Global Vinyl Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Vinyl Acetate, Vinyl Alcohol, Vinyl Chloride, Others), End-User and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Vinyl Market Size

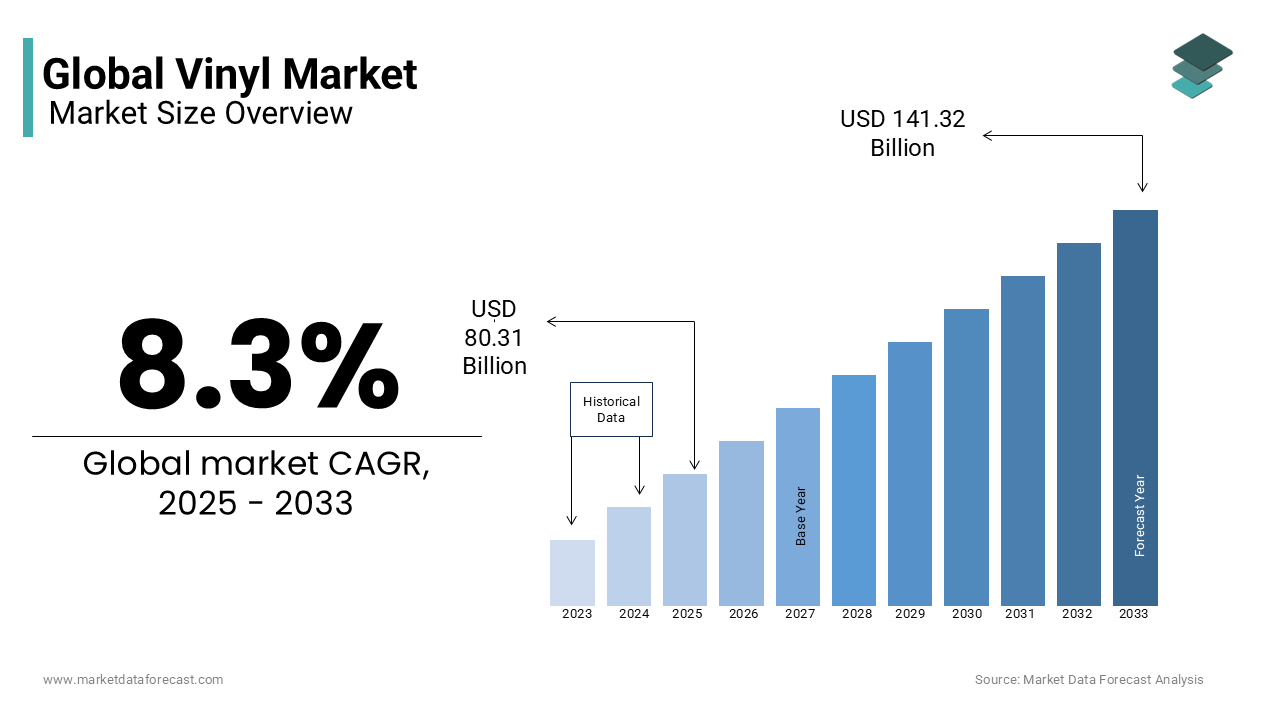

The global vinyl market size was estimated at USD 74.83 billion in 2024 and is projected to reach USD 141.32 billion by 2033 from USD 80.31 billion in 2025, growing at a CAGR of 8.3% from 2025 to 2033.

Vinyl records is crafted from polyvinyl chloride (PVC) and offers an analogue sound quality that many audiophiles and collectors find superior to digital formats. This preference is driven by the rich as well as authentic audio experience and the tangible nature of vinyl including large-format album artwork and the physical act of playing a record.

Vinyl records have achieved remarkable milestones in recent years. According to the Recording Industry Association of America (RIAA), 2023 marked the second consecutive year where vinyl records outsold CDs in the United States with 43 million vinyl units sold compared to 37 million CDs. This trend underscores a sustained consumer interest in physical music formats even amidst the dominance of digital streaming services.

The resurgence of vinyl has also led to significant developments in manufacturing. GZ Media that is headquartered in the Czech Republic has expanded its operations to meet growing demand. The company announced the establishment of Nashville Record Pressing in the United States and is aiming to produce up to 85,000 records daily. This expansion reflects the industry's commitment to scaling production capabilities while maintaining the quality that vinyl enthusiasts expect.

MARKET DRIVERS

Cultural Resurgence and Nostalgia

The revival of vinyl market is largely influenced by cultural resurgence and nostalgia among consumers. The UK's Office for National Statistics in 2024 reintroduced vinyl records into the Consumer Prices Index basket of goods which gives emphasis to their renewed popularity. This move reflects a broader trend where both older and younger generations are gravitating towards the tangible and authentic experience that vinyl offers by seeking a deeper connection to music that digital formats often lack.

Collectibility and Tangible Value

Vinyl records have become highly sought-after collectibles with limited edition releases and exclusive pressings attracting both music enthusiasts and collectors. The tangible nature of vinyl when combined with its aesthetic appeal has led to a surge in demand for physical albums. Nearly six million vinyl records were sold in the UK in 2024 which is marking the highest annual level since 1990, as reported by the British Phonographic Industry. This trend underscores the enduring value consumers place on owning and collecting vinyl records.

MARKET RESTRAINTS

Environmental Impact of Vinyl Production

The production of vinyl records involves the use of polyvinyl chloride (PVC) which is a material associated with significant environmental concerns. The U.S. Environmental Protection Agency (EPA) has identified that the manufacturing of PVC releases hazardous air pollutants including vinyl chloride and vinyl acetate which pose risks to both environmental and human health. These emissions contribute to air and water pollution and is raising concerns about the ecological footprint of vinyl record production. The sustainability of vinyl manufacturing processes is under scrutiny because of increase in environmental awareness which is potentially restraining market growth.

Health Risks Associated with Vinyl Chloride

Vinyl chloride is a key component in PVC used for vinyl records and is recognized as a human carcinogen by the U.S. Environmental Protection Agency. Exposure to vinyl chloride has been linked to an increased risk of a rare form of liver cancer known as angiosarcoma as well as other serious health issues. These health risks have prompted regulatory scrutiny and could lead to stricter safety protocols in vinyl record production and is undoubtedly impacting the market.

MARKET OPPORTUNITIES

Integration of Vinyl Records into Consumer Price Indices

The inclusion of vinyl records in official economic measures underscores their renewed importance in consumer spending. The UK's Office for National Statistics in 2024 reinstated vinyl records into the Consumer Prices Index basket of goods and is reflecting their resurgence in popularity. This move indicates that these records have become a notable component of consumer expenditure and is presenting opportunities for businesses to capitalize on this growing market segment.

Retailers Reintroducing Vinyl Offerings

The revival of vinyl records has prompted major retailers to reintroduce them into their product lines. For instance, in 2024, WH Smith announced it would stock vinyl albums in 80 of its UK stores after a three-decade hiatus. This decision aligns with data from the British Phonographic Industry which reported nearly six million vinyl records sold in the UK in 2023 that is the highest since 1990. The resurgance of vinyl by prominent retailers signifies a recognition of its commercial viability and offers an avenue for increased sales and market expansion.

MARKET CHALLENGES

Regulatory Scrutiny and Potential Policy Changes

The vinyl market is severely affected by the increased regulatory scrutiny over the environmental and health impacts of vinyl chloride. In January 2025, the U.S. Environmental Protection Agency (EPA) initiated a formal review of vinyl chloride that is acknowledging its carcinogenic properties and potential risks to human health. This review could lead to stricter regulations or even bans on the use of vinyl chloride in manufacturing processes. Such policy changes may disrupt production and supply chains within the vinyl industry and thereby necessitating adaptations to comply with new safety and environmental standards.

Supply Chain Vulnerabilities and Transportation Risks

The transportation of vinyl chloride presents major safety risk, as evidenced by the February 2023 train derailment in East Palestine (Ohio) which resulted in a controlled burn of vinyl chloride to prevent a major explosion. This incident throws light on the dangers associated with transporting hazardous materials and led to increased scrutiny of supply chain practices within the vinyl industry. The potential for accidents during transportation not only endangers public health and the environment but also threatens the stability of supply chains which is potentially causing delays and increased costs for manufacturers reliant on vinyl chloride.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

GZ VINYL, Dublin Vinyl, Vinyl Chemicals (India) Ltd., Dow, LyondellBasell Industries Holdings B.V., Wacker Chemie AG, LG Chem., Central Drug House, DCM Shriram, MarvelVinyls, Emerald Performance Materials, Royal Dutch Shell plc. |

SEGMENTAL ANALYSIS

By Type Insights

The vinyl chloride was the predominant segment in the vinyl market and held 70.2% market share in 2024. Its role in producing polyvinyl chloride (PVC) which is a versatile plastic extensively used in construction, automotive, and packaging industries is the primary driver of this segment’s growth. The U.S. Environmental Protection Agency (EPA) highlights that PVC is utilized in products such as pipes, wiring, and building materials and that is underscoring its widespread application. The material's durability and cost-effectiveness contribute to its dominance in the market.

The vinyl acetate segment is flourishing in the vinyl market and is predicted to showcase a CAGR of 6.4% during the forecast period. The application of vinyl acetate in producing polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH) is influencing the segment’s growth. These compounds are integral to adhesives, coatings and textile finishes. The U.S. Department of Health and Human Services notes that vinyl acetate is used in the manufacture of adhesives for packaging and construction, contributing to its increased demand. The rising need for high-performance adhesives and coatings in various industries propels the expansion of the vinyl acetate segment.

By End User Insights

The construction industry is the biggest end-user of vinyl products and accounted for 68.2% of the global market share in 2024. Vinyl materials and particularly polyvinyl chloride (PVC) are extensively used in construction applications such as pipes, siding, windows and flooring due to their durability, cost-effectiveness and resistance to environmental factors. The U.S. Environmental Protection Agency (EPA) highlights PVC's widespread use in building and construction and thereby noting its application in products like piping and wiring. This extensive utilization underscores vinyl's importance in the construction sector.

The healthcare sector is gaining momentum quickly in the adoption of vinyl products and is predicted to witness a notable CAGR over the forecast period. Vinyl and especialy PVC is essential in manufacturing medical devices such as IV bags, tubing and blood bags owing to its flexibility, clarity, and ability to be sterilized. The U.S. Food and Drug Administration (FDA) recognizes PVC as a material commonly used in medical devices and cited its versatility and safety. The increasing demand for disposable medical devices are driven by heightened healthcare needs and infection control measures which propels the growth of vinyl applications in healthcare. This trend underscores the material's critical role in advancing medical technology and patient care.

REGIONAL ANALYSIS

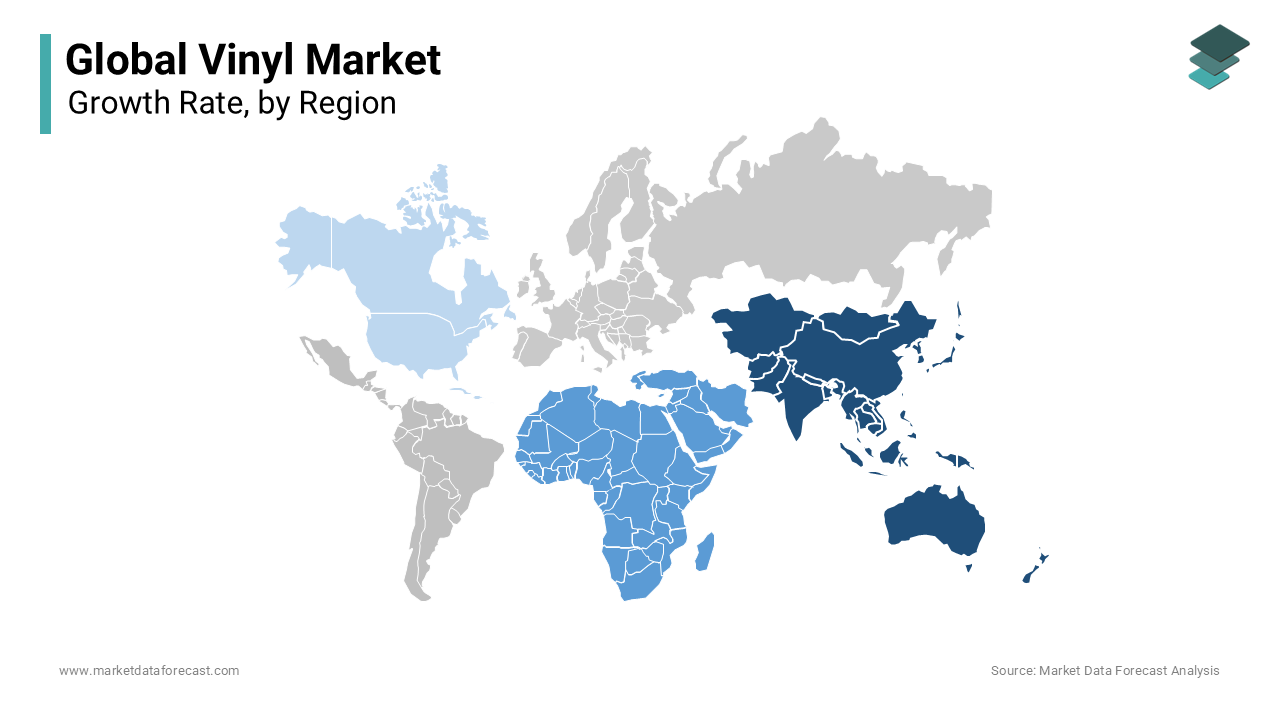

Asia-Pacific commanded the vinyl market by holding 45.3% of the global share in 2024. The region's leading position is linked to its rapid urbanization and industrialization and particularly in China and India. In 2022, China’s construction sector accounted for $4.34 trillion, according to the National Bureau of Statistics of China which is driving demand for vinyl products like PVC pipes and flooring. India’s Smart Cities Mission is estimated to be valued at $1.2 trillion and that further boosts infrastructure development. Asia-Pacific remains pivotal to the global vinyl market due to affordable raw materials and robust manufacturing capabilities.

The vinyl market in Middle East & Africa is projected to grow at a CAGR of 7.8% over the forecast period due to the infrastructure investments under Saudi Vision 2030 and UAE Vision 2030, which aim to diversify economies. The Gulf Cooperation Council (GCC) reports that construction projects in the GCC region are forecasted to be valued at $2.3 trillion. Additionally, South Africa’s Department of Trade, Industry, and Competition highlights rising demand for durable materials in housing projects. These initiatives underscore the region’s importance in scaling vinyl adoption globally.

North America holds a significant share of the vinyl market. The region's growth is driven by the robust housing and construction sector which greatly contributed to the economy in 2024. According to the U.S. Environmental Protection Agency (EPA), increasing demand for sustainable vinyl products, such as energy-efficient windows and eco-friendly flooring. Additionally, Canada’s Infrastructure Bank reports investments exceeding CAD 180 billion in infrastructure projects through 2028. With stringent building codes promoting durable materials, North America remains a key player in the global vinyl market.

Europe represents a mature market for vinyl with steady growth and is supported by green building initiatives. The European Commission reports that sustainable construction investments reached €180 billion in 2022 which is driving demand for recyclable vinyl products. Germany leads the region with its construction industry valued at €350. The European Vinyls Corporation (EVC) emphasizes that over 700,000 tons of PVC are recycled annually in Europe that is underscoring the region’s commitment to sustainability. Stringent environmental regulations and innovation in eco-friendly vinyl applications ensure Europe’s continued relevance in the global market.

Latin America is expected to witness moderate growth in the vinyl market influenced by rising infrastructure investments. Brazil’s Ministry of Infrastructure reports a $130 billion plan for transportation and housing projects through 2025 which is boosting demand for vinyl pipes and fittings. Mexico’s National Development Plan emphasizes affordable housing, with over 500,000 homes constructed annually, as per CONAVI (National Housing Commission). While challenges like limited industrial capacity persist, increasing urbanization and government initiatives position Latin America as a growing contributor to the global vinyl market.

Top 3 Players in the market

GZ Media

GZ Media, headquartered in the Czech Republic, is recognized as the world's largest manufacturer of vinyl records. Established in 1951, the company has a long-standing history in vinyl production and has adapted to the resurgence of vinyl records in recent years. GZ Media operates major facilities in Loděnice, Czech Republic, employing nearly 2,000 people. As of 2016, the company was valued at approximately $100 million and was projected to press over 25 million records annually, accounting for about 60% of global vinyl record production.

Celanese Corporation

Celanese Corporation, based in Irving, Texas, is a global leader in the production of vinyl acetate monomer (VAM), a key chemical used in the manufacture of various vinyl-based products such as adhesives, coatings, and films. The company operates 25 production plants and six research centers across 11 countries, with significant facilities in North America, Europe, and Asia. Celanese's extensive production capacity and global presence make it a pivotal contributor to the vinyl market, particularly in supplying essential raw materials for diverse applications.

LyondellBasell Industries

LyondellBasell Industries is a multinational chemical company known for its production of various vinyl compounds, including polyvinyl chloride (PVC). PVC is widely used in construction, automotive, and healthcare industries due to its durability and versatility. The company's innovations in vinyl production have led to the development of high-performance materials that meet stringent industry standards. LyondellBasell's global operations and commitment to sustainability have solidified its position as a key player in the vinyl market.

Top strategies used by the key market participants

Vinyl Group

Vinyl Group has adopted an aggressive acquisition strategy to expand its presence in the music, media, and entertainment sectors. In 2024, the company made multiple acquisitions, including The Brag Media in January for $8 million, Mediaweek in August for $1 million, and Funkified Entertainment Pty Ltd in September for up to $2.5 million. Additionally, Vinyl Group acquired Serenade, a UK-based digital collectibles startup, integrating digital assets with vinyl records. These strategic moves have strengthened Vinyl Group's position by diversifying its offerings and increasing market reach, making it a dominant player in the vinyl industry.

United Record Pressing

United Record Pressing, the oldest vinyl record manufacturer in the U.S., has focused on technological advancements to maintain its competitive edge. The company blends traditional vinyl production methods with modernized machinery to enhance efficiency and meet the growing demand for vinyl records. By late 2024, United Record Pressing had expanded its production capacity to manufacture up to 80,000 records per day. This investment in production efficiency has enabled the company to capitalize on the vinyl revival and cater to a broad spectrum of artists and record labels.

LyondellBasell Industries

LyondellBasell Industries, a leading global producer of vinyl compounds such as polyvinyl chloride (PVC), has strengthened its market position through innovation and sustainability initiatives. The company continuously develops high-performance vinyl materials for applications in construction, healthcare, and automotive industries. By focusing on sustainability, LyondellBasell has introduced eco-friendly vinyl products, reducing environmental impact and aligning with global regulatory standards. These efforts have reinforced its leadership in the vinyl sector, ensuring long-term market relevance.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

GZ VINYL, Dublin Vinyl, Vinyl Chemicals (India) Ltd., Dow, LyondellBasell Industries Holdings B.V., Wacker Chemie AG, LG Chem., Central Drug House, DCM Shriram, MarvelVinyls, Emerald Performance Materials, Royal Dutch Shell plc are some of the key market players in the vinyl market.

The vinyl market has witnessed a resurgence in recent years, driven by growing consumer demand for physical music formats, nostalgia, and collectible editions. This revival has intensified competition among key players, including established manufacturers, emerging vinyl pressers, and digital-first companies expanding into the physical music space.

Major manufacturers such as GZ Media, United Record Pressing, and Optimal Media dominate the market with large-scale production capabilities and long-standing industry relationships. Their ability to mass-produce records efficiently gives them a competitive advantage. However, boutique pressing plants, such as Third Man Pressing, cater to niche markets by offering high-quality, limited-edition releases, further fragmenting competition.

The competitive landscape is also influenced by material suppliers like LyondellBasell Industries, which provide essential components like polyvinyl chloride (PVC). Supply chain challenges and rising raw material costs have heightened the need for innovation and sustainability initiatives.

In addition to traditional record pressing companies, Vinyl Group has entered the market through strategic acquisitions, integrating media and event businesses with vinyl distribution. The digital-to-physical crossover, including collectible vinyl paired with NFTs, adds another competitive dimension. Overall, the market remains highly competitive, with companies focusing on technological advancements, branding, and sustainability to differentiate themselves.

RECENT MARKET DEVELOPMENTS

- In January 2024, Survitec Group acquired Vinyl Technology, a company specializing in the production of protective equipment and life support systems. This acquisition aimed to enhance Survitec's product offerings in safety and survival solutions.

- In August 2024, Vinyl Group announced the acquisition of Mediaweek, a media and marketing trade publication, for $500,000 in cash and $500,000 in shares.

MARKET SEGMENTATION

This research report on the vinyl market is segmented and sub-segmented into the following categories.

By Type

- Vinyl Acetate

- Vinyl Alcohol

- Vinyl Chloride

- Others

By End User

- Automotive

- Construction

- Electrical

- Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the challenges faced by the Vinyl market?

Challenges include environmental concerns regarding the disposal of vinyl products, regulatory issues, and competition from alternative materials such as wood, metals, and other synthetic polymers.

Which regions are leading the Vinyl market?

Asia Pacific and North America currently dominate the market due to high demand for vinyl-based products in construction, flooring, and automotive. However, the Europe region is expected to experience the highest growth due to rapid urbanization and industrial development.

How does sustainability impact the Vinyl market?

Sustainability is becoming increasingly important, with a growing focus on recycling and using eco-friendly production processes. Manufacturers are working on improving the environmental footprint of vinyl products by developing recyclable and biodegradable vinyl solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]