Global Veterinary Surgical Devices Market Size, Share, Trends & Growth Forecast Report By Product (Sutures, Forceps, Scissors, Electrosurgery Instruments, Cannulas, Staplers and Accessories and Others), Animals (Canines, Felines and Large Animals), Application (Soft Tissue, Sterilization, Gynecology, Orthopedic Surgery and Other Applications) & Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Veterinary Surgical Devices Market Size

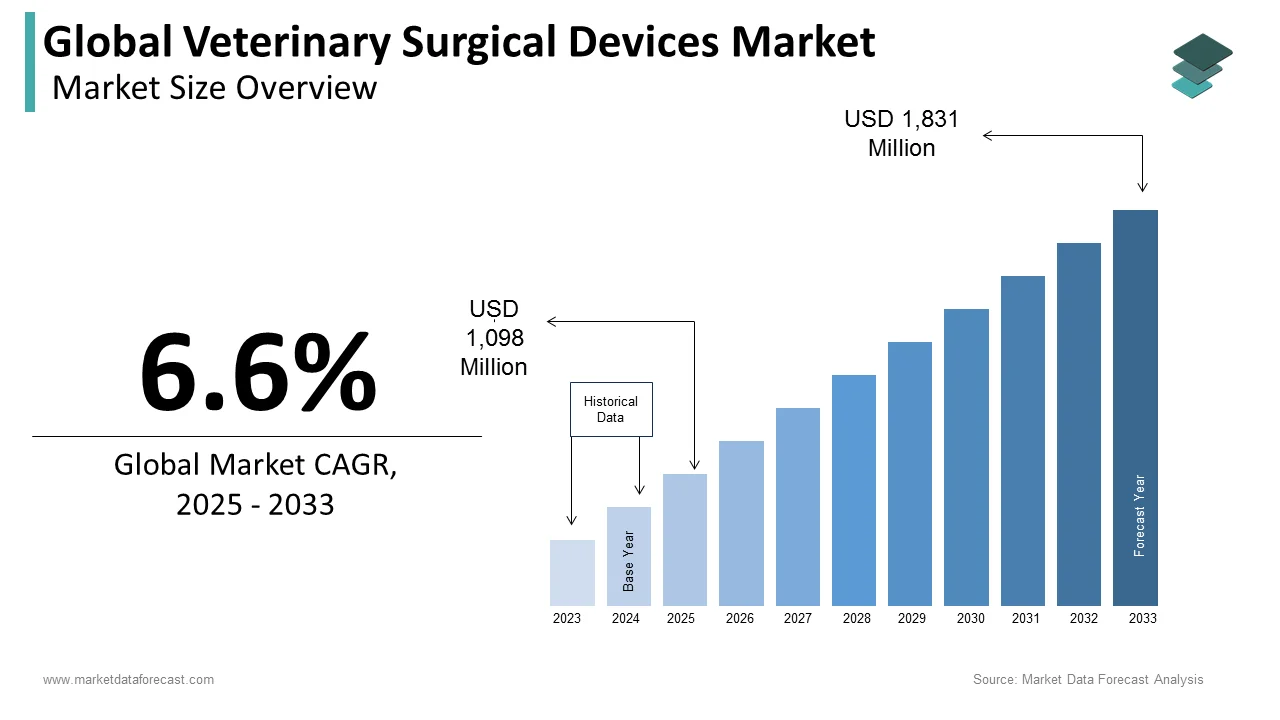

The size of the global veterinary surgical devices market was worth USD 1,030 million in 2024. The global market is anticipated to grow at a CAGR of 6.6% from 2025 to 2033 and be worth USD 1,831 million by 2033 from USD 1,098 million in 2025.

MARKET DRIVERS

The growing adoption of pet insurance, rising animal spending, and the growing number of veterinary practitioners are propelling the growth of the veterinary surgical devices market. The rising number of veterinary practitioners and technological advancements in surgical instruments drive the market further. As per the statistics published by the American Veterinary Medical Association, 113,394 practitioners were present in the U.S as of 2018, compared to 110,531 in 2017. In addition, the pet insurance market is rapidly growing in regions like North America and Europe, and it is estimated to register a CAGR of 12.92% by 2025. Furthermore, the rising adoption of companion animals, favorable government initiatives in preventing zoonotic diseases, and novel product inventions are estimated to accelerate the growth rate of the veterinary surgical devices market.

The growing incidence of periodontal problems in pets and the rising demand for better treatment options are expected to fuel the market growth. In the United States, as of 2018, fractured teeth have been registered in around 49.6% of companion animals. Furthermore, the rising number of livestock infected by infectious diseases strengthens the market growth. As per the 2017-2018 National Pet Owners Survey conducted by the American Pet Products Association (APPA), sixty percent of United States households own a pet. The rising awareness among pet owners regarding their pet's dental health and the surging chronic illness of equine animals snowball the market growth. The demand for animal-derived food products and growing incidences of foodborne, zoonotic diseases, and bacterial infections leading to severe health conditions in animals will drive the veterinary surgical instruments market over the upcoming period. The mushrooming adoption of new technologies like advanced technology services and the surging elderly pet population have escalated global market growth over the historical period.

The rise in pet lovers worldwide is a significant factor driving the market's growth rate. Increasing incidences of various animal diseases are also one factor fueling the market's growth. Growing expenditure on animal healthcare also levels up the market's growth. An increasing population of companion animals also promises a steady growth rate in the review period. Developing markets such as India, China, and Brazil are expected to offer lucrative market growth opportunities during the forecast period. Furthermore, the escalating incidences of oral diseases among cats and dogs build a massive demand for veterinary dental surgery instruments, which authorizes many opportunities for the manufacturers operating in this equipment.

MARKET RESTRAINTS

The expensive nature of the surgeries, combined with low and variable pet insurance coverage, among the advancing nations, hampers the market growth. In addition, strict regulatory policies guiding medical and surgical devices impede market growth during the forecasting timeline. Strict authorities for approving devices hike the production cost and prevent the companies from entering the market. The factors above are significant barriers in the veterinary surgical instruments market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Animals, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

B. Braun Vet Care GmbH, Medtronic Plc., Ethicon Inc., JORGEN KRUSSE A/S |

SEGMENTAL ANALYSIS

By Product Insights

The suture segment accounted for the largest share of the global veterinary surgical devices market in 2024. Factors such as the growing adoption of technological advancements in the manufacturing activities of veterinary surgical devices, growing animal healthcare spending, the increasing number of surgical procedures to treat various health disorders, and increasing demand for quality surgical devices are propelling the growth of the segment.

On the other hand, the electrosurgery segment is expected to witness the fastest CAGR during the forecast period. This is because the growing adoption of these instruments and increasing efforts by the key market participants favor the segment’s growth.

By Animals Insights

Based on animals, the large animal segment had the largest share of the global veterinary surgical devices market in 2024. The rising incidence of chronic diseases among large animals is one of the major factors promoting the segment's growth rate. In addition, factors such as growing veterinary spending, growing awareness of people regarding the available options of veterinary surgeries, and increasing efforts by governments toward veterinary healthcare are propelling the segment's growth.

By Application Insights

Based on the application, the soft tissue segment is anticipated to showcase a healthy CAGR during the forecast period. This is because the devices used for surgeries are accurate and precise, manufactured with the latest technology, and surge the segment's growth.

The orthopedic surgery segment is expected to experience steady growth during the forecast period.

REGIONAL ANALYSIS

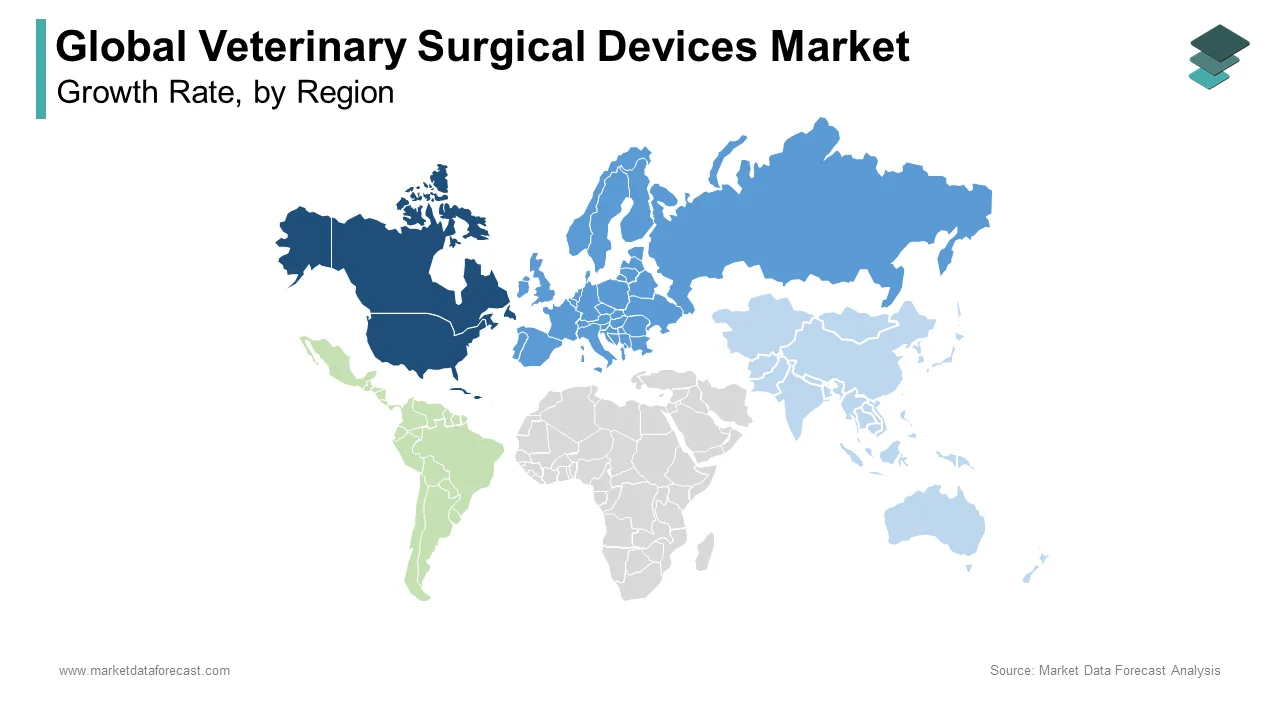

The North American market held a significant global market share in 2024. The domination of the North American region is anticipated to continue throughout the forecast period. The growth of the North American market is anticipated to be driven by the increasing per capita income in developed and developing countries. The key market participants' presence and increasing efforts to manufacture high-quality veterinary surgical devices propelled the market growth in North America. In addition, the adoption of pet insurance is growing considerably in the countries of North America, which is anticipated to result in the growth of the veterinary surgical devices market in this region. The U.S. market captured the most significant share of the North American region in 2021 and is expected to contribute potential support to the North American region and help North America register its global market domination during the forecast period. On the other hand, the Canadian market is estimated to showcase a promising CAGR during the forecast period.

Europe accounted for the second-largest global market share in 2024. The European region is one of the potential regional markets worldwide and is expected to grow at a promising CAGR during the forecast period. Europe followed North America closely in accounting for the leading share of the global market in 2024. The growing number of veterinary hospitals and rising usage of veterinary surgical devices promote market growth in this region. The UK market is expected to hold a vital role in the European region during the forecast period.

The Asia Pacific arket is predicted to showcase the fastest CAGR during the forecast period. The growing incidences of zoonotic diseases, especially in companion animals, are one of the major factors driving the veterinary surgical devices market in this region.

The Latin American region is expected to showcase a steady CAGR during the forecast period.

The market in the Middle East and Africa is expected to have an inclined growth rate in the coming years.

KEY MARKET PLAYERS

A few of the notable companies operating in the global veterinary surgical devices market profiled in this report are B. Braun Vet Care GmbH, Medtronic Plc., Ethicon Inc., JORGEN KRUSSE A/S, Jorgensen Laboratories, Smiths Group Plc., Neogen Corporation, Integra LifeSciences Holding Corporation, STERIS Corporation, DRE Veterinary, GerMedUSA Inc., Surgical Holdings, Sklar Surgical Instruments, World Precision Instruments Inc. and Surgical Direct.

RECENT HAPPENINGS IN THE MARKET

- In March 2019, Bruhat Mahanagara Pallike (BBMP) planned to introduce animal rescue ambulances to rescue injured and sick animals. These ambulances will be fully equipped with support tools, sterilizers, and surgical instruments to treat the animals.

- In July 2018, B. Braun Vet Care announced the collaboration with CP Medical, a leading company involved in the manufacture of instruments for specialized surgical applications and wound closure for developing, selling, and distributing medical devices to the United States and Canada. This collaboration has enabled the company to strengthen its presence in North America's developed markets.

- In October 2017, Henry Schein announced the acquisition of Merritt Veterinary Supplies, a family business dedicated to supplying animal health products. This acquisition aimed to expand its customer base and strengthen its market position in the animal health sector.

MARKET SEGMENTATION

This research report on the global veterinary surgical devices market has been segmented and sub-segmented into the following categories.

By Product

- Sutures

- Forceps

- Scissors

- Electrosurgery Instruments

- Cannulas

- Staplers and accessories

- Others

By Animals

- Canines

- Felines

- Large Animals

By Application

- Soft Tissue

- Sterilization

- Gynecology

- Orthopedic Surgery

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the veterinary surgical devices market?

The global veterinary surgical devices market was valued at USD 1,098 million in 2024.

What is driving the growth of the veterinary surgical devices market?

Factors such as the increasing demand for animal healthcare services, the rising prevalence of animal diseases, and the increasing adoption of advanced surgical techniques in veterinary medicine primarily boost the growth of the veterinary surgical devices market.

What are some challenges faced by the veterinary surgical devices market?

High cost of advanced surgical devices, the lack of skilled veterinary surgeons in certain regions, and the increasing adoption of minimally invasive surgical techniques are the key challenges to the growth of the veterinary surgical devices market.

What are the major players in the veterinary surgical devices market?

B. Braun Vet Care GmbH, Medtronic plc, Ethicon Inc. (a subsidiary of Johnson & Johnson), Eickemeyer Veterinary Equipment Inc., and Jørgen Kruuse A/S are some of the notable companies in the veterinary surgical devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]