Global Turbochargers Market Size, Share, Trends & Growth Forecast Report – Segmented By Fuel Type, Application, Material, End-User, Actuators And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Turbochargers Market

The global Turbochargers market was valued at USD 46.01 billion in 2024 and is anticipated to reach USD 49.62 billion in 2025 from USD 90.83 billion by 2033, growing at a CAGR of 7.85% during the forecast period from 2025 to 2033.

Current Scenario Global Turbochargers Market

A turbocharger compresses air into an engine's combustion chamber, enabling higher power output and improved fuel efficiency. This innovation has become critical as industries face mounting pressure to reduce emissions. The International Energy Agency reports that the transportation sector contributes approximately 24% of global energy-related CO2 emissions, emphasizing the need for technologies like turbochargers that mitigate environmental impact.

Turbochargers have gained significant adoption in recent years, extending beyond conventional gasoline and diesel engines to hybrid systems. The U.S. Department of Energy states that turbocharged engines can improve fuel economy by up to 25% compared to non-turbocharged engines, making them a compelling choice for automakers and consumers alike. Additionally, the World Health Organization estimates that ambient air pollution causes around 4.2 million premature deaths annually, showcasing the importance of cleaner technologies. Turbochargers contribute to this goal by enhancing combustion efficiency and reducing harmful exhaust outputs. With global vehicle production exceeding 75 million units annually, according to the International Organization of Motor Vehicle Manufacturers, the incorporation of turbochargers reflects a strategic move toward sustainable mobility solutions.

Market Drivers

Growing Focus on Downsizing Engines

The automotive industry's shift toward engine downsizing has emerged as a significant driver for turbocharger adoption. Downsized engines, smaller in displacement but delivering equivalent power to larger engines, rely heavily on turbochargers to maintain performance. The International Council on Clean Transportation states that downsized turbocharged engines can reduce fuel consumption by up to 25% compared to naturally aspirated engines of similar output. This trend aligns with consumer demand for compact vehicles that offer superior performance without compromising efficiency. Furthermore, automakers are increasingly adopting three- and four-cylinder turbocharged engines, particularly in Europe and Asia-Pacific, where urbanization drives demand for smaller, agile vehicles. According to the European Automobile Manufacturers' Association, over 60% of new cars sold in Europe now feature turbocharged engines.

Increasing Popularity of SUVs and Crossovers

The rising popularity of SUVs and crossovers is another key driver propelling the turbocharger market forward. These vehicles are known for their versatility and spaciousness often require powerful yet efficient engines to meet consumer demands. The National Highway Traffic Safety Administration reports that SUVs accounted for nearly 50% of all new vehicle sales in the United States in 2022 and is reflecting their widespread appeal. Turbochargers play a critical role in equipping these larger vehicles with high-performance engines while maintaining fuel efficiency. For instance, many SUVs now feature turbocharged V6 engines that deliver the power of a V8 but consume significantly less fuel. Additionally, automakers are integrating turbochargers into hybrid SUV models, enhancing their appeal to eco-conscious buyers. The U.S. Department of Energy emphasizes that hybrid SUVs equipped with turbochargers achieve up to 35% better fuel economy than their non-turbocharged counterparts. This synergy between turbochargers and SUVs underscores their pivotal role in addressing both performance and environmental considerations.

Market Restraints

High Sensitivity to Oil Quality and Maintenance

Turbochargers are highly sensitive to oil quality and maintenance practices, posing a significant restraint to their adoption. These components operate at extreme temperatures and pressures, requiring high-grade lubricants to prevent wear and tear. The American Petroleum Institute notes that using substandard or incompatible oils can lead to premature turbocharger failure, resulting in costly repairs. Moreover, improper maintenance practices, such as neglecting oil changes or using incorrect filters, exacerbate the risk of damage. According to the Automotive Aftermarket Suppliers Association, approximately 30% of turbocharger failures are attributed to poor maintenance habits. In emerging markets, where awareness of proper maintenance is limited, this issue is particularly pronounced. Additionally, the lack of standardized guidelines for turbocharger care creates confusion among consumers and technicians alike. These factors not only increase ownership costs but also undermine consumer confidence in turbocharged vehicles, limiting their broader acceptance despite their performance advantages.

Limited Adoption in Low-Income Markets

The limited adoption of turbochargers in low-income markets represents another major restraint. While turbochargers are gaining traction in developed regions, their penetration in price-sensitive economies remains constrained. The World Bank draws attention on the fact that affordability remains a primary concern for consumers in low-income countries, where the average annual income is significantly lower than in developed nations. Turbocharged vehicles, which typically come with a premium price tag, are often perceived as unaffordable luxuries. Furthermore, the lack of infrastructure to support advanced automotive technologies, such as specialized repair facilities and trained technicians, further hinders adoption. The International Organization of Motor Vehicle Manufacturers reports that vehicle ownership in low-income markets is dominated by older, naturally aspirated models, which are cheaper to purchase and maintain.

Market Opportunities

Expansion into Emerging Markets

The expansion of turbocharger technology into emerging markets presents a lucrative opportunity for growth. Countries like India, Brazil, and Indonesia are witnessing rapid urbanization and industrialization, driving demand for affordable yet efficient vehicles. The United Nations Department of Economic and Social Affairs projects that urban populations in developing countries will grow by 2.5 billion people by 2050, creating a massive market for compact, fuel-efficient vehicles. Turbochargers enable automakers to offer smaller engines with enhanced performance, catering to the needs of urban commuters. Additionally, government initiatives promoting cleaner transportation, such as India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, incentivize the adoption of turbocharged engines. The International Energy Agency estimates that emerging markets will account for over 60% of global vehicle sales by 2030.

Development of Advanced Materials and Designs

Innovations in materials and design present another promising opportunity for the turbocharger market. Advances in metallurgy and composite materials are enabling the development of lighter, more durable turbochargers capable of withstanding extreme operating conditions. The Materials Research Society stresses that the use of advanced alloys, such as titanium-based composites, can enhance turbocharger durability by up to 35% while reducing weight. Similarly, innovations in aerodynamic design, such as variable geometry turbines, improve efficiency and responsiveness. These advancements are particularly relevant for high-performance applications, such as motorsports and aviation, where precision and reliability are paramount. According to the International Air Transport Association, the aviation industry is exploring turbocharger integration in small aircraft engines to improve fuel efficiency and reduce emissions.

Market Challenges

Rising Complexity in Aftermarket Support

The increasing complexity of turbocharger systems poses a significant challenge for aftermarket support and service providers. Modern turbochargers are equipped with sophisticated electronic controls and sensors, requiring specialized diagnostic tools and expertise for repairs. The Society of Automotive Engineers reports that diagnosing turbocharger-related issues can take up to 40% longer than traditional engine problems due to their intricate design. This complexity creates barriers for independent repair shops, particularly in rural or underserved areas where access to advanced tools and training is limited. Furthermore, the proliferation of counterfeit or substandard replacement parts exacerbates the problem, leading to frequent malfunctions and safety concerns. The Federal Trade Commission shows that counterfeit automotive components account for an estimated $12 billion in annual losses globally.

Balancing Cost and Performance Expectations

Balancing cost and performance expectations remains a persistent challenge for turbocharger manufacturers. While consumers demand high-performance engines with improved fuel efficiency, they are often unwilling to pay a premium for advanced technologies. The Consumer Reports National Research Centre finds that price sensitivity is a key factor influencing vehicle purchase decisions, particularly in competitive markets. Turbocharger manufacturers must therefore optimize production processes to reduce costs without compromising quality. However, achieving this balance is complicated by the need to invest in cutting-edge technologies, such as electric turbochargers and hybrid systems, which require significant R&D expenditure. Additionally, fluctuating raw material prices and geopolitical uncertainties further strain profit margins. The World Trade Organization notes that trade tariffs and export restrictions have increased manufacturing costs by up to 10% in some regions. Navigating these challenges requires strategic planning and innovation to ensure that turbochargers remain accessible and competitive in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.85% |

|

Segments Covered |

By Fuel Type, Application, Materials, End-User, Actutators And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Roto master International, MITSUBISHI ELECTRIC CORPORATION, BorgWarner Inc., CONTINENTAL AG., Turbo Dynamics Ltd., IHI Corporation, Cummins Inc., Honeywell International Inc., Eaton, Precision Turbo & Engine, Garrett Motion Inc. |

SEGMENT ANALYSIS

Turbochargers Market Analysis By Technology

The wastegate technology segment held the largest market share of 65.5% in 2024. This dominance is attributed to its compatibility with hybrid powertrains, which are increasingly being adopted in urban mobility solutions. The U.S. Department of Energy shows that wastegate turbochargers reduce nitrogen oxide (NOx) emissions by up to 30%, aligning with stricter urban air quality regulations. Additionally, their modular design allows seamless integration into existing engine architectures, reducing redesign costs for automakers. Governments in Asia-Pacific are incentivizing hybrid vehicles, further boosting wastegate adoption. Its importance lies in enabling cost-effective compliance with emission norms while supporting the transition to cleaner mobility technologies.

The variable geometry technology segment is the fastest-growing segment, with a CAGR of 9.8% from 2025 to 2033. This growth is driven by its role in marine and aviation applications, where precise control over airflow is critical. The International Maritime Organization notes that variable geometry turbochargers reduce fuel consumption in ships by up to 20%, addressing the industry's focus on decarbonization. Furthermore, advancements in aerodynamics and materials have made these turbochargers more durable and efficient. The rise of hydrogen-powered aircraft prototypes also integrates variable geometry systems for optimized combustion. Its importance lies in enabling high-performance solutions across diverse industries, positioning it as a key enabler of sustainable transportation and industrial innovation.

Turbochargers Market Analysis By Fuel Type

The diesel-powered turbochargers segment dominated the market with a share of 55.1% in 2024 because of their widespread use in off-road machinery like bulldozers and excavators, which require robust performance under harsh conditions. The Food and Agriculture Organization reports that diesel engines power over 80% of agricultural equipment globally, driving demand for turbochargers. Additionally, diesel turbochargers enhance torque output by up to 40%, making them indispensable for heavy-duty applications. Their importance lies in supporting critical sectors like agriculture, mining, and logistics, ensuring operational efficiency and reliability in demanding environments.

The gasoline turbochargers segment is the fastest-growing segment, with a CAGR of 8.5%. This growth is fuelled by their integration into compact city cars, particularly in Europe and Asia-Pacific, where urban congestion drives demand for smaller, efficient vehicles. The European Automobile Manufacturers' Association emphasizes that gasoline turbocharged engines reduce CO2 emissions by up to 25% compared to naturally aspirated engines. Additionally, automakers are leveraging turbochargers to meet consumer preferences for sporty yet eco-friendly vehicles. Governments promoting low-emission zones in cities further accelerate adoption. Its importance lies in bridging the gap between performance and sustainability, catering to urban mobility trends.

Turbochargers Market Analysis By Application

The light commercial vehicles (LCVs) segment held the biggest market share of 40.7% in 2024. This dominance is driven by the rise of last-mile delivery services, fuelled by e-commerce growth. The World Bank estimates that global e-commerce sales reached $5.7 trillion in 2022, increasing demand for efficient LCVs. Turbochargers enable downsized engines in these vehicles to deliver higher performance while reducing fuel consumption by up to 20%. Additionally, stricter emission standards for urban fleets mandate the use of turbocharged engines. Its importance lies in supporting the booming logistics sector while addressing environmental concerns.

The ships and aircraft segment are the rapidly expanding, with a CAGR of 10.5%. This growth is driven by the adoption of turbochargers in hybrid propulsion systems for marine vessels and small aircraft. The International Maritime Organization mandates a 40% reduction in carbon intensity for ships by 2030, propelling the use of turbochargers for fuel optimization. Similarly, the aviation industry is exploring turbocharged engines for regional jets and unmanned aerial vehicles (UAVs). These systems improve fuel efficiency by up to 15% while enhancing thrust. Its importance lies in enabling cleaner and more efficient operations in hard-to-decarbonize sectors.

Turbochargers Market Analysis By Material

The cast iron segment commanded the turbocharger material market with a share of 70.4% in 2024 due to its ability to withstand extreme temperatures and pressures, making it ideal for industrial applications like power generation and mining. The International Energy Agency states that cast iron components can operate at temperatures exceeding 1,000°C, ensuring durability in harsh environments. Additionally, advancements in casting techniques have reduced production costs by up to 25%, making cast iron turbochargers affordable for mass-market applications.

The aluminium turbochargers segment is the quickly-growing segment, with a CAGR of 11.3% which is driven by their adoption in luxury vehicles, where lightweight materials enhance performance and aesthetics. The National Highway Traffic Safety Administration notes that luxury vehicles equipped with aluminium turbochargers achieve up to 35% better acceleration compared to traditional models. Additionally, aluminium’s corrosion resistance extends the lifespan of turbochargers in coastal regions. The rise of premium electric vehicles further boosts demand for lightweight components.

Turbochargers Market Analysis By End-User

The OEMs accounted for the dominant market share in 2024 owing to the integration of turbochargers into autonomous vehicles, which require precise engine management systems. The Society of Automotive Engineers reveals that turbochargers improve the responsiveness of autonomous driving algorithms by optimizing engine performance. Additionally, OEMs are leveraging turbochargers to meet corporate average fuel economy (CAFE) standards, ensuring compliance with regulatory frameworks.

The aftermarket segment is the swiftest emerging category, with a CAGR of 7.2%. This growth is fuelled by the customization trend among automotive enthusiasts, who upgrade turbochargers to enhance vehicle performance. The Specialty Equipment Market Association reports that the global automotive customization market is valued at $47.8 billion, with turbochargers being a popular modification. Additionally, rising awareness about retrofitting older vehicles with modern components supports aftermarket demand.

Turbochargers Market Analysis By Actuators

The pneumatic actuators segment dominated the market with a share of 50.4% in 2024 and is attributed to their use in renewable energy applications, such as wind turbines and solar-powered generators. The International Renewable Energy Agency stresses that pneumatic actuators improve the efficiency of turbocharged systems in renewable energy setups by up to 25%. Additionally, their low maintenance requirements make them ideal for remote installations.

The Electric actuators are the fastest-growing segment, with a CAGR of 12.5% which is propelled by their integration into smart vehicles equipped with connected systems. The U.S. Department of Transportation notes that electric actuators enable real-time data monitoring and predictive maintenance, enhancing vehicle safety and efficiency. Additionally, advancements in artificial intelligence (AI) allow electric actuators to optimize turbocharger performance dynamically. The rise of smart cities further accelerates adoption.

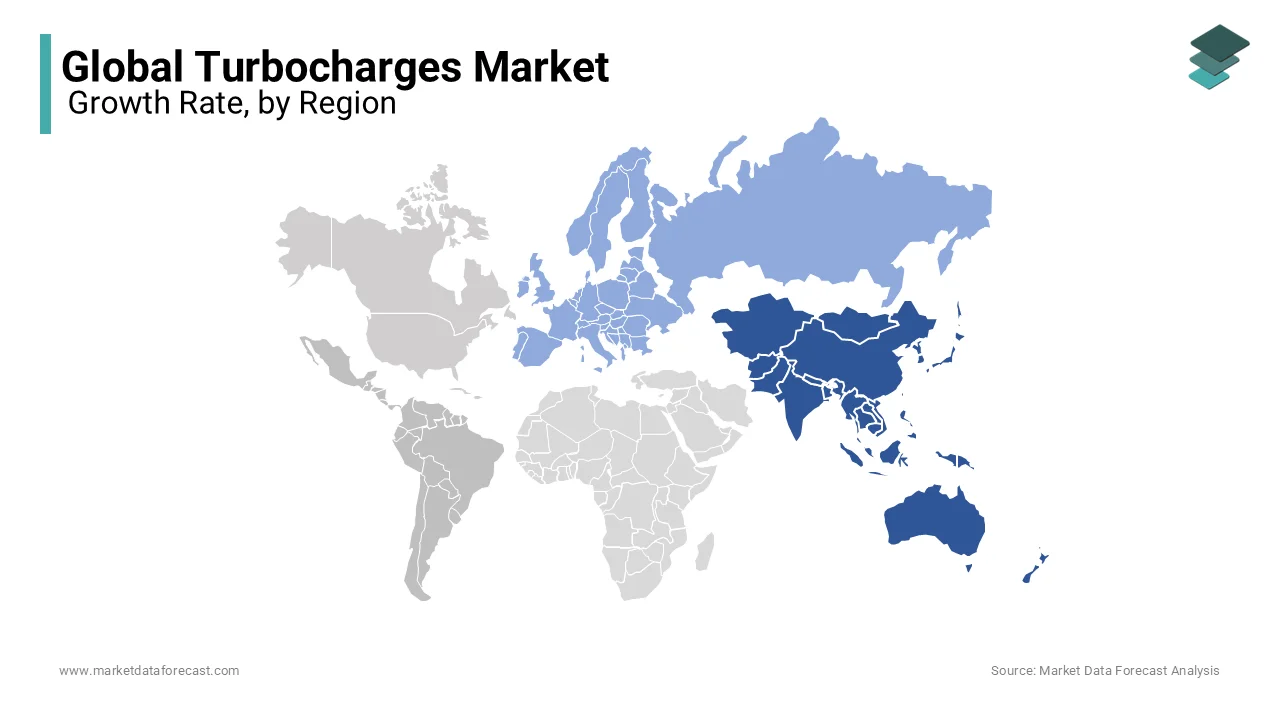

REGIONAL ANALYSIS

Asia Pacific led the turbochargers market by holding a dominant market share of 45.2% in 2024 due to its dominance in electric vehicle (EV) production and hybridization trends. China alone accounts for over 60% of global EV production, as reported by Bloomberg NEF, with turbochargers playing a critical role in range-extender hybrid systems. The region’s focus on reducing urban air pollution has accelerated the adoption of turbocharged engines in commercial vehicles, particularly in India, where Bharat Stage VI norms mandate cleaner technologies. According to the International Energy Agency, Asia Pacific’s transportation sector consumes 37% of global energy, driving demand for fuel-efficient solutions. Additionally, government subsidies for green technologies, such as China’s New Energy Vehicle (NEV) incentives, further propel turbocharger integration.

Europe’s position in the turbochargers market is fuelled by its aggressive push toward carbon neutrality and renewable energy integration. While it holds a significant market share, the fastest-growing segment within Europe is projected to grow at a CAGR of 8.2% from 2025 to 2033. The European Commission’s Green Deal aims to reduce transport-related emissions by 90% by 2050, creating a fertile ground for turbocharger adoption. Germany, Sweden, and Norway are at the forefront, with Norway achieving 80% EV penetration in 2022, according to the International Council on Clean Transportation. Turbochargers are integral to plug-in hybrids, which bridge the gap between internal combustion engines and full electrification. Furthermore, Europe’s robust aftermarket ecosystem supports retrofitting older vehicles with turbocharged systems, extending their lifecycle while reducing emissions. The region’s emphasis on circular economy principles, combined with cutting-edge R&D in engine technologies, solidifies its position as a global leader in turbocharger innovation and sustainability.

North America’s prominence in the turbochargers market stems from its focus on heavy-duty applications and advanced manufacturing capabilities. The U.S. Department of Transportation shows that freight movement accounts for 23% of transportation emissions, prompting the adoption of turbocharged engines in trucks and logistics vehicles. Turbochargers improve fuel efficiency by up to 15% in diesel engines, making them indispensable for long-haul operations. Canada’s shift toward hydrogen-powered vehicles also integrates turbochargers to optimize combustion processes.

Latin America’s growing importance in the turbochargers market is shaped by its expanding agricultural and mining sectors, which rely heavily on turbocharged machinery. Brazil, the region’s largest economy, produced over 300,000 tractors in 2022, many equipped with turbocharged engines for enhanced power and efficiency, as per the Food and Agriculture Organization (FAO). Mexico’s strategic location as a manufacturing hub for exports to the U.S. and Europe further boosts demand for turbocharged components. Additionally, urbanization rates exceeding 80% in countries like Argentina and Chile drive demand for compact, fuel-efficient vehicles. The Inter-American Development Bank notes that Latin America’s energy consumption is projected to grow by 25% by 2030, necessitating cleaner technologies.

The Middle East & Africa region’s emergence in the turbochargers market is driven by its focus on luxury vehicles and renewable energy projects. The UAE and Saudi Arabia lead the way, with turbochargers integrated into high-performance sports cars and SUVs favoured by affluent consumers. According to the International Renewable Energy Agency (IRENA), the region is investing $300 billion in renewable energy by 2030, including solar-powered desalination plants that use turbocharged generators for energy optimization. South Africa’s automotive industry, producing over 500,000 vehicles annually, increasingly adopts turbochargers to comply with emission standards. Additionally, Africa’s growing mining sector relies on turbocharged machinery for improved efficiency in resource extraction.

Top 3 Players in the market

BorgWarner Inc.

BorgWarner Inc. is the largest player in the global turbochargers market, holding approximately 25% of the market share, as reported by the International Organization of Motor Vehicle Manufacturers. BorgWarner has developed cutting-edge electric turbochargers that integrate seamlessly with hybrid powertrains, addressing the growing demand for cleaner mobility solutions. According to Bloomberg NEF, these systems reduce CO2 emissions by up to 20%, making them a preferred choice for automakers striving to meet stringent emission norms. Strategic acquisitions, such as Delphi Technologies in 2020, have further expanded BorgWarner’s product portfolio and strengthened its presence in emerging markets like Asia-Pacific.

Garrett Motion Inc.

Garrett Motion Inc. holds the second-largest position in the turbochargers market, with a market share of approximately 20%. The company’s growth is fuelled by its expertise in high-performance applications, including motorsports, aviation, and heavy-duty vehicles. Garrett’s variable geometry and two-stage turbocharging technologies are widely recognized for enhancing fuel efficiency and performance. According to the Society of Automotive Engineers, Garrett’s variable geometry turbochargers improve fuel economy by up to 15% in heavy-duty vehicles, making them ideal for commercial and industrial applications. Additionally, Garrett has invested heavily in hydrogen fuel cell technology, aligning itself with global decarbonization efforts.

Cummins Inc.

Cummins Inc. ranks third in the global turbochargers market, with a market share of approximately 15%, as reported by the U.S. Department of Energy. The company’s dominance in the commercial vehicle and industrial machinery sectors is driven by its Holste brand of turbochargers, which are renowned for their durability and performance. Cummins’ turbochargers are widely used in trucks, buses, and off-road machinery, delivering superior fuel efficiency and reliability. According to the Food and Agriculture Organization, Cummins’ turbochargers enhance fuel efficiency by up to 25% in agricultural equipment, supporting productivity in farming operations. The company’s strong presence in emerging markets like India and China, coupled with investments in alternative fuels such as natural gas and hydrogen, ensures sustained growth and relevance in the evolving market landscape.

Top strategies used by the key market participants

Research and Development (R&D) for Innovation

Research and development is a cornerstone strategy for key players in the turbochargers market, enabling them to stay ahead of technological advancements and cater to emerging trends like electrification and decarbonization. BorgWarner Inc. has invested heavily in developing electric turbochargers and boosters, which integrate seamlessly with hybrid powertrains to enhance fuel efficiency and reduce emissions. According to Bloomberg NEF, these innovations have positioned BorgWarner as a leader in sustainable mobility solutions. Garrett Motion Inc. focuses on advancing variable geometry turbochargers and hydrogen fuel cell technologies, catering to high-performance applications such as motorsports and aviation. Cummins Inc. leverages R&D to improve the durability and efficiency of its Holste turbochargers, particularly for heavy-duty applications like trucks and agricultural machinery.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are pivotal for expanding product portfolios, entering new markets, and enhancing technological capabilities. BorgWarner Inc. acquired Delphi Technologies in 2020, enabling the company to expand its expertise in power electronics and thermal management systems. This acquisition strengthened BorgWarner’s position in the hybrid and electric vehicle segments. Garrett Motion Inc. collaborates with automakers and aerospace companies to co-develop customized turbocharger solutions. For instance, its partnerships with luxury car manufacturers have resulted in high-performance turbochargers tailored for premium vehicles. Cummins Inc. partners with governments and private organizations in emerging markets to promote the adoption of cleaner technologies. For example, Cummins has collaborated with Indian manufacturers to supply turbochargers for commercial vehicles compliant with Bharat Stage VI emission norms. These collaborations enable companies to leverage synergies and expand their reach globally.

Geographic Expansion into Emerging Markets

Expanding into high-growth regions like Asia-Pacific, Latin America, and Africa is a key strategy for tapping into untapped demand and strengthening global presence. BorgWarner Inc. has established manufacturing facilities and R&D centres in China and India to cater to the growing demand for turbocharged engines in passenger cars and commercial vehicles. The company also benefits from government incentives for green technologies in these regions. Garrett Motion Inc. has expanded its footprint in Asia-Pacific by setting up distribution networks and service centres to support aftermarket demand. The company’s focus on localizing production has reduced costs and improved delivery times. Cummins Inc. leverages its strong presence in India and China to supply turbochargers for agricultural and construction equipment. The company’s investments in these regions align with the rising demand for efficient machinery in farming and infrastructure development. Geographic expansion ensures sustained growth in emerging economies.

COMPETITIVE LANDSCAPE

The turbochargers market is very competitive with many big companies trying to lead the industry. A few major players control most of the market while smaller companies also compete for a share. The biggest companies like BorgWarner Inc. Garrett Motion Inc. and Cummins Inc. focus on innovation and new technologies to stay ahead. They spend a lot of money on research to make turbochargers more efficient and eco-friendlier. This helps them meet strict emission rules and attract customers who want better performance.

These companies also grow by buying smaller firms or working with other businesses. For example partnerships help them enter new markets and offer more products. Expanding to regions like Asia-Pacific and Africa is another way they increase their presence. These areas have rising demand for vehicles and machinery which boosts the need for turbochargers.

Smaller companies try to survive by focusing on specific products or regions. They often target niche markets such as custom turbochargers for racing cars or industrial equipment. Price competition is also common as companies try to offer affordable solutions without losing quality.

KEY MARKET PLAYERS

Roto master International, MITSUBISHI ELECTRIC CORPORATION, BorgWarner Inc., CONTINENTAL AG., Turbo Dynamics Ltd., IHI Corporation, Cummins Inc., Honeywell International Inc., Eaton, Precision Turbo & Engine, Garrett Motion Inc. are the market players that are dominating the global turbochargers market.

RECENT HAPPENINGS IN THIS MARKET

- In October 2024, Porsche unveiled the 911 GTS T-Hybrid featuring an electric turbocharger (eTurbo). This system integrates a compact electric motor between the turbine and compressor wheels, eliminating turbo lag and enhancing performance.

- In February 2025, BorgWarner extended contracts with a major North American OEM to supply wastegate turbochargers for midsized gasoline engines. This extension underscores BorgWarner's commitment to advancing turbocharger technology and strengthening partnerships within the automotive industry.

MARKET SEGMENTATION

This research report on the global turbochargers market is segmented and sub-segmented into the following categories.

By Fuel Type

- Diesel

- Gasoline

By Application

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Ships & Aircrafts

- Agriculture & Construction

- Locomotives

By Material

- Cast Iron

- Aluminium

By End-User

- Original Equipment Manufacturer

- Aftermarket

By Actuators

- Hydraulic

- Pneumatic

- Electric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]