Global Turbines Market Size, Share, Trends, & Growth Forecast Report By Type (Steam Turbines, Gas Turbines, Hydro Turbines, and Wind Turbines), Power Range, End-user, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Turbines Market Size

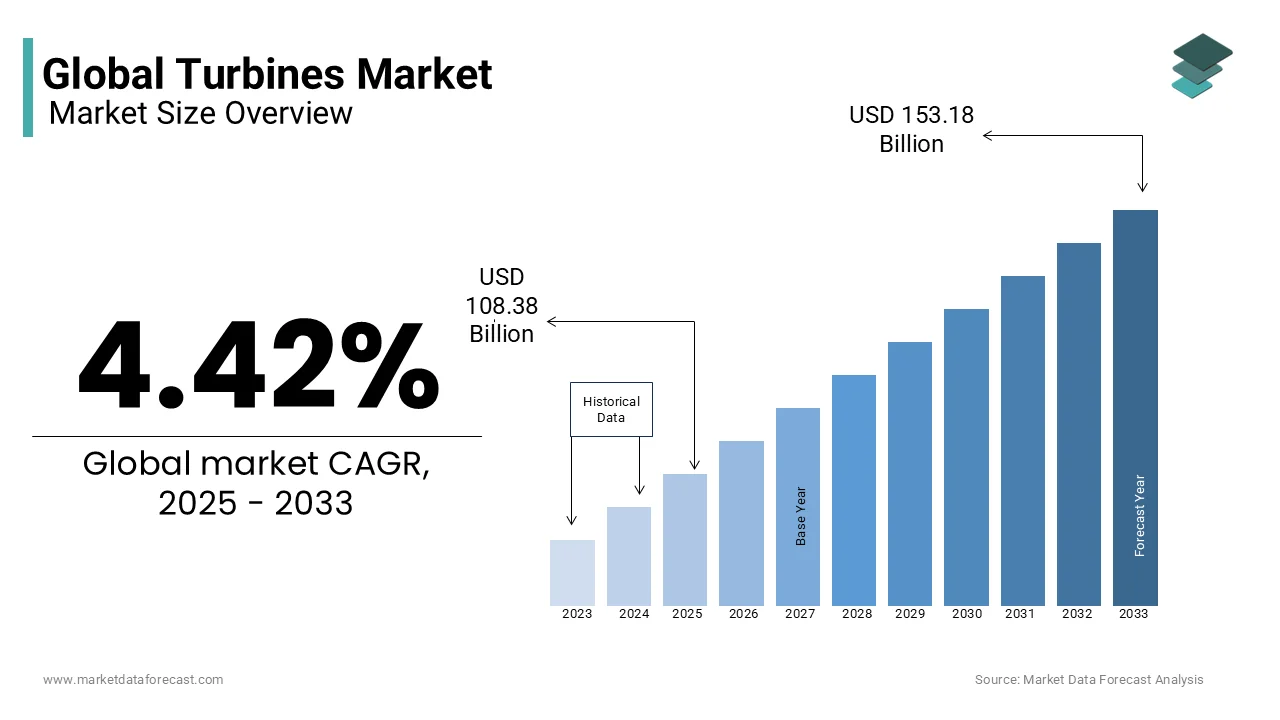

The global turbines market was worth USD 103.79 billion in 2024. The global market is expected to reach USD 153.18 billion by 2033 from USD 108.38 billion in 2025, rising at a CAGR of 4.42% from 2025 to 2033.

Turbines are machines that convert movement energy into power that can be used for electricity or other purposes. They are widely used in different types of energy production, such as water-based (hydroelectric), wind, steam, and gas systems. In 2023, the global turbines market is growing steadily. This growth is happening because the world needs more energy, there is a push toward cleaner energy sources like wind and water, and new technologies are making turbines better.

According to BloombergNEF, a respected energy research group, the wind turbine market added over 88 gigawatts of new capacity in 2022. This is a significant increase compared to previous years, even though supply chain problems made things difficult. The International Energy Agency (IEA) also states that hydropower, which uses water turbines, is still the biggest source of renewable electricity. It provides almost 17% of the world’s electricity.

Wind turbines are becoming very important for clean energy. The Global Wind Energy Council says that by the end of 2022, the total wind power capacity worldwide reached more than 837 gigawatts. Countries like China, the United States, and Germany are leading the way in building new wind farms. At the same time, gas and steam turbines are still important, especially for producing steady power. Gas and steam turbine demand and business will grow decently in the coming years. This growth is driven by the need for reliable power plants.

New technologies, such as tools to predict when maintenance is needed and stronger materials for turbine blades, are making turbines work better and last longer. However, there are challenges, like high costs to build turbines and issues caused by global political tensions affecting supplies. Despite these challenges, the turbines market is essential for reducing carbon emissions and ensuring people have access to sustainable energy as the world moves toward cleaner energy solutions.

MARKET DRIVERS

Growing Demand for Renewable Energy

The world is moving toward renewable energy, and this is a big reason why the turbines market is growing. Governments are focusing on clean energy to fight climate change, with agreements like the Paris Agreement setting big goals. The International Renewable Energy Agency (IRENA) says that in 2022, 83% of all new power capacity added globally came from renewable sources like wind and water. Wind and hydropower turbines are key players in this shift. The Global Wind Energy Council predicts that wind energy could provide up to 35% of the world’s electricity by 2050 if supportive policies are in place. This growth is helped by falling costs; IRENA reports that the cost of onshore wind energy dropped by 68% between 2010 and 2021.

Advancements in Turbine Technology

New technologies are making turbines better and helping the market grow. Modern turbines are more efficient and can work in tough environments. For example, offshore wind turbines can now produce over 15 megawatts of power each, according to the Global Wind Energy Council. Innovations like predictive maintenance help reduce downtime and save money. BloombergNEF says that investments in smart turbine technologies reached $50 billion in 2022, showing strong industry confidence. Advances in materials science have also made turbine blades stronger and lighter, improving performance. These improvements allow turbines to work in places with low wind or deep waters, opening up new markets and boosting global adoption.

MARKET RESTRAINTS

High Initial Investment Costs

One big challenge in the turbines market is the high cost of starting projects. Building wind farms or hydropower plants needs a lot of money, often billions of dollars. The International Energy Agency (IEA) says that building one large wind turbine can cost between $3 million and $4 million, depending on its size. Developing countries struggle to afford these projects, even if they have plenty of natural resources. It’s hard to find investors because it takes a long time to make back the money spent. The World Bank says nearly 70% of renewable energy projects are delayed because of funding problems.

Supply Chain Disruptions

Supply chain problems are another big challenge for the turbines market. Making turbines requires special materials like rare earth metals and advanced composites, which face shortages and delays. Wood Mackenzie reports that shortages of these materials caused turbine manufacturing costs to rise by 20% in 2022. The COVID-19 pandemic made things worse, causing project delays and longer waiting times. The International Renewable Energy Agency (IRENA) says over 30% of planned wind energy projects were postponed in 2021 due to supply chain issues. These disruptions make projects more expensive and slower to complete, slowing down market growth and making it harder to meet renewable energy goals.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets are creating big opportunities for the turbines market. Countries in Asia, Africa, and Latin America are investing in renewable energy to meet rising electricity needs. The International Energy Agency (IEA) predicts that energy use in these regions will grow by 50% by 2040. India plans to install 140 gigawatts of wind power by 2030, creating huge demand for turbines. African nations like Kenya and Morocco are also using wind and hydropower. The World Bank says renewable energy investments in emerging markets grew by 25% every year between 2020 and 2022. These regions offer untapped potential, giving turbine makers a chance to grow their business and boost global market expansion.

Development of Floating Offshore Wind Turbines

Floating offshore wind turbines are a game-changing opportunity for the turbines market. Unlike traditional turbines fixed to the seabed, floating turbines can operate in deep waters where winds are stronger and more consistent. The Global Wind Energy Council estimates that floating offshore wind could add up to 264 gigawatts of power by 2050. Pilot projects in Europe, like those in Norway and Portugal, have shown success. BloombergNEF predicts that costs for these projects will drop by 30% by 2030. Floating turbines can access ocean areas that were previously out of reach, unlocking huge renewable energy potential.

MARKET CHALLENGES

Environmental Concerns and Regulatory Hurdles

Environmental concerns and strict rules are challenges for the turbines market. Large projects often face opposition because they can harm ecosystems. For example, wind turbines can threaten birds, and hydropower can disrupt aquatic life. The United Nations Environment Programme (UNEP) says nearly 40% of renewable energy projects face delays due to environmental reviews and protests. Rules vary widely across countries, making compliance difficult. In the United States, the National Renewable Energy Laboratory notes that getting permits for wind farms can take up to five years. These delays increase costs and slow down projects, making it harder to expand the market and switch to cleaner energy.

Intermittency of Renewable Energy Sources

A huge challenge for the turbines market is the unpredictability of renewable energy. Turbines only generate power when there’s wind or flowing water, leading to ups and downs in energy supply. The International Energy Agency (IEA) says that wind turbines operate at full capacity only 35% of the time on average. To handle this, backup power sources like fossil fuel plants or energy storage systems are needed, which raises costs. BloombergNEF estimates that adding storage solutions can increase project expenses by up to 20%. Additionally, old power grids struggle to manage the inconsistent energy flow. Solving these issues is important to ensure reliable energy delivery and fully use the potential of turbine-based power generation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.42% |

|

Segments Covered |

By Type, Power Range, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bharat Heavy Electricals Limited (BHEL), Mitsubishi Hitachi Power Systems Ltd (MHPS), Harbin Electric Company Limited, ABB, General Electric Company, Siemens AG, Doosan Heavy Industries & Construction Co. Ltd., Toshiba Corporation, Dongfang Electric Corporation Limited, and Nordex SE. |

SEGMENT ANALYSIS

By Type Insights

The wind turbines segment dominated the market with a 35.6% share in 2024. Their rise is bolstered by innovations like floating offshore wind farms which operate in deep waters with stronger winds. BloombergNEF reports that floating offshore wind could add 264 GW of capacity globally by 2050, unlocking new energy potential. Additionally, community wind projects are gaining momentum, with the U.S. Department of Energy noting a 20% annual growth rate between 2020-2022. These localized projects empower communities to invest in renewable energy. Wind turbines are also critical for decarbonization, as they produce no direct emissions. Their ability to harness abundant wind resources makes them indispensable for clean energy transitions worldwide.

The Hydro turbines segment is the fastest-growing segment, with a CAGR of 4.2% during the forecast period. A key driver is the adoption of micro-hydropower systems, which generate less than 100 kW and are ideal for rural electrification. The World Bank states that micro-hydropower could provide electricity to 700 million people in remote areas by 2030 . Another factor is the expansion of pumped-storage hydropower that acts as a giant battery for renewable grids. The U.S. Department of Energy stresses that pumped storage accounts for 94% of global energy storage capacity ensuring grid stability. Hydro turbines are thus vital for integrating intermittent renewables and supporting sustainable energy access.

By Power Range Insights

The "Above 500 MW" segment led with a 40.8% market share in 2024. This dominance is due to their use in combined heat and power (CHP) systems which achieve efficiency rates of up to 80% according to the U.S. Environmental Protection Agency (EPA). Large turbines are also being retrofitted with carbon capture and storage (CCS) technologies to reduce emissions. For example, GE’s gas turbines equipped with CCS can cut CO2 emissions by up to 90%, making them crucial for heavy industries like steel and cement. Their high energy output and adaptability to emission-reduction technologies solidify their importance in global energy infrastructure.

The "Less than 1 MW" segment is growing fastest, with a CAGR of 6.8% over the forecast period. A major driver is the deployment of portable wind turbines for disaster relief. The United Nations Development Programme (UNDP) reports that portable systems have been used in over 50 disaster recovery projects globally since 2020. Another factor is their integration into agricultural operations where small turbines power irrigation systems, reducing costs for farmers. Small turbines are also central to urban microgrids, enabling decentralized energy production. Their flexibility and ability to support underserved regions make them essential for achieving universal electrification goals.

By End-user Insights

The Power generation segment held the largest share at 60.2% in 2024. A key trend is the rise of hybrid power plants which combine turbines with solar panels or battery storage. The National Renewable Energy Laboratory (NREL) confirms that hybrid plants increase energy output by 20-30% compared to standalone systems. Another innovation is the use of AI-driven predictive analytics, which reduces turbine downtime by 30% and improves operational efficiency. These advancements make turbines critical for modernizing energy infrastructure and ensuring reliable power supply in a rapidly evolving energy landscape.

The oil and gas segment is the rapidly expanding, with a CAGR of 5.3% in the coming years. A key driver is the adoption of flare gas recovery systems which convert waste gas into usable energy. The IEA estimates that flare gas recovery could reduce methane emissions by 10% globally by 2030. Another innovation is subsea turbines installed near offshore rigs to generate local power. These systems eliminate long-distance transmission, cutting costs by 15-20% while enhancing safety. Subsea turbines are pivotal for making offshore operations more sustainable and aligning with global environmental goals.

REGIONAL ANALYSIS

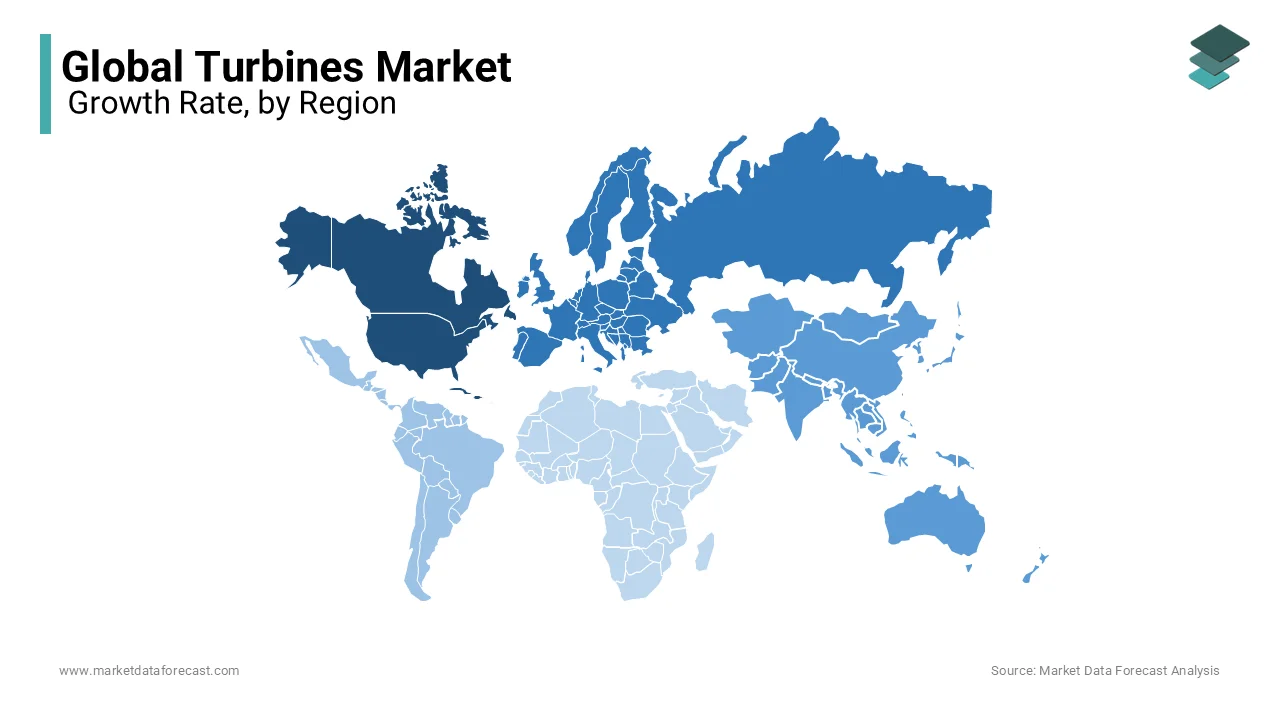

North America was a leader in the turbines market, with the U.S. driving growth through wind energy adoption. The Global Wind Energy Council reports that the U.S. installed over 14 gigawatts of wind capacity in 2022, ranking second globally. Policies like the Inflation Reduction Act provide tax incentives for renewables, boosting investments. According to the U.S. Energy Information Administration (EIA), wind power accounts for 10% of national electricity generation, with Texas contributing 30% of total capacity. Canada complements this growth, as hydropower supplies 60% of its electricity needs. North America’s leadership stems from advanced infrastructure, technological innovation, and strong private sector participation. Its commitment to decarbonization ensures its pivotal role in global renewable energy expansion.

Europe leads the turbines market due to ambitious renewable energy goals and offshore wind expertise. The European Wind Energy Association states that the region added 19 gigawatts of wind capacity in 2022, with Germany and the UK at the forefront. BloombergNEF shows that Europe holds 75% of global offshore wind capacity, with Denmark generating nearly 50% of its electricity from wind. The EU’s Green Deal targets 42.5% renewable energy by 2030, driving turbine demand. Europe benefits from robust regulatory frameworks, significant R&D investments, and public-private partnerships. Its leadership in clean energy transition makes it a critical player in achieving global sustainability and reducing carbon emissions effectively.

Asia Pacific dominated the turbines market, led by China’s massive wind energy investments. The Global Wind Energy Council confirms that China installed over 50 gigawatts of wind capacity in 2022, leading globally. India also plays a key role, aiming for 140 gigawatts of wind power by 2030. China’s National Energy Administration notes that renewables account for 30% of its energy mix, with hydropower being a major contributor. Japan and South Korea are investing heavily in offshore wind, targeting carbon neutrality by 2050. Asia Pacific’s leadership arises from rapid urbanization, supportive policies, and declining technology costs. Its large population and industrial growth make it essential for scaling renewable energy adoption worldwide.

Latin America is emerging as a significant player in the turbines market, driven by Brazil’s dominance in wind and hydropower. The Brazilian Wind Energy Association reports that Brazil added 3.8 gigawatts of wind capacity in 2022, ranking among the top 10 globally. Wind now supplies 12% of Brazil’s electricity, supported by favorable winds and abundant resources. Chile and Mexico are expanding their renewable portfolios, integrating solar and wind with hydropower. The International Renewable Energy Agency (IRENA) states that renewables account for 25% of the region’s energy mix. Latin America’s focus on clean energy reduces fossil fuel dependence, positioning it as a vital contributor to sustainable development and energy security in the Western Hemisphere.

The Middle East & Africa region is gaining traction in the turbines market, led by Morocco, Kenya, and the UAE. Morocco’s Noor Ouarzazate Solar Complex integrates hybrid systems with wind turbines, showcasing renewable innovation. Kenya’s Lake Turkana Wind Power project generates 310 megawatts, supplying 17% of the nation’s electricity. The International Energy Agency (IEA) predicts renewables could meet 50% of Africa’s energy needs by 2030. The UAE’s Masdar is investing $20 billion in global renewable projects, emphasizing clean energy leadership. This region benefits from abundant solar and wind resources, coupled with growing investments. Its progress is crucial for addressing energy poverty and advancing sustainable development across the continent.

KEY MARKET PLAYERS

The major players in the global turbines market include Bharat Heavy Electricals Limited (BHEL), Mitsubishi Hitachi Power Systems Ltd (MHPS), Harbin Electric Company Limited, ABB, General Electric Company, Siemens AG, Doosan Heavy Industries & Construction Co. Ltd., Toshiba Corporation, Dongfang Electric Corporation Limited, and Nordex SE.

TOP 3 PLAYERS IN THE MARKET

Brother Industries Ltd.

Brother Industries Ltd., a Japan-based company, is a global leader in the sewing machines market, known for its innovative and high-quality products. The company holds approximately 25-30% of the global market share. Its leadership stems from a focus on advanced technology, such as computerized sewing machines and IoT-enabled devices, which cater to both hobbyists and industrial users. In 2022, the company reported a 15% year-on-year growth in sewing machine sales and is driven by increased demand in North America and Europe. Brother has significantly contributed to the sewing machines market by introducing user-friendly, feature-rich sewing machines that appeal to diverse customer segments. For instance, its Innov-is series offers embroidery and quilting capabilities, attracting professional sewers. Additionally, Brother’s emphasis on sustainability is evident in its energy-efficient models, aligning with global eco-friendly trends. Its robust distribution network and after-sales services further solidify its dominance, making it a trusted choice for both individual crafters and industrial users.

Janome Sewing Machine Co. Ltd.

Janome, headquartered in Japan, is another major player in the sewing machines market, renowned for its premium and innovative products. The company commands around 20% of the global market share, as per industry estimates. Janome focuses on high-end sewing machines, particularly those used for embroidery, quilting, and crafting, which are popular among professional artisans. In 2022, Janome reported a 10% increase in revenue from its sewing machine segment, driven by rising interest in DIY crafts and home-based hobbies during the post-pandemic era. Janome has played a pivotal role in advancing sewing machine technology. Its flagship models, such as the Memory Craft series, incorporate advanced features like touchscreen interfaces and wireless connectivity, setting new standards in the industry. Janome’s commitment to quality and precision has earned it a loyal customer base, especially in developed regions like North America and Europe. By focusing on digitalization and customization, Janome has positioned itself as a trendsetter in the market, catering to the growing demand for sophisticated and versatile sewing solutions.

Singer (SVP Worldwide)

Singer, a historic brand acquired by SVP Worldwide, remains one of the most recognized names in the sewing machines market. Despite facing stiff competition from newer entrants, Singer retains a strong presence, particularly in emerging markets. It holds approximately 15-20% of the global market share, leveraging its legacy and affordability to attract budget-conscious consumers. In 2022, Singer reported a 5% growth in sales, driven by increased demand for affordable sewing solutions in developing economies. Singer’s contribution lies in making sewing machines accessible to a broader audience. The brand offers a wide range of products, from basic mechanical models to advanced computerized machines, catering to beginners and professionals alike. Its iconic models, such as the Heavy Duty series, remain bestsellers due to their durability and affordability. Singer has also embraced e-commerce, partnering with online platforms to expand its reach in regions like Asia-Pacific and Latin America.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Embracing the Maker Movement and DIY Culture

The global rise of the Maker Movement which is a cultural shift toward creating, crafting, and personalizing products and has opened new avenues for sewing machine manufacturers. Companies like Brother and Janome have tapped into this trend by positioning their machines as tools for creativity and self-expression. For instance, Brother sponsors craft fairs, sewing expos, and online maker communities to engage with hobbyists who value customization and craftsmanship. Similarly, Janome collaborates with influencers in the DIY space to showcase how its advanced embroidery machines can be used to create unique, personalized designs. This strategy not only boosts brand visibility but also fosters a sense of community among users, turning sewing into a lifestyle rather than just a utility.

Subscription-Based Models and Digital Services

In an era where subscription-based models dominate industries like software and entertainment, sewing machine companies are experimenting with similar approaches. Singer has introduced subscription-based access to digital patterns, tutorials, and design libraries through its online platforms, creating recurring revenue streams while keeping customers engaged. Brother offers cloud-based embroidery design services, allowing users to download exclusive patterns or customize designs remotely. These digital-first strategies cater to tech-savvy consumers and provide ongoing value beyond the initial purchase of the machine, ensuring long-term customer retention.

Gamification and Learning Platforms

To attract younger audiences and beginners, companies are incorporating gamification into their customer engagement strategies. Janome has developed interactive apps that guide users through sewing projects step-by-step, rewarding them with badges or points for completing tasks. Brother offers virtual sewing challenges and competitions on social media, encouraging users to share their creations and compete for prizes. This approach makes learning to sew more engaging and fun, lowering the barrier to entry for newcomers and fostering brand loyalty from the start. By blending education with entertainment, these initiatives help build a vibrant user community.

COMPETITIVE LANDSCAPE

The turbines market is characterized by intense competition, driven by the global transition toward renewable energy and the need for efficient power generation solutions. Key players such as General Electric (GE), Siemens Gamesa, Vestas, and Mitsubishi Heavy Industries dominate the industry, leveraging their technological expertise, extensive product portfolios, and strong global presence to maintain leadership. These companies focus on innovation, developing advanced turbine models with higher efficiency, durability, and adaptability to diverse environments. For instance, offshore wind turbines now achieve capacities exceeding 15 megawatts per unit, as reported by the Global Wind Energy Council, showcasing the industry’s rapid technological evolution.

Emerging markets in Asia-Pacific, Latin America, and Africa are becoming battlegrounds for market share, with companies investing heavily to tap into the growing energy demands of these regions. Chinese firms like Goldwind and Envision Energy are also gaining prominence, particularly in Asia, due to their cost-effective solutions and government support. Meanwhile, supply chain disruptions, rising material costs, and regulatory hurdles pose challenges, forcing companies to adopt strategic partnerships, mergers, and acquisitions to strengthen their positions. For example, Siemens Gamesa’s integration with Siemens Energy highlights efforts to streamline operations and enhance competitiveness.

Despite the competitive landscape, the market offers significant growth opportunities, particularly in floating offshore wind and hybrid energy systems. Companies that prioritize sustainability, digitalization, and customer-centric solutions are likely to lead the industry as it evolves to meet decarbonization goals and the increasing demand for clean energy worldwide.

RECENT MARKET DEVELOPMENTS

- In October 2024, Russia launched its first domestically produced high-capacity gas turbine, the GTD-110M, at the Udarnaya power station. This development replaces foreign technology from Siemens and GE, enhancing Russia’s energy independence.

- In February 2025, GE Vernova invested $90 million in its Schenectady plant to expand onshore wind turbine manufacturing. This initiative is part of a broader $600 million effort to boost U.S. clean energy infrastructure.

- In December 2024, Rolls-Royce advanced its micro nuclear reactor technology, designed for terrestrial use and space missions. This innovation supports future lunar missions, including NASA’s Artemis program.

- In May 2024, Godrej Aerospace developed high-temperature brazing methods for aero engines and committed to delivering eight modules of the 48kN Dry Kaveri engine between late 2024 and August 2025.

- In October 2024, HydroQuest secured €51 million in EU funding for the 17.5MW FloWatt tidal stream turbine project, expected to be operational by 2027, advancing renewable marine energy solutions.

MARKET SEGMENTATION

This research report on the global turbines market is segmented and sub-segmented into the following categories.

By Type

- Steam Turbines

- Gas Turbines

- Hydro Turbines

- Wind Turbines

By Power Range

- Less than 1 MW

- 1 MW to 50 MW

- 51 MW to 200 MW

- 201 MW to 500 MW

- Above 500 MW

By End-user

- Power Generation

- Oil and Gas

- Chemical & Fertilizer

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the wind turbine market?

The wind turbine market is expanding due to technological advancements, declining costs, and increased emphasis on renewable energy sources.

How do floating wind turbines differ from traditional ones?

Floating wind turbines are mounted on buoyant platforms, allowing installation in deeper waters where traditional fixed turbines are not feasible.

What role do government initiatives play in turbine market growth?

Government policies, financial incentives, and investments in research and development significantly boost the adoption and advancement of turbine technologies.

What is the future outlook for the global turbines market?

The turbines market is poised for substantial growth, propelled by the global transition to renewable energy and the need for efficient power generation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]