Global Drone Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report By Type (Commercial Drones and Military Drones), Payload (Up to 150 kg, Up to 600 kg, and More than 600 kg), Component (Camera, Battery, Propulsion System, Controller, Sensor, Navigation System, Range Extender, Frame, and Others), Application and Region (North America, Europe, APAC, Latin America, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Drone Market Size

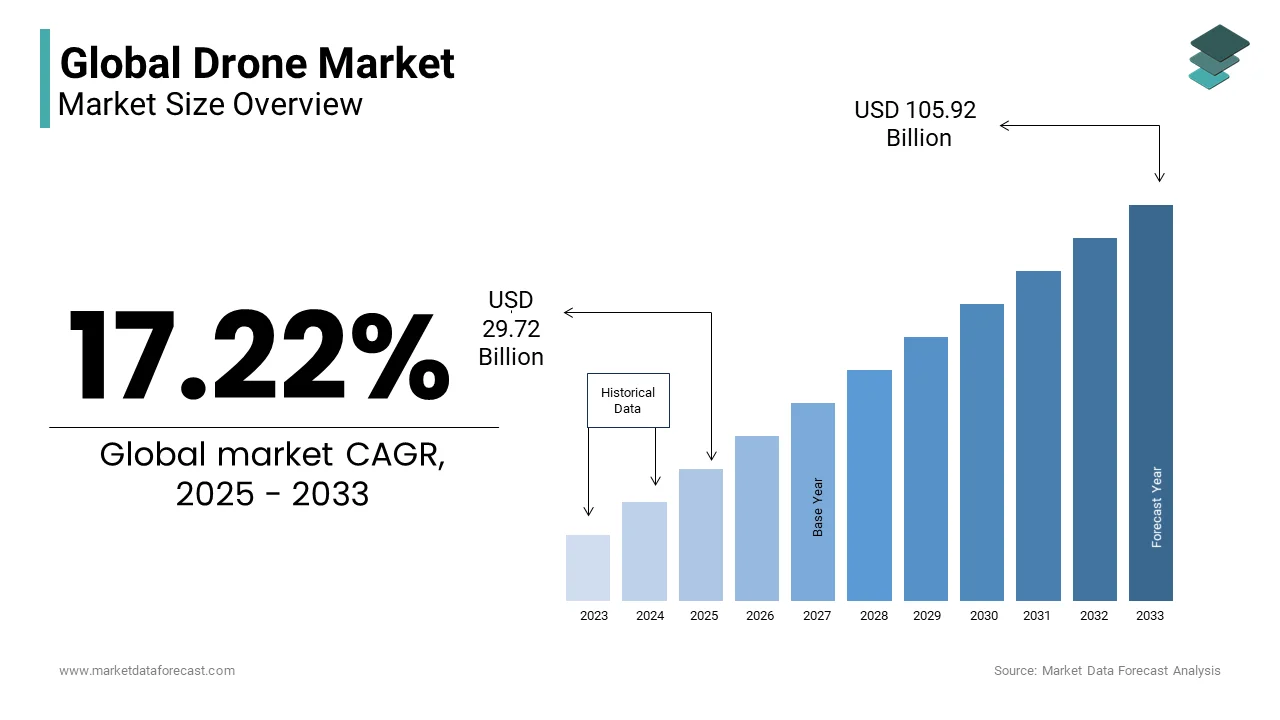

The size of the global drone market size was valued at USD 25.35 billion in 2024. The global market size is anticipated to be worth USD 105.92 billion by 2033 from USD 29.72 billion in 2025, growing at a CAGR of 17.22% from 2024 to 2033.

Drones have evolved from niche military tools to versatile assets across various sectors. These aircraft operate without an onboard human pilot, either through remote control or autonomous systems. Their applications span from aerial photography and agricultural monitoring to infrastructure inspection and emergency response. According to the Federal Aviation Administration (FAA), over one million drones are registered in the United States with approximately 409,000 designated for commercial use. This surge reflects the expanding adoption of drones in business operations. The Association for Uncrewed Vehicle Systems International (AUVSI) reports that companies based in China control 90% of consumer drones and over 70% of enterprises. This dominance is primarily attributed to competitive pricing and rapid technological advancements.

MARKET DRIVERS

Regulatory Support and Integration into National Airspace

Governmental regulatory frameworks have significantly facilitated the integration of drones into national airspaces is propelling market growth. The Federal Aviation Administration (FAA) has implemented comprehensive guidelines by including the Part 107 rule, which outlines operational limitations, certification requirements, and operational waivers for commercial drone use. As of May 2021, the FAA had registered over 873,000 drones in the United States, with approximately 42% designated for commercial purposes. This regulatory clarity has encouraged businesses to adopt drone technology by fostering innovation and expanding applications across various industries. The FAA continues to update its regulations to accommodate advancements in drone capabilities by ensuring safety while promoting industry growth.

Cost Efficiency and Operational Benefits

The cost-effectiveness and operational advantages of drones have been pivotal in their widespread adoption. Drones offer a more affordable alternative to traditional manned aircraft for tasks such as aerial surveying, infrastructure inspection, and agricultural monitoring. The U.S. Department of Transportation highlights that drones can reduce labor and operational costs, increase data acquisition speed, and enhance safety by accessing hazardous or hard-to-reach areas without risking human life. These benefits have led to increased utilization of drones in sectors like construction, agriculture, and public safety, where efficiency and safety are paramount. Drone technology continues to advance with these operational benefits which further drive market expansion.

MARKET RESTRAINTS

Regulatory Challenges

The evolving regulatory landscape presents significant hurdles for drone integration into national airspace. The Federal Aviation Administration (FAA) has established comprehensive guidelines, such as the Part 107 rule, which imposes restrictions on drone operations, including limitations on flying over people, operating at night, and requirements for pilot certification. These regulations, while essential for safety, can limit the scope of commercial drone applications. The FAA's Aerospace Forecast for Fiscal Years 2023–2043 indicates that regulatory constraints are a primary concern for stakeholders by potentially slowing the adoption of drone technology across various industries.

Public Safety and Privacy Concerns

Public apprehension regarding safety and privacy issues poses a significant barrier to the widespread acceptance of drones. Incidents involving unauthorized drone flights near critical infrastructure have heightened these concerns. For instance, in December 2024, the FAA imposed temporary flight restrictions over 22 critical infrastructure sites in New Jersey following reports of unauthorized drone activities. Such incidents underscore the challenges in ensuring safe and responsible drone operations. The FAA emphasizes the importance of addressing these concerns to foster public trust and facilitate the safe integration of drones into the National Airspace System.

MARKET OPPORTUNITIES

Expansion of Drone Delivery Services

The burgeoning field of drone delivery presents a significant opportunity within the drone market. Companies like Zipline have demonstrated the viability of this service, completing over 1.3 million commercial deliveries and covering nearly 100 million miles, primarily in Africa. In the United States, the Federal Aviation Administration (FAA) is advancing regulations to facilitate beyond visual line of sight (BVLOS) operations, a critical step toward widespread drone delivery adoption. As of December 2024, the FAA has been progressing towards more flexible drone operation regulations which could further propel the industry. This regulatory evolution, coupled with technological advancements, positions drone delivery as a transformative force in logistics, offering rapid, efficient, and environmentally friendly solutions for transporting goods.

Advancements in Agricultural Applications

Drones are increasingly integral to precision agriculture which is offering farmers enhanced capabilities in crop monitoring, soil analysis, and resource management. The Federal Aviation Administration (FAA) notes that the agricultural sector is a significant adopter of drone technology, utilizing unmanned aircraft systems (UAS) for tasks such as aerial surveying and monitoring. These applications enable farmers to optimize yields, reduce input costs, and implement sustainable practices. The FAA's Aerospace Forecast indicates that such technological progress is expected to continue is driving the adoption of drones in agriculture. As drone technology advances, its role in agriculture is poised to expand, offering innovative solutions to meet the challenges of modern farming.

MARKET CHALLENGES

Limited Infrastructure for Beyond Visual Line of Sight (BVLOS) Operations

The absence of comprehensive infrastructure to support Beyond Visual Line of Sight (BVLOS) operations poses a significant challenge to the drone market's expansion. The Federal Aviation Administration (FAA) acknowledges that current regulations primarily permit Visual Line of Sight (VLOS) operations, limiting drones' range and potential applications. The FAA's Aerospace Forecast for Fiscal Years 2023–2043 emphasizes the necessity for developing infrastructure and regulatory frameworks to facilitate safe BVLOS operations, which are crucial for applications like package delivery and large-scale agricultural monitoring. Without such infrastructure, the scalability of drone operations remains constrained, hindering market growth.

Cybersecurity Risks

The increasing reliance on drones across various sectors amplifies concerns regarding cybersecurity vulnerabilities. The U.S. Department of Transportation's Research, Development, and Technology Strategic Plan highlights the imperative to address cybersecurity challenges associated with unmanned aircraft systems (UAS). Potential threats include unauthorized access, data breaches, and system hijacking, which could compromise sensitive information and operational integrity. The plan underscores the need for robust cybersecurity measures to protect UAS operations, noting that failure to mitigate these risks could deter adoption and impede the integration of drones into critical infrastructure sectors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.22% |

|

Segments Covered |

By Type, Payload Outlook, Components Outlook, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3D Robotics, Inc. (3DR) (USA), Aeroscout GmbH (Switzerland), AeroVironment, Inc. (the USA), Aidrones GmbH (Germany), Alcore Technologies (France), BAE Systems PLC (United Kingdom). |

SEGMENTAL ANALYSIS

By Type Insights

The commercial segment dominated the drone market by accounting for 74.1% of the global market share in 2024. Globalization and trade are major contributors are majorly driving the expansion of the commercial segment in the global market, with the World Trade Organization (WTO) reporting a 3.5% growth in global trade volumes in 2022, projected to grow at an average of 3.3% annually through 2030. The International Maritime Organization (IMO) highlights that 80% of global trade by volume and 70% by value is transported via maritime shipping with the commercial sector's reliance on global trade. Furthermore, infrastructure investments, such as the $1.2 trillion U.S. Infrastructure Investment and Jobs Act (2021), have bolstered the commercial sector by modernizing transportation networks, airports, and seaports.

On the other hand, the adoption of drones in the military industry is growing at a brisk pace and this segment is estimated to witness a CAGR of 7.4% over the forecast period. The demand for military drones is driven by their strategic advantages in modern warfare. Drones like the MQ-9 Reaper, used by the U.S. military for surveillance and airstrikes, are central to intelligence, surveillance, and reconnaissance (ISR) missions. The global demand for military drones has increased due to their ability to provide real-time data without putting soldiers at risk, especially in high-risk or hostile environments. The U.S. military, for instance, operates over 1,000 MQ-9 Reapers, and global fleets of UAVs are expanding rapidly. The strategic importance of military drones is also reflected in the increasing global arms race and geopolitical tensions. Countries around the world are investing in military UAVs to enhance their defense capabilities. For example, in 2023, China’s defense budget allocated USD 1.5 billion for UAV and drone technology development by making drones a significant part of their modernized military arsenal, according to the Chinese Ministry of Defense.

By Payload Insights

The up to 25 kg payload segment accounted for a dominant share of 78.4% of the global drone market in 2024. The domination of the up to 25 kg payload segment in the global market is primarily driven by its versatility, affordability, and ease of use. This segment is widely used across various industries, including agriculture, construction, media and entertainment, and security. Drones in this payload range are ideal for crop monitoring, precision agriculture, site surveys, aerial photography, and real-time surveillance. The Federal Aviation Administration (FAA) has projected that the number of drones in the U.S. could exceed 2 million by 2025, with a significant portion of these falling into the up to 25 kg category. This broad adoption is also driven by the accessibility of these drones for small businesses and independent operators. Drones in this range are highly favored in commercial applications due to their ability to perform detailed inspections, capture high-quality imagery, and monitor expansive areas at relatively low operational costs. The widespread application and increasing popularity of these drones continue to solidify their dominance in the market.

The above 600 kg payload segment is projected to grow at a CAGR of 25.8% from 2025 to 2033. The above 600 kg payload segment is the fastest-growing in the drone market. The growth in this segment is driven by the rising demand for heavy-lift drones capable of carrying significant cargo over long distances, which is crucial for industries such as logistics, military, and construction. For example, in August 2024, China conducted a test flight of the SA750U, a civilian drone capable of carrying up to 3.2 metric tons of cargo. This test highlights the potential of heavy-lift drones to revolutionize sectors that require transportation to remote or hard-to-reach areas. The low-altitude economy, which includes heavy-lift drones, is projected to become a 2-trillion-yuan industry by 2030, further emphasizing the growth potential in this segment. Additionally, the easing of airspace regulations and increasing investments in drone technology are expected to accelerate the adoption of heavy-lift drones. These drones are also playing a crucial role in military and defense logistics, where they are used to transport equipment to areas with limited infrastructure. The technological advancements in this area, along with the growing demand for more efficient and faster delivery solutions, position the above 600 kg payload segment as the fastest-growing in the drone market.

By Application Insights

The agriculture segment is one of the rapidly growing segments in the global drone market and is projected to showcase a CAGR of 14.14% over the forecast period owing to the increasing adoption of drones in precision agriculture, where they are used for crop health monitoring, irrigation management, pest control, and yield optimization. Drones equipped with advanced multispectral sensors can gather data that is invaluable for precision farming by identifying plant health, soil quality, and irrigation needs. According to the U.S. Department of Agriculture (USDA), drones in agriculture help farmers save costs by reducing the need for manual labor and enhancing productivity through real-time data. Drones are particularly useful for monitoring large fields of crops, as they can cover up to 1,000 acres per day, offering high-resolution images to assess crop conditions.

REGIONAL ANALYSIS

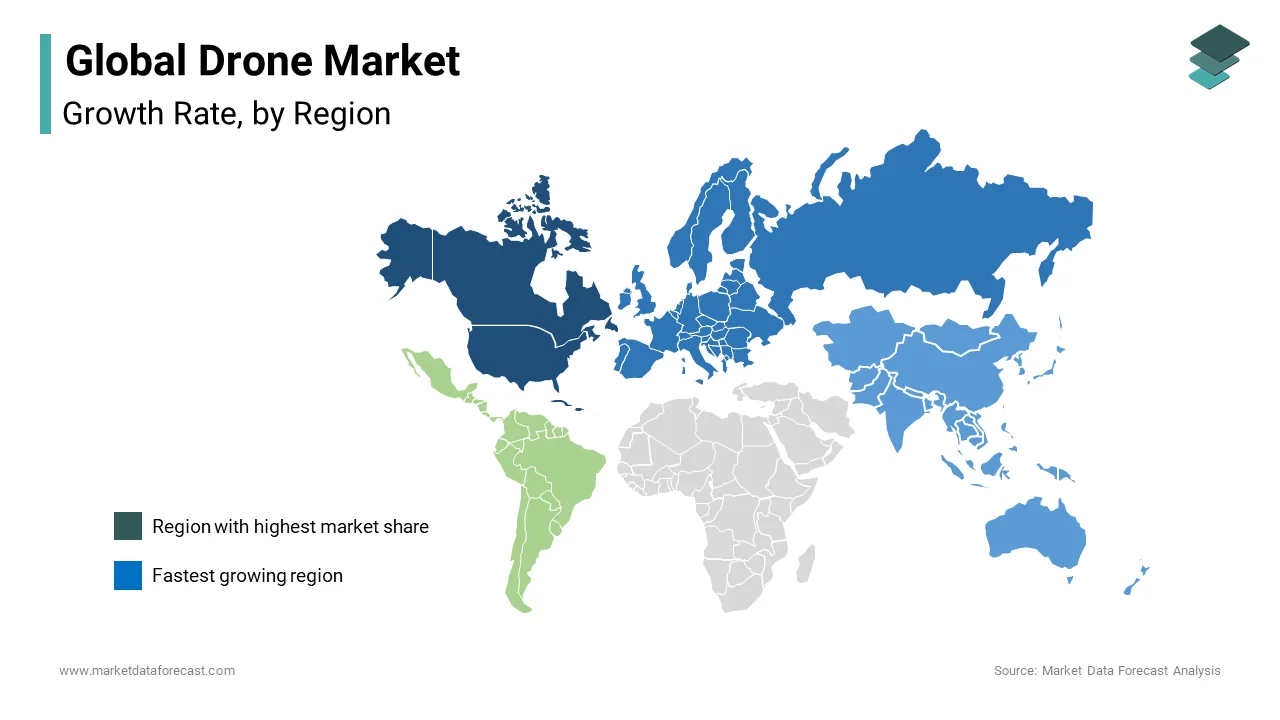

North America played a dominating role in the global market and captured 41.8% of the global drone market share in 2024. The domination of North America is attributed to several factors, including significant investments in drone technology, favorable government policies, and the widespread use of drones across various commercial sectors such as agriculture, construction, film, and media. The Federal Aviation Administration (FAA) has played a critical role in promoting drone adoption by creating a regulatory framework that allows for the safe integration of drones into national airspace. FAA has collaborated with state and local governments to create drone-friendly environments, which has accelerated the growth of the drone market in this region. The robust presence of major drone manufacturers, such as DJI, Parrot, and Skydio, in the region further strengthens North America's leadership in the global market. The U.S. also leads in the use of drones for commercial purposes, such as surveying, agriculture, and last-mile delivery services is contributing to the sector's expansion.

The Asia-Pacific (APAC) region is the fastest-growing segment in the global drone market, with a projected Compound Annual Growth Rate (CAGR) of 11.2% over the forecast period. This rapid growth can be attributed to a combination of factors, including rapid technological advancements, increased industrial applications, and favorable regulatory environments in countries like China, India, Japan, and South Korea. China is one of the largest producers of drones, and the government has been actively supporting the expansion of drone technology in commercial sectors such as agriculture, logistics, public safety, and surveillance. In 2023, the Chinese government rolled out new policies to facilitate the development of commercial drone applications, particularly in agriculture, where drones are being used for crop monitoring, pesticide spraying, and land surveying. The Chinese Ministry of Agriculture reports that drones are being used on over 60 million hectares of land for agricultural purposes, and this number is expected to increase as the government provides financial incentives for drone integration. Japan is another key player in the APAC region, with its Self-Defense Forces (SDF) incorporating drones into military operations. Japan's Drone Industry Association has forecasted rapid growth in drone services across sectors like construction and delivery, projecting the industry to grow to USD 7.5 billion by 2028. The regulatory environment is also evolving, with countries in the region implementing rules to facilitate safe drone operations, particularly in densely populated urban areas. The APAC region’s growing demand for drones in both civilian and military applications is fueling its expansion by making it the fastest-growing globally.

Europe is experiencing strong growth in the global drone market which is driven by increasing demand in aerial surveying, agriculture, and infrastructure inspections. The European Union is actively supporting the drone industry, having established the European Union Aviation Safety Agency (EASA) to regulate and ensure the safety of drones across member states. The UK, in particular, has seen significant growth in the commercial drone market. This growth is fueled by increased use in sectors such as construction for aerial surveys and real estate for property photography. Drones are also being used in emergency situations for search and rescue missions and disaster relief. Germany and France are adopting drones for urban air mobility and delivery services, with companies like Wingcopter and Volocopter leading the way. The EU Drone Strategy 2.0 aims to develop drone traffic management systems by 2025, which will further encourage growth in this sector. This region’s steady demand for drone services in commercial sectors and its focus on innovation and regulatory support make Europe a key player in the global market.

In Latin America, the drone market is gradually growing by increasing adoption in agriculture, mining, and border security. Countries such as Brazil and Mexico have been early adopters of drones in agricultural applications, using them for crop monitoring, precision farming, and soil analysis. Brazil’s government has supported the development of drone technology by implementing national strategies for agricultural sustainability which includes encouraging the use of drones in farm management. The drone market in Latin America is expected to see increased growth in the coming years as regulatory frameworks evolve and technology becomes more accessible. However, adoption rates remain slower compared to regions like North America and Asia-Pacific, due in part to economic challenges and less-developed infrastructure. Drone technology is becoming more affordable and industries recognize its benefits in sectors like agriculture and disaster relief that is expected to enhance the growth rate of the market over the next decade.

The Middle East and Africa (MEA) region is also experiencing gradual growth in the drone market, particularly in military, defense, and infrastructure development. The United Arab Emirates (UAE), in particular, has emerged as a key market for drones, with significant investments in urban air mobility and smart city solutions. The UAE’s Dubai is a leader in drone delivery services and drone-based urban air transport, with initiatives such as the Dubai Drone Program, which aims to develop an autonomous transport network by 2030. In Africa, drones are being used for surveillance, search and rescue, and healthcare logistics, particularly in remote areas. The World Health Organization (WHO) has partnered with drone operators in countries like Rwanda to deliver medical supplies and vaccines to hard-to-reach regions. The MEA region is expected to expand as these technological adoptions increase, and governments focus on enhancing infrastructure and security. Though the market is still in its early stages which is continued investment in both commercial and defense applications will drive growth in the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a key role in the global drone market include 3D Robotics, Inc. (3DR) (USA), Aeroscout GmbH (Switzerland), AeroVironment, Inc. (the USA), Aidrones GmbH (Germany), Alcore Technologies (France), BAE Systems PLC (United Kingdom), Boeing Company (USA), Delta Drone (France), DJI (China), Elbit Systems Ltd. (Israel), General Atomics Aeronautical Systems, Inc. (the USA), ING Robotic Aviation (Canada), Israel Aerospace Industries (IAI) (Israel), Leonardo SpA (Italy), Lockheed Martin Corporation (USA), Nimbus Srl (Italy), Northrop Grumman Corporation (USA), Parrot SA (France), Precisionhawk Inc. (USA), SAAB AB (Sweden), Textron Inc. (USA), Thales Group (France), VTOL Technologies (United Kingdom), Xiaomi, Inc. (China), and Yuneec Asia (Hong Kong).

The drone market is highly competitive, with several key players vying for leadership across various sectors, including consumer drones, military drones, and commercial applications such as agriculture, surveying, and infrastructure inspections. DJI, the dominant player in the consumer drone market, holds a significant market share of over 70% and continues to lead with its consumer-friendly drones and enterprise-grade solutions. However, competitors like AeroVironment, Autel Robotics, and Parrot are carving out niches with advanced technologies, targeting specialized industries such as military defense, public safety, and precision agriculture.

The market is driven by rapid technological innovation, with companies continuously upgrading drone capabilities such as autonomous flight, advanced imaging systems, and AI-powered navigation. This technological race has led to the development of drones capable of more precise data collection, enhanced safety features, and longer flight durations. Moreover, as drones find applications in industries like construction, logistics, and energy, players are investing in specialized solutions to cater to sector-specific needs.

Additionally, there is a surge in partnerships, acquisitions, and international expansion as companies seek to diversify their product offerings and tap into emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East. As the industry evolves, the competition in the drone market remains fierce, with companies focused on innovation and market expansion to secure their position in a rapidly growing sector.

TOP 3 KEY PLAYERS IN THE MARKET

SZ DJI Technology Co. Ltd.

(DJI) is the global leader in the drone market. Based in Shenzhen, China, DJI has fundamentally transformed both the consumer and commercial drone markets with its innovative products. In the consumer segment, DJI’s Phantom and Mavic series have become iconic for their user-friendly design, high-quality cameras, and versatility in aerial photography, cinematography, and recreation. DJI also leads the enterprise drone market, with solutions like the Matrice series used in industries such as agriculture, construction, surveying, and infrastructure inspections. The company’s advanced autonomous flight technologies, along with its ongoing work on drone delivery systems and mapping solutions, further solidify DJI’s leadership role. Its influence on the drone market through technological advancements and product innovation is unparalleled, making it a cornerstone of the industry.

AeroVironment Inc.

AeroVironment Inc. is a major player in the military and defense drone market from the U.S. The company is known for its small unmanned aircraft systems (sUAS) used for reconnaissance, surveillance, and intelligence gathering. Key products like the Raven, Wasp, and Puma drones are heavily utilized by military forces worldwide, particularly by the U.S. Department of Defense, for tactical operations in complex environments. AeroVironment's drones provide real-time data to military personnel, enhancing operational effectiveness. In addition to defense applications, the company has expanded its drone technology into agriculture and commercial sectors. AeroVironment’s ongoing focus on autonomous flight and advanced data analytics strengthens its position in both military and commercial markets, making it a critical contributor to the global drone market.

Autel Robotics

Autel Robotics is an emerging force in the drone market, particularly as a direct competitor to DJI. Based in the U.S., Autel has made significant strides in the consumer and commercial drone markets with products like the EVO series. Known for their high-quality cameras, advanced safety features, and ease of use, Autel drones have gained popularity among both hobbyists and professionals. The company’s EVO II Pro, featuring a 6K camera and 360-degree obstacle avoidance, has become a favored choice for applications in surveying, photography, and inspection services. Autel's expansion into enterprise-grade drones for industries like agriculture and energy inspections highlights its increasing impact on the market. With its focus on developing reliable, cost-effective drone solutions, Autel is gaining market share and establishing itself as a key player in the industry.

Top strategies used by the key market participants

Technological innovation is at the forefront of most market participants’ strategies

Companies like DJI and AeroVironment are constantly enhancing their drones with the latest technologies, such as better camera systems, autonomous flight capabilities, and advanced sensors. DJI, for instance, is known for its continuous product upgrades like the Mavic 3 and Matrice 300 RTK, which offer advanced features for both consumers and enterprise customers in industries like aerial photography, construction, and agriculture. By staying ahead in terms of product development and continuously pushing the envelope in drone functionality, these companies ensure they meet the growing demands of the market.

Strategic partnerships also play a crucial role

For instance, DJI collaborates with companies like Intel to enhance its drones’ capabilities with advanced technology, such as RealSense for obstacle avoidance and AI-driven navigation. AeroVironment has formed strategic alliances with military contractors to expand its presence in defense applications. These partnerships not only allow companies to integrate advanced technologies but also help them tap into new verticals and geographies.

Market Expansion

Many drone companies target emerging markets like Asia-Pacific, Latin America, and the Middle East, where there is increasing demand for drone technologies in sectors such as agriculture, logistics, and infrastructure inspection. By entering these markets, companies diversify their revenue streams and reduce dependence on saturated markets like North America and Europe. Additionally, governments in these regions are introducing favorable regulations for drone operations, creating an opportunity for growth.

Acquisitions

Acquisitions are also a key strategy, particularly for companies looking to diversify their offerings. For example, AeroVironment acquired Arcturus UAV to expand its portfolio of long-endurance military drones. Similarly, Parrot has acquired companies such as Pix4D to enhance its capabilities in aerial mapping and 3D modeling. Acquisitions allow companies to integrate new technologies, broaden their product lines, and strengthen their competitive edge.

Regulatory Frameworks

Regulatory compliance and ensuring that drones adhere to local and international regulations is another important strategy. Players like DJI and AeroVironment work closely with regulatory bodies like the FAA in the U.S. and the EASA in Europe to ensure their products comply with safety standards. This focus on compliance helps avoid market entry barriers and ensures safer and more efficient operations in key regions.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, DJI, a leading drone manufacturer, released the Mavic 3 Pro series of drones. This release is anticipated to enhance the camera quality and advanced flight features for both professionals and consumers, reinforcing DJI's leadership in the consumer drone market and expanding its influence in industries like aerial photography and cinematography.

- In February 2024, AeroVironment, a provider of military and tactical drones, acquired Arcturus UAV for USD 405 million. This acquisition is expected to strengthen AeroVironment's position in the military drone sector by expanding its portfolio with long-endurance drones, particularly for defense and surveillance applications.

- In January 2024, Parrot Drones SAS, a French drone manufacturer, launched the Anafi USA drone with thermal imaging capabilities. This launch is anticipated to target the public safety and infrastructure inspection sectors, offering advanced drone solutions for search and rescue operations and energy inspections.

- In October 2023, Autel Robotics, a competitor to DJI, released the Autel EVO II Pro 6K with enhanced obstacle avoidance and AI-powered flight capabilities. This release is expected to help Autel expand its presence in the enterprise drone market, offering a high-quality drone for surveying, inspection, and mapping.

- In August 2023, Skydio, a leading autonomous drone company, secured USD 230 million in funding to expand its autonomous drone technology. This funding is expected to enhance the development of AI-powered drones for industries such as construction, search and rescue, and infrastructure inspections.

- In June 2023, Guangzhou EHang Intelligent Technology Co. Ltd., a leader in autonomous aerial vehicles, launched the EHang 216 autonomous passenger drone for urban air mobility. This launch is expected to pioneer the urban air mobility (UAM) sector and strengthen EHang's position in autonomous aerial vehicles for passenger and cargo transport.

- In April 2023, Intel Corporation, a technology giant, partnered with Skydio to integrate Intel RealSense technology into Skydio's drones. This partnership is expected to improve autonomous navigation and obstacle avoidance capabilities, expanding Skydio’s market in public safety and enterprise-level applications.

- In March 2023, Draganfly Innovations Inc., a Canadian drone manufacturer, partnered with Alberta Health Services to deploy drones for medical supply deliveries. This partnership is expected to expand Draganfly's use of drones in the healthcare sector, particularly for remote medical supply deliveries in rural or hard-to-reach areas.

- In November 2022, YUNEEC International, a prominent drone manufacturer, released the Typhoon H3, a professional drone for high-end aerial photography. This release is anticipated to strengthen YUNEEC's position in the consumer and commercial drone market, offering professional-grade imaging solutions for film production, construction, and surveying.

- In July 2022, PrecisionHawk Inc., a leader in commercial drone services, acquired Horizon Technologies to integrate satellite data with drone data analytics. This acquisition is expected to expand PrecisionHawk's capabilities in precision agriculture and energy infrastructure, allowing for more accurate real-time decision-making and improving efficiency in these sectors.

MARKET SEGMENTATION

This research report on the global drone market is segmented and sub-segmented based on type, payload, components, application and region.

By Type

- Commercial Drones

- Military Drones

By Payload

- Up to 150 kg

- Up to 600 kg

- More than 600 kg

By Components

- Camera

- Battery

- Propulsion System

- Controller

- Sensor

- Navigation System

- Range Extender

- Frame

- Others

By Application

- Law Enforcement

- Precision Agriculture

- Media & Entertainment

- Retail

- Inspection & Monitoring

- Surveying & Mapping

- Personal

- Education

- Spying

- Search & Rescue Operations

- Border Security

- Combat Operations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key applications of Drone?

UAV drones are used in various applications, including aerial photography and videography, agriculture, surveillance, search and rescue, environmental monitoring, and delivery services.

What are the challenges faced by the Drone Market?

Challenges include regulatory hurdles, concerns about privacy, potential security risks, and the need for robust communication systems for reliable control and data transfer.

What is the future outlook for the Drones Market?

The future of the drone market looks promising, with continued growth expected in areas such as commercial applications, defense, and public safety. Advancements in technology, regulations, and increasing awareness of the benefits of drone technology are likely to shape the market's trajectory.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]