Global Virtual Reality Market Size, Share, Trends & Growth Forecast Report Segmented By Device (Head-Mounted Display (HMD), Gesture-Tracking Device (GTD), and Projectors & Display Wall (PDW)), Technology, Component, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Virtual Reality Market Size

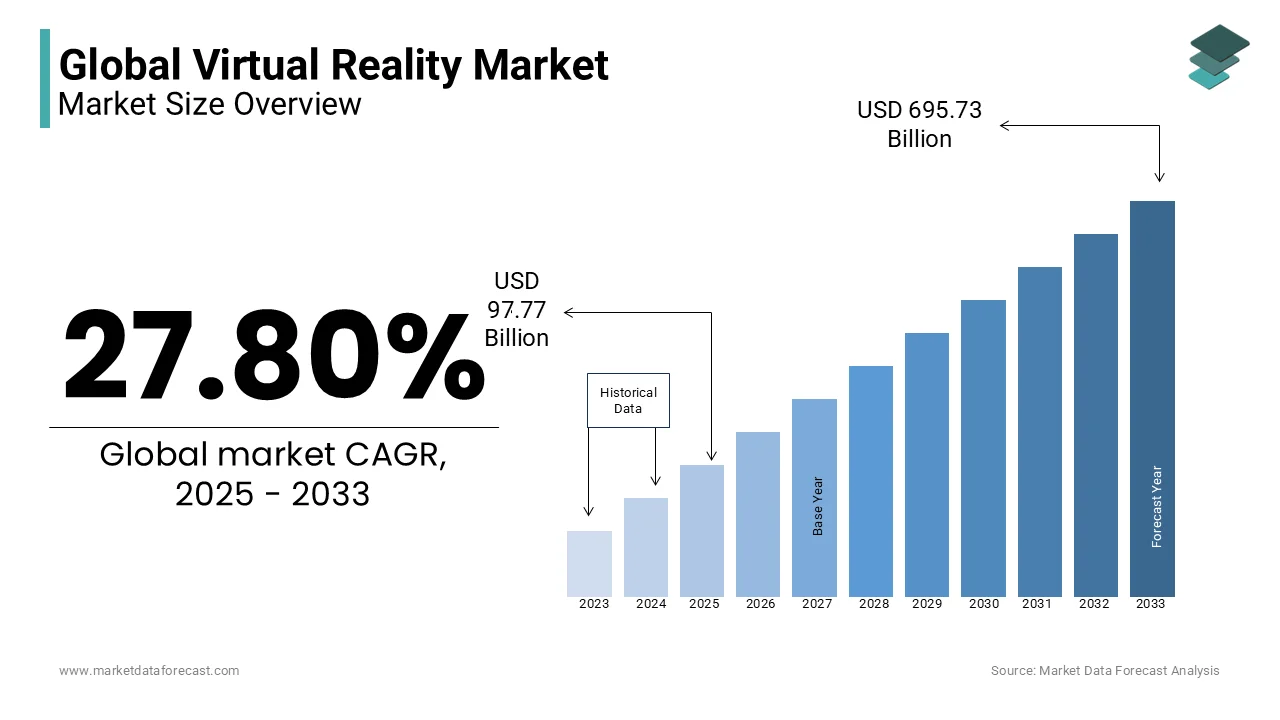

The global virtual reality market was worth USD 76.50 billion in 2024. The global market is projected to reach USD 695.73 billion by 2033 from USD 97.77 billion in 2025, growing at a CAGR of 27.80% from 2025 to 2033.

Virtual Reality (VR) includes the design, development, and commercialization of immersive digital environments that simulate real-world or imagined settings. Users experience these environments through specialized devices such as VR headsets, haptic feedback gloves, and motion controllers, which offer interaction and a sense of presence. The primary sectors driving VR adoption include gaming, healthcare, education, real estate, and defense. The U.S. National Intelligence Council (NIC) reports that the demand for VR technology will expand significantly, particularly in applications such as virtual healthcare and remote collaboration. In healthcare, for instance, the use of VR for surgical training and rehabilitation is advancing, with the National Institutes of Health (NIH) noting VR's effectiveness in reducing patient anxiety during treatments and aiding in post-surgery rehabilitation.

The gaming sector remains one of the most prominent areas for VR adoption. According to the Entertainment Software Association (ESA), over 6 million VR headsets were sold in North America alone in 2021, and the number is anticipated to grow as consumer demand increases. Additionally, the U.S. Bureau of Labor Statistics (BLS) reports a surge in job roles related to VR development, with employment in the VR and AR industry expected to grow by 30% between 2020 and 2030 which is significantly faster than the average for other occupations. Investment in VR hardware and infrastructure is also ramping up. Leading technology companies such as Meta, Sony, and Apple are directing substantial resources towards enhancing the accessibility and quality of VR devices. Meta's Quest 2 headset, for example, achieved over 10 million units sold globally by 2022 that is a landmark achievement reflecting the market's growing acceptance.

MARKET DRIVERS

Increasing Adoption of VR in Healthcare

The use of Virtual Reality (VR) in healthcare is one of the major drivers of the market. VR technology has been adopted for medical training, patient therapy, and surgical simulation, enhancing both learning and patient outcomes. According to the National Institutes of Health (NIH), VR has been shown to significantly reduce pain perception during medical procedures, with studies demonstrating up to a 30% reduction in pain for patients undergoing burn wound care. Moreover, VR is being increasingly used in mental health treatment for PTSD where exposure therapy through VR environments helps reduce symptoms. The adoption of VR-based therapy tools is also growing due to the increasing awareness and integration of such technologies in clinical practices is significantly boosting market demand.

Growth in the Gaming Industry

The gaming industry remains a core driver of the Virtual Reality market, with immersive gaming experiences taking center stage. As gaming platforms evolve, VR has become a key feature in offering more interactive and lifelike experiences. According to the Entertainment Software Association (ESA), over 6 million VR headsets were sold in North America alone in 2021 is highlighting the increasing popularity of VR in gaming. The surge in demand for VR-enabled gaming consoles, such as Sony’s PlayStation VR and Meta’s Oculus Quest reflects this shift. This trend is expected to intensify with consumer spending on VR games projected to grow at a rapid pace which is driven by advancements in both hardware and content.

MARKET RESTRAINTS

High Cost of VR Equipment

One of the primary restraints for the Virtual Reality market is the high cost of VR hardware which limits widespread adoption. High-quality VR headsets, along with compatible computing systems can cost thousands of dollars by making the technology less accessible to a broader audience. The U.S. Consumer Product Safety Commission (CPSC) reports that, VR systems still remain relatively expensive despite falling prices with some advanced models retailing for upwards of $1,000. This price barrier is particularly evident in sectors like education and healthcare, where organizations may be reluctant to invest heavily in VR infrastructure. The affordability of VR hardware remains a significant challenge to market expansion is slowing down its adoption in non-consumer sectors.

Limited Content and Application Variety

The Virtual Reality market also faces a limitation due to the restricted variety of content and applications available. Although VR has made strides in gaming, healthcare, and education, there is still a lack of diverse, high-quality content for broader use cases. According to the U.S. National Science Foundation (NSF), while the gaming industry has seen significant growth in VR content, other sectors such as business, training, and entertainment are still lagging. A limited content ecosystem restricts the market’s ability to expand rapidly, particularly in industries that are less familiar with VR's potential. The need for more versatile applications across various fields remains a challenge for the full-scale adoption of VR technology.

MARKET OPPORTUNITIES

Expansion of VR in Remote Work and Collaboration

The growing shift towards remote work presents a significant opportunity for the Virtual Reality market, as businesses seek immersive collaboration tools to bridge the gap between remote teams. VR has the potential to revolutionize virtual meetings and remote work environments by offering 3D spaces for real-time interaction. The U.S. Bureau of Labor Statistics (BLS) notes that remote work has surged, with over 25% of U.S. workers working remotely in 2023. VR-based platforms offer immersive experiences that are far more engaging than traditional video conferencing. The rise of VR in corporate settings for meetings, training, and team-building activities offers a large growth opportunity for the VR market as companies invest in new technologies to enhance employee engagement.

Advancements in VR for Education and Training

The education sector presents another substantial opportunity for the VR market, particularly in specialized training and simulation-based learning. VR can simulate complex scenarios that are difficult or expensive to recreate in traditional educational settings, such as medical procedures or high-risk industrial operations. The U.S. Department of Education has increasingly supported the use of immersive learning technologies, acknowledging their potential to enhance student engagement and skill development. For example, VR can provide medical students with virtual dissections or allow aviation students to practice flying without risk. VR is poised to become a central feature in modern education and vocational training is driving adoption across universities and vocational institutions.

MARKET CHALLENGES

Technological Limitations and User Experience Issues

Technological constraints, particularly concerning hardware and user comfort, remain a significant challenge for the Virtual Reality (VR) market. One major issue is motion sickness, which affects many users and limits the overall adoption of VR technology. According to the U.S. Food and Drug Administration (FDA), motion sickness can occur in up to 40% of VR users, causing discomfort and hindering prolonged use of VR systems. Additionally, the FDA has raised concerns over the eye strain and headaches associated with long-term VR usage, particularly among younger users. Moreover, the requirement for high-end computers or gaming consoles to run VR applications poses another barrier, as consumers and businesses face costs exceeding $1,000 for a quality VR setup. These technological limitations are critical in restricting VR’s mass-market adoption.

Data Privacy and Security Concerns

As VR technology becomes increasingly embedded into personal and professional life, concerns regarding data privacy and security intensify. VR systems collect sensitive user data, including biometrics such as voice patterns, eye movements, and even emotional responses, leading to potential privacy risks. According to a report by the Federal Trade Commission (FTC), over 35% of U.S. consumers are concerned about the safety of their personal data when using emerging technologies like VR. The FTC has also warned that inadequate data protection in VR platforms could result in serious breaches, especially since VR can access deeper levels of personal information than traditional digital platforms. With VR applications projected to grow across industries, from gaming to healthcare, data security must be strengthened to prevent misuse of sensitive information is posing a significant challenge to the market’s sustainable growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

27.80% |

|

Segments Covered |

By Device, Technology, Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Meta (formerly Facebook), HTC Corporation, Sony Interactive Entertainment, Valve Corporation, Microsoft Corporation, Varjo Technologies, Pimax, ZeniMax Media (Bethesda Softworks), North (by Focals), and Geocreates |

SEGMENTAL ANALYSIS

By Device Insights

The head-mounted display (HMD) segment dominated the virtual reality (VR) market with 50.9% of the global market share in 2024. The growth of the HMD segment is largely driven by consumer demand for immersive gaming and entertainment experiences, as well as professional applications in education and healthcare. According to the U.S. Consumer Product Safety Commission (CPSC), HMDs like Meta Quest 2 and Sony PlayStation VR are becoming increasingly affordable, with the price for high-end models dropping by nearly 30% over the past few years. This affordability has contributed to the rising adoption of HMDs, with the VR and AR Association (VRARA) reporting a surge in headsets sold globally which is highlighting the segment’s leadership in driving the VR market's expansion. The importance of HMDs lies in their ability to provide users with a fully immersive experience.

The gesture-tracking device (GTD) segment is expected to grow rapidly and is likely to register the highest CAGR of 30.7% from 2025 to 2033 owing to the increasing demand for more intuitive and immersive VR interfaces across industries such as healthcare, gaming, and military training. The National Institute of Standards and Technology (NIST) highlights that gesture-based interaction is critical in applications like surgery simulations, where precision and control are paramount. Furthermore, the U.S. Department of Defense has integrated GTDs into training simulators is showcasing their growing importance in high-stakes environments. The GTD market is expected to continue its rapid growth trajectory is reinforcing its pivotal role in the VR ecosystem.

By Technology Insights

The semi-immersive and fully immersive VR technology segment captured 35.9% of the global market share in 2024. These technologies dominate due to their high level of user engagement with deep sensory experiences that replicate real-world environments or entirely new realms. The growing importance of these immersive experiences in sectors like healthcare, training, and entertainment is crucial for their leadership. Semi and fully immersive VR platforms are integral in applications such as military training and medical simulations, where accuracy and realism are vital. For instance, the U.S. Department of Veterans Affairs deployed over 3,500 headsets across 170+ centers to provide enhanced care and therapeutic support to veterans that is showing the market's vital role in healthcare.

On the other hand, non-immersive VR technology segment is expected to register a promising CAGR of 21.4% over the forecast period due to its increased adoption in various industries. This growth is driven by the technology's affordability and ease of use, particularly in training and educational platforms. Non-immersive VR provides interactive environments without the need for headsets, making it ideal for applications in law enforcement training, such as those sponsored by the U.S. Bureau of Justice Assistance (BJA), which is using VR to improve de-escalation techniques in law enforcement

By Component Insights

The hardware segment occupied for 60.9% of the global market share in 2024. The dominance of hardware segment is largely driven by the increasing demand for VR headsets and motion tracking devices. According to the U.S. Bureau of Economic Analysis (BEA), hardware spending in the VR industry has been on the rise, driven by improved headset technologies, such as higher resolution displays, better field of view, and more responsive motion controllers. The Consumer Technology Association (CTA) also reports that VR headset sales in the U.S. grew by 24% in 2022. Hardware is essential as it forms the foundation for immersive VR experiences across gaming, healthcare, and training simulations, making it a critical driver of market growth.

The software segment is expected to expand at a CAGR of 20.4% from 2025 to 2033 owing to the rising need for VR applications in various industries, including healthcare, education, and training. According to the National Science Foundation (NSF), VR software development is gaining momentum as new immersive solutions are being created for medical training, therapeutic interventions, and educational experiences. For example, VR-based therapeutic programs for mental health and PTSD have been adopted widely in clinical settings. The U.S. Department of Veterans Affairs has integrated VR therapy into its treatment programs, which have shown positive results, reducing PTSD symptoms in veterans by up to 30%. Additionally, the U.S. Department of Education has been investing in VR software solutions to support virtual learning environments, with some districts reporting a 12-15% improvement in student engagement when using VR-based curricula. The segment is expected to continue its rapid expansion as demand for specialized software solutions grows which further drives the VR market forward.

By Application Insights

The healthcare segment captured 30.9% of the global market share in 2024. The dominance of healthcare segment is majorly driven by the increasing role of virtual reality in medical training, surgical simulations, and patient treatment. The National Institutes of Health (NIH) reports that VR-based therapies, such as exposure therapy, have shown to reduce anxiety in patients by up to 40% during medical procedures. In addition, VR is being used extensively in rehabilitation programs, helping patients recover from strokes and physical injuries. For example, studies supported by the U.S. Department of Veterans Affairs have found that VR can significantly improve rehabilitation outcomes for veterans with PTSD by improving patient engagement by 70%. The ability to simulate high-risk scenarios for training without harm and its proven success in therapeutic applications have solidified healthcare’s leading role in the VR market.

The enterprise segment is anticipated to witness the fastest CAGR of 22.5% over the forecast period. This remarkable growth of enterprise segment in the global VR market is largely driven by the increasing adoption of VR for employee training, remote collaboration, and product design simulations. According to the U.S. Bureau of Labor Statistics (BLS), businesses are increasingly turning to immersive technologies for training programs, which are especially beneficial in high-risk industries such as manufacturing, aviation, and healthcare. The U.S. Department of Labor notes that VR training programs not only reduce costs associated with physical training resources but also provide employees with practical, hands-on experience without risk. For instance, the U.S. Department of Defense has implemented VR for training pilots and soldiers in realistic environments, reporting improved training outcomes and retention rates. Furthermore, as remote work has increased, companies have begun to use VR for virtual team collaboration, where the market for VR-enabled virtual meetings is growing rapidly, reflecting the demand for more immersive communication tools. This sector’s expansion highlights the increasing value that enterprises place on immersive, scalable, and cost-efficient VR solutions.

REGIONAL ANALYSIS

North America was the largest regional segment for virtual reality worldwide and held 40.7% of the global market share in 2024. The growth in this region is due to the high levels of investment, technological advancements, and widespread adoption of VR across industries like healthcare, gaming, and defense. As of 2023, the United States, according to the U.S. Bureau of Economic Analysis (BEA), invests heavily in research and development through agencies like NASA and the Department of Defense, which have utilized VR for training and simulations. Additionally, the National Institutes of Health (NIH) has funded numerous VR-related health research projects to improve medical treatments. For example, the Department of Veterans Affairs has applied VR in therapeutic practices for veterans by helping them cope with PTSD and chronic pain.

The Asia-Pacific region is the fastest-growing market for virtual reality and is predicted to showcase an impressive CAGR of 27.5% over the forecast period. According to the International Telecommunication Union (ITU), internet penetration in APAC has surged by 15% over the past year, making VR content and services more accessible. China, in particular, has seen substantial growth in its VR market, bolstered by the Ministry of Industry and Information Technology, which reported a 30% increase in VR hardware exports in 2023. The Japan Ministry of Internal Affairs and Communications highlights the rise of VR in remote education and telemedicine, with growing interest in VR for virtual tourism as well. APAC's rapid growth is also reflected in a robust consumer base, with increased disposable income and a high level of technological adoption, making the region the fastest-growing in VR technology.

Europe is making significant strides in VR adoption, especially in sectors like healthcare, automotive, and aerospace. The European Commission has been a major proponent of VR technology, with investments in projects such as Horizon 2020 that focus on VR applications for healthcare and education. Additionally, the European Space Agency has used VR for astronaut training, while major automotive manufacturers like Volkswagen employ VR in vehicle design and safety testing. According to Eurostat, European countries are prioritizing the integration of VR into digital transformation initiatives is aiming to improve education, health, and urban infrastructure.

Latin America is poised for growth in the VR sector, driven by expanding internet access and increasing governmental support for technology adoption. According to the World Bank, internet penetration in the region has risen by 12% over recent years, facilitating greater access to VR content. Countries like Brazil and Mexico are leading the adoption of VR for educational purposes, with local initiatives to bring VR into schools to aid in distance learning. The Inter-American Development Bank (IDB) has also identified VR as a critical component for expanding digital educational tools. The region faces some economic challenges, but the increasing interest in VR from both consumers and governments indicates promising growth in the coming years.

The Middle East and Africa (MEA) region is experiencing significant growth in VR adoption, driven by both government initiatives and technological innovation. The UAE Vision 2021 emphasizes VR integration into sectors like healthcare, education, and tourism. The UAE Ministry of Economy reports investments in VR applications in enhancing tourism experiences, and Dubai has become a hub for VR technology within the tourism industry. The South African Department of Trade, Industry, and Competition has also highlighted VR as a tool to improve manufacturing and educational systems in the region.

KEY MARKET PLAYERS

The major players in the global virtual reality market include Meta (formerly Facebook), HTC Corporation, Sony Interactive Entertainment, Valve Corporation, Microsoft Corporation, Varjo Technologies, Pimax, ZeniMax Media (Bethesda Softworks), North (by Focals), and Geocreates

Top 3 Players in the Market

Meta (formerly Facebook)

Meta, through its Oculus brand, has significantly impacted the VR landscape. The launch of the Oculus Quest 2 and the Meta Quest 3 helped democratize VR by offering affordable and user-friendly standalone VR headsets. Meta’s contribution lies in making VR more accessible to the masses, especially for gaming and entertainment. Additionally, Meta is investing heavily in the metaverse, which includes VR-driven social experiences, gaming, and virtual economies. Meta’s widespread influence stems from its development of Oculus software, hardware, and a large content ecosystem, making VR mainstream and integrated into social platforms. The company is set to remain a dominant player as it continues its metaverse development, with billions invested annually into research and development.

HTC Corporation

HTC, a pioneer in VR, has consistently delivered high-quality VR hardware with the HTC Vive series. The Vive Pro and Vive Focus headsets cater to both consumer and enterprise markets, offering immersive VR experiences for gaming, education, and industrial applications. HTC’s Viveport platform is an important contribution to the VR ecosystem, providing a content library tailored to various VR applications. Moreover, HTC has focused heavily on enterprise-level solutions, positioning the Vive Pro and Vive XR series for professional use in training, architecture, and healthcare sectors. By combining innovative hardware with enterprise-focused software, HTC has cemented its position as a leader in immersive VR technologies.

Sony Interactive Entertainment

Sony is a key player in VR, particularly in the console gaming sector. Its PlayStation VR (PS VR) headsets have been at the forefront of virtual reality gaming, offering players an immersive experience tied to the PlayStation console. With the launch of the PlayStation VR2 for the PlayStation 5, Sony further advanced its VR offerings, delivering enhanced graphics, new gaming experiences, and exclusive content. Sony’s contribution to the VR market is invaluable due to its large gaming community, which has fueled the growth of VR gaming. With exclusive VR titles and innovative hardware, Sony is establishing itself as a major force in the VR entertainment sector.

Top strategies used by the key market participants

Product Diversification and Innovation

Leading VR companies consistently innovate and diversify their product offerings to cater to both consumer and enterprise needs. Meta, for instance, has focused on developing multiple versions of its Oculus Quest series, allowing it to serve different market segments from casual gamers to developers and VR enthusiasts. The company is also advancing in the metaverse, integrating VR with augmented reality (AR) and other immersive technologies to enable new forms of digital interaction.

HTC has adopted a similar approach with its Vive Pro and Vive XR Elite headsets, targeting both consumer and professional markets, such as healthcare, engineering, and architecture. They continue to evolve their product portfolio by adding new features like eye tracking, improved resolution, and standalone capabilities to stay competitive in both gaming and professional VR applications.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are another critical approach used to strengthen market position. Sony Interactive Entertainment focuses heavily on gaming, partnering with top game developers to create exclusive VR titles for its PlayStation VR platform. Exclusive content is a key driver for Sony’s VR success, as it enhances the attractiveness of its hardware and ecosystem. In fact, exclusive VR games, such as Astro Bot Rescue Mission and Blood & Truth, have been instrumental in boosting the PlayStation VR’s popularity.

Meta has also pursued partnerships with developers and content creators to build a robust ecosystem for its VR hardware. Its acquisition of Beat Games, the creators of the hit VR game Beat Saber, bolstered its content offerings and provided exclusive titles that attract new users. Additionally, Meta’s investment in AR/VR applications for the workplace and remote collaboration is evident through collaborations with enterprise software companies like Microsoft.

Expanding Ecosystem and Software Integration

Creating a comprehensive VR ecosystem that integrates hardware, software, and content is a crucial strategy for many players. Meta leads this approach with its integrated platform that includes the Meta Quest Store for apps, games, and experiences, providing a seamless experience between hardware and content. Moreover, its development of Horizon Worlds, a social VR platform, aligns with its broader goal to dominate the metaverse.

Similarly, HTC has built an extensive content platform through Viveport, which offers a subscription model for accessing VR games, apps, and experiences. HTC’s integration of enterprise-focused applications, such as Vive Sync for virtual meetings and collaboration, showcases its focus on strengthening its position in the professional VR market.

Focus on Enterprise and Professional Applications

In addition to consumer VR, companies like HTC and Meta are placing significant emphasis on the enterprise and professional sectors. Meta is investing heavily in business VR solutions, including virtual collaboration tools, which align with the increasing demand for remote work and virtual meetings. For example, Meta has partnered with Microsoft to bring Office 365 and Microsoft Teams into VR environments on its headsets.

HTC, through its Vive Enterprise Solutions, is targeting industries such as healthcare, education, and design. For example, in healthcare, HTC’s Vive headsets are used for medical simulations and training, while in education, VR solutions provide immersive learning experiences.

Expanding Global Presence

Geographic expansion is another crucial strategy. Sony continues to leverage its global reach through PlayStation’s extensive market presence in the U.S., Europe, and Asia, especially with the PlayStation VR2 for the PlayStation 5. Similarly, Meta is aggressively targeting global markets, including developing economies, by offering affordable standalone VR solutions.

HTC, while focusing on enterprise solutions, is expanding its reach in the Asia-Pacific region, where VR adoption is growing rapidly in sectors like manufacturing and education. The company has also strengthened its position in Europe and North America through targeted marketing and partnerships with regional enterprises.

Cost Leadership and Affordability

Companies like Meta have adopted cost leadership strategies to gain a competitive edge. By offering affordable, standalone VR headsets like the Meta Quest 2, which eliminates the need for external computers or consoles, Meta has been able to make VR accessible to a broader audience. This affordability allows Meta to attract both casual gamers and VR enthusiasts, fostering widespread adoption of its devices.

Sony has also worked on reducing the cost of its PlayStation VR hardware, offering bundled packages with the PlayStation console to create an attractive entry point for consumers.

Investment in Research and Development

Continuous investment in research and development (R&D) is vital for staying ahead of the curve in VR technology. Meta has committed billions of dollars to R&D in areas such as AI-driven VR, haptic feedback systems, and advanced motion tracking. Similarly, HTC invests heavily in developing cutting-edge VR technology, such as 6DoF (Six Degrees of Freedom) for enhanced immersion, wireless VR, and eye-tracking technology.

Marketing and Branding

Strong marketing and brand presence also play a crucial role in maintaining market leadership. Meta has effectively leveraged its existing social media ecosystem to market Oculus and Quest products, reaching a vast consumer base through Facebook and Instagram ads. Its focus on the metaverse has also helped position it as a future-forward tech company, appealing to consumers interested in next-gen technologies.

Sony, with its strong brand presence in the gaming industry, uses its established reputation in gaming hardware to sell PlayStation VR. Its focus on quality and immersive experiences appeals to its established base of PlayStation users, bolstering its competitive edge in the VR space.

COMPETITIVE LANDSCAPE

The Virtual Reality (VR) market is highly competitive, with numerous players vying for dominance across diverse sectors, including gaming, entertainment, healthcare, education, and enterprise solutions. Leading companies, such as Meta (formerly Facebook), HTC, Sony, Microsoft, and Valve, are constantly innovating to capture market share, while newer entrants are introducing specialized products targeting niche segments.

Meta has been a key driver of consumer VR adoption with its Oculus line, focusing on affordability and accessibility with products like the Meta Quest 2 and Meta Quest 3. It also heavily invests in the development of the metaverse, positioning itself as a pioneer in the next-generation digital experience.

HTC remains a strong contender, catering to both gaming and enterprise markets with its Vive series. The company’s focus on high-end VR hardware for professional applications, such as medical training and industrial design, differentiates it from consumer-focused players.

Sony capitalizes on its established gaming ecosystem with its PlayStation VR, gaining significant traction among console gamers. Its focus on exclusive content and immersive experiences ensures a strong position in the VR gaming market.

RECENT HAPPENINGS IN THE MARKET

- In October 2021, Meta launched the Meta Quest 2 with enhanced performance, improved resolution, and affordability, aiming to make VR more accessible to mainstream consumers. This move was part of Meta’s broader strategy to dominate the VR and metaverse markets.

- In March 2021, HTC Corporation introduced the Vive Pro 2 headset, which featured a 5K display resolution and wider field-of-view. This product targeted the high-end VR market and strengthened HTC’s position in both gaming and professional VR applications.

- In February 2022, Sony Interactive Entertainment revealed the PlayStation VR2 headset, equipped with new features such as eye-tracking and enhanced motion controls. This launch was designed to enhance the VR gaming experience and attract a broader base of PlayStation users.

- In May 2021, Microsoft Corporation announced a collaboration with Meta to integrate Microsoft Teams and Office 365 into VR environments on Meta’s Quest headsets. This strategic partnership strengthened Microsoft’s presence in the enterprise VR and remote work markets.

- In July 2021, Valve Corporation released the Valve Index bundle, featuring a full-fidelity experience with advanced tracking technology. This move catered to premium PC VR gamers, strengthening Valve's niche in the high-end VR market.

- In April 2021, Varjo Technologies launched the XR-3 and VR-3 headsets, offering ultra-high resolution for professional applications like aviation training and industrial simulations. This strengthened Varjo’s position in the enterprise VR sector.

- In January 2022, Pimax introduced the 8K X VR headset, offering an 8K resolution and wider field-of-view for high-end users. This product was designed to cater to VR enthusiasts and professionals seeking top-tier immersion.

- In November 2020, Oculus Studios (Meta) acquired Beat Games, the developer of the popular VR game Beat Saber. This acquisition enhanced Meta’s content offerings, attracting more users to its Oculus ecosystem.

- In April 2020, HTC Corporation launched Viveport Infinity, a subscription service offering unlimited access to VR content. This initiative aimed to enhance the value proposition of Vive users and strengthen HTC’s VR platform.

- In March 2021, Sony Interactive Entertainment acquired Haven Studios, a game development studio focused on creating next-gen exclusive content for PlayStation VR2. This acquisition ensured a pipeline of exclusive VR titles, boosting the value of PlayStation VR hardware.

MARKET SEGMENTATION

This research report on the global virtual reality market is segmented and sub-segmented into the following categories.

By Device

- Head-Mounted Display (HMD)

- Gesture-Tracking Device (GTD)

- Projectors & Display Wall (PDW)

By Technology

- Semi & Fully Immersive

- Non-immersive

By Component

- Hardware

- Software

By Application

- Aerospace & Defense

- Consumer

- Commercial

- Enterprise

- Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global virtual reality (VR) market?

The growth of the VR market is driven by advancements in hardware, increased adoption in gaming and entertainment, expanding applications in healthcare and education, and growing enterprise use for training and simulations.

What are the latest advancements in VR hardware?

Recent advancements include wireless standalone headsets, improved motion tracking, higher-resolution displays, wider fields of view, and haptic feedback systems for enhanced immersion.

What impact is VR having on the gaming industry?

VR is revolutionizing gaming by offering fully immersive environments, realistic interactions, and motion-based gameplay, making gaming experiences more engaging and lifelike.

What is the future outlook for the VR market?

The VR market is expected to expand with continued technological advancements, lower costs, broader applications across industries, and greater integration with artificial intelligence and cloud computing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]