Turkey Perfume Market Size, Share, Trends & Growth Forecast Report By Product (Perfumes And Premium Perfumes), End-User, Distribution Channel, and Country, Industry Analysis From 2025 to 2033

Turkey Perfume Market Size

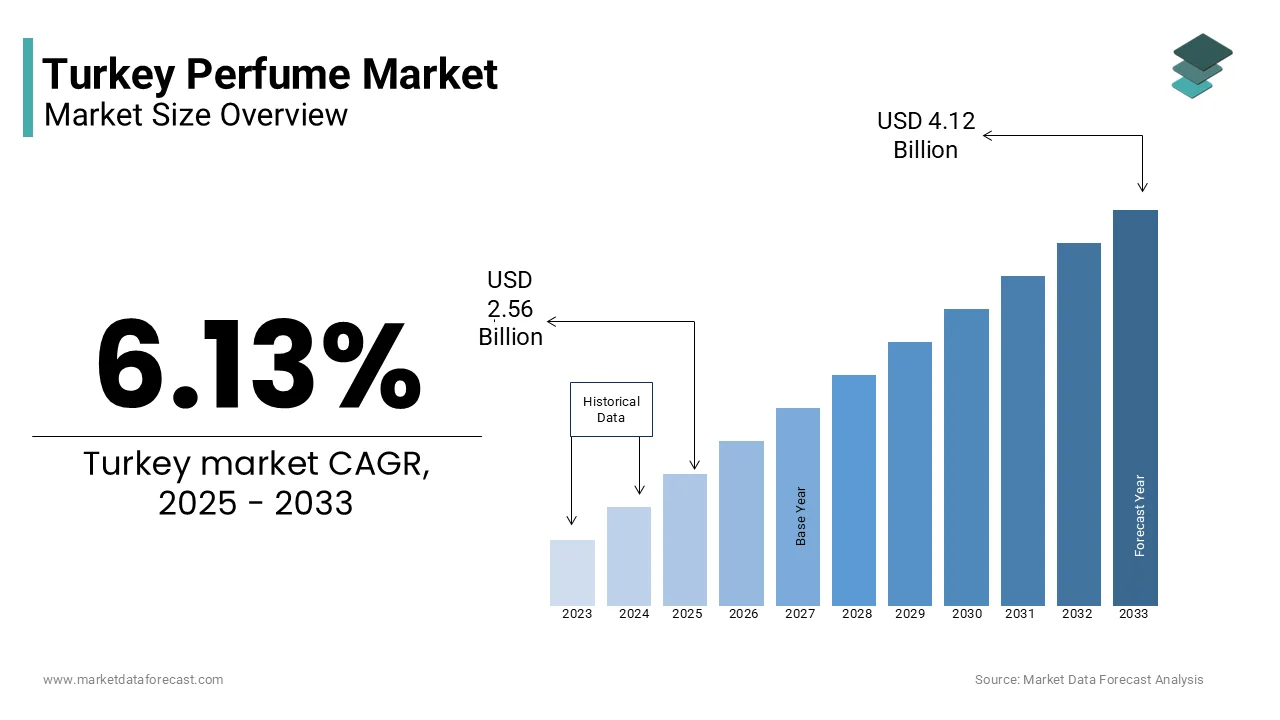

The Turkey Perfume market was worth USD 2.41 billion in 2024. The Turkey Perfume market is estimated to grow at a CAGR of 6.13% from 2025 to 2033 and be valued at USD 4.12 billion by the end of 2033 from USD 2.56 billion in 2025.

The Turkey perfume market has experienced prominent growth in the last few years owing to the cultural heritage, rising consumer sophistication, and the growing influence of digital platforms. Turkey’s historical role as a hub for fragrance production, particularly rose oil from Isparta, continues to shape its modern perfume industry. The Turkish Ministry of Trade reports that exports of fragrances and aromatic oils increased by 25% in 2022, fueled by global demand for natural and artisanal scents. Domestic consumption is also on the rise, with urban consumers increasingly prioritizing luxury and personalized fragrances. Retailers like Boyner and LC Waikiki have expanded their fragrance offerings, while e-commerce platforms like Trendyol and Hepsiburada have witnessed a 40% surge in online sales since 2021. Social media influencers and digital marketing campaigns have further amplified demand, making Turkey a vibrant player in the regional fragrance industry.

MARKET DRIVERS

Cultural Heritage and Artisanal Appeal

Turkey’s rich history in fragrance production, dating back to the Ottoman Empire, serves as a major driver for the domestic and international growth of its perfume market. According to the Turkish Exporters Assembly, Isparta, known as the "City of Roses," produces nearly 70% of the world’s rose oil, which is a key ingredient in high-end perfumes. This heritage has inspired local brands like Gülsha and Nishane to craft artisanal fragrances that blend traditional techniques with modern sensibilities. Consumers, both locally and globally, are drawn to these products for their authenticity and exclusivity. For instance, Gülsha’s rose-based perfumes saw a 35% increase in sales in 2022, reflecting the growing appetite for culturally significant scents. Additionally, the rise of niche perfumery has created opportunities for small-scale artisans to carve out a niche in the premium segment, appealing to affluent buyers who value craftsmanship over mass-market appeal.

Influence of Digital Platforms and Social Media

The explosive growth of social media and e-commerce platforms has revolutionized how perfumes are marketed and consumed in Turkey. As per data from the Turkish Advertising Association, over 70% of fragrance purchases in urban areas are influenced by Instagram and TikTok influencers. Platforms like TikTok have popularized “scent haul” videos and fragrance layering tutorials, encouraging younger consumers to experiment with new scents. Brands like Nishane and Xerjoff have capitalized on this trend by collaborating with influencers to create buzz around their products, achieving a 40% revenue boost in 2022. Furthermore, the rise of subscription-based services like ScentBird has made it easier for consumers to discover and try exclusive fragrances without committing to full-sized bottles. This digital-first approach has not only expanded the reach of Turkish perfumers but also positioned Turkey as a leader in innovative fragrance marketing.

MARKET RESTRAINTS

Economic Volatility and Consumer Spending Patterns

Economic instability in Turkey is one of the significant challenges for the Turkey perfume market, with inflation rates reaching 58% in 2022, as reported by the Turkish Central Bank. This has led to a decline in discretionary spending, particularly among middle-income households, who are more likely to prioritize essential goods over luxury items like premium perfumes. Fluctuations in currency exchange rates have also impacted the cost of imported raw materials, such as essential oils and synthetic compounds, driving up production costs by 30%. Smaller players, who lack the resources to absorb these increases, are forced to either raise prices or compromise on quality, both of which can alienate consumers. Additionally, geopolitical tensions and trade restrictions have created uncertainty, limiting the ability of Turkish brands to expand into international markets.

Limited Awareness of Sustainable Practices

Despite growing global demand for sustainable and ethical products, awareness of eco-friendly practices remains limited among Turkish consumers and manufacturers. According to a survey by the Turkish Chamber of Commerce, only 25% of perfume buyers actively seek out cruelty-free or vegan fragrances. This lack of awareness has hindered the adoption of sustainable practices, such as using biodegradable packaging or ethically sourced ingredients. Furthermore, counterfeit products often use substandard materials, undermining trust in the broader market. The Turkish Food and Drug Administration uncovered that 20% of tested samples failed to meet safety standards, highlighting the prevalence of low-quality imitations. These challenges not only erode consumer confidence but also make it difficult for legitimate brands to differentiate themselves in an increasingly crowded market.

MARKET OPPORTUNITIES

Growing Demand for Personalized Fragrances

The increasing desire for individuality and self-expression is likely to be a major opportunity for the Turkey perfume market. According to a study by the Turkish Retailers Association, over 60% of urban consumers prefer personalized scents that reflect their personality and lifestyle. Brands like Nishane and Arko have responded by launching customizable fragrance options, allowing customers to mix and match notes to create unique blends. This trend has gained particular traction among millennials and Gen Z, who view fragrances as an extension of their identity. Additionally, the rise of AI-powered scent profiling tools has enabled brands to offer tailored recommendations based on consumer preferences, further enhancing the shopping experience. By investing in personalization technologies, Turkish perfumers can tap into this lucrative segment and strengthen their competitive edge.

Expansion into Emerging Markets

Turkey’s strategic geographic location between Europe and Asia positions it as a gateway for expanding into emerging markets, particularly in the Middle East and North Africa. According to the Turkish Exporters Assembly, exports of Turkish perfumes to these regions grew by 30% in 2022, driven by rising disposable incomes and a growing appreciation for luxury goods. Brands like Gülsha and Nishane have successfully leveraged this trend by tailoring their product lines to suit regional preferences, such as musky and woody scents popular in Gulf countries. Furthermore, participation in international trade fairs and cultural events has helped Turkish perfumers build brand recognition abroad. By focusing on export-led growth and cross-cultural collaborations, Turkey can solidify its position as a global leader in the fragrance industry.

MARKET CHALLENGES

Competition from Global Luxury Brands

The dominance of global luxury brands like Chanel, Dior, and Gucci is one of the major challenges for local Turkish perfumers. According to Nielsen data, international brands account for nearly 40% of total sales in the premium segment, leaving smaller players struggling to compete on price and brand equity. These global giants benefit from extensive marketing budgets, celebrity endorsements, and established distribution networks, making it difficult for Turkish brands to gain visibility. Additionally, counterfeit versions of high-end fragrances are widely available in local markets, further diluting consumer trust and creating pricing pressures. To overcome this challenge, Turkish brands must focus on differentiation through storytelling, cultural heritage, and innovation, rather than competing solely on price.

Regulatory Hurdles for International Expansion

Stringent regulatory standards governing fragrance imports and exports is also challenging the growth of the Turkey perfume market. The Turkish Food and Drug Administration rejects nearly 10% of exported fragrances annually due to contamination risks, including synthetic additives and allergens. Compliance with these regulations often requires substantial investments in testing, certification, and quality assurance, which can be burdensome for smaller players. Furthermore, discrepancies in permissible ingredient levels between Turkey and importing countries often result in rejected shipments, leading to financial losses and reputational damage for suppliers. These hurdles not only limit international expansion opportunities but also force companies to divert resources away from innovation and marketing.

SEGMENTAL ANALYSIS

By Product Insights

The mass perfumes segment led the Turkey perfume market by occupying 65.7% of turkey market share in 2024. The affordability and widespread availability of mass perfumes make them accessible to a broad demographic, particularly in rural and semi-urban areas is one of the major factors propelling the Turkey market growth. According to the Turkish Retailers Association, mass fragrances account for nearly 80% of sales in discount stores and hypermarkets, driven by budget-conscious consumers. Popular brands like Axe and Nivea have capitalized on this trend by offering affordable yet appealing scents, achieving steady revenue growth. Promotional activities, such as discounts and bundled offers, have further solidified the segment’s leadership position.

The premium perfumes segment is anticipated to register the highest CAGR of 9.2% over the forecast period. Nielsen data shows that sales of luxury fragrances increased by 25% over the past two years, reflecting shifting consumer preferences toward exclusivity and personalization. Millennials and Gen Z, who constitute a significant portion of the market, are particularly drawn to niche and artisanal brands for their unique storytelling and high-quality ingredients. Social media platforms like Instagram and TikTok have played a pivotal role in popularizing premium scents, encouraging consumers to experiment with luxury fragrances.

By End User Insights

The female consumers segment dominated the Turkey perfume market and accounted for 58.7% of the Turkish market share in 2024. The dominating position of female segment in the Turkish market is driven by the cultural significance of fragrances as a symbol of femininity and self-expression. According to the Turkish Advertising Association, women are twice as likely as men to purchase perfumes, driven by social norms and marketing campaigns targeting female audiences. Leading brands like Estée Lauder and Lancôme have capitalized on this trend by launching exclusive collections tailored to women, achieving significant revenue growth in recent years.

The unisex segment is growing rapidly and is predicted to register the fastest CAGR of 10.5% over the forecast period owing to the rising popularity of gender-neutral scents, particularly among younger demographics. According to Statista, unisex fragrances accounted for 15% of total sales in 2022, up from 10% in 2020. Brands like Nishane and Xerjoff have launched inclusive collections, appealing to consumers seeking versatile and modern scents. The growing emphasis on individuality and breaking traditional gender norms has further amplified demand, positioning unisex fragrances as a transformative force in the market.

By Distribution Channel Insights

The offline retail segment dominated the market by holding 61.4% of the Turkish market share in 2024. The growth of the offline segment in the Turkish market is attributed to their widespread presence of shopping malls, department stores, and specialty boutiques, which offer consumers a tactile shopping experience. According to the Turkish Retailers Association, offline channels benefit from impulse purchases, with 70% of shoppers picking up perfumes during mall visits. Prominent chains like Boyner and LC Waikiki have optimized shelf space for fragrances, introducing private-label brands that offer competitive pricing.

The online retail segment is another promising segment and is anticipated to grow at a CAGR of 12.9% over the forecast period. Platforms like Trendyol and Hepsiburada have witnessed a 40% surge in perfume orders, driven by convenience, competitive pricing, and a wide range of options. Subscription-based models offered by brands like ScentBird have gained significant traction, achieving a 50% year-over-year revenue growth in 2022. Millennials and Gen Z consumers, who prioritize digital shopping, are particularly drawn to these platforms for their ability to access rare and exclusive scents.

TOP PLAYERS IN THE MARKET

Nishane has carved out a niche in the luxury segment, offering handcrafted fragrances inspired by Istanbul’s rich cultural heritage. Known for its artistic packaging and storytelling, the company has successfully positioned itself as a global luxury player.

Gülsha specializes in rose-based fragrances, leveraging Turkey’s reputation as a leading producer of rose oil. The brand’s commitment to sustainability and ethical sourcing has earned it a loyal customer base, particularly among eco-conscious consumers.

Arko is another prominent player, renowned for its affordable yet high-quality mass-market perfumes. The company’s focus on accessibility and innovation has made it a household name across Turkey

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players employ strategies such as cultural storytelling, digital engagement, and sustainability initiatives to strengthen their positions. For instance, Nishane launched a line of limited-edition fragrances inspired by Ottoman architecture to target luxury consumers. Gülsha partnered with e-commerce platforms to enhance its online presence, achieving a 30% increase in sales. Arko invested in AI-driven analytics to optimize supply chains and enhance customer engagement.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Turkey perfume market include Oriflame Holding AG, Hunca Kozmetik AS, Evyap Sabun Yag Gliserin San ve Tic AS, and Natura & Co Holding SA.

The Turkey perfume market is highly competitive, characterized by intense rivalry among established players and emerging startups. Nishane dominates with its premium offerings, leveraging its R&D capabilities. Gülsha and Arko follow closely, focusing on affordability and innovation. Smaller players differentiate themselves through niche offerings, targeting specific consumer segments.

RECENT DEVELOPMENTS IN THE MARKET

- In April 2024, Nishane launched a limited-edition collection targeting luxury buyers.

- In June 2023, Gülsha partnered with Trendyol for enhanced online sales.

- In January 2023, Arko adopted AI for supply chain optimization.

- In September 2022, Nishane expanded exports to Europe.

- In March 2022, Gülsha introduced eco-friendly packaging.

MARKET SEGMENTATION

This research report on the Turkey perfume market is segmented and sub-segmented based on categories.

By Product

- Mass Perfumes

- Premium Perfumes

By End-User

- Female Consumers

- Unisex Segment

By Distribution Channel

- Offline Retail

- Online Retail

Frequently Asked Questions

1. What is the projected growth rate for the Turkey perfume market?

The market is estimated to grow at a compound annual growth rate (CAGR) of 6.13% from 2025 to 2033.

2. What factors are driving growth in the Turkey perfume market?

Key drivers include increasing disposable incomes, changing consumer preferences toward premium fragrances, and a growing interest in niche and artisanal perfumes.

3. Which segments are significant in the Turkey perfume market?

The market is segmented into mass perfumes and premium perfumes, with mass perfumes holding a larger share.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]