Global UHT Processing Market Size, Share, Trends, & Growth Forecast Report - Segmented By Application (Dairy Desserts, Milk, Dairy Alternatives, Juices, Soups And Other Applications), Mode Of Equipment Operation (Direct UHT Processing And Indirect UHT Processing), End Product Form (Liquid And Semi-Liquid), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global UHT Processing Market Size

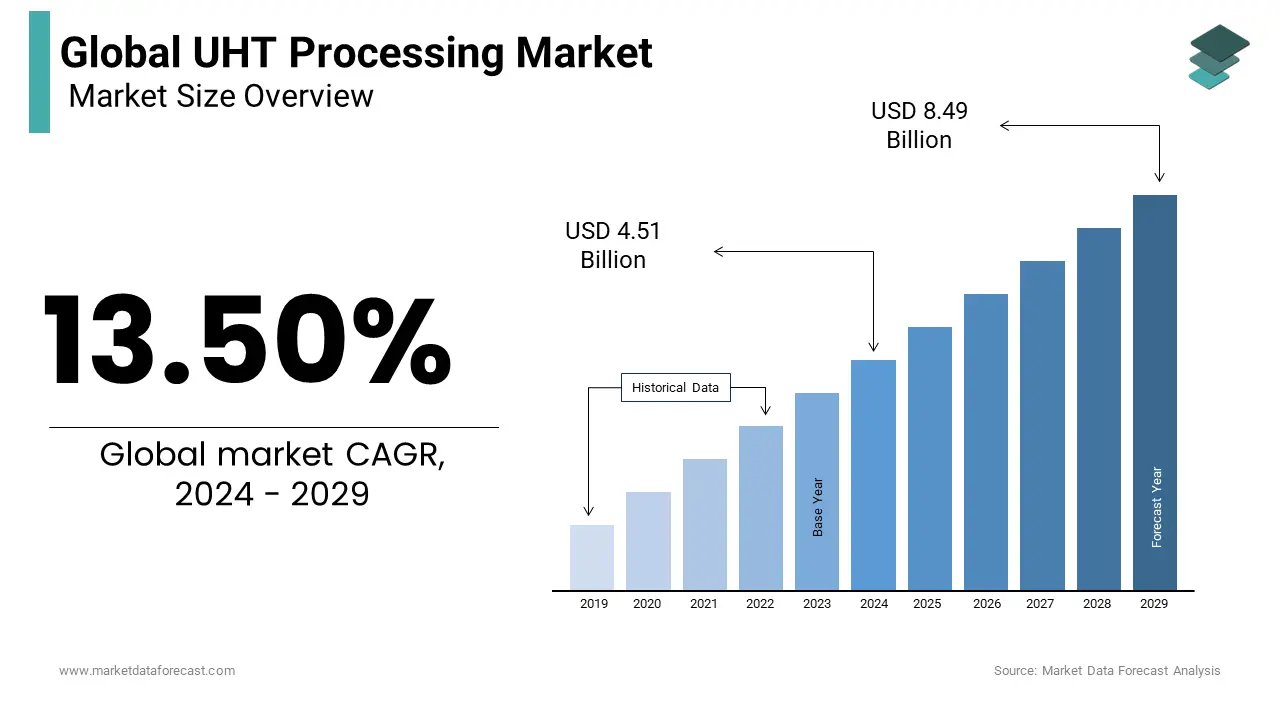

The global UHT processing market size was calculated to be USD 4.51 billion in 2024 and is anticipated to be worth USD 14.10 billion by 2033 from USD 5.12 billion In 2025, growing at a CAGR of 13.50% during the forecast period.

UHT treatment is also known as ultra-high temperature treatment. It is a food processing technology that sterilizes liquid foods and beverages. In the UHT process, milk or cream is heated to 138 to 150 ° C (280 to 302 ° F) for 1-2 seconds to kill harmful bacteria and microbes. UHT processing increases shelf life and primarily helps restore value-added nutrients in dairy products. UHT treatment requires both a sterilizer and a sterile device (for product packaging). The aim of this procedure is to identify the appropriate combination of processing time and temperature for various food products, at the same time, lessening the chemical changes and microbe damages. UHT processing or ultra high temperature processing is a food processing technology that pasteurizes liquid foods and beverages. The ultra-high temperature treatment kills bacteria and other harmful microorganisms present in the product while preserving vitamins and nutrients. The global UHT Processing market for organic acids is primarily driven by the growing demand for beverages with long shelf life.

MARKET DRIVERS

The growth rate of the UHT processing market is due to the use of sterilization, cryogenic sterilization to heat food to kill bacteria and spores present in food.

This process is also essential for human consumption, as it helps to preserve essential vitamins and nutrients. Because these products are processed with UHT, they maintain the restored nutritional value of the products, especially dairy products. In addition, since UHT processed products can be stored for a long time at room temperature without the need for refrigeration, manufacturers can store the products for longer, reducing logistics and storage costs. You need a cold warehouse to store. In addition, these products can withstand any atmospheric temperature, allowing long-distance transportation, which can reduce refrigeration costs and benefit especially in developing countries with very low refrigeration or power supply infrastructure. UHT treatment progresses at a high growth rate during the prognostic period. This process allows you to extend the shelf life of the liquid and dairy industry. This enhances the nutritional and functional benefits of the product. The growth of the processed food industry, food and beverage logistics, and customer expectations will generate high demand for these processes. Government funding for food testing labs and changing consumer dynamics on healthy eating habits will expand the market over the forecast period. The increase in food and beverage safety during the COVID-19 period will have a positive impact on the UHT processing market. However, the high cost of installing UHT plants limits the growing demand for this technology. With a growing demand for various products with a long shelf life; Coupled with the ability to store UHT processed products at room temperature for a longer period of time without the need for refrigeration, manufacturers can store their products longer, which is why these products do not, reducing logistics and storage costs. During the forecast period, it is necessary to stock cold warehouses which can be considered a key driver of UHT processing in the market. The demand for UHT processing is increasing as the demand for products with a longer shelf life increases and the demand for milk and dairy products grows around the world. The growing demand for packaged beverages with minimal manipulation of the nutritional components of foods and a long shelf life will accelerate the growth of the global market for ultra-high throughput processes. Additionally, reducing product degradation during shipping and eliminating additional refrigeration costs are some of the key factors that will drive market growth in the near future. As the demand for food and beverage products with a long shelf life increases, so does the market demand for UHT processing.

MARKET RESTRAINTS

Food and beverage processing manufacturers require significant capital investments to purchase and install UHT processing equipment.

These types of processing equipment not only have high installation costs, but require timely maintenance, which is a costly addition that affects operating margins and profits for food and beverage processors and manufacturers. The massive investment that prevents manufacturers from entering UHT processing serves to limit the market for UHT processing. Strict rules and regulations on processing and preservation prior to distribution and sale are a major problem in some regions of the Asia Pacific region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.50% |

|

Segments Covered |

By Application, Mode of operation, End product & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alfa Laval, GEA Group, Paul Mueller Company, Krones AG, IMA Group, Tetra Pak International SA, JBT Corporation, SPX Flow Inc, Natural Source group, Royal Bengal GmbH, Mina Mina, Veder Supplies BV, Dana Europe OU, Dano Food, Regilait, and Others. |

SEGMENTAL ANALYSIS

Global UHT Processing Market Analysis By Application

The dairy sector will occupy a large part of the market. This process extends the shelf life of the milk, reduces refrigeration, and adds nutritional and functional value. In addition to this, the consumption of UHT milk in European countries is increasing, leading to higher demand and market growth.

Global UHT Processing Market Analysis By Mode of Operation

The direct UHT section will generate high revenues in this market. Direct processing is less damaging to dairy products and has a relatively low investment cost compared to indirect processing. The straightforward process keeps the product at a reasonably high temperature for a short period of time, which is the biggest advantage for segment growth.

Global UHT Processing Market Analysis By End Product

The liquid form will show an upward trend in this market. Juice, milk, and soy milk are excellent sources of nutrition and can lead the UHT process market to better growth opportunities.

REGIONAL ANALYSIS

North America and European countries dominate the UHT processing market due to advanced economic and technological regions that use advanced equipment like UHT processing machines in their home countries, and Asia Pacific is the fastest growing region for the UHT processing market. The European region will lead the UHT process market towards high growth. The increasing levels of consumption of UHT milk and the strict regulations and protocols for local manufacturers will certainly have a positive impact on the market. The growth of healthy eating habits and the growth of the food processing industry will drive market demand in the region. Asia Pacific is the second largest and fastest growing market for UHT processing worldwide. As India is the largest milk producer in the world, the UHT processing market continues to increase in the Indian dairy processing equipment market. Australia and New Zealand are the world's leading manufacturers and suppliers of dairy and non-dairy products, importing equipment from Germany and the United States. UHT milk production is higher with dairy juice and dessert processing in Asia Pacific. Japan has made several advances in the use of membrane filters in the UHT plant. These factors have helped drive market growth.

KEY PLAYERS IN THE GLOBAL UHT PROCESSING MARKET

Major Key Players in the global UHT processing market are Alfa Laval, GEA Group, Paul Mueller Company, Krones AG, IMA Group, Tetra Pak International SA, JBT Corporation, SPX Flow Inc, Natural Source group, Royal Bengal GmbH, Mina Mina, Veder Supplies BV, Dana Europe OU, Dano Food, Regilait, and Others.

RECENT HAPPENINGS IN THE MARKET

- In June 2020, Tetra Pak introduced the first energy efficient treatment line for nectar, juices and beverages. This technology revolutionizes the beverage treatment process in two separate streams using a combination of filtration, pasteurization and UV technology.

- In February 2020, Alfa Laval launched a new generation of double wall heat exchangers that offer minimal risk with maximum thermal performance.

- In December 2018, the Keventer Group launched 'Keventer Milk', a UHT milk prepared using Tetra Pak's aseptic processing and packaging technology.

DETAILED SEGMENTATION OF THE GLOBAL UHT PROCESSING MARKET INCLUDED IN THIS REPORT

This research report on the global UHT processing market has been segmented and sub-segmented based on application, mode of operation, form of product, and region.

By Application

- Dairy Desserts

- Soups

- Milks

- Juices

By Mode of Operation

- Direct Processing

- Indirect Processing

By form of the product

- Liquid

- Semi-Liquid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East And Africa

Frequently Asked Questions

1. What are the technological aspects of UHT processing?

UHT processing typically involves heating the liquid product using direct or indirect heating methods, followed by rapid cooling and aseptic packaging to prevent recontamination. Advanced equipment ensures precise temperature control and sterilization.

2. What are the global market trends driving the UHT processing industry?

Trends include increasing consumer demand for convenience foods with extended shelf life, growth in the dairy alternatives market, expansion of urban populations seeking ambient-stable products, and technological advancements in packaging and processing equipment.

3. What challenges does the UHT processing industry face?

Challenges include maintaining product quality and taste after processing, addressing energy consumption during high-temperature heating, managing costs associated with specialized equipment and packaging, and meeting regulatory standards for food safety.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]