U.S. Negative Pressure Wound Therapy (NPWT) Market Size, Share, Trends & Growth Forecast Report By Product Type, Wound Type, End-User and Country, Industry Analysis From 2025 to 2033

U.S. Negative Pressure Wound Therapy Market Size

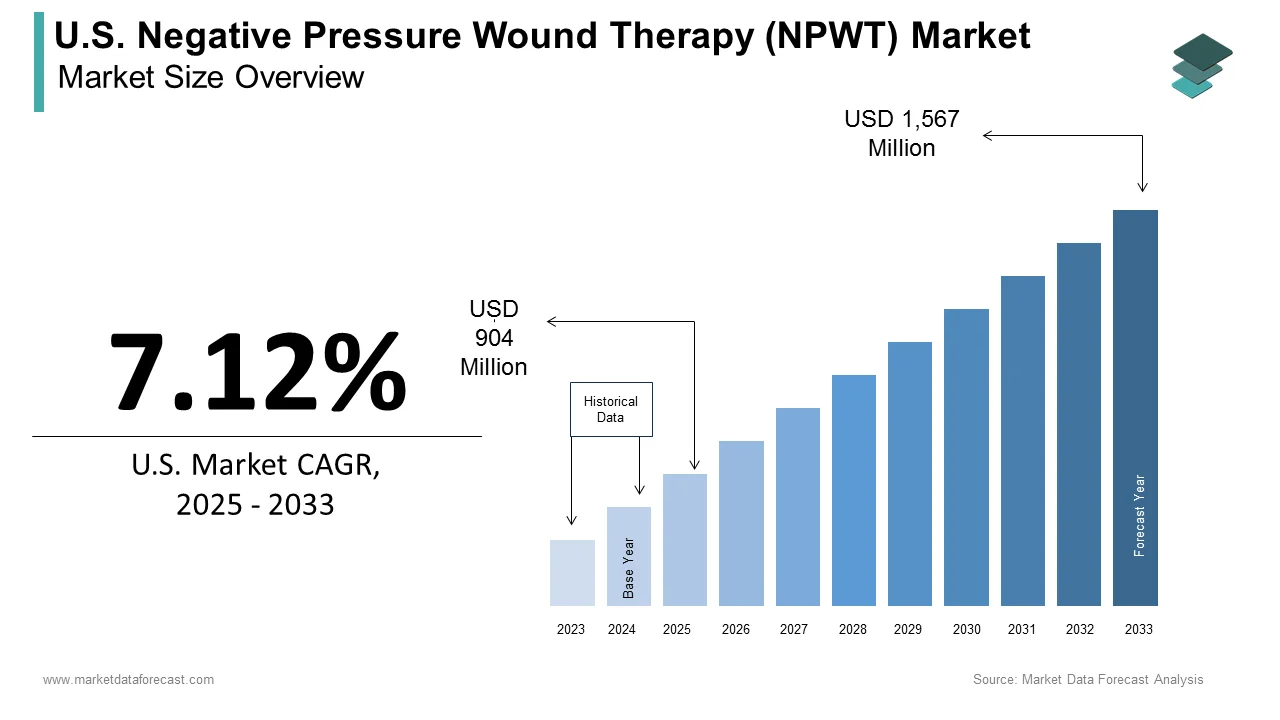

The negative pressure wound therapy (NPWT) market size in the United States was valued at USD 844 million in 2024. The U.S. market size is further estimated to be worth USD 1,567 million by 2033 from USD 904 million in 2025, showcasing a CAGR of 7.12% from 2025 to 2033.

MARKET DRIVERS

The growing number of people diagnosed with diabetes across the U.S. is one of the key factors driving the negative pressure wound therapy market in the U.S. Nearly 15% of the diabetic population suffer from diabetic foot ulcers and chronic wounds. A diabetic foot ulcer is a significant chronic wound in the diabetic patient, which takes a long time to heal. Negative pressure wound therapy (NPWT) can be an effective treatment option for chronic and complex wounds. NPWT is a non-invasive therapy that removes the excess fluid/bad fluid from the wound, which results in wound healing and reduces pain in the wound area.

The growing incidence of surgical wounds further drives growth in the U.S. market. The number of surgical wounds that result from the surgeries is increasing with each year passing. After surgical procedures, people suffer from a wound that requires treatment for a fast cure without any further infection. This surgical-related infection can be treated using negative pressure wound therapy for positive results.

The increasing prevalence of burns and c-section surgeries is anticipated to favor the negative pressure wound therapy market growth in the U.S. Caesarean delivery is a standard surgical procedure among women in the United States; an estimated 30% of births are from cesarean deliveries. However, one-fourth of the women suffer from surgical site infection post-cesarean delivery for various reasons. As a result, prophylactic negative pressure wound therapy is a single-use and battery-powered system approved by the FDA and can be used after cesarean delivery at the surgical site. In addition, the growing aging population is expected to contribute to market growth in the coming days.

MARKET RESTRAINTS

However, the availability of alternative therapies and the high costs associated with the therapies are hampering the market growth. In addition, the lack of skilled professionals, the slow process of regulatory approvals, and complications with negative pressure wound therapy usage are hindering the market’s growth rate.

REGIONAL ANALYSIS

The U.S. market is expected to occupy a significant share of the global negative pressure wound therapy market during the forecast period. The market growth in the U.S. can be attributed to the growing number of people suffering from surgical and traumatic wounds and increased healthcare spending. For instance, an estimated 2% U.S. population is suffering from diabetic ulcers. The negative pressure wound therapy market in the United States is moderately competitive. Therefore, the market participants use strategies such as agreements, collaborations, and new product launches to strengthen their position in the market and outrank the competition. Molnlycke Health Care, ConvaTec Inc., Cardinal Health, Inc., Smith & Nephew plc, and 3M Company are some notable players in the U.S. market.

According to a report published by the National Institute of Health, an estimated 6.5 million people in the United States suffer from chronic wounds that take longer. According to the Centers for Disease Control and Prevention, an estimated 73,000 lower limb amputations are performed on diabetic patients in the United States each year. In addition, the incidence of foot ulcers is rising with the growing number of people diagnosed with diabetes. An estimated 10% of diabetics have a foot ulcer.

KEY MARKET PLAYERS

Companies playing a promising role in the U.S. negative pressure wound therapy market analyzed in this report are Acelity, Smith & Nephew, Mölnlycke Health Care AB, Convatec Group, Cardinal Health, Paul Hartmann AG, Deroyal, Lohmann & Rauscher International, Medela, Genadyne Biotechnologies, Triage Meditech, Talley Group, Alleva Medical, Cork Medical, 4l Health, Carilex Medical, Chongqing Sunshine Medical Industry, and Trading, Wuhan VSD Medical Science & Technology, Pensar Medical, and Haromed BVBA.

MARKET SEGMENTATION

This market research report on the U.S. negative pressure wound therapy market has been segmented and sub-segmented into the following categories.

By Product Type

- Conventional NPWT Devices

- Single-use NPWT Devices

- Accessories

By Wound Type

- Surgical and Traumatic Wounds

- Ulcers

- Pressure Ulcers

- Venous Ulcers

- Diabetic Foot Ulcers

- Other Ulcers

- Burns

By End-User

- Hospitals

- Home Care Settings

- Other End Users

By Country

- The United States

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com