Turkey Spices Market Size, Share, Trends & Growth Forecast Report By Product Type (Ground Spices (Red Pepper Flakes, Cumin, And Paprika), Spice Blends (Baharat and Isot Pepper), Application, Distribution Channel, and Country, Industry Analysis From 2025 to 2033

Turkey Spices Market Size

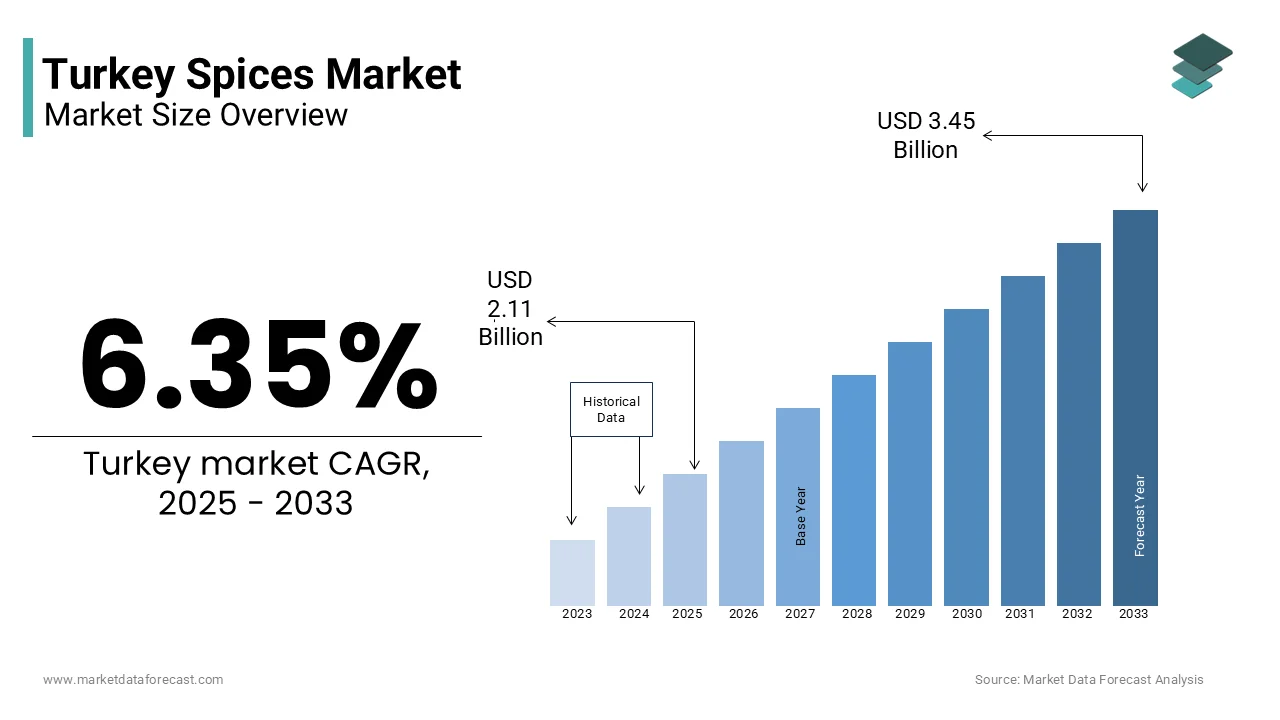

The Turkey Spices market was worth USD 1.98 billion in 2024. The Turkey Spices market is estimated to grow at a CAGR of 6.35% from 2025 to 2033 and be valued at USD 3.45 billion by the end of 2033 from USD 2.11 billion in 2025.

The Turkey spices market stands at a pivotal juncture in the global spices market due to its historical significance as a global spice trade hub, its rich culinary heritage, and evolving consumer preferences. The strategic geographic location of Turkey between Europe and Asia has historically positioned it as a bridge for spice trade, with key exports like red pepper flakes (pul biber), isot pepper, and sumac gaining international acclaim. The Turkish Exporters Assembly reports that spice exports grew by 20% in 2022, fueled by rising demand from Europe, the Middle East, and North America. Domestically, spices remain integral to Turkish cuisine, with traditional blends like baharat and salep powder being household staples.

Urbanization and changing lifestyles have further propelled growth, with supermarkets and hypermarkets accounting for 45% of total sales, as per Nielsen data. Online retail is rapidly emerging as a key channel, with platforms like Trendyol and Hepsiburada reporting a 35% year-over-year increase in spice purchases. Consumers are increasingly prioritizing organic and sustainably sourced spices, creating opportunities for brands to innovate. Additionally, the rise of food delivery apps and meal kit services has amplified spice consumption, as these platforms often feature dishes that rely heavily on traditional seasoning profiles.

MARKET DRIVERS

Globalization of Turkish Cuisine

The globalization of Turkish cuisine is a key driver propelling the turkey market growth. As per the Turkish Ministry of Trade, Turkish spices like isot pepper, sumac, and urfa pepper have gained recognition as premium ingredients in gourmet cooking, particularly in Europe and North America. Michelin-starred chefs and fusion restaurants have embraced these spices for their unique flavors, driving international demand. For instance, exports of isot pepper increased by 30% in 2022, reflecting its growing popularity. Social media platforms like Instagram and YouTube have played a significant role in popularizing Turkish recipes, encouraging home cooks worldwide to experiment with spices. Brands like Öncü Baharat and Nusret Spice have capitalized on this trend by launching export-focused product lines, achieving double-digit revenue growth in recent years.

Rising Health Consciousness

The increasing focus on health and wellness that has positioned spices as functional ingredients in both food and dietary supplements is further boosting the expansion of turkey spices market. Turmeric, known for its anti-inflammatory properties, has seen a surge in demand, with retail sales increasing by 25% in 2022, according to Nutrition Business Journal. Similarly, cinnamon and ginger are widely consumed for their digestive and immune-boosting benefits, making them popular choices among health-conscious consumers. A survey conducted by the Turkish Health Ministry found that 70% of urban consumers actively seek foods with added health benefits, creating a lucrative opportunity for spice manufacturers. Retailers like Migros and CarrefourSA have expanded their organic spice offerings, witnessing a 20% increase in sales within this category over the past two years.

MARKET RESTRAINTS

Climate Change and Agricultural Challenges

Climate change is one of the significant challenges to the Turkey spices market, disrupting production and driving up costs. According to the Turkish Meteorological Service, erratic rainfall and prolonged droughts have reduced spice harvests by up to 20% in key regions like Gaziantep and Hatay. For example, red pepper production declined by 15% in 2022 due to water scarcity, leading to a 35% spike in prices. Extreme weather events, such as floods in the Black Sea region, have further strained supply chains, exacerbating the problem. These environmental challenges not only impact domestic availability but also hinder Turkey’s ability to meet international export demands, posing long-term risks to market stability.

Counterfeit Products and Consumer Trust Issues

Counterfeit and adulterated products undermine consumer trust and brand reputation are further hindering the growth of the Turkey spices market. The Turkish Chamber of Commerce estimates that economic adulteration costs the food industry $500 million annually, with spices being particularly vulnerable due to their high value-to-weight ratio. Instances of synthetic dyes, fillers, and unauthorized additives being added to spices like saffron and chili powder have been widely reported, prompting stricter scrutiny from regulators. The Turkish Food Safety Authority uncovered that 12% of tested samples contained unauthorized additives, highlighting the scale of the issue. Such practices force legitimate manufacturers to invest heavily in authentication technologies, adding to operational costs.

MARKET OPPORTUNITIES

Expansion into Halal and Kosher Markets

Turkey’s strategic position as a predominantly Muslim country and its alignment with Islamic dietary laws present a significant opportunity to expand into halal-certified spice markets. According to the Halal Certification Institute, the global halal food market is projected to reach $1.9 trillion by 2025, with spices playing a crucial role in flavoring halal dishes. Turkish spices like cumin, coriander, and sumac are already staples in Middle Eastern cuisines, making them ideal candidates for halal certification. Additionally, kosher-certified spices are gaining traction in Jewish communities worldwide, creating cross-cultural opportunities. Companies like Nusret Spice and Öncü Baharat have begun exploring these niche markets, achieving a 25% revenue boost in 2022.

Digital Transformation and E-Commerce Growth

The rapid adoption of e-commerce is also a lucrative opportunity for the Turkey spices market. Statista reports that online grocery sales accounted for 18% of total retail in 2023, with spices being one of the fastest-growing categories. Platforms like Trendyol and Hepsiburada have witnessed a 40% surge in spice orders, driven by convenience and competitive pricing. Subscription-based models offered by brands like Spice Tribe have gained significant traction, achieving a 50% year-over-year revenue growth in 2022. Millennials and Gen Z consumers, who prioritize digital shopping, are particularly drawn to these platforms for their ability to access rare and exotic spices not typically available in brick-and-mortar stores.

MARKET CHALLENGES

Stringent Export Regulations in Turkey

Stringent regulatory standards governing spice exports is a major challenge for the Turkey spices market. The Turkish Food Safety Authority rejects nearly 10% of exported spices annually due to contamination risks, including microbial pathogens and pesticide residues. Compliance with these regulations often requires substantial investments in testing, certification, and quality assurance, which can be burdensome for smaller players. The Turkish Chamber of Commerce highlights that small-scale exporters face up to $20,000 in additional costs annually to meet regulatory requirements. Furthermore, discrepancies in permissible pesticide levels between Turkey and importing countries often result in rejected shipments, leading to financial losses and reputational damage for suppliers.

Price Volatility and Economic Uncertainty

Price volatility and economic uncertainty is also challenging the Turkey spices market. Fluctuations in currency exchange rates and inflationary pressures have driven up production costs, squeezing profit margins for manufacturers. According to the Turkish Central Bank, inflation reached 58% in 2022, impacting consumer purchasing power and reducing discretionary spending on premium spices. Additionally, geopolitical tensions and trade restrictions have created an unpredictable business environment, forcing companies to adopt cost-saving measures while striving to maintain innovation and quality standards.

SEGMENTAL ANALYSIS

By Product Type Insights

The ground spices segment dominated the Turkey spices market by holding the leading market share in 2024. The versatility, ease of use and ability to enhance flavor instantly make them indispensable in everyday cooking is primarily boosting the growth of the ground spices segment in the Turkey market. Popular varieties like red pepper flakes, cumin, and paprika are staples in Turkish kitchens, with sales growing at a steady rate of 6% annually. The rise of meal prep culture and the popularity of ready-to-cook meals have further fueled demand for ground spices.

The spice blends segment is estimated to progress at a CAGR of 7.74% over the forecast period. Nielsen data shows that pre-mixed blends like baharat and isot pepper have seen a 25% uptick in sales over the past two years, reflecting shifting consumer preferences. Millennials and Gen Z, who constitute a significant portion of the market, are particularly drawn to these blends for their ability to recreate complex traditional flavors effortlessly.

By Application Insights

The food and beverage (F&B) segment dominated the turkey spices market and held 64.8% of the regional market share in 2024. The dominance of F&B segment in the Turkish market is driven by the widespread use of spices in both commercial and household cooking. According to the Turkish Restaurant Association, 80% of restaurants incorporate spices to create signature dishes, driving bulk purchases.

The cosmetics and personal care segment is predicted to witness a CAGR of 9.2% over the forecast period due to the incorporation of spices like turmeric, cinnamon, and ginger into skincare and haircare formulations due to their antioxidant, anti-inflammatory, and antimicrobial properties.

By Distribution Channel Insights

The supermarkets and hypermarkets segment led the market by commanding the major share of 41.9% of the Turkish market share in 2024. The leading position of supermarkets and hypermarkets segment in the Turkish market is driven by their extensive reach, ability to cater to diverse consumer needs, and convenience of one-stop shopping. Prominent chains like Migros and CarrefourSA have optimized shelf space for spices, introducing private-label brands that offer competitive pricing.

The online retail segment is on the rise and is estimated to grow at a CAGR of 11.7% over the forecast period. Platforms like Trendyol and Hepsiburada have witnessed a 40% surge in spice orders, driven by convenience, competitive pricing, and a wide range of options.

TOP PLAYERS IN THE MARKET

Nusret Spice has established itself as a premium brand, offering high-quality, locally sourced spices that cater to both domestic and international markets. Known for its innovative packaging and marketing strategies, the company has successfully positioned itself as a leader in the gourmet spice segment.

Öncü Baharat is another prominent player, renowned for its wide range of traditional spice blends like baharat and isot pepper. The company’s commitment to sustainability and quality has earned it a loyal customer base, particularly among health-conscious consumers.

Migros Private Label spices have gained significant traction due to their affordability and accessibility. Leveraging its strong retail network, Migros has introduced a variety of organic and sustainably sourced spices, appealing to eco-conscious buyers.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players employ strategies such as product innovation, digital transformation, and partnerships to strengthen their positions. For instance, Nusret Spice launched a line of organic spice blends, targeting health-conscious consumers. Öncü Baharat partnered with e-commerce platforms to enhance its online presence, achieving a 25% increase in sales. Migros invested in AI-driven analytics to optimize supply chains and enhance customer engagement.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Turkey spices market include Aegean Grain Pulses Oil Seeds and Products Exporters' Association, McCormick & Company, Olam International, The Kraft Heinz Company, Migros, CarrefourSA, Trendyol, and Hepsiburada.

The Turkey spices market is highly competitive, characterized by intense rivalry among established players and emerging startups. Nusret Spice dominates with its premium offerings, leveraging its R&D capabilities. Öncü Baharat and Migros follow closely, focusing on affordability and innovation. Smaller players differentiate themselves through niche offerings, targeting specific consumer segments.

RECENT DEVELOPMENTS IN THE MARKET

- In April 2024, Nusret Spice launched an organic line targeting health-conscious buyers.

- In June 2023, Öncü Baharat partnered with Trendyol for enhanced online sales.

- In January 2023, Migros adopted AI for supply chain optimization.

- In September 2022, Nusret Spice expanded exports to Europe.

- In March 2022, Öncü Baharat introduced eco-friendly packaging.

MARKET SEGMENTATION

This research report on the Turkey spices market is segmented and sub-segmented based on categories.

By Product Type

- Ground Spices

- Red Pepper Flakes

- Cumin

- Paprika

- Spice Blends

- Baharat

- Isot Pepper

By Application

- Food and Beverage (F&B)

- Commercial Cooking

- Household Cooking

- Cosmetics and Personal Care

- Skincare Formulations

- Haircare Products

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Retail

Frequently Asked Questions

1. What is the projected growth rate for the Turkey spices market?

The market is estimated to grow at a compound annual growth rate (CAGR) of 6.35% from 2025 to 2033.

2. What factors are driving growth in the Turkey spices market?

Key drivers include increasing consumer interest in diverse flavors, health benefits associated with spices, and the rise of culinary trends.

3. Which segments are contributing to the growth of the Turkey spices market?

The ground spices segment, particularly red pepper flakes and cumin, as well as spice blends like baharat, are significant contributors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]