Global Veterinary Vaccines Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Livestock Vaccines (Bovine, Porcine, Ovine, Poultry and Equine), Companion Vaccines (Feline Vaccines and Canine Vaccines), Production Technologies (Live Attenuated Vaccines, Inactivated Vaccines, Recombinant Vaccines, Toxoid Vaccines, Subunit Vaccines, DNA Vaccines and Conjugate Vaccines) and Region (North America, Europe, APAC, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2032)

Global Veterinary Vaccines Market Size (2024 to 2032)

The global veterinary vaccines market size is poised to grow to USD 11.66 Billion by 2032 from USD 7.6 Billion in 2024, registering a CAGR of 5.5% from 2024 to 2032.

The veterinary vaccines market has seen significant growth over the past few years due to fear of imminent epidemics that have led to substantial losses, particularly in the poultry segment.

MARKET DRIVERS

The growing demand for animal protein worldwide contributes to the growth of the veterinary vaccines market.

The population worldwide is growing rapidly and asking for more animal protein products such as meat, milk, and eggs. According to the Food and Agriculture Organization of the United Nations (FAO) estimation, global meat production is expected to grow by 16% between 2021 and 2027, owing to increasing demand for animal protein products from developing countries. To address the growing demand, livestock production must be increased. On the other hand, the growing incidence of animal diseases is hampering livestock production and incurring losses to the veterinary industry. To safeguard the health and lives of the animals from animal diseases and maintain a healthy livestock population, effective vaccination programs must be conducted. In recent years, increased adoption of vaccination programs by farmers has been noticed to protect livestock animals and ensure the sustainability of their businesses, and this trend is expected to continue in the coming years and boost the veterinary vaccines market growth.

The growing prevalence of animal diseases is boosting the growth rate of the veterinary vaccines market.

Increased usage of veterinary vaccines has been noticed in recent years owing to the growing number of animals suffering from various livestock and zoonotic diseases and the trend is likely to continue in the coming years. Zoonotic are diseases that pass from animals to humans and are now a global health concern. As per the estimations of the World Health Organization (WHO), an estimated 60% of infectious diseases among humans are originated from zoonoses. Veterinary vaccines help significantly to prevent the spread of zoonotic diseases. Avian influenza, swine flu, and Ebola are some of the notable zoonotic diseases and are major reasons for the growing demand for veterinary vaccines. For instance, the H5N1 avian influenza outbreak in 2004 propelled the demand for avian influenza vaccines for poultry.

Technological advancements in vaccine development are fuelling the growth rate of the veterinary vaccines market.

In the last few years, technology penetration in the veterinary industry has been growing rapidly. Advanced technologies such as recombinant DNA technology, live attenuated vaccines, and subunit vaccines have received considerable acceptance from the manufacturers of veterinary vaccines. These players are increasingly using these technologies to develop advanced veterinary vaccines. During the forecast period, the intervention of technological developments in the manufacturing and R&D of veterinary vaccines is expected to grow and contribute to market growth.

The growing number of initiatives and awareness programs by various governments in favor of the veterinary industry is further accelerating the growth rate of the veterinary vaccines market. Governments of several countries have been conducting several awareness programs to spread awareness among farmers about animal health and welfare. For instance, the European Union prioritized improving animal health and has been implementing several measures to promote animal vaccination. In addition, the United States Department of Agriculture (USDA) launched the National Animal Vaccine and Veterinary Countermeasures Bank to manufacture and store veterinary vaccines and other countermeasures for animal diseases.

The growing number of investments in R&D animal vaccines is boosting the market growth.

By realizing the importance of veterinary vaccines, several pharmaceutical companies and governmental organizations have invested significant amounts in the R&D of advanced veterinary vaccines and veterinary technologies. For instance, Boehringer Ingelheim Animal Health announced a significant investment to develop the capacity of a vaccine production unit in France further in 2019. Similarly, The Bill and Melinda Gates Foundation invested in developing livestock vaccines in developing countries.

In addition, increasing awareness among farmers about animal health and the growing number of animal welfare organizations are contributing to the veterinary vaccines market growth. Furthermore, factors such as the growing animal health expenditure, rising number of advancements in the animal health infrastructure and increasing demand for animal-derived food products, rising emphasis on preventative healthcare for animals, and the increasing number of animal vaccination programs are further fuelling the growth rate of the veterinary vaccines market.

MARKET RESTRAINTS

Factors such as the stringent regulatory environment for the approval of veterinary vaccines, the high costs involved in developing and producing veterinary vaccines, and the scarcity of skilled workforce are notably hampering the veterinary vaccines market growth. In addition, poor awareness levels about animal vaccination among farmers, lack of access to veterinary healthcare in some countries, adverse reactions associated with the usage of veterinary vaccines, and increasing competition from generic and counterfeit products are inhibiting the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Type, Production Technologies, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Bayer HealthCare AG, Sanofi Animal Health, Inc., Heska Corporation, Indian Immunologicals Ltd., Biogenesis Bago SA, Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc. and Protein Sciences. |

SEGMENTAL ANALYSIS

Global Veterinary Vaccines Market Analysis By Type

The livestock vaccine segment is estimated to dominate the global veterinary vaccines market during the forecast period. Increasing the livestock population is majorly attributing the growth to this segment. In addition, growing concern towards animal healthcare and the rise in the demand to prevent the spread of diseases from animals to humans is helping this segment shine. Among different types of livestock vaccines, the porcine segment has the highest share of the market owing to the growing incidences of zoonotic diseases. In addition, the rise in campaigns to spread awareness of the benefits of vaccines in rural areas is further propelling the growth rate of the porcine segment in the global market.

The canine vaccines segment accounted for a slightly larger share (in terms of revenue) than the feline vaccines segment due to the higher average cost allied with canine vaccination.

Global Veterinary Vaccines Market Analysis By Production Technologies

The live attenuated vaccine production technology has had the highest growth rate in the past few years. It is to continue the same growth in the coming years. Introducing various products with advanced technologies and increasing awareness towards manufacturing effective vaccines inappropriate for diseases is spurring the market's growth rate. In addition, the rise in investments in veterinary hospitals by private and public organizations is further gearing up the segment's demand.

REGIONAL ANALYSIS

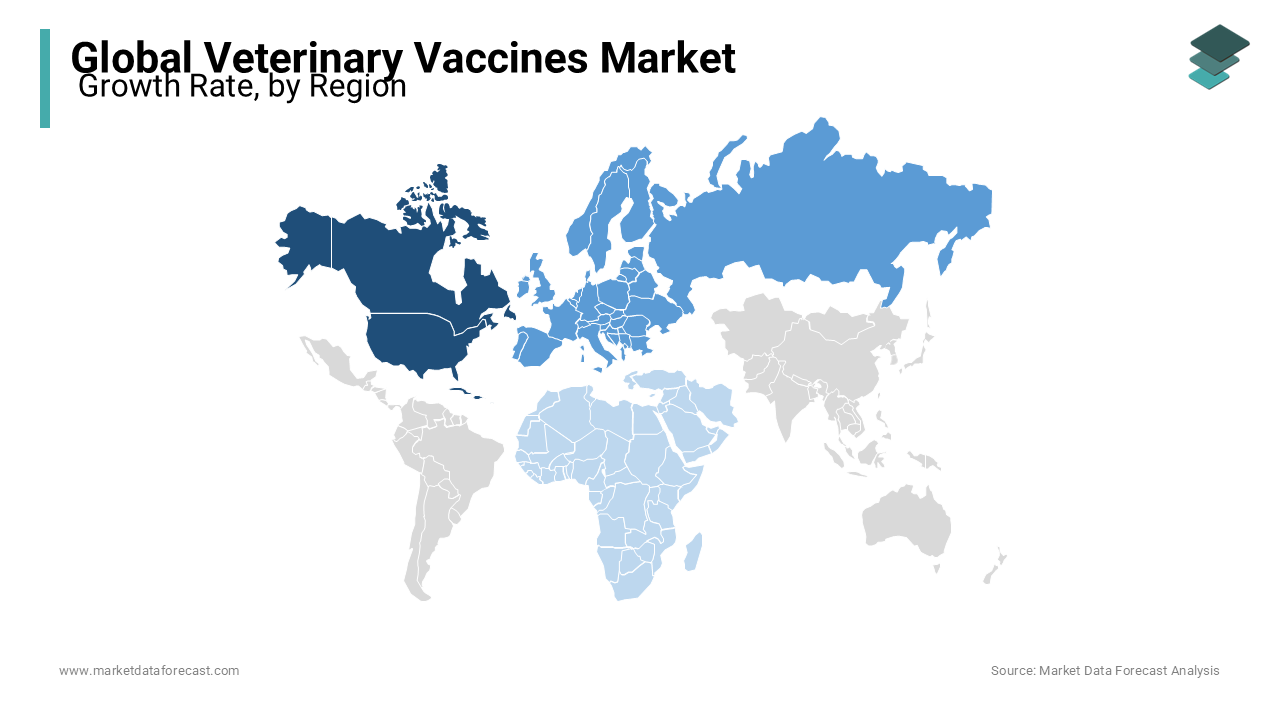

During the forecast period, the North American region is estimated to account for the largest share of the global veterinary vaccine market in consumption, followed by Europe during the forecast period. These two regions account for over 70% of the global veterinary vaccine market revenue. In Europe, increasing incidences of zoonotic diseases and demand to prevent and cure these diseases with certain medications are expanding the growth rate of the veterinary vaccines market. In addition, stringent rules and regulations to promote effective treatment procedures in hospitals are leveraging the market's growth in this region.

The European region is expected to grow at a healthy CAGR due to the quick adoption of the latest technologies and the launch of various quality products at a low cost. Besides, increasing per capita income in developed and developing countries is likely to outshine the market's growth.

The Asia Pacific market is positioned next to North America in leading dominant market shares with the increased priority to improve the quality of poultry products, escalating the market's growth. Also, increasing awareness programs through campaigns and digital advertisements elevates the market's growth rate in APAC.

The Middle East and African region has had a slow growth rate in recent years, and it is expected to have a slight inclination in the growth rate in the coming years.

KEY PLAYERS IN THE GLOBAL VETERINARY VACCINES MARKET

Notable companies in the global animal / veterinary vaccines market profiled in the report are Bayer HealthCare AG, Sanofi Animal Health, Inc., Heska Corporation, Indian Immunologicals Ltd., Biogenesis Bago SA, Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc. and Protein Sciences.

RECENT MARKET DEVELOPMENTS

- In 2019, Zoetis Company acquired ZNLabs and Phoenix Lab to enhance its diagnostics and laboratory services for veterinarian professionals and customers in the United States.

- In 2019, Boehringer Ingelheim Company recently developed a swine vaccine called angel vac PRRS MLV in its manufacturing plant in China. The company officially started supplying the vaccines to China's market in January 2019.

- In 2017, Merck Animal Health acquired Valee S.A.; this deal is likely to expand the distribution network of Merck animal health products in Brazil.

- In 2017, Elanco Animal Health Company expanded its vaccine product portfolio by acquiring Boehringer Ingelheim Vetmedica's U.S. Feline, Canine, and Rabies Vaccines Portfolio.

DETAILED SEGMENTATION OF THE GLOBAL VETERINARY VACCINES MARKET INCLUDED IN THIS REPORT

This research report on the global veterinary vaccines market has been segmented based on the type, production technologies, and region.

By Type

- Livestock Vaccines

- Bovine

- Porcine

- Ovine

- Poultry

- Equine

- Companion Vaccines

- Feline Vaccines

- Canine Vaccines

By Production Technologies

- Live Attenuated Vaccines

- Inactivated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Subunit Vaccines

- DNA Vaccines

- Conjugate Vaccines

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the veterinary vaccines market worldwide in 2024?

The global veterinary vaccines market size was valued at USD 7.6 billion in 2024.

Which region is growing the fastest in the global veterinary vaccines market?

Geographically, the North American veterinary vaccines market accounted for the largest share of the global market in 2023.

At What CAGR, the global veterinary vaccines market is expected to grow from 2024 to 2032?

The global veterinary vaccines market is estimated to grow at a CAGR of 5.50 % from 2024 to 2032.

Who are the leading players in the veterinary vaccines market?

Indian Immunologicals Ltd., Biogenesis Bago SA, Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health, Inc., Merck & Co. Inc., and Protein Sciences are some of the leading players in veterinary vaccines market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]