Global Urea Market Size, Share, Trends & Growth Forecast Report – Segmented By Grade (Fertilizer, Feed, Technical), Application (Chemical, Agriculture, Automotive, Medical), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2024 to 2032)

Global Urea Market Size (2024 to 2032)

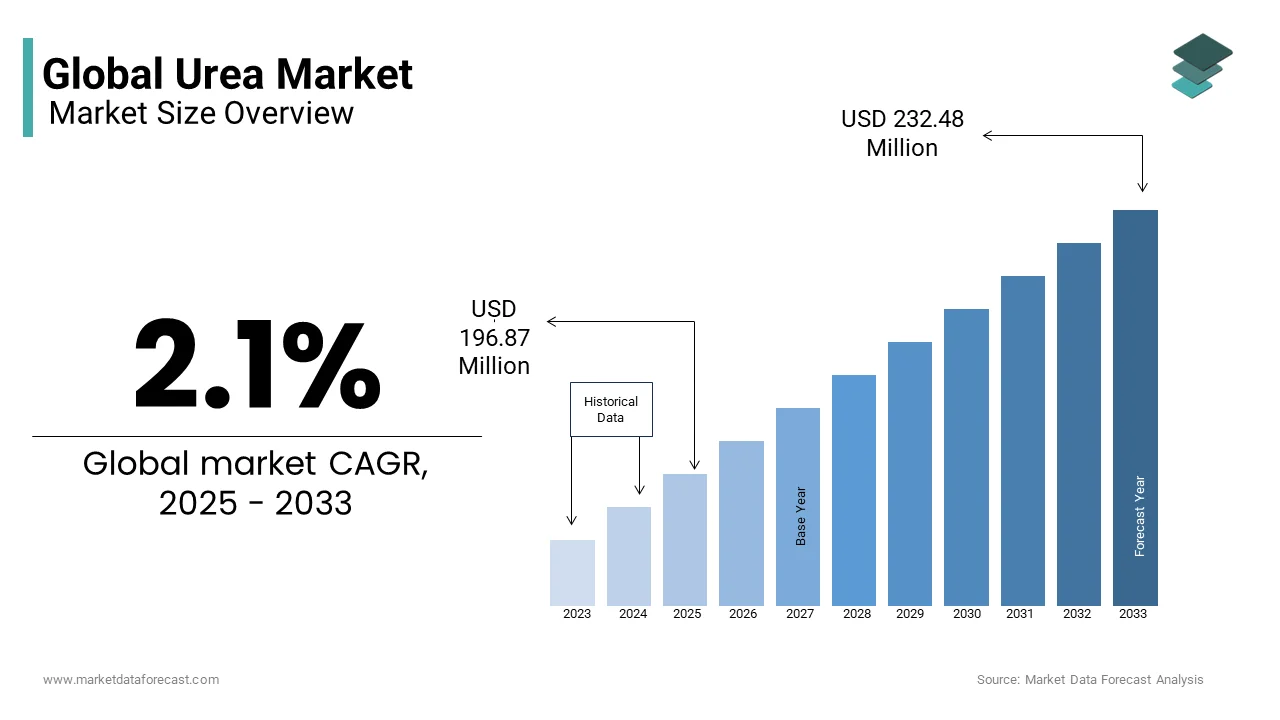

The global urea market was valued at USD 188.85 billion in 2023 and is anticipated to reach USD 192.82 million in 2024 from USD 227.69 million by 2032, growing at a CAGR of 2.1%from 2024 to 2032.

CURRENT SCENARIO OF THE GLOBAL UREA MARKET

According to science, Urea is a valuable source of nitrogen, and it is utilized chiefly in nitrogen-based fertilizers due to its high nitrogen content. Increased demand for Urea as fertilizer from the agriculture industry is likely to drive market growth in the short term. It's also used in modest amounts in multi-component solid fertilizer foliar sprays. Urea is transformed into ammonium bicarbonate when it comes into touch with the soil. To prevent the gas generated by ammonium, Urea is combined with the soil. The health risks associated with Urea are anticipated to stifle market growth. The discovery of urea applications in the preparation of bio-bricks is expected to open up new business prospects in the following years.

MARKET DRIVERS

The increased usage of fertilizers worldwide to boost per hectare production capacity of the land to meet the rising demand for food and other agricultural-based products is driving up demand for Urea. Due to the significant output of agricultural-based products in these nations, the fastest-growing markets include India, Brazil, Indonesia, and Mexico, rising at a robust CAGR.

Due to its large population and manufacturer-friendly government restrictions, China is one of the most attractive markets for manufacturers.

Urea is a nitrogenous chemical with the molecular formula NH2CONH2. It has two amine groups connected to a carbonyl group. With a nitrogen content of roughly 46%, it is employed in prilled and granular forms in the agricultural business. The utilization of Urea primarily in both selective non-catalytic reduction (SNCR) and selective catalytic reduction (SCR) procedures, intended to limit the emission of toxic gases from automotive engines, is driving up demand for industrial-grade Urea. The agriculture industry has experienced a tremendous expansion in recent years, and this trend is projected to continue in the years ahead. It is primarily due to the growing demand for food and other agricultural goods due to global population growth. Urea, primarily known as carbamide, is an organic compound commonly used in fertilizer, feed supplements, and as a raw material to prepare plastics and drugs. It's a colorless crystalline product with high nitrogen content, making it one of the market's most highly concentrated nitrogenous fertilizers.

The overall urea market trends are being fueled by increased awareness of the utilization of Urea in beauty products for its exfoliating and moisturizing properties, the rapid adoption of urea fertilizers to reduce pollution, and the widespread use of the product for the treatment of nail diseases.

MARKET RESTRAINTS

Manufacturers have long struggled to comply with various environmental laws imposed on the use of solid Urea due to the emission of gaseous ammonia, which can be hazardous to the environment and human health. Only after 4-5 days of transformation at room temperature may Urea be used. In the ammoniation process, the majority of the nitrogen is easily volatilized. In most cases, the real utilization rate is only around 30%. When Urea is applied to alkaline soil or soil with a high organic matter concentration, nitrogen loss is accelerated and increased.

Furthermore, weeds readily eat Urea. Because urea has a high nitrogen content, it should not be used in excess to avoid waste and fertilizer damage. Unfortunately, many farmers in fruit-producing areas use a lot of Urea, which kills trees and has catastrophic implications. Whenever Urea is utilized as a top dressing, we must know how it decomposes in the soil. To provide a fertilizer effect, Urea must be transformed into ammonia nitrogen about seven days after application. Most nitrogen will convert to ammonia gas and volatilize in alkaline circumstances. As a result, Urea cannot be blended or applied with other essential fertilizers such as lime, plant ash, calcium magnesium phosphate, and others.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

2.1% |

|

Segments Covered |

By Grade, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Acron, BASF SE, CF Industries Holdings Inc., China National Petroleum Corporation, EuroChem Group, Industries Qatar, Koch Fertilizer LLC, Notore Chemical Industries PLC, Nutrien Ltd, OCI NV. |

SEGMENTAL ANALYSIS

Global Urea Market By Grade

Based on grade, the technical segment tends to dominate the global urea market. The nitrogen content of technical grade urea must be at least 46% by weight (on a dry basis). Furthermore, as the global automobile fleet grows, the usage of selective catalytic reduction (SCR) technology is expected to rise, increasing technical grade urea use over the forecast period.

Urea-formaldehyde resins, adhesives, plywood, animal feed, and cloud-seeding agents require technical-grade urea.

Global Urea Market By Application

Based on application, the agriculture sector is expected to hold the highest global urea market share. The agriculture industry has experienced a tremendous expansion in recent years, and this trend is projected to continue in the years ahead. It is primarily due to the growing demand for food and other agricultural goods due to global population growth. Because of its high nitrogen concentration, Urea is the most effective nitrogenous fertilizer (46 percent N). Therefore, it is utilized as a cow feed supplement to replace some protein requirements and applications in crops.

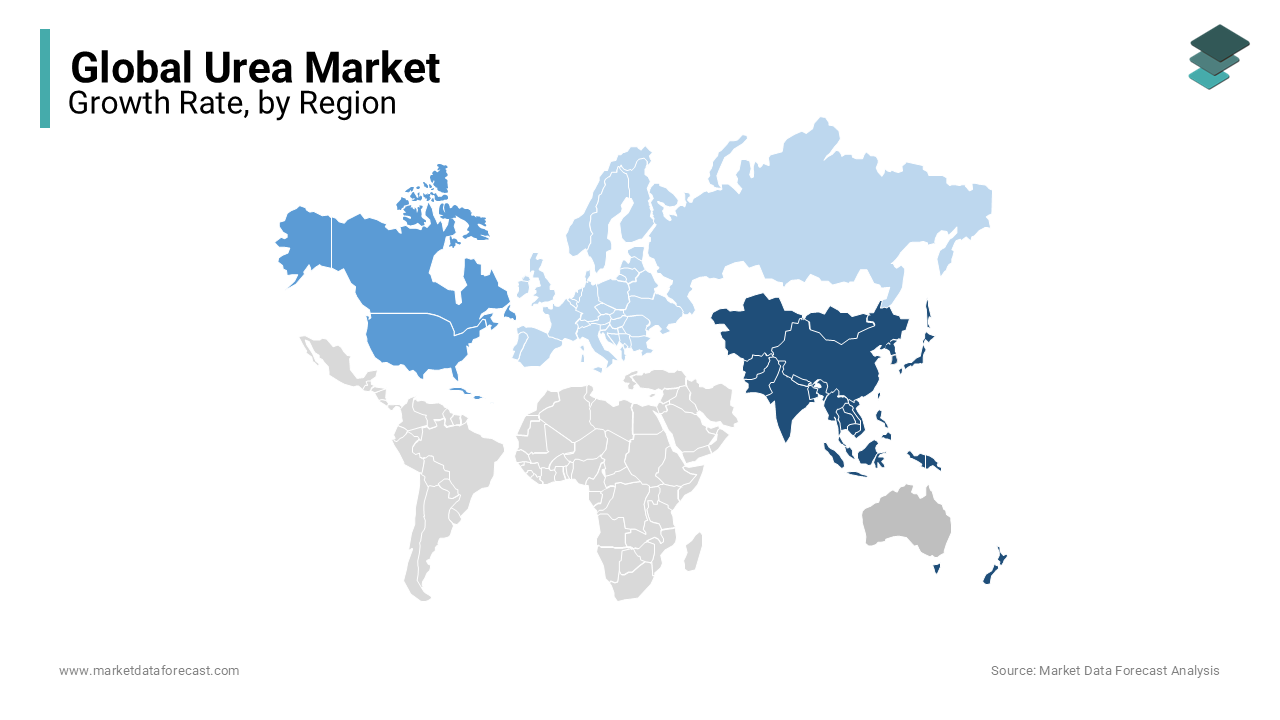

REGIONAL ANALYSIS

The Asia Pacific has the largest global urea market share. China is declared one of the leading producers of urea-formaldehyde resin across the world. Urea-formaldehyde resins are utilized as adhesives to bond plywood, particleboard, and other wood products in the construction sector. Moreover, developments in the agriculture industries are taking place in nations like India and China as the population grows. As a result, the demand for nitrogen fertilizers rises, propelling the market forward.

North America is likely to boost production, reducing the region's need for imports. Several projects have been suggested to increase capacity and, as a result, supply in the area. As a result, North American demand for the product is growing faster than the worldwide market. The growing demand can also be ascribed to the region's improving economy.

Europe is anticipated to hold a significant global urea market share. The increasing demand for the agriculture sector in the U.K. drives the market forward in the European region.

KEY PLAYERS IN THE GLOBAL UREA MARKET

Acron, BASF SE, CF Industries Holdings Inc., China National Petroleum Corporation, EuroChem Group, Industries Qatar, Koch Fertilizer LLC, Notore Chemical Industries PLC, Nutrien Ltd, OCI NV. These are some of the market players dominating the global urea market.

DETAILED SEGMENTATION OF THE GLOBAL UREA MARKET INCLUDED IN THIS REPORT

This research report on the global urea market is segmented and sub-segmented based on the By Grade, Application, and Region.

By Grade

- Fertilizer

- Feed

- Technical

By Application

- Chemical

- Agriculture

- Automotive

- Medical

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]