UK Pet Insurance Market Research Report, Analysis on Size, Share, Trends and Growth Forecast from 2025 To 2033

UK Pet Insurance Market Size

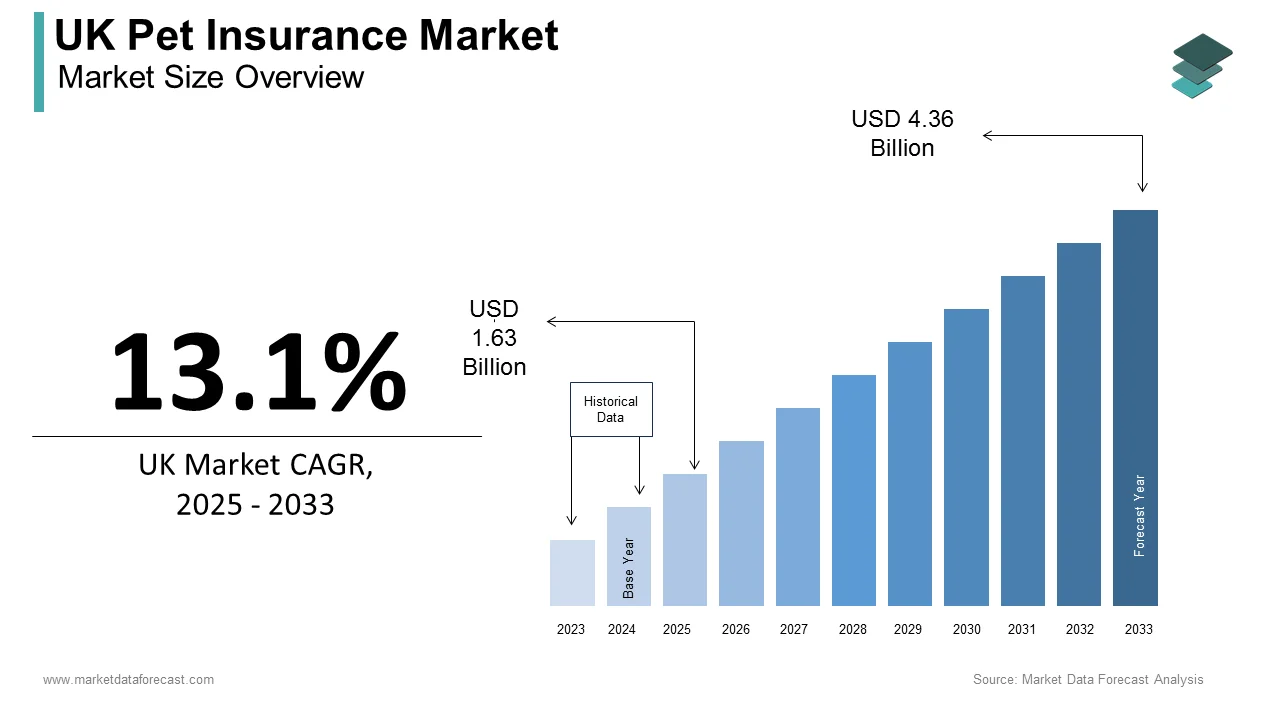

The size of the UK pet insurance market was valued at USD 1.44 billion in 2024. The UK market is further predicted to grow at a CAGR of 13.1% from 2025 to 2033 and be worth USD 4.36 billion by 2033 from USD 1.63 billion in 2025. Medical inflation contributes to the rise in the GWPs, with insurers continuing to pass on costs to policyholders.

Pet Insurance is designed to provide pet owners with financial protection against unforeseen veterinary expenses. Pet health and well-being have become paramount concerns for British households as pets increasingly assume roles as integral family members. Pet insurance offers coverage for treatments ranging from routine check-ups to complex surgeries by ensuring that pets receive necessary care without imposing prohibitive costs on their owners. The rising awareness of pet healthcare needs and escalating veterinary costs are escalating the growth of the market. According to a report by the Pet Food Manufacturers’ Association, approximately 51% of UK households own a pet, which is equal to around 12 million homes, which empowers the immense customer base for insurers.

Furthermore, it is estimated by the PDSA Animal Charity that over 40% of pet owners in the UK are unprepared for unexpected veterinary bills exceeding £1,000. Additionally, the RSPCA reports that millions of animals are abandoned annually in the UK due to owners being unable to afford treatment costs, further illuminating the societal implications of inadequate access to affordable pet healthcare solutions. Collectively, these statistics demonstrate not only the growing relevance of pet insurance but also its broader impact on animal welfare and responsible pet ownership in contemporary Britain.

|

PET |

NUMBERS IN THE UK (MILLIONS, 2018) |

|

Cat |

102.6 |

|

Dog |

84.9 |

|

Bird |

49.8 |

|

Small mammal |

28.7 |

|

Reptile |

7.8 |

MARKET DRIVERS

Increasing Pet Ownership and Humanisation of Pets

The UK has witnessed a significant surge in pet ownership, particularly during and after the COVID-19 pandemic. According to the Office for National Statistics, pet ownership rose by approximately 8% between 2019 and 2021, with over 17 million households now owning a pet. This trend reflects a deeper emotional connection between humans and their pets, often referred to as the "humanization" of pets. Pets are increasingly regarded as family members, which is leading to heightened awareness of their health and well-being. The Department for Environment, Food & Rural Affairs reports that spending on pet-related products and services reached £6 billion in 2022, indicating a growing willingness to invest in pet care. This shift in perception has directly fuelled demand for pet insurance, as owners seek financial security to ensure their pets receive the best possible medical attention without compromising on quality or affordability.

Rising Veterinary Costs and Financial Preparedness

The escalating veterinary costs have become a pivotal driver for the UK pet insurance market is compelling pet owners to seek financial safeguards. According to the British Veterinary Association, the average cost of treating common conditions such as fractures or chronic illnesses can range from £2,000 to £5,000. These expenses are further compounded by advancements in veterinary technology and treatments, which, while improving outcomes, also increase costs. A study by the Money Advice Service reveals that nearly 40% of UK households lack savings to cover unexpected expenses exceeding £500 making it challenging to manage sudden veterinary bills. This financial vulnerability escalates the importance of pet insurance as a safety net. The Department of Health and Social Care notes that rising healthcare standards for animals have paralleled human medical advancements, creating a dual need for affordability and accessibility in pet healthcare financing solutions like insurance.

MARKET RESTRAINTS

Limited Awareness and Misconceptions About Pet Insurance

The limited awareness and misconceptions about pet insurance remain significant barriers to market expansion. According to the Financial Conduct Authority, nearly 60% of pet owners in the UK are either unaware of pet insurance or misunderstand its coverage and benefits. Many perceive it as an unnecessary expense if their pets have no pre-existing health conditions. Additionally, a survey conducted by the Citizens Advice Bureau reveals that approximately 35% of pet owners believe insurance policies are too complex or laden with exclusions, deterring them from purchasing coverage. This lack of clarity is further compounded by inconsistent messaging from insurers, which confuses potential customers. The Department for Business, Energy & Industrial Strategy notes that such gaps in understanding hinder consumer trust is preventing the market from reaching its full potential despite rising veterinary costs and increasing pet ownership rates.

High Premium Costs and Affordability Concerns

Affordability remains a critical restraint in the adoption of pet insurance across the UK. According to the Office for National Statistics, over 20% of households in the UK are considered financially vulnerable, making it challenging for them to allocate additional funds toward non-essential expenses like pet insurance. The Competition and Markets Authority reports that premium prices have risen by an average of 15% over the past five years, which is outpacing inflation and wage growth. For low-income families, this creates a significant barrier to entry, even when they recognize the value of insuring their pets. Furthermore, the Money and Pensions Service states that many pet owners prioritize immediate expenses, such as food and grooming, over long-term financial safeguards like insurance. These affordability challenges disproportionately affect younger pet owners and those in economically deprived regions, limiting the market's inclusivity and overall penetration.

MARKET OPPORTUNITIES

Expansion of Customised Insurance Products

The growing demand for personalized services presents a significant opportunity for the UK pet insurance market to innovate and expand its offerings. According to the UK Office for Product Safety & Standards, over 70% of consumers prefer tailored solutions that align with their specific needs, a trend that extends to pet care. Insurers can capitalize on this by introducing flexible policies, such as coverage for alternative therapies or breed-specific conditions, which are not widely available. For instance, the Kennel Club estimates that pedigree dogs account for 25% of the UK dog population, many of which are prone to genetic health issues. Insurers can attract a broader customer base by addressing these niche requirements, according to the Department for Digital, Culture, Media & Sport, the increasing use of digital platforms for financial services by enabling insurers to leverage technology to design and market customised plans more effectively.

Integration of Preventive Healthcare and Wellness Plans

The UK's focus on preventive healthcare creates an untapped opportunity for insurers to integrate wellness programs into their pet insurance policies. Public Health England reports that preventive measures can reduce long-term healthcare costs by up to 30%, a principle that applies to veterinary care as well. The providers can promote proactive pet health management while differentiating themselves in a competitive market by incorporating routine check-ups, vaccinations, and dental care into insurance plans. According to the Animal and Plant Health Agency, preventable diseases account for nearly 40% of veterinary visits, underscoring the potential impact of wellness-focused policies. Furthermore, the Department for Environment, Food & Rural Affairs notes that 65% of pet owners express interest in holistic care options, including dietary consultations and fitness tracking. The insurers can enhance policy value, foster customer loyalty, and contribute to better overall pet health outcomes by embedding these services into their offerings.

MARKET CHALLENGES

Regulatory Scrutiny and Policy Complexity

The UK pet insurance market faces significant challenges due to increasing regulatory scrutiny and the inherent complexity of policy terms. The Financial Conduct Authority has identified that over 40% of consumer complaints in the insurance sector stem from unclear or misleading policy documentation, which is a concern that extends to pet insurance. This lack of transparency often leads to disputes over claims regarding exclusions or pre-existing conditions. According to the Competition and Markets Authority, nearly 25% of rejected claims are attributed to misunderstandings about policy coverage, which undermines trust in insurers. Additionally, evolving regulations aimed at enhancing consumer protection require insurers to invest heavily in compliance measures, increasing operational costs. According to the Department for Business, Energy & Industrial Strategy, smaller insurers may struggle to adapt to these regulatory demands, which may hinder the growth of the market.

Rising Incidence of Pet Obesity and Chronic Illnesses

The growing prevalence of pet obesity and chronic illnesses poses a dual challenge for the pet insurance market by increasing claim frequency and severity. The Department of Health and Social Care reports that over 50% of dogs and 40% of cats in the UK are overweight or obese, leading to a higher incidence of conditions such as diabetes and arthritis. These chronic ailments result in prolonged treatments is driving up veterinary costs and straining insurer resources. The Animal Welfare Foundation estimates that obesity-related conditions account for approximately 30% of all veterinary claims, creating financial pressure on insurers to balance affordability with profitability. According to the Office for Health Improvement & Disparities, many pet owners remain unaware of the link between diet and health, which is complicating efforts to mitigate these risks. Insurers must address this challenge through education initiatives while managing the rising cost burden associated with treating chronic conditions.

SEGMENTAL ANALYSIS

The UK Pet Insurance Market Analysis By Pet Type

The dog insurance segment dominated the UK pet insurance market by accounting for 63.2% of the share in 2024 owing to the high population of dogs in the UK, with over 12 million households owning a dog, according to the Office for National Statistics. Dogs are more prone to accidents and illnesses requiring costly treatments, which is driving demand for insurance. According to the British Veterinary Association, the average annual veterinary cost for dogs exceeds £700, making insurance a critical financial safeguard.

The exotic pet insurance segment is likely to experience a CAGR of 12.2% projected between 2020 and 2025. This rapid growth is driven by the rising popularity of exotic pets such as reptiles, birds, and small mammals, with ownership increasing by 30% over the past five years, as noted by the Department for Environment, Food & Rural Affairs. Exotic pets often require specialized care, including habitat maintenance and dietary needs, which can be expensive. Additionally, advancements in veterinary expertise for exotic species have increased treatment availability, raising awareness about insurance. This segment’s growth is attributed to evolving consumer preferences and the importance of addressing niche markets to ensure comprehensive pet healthcare coverage.

The UK Pet Insurance Market Analysis By Policy Type

The lifetime cover segment dominated the UK pet insurance market, holding approximately 60% of the market share, as reported by the Association of British Insurers. This policy type is preferred due to its comprehensive nature, offering continuous coverage for chronic conditions and ongoing treatments without annual limits. According to the Financial Conduct Authority, over 70% of pet owners value the predictability of lifetime policies, which align with rising veterinary costs, now averaging £2,500 per claim. Its importance lies in addressing the growing demand for long-term financial security as pets live longer due to improved healthcare.

The non-lifetime cover segment is anticipated to achieve a CAGR of 8.5% during the forecast period. This growth is driven by affordability and simplicity by appealing to younger pet owners and those with tighter budgets. According to the Money Advice Service, nearly 45% of millennials opt for non-lifetime policies due to lower premiums despite limited coverage. According to the Department for Business, Energy & Industrial Strategy, the rise in first-time pet ownership post-pandemic has boosted demand for cost-effective options. While non-lifetime policies lack the comprehensiveness of lifetime cover, their accessibility ensures broader market penetration. This segment's rapid expansion is amplified by the need for flexible, budget-friendly solutions, which is making it a critical growth driver in the evolving pet insurance landscape.

KEY MARKET PLAYERS

The companies playing an active role in the UK pet insurance market include Petplan Pet Insurance, Embrace Pet Insurance Agency, Royal & Sun Alliance (RSA), Pethealth Inc., Agria Pet Insurance, Petfirst Healthcare, Nationwide Pet Insurance, PetSure Pty Ltd., Petsecure Pet Health Insurance and Hartville Group.

The UK pet insurance market is characterized by intense competition, driven by a mix of established players and emerging entrants striving to capture a share of this rapidly growing industry. Leading companies such as Petplan, Royal & Sun Alliance (RSA), and Agria dominate the landscape, leveraging their strong brand recognition, extensive distribution networks, and innovative product offerings to maintain their positions. Petplan, for instance, holds approximately 25% of the market share, according to the Association of British Insurers, due to its comprehensive lifetime cover policies and customer-centric approach. Meanwhile, RSA’s MoreThan brand appeals to budget-conscious consumers with affordable non-lifetime policies, while Agria specializes in breed-specific coverage, catering to niche markets. Despite the dominance of these key players, smaller insurers and digital-first startups are intensifying competition by offering flexible, tech-driven solutions. According to the Financial Conduct Authority, over 40% of pet owners now prioritize user-friendly digital platforms, prompting insurers to adopt AI-driven tools and mobile apps for seamless policy management. Additionally, partnerships with veterinary clinics and animal welfare organizations have become a strategic battleground, enhancing accessibility and credibility.

Petplan Pet Insurance

Petplan Pet Insurance is one of the most prominent players in the UK pet insurance market, renowned for its comprehensive lifetime cover policies and strong brand recognition. Petplan’s success stems from its focus on customer-centric innovations, such as flexible payment plans and coverage for pre-existing conditions under specific circumstances. Its global presence extends to Europe and North America, where it contributes significantly to standardizing high-quality pet healthcare solutions. According to the Financial Conduct Authority, Petplan processes over 30% of all pet insurance claims in the UK annually, showcasing its dominance. By leveraging advanced data analytics, Petplan ensures efficient claims management, setting benchmarks for transparency and reliability in the global pet insurance industry.

Royal & Sun Alliance (RSA)

Royal & Sun Alliance (RSA), through its MoreThan brand, is a key player in the UK pet insurance market. RSA’s contribution to the global market lies in its robust distribution networks, including partnerships with veterinary clinics and online platforms, which enhance accessibility for pet owners. The company’s emphasis on affordable non-lifetime policies has attracted a broad customer base, particularly first-time pet owners. The Department for Business, Energy & Industrial Strategy notes that RSA’s streamlined underwriting processes have reduced policy issuance times by 20%, enhancing customer satisfaction. Globally, RSA’s expertise in risk management and diversified product portfolios has positioned it as a leader in promoting inclusive pet insurance solutions, catering to varying income levels and regional preferences.

Agria Pet Insurance

Agria Pet Insurance is a specialist insurer with a long-standing reputation for offering tailored policies, particularly for pedigree and working dogs. Agria’s unique value proposition lies in its breed-specific coverage, addressing genetic health issues prevalent in certain breeds. On a global scale, Agria collaborates with international veterinary associations to promote preventive healthcare, influencing trends in pet insurance product design. According to the Animal Welfare Foundation, Agria’s proactive approach to wellness has led to a 25% reduction in claims related to preventable conditions. Its commitment to education and research further solidifies its role as a thought leader, contributing to the global shift toward holistic pet care and sustainable insurance practices.

Pet insurance companies are increasingly offering pet owners the ability to customize the coverage provided by allowing them to choose their levels of deductibles or co-insurances. It has resulted in the pet owner getting access to more control over the monthly premium and selecting the best coverage suited for their needs. The UK continues to be a significant contributor to market growth in the region of Europe, owing to the market being developed, which results in deeper penetration of insurance providers in the area. Overall, the pet insurance market in the UK remains conducive for growth owing to an increasing trend of owning companion animals in the region and due to the potential for offering previously untapped premiums and services to pet owners, who are highly aware and are willing to spend on pet care.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Customisation

Key players in the UK pet insurance market, such as Petplan and Agria, have prioritized product innovation to differentiate themselves. These companies offer tailored policies, including breed-specific coverage and wellness plans, which cater to niche customer needs. According to the Financial Conduct Authority, over 60% of consumers prefer insurers that provide flexible options, such as coverage for alternative therapies or chronic conditions. By integrating advanced data analytics, these players assess risk more accurately, enabling them to design personalized plans. For instance, Agria’s focus on pedigree dogs has strengthened its reputation among breeders and owners of high-risk animals. This strategy enhances customer loyalty and expands market reach by addressing underserved segments.

Digital Transformation and Customer Engagement

Digitalization has become a cornerstone strategy for companies like Royal & Sun Alliance (RSA) and Nationwide Pet Insurance. RSA’s MoreThan brand leverages online platforms and mobile apps to streamline policy purchases and claims processing, reducing turnaround times by up to 30%, as reported by the Department for Business, Energy & Industrial Strategy. Similarly, Nationwide Pet Insurance has adopted AI-driven chatbots to enhance customer support, resolving queries in real time. These innovations improve user experience and increase accessibility, particularly among tech-savvy millennials. According to the Office for National Statistics, over 70% of UK households now use digital tools for financial services.

Strategic Partnerships and Collaborations

Collaborations with veterinary clinics, animal welfare organizations, and retailers have been instrumental in strengthening market positions. Petplan, for example, partners with veterinary associations to promote preventive healthcare by aligning its offerings with rising awareness of proactive pet care. The British Veterinary Association notes that such partnerships increase insurer credibility and foster trust among pet owners. Additionally, Nationwide Pet Insurance collaborates with pet stores to offer bundled services, enhancing affordability and convenience. These alliances not only expand distribution channels but also reinforce brand visibility, ensuring sustained growth in a competitive landscape.

Focus on Education and Awareness Campaigns

Educating consumers about the benefits of pet insurance remains a key strategy for players like Agria and Pethealth Inc. These companies invest in campaigns due to the financial risks of unexpected veterinary bills, which the Money Advice Service estimates exceed £1,000 for 40% of pet owners. By hosting webinars, publishing research, and collaborating with animal welfare groups, they address misconceptions and build trust. The Animal Welfare Foundation reports that regions with higher awareness campaigns see a 25% increase in insurance adoption, demonstrating the effectiveness of this approach in driving market penetration and reinforcing brand authority.

RECENT HAPPENINGS IN THE MARKET

- In 2023, Petplan, a subsidiary of Allianz, maintained its market position is by contributing the largest share of premiums in the UK pet insurance market.

- In 2023, RSA remained one of the leading companies in the UK pet insurance market, continuing its significant presence in the industry.

- In 2024, PetSure expanded its reach by offering tailored policies based on pet breed, age, and medical history, aligning with market trends towards personalized insurance products.

- In 2024, Petsecure enhanced its offerings by integrating preventative care plans, covering vaccinations, dental care, and wellness check-ups, to provide more comprehensive coverage.

- In 2024, Hartville Group embraced digital transformation by incorporating AI-driven tools for policy customization and real-time claims processing, improving customer experience.

MARKET SEGMENTATION

This research report on the UK pet insurance market is segmented and sub-segmented into the following categories.

By Policy

- Cat Insurance

- Dog Insurance

- Horse Insurance

- Rabbit Insurance

- Exotic Pet Insurance

- Others

By Policy Type

- Lifetime Cover

- Accidental Cover

- Illness Cover

- Non-lifetime Cover

- Accidental Cover

- Illness Cover

- Others

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]