Global Urban Air Mobility Market Size, Share, Trends, & Growth Forecast Report – Segmented By Solution (Infrastructures, & Platforms), Mobility Type (Air Taxis, Air Shuttles and & Air Metros, Personal Air Vehicles, Cargo Air Vehicles, and Air Ambulances & Medical Emergency Vehicles), Range (Intercity (> 100 km), and Intracity (< 100 km)), Platform Operation (Piloted, and Autonomous(Remotely Piloted, Fully Autonomous)), Platform Architecture(Rotary-wing, Fixed-wing Hybrid, and Fixed-wing ), End User(Ridesharing Companies, Scheduled Operators, E-commerce Companies, Hospitals & Medical Agencies, and Private Operators), & Region - Industry Forecast From 2024 to 2032

Global Urban Air Mobility Market Size (2024 to 2032)

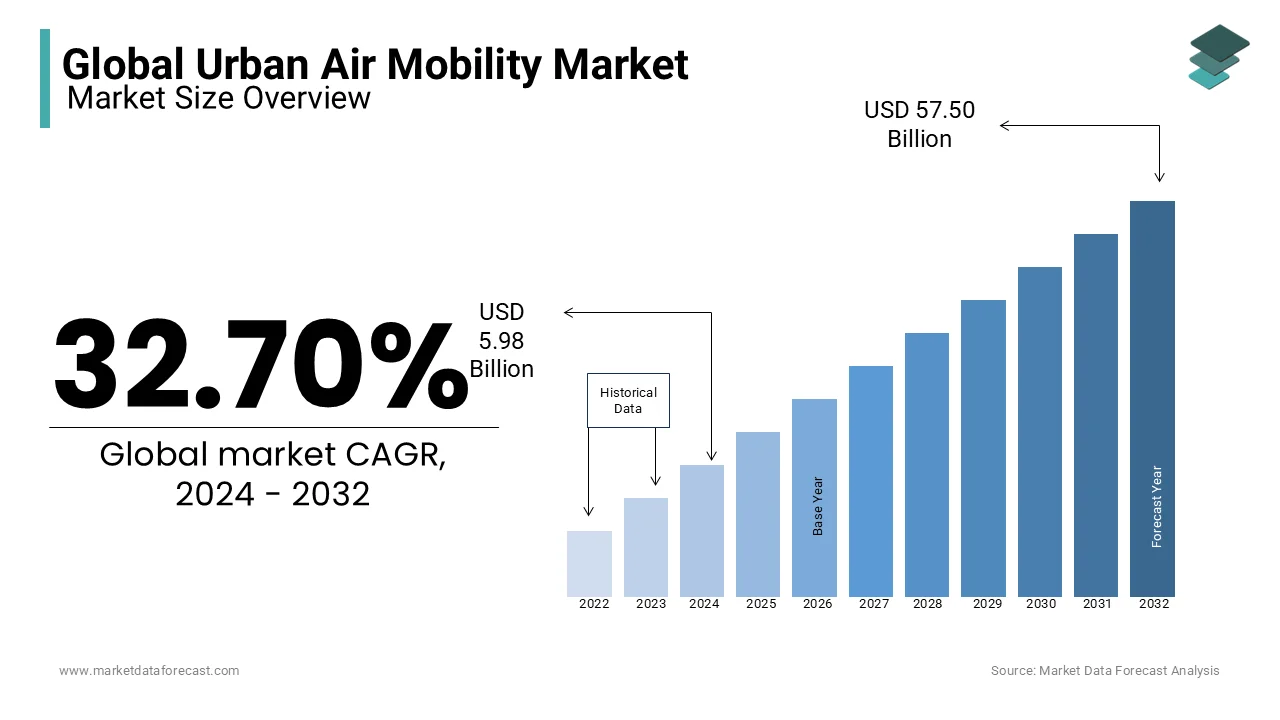

The global urban air mobility market was worth USD 4.51 billion in 2023. The global market is predicted to reach USD 5.98 billion in 2024 and is estimated to reach USD 57.50 billion by 2032, with an estimated CAGR of 32.70% during the forecast period.

MARKET DRIVERS

Increasing urban population and rising prominence to reduce the traffic congestion in the cities are escalating the growth rate of the market.

With the rising population, traffic congestion is becoming worse in urban areas, where the need to adopt urban air mobility is becoming popular. Urban air mobility demand is increasing at a higher rate from both businesses and individuals for faster and more efficient ways to transport goods and services. The increasing demand for ground-based alternatives like aerial transportation to reduce travel time is increasing day to day. In metropolitan cities, traffic congestion causes severe losses for companies as productivity is reduced proportionally. Also, when people are caught in traffic, the fuel gets wasted, which is becoming a concern with the rising crisis around the world.

Focus on the development of new intelligent aerial vehicles using advanced technologies for mobility is likely to fuel the urban air mobility market. Wisk, one of the most advanced air mobility companies in the world, secured USD 450 million from Boeing Company for its 6th generation eVTOL aircraft, the first to get certified as autonomous. It is an electric aircraft that can accommodate passengers and can be a self-flying air taxi in the US if it receives FAA certification. The eVTOL is manufactured with several advanced features that enable it to operate in urban areas without the need for specialized infrastructure. The eVTOL is an alternative to traditional ground-based transportation that is efficient and reliable in routing and scheduling.

The UAM will become a means of transport in the coming years with the increasing demand for eco-friendly transportation. It is estimated that 60% of the world’s population will live in urban areas by 2029, which amplifies the need to reduce carbon emissions and adopt new mobility solutions. Major companies are focusing on the development of commercial urban air services that are anticipated to propel the market share.

The launch of electric vertical takeoff and landing aircraft is one of the key opportunities for the market to grow eventually in the foreseen period.

These aircraft impose significant opportunities to adopt sustainable development in urban transportation. Also, stringent government regulations to lower carbon emissions by reducing the use of fossil fuels and increasing prominence for electrical-powered vehicles are enhancing the growth rate of the UAM market. Increasing R&D activities and growing investments in the development of aerial vehicles are accounted for in prompting the market value. Hyundai and Uber made an agreement to launch Uber air taxis by the end of 2030. Urban mobility will rely on air taxis in the future, and this partnership will enhance urban air mobility.

MARKET RESTRAINTS

The high cost of the UAM for installation and maintenance is restricting the market growth rate. In addition, the difficulty in getting certifications from government organizations is impeding the market share. Lack of complete knowledge of the innovative features of the traditional aviation process of certification is also a factor that is hampering the growth rate of the urban air mobility market. The need to establish new standards and procedures is increasing day by day, which promotes the rigorous testing, evaluation, and validation of newly launched aerial vehicles. These new standards and protocols will elevate the production rate of aerial vehicles in the coming years.

MARKET CHALLENGES

The lack of skilled people to operate urban air mobility as it is featured with highly technological developments is inhibiting the growth rate of the urban air mobility market. Urban air mobility devices need high-quality support from people with high knowledge in various technological fields. Hence, finding skilled personnel in the military forces is a big challenge for the key players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

32.70% |

|

Segments Covered |

By Solution, Mobility Type, Range, Platform Operation, Platform Architecture, End User, & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Pipistrel Group, EHang, Lilium, Workhorse Group Inc., Kitty Hawk, Volocopter GmbH, Neva Aerospace, Airbus, The Boeing Company, Opener |

SEGMENTAL ANALYSIS

Global Urban Air Mobility Market Analysis By Solution

The infrastructure segment is leading with the dominant share of the market with the rising need to adopt various technological developments in developed and developing countries. Investments from the government authorities to improve the infrastructure, along with the traffic management regulations, are escalating the growth rate of this segment.

Global Urban Air Mobility Market Analysis By Mobility Type

Air ambulances & medical emergency vehicles are gaining traction over the market share. Traffic congestion in urban areas is becoming a concern, and the demand to adopt air ambulances has been growing at a higher rate in the past few years. The air taxi segment is likely to have the strongest growth opportunities in the coming years as key players are focusing on adopting new technologies.

Global Urban Air Mobility Market Analysis By Range

Intercity(>100 Km) segment is likely to hit the highest CAGR during the forecast period. Increasing disposable income and growing expenditure on luxury things are ascribed to bolster the growth rate of the market. Intracity (<100 km) is expected to have significant growth opportunities in the near future.

Global Urban Air Mobility Market Analysis By Platform Operation

The pilot segment is greatly inclined to have a positive growth rate during the foreseen period, whereas the autonomous segment is expected to have significant growth opportunities. Increasing prominence for convenient and efficient transportation techniques is likely to leverage the segment’s growth.

Global Urban Air Mobility Market Analysis By Platform Architecture

The rotary wing segment is leading with the dominant share of the market. Rotary wings play a major role in providing stability while taking off and landing vertically. Growing prominence for eVTOL is enhancing the demand for rotary wings. It also provides safety for the passenger to enable a smooth travel experience. Thus, the growth rate of the rotary wing segment is increasing enormously.

Global Urban Air Mobility Market Analysis By End User

The scheduled operators segment has the prominent growth rate in the market, whereas the hospitals & medical agencies segment is likely to have a prominent growth rate throughout the forecast period.

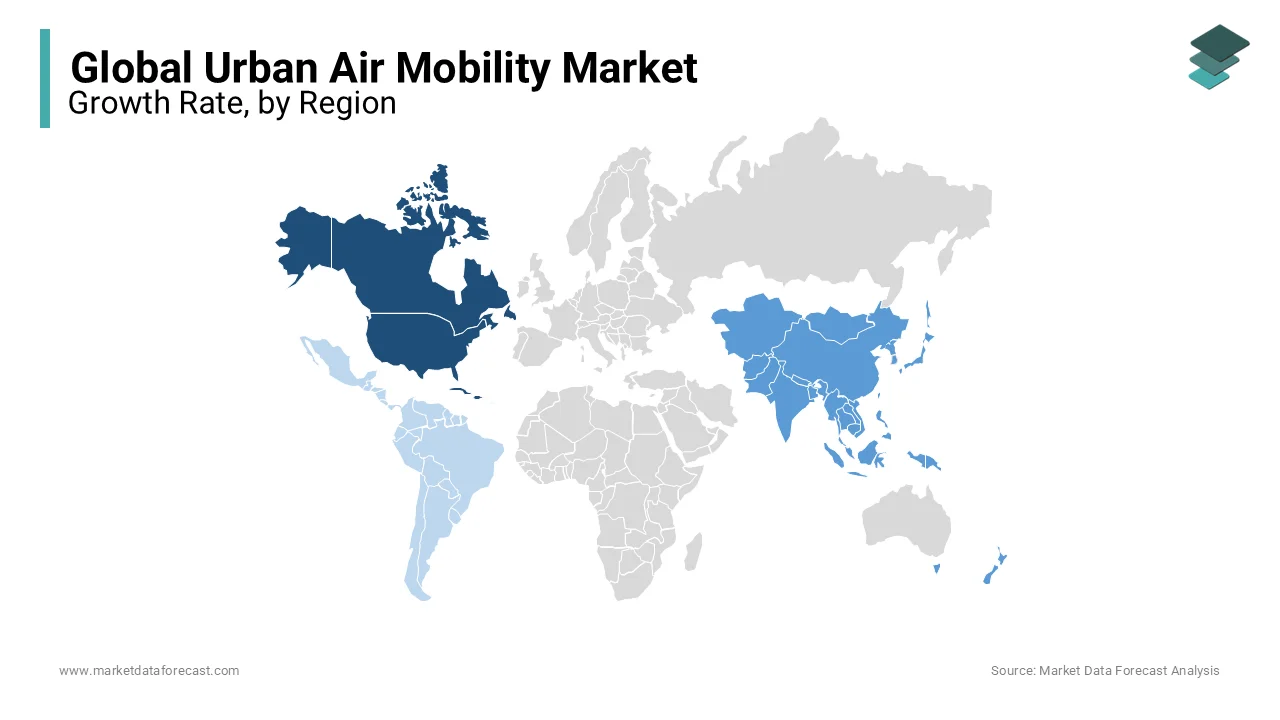

REGIONAL ANALYSIS

North America is leading with the largest share of the urban air mobility market. The US is a highly developed country with an increasing urban population every year. Traffic congestion is a major concern for the people in the US. On average, an American commuter will waste time and fuel, which costs around $1377 per year. In addition, Americans waste 8 billion hours every year only due to traffic congestion. These statistics imply that urban air mobility is at a faster rate. The rapid adoption of innovative technological advancements is amplifying the growth rate of the market in the US, as UAM can reduce traffic congestion and is a better way to commute in small electric aircraft.

Asia Pacific is next in holding a prominent share of the market. The increasing population in urban areas is a major factor that has caused the market to grow enormously in this region. China has been leading with the highest market share in the past few years. China is a topmost country in adopting highly advanced technology, especially in launching unmanned aerial vehicles. This country planned to accelerate the applications of drones and increase air mobility in urban areas. Advanced technologies are replacing traditional means of transportation.

Europe is deemed to have the highest CAGR throughout the forecast period with the rising per capita income. The Civil Aviation Authority’s future air mobility regulatory sandbox was organized in the UK to meet sustainable transportation needs. The organization is working closely with top companies to bring a clean, safe, and practicable electric air taxi ecosystem.

Latin America and the Middle East & Africa are set to have huge growth opportunities in the foreseen years.

KEY MARKET PLAYERS

Pipistrel Group, EHang, Lilium, Workhorse Group Inc., Kitty Hawk, Volocopter GmbH, Neva Aerospace, Airbus, The Boeing Company, Opener

RECENT HAPPENINGS IN THE MARKET

-

On May 30, 2023, CityAirBus NextGen was developed by Airbus SE, which is a realistic idea to promote efficient air transport, especially in urban areas. This will be an alternative to the existing means of transportation with the advanced technology that can be moved into the sky to reach their destination in less time.

-

On January 02, 2024, Ehang, a global leader in urban air mobility, successfully completed the demonstration of EHang’s EH216-s passenger aerial vehicle in China. This demonstration is paving the way to integrate air mobility in urban areas. This vehicle is a pilotless passenger-carrying vehicle that has received certification from the Civil Aviation Administration of China (CAAC).

DETAILED SEGMENTATION OF THE GLOBAL URBAN AIR MOBILITY MARKET INCLUDED IN THIS REPORT

This research report on the global urban air mobility market has been segmented and sub-segmented based on the solution, mobility type, range, platform operation, platform architecture, end user, and region.

By Solution

-

Infrastructures

-

Charging Stations

-

Vertiports

-

Air Traffic Management Facilities

-

Maintenance Facilities

-

Platforms

-

Aerostructures

-

Avionics

-

Electrical Systems

-

Propulsion Systems

-

Software

By Mobility Type

-

Air Taxis

-

Air Shuttles and & Air Metros

-

Personal Air Vehicles

-

Cargo Air Vehicles

-

Air Ambulances & Medical Emergency Vehicles

By Range

-

Intercity (> 100 km)

-

Intracity (< 100 km)

By Platform Operation

-

Piloted

-

Autonomous

-

Remotely Piloted

-

Fully Autonomous

By Platform Architecture

- Rotary-wing

- Fixed-wing Hybrid

- Fixed-wing

By End User

- Ridesharing Companies

- Scheduled Operators

- E-commerce Companies

- Hospitals & Medical Agencies

- Private Operators

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of the UAM market globally?

Key drivers include technological advancements in aviation and battery technology, increasing urbanization, rising demand for efficient transportation alternatives, supportive government regulations, and significant investments from major aerospace companies and startups.

What are the primary challenges facing the UAM market?

Primary challenges include regulatory and safety concerns, public acceptance, technological hurdles such as battery life and noise reduction, air traffic management integration, and the need for substantial infrastructure investments.

What are the potential applications of UAM beyond passenger transport?

Beyond passenger transport, UAM applications include cargo delivery, medical transport (such as organ or emergency supply delivery), aerial surveying and mapping, infrastructure inspection, and even emergency response and disaster relief operations.

How is public perception influencing the development of the UAM market?

Public perception plays a critical role in the development of the UAM market. Concerns about safety, noise, privacy, and the visual impact of frequent low-altitude flights must be addressed. Public acceptance can be fostered through transparent communication, demonstration projects, and incremental integration of UAM services into daily life.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]