Global Turf & Ornamental Inputs Market Size, Share, Trends, & Growth Forecast Report - Segmented By Synthetic Chemical Inputs (fertilizers, plant Growth Regulators, PesticidesType Of Turf Grass, Type Of Ornamental Grass, and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industrial Analysis From (2025 to 2033)

Global Turf and Ornamental Inputs Market Size

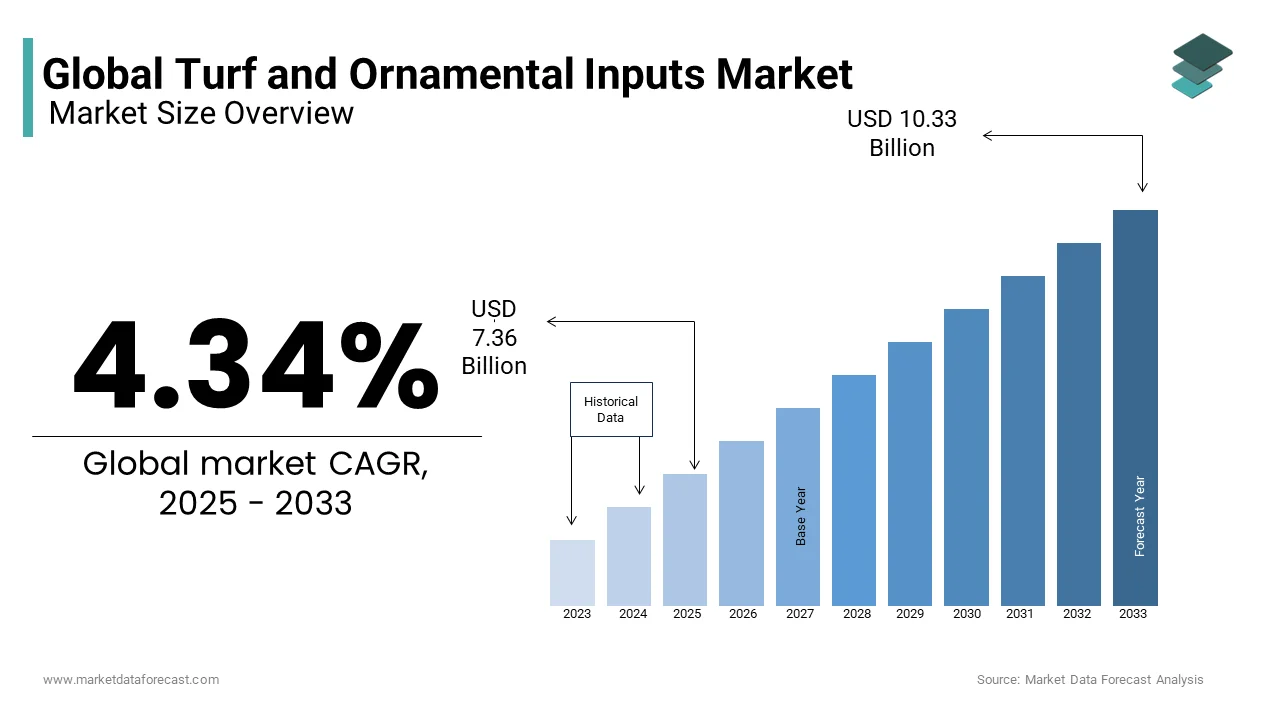

The global turf and ornamental inputs market was valued at USD 7.05 billion in 2024 and is anticipated to reach USD 7.36 billion in 2025 from USD 10.33 billion by 2033, growing at a CAGR of 4.34% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL TURF AND ORNAMENTAL INPUTS MARKET

The turf & ornamental inputs market is poised to grow significantly during the forecast period. The market consists of providing, handling, and sale of several types of turf and ornamental scientific inputs like pesticides, fertilizers, and plant growth regulators (PGR) for proper management and upkeep of turf and ornamental grass.

Presently, it is witnessing an influx of new technologies and innovations which is accelerating the market growth rate. For instance, to considerably cool down artificial turf, a new system was developed by the research team of Cirkel Dutch that utilizes evaporation. These depend on rainwater stored below an area of plastic grass.

It also saw the arrival of developments in blade structure and design, advancements in synthetic turf using environmentally friendly materials, superior grass fiber design, improved shock absorbency, and multi-ply backing which are some of the recently introduced technologies for artificial turf. These innovations strive to enhance the resilience, durability, and ecological footprint of this grass type.

Apart from this, there is extensive adoption of synthetic grass as the playing surface in North America which has a valuation of more than 2.7 billion U.S. dollars. So, currently, the market is advancing at a steady pace and is expected to gradually accelerate in the coming years.

MARKET DRIVERS

The growth of the global turf & ornamental inputs market is majorly driven by its greater functionality and reduced cost in contrast to natural grass. This is because it facilitates an increased number of sports to play on the field for a prolonged period of time with lower maintenance expenditure. From a biomechanical point of view, synthetic grass displays larger functional coefficients than natural turf leading to ankle and foot injury rates. In comparison with natural ones, the concussion rates on this grass type are much lesser owing to decreased values of g-max on well-kept artificial surfaces. For instance, knee, hip, and overall rates of injuries are rarely similar between the two field surfaces apart from certain populations comprising top-tier American football players that show higher knee hurt or incident rates on synthetic turf are few. It is due to these advantages, the market players and other stakeholders put forward that athletic or sporting associations with financial assistance to help professional groundskeeping must think about investing in this business.

The expanding population, dropping portions of farming land, food security, and the necessity for enhanced agricultural efficiency are the primary aspects propelling the market growth rate. Moreover, lately, there have been few findings and trends in the sphere of turf chemicals, which contributes to the market expansion. This includes bio-based formulations, sustainable solutions, green chemicals, etc. Besides these, water conservation, surging pollution levels in air and ground and the requirement for environment friendly options are also escalating the demand for input materials for ornamentals and turfs.

Additionally, other factors fuelling the market growth are increasing demand for these inputs from IPM practices, ease of availability, and better awareness about their scientific upkeep.

MARKET RESTRAINTS

However, factors such as high installation & usage costs and strict regulations are restraining the growth of the turf & ornamental market. The rules and guidelines in every country are different which makes it tough for market players to carry on their business without obstructions. The issues concern the use of chemicals, leading to a lack of understanding or uncertainty among the consumers who are operating in various areas.

- According to a study regarding the expenses and value of missed opportunities because of rules for the ornamental aquaculture industry in the state of Florida published in the Wiley Online Library, it was estimated that about 23.2 million dollars and 5.2 million dollars, respectively, was the projected value and legal expenditure of lost production for ornamental farms or estates in Florida.

The outcomes of a sector-level census have revealed that ornamental farmers face a substantial regulatory or compliance burden in specific categories.

MARKET OPPORTUNITIES

Bio-degradable coatings present potential opportunities for the expansion of the turf & ornamental inputs market.

- For instance, in May 2023, ICL introduced a novel bio-degradable coating, named eqo.s which is among the promising inventions or break-throughs given that controlled release fertilisers (CRFs) were launched in the market more than 50 years ago.

CRFs are an important component of sustainable turf management and a highly effective method for supplying nutrition for turf grass. Moreover, the eqo.s is the foremost technology for coating that bio-degrades rapidly once all the nutrients are discharged.

In the field of ornamental, bio-fertilisers are believed to gain more traction considering the growing focus on sustainability, environment and plant protection while ensuring attraction or aesthetic features. With their potential to improve the productivity of crops and lower reliance on chemicals, bio-fertilisers play a crucial part in encouraging eco-friendly and sustainable agricultural systems. For instance, Bacillus subtilis prevents the progress of pathogens like Alternaria, Phytophthora, and Botrytis, and enables suppression of disease in crops such as ornamentals, fruits, and vegetables. Further, several studies have stated they can enhance overall harvest output by between 10 per cent and 25 per cent.

MARKET CHALLENGES

Harmful chemicals are one of the major challenges derailing the growth trajectory of the turf & ornamental market. Given their surging application and popularity, it is expected to emerge or become an even bigger issue for the market players because it consists of hundreds of detrimental chemicals such as phthalates, PFAS, Volatile Organic Compounds (VOCs), arsenic, benzene, heavy metals, and lead, few of which are endocrine disruptors, neurotoxins, and carcinogenic (or carcinogens). Hence, it takes place as the prime impediment to market expansion.

Despite the introduction of new safer alternatives or options for turf filling materials, even they also include neurotoxins and carcinogens (like, PAHs, lead, etc.). This can possibly be happening owing to the limited understanding or knowledge of synthetic turfs as producers are not legally bound to disclose each and every information about the chemical used. Therefore, this decelerates the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.34% |

|

Segments Covered |

By Synthetic Chemical Inputs, Type of Turf Grass, Type of Ornamental Grass, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer, Syngenta, BASF, Best Forage LLC, Chemtura Agro Solutions, American Vanguard Corporation, Dow Agro Sciences, Adama Agricultural Solutions and Nufarm Ltd. |

SEGMENTAL ANALYSIS

Global Turf and Ornamental Inputs Market By Synthetic Chemical Inputs

The Fertilizers segment is the largest segment, by Synthetic Chemical Inputs, with a market share of around 74%.

The fertilizers segment is the biggest category of the turf & ornamental inputs market and is expected to remain on the growth course during the forecast period. The growth of the segment’s market share can be linked to the greater emphasis on lawn care. Moreover, lawn fertilization is important for setting up and ensuring strong roots, dense grass, and a wholesome and green lawn. On the other hand, the plant growth regulators segment is steadily gaining traction and is likely to advance in the coming years owing to

Global Turf and Ornamental Inputs Market By Type of Turf Grass

Bermuda grass commands this segment, holding a notable share of the turf & ornamental inputs market. It is anticipated to be the swiftly rising category over the estimation period. It is a popular option for homeowners searching for a lasting and healthy lawn. In addition, one of the key reasons this grass type is so widely accepted is its resilience. This positions it ideal for areas with reduced water and hot, and arid weather.

Global Turf and Ornamental Inputs Market By Type of Ornamental Grass

This Ravenna Grass segment led the market with a market share of around 32% in 2022.

The feather reed grass segment is anticipated to spearhead the turf & ornamental inputs market. This type of ornamental grass is generally seen within the premier garden plants. Its adaptability and architectural characteristics were reasons behind the consumer's preference. Whereas, the fountain grans segment holds a distinct position in this market because of its colour plumes and softer appearance.

REGIONAL ANALYSIS

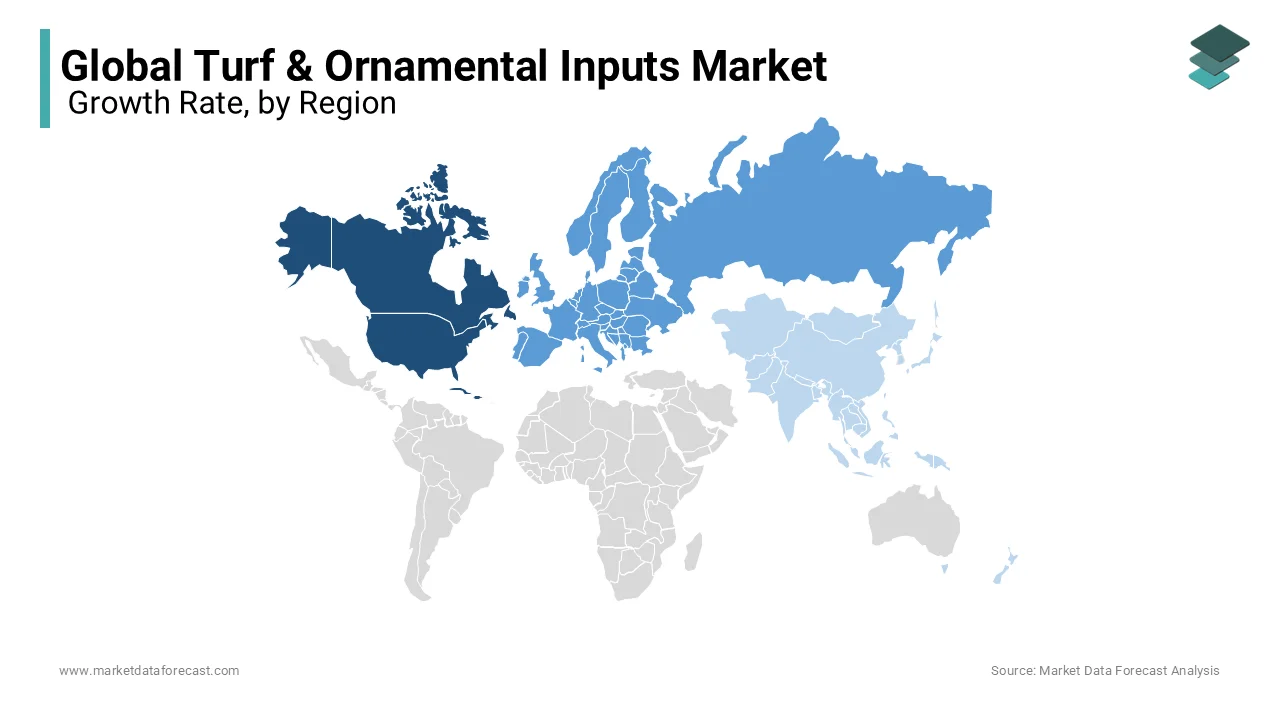

North America and Europe together account for more than 65% of the global turf & ornamental inputs market. The regional market has gained traction for the manufacture and maintenance of high-quality lawn grasses and ornamental plants. It deals with the logistics and trade of various kinds of modern turf and garden scientific materials such as plant growth regulators, fertilizers, and pesticides for the proper handling and upkeep of greensward and decorative grass. Moreover, the progress of the North American market is primarily propelled by aspects like swift advancement of the tourism sector, rising area of land under golf courses and gardens, and better cognizance around the scientific maintenance of turf & ornamentals. However, factors such as legal issues and high installation & application costs are stopping the development of the market in this region.

Asia Pacific region is the rapidly expanding market owing to several factors such as the quick rise of the tourism sector and the growing area of land under parks and golf courses. Especially, India where the agricultural sector displayed progress with 3.5 per cent yearly growth in July-September 2024, upward from 2 per cent formerly. On the other hand, manufacturing sector weakened to 2.2 per cent from 7 per cent in the earlier quarter of 2024. Experts observed that private consumption, which includes 60 per cent of GDP, has suffered from lower urban spending, linked to elevated food inflation, escalating borrowing costs and decreased real wage rise, even though rural demand exhibiting signs of recovery.

KEY MARKET PLAYERS

The market is categorized by the existence of diversified international and national companies, where global retailers lead the market and are predicted to grow exponentially by securing regional or local players. The major companies dominating the global turf and ornamental inputs market are Bayer, Syngenta, BASF, Best Forage LLC, Chemtura Agro Solutions, American Vanguard Corporation, Dow Agro Sciences, Adama Agricultural Solutions, and Nufarm Ltd.

RECENT HAPPENINGS IN THIS MARKET

- In May 2024, AstroTurf Corporation, a well-known company in sports surface technology, and the LA Galaxy, 5 times champion of Major League Soccer, reported via press release the signing of a new strategic marketing collaboration. Under this partnership, AstroTurf has been made the Official partner of the club for hybrid turf and Synthetic Turf. Moreover, AEG Global Partnerships was the broker of this deal, stands on the success of AstroTurf’s ongoing collaboration with Dignity Health Sports Park which is home to the LA Galaxy. This signifies a major sponsorship contract or brand networking focused on improving the visibility of AstroTurf in the realm of soccer, coupled with, over among the most famous and globally acknowledged clubs in MLS. Additionally, this will significantly improve the brand awareness of this turf company in the United States and across the world.

MARKET SEGMENTATION

This research report on the global turf and ornamental inputs market has been segmented and sub-segmented based on synthetic chemical inputs, type of turf grass, type of ornamental grass, and region.

By Synthetic chemical Input

- Fertilizers

- Plant Growth Regulators

- Pesticides

- Others

By Turf Of Grass

- Zoysia Grass

- Rye Grass

- Bermuda Grass

- Blue Kentucky Grass

- Tall Fescue

- Others

By Type Of Ornamental Grass

- Fountain Grass

- Ravenna grass

- Feather Reed Grass

- Purple millet

- Fibre Optic Grass

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

what is the current size of the global Turf & Ornamental Inputs market?

The global turf and ornamental inputs market is worth USD 7.36 billion in 2025.

what are the market growth drivers in global Turf & Ornamental Inputs market?

The growth of the global turf & ornamental inputs market is majorly driven by factors such as increasing demand for turf & ornamental inputs from IPM practices, ease of availability, and better awareness about the scientific upkeep of turf & ornamentals.

which is the leading region in global Turf & Ornamental Inputs market?

Asia- Pacific is the leading region market in the global Turf & Ornamental Inputs market.

who are the market key players involved in the global Turf & Ornamental Inputs market?

Bayer, Syngenta, BASF, Best Forage LLC, Chemtura Agro Solutions, American Vanguard Corporation, Dow Agro Sciences, Adama Agricultural Solutions and Nufarm Ltd.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]