Global Veterinary Services Market Size, Share, Trends & Growth Forecast Report By Service Type (Surgery, Diagnostic Tests and Imaging, Physical Health Monitoring & Others), Animal Type (Companion Animals and Farm Animals) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Veterinary Services Market Size

The global veterinary services market was worth US$ 135.85 billion in 2024 and is anticipated to reach a valuation of US$ 265.29 billion by 2033 from US$ 146.34 billion in 2025, and it is predicted to register a CAGR of 7.72% during the forecast period 2025-2033.

Veterinary service is a field of medicine that deals with researching, diagnosing, preventing, and treating all kinds of animal diseases and injuries. Various drugs are designed to treat the many ailments that animals may get and to enhance veterinary healthcare. In addition, veterinary pharmaceuticals provide a variety of medications, vaccinations, antibiotics, nutritional supplements, and other essential technologies for preventing animal infections, improving animal health and welfare, providing wholesome food, and advancing public health. The services are provided by professionals like veterinarians and animal groomers who have mastered animal care. This branch of medicine has multiple markets such as the diagnostics market, drugs market, analytics market, chemical analyzer market, surgical market, and so much more. This market is a compilation of all the different services which are provided for animal care.

MARKET DRIVERS

The veterinary services market has grown due to the rising incidence of chronic illnesses in animals and the adoption rate of pets in society.

In addition, the market is expanding as a result of the increased demand for poultry throughout the world. It is claimed that zoonotic contagious illnesses are pretty typical. Therefore, veterinary medication adoption has increased dramatically over the past few years and will continue to do so during the projection. Additionally, increasing bacterial and parasite illnesses in animals would boost the market.

Government support and an increasing companion animal population support the growth of the veterinary services market.

Increasing support from the government for R&D in the field is expected to propel market growth. Additionally, the number of dogs in the United States increased from around 69.9 million in 2012 to over 89.7 million in 2016, according to the 2017 APPA research. Additionally, the number of cats increased from 74.05 million in 2012 to 8.66 million in 2016. In 2017, 85 million homes in the U.S. had a pet, according to an APPA poll.

Furthermore, the global veterinary services market is expected to rise due to increased expenditure on animal health, growing veterinarian numbers, and an increase in infectious animal illnesses; for instance, according to predictions, 3 out of every four newly emerging diseases and more than 6 out of every ten infectious diseases known to affect humans may be attributed to animals. Advances in point-of-care diagnostic technologies and rising disposable income levels in emerging nations. Furthermore, the increasing demand for animal-based foods, the expansion of the veterinary industry, the adoption of disease prevention and control measures, the rise in applications from emerging economies, the increase in the number of vegans, and the popularity of pet insurance plans are a few of the most significant factors that open up opportunities for market growth.

MARKET RESTRAINTS

The market for veterinary services is being constrained from growing due to the rising prices of medication, equipment, and treatment. The lack of public comprehension of the government's stringent laws and regulations and the shortage of qualified professionals to run the system further hinder the market's expansion. Additionally, the market's strict clearance procedures for goods and equipment and the general lack of public awareness regarding animal health impede the development of veterinary services.

Impact of COVID-19 on the Global Veterinary Services Market

The COVID-19 epidemic has caused difficult times in many different parts of the world. Due to the restrictions on the production and supply of commodities, all firms faced losses due to the strict quarantines and lockdowns. As a result, access to even the bare essentials of everyday living became quite challenging. The epidemic also significantly impacted the healthcare sector, and hospitals completely turned their focus to providing treatment for covid patients. The other healthcare department activities were thus frequently put off. However, the pandemic has had a negative impact on the veterinary services market as many groomers and pet care shops were closed down due to the lockdown animal care faced significant losses. In addition, veterinary clinics and hospitals were shut down during the lockdown, and people who were quarantined could not access medications, diagnostics, or treatments for their companion animals. The production and supply of veterinary drugs also became scarce, and cattle breeders and animal zoo caretakers suffered a great deal of trouble. However, the market is expected to bounce back into revenue due to the latest adoption of E-platforms and IT technology for veterinary care. Therefore, the market can expect a rise in the post-pandemic era.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.72% |

|

Segments Covered |

By Service Type, Animal Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

National Veterinary Care Ltd., Pets at Home Group PLC, CVS Group PLC, Ethos Veterinary Health, Addison Biological Laboratory, Armor Animal Health, PetIQ, LLC., and Others. |

SEGMENTAL ANALYSIS

By Service Type Insights

Based on the service type, the diagnostic tests and imaging segment is anticipated to grow at a healthy CAGR during the forecast period. The growing prominence of infectious diseases in animals leading to deaths and contaminated meat, along with the need for fast and efficient technologies to detect and eradicate such diseases in animals, is boosting the growth of the market's diagnostics and imaging systems segment. In addition, the advancements in imaging and diagnostics can help prevent the spread of deadly zoonotic diseases and also help provide fast and efficient treatment to animals. Therefore, this segment, which helps detect animal pathogens and assists in their elimination, was funded to dominate the market in the past and is expected to continue dominating the market in the future.

By Animal Type Insights

Based on the animal type, companion animals led the veterinary services market worldwide in 2024. The high adoption rate of companion animals, the increasing number of diseases in pets, and the need for better drugs and pet care services promote the companion animals segment of the market. In addition, the growing cases of pet animals requiring surgical procedures, diagnostics, and constant care propel this segment's dominance. Furthermore, increasing disposable incomes and public awareness about animal and pet care are other reasons for the market's high share.

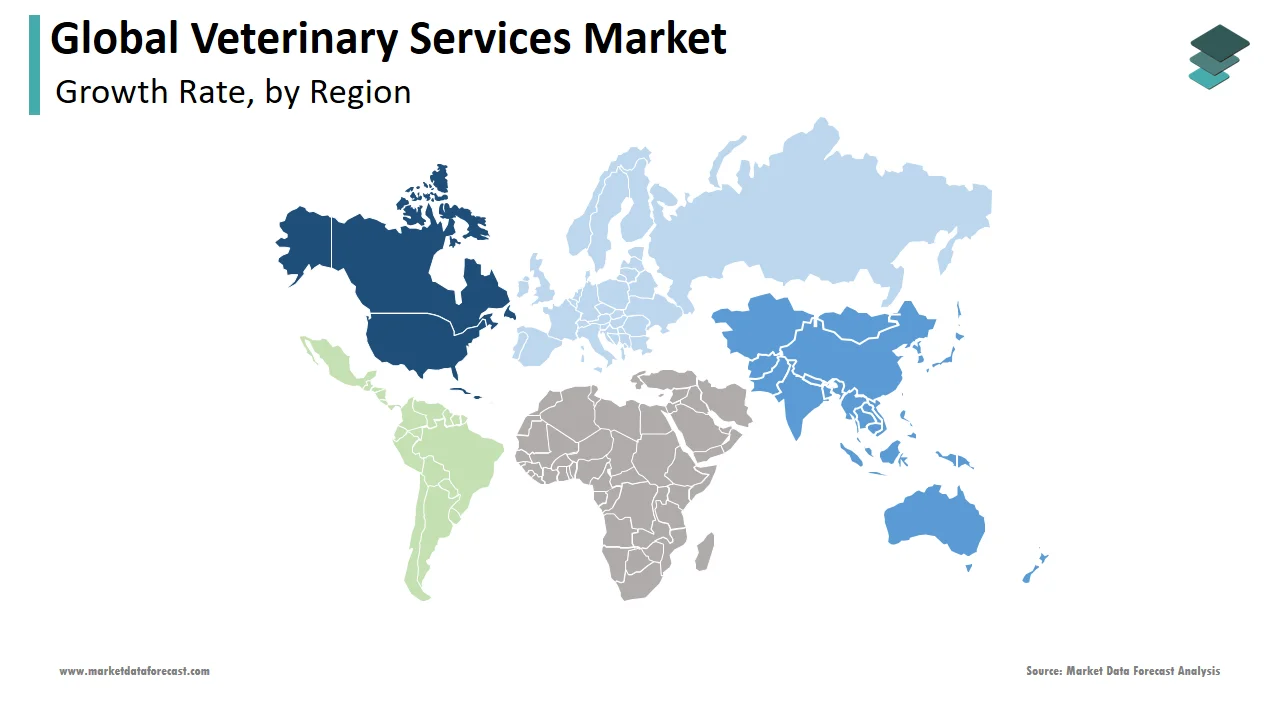

REGIONAL ANALYSIS

Geographically, North America accounted for a share of 47% of the global market in 2024, and the domination of this region is anticipated to continue throughout the forecast period. The leading causes of this significant expansion are the determined actions conducted by various government animal welfare groups geared at the enhancement of veterinary services in the United States and Canada. As a result, the U.S. contributes a sizeable amount, which is mainly impacted by increased pet adoption rates and per capita increases in spending on veterinary care for animals. In addition, several studies indicate that dogs and cats kept as pets are more likely to get cancer; as a result, pet owners are becoming more conscious of this fact. Therefore, the country's need for cutting-edge veterinary services is anticipated to rise due to pet parents' growing awareness, propelling the region's market expansion.

Asia-Pacific is expected to grow significantly fast during the forecast period. The region's developed and developing economies' expanding pet and livestock populations cause the exponential rise. In addition, an increase in disposable income is anticipated to boost the possibility of pet adoption and open up chances for market expansion due to the rising need for veterinary services in developing nations, particularly India and China. Veterinary services also aid in eradicating poverty, particularly in rural areas of developing countries where livestock populations are precious. Throughout the projected period, the market is anticipated to grow as advanced healthcare infrastructure continues to be modernized.

KEY MARKET PLAYERS

There are several prominent players in the global veterinary services market, and some of the notable players included in this report are National Veterinary Care Ltd., Pets at Home Group PLC, CVS Group PLC, Ethos Veterinary Health, Addison Biological Laboratory, Armor Animal Health, and PetIQ, LLC.

RECENT MARKET HAPPENINGS

- In August 2022, Petfolk announced the completion of a USD 40 million Series A financing. It was organized with support from Triple Point Capital and animal lovers Miranda Lambert, Dierks Bentley, Midland's Mark Wystrach and Cameron Duddy, Jimmie Johnson, Erik Jones, and Danica Patrick by White Star Capital and Freshly founder Michael Wystrach.

- In September 2022, to install the GlobalVetLink (GVL) Compliance Assistant in its veterinary clinics throughout the Northeast, Heart + Paw worked with GlobalVetLink. To streamline animal health compliance for all veterinary offices, the GVL Compliance Assistant is a complete SaaS platform that promotes smooth compliance and increased productivity for doctors of veterinary medicine and hospital employees.

MARKET SEGMENTATION

This research report on the global veterinary services market has been segmented based on the service type, animal type, and region.

By Service Type

-

Surgery

- Diagnostic Tests and Imaging

- Physical Health Monitoring

- Others

By Animal Type

- Companion Animals

- Farm Animals

By Region

-

North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]