Global Valves Market Size, Share, Trends, & Growth Forecast Report By Type (Ball, Butterfly, Gate/Globe/Check, Plug, Control, and Other Types), End-User Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Valves Market Size

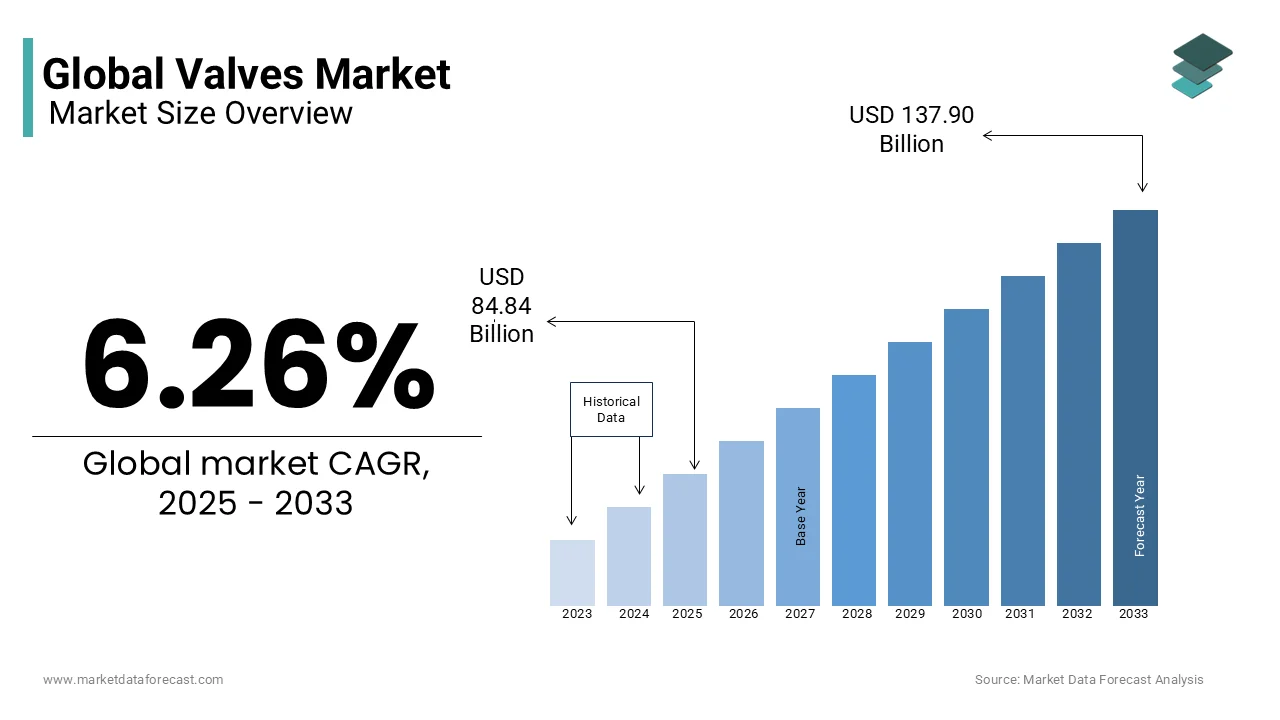

The global valves market was worth USD 79.84 billion in 2024. The global market is projected to reach USD 137.90 billion by 2033 from USD 84.84 billion in 2025, rising at a CAGR of 6.26% from 2025 to 2033.

Valves are integral components across industries such as oil and gas, water treatment, power generation, pharmaceuticals, food processing, and HVAC systems, serving critical functions like isolation, throttling, pressure relief, and backflow prevention. As of 2023, the global demand for valves reflects their indispensable role in industrial infrastructure and technological advancements. For instance, according to the International Energy Agency (IEA), the oil and gas sector alone accounts for nearly 30% of total valve consumption worldwide due to extensive pipeline networks and refining operations.

According to the World Health Organization, approximately 26% of the global population lacks access to safely managed drinking water services by amplifying the importance of efficient water management systems where valves play a pivotal role. Furthermore, data from the United Nations Environment Programme have shown that industrial processes contribute about 24% of global greenhouse gas emissions with the growing need for energy-efficient valve solutions to minimize leaks and optimize resource use. Additionally, as per the U.S. Department of Energy, steam systems, heavily reliant on high-performance valves that consume roughly one-third of all energy used in industrial applications. These statistics collectively illustrate how valves not only support operational efficiency but also align with sustainability goals by making them vital in addressing modern environmental and infrastructural challenges.

MARKET DRIVERS

Increasing Industrialization and Infrastructure Development

The rapid pace of industrialization in emerging economies is a significant driver for the valves market. According to the International Monetary Fund, global industrial production has grown by an average of 3.5% annually over the past decade, with manufacturing hubs in Asia-Pacific contributing significantly to this growth. This expansion necessitates robust infrastructure, including pipelines, refineries, and power plants, all of which rely heavily on valves for safe and efficient operations. For instance, the U.S. Energy Information Administration, global energy consumption is projected to increase by nearly 50% by 2050 is driven by industrial activities. Such projections are rising demand for specialized valves in sectors like oil and gas, where pipeline networks span thousands of kilometers. Furthermore, the World Bank notes that urbanization rates in developing nations are accelerating is leading to increased investments in water supply and wastewater management systems.

Stringent Environmental Regulations and Sustainability Initiatives

The stringent environmental regulations aimed at reducing emissions and conserving resources are driving innovation and demand within the valves market. The Environmental Protection Agency states that methane emissions from natural gas systems account for approximately 30% of total U.S. methane emissions, prompting stricter leak detection and repair mandates. High-performance valves are critical in minimizing such leaks, ensuring compliance with regulatory standards. According to the International Renewable Energy Agency, renewable energy capacity additions reached a record 295 gigawatts globally in 2021 with the growing need for valves in solar thermal and hydropower applications. These trends are complemented by the European Environment Agency’s findings that industries adopting energy-efficient technologies can reduce their carbon footprint by up to 20%. The demand for advanced, eco-friendly valves continues to rise by aligning with global decarbonization goals.

MARKET RESTRAINTS

High Costs of Advanced Valve Technologies

The high costs associated with advanced valve technologies pose a significant restraint to market growth for small and medium-sized enterprises. According to the U.S. Department of Commerce, the average cost of industrial valves used in critical applications, such as cryogenic or high-pressure environments, can exceed $50,000 per unit. These expenses are often prohibitive for industries operating on tight budgets in developing regions. According to the International Trade Administration, maintenance and replacement costs for specialized valves account for nearly 15% of total operational expenses in sectors like oil and gas. Such financial burdens limit the adoption of cutting-edge solutions, even when they offer superior performance and efficiency. Furthermore, the World Bank notes that capital expenditure constraints in emerging economies often lead to reliance on outdated valve technologies is hindering progress toward modernization and sustainability goals. This economic barrier increases the need for cost-effective innovations in the valve market.

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages have emerged as critical restraints impacting the valves market. According to the U.S. Bureau of Labor Statistics, global supply chain bottlenecks caused a 20% increase in raw material prices for metal components, such as stainless steel and alloys, during the past two years. These materials are essential for manufacturing durable and corrosion-resistant valves by making production more challenging and expensive. According to the International Monetary Fund, global trade disruptions, exacerbated by geopolitical tensions and the COVID-19 pandemic have led to delays in valve deliveries, with some industries experiencing lead times extending up to six months. According to the Federal Reserve, logistical challenges have increased operational costs for manufacturers by approximately 25%. These factors collectively impede timely project completions and strain industrial operations reliant on valves by creating significant hurdles for market expansion.

MARKET OPPORTUNITIES

Expansion of Smart Valve Technologies in Industrial Automation

The integration of smart valve technologies into industrial automation systems presents a significant growth opportunity for the valves market. According to the U.S. Department of Energy, the adoption of smart valves can enhance energy efficiency by up to 15% in industrial processes in sectors like chemical manufacturing and power generation. These valves, equipped with sensors and IoT capabilities, enable real-time monitoring and predictive maintenance by reducing downtime and operational costs. According to the European Commission, industries leveraging digitalization can achieve up to a 20% reduction in resource wastage. This trend toward Industry 4.0 is driving investments in smart valve technologies by positioning them as a key enabler of sustainable and efficient industrial operations.

Rising Investments in Water and Wastewater Infrastructure

The increased global investments in water and wastewater infrastructure offer another promising opportunity for the valves market. According to the United Nations World Water Development Report, approximately $114 billion annually is required to achieve universal access to safe drinking water and sanitation by 2030. The valves play a critical role in these systems by ensuring efficient flow control and leak prevention. According to the U.S. Environmental Protection Agency, aging water infrastructure in the United States alone necessitates an investment of over $472 billion over the next two decades, with valves being a core component of upgrades and replacements. As per the Asian Development Bank, Asia-Pacific countries are investing heavily in wastewater treatment projects with an estimated $700 billion allocated to such initiatives by 2030. These substantial investments are increasing the demand for durable and high-performance valves in regions facing water scarcity and urbanization challenges.

MARKET CHALLENGES

Fluctuating Raw Material Prices and Economic Uncertainty

The valves market faces significant challenges due to fluctuating raw material prices and broader economic uncertainties. According to the International Monetary Fund, global commodity prices, including those for steel and alloys essential in valve manufacturing that have experienced volatility with price swings of up to 30% in recent years. Such fluctuations increase production costs and create budgetary unpredictability for manufacturers and end-users alike. As per the U.S. Bureau of Economic Analysis, inflation rates in major economies have risen by an average of 6% annually over the past two years, further straining procurement budgets. These economic pressures are compounded by geopolitical tensions, which disrupt supply chains and exacerbate cost inefficiencies. According to the World Trade Organization, trade restrictions and tariffs have added an estimated 10% to the cost of imported raw materials by making it harder for valve manufacturers to maintain competitive pricing while ensuring product quality.

Limited Skilled Workforce for Installation and Maintenance

A shortage of skilled labor for the installation and maintenance of industrial valves presents another critical challenge. As per U.S. Department of Labor, the demand for skilled technicians in the industrial machinery sector will grow by 7% annually through 2030 with the current workforce is insufficient to meet this demand. According to the International Labour Organization, only 35% of workers in technical fields receive adequate training. Furthermore, the European Agency for Safety and Health at Work studies have shown that improper valve installation or maintenance can lead to operational failures by resulting in losses of up to $50 billion annually across industries. The lack of expertise not only delays project timelines but also increases the risk of costly errors with the urgent need for workforce development initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.26% |

|

Segments Covered |

By Type, End-User Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alfa Laval, Velan Inc, Delta Pacific Valves Ltd, GWC Valve International Inc, Cameron International, Goodwin Plc, Camtech Valves, |

SEGMENT ANALYSIS

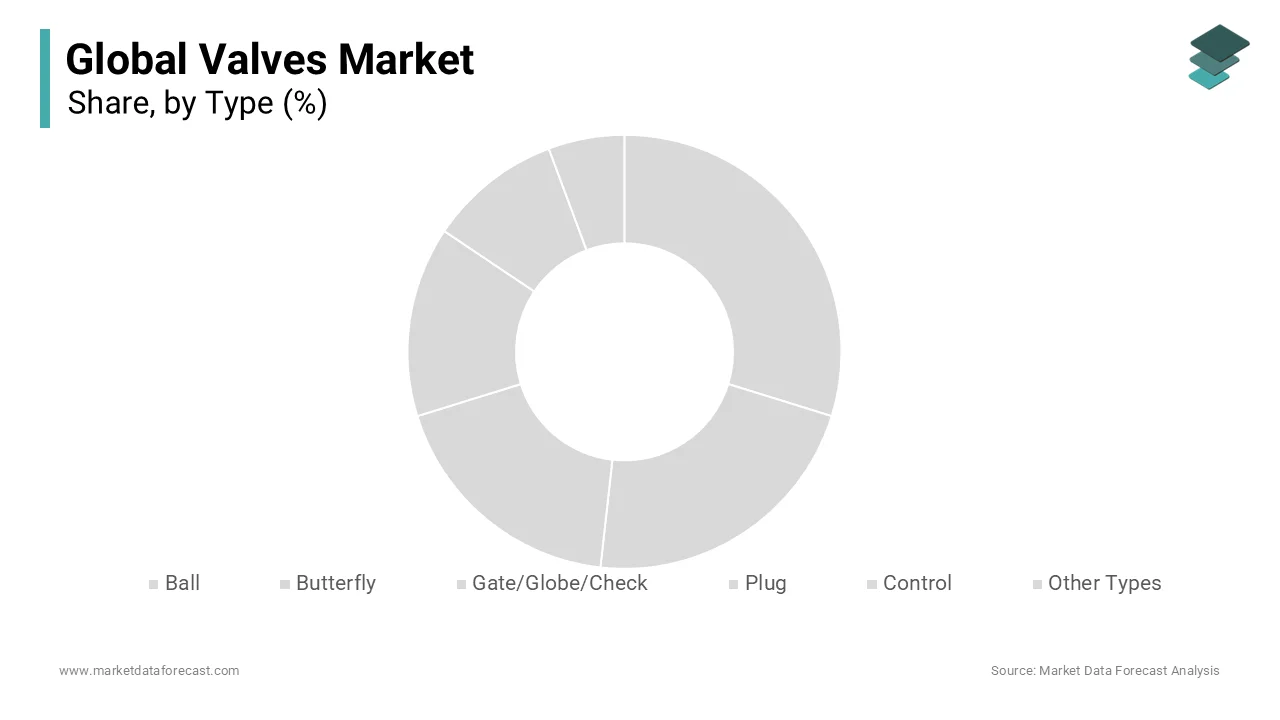

By Type Insights

The ball valves segment dominated the valves market and held 28.1% of share in 2024. Their widespread adoption stems from their versatility, reliability, and ability to provide leak-proof shutoff in high-pressure and high-temperature applications. According to the International Energy Agency, ball valves are extensively used in oil and gas pipelines, which account for nearly 35% of global valve consumption. Their robust design and low maintenance requirements make them indispensable in critical industries. According to the World Bank, urbanization trends have increased demand for water distribution systems that further boosts the ball valve usage.

The control valves segment is likely to experience a fastest CAGR of 7.5% during the forecast period. This rapid growth is driven by the increasing adoption of automation and smart technologies in industrial processes. According to the U.S. Department of Energy, control valves enhance energy efficiency by up to 20% in manufacturing plants by making them vital for sustainability initiatives. According to the European Commission, investments in renewable energy projects, such as solar thermal and hydropower, require precise flow regulation by propelling demand for advanced control valves. These valves enable real-time monitoring and predictive maintenance are reducing operational costs.

By End-User Vertical Insights

The oil and gas sector was the largest by capturing 26.1% of the global valves market share in 2024. This dominance is due to the extensive use of valves in upstream, midstream, and downstream operations, including pipelines, refineries, and offshore platforms. According to the U.S. Energy Information Administration, global oil production reached nearly 100 million barrels per day in 2022 which is driving demand for high-performance valves. The sector relies heavily on specialized valves to manage extreme pressures and temperature due to their role in ensuring operational reliability.

The water and wastewater segment is estimated to register a CAGR of 6.4% from 2025 to 2033. This growth is fueled by increasing investments in water infrastructure, which is driven by urbanization and aging systems. According to the U.S. Environmental Protection Agency, over $472 billion is needed for water infrastructure upgrades in the United States alone by 2030. According to the Asian Development Bank, Asia-Pacific nations are allocating $700 billion to wastewater treatment projects by 2030. Efficient flow control via advanced valves is vital by making this segment pivotal for sustainable development and resource management.

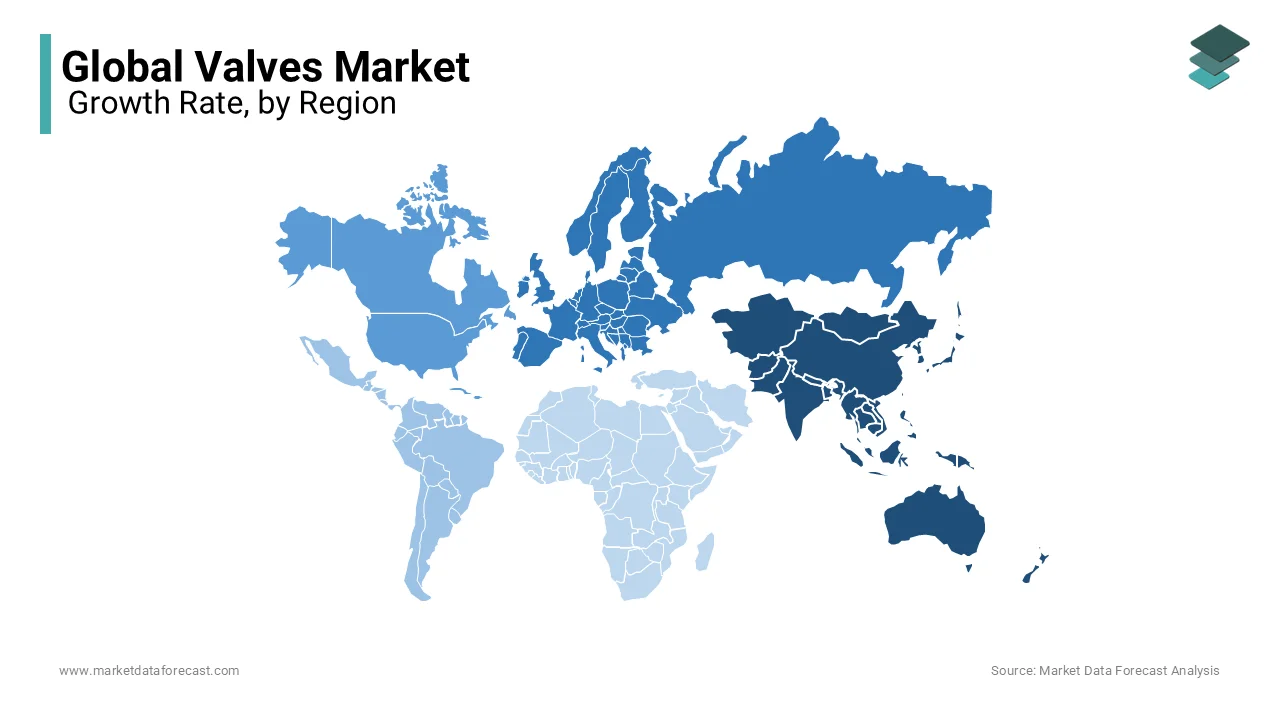

REGIONAL ANALYSIS

The Asia-Pacific dominated the valves market with 35.4% of the global share in 2024, which is driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. According to the Asian Development Bank, the region accounts for over 60% of global energy demand by necessitating extensive valve usage in power generation and oil refineries. Additionally, water scarcity concerns have spurred investments in desalination plants that further boosts the valve demand. Asia-Pacific's prominence in the valves market reflects its role as a global economic engine with manufacturing hubs expanding and government initiatives promoting renewable energy.

Europe valves market is expected to witness a fastest CAGR of 5.9% during the forecast period. This growth is driven by stringent environmental regulations and the continent's commitment to achieving carbon neutrality by 2050. According to the International Energy Agency, Europe is investing heavily in renewable energy projects, including wind and solar power, which require advanced valve systems for thermal and hydraulic applications. As per the European Environment Agency, over €1 trillion is being allocated to modernize aging water and wastewater infrastructure across the region. These initiatives, coupled with the growing adoption of smart valve technologies in industrial automation, position Europe as a leader in sustainable innovation. The emphasis on energy efficiency and green technologies further amplifies the demand for high-performance valves.

North America is deemed to have a steady growth throughput the forecast period. The investments in shale gas extraction and pipeline modernization, as per the U.S. Energy Information Administration is expected to promote the growth of the valves market in North America. Asia-Pacific continues to dominate globally, which is driven by industrial expansion and urbanization, while Latin America shows moderate growth due to mining and agricultural advancements, as per the Inter-American Development Bank. Meanwhile, the Middle East and Africa focus on oil and gas infrastructure and renewable energy projects by ensuring consistent demand for valves. Collectively, these regions reflect diverse growth trajectories shaped by industrial priorities and sustainability goals.

KEY MARKET PLAYERS

The major players in the global valves market include Alfa Laval, Velan Inc, Delta Pacific Valves Ltd, GWC Valve International Inc, Cameron International, Goodwin Plc, Camtech Valves, Pentair Plc., Neway Valve (Suzhou) Co., Ltd, and Valvitalia S.P.A.

TOP 3 PLAYERS IN THE MARKET

Emerson Electric Co. (USA)

Founded in 1890 and headquartered in St. Louis, Missouri, Emerson Electric Co. has established itself as a global leader in technology and engineering. The company's Automation Solutions division offers a comprehensive range of industrial valves, actuators, and regulators, catering to diverse industries such as oil and gas, chemical, power generation, and water management. Emerson's commitment to innovation is evident through its continuous development of advanced valve technologies that enhance process efficiency and safety. For instance, in December 2022, Emerson introduced new technologies for its Crosby J-Series pressure relief valves, aiming to reduce ownership costs and improve performance.

Flowserve Corporation (USA)

Headquartered in Irving, Texas, Flowserve Corporation is a prominent provider of flow control products and services. With a history dating back to 1912, Flowserve offers an extensive portfolio of industrial valves, pumps, and seals, serving industries including oil and gas, power generation, chemical processing, and water treatment. The company's focus on innovation and customer-centric solutions has solidified its position in the market. In February 2023, Flowserve announced the acquisition of Velan Inc., a Montreal-based manufacturer of engineered industrial valves. This strategic move is expected to enhance Flowserve's valve offerings and expand its presence in key markets.

KSB SE & Co. KGaA (Germany)

Established in 1871 and based in Frankenthal, Germany, KSB SE & Co. KGaA is a leading producer of pumps and valves. The company's industrial valve products are integral to sectors such as water and wastewater management, energy, building services, and industrial processes. KSB's dedication to quality and technological advancement has reinforced its reputation in the global market. The company's continuous investment in research and development ensures the delivery of efficient and reliable valve solutions that meet the evolving needs of various industries.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation & Advanced Technology Integration

Technological advancement is a key driver in the valves market, with companies investing heavily in smart valve technologies, automation, and IoT-enabled solutions. Emerson Electric Co. has developed predictive maintenance and real-time performance analytics systems that improve valve reliability and reduce downtime in industrial applications. Similarly, Flowserve Corporation has launched high-performance control valves that enhance energy efficiency, particularly in the oil & gas and power generation industries. These innovations help industries streamline operations, reduce energy costs, and improve safety, making them highly sought-after solutions.

Mergers & Acquisitions (M&A) for Market Expansion

Strategic acquisitions allow valve manufacturers to expand their product portfolios and market reach. In February 2023, Flowserve Corporation acquired Velan Inc., a Montreal-based valve manufacturer specializing in engineered industrial valves, to strengthen its position in the high-performance valve market. Pentair Plc. has also made several acquisitions in recent years, helping it diversify its offerings across multiple industries, including water treatment and chemical processing. Similarly, Cameron International, a subsidiary of Schlumberger, has expanded its footprint in the oil & gas sector through acquisitions, ensuring a broader customer base and enhanced production capabilities.

Geographic Expansion & Global Partnerships

Global expansion is a crucial strategy for valve manufacturers looking to increase market penetration in high-growth regions such as Asia-Pacific, the Middle East, and South America. KSB SE & Co. KGaA has expanded its manufacturing facilities in China and India, responding to rising demand for industrial and municipal valves in these markets. Similarly, Neway Valve (Suzhou) Co., Ltd. has formed distribution partnerships in North America and Europe, ensuring a steady supply of its products to global clients. These expansions help companies reduce production costs, improve supply chain efficiency, and better serve regional customers.

Diversification into High-Growth Sectors

To remain competitive, leading valve manufacturers are expanding their product lines into fast-growing industries such as water treatment, renewable energy, and LNG (liquefied natural gas). Alfa Laval has introduced specialized sanitary valves designed for food & beverage and pharmaceutical industries, ensuring compliance with strict hygiene and safety regulations. Valvitalia S.P.A. has focused on high-pressure valves for LNG applications, capitalizing on the global shift toward cleaner energy sources. By catering to diverse industries, these companies secure new revenue streams and reduce dependence on traditional oil & gas markets.

Sustainability & Eco-Friendly Manufacturing

The growing environmental regulations and industry demand for sustainable solutions is leading valve manufacturers by investing in eco-friendly materials and energy-efficient production processes. Pentair Plc. has developed low-emission valve technologies that help industrial facilities meet stringent environmental standards while reducing operational costs. Similarly, Emerson Electric Co. has designed energy-efficient control valves that minimize energy waste in process industries. These initiatives align with global sustainability goals and improve the long-term viability of industrial valve solutions.

Strategic Partnerships with End-Users

To ensure steady demand and long-term contracts, major valve manufacturers collaborate closely with industries such as oil & gas, power generation, and water treatment. Cameron International has secured multi-year contracts with global oil & gas companies, supplying custom valve solutions for offshore and onshore drilling projects. Velan Inc. has partnered with nuclear power plants to develop nuclear-grade valves capable of withstanding extreme pressure conditions. These partnerships reinforce brand credibility and enable manufacturers to tailor their offerings to specific industry needs.

Focus on Aftermarket Services & Maintenance Solutions

A strong aftermarket service network helps valve manufacturers differentiate themselves in a competitive market. Flowserve Corporation has expanded its aftermarket services division, providing predictive maintenance solutions, on-site repairs, and spare parts management to industrial clients. KSB SE & Co. KGaA offers digital valve monitoring systems that provide real-time diagnostics, reducing the risk of unexpected failures. These services help customers optimize their valve performance, minimize downtime, and extend product lifespan, making them a valuable revenue stream for manufacturers.

COMPETITIVE LANDSCAPE

The global valves market is highly competitive, with numerous manufacturers striving for dominance across industrial, commercial, and residential applications. Key players such as Emerson Electric Co., Flowserve Corporation, KSB SE & Co. KGaA, Alfa Laval, Velan Inc., and Cameron International compete through innovation, strategic acquisitions, and global expansion. The market is characterized by technological advancements, increasing demand for automation, and stringent industry regulations that drive companies to enhance their product portfolios.

Competition is particularly intense in sectors such as oil & gas, water treatment, power generation, chemical processing, and food & beverage industries, where companies focus on delivering high-performance, durable, and energy-efficient valves. The shift toward IoT-enabled smart valves and predictive maintenance solutions has further intensified the competitive landscape, with firms investing heavily in research and development.

Regional manufacturers, especially in Asia-Pacific and the Middle East, are challenging established Western players by offering cost-effective solutions and expanding their presence in emerging economies. Additionally, sustainability concerns and regulatory compliance are shaping competition, as companies focus on low-emission, eco-friendly valve technologies.

RECENT MARKET DEVELOPMENTS

- In February 2023, Flowserve Corporation acquired Velan Inc., a Montreal-based manufacturer of industrial valves. This acquisition is expected to enhance Flowserve's product portfolio and expand its presence in key markets.

- In May 2023, Emerson Electric Co. introduced the ASCO Series 209 proportional flow control valves, designed to offer superior accuracy, pressure ratings, and energy efficiency. This product launch elevates Emerson's commitment to innovation in flow control solutions.

- In August 2023, Rotork plc acquired Hanbay Inc., a company specializing in miniature electric actuators. This acquisition aims to broaden Rotork's product offerings and enhance its capabilities in providing compact flow control solutions.

- In January 2025, Curtiss-Wright Corporation completed the acquisition of Ultra Energy, comprising Ultra Nuclear Limited and Weed Instrument Co., Inc., for $200 million. This acquisition is anticipated to strengthen Curtiss-Wright’s portfolio in the energy sector, particularly in nuclear technologies.

- In February 2025, Vexve finalized the acquisition of Frese A/S, a leading Danish valve manufacturer. This strategic move is expected to bolster Vexve's position in the global valve market by expanding its product range and market reach.

- In February 2025, Lesjöfors Group expanded into the Indian market by acquiring International Industrial Springs (IIS). This acquisition aims to enhance Lesjöfors' global footprint and diversify its product offerings in the industrial sector.

- In February 2025, Altrad completed the purchase of Stork TS Holdings Limited, encompassing the Stork UK group of companies. This transaction is expected to strengthen Altrad's service offerings in the UK industrial market.

- In January 2025, Trelleborg finalized the acquisition of CRC Distribution, a distributor specializing in polymer seals and services for hydraulics and fluid applications. This move aims to enhance Trelleborg's capabilities in providing comprehensive sealing solutions.

- In January 2025, Wabtec Corporation announced a definitive agreement to acquire Evident's Inspection Technologies division, formerly part of Olympus Corporation. This acquisition is expected to enhance Wabtec's offerings in inspection and nondestructive testing technologies.

- In December 2021, ams OSRAM sold Fluence, its horticultural lighting business, to Signify for $272 million. This divestment allowed ams OSRAM to streamline its focus on core technologies while enabling Signify to strengthen its horticultural lighting offerings.

MARKET SEGMENTATION

This research report on the global valves market is segmented and sub-segmented into the following categories.

By Type

- Ball

- Butterfly

- Gate/Globe/Check

- Plug

- Control

- Other Types

By End-User Vertical

- Oil and Gas

- Power Generation

- Chemical

- Water and Wastewater

- Mining

- Other End-User Verticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the demand for industrial valves in the oil and gas industry?

The demand is propelled by extensive applications across upstream, midstream, and downstream operations, alongside significant investments in new oil field exploration and enhanced extraction technologies to meet the growing global demand for oil and gas products.

How is the integration of IIoT and Industry 4.0 technologies influencing the valves market?

The integration enables real-time monitoring and predictive maintenance of valves, reducing unplanned downtime and maintenance costs, thus driving demand for smart valves equipped with sensors and diagnostic capabilities.

How are stringent environmental regulations impacting the valves market?

Increasing industrialization has led to stricter emission and effluent regulations, prompting the development of valves that comply with standards like ISO 15848 to prevent fugitive emissions and ensure environmental safety.

What opportunities exist for valve manufacturers in the LNG sector?

The adoption of custom-engineered valves for large-diameter oil pipelines and the reliance on valves in Floating Production Storage and Offloading (FPSO) operations present growth opportunities in the LNG sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]