Global Video on Demand (VoD) Market Size, Share, Trends, & Growth Forecast Report – Segmented By Solution (Pay TV, OTT Services, and IPTV); Monetization Model (Subscription-based, and Advertising-based); Industry Vertical (Media, Entertainment, Gaming and Education) & Region - Industry Forecast From 2024 to 2032

Global Video on Demand (VoD) Market Size (2024 to 2032)

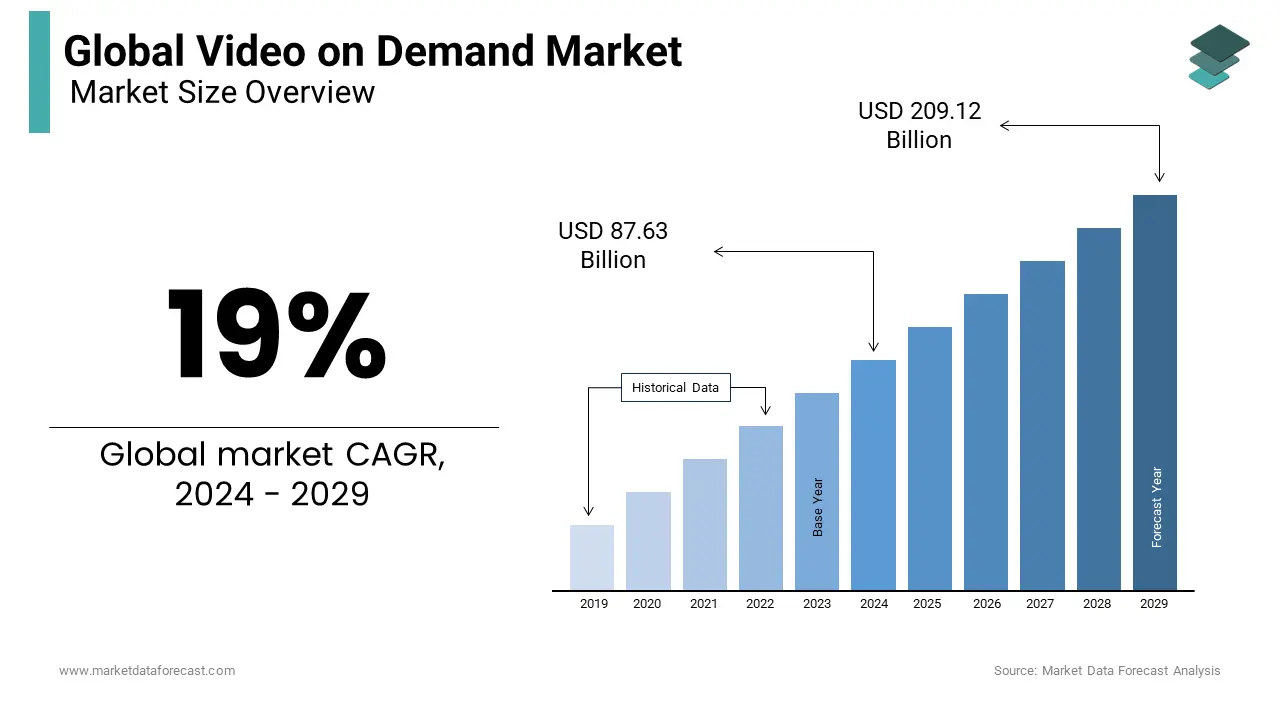

The global video on demand (VoD) market was worth USD 73.64 billion in 2023. The global market is predicted to reach USD 87.63 billion in 2024 and USD 352.39 billion by 2032, growing at a CAGR of 19% during the forecast period.

Video on demand (VoD) enables people worldwide to access an extensive range of digital libraries and have controlled viewing time over the web. Movies, music, web series, and sports are the main components of the VoD content available for offline download. These services can be easily accessed from any corner of the world with the help of smartphones, computers, smart televisions, tablets, and others. To improve its consumer base and product portfolio, several VoD service providers are partnering with content developers to offer exclusive and premium content to its user base.

MARKET DRIVERS

The global video-on-demand market is foreseen to record considerable growth in the future because of the increased flexibility and availability of international content at affordable prices.

VoD services offer access to various programs in industries like entertainment, sports, movies, and educational programs, further driving its call in the global business. The video on demand (VoD) market is expected to become an efficient revenue generator for content providers and cable operators worldwide.

The increasing use of video solutions and services among individuals indicates that video streaming has become the most popular medium. Internet Protocol Television (IPTV) is the most trending way for consumers worldwide to subscribe to videos and other services. The added advantage of IPTV is that we can watch television and also access the Internet simultaneously. Operators manage these services in the same way as TV platforms.

The subscription monetization model is one of the most popular and requires a fixed payment for a specific period. It is a business model in which the user has to pay a subscription price to access video streaming services. Subscriptions can be of any duration, such as monthly, quarterly, semi-annually, and annually. The video on demand (SVoD) subscription offers viewers an easy option to accept and refuse. Subscription monetization models are expected to reach the highest CAGR over the forecast period as they provide a wide variety of entertainment video content, such as pay-TV programs, movies, dramas, and other series, to attract the public.

MARKET RESTRAINTS

The services offered by the video-on-demand market face challenges such as managing several screen formats, digital rights management (DRM), and personalizing content according to different systems, which diversify operating and bit rates. The effect of coronavirus is also proven to supplement business growth in the next few years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

19% |

|

Segments Covered |

By Solution, Monetization Model, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Netflix (USA), Amazon (USA), Google (USA), YouTube (USA), Apple (USA), HBO (USA), Cisco (USA), Roku (USA), IndieFlix (USA), Vudu (USA), Hulu (USA), Comcast (USA), Akamai (USA), Huawei (China), Fujitsu (Japan), CenturyLink (USA), Muvi (USA), Vubiquity (USA) and Others. |

SEGMENTAL ANALYSIS

Global Video on Demand (VoD) Market Analysis By Solution

IPTV is generally funded and supported by large telecommunications providers who wish to create an alternative product for digital cable and satellite services. This segment is foreseen to develop considerably in the future.

Global Video on Demand (VoD) Market Analysis By Monetization Model

Among these models, the subscription-based segment is expected to experience significant growth due to unique features such as unlimited content access.

Global Video on Demand (VoD) Market Analysis By Industry Vertical

Film studios, producers, and record labels are increasing their production of content such as films, music, television series, and documentaries, driving the adoption of entertainment services worldwide.

REGIONAL ANALYSIS

North America had the most significant video on demand market share in 2019. This is mainly due to the significant presence of video on demand service providers and the increased demand for video on demand services. In addition, the rise in content creation in entertainment, sports, and TV content, along with the partnerships between content producers and on-demand service providers, has resulted in a surge in the adoption of video-on-demand services across the area. The Asia-Pacific region is predicted to grow considerably due to increased pay programs and film consumption.

The Asia-Pacific (APAC) is the most promising market for video on demand services, with a vast population base and access to the Internet and other services. China and Japan are the two central countries that contribute significantly to the VoD market. The increased penetration of smart devices, broadband, and the Internet due to the advent of technologies like 5G and 4G, payment infrastructures, and a dynamic ecosystem is the driving force of the local VoD market.

KEY PARTICIPANTS IN THE GLOBAL VIDEO ON DEMAND (VoD) MARKET

The major companies operating in the global video on demand (VoD) market include Netflix (USA), Amazon (USA), Google (USA), YouTube (USA), Apple (USA), HBO (USA), Cisco (USA), Roku (USA), IndieFlix (USA), Vudu (USA), Hulu (USA), Comcast (USA), Akamai (USA), Huawei (China), Fujitsu (Japan), CenturyLink (USA), Muvi (USA), and Vubiquity (USA).

RECENT HAPPENINGS IN THE GLOBAL VIDEO ON DEMAND (VoD) MARKET

-

In October 2019, Roku collaborated with Apple TV to stream their shows for free on the Roku application. This gives the former application users access to several Apple features on Roku devices.

-

In September 2019, Amazon introduced Amazon Music HD, a high-quality audio streaming service. It allows customers to access and stream above 50 million songs in HD audio and millions of songs in Ultra HD, offering a great listening experience.

-

In September 2019, Apple announced the launch of Apple TV +, an original video subscription service with a range of original programs, movies, and documentaries available on devices such as the Apple TV, iPhone, iPad, Apple TV, iPod app touch, and Mac, and also online at tv.apple.com.

-

In October 2018, Cisco made a deal with the United States Golf Association (USGA) to employ Cisco video collaboration and technology to enhance the fan experience at USGA championships, creating new opportunities. Content distribution is on-site and worldwide, and missions are sped up. Initiatives to stimulate global innovation in golf

-

In September 2019, YouTube launched a new vertical called YouTube Fashion. It aims to capitalize on popular styles and beauty content that pulls millions of viewers to its platform and generates billions of visits in 2018.

DETAILED SEGMENTATION OF THE GLOBAL VIDEO ON DEMAND (VoD) MARKET INCLUDED IN THIS REPORT

This research report on the global video on demand (VoD) market has been segmented and sub-segmented based on the solution, monetization model, industry vertical, and region.

By Solution

-

OTT

-

IPTV

-

Pay TV

By Monetization Model

-

Subscription-Based

-

Advertising-Based

By Industry Vertical

-

Media

-

Entertainment

-

Gaming

-

Education

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What role do original content and exclusive productions play in the competitiveness of VoD platforms globally?

Original content and exclusive productions are crucial for the success of VoD platforms, as they differentiate services, attract subscribers, and foster brand loyalty.

How is the global VoD market addressing issues related to content piracy and unauthorized distribution?

The industry is actively implementing advanced content protection technologies, digital rights management (DRM), and legal actions to combat piracy and unauthorized distribution, safeguarding the interests of content creators and distributors.

What technological advancements are shaping the future of the Video on Demand market globally?

Emerging technologies such as artificial intelligence, virtual reality, and 5G are expected to transform the VoD landscape, enhancing user experiences with personalized recommendations, interactive content, and faster streaming.

How are traditional television broadcasters adapting to the rise of Video on Demand platforms globally?

Traditional broadcasters are increasingly embracing digital transformations by launching their own VoD platforms or forming partnerships with existing streaming services, aiming to stay competitive in the evolving media landscape.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]