U.S. Spices Market Size, Share, Trends & Growth Forecast Report By Product (Whole Spices, Ground Spices, Spice Blends, And Herbs), Application, Distribution Channel, and Country, Industry Analysis From 2025 to 2033

U.S. Spices Market Size

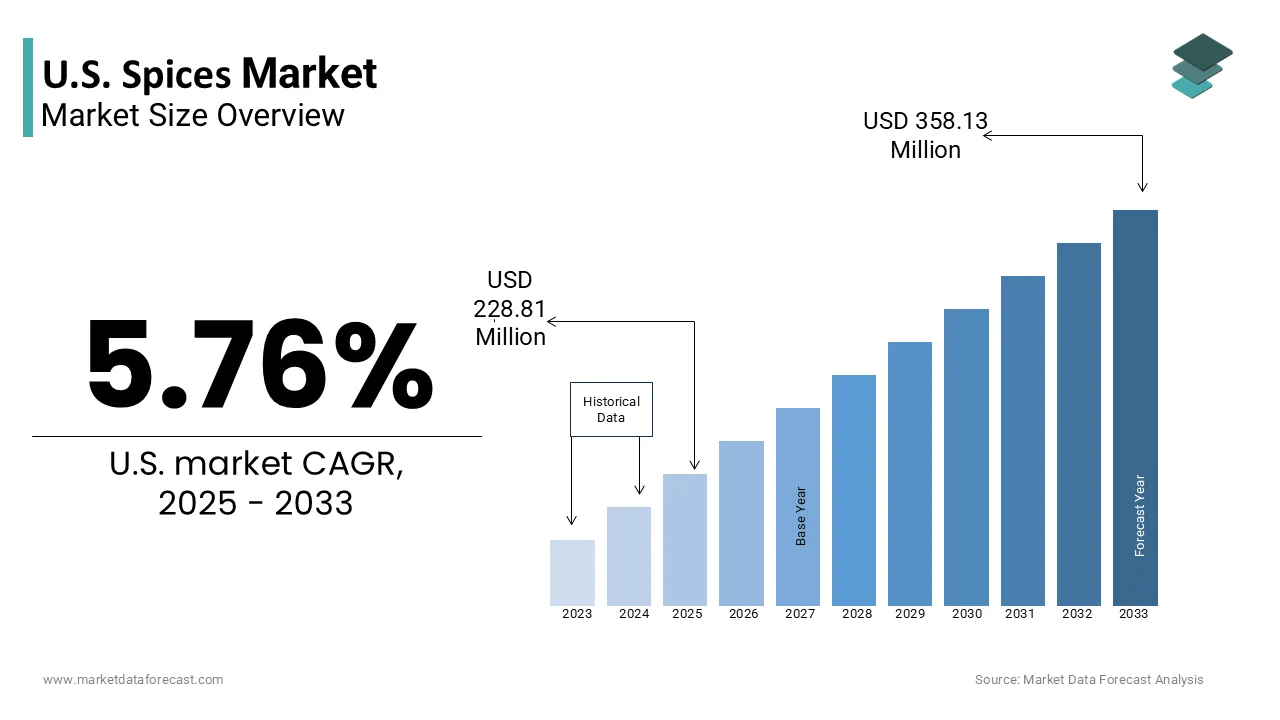

The U.S. Spices market was worth USD 216.35 million in 2024. The U.S. Spices market is estimated to grow at a CAGR of 5.76% from 2025 to 2033 and be valued at USD 358.13 million by the end of 2033 from USD 228.81 million in 2025.

The U.S. spices market has been experiencing steady growth over the last few years due to evolving consumer preferences, culinary innovations, and an increasing focus on health-conscious living. The growing popularity of ethnic cuisines, the resurgence of home cooking post-pandemic, and the integration of spices into functional foods and supplements are anticipated to continue to drive the spices market growth in the U.S. over the forecast period. For instance, turmeric has gained immense popularity due to its anti-inflammatory properties, with imports into the U.S. increasing by 12% in 2022 alone, as noted by the USDA. Similarly, spices like cumin, coriander, and cardamom are now staples in American kitchens, reflecting the nation’s growing appetite for bold and exotic flavors.

Supermarkets and hypermarkets remain the dominant distribution channels, accounting for the largest share of total sales of spices in the U.S., according to data from the Food Marketing Institute. However, online retail is rapidly gaining ground, with e-commerce platforms reporting a 20% year-over-year increase in spice purchases. Consumers are increasingly prioritizing organic and sustainably sourced spices, creating opportunities for brands to innovate and cater to these demands. The proliferation of subscription-based models, curated spice blends, and direct-to-consumer offerings further underscores the dynamic nature of this market. Additionally, the rise of meal kit services and food delivery apps has amplified spice consumption, as these platforms often feature dishes that rely heavily on spice-heavy seasoning profiles.

MARKET DRIVERS

Growing Demand for Ethnic Cuisines in the U.S.

The increasing popularity of ethnic cuisines is one of the most significant drivers propelling the U.S. spices market forward. According to the National Restaurant Association, 66% of Americans are more inclined toward trying international dishes than they were a decade ago. This shift has led to a surge in demand for spices that are integral to global cuisines, such as Indian, Thai, Middle Eastern, and Mexican. For example, curry powder, garam masala, and za’atar have become household staples, with Mintel reporting an 18% increase in curry powder sales between 2020 and 2022. The rise of fast-casual dining chains specializing in ethnic cuisines, such as Chipotle, Panda Express, and Taco Bell, has further amplified this trend. These establishments rely heavily on spices to create signature dishes that appeal to adventurous palates. Food delivery apps and meal kit services have also played a pivotal role in driving spice consumption. Grubhub, for instance, reported a 25% increase in orders featuring spice-heavy dishes in 2022. Millennials and Gen Z consumers, who constitute a significant portion of the market, are particularly drawn to bold and exotic flavors. Social media platforms like TikTok and Instagram have further popularized fusion recipes and global cuisines, encouraging home cooks to experiment with spices. Brands like McCormick and Simply Organic have capitalized on this trend by launching innovative spice blends tailored to trending cuisines, achieving double-digit revenue growth in recent years.

Health and Wellness Trends

The rising emphasis on health and wellness that has positioned spices as functional ingredients in both food and dietary supplements is another major factor propelling the growth of the U.S. spices market. Turmeric, known for its anti-inflammatory and antioxidant properties, has emerged as a star player in this space. Retail sales of turmeric supplements reached $328 million in 2022, according to Nutrition Business Journal. Similarly, cinnamon and ginger are widely consumed for their digestive and immune-boosting benefits, making them popular choices among health-conscious consumers. A survey conducted by the International Food Information Council found that 70% of consumers actively seek foods with added health benefits, creating a lucrative opportunity for spice manufacturers. Retailers like Whole Foods Market have expanded their organic spice offerings, witnessing a 30% increase in sales within this category over the past two years. The clean-label movement has also encouraged the use of natural spices as alternatives to artificial flavorings, further boosting demand. Brands like Spiceology and Frontier Co-op have responded by launching lines of organic and sustainably sourced spices, appealing to eco-conscious consumers. The integration of spices into plant-based and functional foods, such as energy bars, beverages, and supplements, has opened new avenues for innovation and growth.

MARKET RESTRAINTS

Supply Chain Disruptions

Supply chain disruptions are one of the significant challenges to the U.S. spices market, exacerbated by geopolitical tensions, climate-related events, and logistical bottlenecks. According to the USDA, extreme weather conditions in key spice-producing regions like India, Indonesia, and Madagascar resulted in a 15% decline in global spice exports in 2022. For instance, prolonged droughts in Madagascar led to a 25% reduction in vanilla production, driving prices up by 50%. Similarly, erratic rainfall and hurricanes in Southeast Asia disrupted the supply of black pepper, cloves, and nutmeg, causing wholesale costs to spike by 22% during the same period. Logistical challenges, such as port congestion and labor shortages, have further compounded the issue. The Port of Los Angeles reported a 40% delay in container shipments during the first half of 2023, severely impacting inventory levels for major retailers and distributors. These disruptions not only strain profit margins but also hinder suppliers’ ability to meet escalating consumer demand. Smaller players, in particular, face significant hurdles in navigating these challenges, as they lack the resources and infrastructure to mitigate risks effectively.

Stringent Regulatory Standards

Stringent regulatory standards governing spice imports is another formidable challenge for the U.S. spices market. The FDA rejects nearly 12% of imported spices annually due to contamination risks, including microbial pathogens, pesticide residues, and unauthorized additives. Compliance with these regulations often requires substantial investments in testing, certification, and quality assurance, which can be burdensome for smaller players. As per the American Spice Trade Association, small-scale importers face up to $50,000 in additional costs annually to meet FDA requirements. Furthermore, the lack of uniformity in global standards creates confusion and delays in cross-border trade. For instance, discrepancies in permissible pesticide levels between the U.S. and other countries often result in rejected shipments, leading to financial losses and reputational damage for suppliers. These regulatory hurdles not only escalate operational costs but also limit market entry for new participants, constraining overall industry expansion.

MARKET OPPORTUNITIES

Expansion into Plant-Based and Functional Foods

The integration of spices into plant-based and functional foods is a promising opportunity for the U.S. spices market. The demand for plant-based foods in the U.S. is growing rapidly and spices are playing an increasingly pivotal role in enhancing flavor profiles and adding nutritional value to these products. Ingredients like paprika, nutmeg, and turmeric are being used to mimic the taste of meat in plant-based alternatives, while cinnamon and ginger are incorporated into energy bars, beverages, and supplements for their health-enhancing properties. For instance, Beyond Meat, which is a leading player in the plant-based sector, reported a 35% increase in spice-infused product lines in 2022, underscoring the potential for innovation in this space. Similarly, companies like Herbalife and Garden of Life have launched turmeric-infused supplements, achieving significant revenue growth. The clean-label movement has further amplified this opportunity, as consumers increasingly prioritize transparency and quality in their food choices. Brands like Simply Organic and Frontier Co-op have capitalized on this trend by expanding their organic spice portfolios, appealing to health-conscious and eco-friendly consumers.

Adoption of E-Commerce Platforms

The digital transformation of retail is likely to be another lucrative opportunity for the U.S. spices market, as online sales continue to soar. Statista reports that e-commerce accounted for 22% of total grocery sales in 2023, with spices being one of the fastest-growing categories. Platforms like Amazon, Thrive Market, and Instacart have witnessed a 40% surge in spice orders, driven by convenience, competitive pricing, and a wide range of options. Subscription-based models offered by brands like Spice Tribe and Spiceology have gained significant traction, achieving a 60% year-over-year revenue growth in 2022. Millennials and Gen Z consumers, who prioritize digital shopping, are particularly drawn to these platforms for their ability to access rare and exotic spices not typically available in brick-and-mortar stores. Enhanced logistics and faster delivery options have further solidified the appeal of online retail, positioning it as a transformative force in the spices market. Companies that invest in user-friendly e-commerce platforms, personalized recommendations, and seamless customer experiences are well-positioned to capitalize on this trend and achieve sustainable growth.

MARKET CHALLENGES

Counterfeit and Adulterated Products

Counterfeit and adulterated products undermine consumer trust and brand reputation is one of the significant challenges to the U.S. spices market. According to the estimations of the Grocery Manufacturers Association, economic adulteration costs the food industry $10-$15 billion annually, with spices being particularly vulnerable due to their high value-to-weight ratio. Instances of synthetic dyes, fillers, and unauthorized additives being added to spices like saffron, chili powder, and paprika have been widely reported, prompting stricter scrutiny from regulators. The FDA’s Operation Spices uncovered that 10% of tested samples contained unauthorized additives, highlighting the scale of the issue. Such practices not only erode consumer confidence but also force legitimate manufacturers to invest heavily in authentication technologies, adding to operational costs. Smaller players, in particular, face significant challenges in combating counterfeit products, as they lack the resources to implement advanced traceability systems. Addressing this issue requires collaboration between industry stakeholders, regulatory bodies, and technology providers to ensure transparency and quality across the supply chain.

Price Volatility Due to Climate Change

Climate change-induced volatility in spice production is another major challenge for the U.S. spices market. Rising temperatures, unpredictable rainfall, and extreme weather events have disrupted crop yields in key spice-producing regions. The Intergovernmental Panel on Climate Change (IPCC) reports that these factors have reduced spice harvests by up to 30% in some areas. For example, vanilla production in Madagascar declined by 25% in 2022 due to prolonged droughts, leading to a 50% spike in prices. Similarly, hurricanes and floods in Southeast Asia have strained supply chains, exacerbating the problem. These environmental challenges not only drive-up costs but also create uncertainty for suppliers and retailers. To mitigate long-term risks, companies are investing in climate-resilient farming techniques, diversifying sourcing regions, and exploring alternative ingredients. However, these strategies require significant capital and time, posing challenges for smaller players. Addressing price volatility will require a concerted effort to promote sustainable agricultural practices and enhance supply chain resilience.

SEGMENTAL ANALYSIS

By Product Type Insights

The ground spices segment dominated the U.S. spices market by occupying 46.4% of the U.S. market share in 2024. The dominating position of ground spices segment in the U.S. is driven by their versatility, ease of use, and ability to enhance flavor instantly make them indispensable in everyday cooking. Euromonitor reports that ground spices are favored by 70% of households for their convenience, particularly in busy urban settings where time is a premium. Popular varieties like garlic powder, onion powder, and paprika are staples in American kitchens, with sales growing at a steady rate of 6% annually. The rise of meal prep culture and the popularity of ready-to-cook meals have further fueled demand for ground spices. For instance, McCormick’s line of pre-mixed spice blends, such as taco seasoning and curry powders, has expanded the appeal of this segment, driving a 15% increase in sales in 2022. Retailers like Walmart and Kroger have optimized shelf space for ground spices, introducing private-label brands that offer competitive pricing. Promotional activities, such as discounts and bundled offers, have also contributed to the segment’s dominance, making it a preferred choice for bulk buyers and households alike.

The spice blends segment is predicted to be the fastest growing segment with a CAGR of 7.78% over the forecast period. Nielsen data shows that pre-mixed blends like garam masala, za’atar, and berbere have seen a 25% uptick in sales over the past two years, reflecting shifting consumer preferences. Millennials and Gen Z, who constitute a significant portion of the market, are particularly drawn to these blends for their ability to recreate complex global flavors effortlessly. Social media platforms like TikTok and Instagram have played a pivotal role in popularizing fusion recipes and exotic cuisines, encouraging home cooks to experiment with unique spice combinations. Companies like Simply Organic and Spice Tribe have capitalized on this trend by launching curated spice blends tailored to trending cuisines, achieving a 40% revenue boost in 2022. Subscription-based models, which deliver exotic spice blends directly to consumers’ doorsteps, have further amplified the segment’s growth. As consumer interest in global flavors continues to rise, spice blends are poised to remain a key driver of market expansion.

By Application Insights

The food and beverage (F&B) segment accounted for the largest share of the U.S. spices market by holding 68.7% of the U.S. market share in 2024. The widespread use of spices in both commercial and household cooking is one of the key factors propelling the food and beverages segment in the U.S. market. According to the National Restaurant Association, 80% of restaurants incorporate spices to create signature dishes, driving bulk purchases. Fast-casual dining chains specializing in ethnic cuisines, such as Chipotle, Panda Express, and Taco Bell, have further amplified demand. The post-pandemic resurgence of home cooking has also spurred retail sales of spices, with supermarkets reporting a 20% increase in spice aisle traffic. Key players like McCormick and Kraft Heinz have strengthened their foothold in this segment by partnering with foodservice providers and launching innovative product lines. For instance, McCormick’s acquisition of Cholula Hot Sauce in 2021 expanded its footprint in the condiments segment, reinforcing its leadership in the F&B industry.

The cosmetics and personal care segment is experiencing the fastest growth and is expected to progress at a CAGR of 9.5% over the forecast period owing to the incorporation of spices like turmeric, cinnamon, and ginger into skincare and haircare formulations due to their antioxidant, anti-inflammatory, and antimicrobial properties. Brands like Herbivore Botanicals and Tata Harper have capitalized on this trend by launching turmeric-infused face masks and cinnamon-based serums, achieving a 60% sales increase in 2022. The clean beauty movement has further boosted demand, as consumers increasingly seek products free from synthetic additives. Rising awareness of holistic wellness has positioned spices as indispensable ingredients in this rapidly expanding segment, offering immense opportunities for innovation and growth.

By Distribution Channel Insights

The supermarkets and hypermarkets segment commanded the largest share of 43.9% of the U.S. spices market in 2024. The extensive reach of supermarkets and hypermarkets and their ability to cater to diverse consumer needs, and convenience of one-stop shopping are driving the growth of the segment in the U.S. market primarily. According to Nielsen, these outlets benefit from impulse purchases, with 70% of shoppers picking up spices during grocery trips. Prominent chains like Walmart, Kroger, and Target have optimized shelf space for spices, introducing private-label brands that offer competitive pricing. Promotional activities, such as discounts, bundled offers, and loyalty programs, have further driven sales within this channel. For instance, Walmart’s Great Value line of spices has gained significant traction, achieving a 15% increase in sales in 2022. The convenience of purchasing spices alongside other grocery items makes supermarkets and hypermarkets a preferred choice for bulk buyers and households alike.

The online retail segment is the fastest-growing distribution channel and is projected to witness a CAGR of 10.3% over the forecast period. According to Statista, e-commerce accounted for 22% of total grocery sales in 2023, with spices being one of the fastest-growing categories. Platforms like Amazon, Thrive Market, and Instacart have witnessed a 40% surge in spice orders, driven by convenience, competitive pricing, and a wide range of options. Subscription-based models offered by brands like Spice Tribe and Spiceology have gained significant traction, achieving a 60% year-over-year revenue growth in 2022. Millennials and Gen Z consumers, who prioritize digital shopping, are particularly drawn to these platforms for their ability to access rare and exotic spices not typically available in brick-and-mortar stores. Enhanced logistics and faster delivery options have further solidified the appeal of online retail, positioning it as a transformative force in the spices market.

TOP PLAYERS IN THE U.S. SPICES MARKET

McCormick & Company leads the U.S. spices market and is known for its flagship brands like Old Bay, French’s, and Zatarain’s, the company has consistently innovated to meet evolving consumer demands. Their acquisition of Cholula Hot Sauce in 2021 expanded their footprint in the condiments segment, reinforcing their global leadership.

Kraft Heinz is another promising player in the U.S. spices market. The focus of Kraft Heinz on sustainable sourcing and clean-label products has strengthened their appeal among health-conscious consumers. Kraft Heinz’s partnership with local farmers ensures consistent quality, bolstering its global reputation.

Conagra Brands emerged as another key player in the U.S. spices market by using its Pampered Chef and Hunt’s brands to appeal to diverse consumer segments. With $12 billion in annual revenue, Conagra has invested heavily in digital marketing and e-commerce, achieving a 25% increase in online spice sales in 2022. Their commitment to affordability and innovation has enabled them to compete effectively on a global scale.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the U.S. spices market employ diverse strategies to strengthen their positions. Mergers and acquisitions are a primary tactic, exemplified by McCormick’s acquisition of Cholula, which expanded its product portfolio and market reach. Another strategy is product innovation, with companies like Kraft Heinz launching organic and sustainably sourced spice lines to align with consumer trends.

Digital transformation is also pivotal, as Conagra Brands has leveraged AI-driven analytics to optimize supply chains and enhance customer engagement. Partnerships with e-commerce platforms have further amplified online visibility, while investments in sustainable farming practices ensure long-term resilience. These strategies reflect a deep understanding of consumer behavior and market dynamics, enabling companies to maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Ajinomoto Co., Inc., McCormick & Company Incorporated, Olam International, Kerry Group PLC, Döhler GmbH, All Seasonings Ingredients Inc., Cargill Incorporated, and Associated British Foods PLC are playing dominating role in the U.S. spices market.

The U.S. spices market is highly competitive, characterized by intense rivalry among established players and emerging startups. McCormick & Company dominates with a 20% market share, leveraging its extensive distribution network and robust R&D capabilities. Kraft Heinz and Conagra Brands follow closely, focusing on cost leadership and innovation to capture consumer interest.

Smaller players like Simply Organic differentiate themselves through niche offerings, targeting health-conscious segments. The rise of private-label brands from retailers like Walmart adds another layer of competition, pressuring incumbents to innovate continuously. Overall, the market’s fragmented nature and dynamic consumer preferences ensure sustained competition.

RECENT MARKET DEVELOPMENTS

- In April 2024, McCormick acquired Spice Tribe, a premium spice brand, to expand its specialty offerings and target gourmet consumers.

- In June 2023, Kraft Heinz launched a line of organic spices under its Heinz brand, emphasizing sustainability and clean-label ingredients.

- In January 2023, Conagra partnered with Instacart to enhance its e-commerce presence, achieving a 30% increase in online spice sales.

- In September 2022, Simply Organic introduced a subscription service for exotic spice blends, driving a 50% rise in customer retention.

- In March 2022, McCormick invested $50 million in AI-driven supply chain solutions to improve efficiency and reduce costs.

MARKET SEGMENTATION

This research report on the U.S. spices market is segmented and sub-segmented based on categories.

By Product Type

- Whole Spices

- Ground Spices

- Spice Blends

- Herbs

By Application

- Food and Beverage

- Meat and Poultry

- Sauces and Condiments

- Snacks

- Bakery Products

- Ready-to-Eat Meals

- Pharmaceuticals

- Cosmetics and Personal Care

- Others (e.g., animal feed)

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

Frequently Asked Questions

1. What is the projected market value of the U.S. Spices market by 2033?

The market is estimated to be valued at USD 358.13 million by the end of 2033.

2. What factors are driving growth in the U.S. Spices market?

Key drivers include increasing consumer demand for diverse flavors, health benefits associated with spices, and the rise of global culinary trends.

3. What challenges does the U.S. Spices market face?

Challenges include supply chain disruptions, price volatility, and maintaining consistent quality and safety of spices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]