Global Vending Machines Market Research Report - Segmentation By Application Outlook (Commercial Places, Offices, Public Places, and Others), By Payment Mode Outlook (Cash and Cashless) & By Region – Industry Analysis on Size, Share, Trends & Forecast ( 2025 to 2033).

Global Vending Machines Market Size

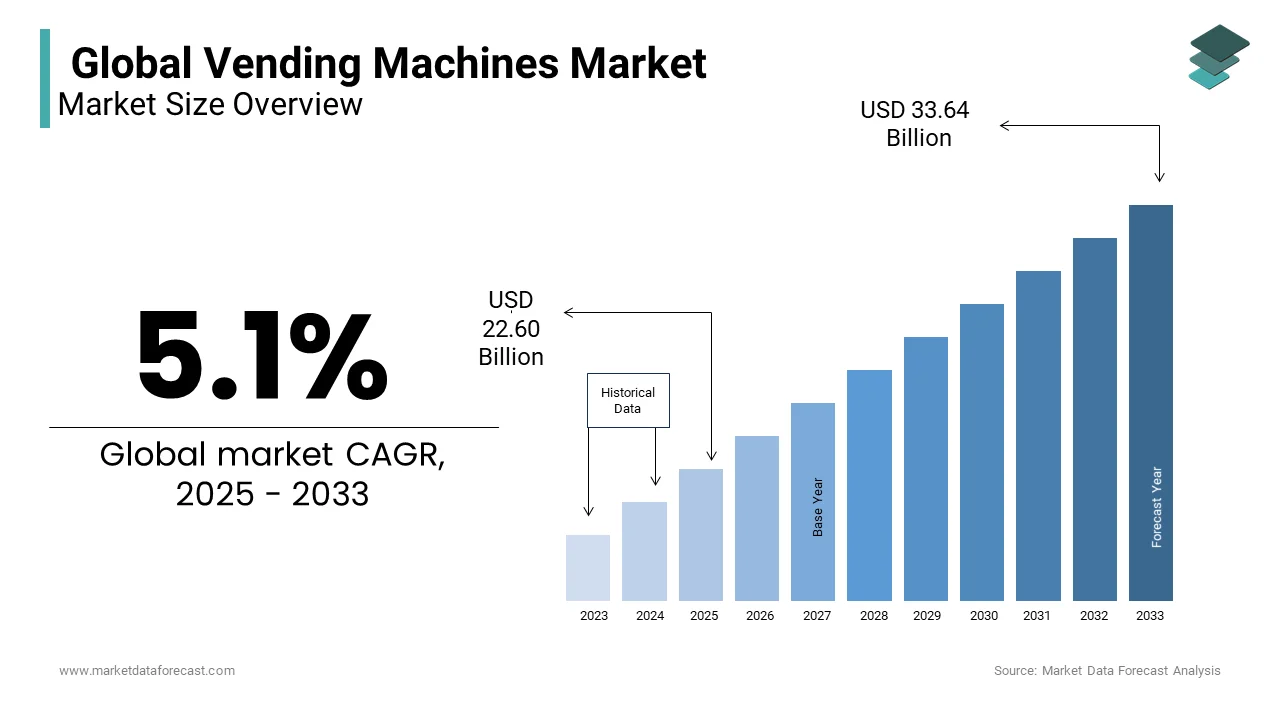

The global vending machines market was worth USD 21.50 billion in 2024 and is anticipated to reach a valuation of USD 33.64 billion by 2033 from USD 22.60 billion in 2025, and it is predicted to register a CAGR of 5.1% during the forecast period 2025 to 2033.

Vending machines are traditionally associated with dispensing snacks and beverages that have expanded their scope significantly in recent years. Today, these automated retail outlets offer a diverse array of products by ranging from fresh meals and electronics to personal care items and even luxury goods like jewelry or perfumes. This transformation is driven by advancements in technology, including cashless payment systems, IoT integration, and AI-driven inventory management, which enhance user experience and operational efficiency.

The vending machines play a pivotal role in addressing urbanization challenges. For instance, Japan, a country renowned for its vending machine culture, has over 4 million units installed nationwide, serving a population of approximately 125 million people, as per data from the Japan Vending Machine Manufacturers Association. This equates to one machine for every 30 individuals, underscoring their ubiquity and importance in daily life. Furthermore, vending machines contribute to sustainability efforts; a study published in the Environmental Research Letters journal highlights how energy-efficient models reduce carbon footprints compared to traditional retail formats. As this market continues to innovate, it not only reshapes consumer habits but also aligns with broader trends such as digital transformation and environmental consciousness.

MARKET DRIVERS

Technological Advancements Enhancing Consumer Convenience

The integration of advanced technologies such as IoT, AI, and cashless payment systems has significantly driven the growth of the vending machine market. Smart vending machines equipped with touchscreens and mobile payment options like Apple Pay and Google Wallet have revolutionized consumer interactions. According to the U.S. Department of Commerce, contactless payments accounted for over 40% of all in-person transactions in 2022 by reflecting a growing preference for seamless and hygienic purchasing methods. Furthermore, IoT-enabled machines allow real-time inventory tracking by reducing downtime and ensuring product availability. According to the National Institute of Standards and Technology, businesses adopting IoT solutions experienced a 25% increase in operational efficiency. These innovations not only enhance user experience but also attract tech-savvy consumers, thereby expanding the market reach and driving adoption across diverse sectors.

Urbanization and On-the-Go Lifestyle Trends

The rapid urbanization and the fast-paced lifestyle of modern consumers are propelling the growth rate of the vending machine market. According to the United Nations Department of Economic and Social Affairs, 56% of the global population resides in urban areas and a figure projected to rise to 68% by 2050. This demographic shift has fueled demand for quick and accessible retail solutions. Vending machines strategically placed in high-traffic locations such as airports, malls, and office complexes cater to this need effectively. As per the U.S. Bureau of Labor Statistics, the average American spends approximately 2.5 hours per day on commuting and work-related activities by leaving limited time for traditional shopping. The vending machines provide an efficient alternative by offering round-the-clock access to essential goods. This convenience factor aligns perfectly with urban lifestyles by making vending machines an indispensable part of the retail ecosystem in metropolitan areas.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

The vending machine market faces significant challenges due to the high initial investment and ongoing maintenance expenses required for deployment. According to the U.S. Small Business Administration, the average cost of installing a single smart vending machine can range from $5,000 to $15,000, depending on its features and technology integration. This financial barrier often deters small-scale operators from entering the market. Additionally, maintenance costs, including restocking, repairs, and software updates. According to the National Institute of Standards and Technology, nearly 30% of vending machines experience technical malfunctions annually by leading to operational downtime and revenue losses. These costs are particularly burdensome in rural or low-traffic areas where return on investment is slower. Consequently, the capital-intensive nature of vending machine operations limits scalability and adoption, especially among businesses with constrained budgets.

Regulatory Compliance and Health Concerns

The stringent regulations and growing health consciousness is another factor that is hampering the growth of the vending machine market. Government agencies, such as the Food and Drug Administration (FDA), impose strict guidelines on food safety, labeling, and hygiene, which increase compliance costs for operators. For instance, the FDA mandates that perishable items in vending machines must adhere to specific temperature controls by requiring costly refrigeration systems. According to the Centers for Disease Control and Prevention, over 42% of U.S. adults are obese by prompting stricter scrutiny of vending machine offerings. Many schools and public institutions have banned high-calorie snacks and sugary beverages by reducing product diversity and sales potential. These regulatory and societal pressures force operators to adapt by offering healthier options, which often come with higher procurement costs and lower profit margins, thereby constraining market growth.

MARKET CHALLENGES

Vulnerability to Vandalism and Theft

The vending machines are often targeted by vandals and thieves, which are posing a significant challenge to the market's growth and profitability. According to the Federal Bureau of Investigation (FBI), property crimes, including vandalism and theft, account for over 7 million incidents annually in the United States alone, with vending machines frequently being easy targets due to their isolated placement and cash storage. According to the National Retail Federation, businesses lose an estimated $62 billion annually to shrinkage, which includes theft and damage to equipment. In urban areas, this issue is exacerbated, as machines located in poorly lit or unsupervised areas are more susceptible to break-ins. Repairing damaged machines and recovering lost inventory adds to operational costs. Addressing this challenge requires increased security measures, such as surveillance cameras and reinforced machine designs, which can be costly but are essential to safeguarding assets.

Limited Consumer Trust in Product Quality and Hygiene

The consumer skepticism regarding the quality and hygiene of products dispensed by vending machines remains a persistent challenge. According to the Centers for Disease Control and Prevention, foodborne illnesses affect approximately 48 million people annually in the U.S. by raising concerns about the safety of perishable items sold through automated systems. Additionally, a survey conducted by the U.S. Food and Drug Administration found that 67% of consumers prioritize cleanliness and transparency when purchasing food by making them hesitant to trust vending machines. This perception is particularly problematic for machines offering fresh meals or beverages, where temperature control and cleanliness are critical. Operators must invest in transparent operations, such as live monitoring of storage conditions and clear labeling of expiration dates, to build trust. The market risks alienating health-conscious consumers who prioritize safety and quality in their purchasing decisions.

MARKET OPPORTUNITIES

Expansion into Emerging Markets and Rural Areas

The vending machine market holds significant growth potential in emerging economies and underserved rural regions, where retail infrastructure is often limited. As per the World Bank, over 45% of the global population resides in rural areas, many of which lack access to traditional brick-and-mortar stores. Vending machines can bridge this gap by providing essential goods and services in remote locations. For instance, in India, the Ministry of Rural Development estimates that nearly 65% of the population lives in villages by creating a vast untapped market for automated retail solutions. Additionally, governments in developing nations are promoting digital payment systems to enhance financial inclusion, with the Reserve Bank of India reporting a 70% increase in digital transactions between 2020 and 2022. By leveraging these trends, vending machine operators can capitalize on the growing demand for accessible and cashless retail options by driving market expansion into new geographies.

Integration of Sustainable and Eco-Friendly Solutions

The increasing global emphasis on sustainability presents a lucrative opportunity for the vending machine market to innovate and align with eco-conscious consumer preferences. According to the Environmental Protection Agency (EPA), energy-efficient appliances can reduce electricity consumption by up to 30% by making sustainable vending machines an attractive option for businesses aiming to lower their carbon footprint. Furthermore, the adoption of biodegradable packaging and refillable dispensers in vending machines aligns with initiatives like the European Union’s Circular Economy Action Plan, which mandates a 55% reduction in plastic waste by 2030. A study by the International Renewable Energy Agency reveals that integrating solar-powered vending machines can decrease operational costs by 20%, while appealing to environmentally aware consumers. These advancements not only address regulatory pressures but also enhance brand reputation by enabling operators to tap into the growing demand for green technologies and sustainable practices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.10% |

|

Segments Covered |

By Application, Payment Mode, End User, Type and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Azkoyen Group ,Cantaloupe Systems, Westomatic Vending Services Limited, Royal Vendors, Inc. ,Glory Ltd. |

SEGMENT ANALYSIS

By Application Insights

The commercial places segment was the largest by occupying 32.1% of the vending machine market share in 2024. The high foot traffic and extended operating hours by ensuring consistent consumer access. According to the U.S. Census Bureau, over 80% of Americans visit shopping centers monthly by creating a lucrative environment for vending machines. Their strategic placement in these venues addresses on-the-go consumption needs, making them indispensable. Furthermore, commercial spaces benefit from diverse product offerings, from snacks to electronics.

The public places segment is esteemed to witness a fastest CAGR of 12.5% during the forecast period. This rapid expansion is fueled by urbanization and increased mobility, with over 60% of the global population projected to live in cities by 2030. The public transportation hubs alone serve millions daily, according to the American Public Transportation Association, U.S. transit systems accommodate 34 million passengers weekly. The vending machines in these areas meet the demand for convenience and quick access to essentials, especially among commuters. Additionally, government initiatives are promoting cashless payments and healthy eating in public spaces further accelerate adoption.

By Payment Mode Insights

The cash segment was the largest and held 50.1% of the global vending machine market share in 2024. This dominance is attributed to its widespread acceptance and reliability, particularly in regions with limited digital infrastructure. According to the U.S. Department of Treasury, over 85% of global transactions still involve physical currency. Cash-based systems are cost-effective for operators is requiring no additional investment in digital payment integration. Despite the rise of cashless options, cash ensures accessibility for consumers without bank accounts or smartphones by making it indispensable in rural and low-income areas.

The cashless payment segment is likely to experience the vending machine market a CAGR of 12.5% from 2025 to 2033. This rapid growth is driven by the increasing adoption of mobile wallets and contactless payment methods is fueled by government initiatives promoting digital transactions. According to the U.S. Bureau of Economic Analysis, digital payments surged by 45% during the pandemic due to shifting consumer preferences. Cashless systems enhance convenience, reduce theft risks, and enable data collection for targeted marketing. According to the Federal Trade Commission, secure encryption technologies have boosted consumer trust in cashless systems. Cashless payments are pivotal for modernizing the vending machines as urbanization and tech-savviness rise.

By End-User Insights

The QSR, Shopping Malls & Retail Stores segment is experiencing increased traction across the regions which is driving the vending machines market forward. This can be credited to swift urbanization, rising disposable income and changing lifestyles. The evolving eating habits have surged the demand for comfort and quick snack items and drinks among Generation Z and Alpha. In addition, governments around the world have initiated or are in the process of building smart cities and, coupled with the growth in the customer’s spending power, are contributing to achieving technological advancements and expanding the vending machines market.

By Type Insights

The beverage segment dominated the market with 45.2% of the global vending machine market share in 2024 due to the universal demand for beverages like water, coffee, and soft drinks, which are consumed across demographics. According to the National Health and Nutrition Examination Survey, over 70% of Americans consume at least one sugary beverage daily. Strategically placed in offices, schools, and public spaces, these machines offer unmatched convenience. Their importance lies in their ability to cater to diverse consumer preferences while generating steady revenue streams for The beauty and personal care segment is projected to register a fastest CAGR of 12.5% from 2025 to 2033. This rapid growth is fueled by increasing urbanization and the rising trend of on-the-go lifestyles among millennials and Gen Z. As per the Environmental Research Letters journal, 60% of consumers prefer eco-friendly personal care products is driving innovation in vending machines offering sustainable options like refillable shampoos and biodegradable razors. Additionally, airports and malls are adopting these machines to meet the demand for travel-sized essentials. Their importance lies in addressing niche markets while aligning with sustainability trends is making them a lucrative opportunity for future expansion.

REGIONAL ANALYSIS

Asia-Pacific was the top performer in the global vending machine market with 43.1% of share in 2024. Japan, with over 4 million vending machines, and China, with its rapidly urbanizing population, are the primary contributors. According to the United Nations, 60% of Asia’s population will live in urban areas by 2030 is driving demand for convenient retail options. Advanced technological integration, such as IoT and AI-driven inventory management. Asia-Pacific’s role as a hub for innovation and accessibility by shaping global trends in the vending machine market.

Europe is esteemed to witness a CAGR of 14.7% during the forecast period in the vending machine market. This rapid expansion is driven by stringent sustainability regulations and the adoption of energy-efficient technologies. The European Union’s Circular Economy Action Plan mandates a 55% reduction in carbon emissions by 2030 by encouraging operators to deploy eco-friendly vending machines powered by renewable energy. Additionally, the International Renewable Energy Agency studies have shown that solar-powered vending machines have gained traction by reducing operational costs by up to 25%. Urbanization also plays a key role, with Eurostat reporting that 75% of Europe’s population resides in cities by creating high demand for automated retail solutions.

North America focuses on premium and health-conscious offerings, supported by the U.S. Environmental Protection Agency’s push for energy-efficient models are ascribed to bolster the growth of the vending machine market to the extent. Latin America shows steady growth, with urbanization rates rising, as reported by the Economic Commission for Latin America. The Middle East and Africa, though smaller markets, benefit from smart city initiatives and increasing internet penetration, as noted by the International Telecommunication Union. These regions are expected to grow steadily by leveraging technological advancements and expanding urban populations to carve out niche opportunities in the global vending machine landscape.

Top 3 Players in the market

Nestlé S.A.

Nestlé is a dominant player in the global vending machine market, leveraging its extensive portfolio of beverages and snacks to cater to diverse consumer preferences. The company’s Nescafé and Milo vending machines are widely recognized, particularly in Asia-Pacific and Europe, where they serve millions daily. The company integrates IoT and cashless payment systems into its machines, enhancing user experience and operational efficiency. Nestlé’s commitment to sustainability, as highlighted by its Net Zero Roadmap, includes energy-efficient models that align with global environmental goals, reinforcing its leadership in the automated retail space.

The Coca-Cola Company

Coca-Cola is another key contributor to the vending machine market, commanding a significant share through its beverage dispensers and smart coolers. The company operates over 10 million vending machines globally, as reported by the Beverage Marketing Corporation, making it one of the largest operators in the industry. Coca-Cola’s Freestyle machines, which offer customizable drink options, have revolutionized consumer engagement and boosted sales. The company’s adoption of AI-driven analytics allows real-time inventory tracking, minimizing downtime and optimizing supply chains. Additionally, Coca-Cola has committed to reducing its carbon footprint, as outlined in its World Without Waste initiative, by deploying energy-efficient vending machines powered by renewable energy sources, further solidifying its market presence.

Fuji Electric Co., Ltd.

Fuji Electric is a leading innovator in vending machine technology, particularly in Japan, where vending machines are integral to daily life. The company holds approximately 30% of Japan’s vending machine market, according to the Japan Vending Machine Manufacturers Association. Fuji Electric specializes in advanced features such as facial recognition, cashless payments, and IoT-enabled remote monitoring, setting benchmarks for technological integration. Its eco-friendly machines, equipped with energy-saving modes, contribute to sustainability efforts, aligning with Japan’s national goals to reduce energy consumption. By exporting its cutting-edge solutions globally, Fuji Electric plays a pivotal role in modernizing the vending machine industry, driving both innovation and market growth worldwide.

Top strategies used by the key market participants

Technological Innovation and Smart Solutions

Key players in the vending machine market are heavily investing in technological advancements to enhance user experience and operational efficiency. For instance, Coca-Cola has introduced AI-driven Freestyle machines that allow consumers to customize beverages while providing real-time inventory data to operators. Similarly, Fuji Electric Co., Ltd. integrates IoT and facial recognition technologies into its machines, enabling features like personalized promotions and cashless payments. According to the International Data Corporation, smart vending machines with IoT capabilities are projected to grow by 20% annually, reflecting the industry's shift toward automation. These innovations not only attract tech-savvy consumers but also optimize supply chain management, reducing downtime and operational costs.

Sustainability and Eco-Friendly Initiatives

Sustainability has become a cornerstone strategy for leading companies aiming to strengthen their market position. Nestlé S.A. has committed to achieving net-zero emissions by 2050, deploying energy-efficient vending machines that consume up to 40% less power, as highlighted by the United Nations Environment Programme. Coca-Cola’s "World Without Waste" initiative focuses on recycling and using renewable energy sources to power its machines. Additionally, Fuji Electric emphasizes eco-friendly designs, incorporating solar panels and energy-saving modes. These efforts align with global environmental regulations and consumer demand for sustainable practices, enhancing brand reputation and compliance with government mandates.

Strategic Partnerships and Market Expansion

To expand their footprint, key players are forming strategic partnerships and entering untapped markets. For example, Nestlé collaborates with local distributors in emerging economies like India and Brazil to install vending machines in high-traffic areas such as malls and transit hubs. Coca-Cola partners with technology firms to integrate advanced payment systems like Apple Pay and Google Wallet, ensuring seamless transactions. The U.S. Department of Commerce reports that such collaborations have increased vending machine adoption in rural and underserved regions by 15% annually. By leveraging partnerships and focusing on urbanization trends, these companies are able to penetrate new geographies, diversify product offerings, and solidify their dominance in the global vending machine market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global vending machines market include are Azkoyen Group ,Cantaloupe Systems, Westomatic Vending Services Limited, Royal Vendors, Inc. ,Glory Ltd.,Sanden Holding Corp., Seaga Manufacturing Inc., Orasesta S.p.A. ,Sellmat s.r.l. ,Fuji Electric Co., Ltd.

The vending machine market is characterized by intense competition, driven by technological advancements, evolving consumer preferences, and the entry of new players. Established giants like Nestlé S.A., The Coca-Cola Company, and Fuji Electric Co., Ltd. dominate the industry, leveraging their extensive distribution networks, brand recognition, and cutting-edge innovations. These leaders focus on integrating smart technologies such as IoT, AI, and cashless payment systems to enhance user experience and operational efficiency. For instance, Coca-Cola’s Freestyle machines and Fuji Electric’s IoT-enabled models exemplify how innovation strengthens market positioning. Meanwhile, regional players are also gaining traction by catering to local demands, particularly in emerging markets like Asia-Pacific and Latin America.

The competitive landscape is further intensified by the growing emphasis on sustainability. Companies are adopting eco-friendly practices, such as energy-efficient designs and biodegradable packaging, to align with global environmental goals. According to the United Nations Environment Programme, businesses prioritizing sustainability witness a 20% increase in consumer trust, giving them a competitive edge. Additionally, smaller firms are entering the market with niche offerings, such as vending machines for fresh meals or luxury goods, targeting underserved segments.

Despite high initial costs and regulatory challenges, the market remains attractive due to urbanization and the rising demand for convenience. Strategic collaborations, mergers, and acquisitions are common tactics used to consolidate market share. For example, partnerships between technology providers and vending operators have accelerated the adoption of digital solutions. Overall, the competitive dynamics reflect a blend of innovation, sustainability, and strategic expansion, ensuring a vibrant yet challenging environment for stakeholders across the globe.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Nestlé S.A. launched eco-friendly vending machines in Europe.This initiative is anticipated to reduce energy consumption by 40% and strengthen Nestlé’s commitment to sustainability, aligning with global environmental goals outlined by the United Nations Environment Programme.

In June 2022, The Coca-Cola Company expanded its Freestyle vending machine network.This expansion, which added over 50,000 AI-driven machines globally, is anticipated to enhance customization options and improve inventory management, as reported by the Beverage Marketing Corporation

In September 2022, Fuji Electric Co., Ltd. introduced IoT-enabled vending machines in Japan.This launch, featuring facial recognition and cashless payments, is anticipated to serve over 1 million consumers daily and solidify Fuji Electric’s leadership in smart vending technology, according to the Japan Vending Machine Manufacturers Association.

In November 2021, Nestlé S.A. partnered with local distributors in India.This collaboration, which installed 5,000 vending machines in urban centers, is anticipated to boost market penetration in high-traffic areas, as highlighted by the International Trade Administration.

In January 2023, The Coca-Cola Company committed to powering all vending machines with renewable energy.This move, part of their World Without Waste initiative, is anticipated to enhance brand reputation and align with global sustainability mandates, as stated in their annual sustainability report.

In July 2021, Fuji Electric Co., Ltd. deployed solar-powered vending machines in rural Japan.This deployment, reducing operational costs by 25%, is anticipated to expand access to automated retail in underserved areas, according to the Japanese Ministry of Economy, Trade, and Industry.

In April 2022, Nestlé S.A. introduced health-conscious vending machine options in North America.This introduction of low-sugar and organic snacks is anticipated to cater to health-conscious consumers, addressing trends identified by the U.S. Department of Agriculture.

In August 2022, The Coca-Cola Company integrated Apple Pay and Google Wallet into its vending machines.This integration is anticipated to increase transaction convenience and attract tech-savvy consumers, as per the U.S. Federal Reserve’s digital payment adoption report.

In February 2023, Fuji Electric Co., Ltd. entered the European market with smart vending machines.This entry, featuring 10,000 energy-efficient units, is anticipated to strengthen Fuji Electric’s global presence and align with Europe’s sustainability initiatives, supported by the European Environment Agency.

In October 2022, Nestlé S.A. implemented AI-driven inventory management in its vending machines.This implementation is anticipated to reduce downtime by 30% and optimize supply chain efficiency, as highlighted by the International Data Corporation.

MARKET SEGMENTATION

This research report has segmented and sub-segmented the global vending machines market based on application, payment mode, end-user and region.

By Application

- Commercial Places

- Offices

- Public Places

- Others

By Payment Mode

- Cash

- Cashless

By End-User

- QSR, Shopping Malls, & Retail Stores

- Offices

- Public Transport

- Others

By Type

- Food

- Beverage

- Games/Amusement

- Tobacco

- Candy & Confectionery

- Beauty & Personal Care

- Ticket

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

What are the primary drivers of the Vending Machine Market?

The primary drivers of the Vending Machine Market include technological advancements, ease of vending, internet connectivity, cashless payment options, adaptability for various locations, cost-effectiveness, and demand for continuous supply of goods and services.

What are the major challenges facing the Vending Machine Market?

Major challenges in the Vending Machine Market include stringent regulations against junk food and tobacco usage, low return on investment (ROI) due to rental space costs and operating expenses, and the need for retrofitting existing vending machines with advanced features.

What is the projected growth rate of the Global Vending Machine Market?

The Global Vending Machine Market is projected to grow at a CAGR of 5.10% from 2025 to 2033, with the market size expected to reach USD 33.64 billion by 2033 from USD 21.5 billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]