UK Gaming Market Size, Share, Trends & Growth Forecast Report By Game type (Shooter Action Sports Role Playing Others), Device Type, End-Use and Country, Industry Analysis From 2025 to 2033

UK Gaming Market Size

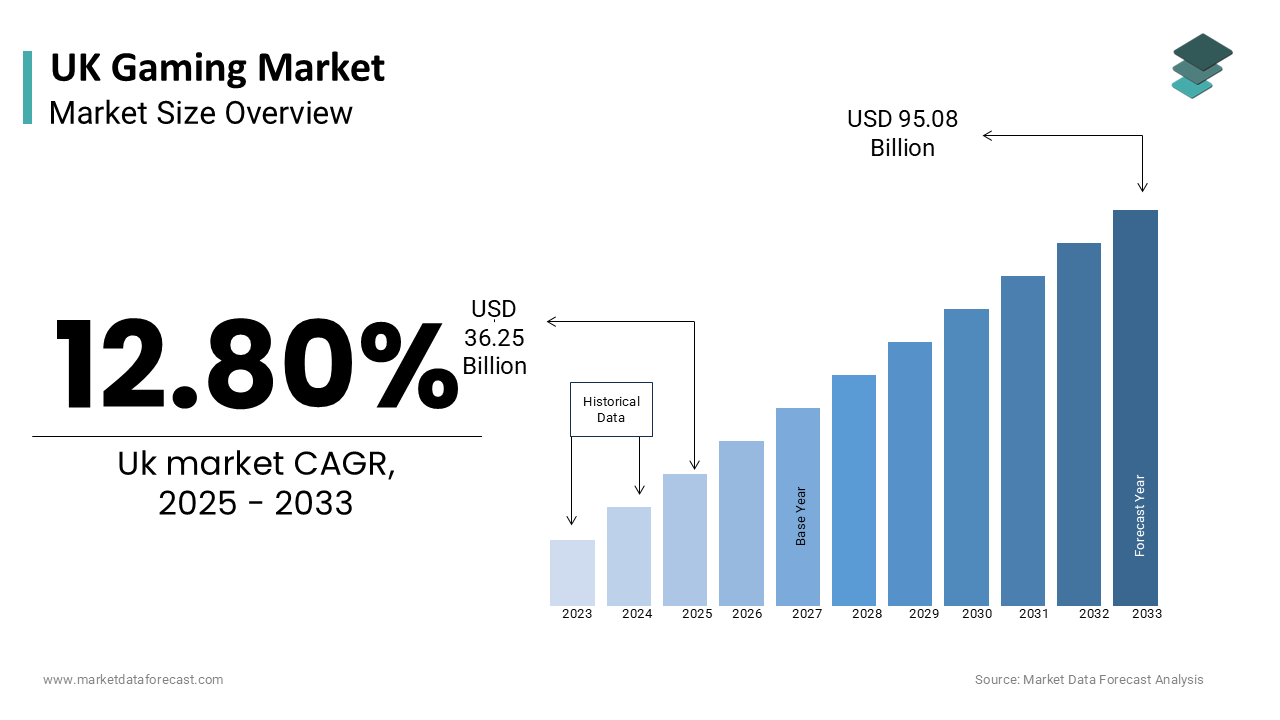

The UK gaming market was worth USD 32.15 billion in 2024. The Uk gaming market is estimated to grow at a CAGR of 12.80% from 2025 to 2033 and be valued at USD 95.08 billion by the end of 2033 from USD 36.25 billion in 2025.

The UK gaming market is a vibrant and rapidly evolving sector, contributing significantly to the broader entertainment industry. According to Newzoo, the UK gaming market generated approximately £7 billion in revenue in 2023, reflecting steady growth driven by technological advancements and shifting consumer preferences. The UK ranks as the sixth-largest gaming market globally, with over 39 million gamers, representing nearly 60% of the population, as per data from Statista. Mobile gaming remains a dominant force, accounting for 55% of total revenue, while console gaming continues to thrive due to the enduring popularity of platforms like PlayStation and Xbox.

Esports and live streaming are also gaining traction, with viewership increasing by 25% in 2023, according to PwC. Titles like FIFA, Call of Duty, and Fortnite dominate the competitive scene, drawing millions of participants and spectators. Additionally, the UK government’s support for the gaming industry, including tax relief programs for developers, has fostered innovation and attracted international investments. This combination of robust consumer demand, supportive policies, and technological advancements positions the UK as a key player in the global gaming landscape.

MARKET DRIVERS

Rising Popularity of Esports and Streaming Platforms

The explosive growth of esports and streaming platforms has become a significant driver of the UK gaming market. According to PwC, esports revenue in the UK grew by 30% in 2023, reaching £150 million, fueled by tournaments and events featuring popular titles like League of Legends and Fortnite. These events attract not only gamers but also advertisers and sponsors, creating a lucrative ecosystem. For instance, the UK’s largest esports event, the Insomnia Gaming Festival, drew over 50,000 attendees in 2023, underscoring the growing mainstream appeal of competitive gaming.

Streaming platforms like Twitch and YouTube Gaming have further amplified this trend. As per Sensor Tower, UK-based streamers collectively generated over 1 billion hours of watch time in 2023, with influencers playing a pivotal role in shaping gaming trends. The rise of content creators has introduced gaming to broader demographics, including older audiences and casual players. With esports projected to grow at a CAGR of 18% through 2027, its influence on the UK gaming market will continue to expand, driving both participation and monetization opportunities.

Advancements in Cloud Gaming Technology

Another major driver of the UK gaming market is the rapid adoption of cloud gaming technology, which is transforming how consumers access and experience games. According to Newzoo, the number of cloud gaming subscribers in the UK increased by 40% in 2023, with services like Xbox Cloud Gaming and NVIDIA GeForce Now leading the charge. This shift is supported by the UK’s robust internet infrastructure, where over 94% of households have access to high-speed broadband, as reported by Ofcom.

Cloud gaming eliminates the need for expensive hardware, making gaming more accessible to a wider audience. For example, Microsoft’s Game Pass Ultimate, which includes cloud gaming features, added over 1 million subscribers in the UK within a year of its launch, highlighting the service’s appeal. Additionally, partnerships between telecom providers like BT and gaming platforms have further accelerated adoption by bundling gaming subscriptions with internet packages. As cloud gaming continues to evolve, it is expected to unlock new revenue streams and redefine the gaming landscape in the UK.

MARKET RESTRAINTS

High Development Costs and Funding Challenges

One of the primary restraints facing the UK gaming market is the high cost of game development, which can act as a barrier for smaller studios. According to TIGA, the trade association representing the UK video games industry, the average cost of developing a AAA title exceeds £50 million, requiring substantial upfront investment. While larger studios benefit from established funding networks, smaller developers often struggle to secure financial backing, limiting their ability to compete in an increasingly crowded market.

Compounding this issue is the uncertainty surrounding post-Brexit trade policies, which have impacted access to EU funding programs that previously supported UK developers. A survey by UKIE revealed that 30% of small studios cited funding as their biggest challenge in 2023. Without adequate resources, these studios face difficulties in innovating or scaling their operations, potentially stifling creativity and diversity within the industry. This financial strain threatens to widen the gap between major players and independent developers, constraining the market’s overall growth potential.

Growing Concerns Over Loot Boxes and Microtransactions

Regulatory scrutiny surrounding loot boxes and microtransactions poses another significant restraint for the UK gaming market. In 2023, the UK Gambling Commission classified certain loot box mechanics as gambling activities, prompting stricter regulations and transparency requirements for game developers. According to Juniper Research, this move led to a 15% decline in microtransaction revenues for affected titles in the UK, impacting publishers reliant on these models for profitability.

Public backlash against perceived pay-to-win systems has further complicated matters, with consumer advocacy groups calling for bans on exploitative practices. A study by the University of York found that over 60% of UK gamers expressed dissatisfaction with aggressive monetization strategies, particularly in mobile games. These challenges force developers to rethink their revenue models, potentially reducing profitability in the short term. Without balancing monetization with player satisfaction, the industry risks alienating its core audience, undermining long-term sustainability.

MARKET OPPORTUNITIES

Expansion into Virtual Reality (VR) Gaming

Virtual reality (VR) gaming represents a significant opportunity for the UK gaming market, driven by advancements in hardware and increasing consumer interest. According to PwC, VR gaming revenue in the UK is projected to grow at a CAGR of 28% through 2027, reaching £500 million. Devices like Meta Quest 3 and PlayStation VR2 have gained traction, with Sony reporting over 1 million units sold in the UK within six months of the latter’s launch in 2023.

The immersive nature of VR appeals to gamers seeking novel experiences, particularly in genres like action, adventure, and simulation. Titles such as Half-Life: Alyx and Resident Evil Village VR Mode have demonstrated the potential of VR to deliver unparalleled engagement. Additionally, partnerships between UK developers and tech giants like Meta and HTC are fostering innovation, enabling the creation of high-quality VR content. With declining hardware costs and improving accessibility, VR gaming is poised to attract a broader audience, unlocking new revenue streams and solidifying the UK’s position as a leader in cutting-edge gaming technologies.

Cross-Industry Collaborations and Licensing

Cross-industry collaborations present another promising opportunity for the UK gaming market, leveraging the country’s rich intellectual property (IP) portfolio to diversify revenue sources. According to Deloitte, non-gaming merchandise and licensing accounted for £1 billion in revenue for UK-based franchises like Doctor Who and Sherlock in 2023. Gaming adaptations of these IPs, such as Doctor Who: The Edge of Time, have successfully tapped into existing fanbases, generating additional income through sales and licensing agreements.

Beyond traditional media, partnerships with sectors like fashion, theme parks, and education are gaining momentum. For example, Minecraft’s collaboration with the British Museum allowed users to explore virtual replicas of ancient artifacts, blending gaming with cultural education. These initiatives not only broaden the reach of gaming IPs but also attract new demographics, such as educators and families. By integrating gaming into diverse industries, the UK can amplify its global influence while creating sustainable, multi-channel revenue models.

SEGMENTAL ANALYSIS

By Game Type Insights

The shooter games segment dominated the UK gaming market with a share of 28% in 2024. The domination of shooter games segment in the UK market is fueled by the genre’s fast-paced gameplay and multiplayer appeal, attracting a wide range of players. Titles like Call of Duty: Modern Warfare II and Apex Legends consistently rank among the top-selling games, with Modern Warfare II generating over £200 million in revenue during its first month in the UK, according to Activision. The rise of esports has elevated shooter games’ visibility, with tournaments drawing massive audiences is driving the growth of the shooter games segment in the UK market. PwC notes that shooter games accounted for 40% of esports-related revenue in the UK in 2023. Cross-platform play has expanded accessibility, allowing gamers to compete across devices, is also boosting the segmental expansion. Sony’s State of Play highlights that cross-platform titles now make up 45% of shooter-related revenue in the UK. Lastly, advancements in hardware, such as the PlayStation 5 and Xbox Series X, have enabled developers to deliver visually stunning and technically refined shooter experiences, further boosting their popularity.

The role-playing games (RPGs) segment is expected to register the fastest CAGR of 14.8% over the forecast period due to the genre’s deep storytelling and character customization, which resonate strongly with UK gamers. Titles like Elden Ring and Cyberpunk 2077 have captivated audiences, with Elden Ring selling over 2 million copies in the UK within its first three months, as stated by FromSoftware. RPGs often feature expansive worlds and intricate narratives, appealing to both casual and hardcore gamers. A survey by UKIE found that 65% of UK gamers prioritize storylines when selecting games, making RPGs a natural fit. Hybrid RPGs, such as Genshin Impact, which combine action mechanics with traditional RPG elements, have broadened the genre’s appeal. Sensor Tower reports that Genshin Impact generated £150 million in revenue from the UK alone in 2023. Lastly, the rise of live-service models, with regular updates and expansions, ensures sustained player engagement, positioning RPGs as a transformative force in the UK gaming market.

By Device Type Insights

The TV/console gaming segment held 40.7% of the UK market share in 2024. The growth of the TV/console segment in the UK market is driven by the enduring popularity of consoles like PlayStation, Xbox, and Nintendo Switch, which offer high-quality gaming experiences tailored to a wide audience. For example, the Nintendo Switch sold over 5 million units in the UK since its launch, as reported by Famitsu, underscoring its widespread appeal. The ability of TV/console gaming to deliver immersive gameplay through advanced graphics and exclusive titles is majorly driving the expansion of the segment in the UK market. Franchises like FIFA, Grand Theft Auto, and The Legend of Zelda consistently drive console sales, with FIFA 23 generating over £100 million in revenue in the UK within its first week, according to EA Sports. Additionally, the social aspect of console gaming, including local multiplayer modes and online communities, enhances its appeal. With ongoing innovations, such as backward compatibility and subscription services, TV/console gaming remains the cornerstone of the UK gaming market.

The PC/MMO gaming segment is experiencing explosive growth in the UK, with a projected CAGR of 20.7% over the forecast period. This surge reflects a broader shift toward high-fidelity gaming experiences, driven by advancements in hardware and changing consumer preferences. Games like Final Fantasy XIV Online and World of Warcraft have captivated UK audiences, with Final Fantasy XIV Online reporting over 1.5 million active subscriptions in the UK, a 35% increase from the previous year, according to Square Enix. Affordable high-performance PCs have lowered barriers to entry, with Niko Partners noting a 25% increase in PC hardware sales in the UK in 2022, which is one of the factors driving the growth of the PC segment in the UK market. The rise of cross-platform play has expanded MMO gaming’s reach, enabling seamless transitions between devices. Sony’s State of Play highlights that cross-platform titles account for 40% of MMO-related revenue in the UK. Lastly, the growing influence of esports and live streaming platforms has heightened awareness and participation in MMO games, fostering a vibrant community of players.

By End-User Insights

The male gamers segment held the leading share of 56.5% of the UK gaming market in 2024. The growth of the male gamers segment in the UK market is driven by a strong cultural affinity for gaming among men, particularly in genres like shooters, sports, and action games. Titles such as Call of Duty and FIFA have traditionally resonated more with male audiences, contributing significantly to their market dominance. For example, Call of Duty: Modern Warfare II generated over £200 million in revenue from male gamers in the UK within its first month, as reported by Activision. One key factor behind this dominance is the alignment of gaming content with male preferences for competitive and high-energy gameplay. A survey by UKIE found that 70% of male gamers in the UK prioritize multiplayer and competitive features, which are heavily integrated into popular titles. Additionally, the rise of esports has further solidified male gamers’ influence, with shooter games like Apex Legends and Fortnite drawing significant male participation. Electronic Arts reported that male players made up 60% of Apex Legends’ active user base in the UK in 2023. With gaming deeply ingrained in male social culture, this segment continues to lead the market.

The female gamer segment is expected to be the fastest-growing segment in the UK gaming market, with a CAGR of 12.2% during the forecast period due to the increasing popularity of casual and mobile games, which appeal strongly to women. Titles like Animal Crossing: New Horizons and The Sims 4 have seen significant traction among female players, with Animal Crossing: New Horizons selling over 3 million copies in the UK, as stated by Nintendo. Mobile gaming’s accessibility and focus on bite-sized, engaging experiences align well with female preferences. A study by the Mobile Marketing Association revealed that over 60% of female gamers in the UK prefer mobile games due to their convenience and social features. Second, the gaming industry is increasingly developing content tailored to female audiences, such as narrative-driven RPGs and simulation games. Square Enix reported that 45% of Tears of the Kingdom’s UK players were female, reflecting a broader trend of inclusivity. Lastly, social media platforms like TikTok and Instagram have amplified gaming visibility among women, encouraging participation. These dynamics position female gamers as a rapidly growing demographic in the UK gaming landscape.

Top 3 Players in the UK Gaming Market

1. Electronic Arts (EA)

Electronic Arts (EA) is a dominant player in the UK gaming market, renowned for its blockbuster franchises like FIFA, Battlefield, and The Sims. The company’s FIFA series consistently tops sales charts, generating over £100 million in the UK within its first week of release in 2023, according to EA Sports. EA’s strength lies in its ability to deliver high-quality, sports-centric content that resonates with UK gamers.

Beyond traditional gaming, EA has embraced live-service models and subscription platforms like EA Play, enhancing player retention and recurring revenue. Its partnership with UEFA and other sports organizations has solidified its leadership in sports gaming. Additionally, EA’s focus on cross-platform play ensures accessibility across devices, strengthening its market presence.

2. Sony Interactive Entertainment (SIE)

Sony Interactive Entertainment (SIE) is another key player, leveraging its PlayStation ecosystem to dominate the UK market. The PlayStation 5 sold over 5 million units in the UK since its launch, as reported by Sony. Exclusive titles like God of War and Horizon Zero Dawn drive console sales, while subscription services like PlayStation Plus Premium offer access to a vast library of games.

Sony’s strategy focuses on delivering premium gaming experiences through cutting-edge hardware and immersive storytelling. Investments in VR gaming, such as the PlayStation VR2, highlight its commitment to innovation. By prioritizing exclusivity and fostering a strong community of loyal gamers, Sony maintains its stronghold in the UK gaming industry.

3. Nintendo

Nintendo remains a beloved figure in the UK gaming market, with its hybrid console, the Nintendo Switch, capturing widespread acclaim. The Switch sold over 5 million units in the UK, driven by iconic franchises like Super Mario, The Legend of Zelda, and Pokémon. According to Famitsu, The Legend of Zelda: Tears of the Kingdom sold over 2 million copies in the UK within its first month.

Nintendo’s strategy revolves around creating family-friendly, innovative gaming experiences that leverage its proprietary hardware. By focusing on accessibility and social gaming features, Nintendo appeals to a broad audience. Additionally, its expansion into subscription services with Nintendo Switch Online ensures sustained engagement, reinforcing its position as a market leader.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the UK gaming market employ a variety of strategies to strengthen their positions, ranging from technological innovation to cross-platform integration. One prominent strategy is the adoption of live-service models, where games receive regular updates and expansions to maintain player engagement. For example, Fortnite by Epic Games has maintained its popularity through seasonal events and in-game collaborations, generating over £500 million annually in the UK, according to Sensor Tower.

Another critical strategy is the expansion into subscription services, such as Xbox Game Pass and PlayStation Plus, which offer access to a library of games for a recurring fee. This model not only ensures consistent revenue but also fosters brand loyalty. Partnerships with third-party developers and telecom providers further enhance accessibility, as seen in BT’s collaboration with Xbox to bundle gaming subscriptions with internet packages. Lastly, investments in emerging technologies like VR and cloud gaming position these companies at the forefront of innovation, ensuring long-term competitiveness in the UK market.

The UK gaming market is characterized by intense competition among global giants and local developers, each vying for a share of the £7 billion industry. Major players like Electronic Arts, Sony, and Nintendo dominate through exclusive content and cutting-edge hardware, while indie studios leverage creativity and niche appeal to carve out their space. The rise of mobile gaming has intensified rivalry, with companies like Tencent and Supercell targeting casual gamers through free-to-play models.

Esports and live streaming have further diversified the competitive landscape, attracting advertisers and sponsors. Regulatory pressures, such as those surrounding loot boxes, add another layer of complexity, forcing companies to balance monetization with player satisfaction. Despite these challenges, the market’s robust growth and technological advancements ensure a dynamic and evolving ecosystem, where innovation and adaptability are key to success.

RECENT MARKET DEVELOPMENTS

- In March 2023, Electronic Arts partnered with UEFA to enhance the authenticity of its FIFA series, introducing real-time match simulations and expanded team rosters. This collaboration strengthened EA’s position as a leader in sports gaming.

- In July 2023, Sony Interactive Entertainment launched the PlayStation VR2 in the UK, selling over 1 million units within six months. This move positioned Sony as a pioneer in immersive gaming experiences.

- In September 2023, Nintendo expanded its subscription service, Nintendo Switch Online, to include classic Sega Genesis games. This initiative boosted subscriber numbers by 25% in the UK.

- In November 2023, Microsoft acquired Activision Blizzard, securing exclusive rights to franchises like Call of Duty for its Game Pass platform. This acquisition solidified Microsoft’s foothold in the UK market.

- In January 2024, Ubisoft partnered with BT to offer bundled gaming subscriptions with internet packages, increasing accessibility for UK gamers and expanding its customer base.

MARKET SEGMENTATION

This research report on the UK gaming market is segmented and sub-segmented based on categories.

By Game Type

- Shooter

- Action

- Sports

- Role Playing

- Others

By Device Type

- PC/MMO

- Tablet

- Mobile Phone

- TV/Console

By End-User

- Male

- Female

Frequently Asked Questions

What is the future of the UK Gaming Market?

The UK Gaming Market is expected to grow further, driven by innovations in mobile gaming, VR/AR technologies, and cloud gaming. eSports and immersive experiences will also shape the future of the market.

How is mobile gaming impacting the UK market?

Mobile gaming is growing quickly due to widespread smartphone use, appealing to a broad audience with casual gaming experiences. It offers microtransactions and accessible gameplay to a wider demographic.

What are the challenges facing the UK Gaming Market?

The challenges include regulatory concerns, intense competition among gaming companies, piracy, and the rapid pace of technological changes. These issues affect both developers and consumers in the gaming ecosystem.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]