Global Turboprop Engine Market Size, Share, Trends, & Growth Forecast Report – Segmented by Application (Military Aircraft and Civil Aircraft), Power Transmission (Single Shaft and Free Turbines), Technology (Conventional Engine and Electric/Hybrid Engine), & Region - Industry Forecast From 2024 to 2032

Global Turboprop Engine Market Size (2024 to 2032)

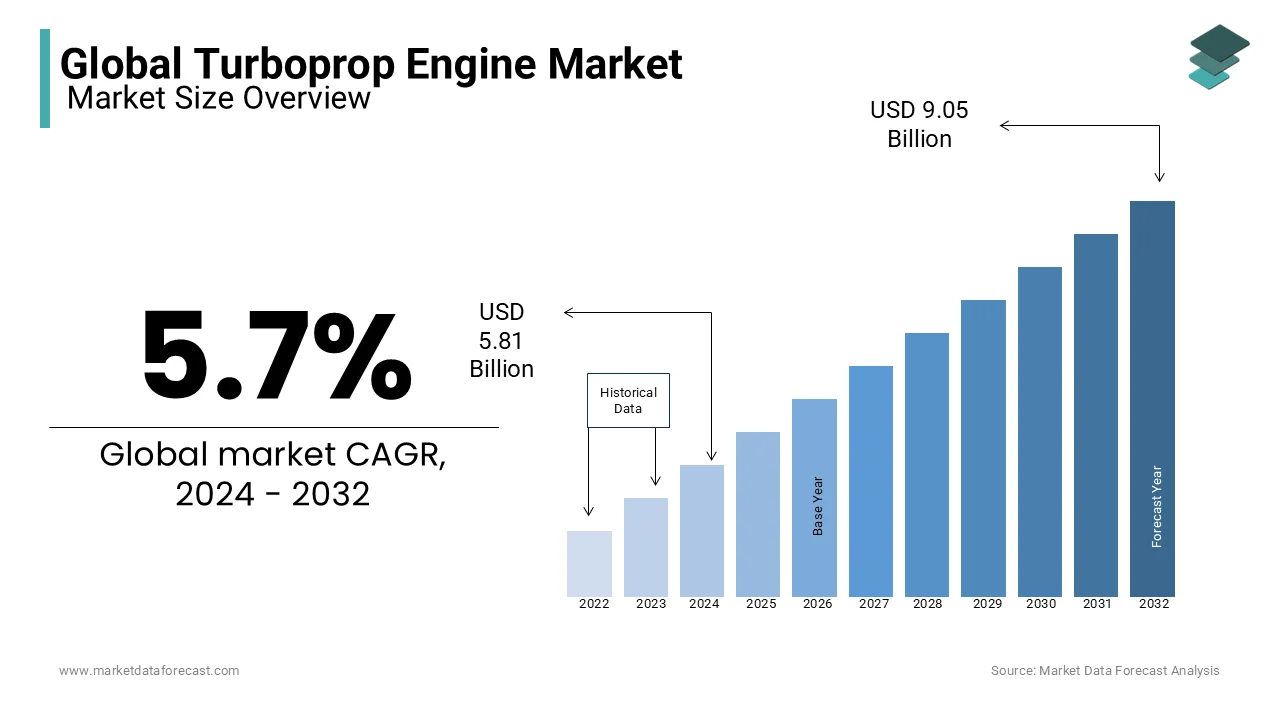

The global turboprop engine market was worth USD 5.50 billion in 2023. The global market size is predicted to be worth USD 9.05 billion by 2032 from USD 5.81 billion in 2024, growing at a CAGR of 5.7% during the foreseen period.

The turboprop engine is a turbine that drives the aircraft's propeller. It is a variant of a jet engine that has been optimized to drive a propeller. The turboprop engine consists of an intake, reduction gearbox, compressor, combustor, turbine, and propelling nozzle. In turboprop engine aircraft, the air is drawn in intake; the compressor compresses the air. Fuel is then combined with the compressed air in the combustor, and then the hot combust gases expand through the turbine to propel the aircraft. The turboprop engine-equipped aircraft are very efficient at low flight speeds, have less fuel consumption, and require significantly less runway or airstrip to take off or land an aircraft. The hybrid engines are most efficient at speeds between 250 and 400mph and altitude between 18,000 and 30,000 speeds.

MARKET DRIVERS

The turboprop engine has high demand in civil aviation due to its ability to fly at low altitudes, as it is very efficient for short distances. North America and the Asia Pacific region contribute to the largest market for the growth of the global turboprop engine market.

The increasing deployment of new technologies in aircraft and investment by the government to strengthen the defense boosts the growth of the global turboprop engine market during the forecast period. The growing demand for newer general aviation craft that can fly at low altitudes and growing military transportation are contributing to the growth of the global turboprop engine market.

Newly developed short routes and low altitude flying capability with an efficient cost increase the demand for turboprop engine market in the future. The hybrid type of turboprop engine is dominating the turboprop engine market due to its increasing demand in civil aviation. The deployment of turboprop engines is also high as old aircraft are reinstalled with these hybrid engines. The newer aircraft have already come with this modern turboprop engine. The turboprops engines are very efficient in flying on low attitudes, at short distances, need a small airstrip for take-off and landing, and increase fuel efficiency. Owing to these reasons, the air journey becomes more affordable and easier for the people due to which growing demand for turboprop engines is driving the market.

Moreover, with the growing demand for newer general aviation aircraft models featuring the latest avionics and technological advancements in performance & efficiency, several turboprop aircraft manufacturers are developing new aircraft to boost the growth of the global turboprop engine market. Additionally, the governments of various countries are spending on strengthening their defense to further boost the growth of the turboprop engine market in the forecasted period.

MARKET RESTRAINTS

The major restraint is the aircraft liquidity crisis that affects the growth of the global turboprop engine.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.7% |

|

Segments Covered |

By Power Transmission, Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Pratt And Whitney, Rolls-Royce plc, Motor Sich, PBS Velka Bites, GE Aviation, Safran, Honeywell International, Inc. and Others. |

SEGMENTAL ANALYSIS

Global Turboprop Engine Market Analysis By Power Transmission

Based on the power transmission, the single shaft segment is anticipated to dominate the market during the forecast period. The single-shaft turbine has a free mechanical connection from the gas generator to the reduction gearbox and propeller. In contrast, the free turbine has only an air link from the gas generator to the power turbines. The free-turbine turboprop engine is highly used to reduce the torque load when the engine starts. The start mechanism only needs to rotate the compressor and turbine, excluding the propeller and reduction gear. Owing to these factors, the free turbine turboprop engine is in more demand that driving the growth of the global turboprop engine market in the coming years.

The free turbines segment is expected to hold a substantial share of the worldwide market during the forecast period. The hybrid type of turboprop engine is driving the growth of the turboprop engine market due to its increasing demand in civil aviation. Hybrid engines replace the conventional engines in those aircraft that have been in use for decades. The newly developed crafts are already installed with the hybrid engine.

Global Turboprop Engine Market Analysis By technology

The hybrid engines of turboprops are growing due to the upgradation of conventional engines with the hybrid engine, and the newly developed aircraft are already installed with hybrid engines. The hybrid turboprop engine drives the propeller only through an electric motor. The engine power is derived from combustion and converted into electric power via a generator. Therefore, owing to these features, the growing demand for hybrid engines drives the global turboprop engines market during the forecast period.

Global Turboprop Engine Market Analysis By Application

The demand for turboprop engines is growing in civil aircraft as these turboprop engines are highly used for short distances and very efficient for flying in low altitudes. Additionally, the development of new crafts powered by turboprop engines fuels the demand in the general aviation segment.

REGIONAL ANALYSIS

North America is the largest market for turboprop engines globally. It is also anticipated that North America will sustain its position in the forecasted period due to the increasing demand for turboprop aircraft in the United States. The United States alone holds 50% of turbo aircraft in the general aviation segment.

The Asia-Pacific countries like India, China, and Japan are significantly spending on defense to strengthen their respective air forces' cargo and troop transportation capability. The development of small and medium-sized airports in India and China is growing due to the increasing traffic of air passengers. Due to newly developed routes between the states and cities reducing the cost fare will drive the growth of the turboprop engine market in the Asia-Pacific Region during the forecast period.

Europe is a prominent regional market for turboprop engines and is estimated to account for a considerable share of the global market during the forecast period due to the acquisition of new turboprop aircraft by airlines fuels the demand for turboprop engines.

KEY MARKET PLAYERS

Companies playing a dominating role in the global turboprop engine market include Pratt and Whitney, Rolls-Royce plc, Motor Sich, PBS Velka Bites, GE Aviation, Safran and Honeywell International, Inc. Pratt & Whitney had the largest share of the world’s Turboprop Engine in terms of sales revenue in 2020.

RECENT HAPPENINGS IN THE MARKET

- In December 2021, Pratt and Whitney Canada (a business unit of Pratt & Whitney) announced that Amphibian Aerospace Industry Pvt. Ltd. had selected a PT6A-67F turboprop engine to power its iconic twin-engine G-111T amphibious aircraft. The PT6A-67F is recognized as the engine of the PT6A family for the G-111T aircraft application. Pilots and operators fly PT6A craft easily and confidently, even in adverse weather conditions.

- In November 2021, Pratt & Whitney Canada announced its new engine series, “PW127XT”. This series has a new standard for operating economics, maintenance, and sustainability for regional turboprop engine crafts. “PW127XT” has been designed to improve 3% fuel efficiency, reduce 20% maintenance costs and offer 40% extended time-on-wing service.

DETAILED SEGMENTATION OF THE GLOBAL TURBOPROP ENGINE MARKET INCLUDED IN THIS REPORT

This research report on the global turboprop engine market has been segmented and sub-segmented based on power transmission, technology, application and region.

By Power Transmission

- Single shaft

- Free turbine

By Technology

- Conventional Engine

- Electric/Hybrid Engine

By Application

- Military Aircraft

- Civil Aircraft

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the major drivers of growth in the global turboprop engine market?

Key drivers include the rising demand for regional and business aircraft, advancements in engine efficiency and fuel economy, increasing air passenger traffic, and the need for lower carbon emissions in aviation. Government initiatives promoting cleaner and more sustainable aviation technologies are also boosting market growth.

What is the role of sustainability in the turboprop engine market?

Sustainability is becoming a significant focus, with manufacturers developing more fuel-efficient turboprop engines that emit fewer greenhouse gases. Hybrid-electric and fully electric turboprop aircraft technologies are also being explored to reduce the carbon footprint of aviation. Governments and international organizations are pushing for stricter environmental regulations, further driving innovation in this area.

How is the turboprop engine market impacted by rising fuel costs?

The turboprop engine market benefits from rising fuel costs because turboprop aircraft are generally more fuel-efficient than jet-engine aircraft for short-haul routes. This efficiency makes them attractive for regional airlines looking to reduce operational costs, leading to increased demand for turboprop-powered aircraft.

What technological advancements are being seen in the turboprop engine market?

The turboprop engine market is seeing advancements in engine materials (e.g., lighter composites), improved aerodynamics, noise reduction technologies, and enhanced fuel efficiency. Developments in avionics and predictive maintenance systems are also improving the reliability and lifespan of turboprop engines, making them more cost-effective for operators.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]