Global Urology Devices Market Size, Share, Trends & Growth Forecast Report By Product, Disease, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Urology Devices Market Size

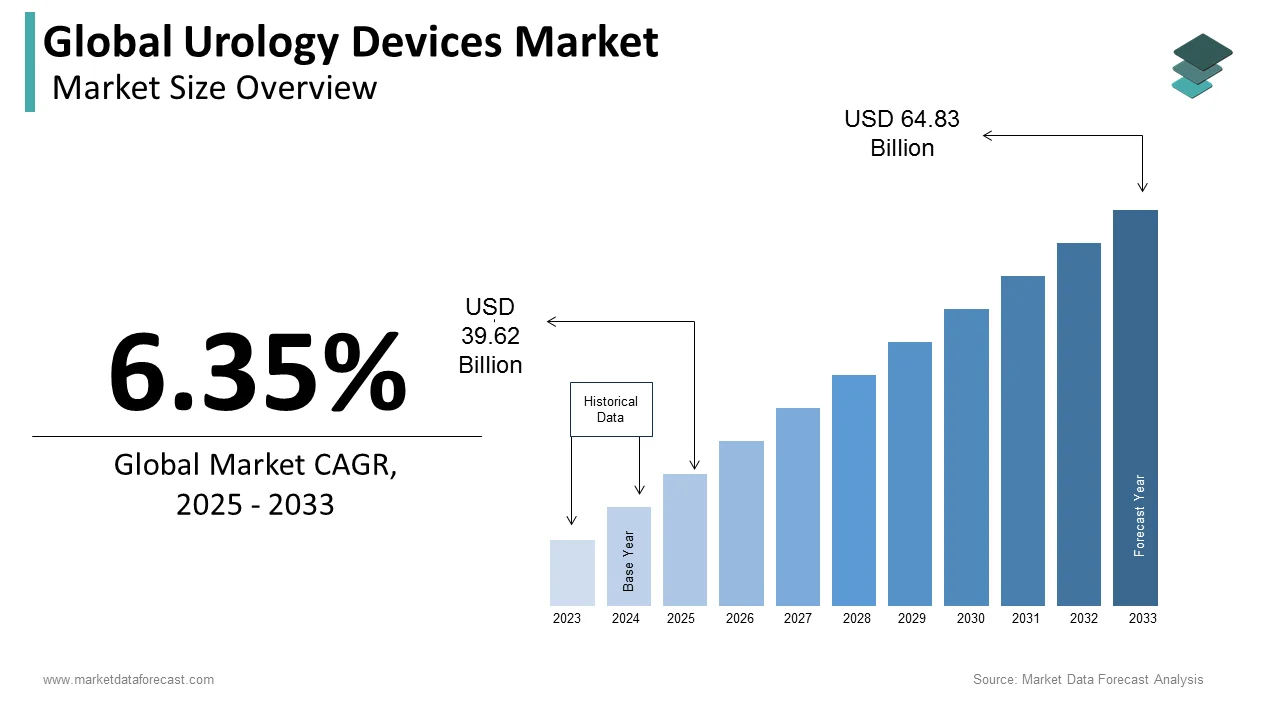

The size of the global urology devices market was worth USD 37.25 billion in 2024. The global market is anticipated to grow at a CAGR of 6.35% from 2025 to 2033 and be worth USD 64.83 billion by 2033 from USD 39.62 billion in 2025.

MARKET DRIVERS

The rising demand from end-users, such as hospitals and clinics, to treat urological disorders is the main driving factor to the growth of the global urology devices market.

The high incidence rates and complications health-related to urological diseases and growing demand from end-users to manage them propel the growth of the urology devices market. The National Kidney Foundation estimated that chronic kidney diseases (CKD) affect approximately 10% of the world's population. The United States Department of Health and Human Services pegs CKD prevalence among the American population at about 14%, with more than 661,000 Americans suffering from kidney failure and 468,000 patients being given dialysis. George Institute for Global Health also estimated that the number of dialysis patients is expected to increase by about 2.5 times in the Latin American and Caribbean regions.

The prevalence of kidney diseases continues to fuel demand for various non-invasive and minimal treatment procedures. In addition, lifestyle habits such as unmanaged obesity and excessive smoking have increased the incidence of various urological disorders among different age groups. The growing health awareness in developing countries like Brazil, Russia, India, China, and South Africa (BRICS) offers growth opportunities for the urology devices market players. In addition, the increasing burden of cancer (prostate & bladder), infrastructure improvements, a less-stringent regulatory environment, and growing medical tourism have prompted the rise of the market in these regions.

Several companies have recently started upgrading their devices to treat Benign prostatic hyperplasia (BPH) by collaboration or acquisition. For instance, in 2018, Boston Scientific Corporation acquired NxThera and its Rezum benign prostatic hyperplasia device, with other players rushing to develop devices in this domain.

MARKET RESTRAINTS

However, factors such as expensive instruments, a high degree of consolidation, and complicated/complex regulatory frameworks for developing and approving new products restrain the growth of the urology devices market. The high cost of urology endoscopes and similar devices is a major factor restraining market growth, particularly in price-sensitive regions such as some countries in Asia. Healthcare providers in developing countries have low financial resources to invest in such expensive technologies. Furthermore, the sluggish replacement of old systems further limits the adoption of advanced endoscopy systems in major markets.

Also, the COVID-19 pandemic has thrown a curveball to the players in this sector due to the increasing rate of COVID-19 infections among dialysis patients, mainly due to contact with infected individuals in hospitals, the only place a patient can go to for their ongoing treatment.

Impact of COVID-19 on the Global Urology Devices Market

The emergence of the global pandemic COVID-19 has disrupted health systems worldwide; healthcare facilities, such as hospitals, have been overcrowded with such patients; as a result, several nations have temporarily postponed elective operations and other medical treatments. This has had a significant influence on urological care and the providers of urological treatment. The increasing number of COVID-19 cases worldwide has overwhelmed many hospitals with critically sick patients.

However, renal disease treatment items for home care have rapidly increased. Similarly, demand for home healthcare is growing since the elderly are at a higher risk of infection and cannot visit a healthcare center. This is expected to boost the growth of the nephrology and urology devices market during the projected period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.35% |

|

Segments Covered |

By Product, Disease, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fresenius Medical Care (Germany), Baxter (US), Boston Scientific (US), Olympus (Japan), Richard Wolf (US), KARL STORZ (Germany), Cook Medical (US), and Medtronic (US), and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the instruments segment is anticipated to account for the largest share of the global urology devices market during the forecast period. The increasing adoption of minimally invasive techniques and evolving research is resulting in the growth of this segment. Catheters, cystoscopy, endoscopes, bladder forceps, kidney and kidney stones forceps, optical stone forceps, urethra forceps, visual cystoscopic instruments, flexible cystoscopic instruments, hohenfellner, prostatectomy instruments, precise spermatic instruments are some of the most common pieces of equipment used as urology devices. Also, the advances in technology for developing novel instruments are other reasons for the projected growth of the instruments segment.

The consumables and accessories segment is also anticipated to hold a significant market share. The most used accessories include a Urodynamic catheter for cystometry, urethral pressure profilometry, and minimally invasive and flexible Endoscopes.

By Disease Insights

Among the mentioned diseases, kidney diseases are calculated to be the fastest growth rate during the forecast period. Early identification is necessary for effective treatment since most kidney diseases like cystic kidney disease, kidney cysts, hemolytic uremic syndrome, chronic kidney disease, and lupus nephritis lead to kidney failures. Technological advancements and the increasing adoption of instruments in diagnosing and treating kidney diseases are the reasons for its rapid growth in the global Urology Devices market.

Due to the rising incidence of urological cancers, it is estimated to have a good share in the urology devices market, under this segment, over the forecast period.

By End-User Insights

Based on End-User, the largest segment in the global market in the forecast period is the hospitals and clinics segment. The growing number of hospitals with better accessibility and availability is the primary factor responsible for this segment's growth.

Dialysis centers are foreseen to dominate the urology devices market. A hospital or stand-alone unit approved and authorized to provide ambulatory dialysis services is called a dialysis center, helping people with end-stage renal disease (IRT) and kidney disease or kidney failure to provide comprehensive care for people.

REGIONAL ANALYSIS

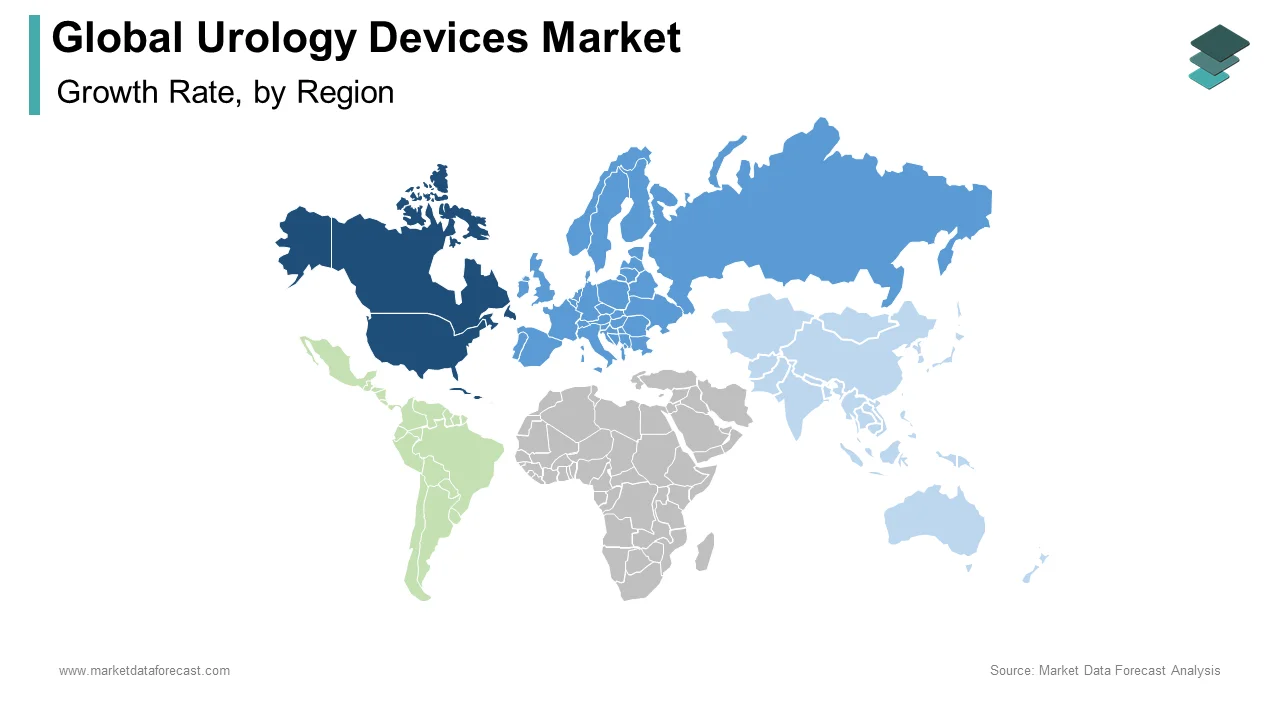

The North American region is the leading global Urology Devices market owing to well-established and proper healthcare facilities and early adoption of technically advanced products. Furthermore, it represents the majority of the market for urology devices due to the high prevalence of urinary tract diseases in the regional population and more focus of US-based companies on improving products in one of the least explored niches in the urology market, Benign prostatic hyperplasia (BPH). These further help in driving the urology devices market.

Europe is projected to show significant growth during the forecast. Many patients suffer from overactive bladder symptoms and stress urinary incontinence. Urinary incontinence in this region is considered more common than hay fever, leading to one in three women. One in 10 men suffering from this problem In the UK is expected to drive the growth of the global urology devices market over the forecast period. Due to the large proportion of urology patients in hospitals, there has been a rise in technological advancements to treat these diseases. Due to the growing incidences and prevalence of urinary disorders in the region and high per capita expenditure on healthcare, the regional market is expected to grow significantly.

Asia is anticipated to show the highest growth during the forecast period, with significant share accounting to countries like India, China, and Japan. It is due to the increasing number of patients and the availability of financial products. Furthermore, increasing funding from the government, increased focus on improving healthcare infrastructure, technological advancements, and public awareness in diagnosing urological problems further drive regional market growth.

In Latin America, the Middle East, and African regions, lifestyle-related diseases like high blood pressure and diabetes due to stress are leading to kidney failure, which is resulting in high demand for home dialysis machines, dialysis equipment, and surgical instruments in hospitals and dialysis centers.

KEY MARKET PARTICIPANTS

Companies such as Fresenius Medical Care (Germany), Baxter (US), Boston Scientific (US), Olympus (Japan), Richard Wolf (US), KARL STORZ (Germany), Cook Medical (US), and Medtronic (US) are the leading shareholders in the global urology devices market.

RECENT MARKET DEVELOPMENTS

- In November 2022, OmniVision and AdaptivEndo collaborated to help doctors by improving the tools they use and, ultimately, by improving patient care, providing the medical industry with unified endoscope consoles for use specifically inside and outside the operating room, using for high-performance image sensors of OmniVision and low-cost AdaptivEndo's clinician-led system.

- In June 2022, Endoluxe entered a multi-year exclusive distribution agreement with Dornier MedTech for urology-focused products with advanced portable technology at 1/6 the cost. In addition, a new picture stabilization function on the Endoluxe Orb helps urologists perform both straightforward and intricate urological treatments.

- Baxter International Inc. collaborated with the International Society of Nephrology in 2018 to address the increasing prevalence of kidney diseases. The agreement has a five-year period and supports access to education and research, cost-effective instruments, and integrated renal care through core awareness building, mainly in low- to middle-income countries. The collaboration mainly focuses on slowing disease progression and diagnosing and treating chronic kidney diseases.

MARKET SEGMENTATION

This market research report on the global urology devices market has been segmented and sub-segmented based on the product, disease, end-user, and region.

By Product

- Instruments

- Consumables & Accessories

By Disease

- Urological Cancer

- Kidney Diseases

- Pelvic organ prolapses

- Other diseases

By End-User

- Dialysis Centres

- Hospitals and clinics

- Other end-users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which are the major players operating in the urology devices market?

Companies such as Fresenius Medical Care (Germany), Baxter (US), Boston Scientific (US), and Olympus (Japan) are the major players in the urology devices market.

How big is the global urology devices market size?

As per our research report, the global urology devices market is estimated to be worth USD 64.83 billion by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]