmental Protection Agency states that high-efficiency washing machines use 33 percent less water and 25 percent less energy compared to traditional models which helps conserve resources in regions facing water and energy shortages.

In developing countries rising electrification has made washing machines more accessible. For example, according to the International Energy Agency, electricity access in rural areas of Africa and Asia has improved significantly with over 500 million people gaining access since 2010. This progress has enabled more households to adopt modern appliances like washing machines. With advancements in technology features such as noise reduction quick wash cycles and fabric care options are becoming standard. These innovations reflect how washing machines are designed not only to clean clothes but also to address broader lifestyle and environmental needs.

MARKET DRIVERS

Rising Urbanization

Rising urbanization is a key driver of the washing machines market as more people move to cities where space and time are limited. The United Nations Department of Economic and Social Affairs reports that 56 percent of the global population now lives in urban areas and this figure is expected to reach 68 percent by 2050. Urban households often prefer appliances that save time and effort making washing machines essential. Additionally, as per the World Bank, urban households spend 30 percent more on home appliances than rural households due to higher disposable incomes. In developing countries like India and Nigeria government initiatives to improve urban infrastructure have increased electricity access which supports appliance adoption. This trend shows how urbanization creates a growing demand for convenient and efficient household solutions.

Focus on Sustainability

The focus on sustainability is driving innovation in the washing machines market as consumers and governments prioritize energy and water efficiency. The U.S. Environmental Protection Agency states that high-efficiency washing machines use 33 percent less water and 25 percent less energy than traditional models. This aligns with global efforts to reduce resource consumption. The European Environment Agency notes that 80 percent of washing machines sold in Europe meet the highest energy efficiency standards due to strict regulations and consumer awareness. Additionally, the International Energy Agency reports that global electricity demand for appliances has decreased by 15 percent over the past decade thanks to advancements in technology. These statistics show how sustainability not only benefits the environment but also meets consumer expectations for eco-friendly products.

MARKET RESTRAINTS

High Initial Costs

High initial costs act as a restraint for many households especially in low-income regions where affordability is a concern. The World Bank reports that over 700 million people globally live on less than two dollars per day making it difficult for them to afford expensive appliances like washing machines. Even in middle-income households the upfront cost of energy-efficient models can be prohibitive. For example, the U.S. Bureau of Labor Statistics states that the average price of a new washing machine is around eight hundred dollars which is a significant expense for families with limited budgets. In developing nations lack of financing options further limits access to these appliances. This financial barrier slows down adoption rates despite the long-term savings they offer through reduced utility bills.

Limited Electricity Access

Limited electricity access remains a major restraint particularly in rural areas of developing countries. The International Energy Agency reports that nearly 770 million people worldwide still lack access to electricity which directly impacts their ability to use appliances like washing machines. In Sub-Saharan Africa for instance only 48 percent of the population has access to electricity according to the African Development Bank. Even in areas with partial electrification frequent power outages make it impractical to rely on electric appliances. Governments are working to address this issue but progress is slow. For example, India’s Ministry of Power states that while rural electrification has improved significantly there are still challenges in providing consistent and reliable power supply. This lack of infrastructure hinders the widespread adoption of washing machines.

MARKET OPPORTUNITIES

Smart Technology Integration

Smart technology integration presents a major opportunity for the washing machines market as consumers increasingly seek connected and convenient solutions. The U.S. Census Bureau reports that 30 percent of new homes in the United States are now equipped with smart home systems which include appliances like washing machines. These devices allow users to control settings remotely monitor energy usage and receive maintenance alerts via smartphone apps. The International Telecommunication Union notes that internet penetration has reached 66 percent globally enabling more households to adopt smart technologies. Additionally, the European Commission states that smart appliances can reduce energy consumption by up to 20 percent when integrated into smart grids. This trend shows how technological advancements can enhance user experience while promoting energy efficiency.

Government Initiatives

Government initiatives aimed at improving living standards provide a significant opportunity for the washing machines market. For example, India’s Ministry of Rural Development states that its rural electrification program has brought electricity to over 99 percent of villages enabling more households to purchase appliances. Similarly, Brazil’s Linha Branca program offers subsidies and financing options for low-income families to buy essential home appliances including washing machines. The World Bank reports that such programs have increased appliance ownership by 25 percent in targeted regions. In Africa the African Development Bank supports projects to expand electricity access which indirectly boosts demand for modern appliances. These initiatives demonstrate how government policies can create favorable conditions for market growth by addressing barriers like affordability and infrastructure.

MARKET CHALLENGES

Water Scarcity Concerns

Water scarcity concerns pose a challenge for the washing machines market as many regions face severe shortages. The United Nations Water Agency reports that 2 billion people globally live in countries experiencing high water stress which affects their ability to use water-intensive appliances. In India for example the Ministry of Jal Shakti states that groundwater levels have declined by 60 percent in some areas making it unsustainable to operate traditional washing machines. Even in developed nations like Australia prolonged droughts have led to stricter water usage regulations. The U.S. Geological Survey notes that residential water use accounts for 12 percent of total consumption exhibits the need for more water-efficient designs. This challenge requires manufacturers to innovate and develop machines that consume significantly less water.

E-Waste Management

E-waste management is a growing challenge as the disposal of old washing machines contributes to environmental pollution. The Global E-Waste Monitor reports that 53 million metric tons of electronic waste were generated globally in 2022 and only 17 percent was recycled properly. Washing machines contain hazardous materials like lead and mercury which can harm ecosystems if not disposed of responsibly. The United Nations Environment Programme states that improper e-waste disposal releases toxic substances into soil and water sources affecting human health. In addition, the U.S. Environmental Protection Agency reveals that recycling one million laptops saves enough energy to power 3657 homes for a year showing the potential impact of better practices. Addressing this issue requires stronger regulations and consumer awareness about sustainable disposal methods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.68% |

|

Segments Covered |

By Product Type, Capacity, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Whirlpool Corporation (U.S.), Samsung Electronics (South Korea), LG Electronics Inc. (South Korea), Electrolux AB (Sweden), Haier Smart Home Co. Ltd. (China), Godrej Industries Ltd. (India), IFB Industries Ltd. (India), Panasonic Holdings Corporation (Japan), Mirc Electronics Limited (India), BSH Hausgeräte GmbH (Germany), and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The Fully Automatic Top Load washing machines segment dominated the market and captured a 60.1% market share in 2024. Their popularity stems from affordability and ease of use, making them ideal for middle-income households. The U.S. Environmental Protection Agency (EPA) states that Top Load models consume 10-15% less water than Front Load machines, appealing to eco-conscious consumers. Additionally, India’s Ministry of Consumer Affairs noted that over 70% of first-time buyers prefer Top Load due to their budget-friendly pricing and reliability. This segment's dominance reflects its alignment with consumer preferences for cost-effective and efficient appliances, especially in urban and semi-urban areas.

The Dryer segment is the rapidly growing with a CAGR of 8.5% from 2025 to 2033. Rising urbanization and disposable incomes drive demand, particularly in humid regions. According to the U.S. Census Bureau, 40% of households in high-humidity states like Florida and Louisiana now own dryers and is reflecting climatic influences. Furthermore, the International Energy Agency (IEA) notes that advancements in energy-efficient technology have reduced dryer energy consumption by 15% over the past decade which is making them more appealing. Dryers are gaining traction in developing nations like India, where monsoon seasons necessitate indoor drying solutions, underscoring their role in enhancing lifestyle convenience.

By Capacity Insights

The 5-7 Kg capacity segment led the market and held a 45.3% share in 2024. This capacity caters to small families (3-5 members), which constitute 60% of global households, as per the United Nations Department of Economic and Social Affairs. These machines balance affordability and functionality, making them ideal for middle-income groups. Additionally, the European Environment Agency (EEA) notes that 5-7 Kg machines consume 20% less electricity than larger models and is aligning with eco-conscious consumer trends.

The Above 7 Kg segment is growing at the fastest rate and a CAGR of 9.2% during the forecast period. This growth is fueled by rising nuclear family sizes and increasing urbanization. The World Bank reports that urban households are expanding by 2.5% annually, driving demand for larger-capacity machines. Moreover, the U.S. Department of Energy shows that newer models in this segment are 30% more energy-efficient than older versions, attracting eco-conscious buyers. In emerging markets like China and India, government incentives for energy-efficient appliances further boost adoption. This segment’s rapid growth signifies its critical role in meeting evolving household needs and promoting sustainable living.

REGIONAL ANALYSIS

Asia-Pacific dominated the washing machines market and held a 45.6% market share in 2024 because of the rapid urbanization and rising disposable incomes, particularly in China and India. The Asian Development Bank reports that urban households in the region are growing at 3% annually, boosting appliance demand. Additionally, India’s Ministry of Statistics shows that rural electrification has reached 99%, enabling widespread adoption of washing machines. The United Nations notes that Asia-Pacific accounts for 60% of global middle-class growth, further fueling sales. This region’s dominance underscores its role as a key growth driver for manufacturers, supported by affordability and increasing consumer awareness.

The Middle East and Africa is the fastest-growing region with a CAGR of 7.8% from 2025 to 2033 and the expansion is fueled by improving infrastructure and rising middle-class populations. The World Bank states that urbanization in Sub-Saharan Africa is increasing at 4.5% annually, driving demand for modern appliances. Furthermore, the African Development Bank notes that electricity access has improved by 20% over the past decade, enabling greater adoption of washing machines. Government initiatives like Saudi Arabia’s Vision 2030 emphasize sustainable living, propelling demand. This region’s rapid growth displays its untapped potential and importance in shaping future market dynamics.

North America is a mature market with steady demand for washing machines driven by upgrades to energy-efficient models. The U.S. Energy Information Administration (EIA) reports that 70% of households now prioritize eco-friendly appliances, reflecting growing environmental awareness. Additionally, the U.S. Census Bureau states that household sizes are shrinking, increasing demand for compact and mid-sized machines. Government incentives, such as tax rebates for ENERGY STAR-rated appliances, further boost adoption. According to the National Association of Home Builders, smart home integration is becoming a key trend, with 30% of new homes equipped with connected appliances. This region’s focus on sustainability and innovation ensures its continued relevance in the global market.

Europe remains a significant player in the washing machines market, supported by stringent energy efficiency regulations. The European Environment Agency (EEA) notes that over 80% of washing machines sold in the EU meet the highest energy efficiency standards, driven by consumer awareness and regulatory frameworks. Germany, France, and the UK account for the majority of sales, with urban households driving demand. Eurostat reports that 65% of European households have upgraded to modern appliances in the past decade. Additionally, the European Commission’s Green Deal initiative promotes sustainable living, encouraging the adoption of eco-friendly machines. Europe’s emphasis on sustainability and quality positions it as a leader in premium appliance markets.

Latin America shows moderate growth in the washing machines market, supported by economic recovery and rising urbanization. The Economic Commission for Latin America and the Caribbean (ECLAC) reports that urban households account for 80% of the population, driving demand for affordable and durable appliances. Brazil and Mexico lead regional sales, with government programs like Brazil’s “Linha Branca” promoting appliance purchases. According to the Inter-American Development Bank, household spending on durable goods has increased by 15% over the past five years. Despite challenges like income inequality, improving infrastructure and access to credit are expected to sustain growth. This region’s evolving consumer base exhibits its potential for long-term expansion.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Whirlpool Corporation (U.S.), Samsung Electronics (South Korea), LG Electronics Inc. (South Korea), Electrolux AB (Sweden), Haier Smart Home Co. Ltd. (China), Godrej Industries Ltd. (India), IFB Industries Ltd. (India), Panasonic Holdings Corporation (Japan), Mirc Electronics Limited (India), BSH Hausgeräte GmbH (Germany) are playing dominating role in the global washing machine market.

The global washing machine market is highly competitive, driven by technological advancements, shifting consumer preferences, and increasing demand for energy-efficient appliances. Leading players such as Haier, LG Electronics, Whirlpool, Samsung, and Bosch dominate the market, competing on innovation, brand reputation, and pricing. These companies invest heavily in AI-driven smart features, IoT connectivity, and sustainable technologies to differentiate their products and appeal to tech-savvy and environmentally conscious consumers.

Competition is intensified by regional and local manufacturers, especially in emerging markets like India, China, and Southeast Asia, where demand for affordable and compact washing machines is rising. Price-sensitive consumers in these regions create opportunities for brands offering budget-friendly yet high-quality appliances. Companies like Midea, Godrej, and Panasonic leverage cost-effective manufacturing and localized product designs to gain market share.

Sustainability is another critical battleground, with manufacturers focusing on water and energy efficiency, reduced carbon footprints, and recyclable materials. Regulations and government incentives further push brands to innovate in this area.

So, the market remains highly fragmented, with premium brands targeting high-end consumers through advanced features, while budget brands cater to cost-conscious buyers.

TOP 3 PLAYERS IN THE MARKET

Haier Group

Haier Group, a Chinese multinational, has established itself as a dominant force in the global home appliances market, including washing machines. The company's growth strategy emphasizes innovation and user-centric designs, catering to diverse consumer needs worldwide. Haier's commitment to smart home solutions and energy-efficient appliances has bolstered its market position. By integrating advanced technologies into their products, Haier addresses the increasing consumer demand for convenience and sustainability.

Whirlpool Corporation

Whirlpool, an American multinational, has a longstanding presence in the home appliance industry. The company offers a comprehensive range of washing machines known for reliability and innovation. Despite recent challenges, including a reported loss in the fourth quarter of 2024 due to an impairment charge related to its Maytag brand, Whirlpool continues to focus on strategic initiatives to maintain its market share. The company's global reach and diverse product portfolio contribute significantly to the washing machine market.

LG Electronics

LG Electronics, a South Korean multinational, is renowned for its innovative consumer electronics and home appliances. The company's washing machines are acclaimed for incorporating cutting-edge technologies, such as AI-powered systems and smart connectivity. LG's commitment to research and development has facilitated the introduction of products that enhance user convenience and energy efficiency. In December 2024, LG's Indian subsidiary filed for an initial public offering (IPO), aiming to capitalize on the growing demand for consumer durables in the region.

STRATEGIES USED BY THE MARKET PLAYERS

Technological Innovation and Smart Connectivity

Leading companies such as LG, Haier, and Whirlpool continuously invest in technological advancements to offer innovative washing machines with smart features. AI-powered washing machines, IoT integration, and advanced sensors have become standard offerings. For instance, LG and Samsung have developed AI-driven washing machines that automatically adjust wash cycles based on fabric type and dirt levels. This strategy helps these brands differentiate themselves in the market, catering to consumers who seek convenience, efficiency, and sustainability. Smart connectivity features, such as mobile app controls and voice assistant compatibility, further enhance user experience, making these brands stand out in the competitive landscape.

Sustainable and Energy-Efficient Product Development

Environmental consciousness is a significant driver in the washing machine market, leading companies to develop energy-efficient and water-saving appliances. Haier and LG have focused on producing eco-friendly washing machines that comply with global sustainability standards. Whirlpool, for instance, has introduced models with adaptive water and energy consumption to reduce the environmental impact. By addressing growing regulatory requirements and consumer preferences for sustainable products, these companies position themselves as responsible market leaders, enhancing brand reputation and customer loyalty.

Market Expansion and Localization Strategies

To capture new customer segments and strengthen their global presence, leading brands are expanding into emerging markets and localizing their offerings. Haier, for example, has aggressively expanded its footprint in Asia, Africa, and Latin America, tailoring its products to meet regional consumer preferences. LG and Whirlpool have also localized their manufacturing and R&D efforts, ensuring that washing machines cater to local water conditions, detergent types, and consumer habits. By establishing local production facilities and distribution networks, these companies reduce costs, improve customer service, and gain a competitive edge in diverse markets.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Samsung India launched a new range of AI-powered front-load washing machines with a 12 kg capacity. This innovation aims to reduce energy consumption by over 70% and features AI that detects fabric types and water turbidity to optimize detergent use and fabric care.

- In January 2025, China expanded a subsidy program for consumers trading in old appliances, including washing machines, to boost consumption amid economic slowdowns. The initiative provides subsidies of 15-20% for consumers who trade in old goods, funded by an Rmb81bn ($11bn) allocation for 2025.

MARKET SEGMENTATION

This research report on the global Washing machine market has been segmented and sub-segmented based on product type, capacity, and region.

By Product Type

- Fully Automatic

- Front Load

- Top Load

- Semi- Automatic

- Dryer

By Capacity

- Below 5 Kg

- 5-7 Kg

- Above 7 Kg

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the Compound Annual Growth Rate (CAGR) of the global washing machine market from 2025 to 2033?

The global washing machine market is projected to grow at a CAGR of 4.68% from 2025 to 2033.

2. What factors are driving the growth of the global washing machine market?

Key drivers include urbanization, rising disposable incomes, changing lifestyles, technological advancements, and increasing demand for energy-efficient and smart appliances.

3. Which region dominates the global washing machine market?

The Asia Pacific region currently holds the largest market share due to rapid urbanization and increasing consumer spending on household appliances.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]