Global Vegan Cheese Market Size, Share, Trends & Growth Forecast Report - Segmented By Source (Soy Milk, Almond Milk, Coconut Milk, and Rice Milk), Product Type, Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis Forecast 2025 to 2033

Global Vegan Cheese Market Size

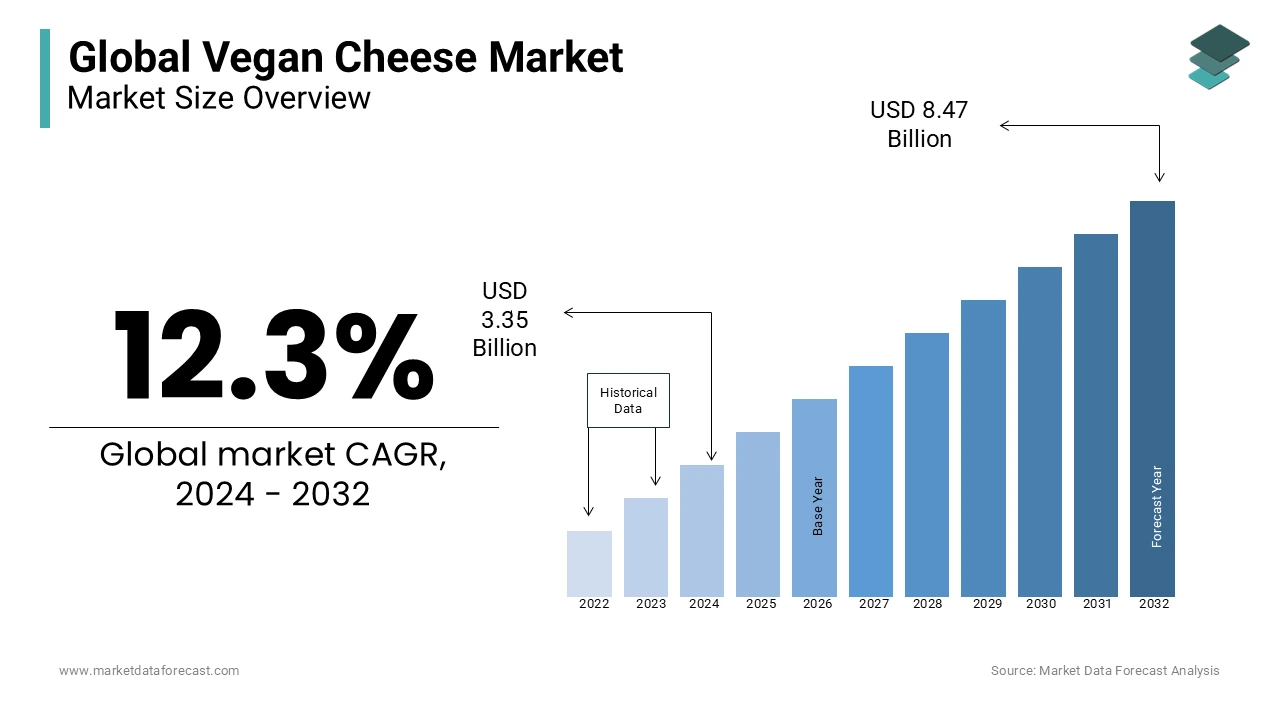

The global vegan cheese market size was valued at USD 3.35 billion in 2024, and the global market size is expected to reach USD 8.47 billion by 2033 from USD 3.76 billion in 2024. The market's promising CAGR for the predicted period is 12.3%.

Lactose- and easily digestible cheese is nothing but vegan. Soy milk, almond milk, rice milk, as well as additional sources including peanut milk, coconut milk, and others are used to make vegan cheese, which is totally made of plant-based components. A few of the factors influencing the rise of the worldwide vegan sector include customer desire for environmentally friendly, animal-free sources of protein, increased consumer concern about the use of antibiotics, allergies, and hormones, and worries about animal welfare. The global vegan cheese market is growing as a result of the widespread usage of vegan cheeses in fast food snacks, bakeries, and confectioneries.

Current Scenario of the Global Vegan Cheese Market

The global vegan cheese market has accounted for significant growth in the past years and is anticipated to have notable growth during the forecast period. The market is driven by consumers seeking sustainable and cruelty-free substitutes for traditional dairy products. The global vegan cheese market is growing due to the widespread usage of vegan cheeses in fast food snacks, bakeries, and confectioneries. The vegan cheese is 100% animal-free and made using vegetable proteins. These are made mainly from soy, cashews, and vegetable oils like coconut oil. These consist of starches and thickeners such as carrageenan and xanthan gum. The global vegan population will accelerate the market growth opportunities in the coming years.

- According to various reports data, by 2023, the total number of vegans will be around 3 to 4% of the total population worldwide, and the total number of vegetarians, including vegans, will be around 11 to 15%.

MARKET DRIVERS

The growing popularity and adoption of veganism worldwide are majorly propelling the growth of the global vegan cheese market. The adoption of veganism has been continuously increasing in all parts of the world, particularly among millennials. Consumers are being pushed to choose plant-based goods due to rising awareness of animal cruelty and the damaging effects the dairy sector has on the environment. A significant portion of the population is switching to a plant-based diet, fuelling the growth of the vegan consumer goods industry. Growing customer demand for plant-based dairy products has caused producers to move quickly because of growing public awareness of animal cruelty and the adverse environmental effects of a carnivorous diet. European region held the most significant vegan population; the increased number is demanding plant-based alternatives like vegan cheese among consumers, positively impacting the market growth. Most of the cheese consumed worldwide is made from dairy. Demand for plant-based vegan cheese has increased as the vegan market expands.

- According to a study published by the Alpro Foundation, in the different hypothetical cases, a slow replacement of animal-sourced foods (ASF) with plant-based alternatives (PBA) between 2020 and 2050 would lead to a reduced consumption of and hence a decline in land application for agricultural output in contrast to REF scenario. In the 50 per cent substitution case which produced the best outcomes, the ecological effects of food production would decrease with the decrease in agricultural land usage to a 31 per cent decline in greenhouse gas emissions by 2050. Also, nitrogen inputs can be divided and about one-tenth of water and land application would be lowered by 10 per cent and 12 per cent respectively.

Changes in consumer eating preferences and emerging trends in the food and beverage industries are driving the demand for vegan cheese on a global scale. Due to the rise in cases of lactose intolerance and other food-related allergies in both children and adults, consumer food preferences have changed recently. The increasing lactose intolerance cases influence people to adopt plant-based alternatives such as vegan cheese products, boosting market growth opportunities. The introduction of various innovations by the market players, such as unique flavours, textures, and formulations, is gaining traction among people and providing growth opportunities to the global vegan cheese market.

MARKET RESTRAINTS

Significant changes in the food and beverage industry are anticipated to result from the arrival of the COVID-19 pandemic. The global vegan cheese market is expected to grow slowly as consumer demand keeps falling due to the ongoing health problem. Normal cheese is a rich source of calcium and protein; however, it usually contains large amounts of salt and saturated fat. Given today’s eating pattern, people consume cheese in excessive quantities which is causing high blood pressure and cholesterol, raising the danger of cardiovascular disease (CVD). As a result, people have started to reduce or stop the consumption of all types of cheese, including vegan cheese, affecting the market growth.

The presence of a significant portion of society does not want to lower their cheese consumption but also wants to achieve health goals. So, the increased demand for vegan cheese burdens raw material suppliers such as cashews, soy, coconut, and almonds, which may hamper the market growth in the coming years. The high demand may lead to fluctuations in the price ranges of raw materials, which restricts access to small-scale businesses. In 2022, and 2023, the supply chain worldwide, comprising the cashew industry, has slowly restored from the COVID-19 pandemic. But, besides the serious consequences of the pandemic, the world’s economy and community have been substantially impacted by the war between Ukraine and Russia; and Israel and Hamas. Elevated inflation on a global scale, central banks enforcing strict monetary policies, a slump in the global economy, and dropping customer spending power have greatly affected the cashew industry in Vietnam and worldwide.

The expensiveness of the plant-based alternatives, where the vegan cheese is expensive compared to the regular cheese, is expected to impede the market growth. The shorter shelf-life of vegan cheese compared to dairy cheese is another factor hindering the market growth opportunities due to limited adoption. The presence of stringent regulations by the US Food and Drug Administration (USFDA) for approval of the products will be challenging for the market players in terms of market expansion.

MARKET OPPORTUNITIES

The combination of multiple factors presents potential opportunities for the expansion of the vegan cheese market. The growing shift to plant-based cheese and changing eating habits is expected to push the market forward. Vegan cheese has become a transformational element in the culinary world which provides a plant-sourced substitute that satisfies the rising demand for ecologically friendly and health-conscious choices.

- As per the findings of the Smart Protein Project which received financial support from the European Union, nearly 30 per cent of European customers are seeking to decrease their consumption of dairy items, it appears that flexitarian people provide a tremendous potential for plant-based cheese items.

Hence, companies should emphasize developing products with pleasing textures and great taste, promoting their closeness by highlighting utility, bringing products to consumer attention, and being cautious with regulations and labelling.

Another factor holding the potential to thrive the market growth is technological innovation regarding plant-based cheese. Many promising innovations in development surround the application of casein and functional analogues to protein or legume to make plant-based cheese which stretches and melts without utilizing many non-clean label ingredients. Further, there are also market players working to reproduce or imitate the functional outcome of casein in this with other plant-sourced proteins.

Now, genetic engineering and Recombinant DNA technologies have successfully made proteins like casein utilising fungi, bacteria, and plants. This advancement is slated to significantly propel the market forward. Precision fermentation, especially, joins potent and robust tools like machine learning and artificial intelligence with fermentation to produce the genetic power of bacteria and fungi to serve as factories to make target proteins at the maximum possible cultivation in the minimum amount of time.

MARKET CHALLENGES

Building a stretchable and meltable plant-based cheese so far is the unfulfilled technological challenge in front of producers, making it one of the main obstacles to the growth of the vegan cheese market. These plant-based cheeses include a network of protein, starch or a mix of both with water and embedded fats. The majority of these cheeses, available to the general public, are made by a procedure by which functional elements. These ingredients are derived from various sources, processed, and blended to constitute a solidified, and emulsion. They even have minimal or zero ingredients and proteins which involve functional additions, for example, gelling agents, stabilizers, or thickeners. With the assistance of these components, cheese maintains its shape even at room temperature. Modified xanthan gum, agar, guar gum, carrageenan, alginate, and starches are all added to that. Furthermore, elements like ‘colour’ and ‘natural flavourings’ are also commonly included in these so-called plant-based cheeses (PBCs). A lot of these ingredients stop manufacturers of these cheeses from promoting them as clean-label items. This is one of the problems faced by the market players.

Casein is an important organizational element of dairy-based cheese, the reason behind its melting behaviour and texture. Plant-based ones do not have this and still, at room temperature, these can keep their shape. However, the 3D structure caused by casein at the time of heating is missing from these PBCs due to the functional additives. Hence, these PBCs melt with short stretches and form free oil, or in some situations, it does not even melt. Therefore, this is one of the major technological challenges for market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.3% |

|

Segments Covered |

By Source, Product, End Use, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Violife Foods, Daiya Foods, Tyne Chease Limited, Vtopian Artisan Cheese Company, Kite Hill, Miyoko’s Kitchen Company, Vermont Farmstead Company, Good Planet Foods, Follow Your Heart, Galaxy Nutritional Foods, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The mozzarella segment was the most significant segment in the global market in 2023, capturing more than 30% of the global market share. It is anticipated to continue to lead during the forecast period in the global vegan cheese market. In Italian dishes, including spaghetti, pizza, croquettes, and Caprese salad, mozzarella is widely used as slices, cubes, shredded cheese, and spreads. The demand for mozzarella is exceptionally high in countries where Italian food is popular, which fuels the expansion of segment revenue.

- Similarly, New Culture, a Bay-area-based start-up, has made a stretchable and meltable vegan mozzarella utilising recombinant casein. It secured a funding round in late 2022 from CJCheilJedang which is a Korean multinational conglomerate holding a 25 per cent share in the frozen pizza market in the United States. The company is looking for approval from the US FDA (Food and Drugs Administration) for its mozzarella which it intends to introduce in the Bay area in the food service in 2024 or early 2025, before tapping into a broader market.

Ricotta is anticipated to experience the fastest CAGR of 14.0% over the forecast period. This product's expanding range of use in Italian cuisines, such as manicotti, lasagna, roll-ups, high tea, and ravioli, has been driving demand and boosting category growth.

By Source Insights

The cashew segment had 36.4% of the global market share in 2023 and is anticipated to remain prominent during the forecast period. Vegan cheese made from cashews is low in fat and contains vitamins B2 and B12, gaining traction among people who consider that health fuels the segment's growth. Due to its health advantages, gluten-free and cholesterol-free cashew products are also becoming more popular, contributing to the market revenue.

- In January 2023, Treeline Cheesemakers, a prominent plant-based manufacturer and innovator of non-dairy cheese, reported that their best-rated, Tasting Table called “best vegan cheese, plain Cashew Cream Cheese is available in nearby single-serving snack packs. These packs of Treeline snacks consist of 6 number of boxes, enabling consumers to eat at their convenience and store for the latter.

Moreover, the segment’s market share is also elevated by the growing number of startups working on transforming dairy alternatives. Start-ups such as Kite Hill and Miyoko’s Kitchen have emerged as popular choices within vegan society for households. They excelled in the craft of producing vegan butter and plant-based cheese, utilising elements, including cashews, almonds, etc. to emulate the functionality and taste of dairy. Especially, cashew butter has been a turning point for making creamy and rich vegan cheese holding its ethic and taste.

The soy segment is anticipated to grow fastest during the forecast period. Soy milk is an affordable alternative to dairy and contains a perfect ratio of healthy fatty acids and amino acids. As a result, it is an economical choice for large-scale vegan cheese makers. Additionally, soy-based cheese is simple to melt, so it is becoming more popular among customers. These advantages are boosting the segment growth.

By End Use Insights

The B2C segment led the market and occupied 56.7% of the worldwide market share in 2023. It is expected to grow exponentially during the forecast period owing to rising consumer disposable income levels and their willingness to spend on high-end items. The demand for plant-based products in the B2C sector has increased. The straightforward accessibility of goods in supermarkets and convenience stores has also contributed to the growth of this market.

- According to The Plantation, the sales revenue of plant-based “cheese” in the United Kingdom has surged by more than 160 per cent during the past two years.

The B2B segment is projected to grow prominently in the coming years. Most restaurants, cafes, and hotels are adopting plant-based alternatives, considering the vegan population, driving the segment's growth.

REGIONAL ANALYSIS

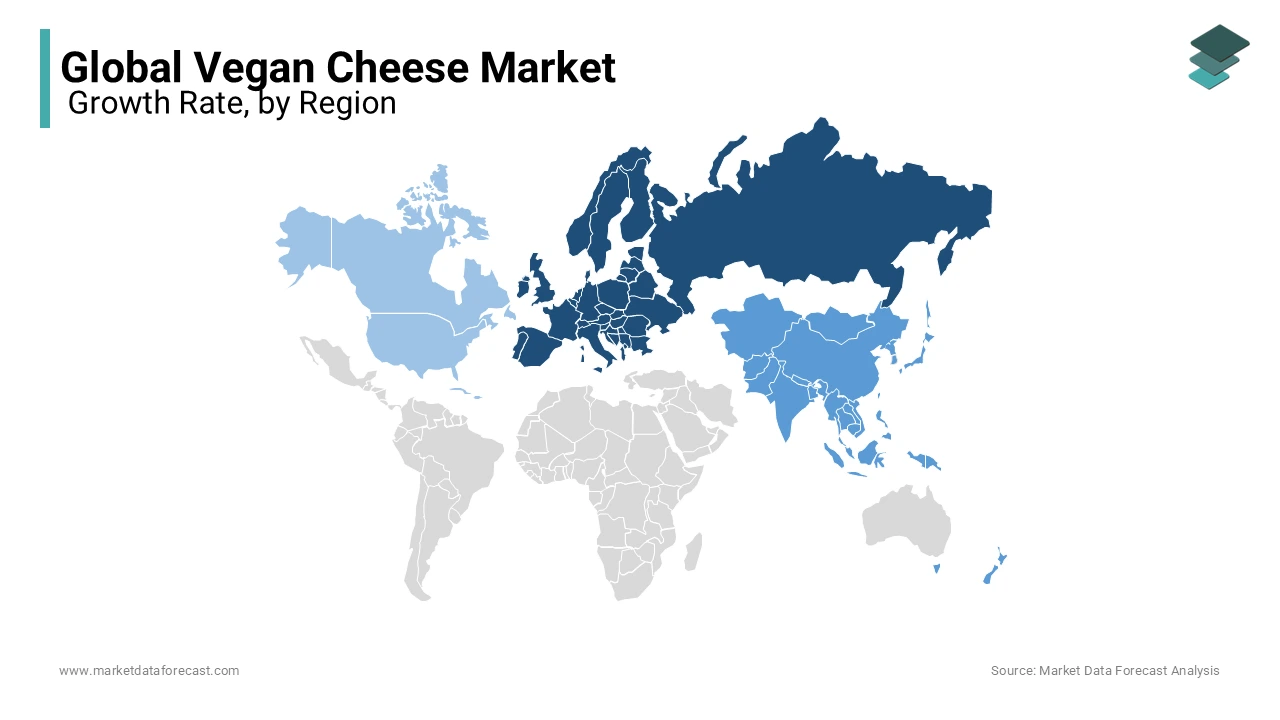

More than 35.0% of global revenue was generated in Europe in 2023, and this region will continue to hold the top spot throughout the coming years. Consumers are progressively adopting more environmentally friendly and vegan goods as a result of rising awareness of animal cruelty and the region's growing carbon footprint brought on by the use of commodities produced from animals, such as milk, honey, eggs, beef, pig, and seafood.

- According to a Study supported by the European Commission, about 9 per cent of European people consume plant-based cheese. Substituting dairy with plant-based options is the second most favoured selection for 37 per cent of Europeans.

The European region has many vegan people and flexitarians actively seeking alternatives, fueling regional market growth. The well-established distribution network for plant-based alternatives is expected to impact the vegan cheese market's growth positively.

- For Instance, In October 2022, the European Commission registered the European Citizens initiative for vegan meals, which proposes a law mandating the availability of vegan alternatives in private and public establishments that sell food and beverages in Europe.

The Asia Pacific is predicted to be the fastest-growing regional market for vegan cheese, growing at a CAGR of 14.1% from 2024 to 2029. The increased demand for plant-based baking and confectionery products in the region is predicted to increase sales of the product. China, Japan, and Australia are the leading proponents of the Asia Pacific vegan cheese market's growth.

- As per a study conducted between March 2024 and April 2024 by ProVeg, about 98 per cent of people in China will consume more plant-based foods after they have been notified of the advantages, especially to their well-being, of following a plant-centered diet.

The North American region is projected to have considerable growth during the forecast period due to increasing demand for gluten-free food products. The increasing awareness among people regarding the need for good health and rising demand for products with low cholesterol levels is driving the demand for vegan cheese, leading to market growth across North America.

- According to a study published in 2023 in Protein Production Technology, over 2 out of 5 people in the United States, i.e. about 42 per cent, earlier set a New Year’s resolution to include more plant-derived food items in their eating habits, but failed to follow through.

- A survey revealed that around 68 per cent of US people have tasted or at least consumed once a meat substitute from a dairy replacement or plant source. The data also showed that one-third, i.e. 31 per cent, of Americans, change dairy, cheese, or meat with a plant-based substitute in approximately eight meals per week, recommending that although they may not adopt a fully vegan lifestyle, there is a rising desire or hunger to practice an occasional flexitarian or plant-based diet.

KEY PLAYERS IN THE VEGAN CHEESE MARKET

Violife Foods, Daiya Foods, Tyne Chease Limited, Vtopian Artisan Cheese Company, Kite Hill, Miyoko’s Kitchen Company, Vermont Farmstead Company, Good Planet Foods, Follow Your Heart and Galaxy Nutritional Foods, Inc. are some of the notable companies in the global vegan cheese market.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, Cathedral City broadened its range of plant-based products by introducing a new Vegan Cheese Flavour in the United Kingdom supermarkets.

- In September 2024, Plonts launched itself as a new brand in vegan cheese in the United States with the help of seed funding of 12 million dollars.

- In January 2024, South Korean food tech company Armored Fresh created almond-based products that mimic the taste and texture of dairy cheese with nutrient-infused protein content.

- In January 2024, The Laughing Cow, a Chicago-based company, introduced a plant-based spreadable cheese product line in the United States. This line caters to consumers seeking dairy-free, creamy alternatives made from almond milk.

- In February 2024, Stockeld Dreamery, a Swedish vegan dairy start-up, introduced a fermented Cheddar slice to elevate the vegan cheese experience. This newly made plant-based cheese is developed from fermented legume milk.

- In April 2024, The Compleat Food Group returned to the M&A industry by acquiring Palace Culture, a UK-based dairy-free cheese business. Palace Culture contributes to the group's plant-based product line but is distinguished by its move away from meat alternatives.

- In October 2023, PETA published on its site that it would give Babybel dairy-free cheese to passersby and attendees of the International Dairy Federation World Dairy Summit. PETA reminded people that loving cheese, yogurt, and milk can go hand in hand with being kind to animals.

MARKET SEGMENTATION

This research report on the global vegan cheese market has been segmented and sub-segmented based on Product, Source, End-Use & region.

By Product

- Mozzarella

- Cheddar

- Parmesan

- Ricotta

- Cream Cheese

By Source

- Cashew

- Soy

By End Use

- B2C

- B2B

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.Is vegan cheese environmentally friendly?

Vegan cheese production generally has a lower environmental footprint compared to dairy cheese production, as it requires fewer natural resources such as water and land and produces fewer greenhouse gas emissions. Additionally, vegan cheese production does not involve animal farming practices associated with deforestation and habitat destruction.

2.What are the different types of vegan cheese available?

There are various types of vegan cheese available, including soft cheeses (like cream cheese and ricotta), hard cheeses (like cheddar and gouda), and specialty cheeses (like blue cheese and camembert). These cheeses may be flavored or aged to replicate the characteristics of traditional dairy cheeses.

3. How is vegan cheese made?

Major changes in the food and beverage industry are anticipated to result from the arrival of the COVID-19 pandemic. The global vegan cheese market is anticipated to have slow growth, particularly in 2020 as consumer demand keeps falling, as a result of the ongoing health problem.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]