Global Variable Frequency Drive (VFD) Market Size, Share, Trends, & Growth Forecast Report By Product Type (AC Drives, DC Drives, and Servo Drives), Power Range, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Variable Frequency Drive Market Size

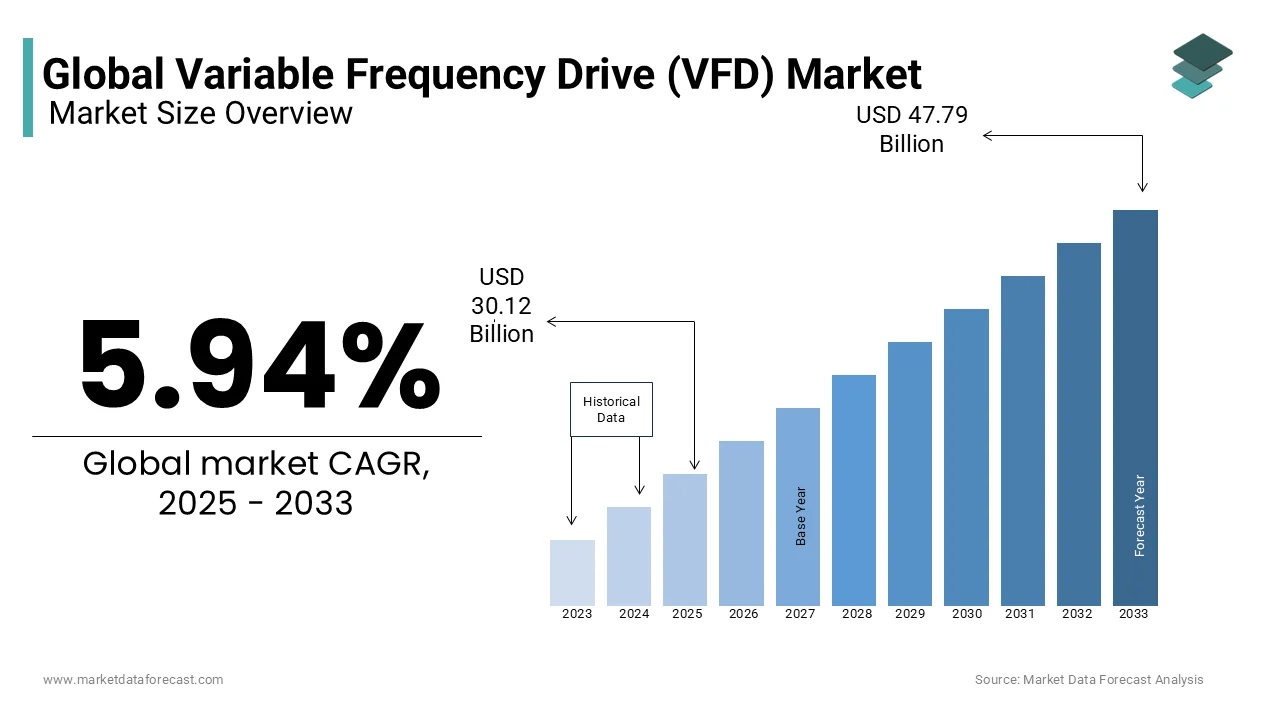

The global variable frequency drive (VFD) market was worth USD 28.43 billion in 2024. The global market is projected to reach USD 47.79 billion by 2033 from USD 30.12 billion in 2025, rising at a CAGR of 5.94% from 2025 to 2033.

A Variable Frequency Drive (VFD) is an electronic device that regulates the speed and torque of alternating current (AC) motors by adjusting the frequency and voltage of the electrical power supplied to the motor. This precise control enables motors to operate at variable speeds by enhancing process efficiency and reducing energy consumption. VFDs are integral components in various industrial applications, including fans, pumps, conveyors, and compressors, where they facilitate optimized performance and energy savings.

The operational principle of a VFD involves converting the fixed-frequency AC input power into direct current (DC) through a rectifier. This DC power is then inverted back into AC with variable frequency and voltage, which is supplied to the motor. The VFD ensures that the motor's speed aligns with the specific requirements of the load, thereby improving system efficiency and performance.

The adoption of VFDs has been significantly driven by their potential for energy conservation. Electric motors account for a substantial portion of industrial electricity consumption, with estimates indicating that they consume about 70% of the electricity used in industrial settings. Implementing VFDs can lead to energy savings ranging from 20% to 50%, depending on the application and load profile. For instance, in pump and fan systems, reducing the motor speed by 20% can result in energy savings of up to 50%, due to the cubic relationship between speed and power consumption.

Beyond energy efficiency, VFDs contribute to extended equipment lifespan and reduced maintenance costs. By enabling soft starting and stopping of motors, VFDs minimize mechanical stress and wear on components by leading to improved reliability and decreased downtime. Additionally, the precise control offered by VFDs enhances process control by leading to improved product quality and operational flexibility.

MARKET DRIVERS

Energy Efficiency and Regulatory Compliance

The global emphasis on energy conservation has significantly propelled the adoption of Variable Frequency Drives (VFDs). Electric motors are responsible for approximately 45% of the world's electricity consumption in industrial applications. By integrating VFDs, industries can achieve energy savings of up to 25%, as these devices optimize motor speed to match load requirements, thereby reducing unnecessary energy usage. This efficiency not only lowers operational costs but also aids in meeting stringent energy regulations. For instance, the European Union's Ecodesign Directive mandates improved energy performance standards by encouraging the implementation of VFDs to comply with such directives.

Industrial Automation and Technological Advancements

The surge in industrial automation has markedly increased the demand for VFDs. Industries are progressively integrating automation to enhance productivity and precision. VFDs play a crucial role in this transformation by offering precise motor control, which is essential for automated processes. The International Federation of Robotics reported a significant rise in industrial robot installations, indicating a trend towards automation. Additionally, advancements in VFD technology, such as the integration of Internet of Things (IoT) capabilities, have expanded their functionality, enabling real-time monitoring and predictive maintenance. These technological enhancements not only improve operational efficiency but also reduce downtime, further driving the adoption of VFDs in automated industrial systems.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

The high initial investment required for variable frequency drives (VFDs) poses a significant restraint to market growth for small and medium-sized enterprises. According to the U.S. Department of Energy, the average cost of industrial-grade VFDs ranges from $500 to $20,000 per unit, depending on capacity and specifications by making them unaffordable for many businesses in developing regions. According to the International Monetary Fund, capital expenditure constraints have led to slower adoption rates in emerging economies, where industries prioritize lower-cost alternatives despite long-term efficiency benefits. According to the World Bank, that energy-efficient technologies like VFDs often require additional infrastructure upgrades, increasing overall implementation costs by up to 25%. These financial barriers hinder widespread adoption, especially in sectors with limited budgets, despite the potential for energy savings and operational improvements.

Technical Challenges and Maintenance Complexity

Technical challenges and maintenance complexities associated with VFDs present another major restraint in their adoption. According to the U.S. Bureau of Labor Statistics, improper installation or operation of VFDs can lead to motor overheating, harmonic distortions, and equipment failure, resulting in annual losses exceeding $1 billion in industrial sectors. As per the European Commission, maintaining VFD systems requires specialized skills with only 30% of technicians in Europe are adequately trained for such tasks. According to the International Energy Agency, VFDs operating in harsh environments, such as mining or oil and gas, experience higher failure rates, necessitating frequent repairs and replacements. These technical and skill-related challenges increase operational downtime and costs by discouraging industries from adopting VFDs without robust support systems in place.

MARKET OPPORTUNITIES

Growing Demand for Energy Efficiency in Industrial Operations

The increasing global emphasis on energy efficiency presents a significant opportunity for the Variable Frequency Drive (VFD) market. According to the U.S. Department of Energy, VFDs can reduce energy consumption in motor-driven systems by up to 60% by making them a key solution for industries aiming to meet sustainability goals. As per the International Energy Agency, industrial motor systems account for approximately 45% of global electricity consumption by creating a vast potential market for VFD adoption. As per the European Commission, industries adopting energy-efficient technologies could achieve annual savings of €60 billion across Europe by 2030. As nations implement stricter energy regulations, such as the EU’s Energy Efficiency Directive, the demand for VFDs is expected to surge. This trend aligns with global decarbonization efforts by positioning VFDs as critical tools for reducing industrial carbon footprints.

Expansion of Smart Manufacturing and Industry 4.0 Initiatives

The rise of smart manufacturing and Industry 4.0 initiatives offers another major growth avenue for the VFD market with the integration of IoT-enabled devices like VFDs. These drives provide real-time data monitoring and predictive maintenance capabilities by enhancing operational efficiency. According to the U.S. Bureau of Economic Analysis, smart manufacturing investments in the United States exceeded $200 billion in 2022, with VFDs playing a pivotal role in optimizing motor performance. According to the Asian Development Bank, Asia-Pacific countries are investing heavily in digital transformation, with over $1 trillion allocated to smart factories by 2030. VFDs are set to become indispensable components of modernized manufacturing ecosystems.

MARKET CHALLENGES

Harmonic Distortion and Power Quality Issues

Harmonic distortion caused by Variable Frequency Drives (VFDs) poses a significant challenge in sensitive industrial environments. According to the U.S. Department of Energy, VFDs can introduce harmonic distortions, which account for up to 15% of total power quality issues in electrical systems by leading to equipment overheating and inefficiencies. According to the International Electrotechnical Commission, industries with high VFD usage, such as manufacturing and water treatment, often require additional harmonic filters by increasing system costs by approximately 20%. According to the European Environment Agency, harmonic distortions contribute to energy losses equivalent to 5% of total electricity consumption in industrial facilities. These technical challenges necessitate costly mitigation measures, deterring smaller enterprises from adopting VFDs despite their long-term benefits, while also complicating compliance with stringent power quality standards.

Limited Awareness and Technical Expertise in Emerging Markets

Limited awareness and technical expertise regarding VFD installation and operation hinder market growth, especially in emerging economies. According to the United Nations Industrial Development Organization, only 40% of industrial operators in developing regions are adequately trained to handle advanced technologies like VFDs by leading to improper usage and frequent system failures. As per World Bank, lack of awareness about energy-efficient solutions results in underutilization of VFDs, with adoption rates in Africa and South Asia being 30% lower than global averages. A report by the International Labour Organization have shown that skill gaps in technical education systems exacerbate the issue by leaving industries reliant on outdated motor control methods. This knowledge gap not only limits VFD adoption but also increases operational risks by undermining their potential to enhance efficiency and sustainability in these regions

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.94% |

|

Segments Covered |

By Product Type, Power Range, Application, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB, Eaton, General Electric, Hitachi Ltd., Rockwell Automation Inc., Schneider Electric, Siemens AG, The Danfoss Group, WEG S.A., and Yaskawa Electric Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

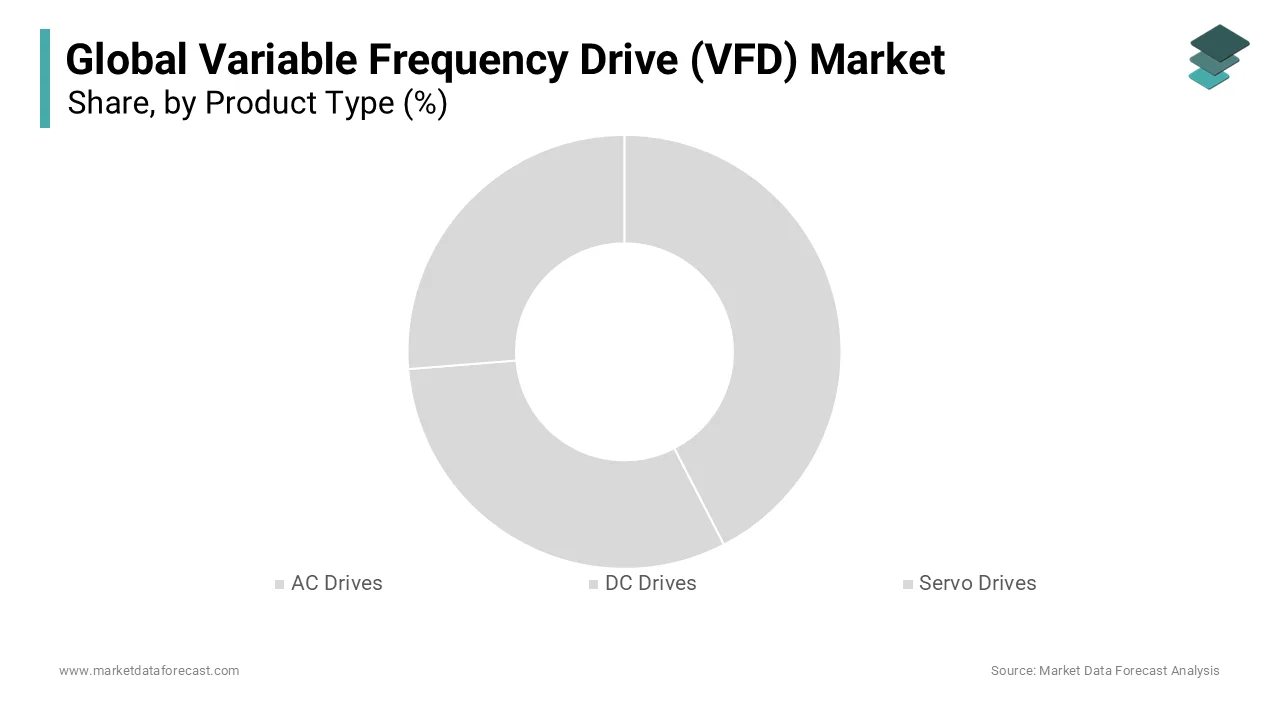

The AC Drives segment dominated the Variable Frequency Drive (VFD) market with 57.1% of the total share in 2024. The widespread use in industrial applications such as HVAC systems, pumps, and fans is promoting the growth of the market. As per International Energy Agency, AC Drives can reduce motor energy consumption by up to 50% by making them indispensable for industries aiming to meet sustainability goals. Their ability to handle a wide range of voltages and frequencies further enhances their versatility. The demand for AC Drives remains robust with over 80% of industrial motors being AC-powered.

The servo drives segment is likely to experience a fastest CAGR of 8.5% from 2025 to 2033. This growth is driven by the rapid adoption of automation and precision control systems in industries like robotics, packaging, and CNC machining. As per the European Commission, Servo Drives enable energy savings of up to 30% in precision applications by aligning with sustainability initiatives.

By Power Range Insights

The low power range (6-40 kW) was the largest by occupying the Variable Frequency Drive (VFD) market with 45.1% of the global share in 2024. This segment's growth is attributed due to its widespread use in HVAC systems in various industries. According to the U.S. Department of Energy, VFDs in this range can reduce energy consumption by up to 30% by making them highly attractive for commercial and light industrial applications. This segment plays a pivotal role in achieving sustainability goals while supporting cost-effective motor control solutions across diverse industries.

The high power range (>200 kW) segment is anticipated to register a CAGR of 7.9% throughout the forecast period. This growth is fueled by increasing investments in heavy industries such as oil and gas, mining, and renewable energy, where large motors require precise control. According to the International Renewable Energy Agency, wind turbines and hydropower plants, which rely on high-power VFDs, are expanding rapidly, with global renewable capacity additions reaching 295 GW in 2021. According to the World Bank, infrastructure development in emerging economies is driving demand for high-power VFDs in water treatment and desalination plants.

By Application Insights

The pumps segment dominated the variable frequency drive market share in 2024 with the rising support from the government agencies through investments. According to the International Energy Agency, motor-driven systems, including pumps, consume nearly 40% of global electricity by making VFDs essential for optimizing energy usage. VFDs can cut energy consumption by up to 50% by reducing pump speeds to match demand.

The HVAC segment is projected to exhibit a CAGR of 8.2% from 2025 to 2033. This growth is driven by increasing urbanization and the rising adoption of smart building technologies. According to the U.S. Environmental Protection Agency, HVAC systems account for approximately 40% of energy usage in commercial buildings is creating a strong demand for energy-efficient solutions like VFDs. According to the International Renewable Energy Agency, the integration of VFDs in HVAC systems can reduce energy consumption by up to 30% by aligning with global decarbonization efforts. The role of VFDs in enhancing HVAC efficiency is set to expand significantly as climate control becomes a priority in both residential and commercial spaces.

By End Use Insights

The industrial sector was accounted in holding the dominant share of the variable frequency drive market share in 2024 with the widespread use of motor-driven systems in manufacturing, chemical processing, and material handling, where VFDs optimize energy consumption and enhance operational efficiency. As per the International Energy Agency, industrial motor systems consume nearly 45% of global electricity by making VFD adoption critical for reducing energy costs. VFDs play a pivotal role in minimizing carbon emissions and improving process control with industries under pressure to meet sustainability goals.

The infrastructure segment is estimated to exhibit a CAGR of 8.2% during the forecast period. This growth is fueled by rapid urbanization and investments in smart city projects in Asia-Pacific, where over $1 trillion is being allocated to infrastructure development by 2030. As per the European Commission, water and wastewater management systems, which rely heavily on VFDs for efficient pump operations is anticipated to fuel the growth of the market. According to the United Nations Environment Programme, energy-efficient infrastructure is essential for achieving global decarbonization targets.

REGIONAL ANALYSIS

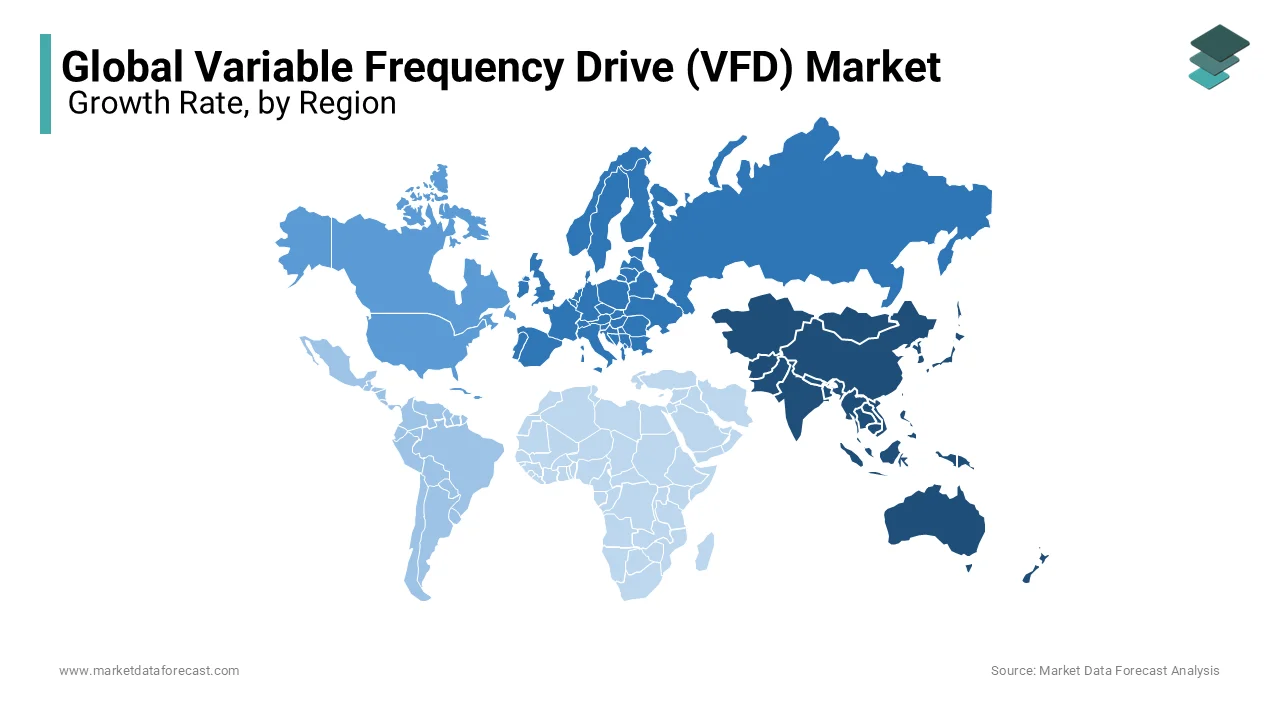

The Asia-Pacific variable frequency drives (VFDs) market was the top performer in the global market with 38.2% in 2024. Rapid industrialization, urbanization, and infrastructure development in countries like China and India are majorly elevating the growth of the market. According to the Asian Development Bank, the region accounts for over 60% of global energy demand with VFDs playing a critical role in optimizing energy efficiency in industrial motors. Additionally, government initiatives are promoting renewable energy and smart manufacturing that further boost the market growth.

Europe is estimated to witness a CAGR of 7.2% during the forecast period. This growth is fueled by stringent environmental regulations, such as the EU’s Energy Efficiency Directive, which mandates energy-saving measures in industrial operations. According to the International Energy Agency, industries adopting VFDs can achieve energy savings of up to 30% by aligning with Europe’s goal of carbon neutrality by 2050. According to the European Environment Agency, over €1 trillion is being invested in modernizing aging infrastructure by including water and wastewater systems reliant on VFDs. These factors position Europe as a leader in sustainable innovation by driving rapid adoption of energy-efficient technologies.

North America is likely to grow steadily throughout the forecast period owing to the investments in shale gas extraction and pipeline modernization. Latin America shows moderate growth due to mining and agricultural advancements with the Inter-American Development Bank by projecting a 5.8% rise in industrial investments by 2025. Meanwhile, the Middle East and Africa focus on oil and gas infrastructure and renewable energy projects by ensuring consistent demand for VFDs.

KEY MARKET PLAYERS

The major players in the global variable frequency drive (VFD) market include ABB, Eaton, General Electric, Hitachi Ltd., Rockwell Automation Inc., Schneider Electric, Siemens AG, The Danfoss Group, WEG S.A., and Yaskawa Electric Corporation.

TOP 3 PLAYERS IN THE MARKET

ABB: A Global Leader in VFD Innovation

ABB is one of the leading players in the global Variable Frequency Drive (VFD) market, commanding a significant market share of approximately 20%, as per the International Energy Agency. The company’s comprehensive portfolio includes low-voltage and medium-voltage VFDs tailored for industries such as oil and gas, water utilities, and manufacturing. ABB’s commitment to sustainability is evident through its energy-efficient drives, which help reduce motor energy consumption by up to 60%. The U.S. Department of Energy notes that ABB’s VFD solutions have been instrumental in advancing industrial automation and smart manufacturing globally. With a strong focus on R&D and digitalization, ABB continues to set benchmarks in innovation, contributing significantly to the adoption of VFDs in energy-intensive applications.

Siemens AG: Driving Efficiency Across Industries

Siemens AG is another dominant player in the VFD market, holding an estimated 18% market share, according to the European Commission. Siemens offers advanced VFD solutions, including its SINAMICS series, designed for applications ranging from HVAC systems to heavy-duty industrial processes. The company plays a pivotal role in promoting energy efficiency, with its drives enabling industries to achieve compliance with stringent environmental regulations like the EU’s Energy Efficiency Directive. According to the International Electrotechnical Commission, Siemens’ VFDs are integral to reducing carbon emissions in sectors such as power generation and infrastructure development.

Schneider Electric: Pioneering Sustainable Solutions

Schneider Electric ranks among the top three players in the VFD market, with a market share of approximately 15%, as per the International Energy Agency. The company’s Altivar series of VFDs are widely recognized for their robust performance and energy-saving capabilities, particularly in industrial and infrastructure applications. Schneider Electric emphasizes sustainability, aligning its VFD offerings with global decarbonization goals. The United Nations Environment Programme notes that Schneider’s solutions have helped industries reduce energy consumption by up to 30%, contributing to lower operational costs and minimized environmental impact. Schneider Electric continues to drive the adoption of VFDs with a strong presence in emerging markets and a focus on smart technologies.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the Variable Frequency Drive (VFD) market, such as ABB, Siemens AG, and Schneider Electric, have heavily relied on strategic collaborations and partnerships to expand their market presence. For instance, ABB has partnered with global industrial firms to integrate its VFD solutions into smart grid and renewable energy projects, as per the International Energy Agency. These alliances enable companies to leverage complementary technologies and access new markets. Similarly, Schneider Electric collaborates with regional distributors and system integrators in emerging economies to enhance its reach in untapped regions. Such partnerships not only strengthen brand visibility but also ensure that VFD solutions are tailored to meet local industrial demands, fostering long-term customer relationships.

Focus on Research and Development (R&D)

Investment in R&D is a cornerstone strategy for leaders like Siemens AG and Rockwell Automation Inc., enabling them to maintain a competitive edge through innovation. The European Commission reports that Siemens dedicates over 5% of its annual revenue to R&D, focusing on IoT-enabled VFDs and predictive maintenance capabilities. These advancements align with Industry 4.0 trends, enhancing operational efficiency and reducing downtime for end-users. Similarly, Rockwell Automation has developed intelligent VFDs that integrate seamlessly with its FactoryTalk software suite, offering real-time data analytics. By prioritizing technological breakthroughs, these companies address evolving customer needs while setting higher industry standards by ensuring sustained market dominance.

Expansion into Emerging Markets

Market leaders are aggressively targeting emerging markets in Asia-Pacific, Latin America, and Africa to capitalize on rapid industrialization and urbanization. According to the Asian Development Bank, companies like WEG S.A. and Yaskawa Electric Corporation have established manufacturing hubs and service centers in countries like India and Brazil to cater to localized demand. This strategy reduces production costs and delivery times while complying with regional regulatory frameworks. Additionally, Danfoss Group has launched affordable VFD models tailored for small and medium enterprises in developing regions, addressing budget constraints. By expanding their geographic footprint, these players tap into high-growth markets by driving revenue growth.

Emphasis on Sustainability and Energy Efficiency

Sustainability has become a key differentiator in the VFD market, with companies like Schneider Electric and Hitachi Ltd. emphasizing eco-friendly solutions. According to the United Nations Environment Programme, Schneider’s EcoStruxure platform integrates VFDs with energy management systems, helping industries achieve up to 30% energy savings. Similarly, Hitachi focuses on developing VFDs for renewable energy applications, such as wind turbines and solar power plants, aligning with global decarbonization goals. These companies not only comply with stringent environmental regulations but also appeal to environmentally conscious customers by enhancing brand loyalty and market share.

Mergers and Acquisitions (M&A)

Mergers and acquisitions are pivotal strategies used by key players to consolidate their market position and diversify their product portfolios. For example, Eaton Corporation acquired Ulusoy Elektrik, a Turkish electrical equipment manufacturer, to strengthen its presence in the Middle East and Africa, as reported by the U.S. Department of Commerce. Similarly, General Electric expanded its VFD offerings through acquisitions of niche automation firms, enabling it to compete more effectively in the industrial segment. These strategic moves allow companies to eliminate competition, acquire cutting-edge technologies, and enter new verticals, ensuring sustained growth in a highly competitive market.

COMPETITIVE LANDSCAPE

The Variable Frequency Drive (VFD) market is characterized by intense competition, driven by the presence of established global players and emerging regional firms striving to capture market share. Leading companies such as ABB, Siemens AG, Schneider Electric, and Rockwell Automation dominate the landscape, leveraging their extensive product portfolios, technological expertise, and strong distribution networks. These players focus on innovation, sustainability, and digitalization to maintain their competitive edge, with significant investments in R&D to develop IoT-enabled and energy-efficient VFD solutions. For instance, ABB’s integration of predictive maintenance features and Siemens’ emphasis on smart manufacturing align with Industry 4.0 trends, setting high benchmarks for competitors.

Emerging players like WEG S.A., Yaskawa Electric Corporation, and Danfoss Group are also gaining traction by targeting niche markets and offering cost-effective solutions tailored for small and medium enterprises. According to the International Energy Agency, these companies are increasingly penetrating emerging economies through localized strategies, such as establishing manufacturing hubs and partnerships with regional distributors. This has intensified competition, particularly in Asia-Pacific and Latin America, where rapid industrialization and urbanization drive demand.

Furthermore, mergers, acquisitions, and strategic collaborations have become pivotal in reshaping the competitive dynamics. For example, Eaton and General Electric have expanded their offerings through acquisitions, while Schneider Electric collaborates with local firms to enhance market penetration. The competitive environment is further fueled by stringent environmental regulations and the growing emphasis on energy efficiency, compelling companies to innovate and differentiate themselves. Overall, the VFD market remains highly dynamic, with key players adopting multifaceted strategies to consolidate their positions and address evolving customer needs.

RECENT MARKET DEVELOPMENTS

- In March 2023, ABB launched its next-generation medium voltage drive, the ACS880MV, designed to enhance industrial performance and reliability. This innovation is anticipated to provide industries with superior energy efficiency, precise motor control, and improved operational resilience. By incorporating advanced IoT capabilities and predictive maintenance features, the new drive aims to reduce downtime and optimize energy consumption.

- In February 2025, Siemens AG announced a strategic partnership with Guofu Hydrogen, a leader in hydrogen energy solutions, to accelerate global green hydrogen production. As part of this collaboration, Siemens is integrating its advanced SINAMICS VFDs into hydrogen electrolysis systems, enabling more efficient and reliable energy conversion processes. This initiative is anticipated to enhance the scalability and sustainability of green hydrogen projects worldwide, aligning with global decarbonization goals.

- In January 2023, Rockwell Automation completed its acquisition of Plex Systems, a leading provider of cloud-native smart manufacturing platforms. This acquisition is anticipated to enhance Rockwell's ability to deliver comprehensive, integrated solutions that combine Variable Frequency Drives (VFDs) with advanced data analytics and industrial automation technologies. By incorporating Plex Systems' capabilities, Rockwell aims to strengthen its position in the Industry 4.0 landscape, enabling customers to achieve greater operational efficiency, scalability, and real-time insights.

- In April 2022, WEG S.A. introduced its Variable Speed Drive CFW700 series, a legacy product line tailored for industrial applications, including mining, water treatment, and manufacturing. Designed to deliver high performance and energy efficiency, the CFW700 series is anticipated to address the specific needs of heavy-duty operations in Brazil and other emerging markets.

- In August 2022, Yaskawa Electric Corporation reinforced its market presence by showcasing its advanced Variable Frequency Drives (VFDs) through partnerships with distributors like Kundinger, a leading provider of industrial automation solutions. These VFDs, known for their energy efficiency and precision in motor control, are widely adopted in industries such as automotive manufacturing, HVAC systems, and material handling.

- In February 2023, Danfoss Group announced its "Energy Efficiency First" program, promoting VFD adoption in HVAC systems. This initiative is anticipated to reduce carbon emissions by 30%, enhancing Danfoss' reputation as a sustainability-focused company.

- In July 2022, Eaton Corporation acquired Ulusoy Elektrik, a Turkey-based electrical equipment manufacturer. This acquisition is expected to expand Eaton's VFD distribution network in the Middle East and Africa, strengthening its regional presence.

- In September 2022, Hitachi Ltd. integrated its VFDs into solar power plants in India, improving energy conversion efficiency by 20%. This move is anticipated to position Hitachi as a leader in renewable energy infrastructure solutions.

- In December 2022, General Electric partnered with U.S.-based utilities to deploy VFDs in smart grid infrastructure. This collaboration is expected to enhance energy management capabilities, reinforcing GE's role in modernizing power systems.

MARKET SEGMENTATION

This research report on the global variable frequency drive (VFD) market is segmented and sub-segmented into the following categories.

By Product Type

- AC Drives

- DC Drives

- Servo Drives

By Power Range

- Micro (0-5 kW)

- Low (6-40 kW)

- Medium (41-200 kW)

- High (>200 kW)

By Application

- Pumps

- Electric Fans

- Conveyors

- HVAC

- Extruders

- Others

By End Use

- Oil & Gas

- Power Generation

- Industrial

- Infrastructure

- Automotive

- Food & Beverages

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the Variable Frequency Drive Market growth rate during the projection period?

The Global Variable Frequency Drive Market is expected to grow with a CAGR of 5.94% between 2025-2033.

What can be the total Variable Frequency Drive Market value?

The Global Variable Frequency Drive Market size is expected to reach a revised size of USD 47.79 billion by 2033.

Name any three Variable Frequency Drive Market key players?

Rockwell Automation, Inc. (U.S.), WEG (Brazil), and Yaskawa Electric Corporation (Japan) are the three Variable Frequency Drive Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]