Global Turbine Oil Market Research Report - Segmentation By Type (Mineral Oil-Based Turbine Oils and Synthetic Oil-Based Turbine Oil), By Application (Steam Turbines, Gas Turbines, Wind Turbines and Hydro Electric Turbines), and Region - Industry Forecast of 2024 to 2032.

Global Turbine Oil Market Size (2024 to 2032):

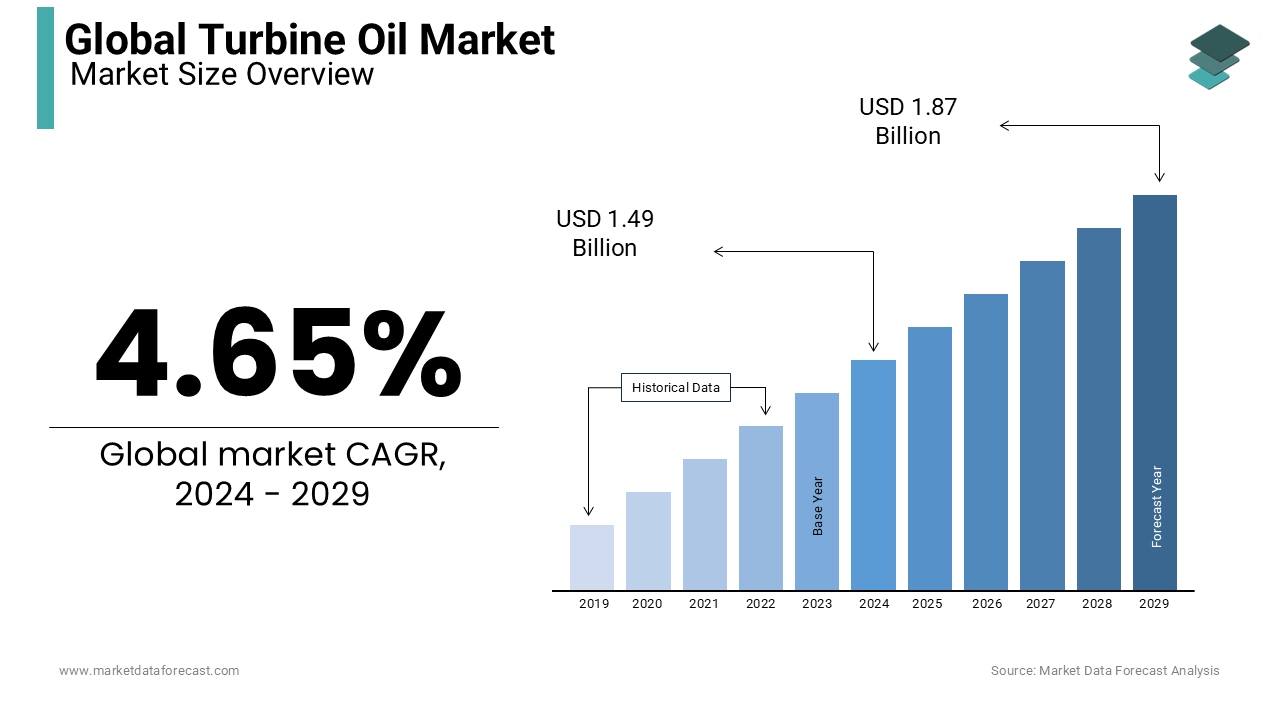

The global turbine oil market was estimated at US$ 1.42 billion in 2023 and is anticipated to reach a valuation of US$ 2.14 billion by 2032 from US$ 1.49 billion in 2024, growing at a CAGR of 4.65% during the forecast period 2024-2032.

Current Scenario of the Global Turbine Oil Market

The Turbine Oil Market is showing strong expansion due to improving economies and escalated call for energy in developing and developed nations of the world. Conventional Turbine Oils are the most widely employed mineral-based lubricating oils, helping to remove external contamination and oxidation control products. With the recent expansion of bio-based turbine oils, relatively faster expansion is predicted, particularly in North America and Europe.

Turbine oil was primarily designed for use in turbines, but with the development of chemical techniques, it has now become an oil that inhibits rust and oxidation, providing long life with the use of conventional filters. Maintenance professionals are challenged to implement tactics that improve equipment performance over long service periods, like high temperatures, and water contamination. Turbine oil is a high-quality mineral oil with excellent water-separating ability. Turbine oil formulations are a blend of base oil (97%), corrosion inhibitors, rust and oxidation inhibitors, antifoam, and demulsifiers. Turbine oils are high-quality oils with excellent water separation properties. These oils are primarily employed as lubricants for turbine applications like steam, hydroelectric, and gas applications.

MARKET TRENDS

Aviation has the largest market size in the turbine oil end-user segment in the world, followed by the automotive end-use segment. India's civil aviation industry is on a high expansion trajectory. Market call for turbine oils clearly indicates that India will become the third-largest aviation market by 2020 and the largest by 2030. Higher horsepower designs, resulting in higher thermal stresses on lubricants, have been a general trend over the years. Resistance to thermal degradation is one of the vital properties concentrated for modern gas turbine oil lubricants. For exceptional oil life and deposit control and resistance to thermal and chemical degradation, as well as balance, manufacturers use specific additives that maximize the benefits of synthetic base oils.

MARKET DRIVERS

To provide exceptional performance in evolving turbine equipment designs, lubricant manufacturers continually work with OEMs to ensure highly calibrated product offerings.

In product development, the evolution of designs and operating conditions are key element in the application of lubricant technology that is predicted to provide the performance that users call for. The escalated call for electricity around the world has led to an augmented need to install new gas, steam, and hydroelectric turbines. This is the main factor driving the global turbine oil market. The rising call for electricity around the world has led to an improved need to install new gas, steam, and hydroelectric turbines. It is the leading factor in the turbine oil business.

MARKET RESTRAINTS

Restrictions, like rising hardware and software costs, could become critical impediments to market expansion. The shortage of capacity in the placement of VR solutions and the lack of skills of healthcare professionals to adapt to new technologies will also hamper market expansion.

MARKET OPPORTUNITIES

The escalating use of turbine oils in hydraulic turbines, rotary air compressors, steam turbines, and hydro and gas turbines has created an escalated call for turbine oils.

Oil replacement and maintenance of aging turbines and industrial machinery are also predicted to generate a significant call for turbine oils during the foreseen period. The automotive and aviation industry is a major consumer of turbine oils, whose expansion is predicted to increase during the foreseen period. The proliferation of wind farms and the installation of steam and hydroelectric turbines to meet the growing call for electricity around the world has created substantial opportunities for the turbine oil industries. Growing investments in the wind energy sector and favorable government initiatives to achieve sustainable development goals are predicted to stimulate expansion in the turbine oil industry during the outlook period.

MARKET CHALLENGES

The main challenge gas turbine lubricant manufacturers face is delivering long-lasting performance while exposed to high temperatures.

The challenge that prevailed in the contemporary phase of the gas turbine lubricant formulators market can only be changed by machines with exceptional thermal stability and oxidation resistance to operate under severe operating conditions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.65% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lukoil Lubricants Company, Chevron USA Inc., RoyalDutch Shell Plc., FUCHS Lubritech GmbH, Exxon Mobil Corporation, Shell India, Eastern Petroleum Pvt. Ltd., Klüber Lubrication NA LP, Penrite Oil Company, and Paras Lubricants Limited and Others. |

SEGMENTAL ANALYSIS

Global Turbine Oil Market Analysis By Type

The mineral oil segment dominated the turbine oil market in 2023. Mineral oil-based lubricants are made from crude oil and are readily available and affordable compared to other types of lubricants.

Global Turbine Oil Market Analysis By Application

The wind turbine segment is predicted to grow at a high CAGR during the foreseen period due to escalated investment in wind power and favorable government policies and initiatives.

REGIONAL ANALYSIS

The Asia Pacific region dominated the worldwide turbine oil market in 2023 and is likely to grow at a significant CAGR.

A strong call for power generation in China, Japan, India, and Southeast Asia would eventually increase the number of steam and wind turbine installations. According to the Worldwide Wind Energy Council (GWEC), about 104,934 wind turbines were in service in China at the end of 2016. North America and Europe are also predicted to see significant expansion during the outlook period due to the growing call for ecological bioproducts based on turbine oils. According to the Worldwide Wind Energy Council (GWEC), approximately 52,343 wind turbines were operating in the United States at the end of 2016. Nevertheless, the Latin America region is foreseen to develop in a considerable manner in the turbine oil business over the outlook period.

KEY PLAYERS IN THE GLOBAL TURBINE OIL MARKET

Companies playing a prominent role in the global turbine oil market include Lukoil Lubricants Company, Chevron USA Inc., RoyalDutch Shell Plc., FUCHS Lubritech GmbH, Exxon Mobil Corporation, Shell India, Eastern Petroleum Pvt. Ltd., Klüber Lubrication NA LP, Penrite Oil Company, and Paras Lubricants Limited and Others.

RECENT HAPPENINGS IN THE GLOBAL TURBINE OIL MARKET

-

Fluitec International has introduced Infinity Fluids' new turbine oil (TO), the first of its type in the industry. By effectively removing by-products from varnish production, Fluitec has created a "pure" turbine oil that can dramatically extend the life of the application.

DETAILED SEGMENTATION OF THE GLOBAL TURBINE OIL MARKET INCLUDED IN THIS REPORT

This global turbine oil market research report has been segmented and sub-segmented based on type, application, and region.

By Type

- Mineral Oil-Based

- Synthetic Oil-Based

By Application

- Steam Turbines

- Gas Turbines

- Wind Turbines

- Hydroelectric Turbines

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Turbine Oil Market growth rate during the projection period?

The Global Turbine Oil Market is expected to grow with a CAGR of 4.65% between 2024-2029.

What can be the total Turbine Oil Market value?

The Global Turbine Oil Market size is expected to reach a revised size of US$ 1.87 billion by 2029.

Name any three Turbine Oil Market key players?

RoyalDutch Shell Plc, FUCHS Lubritech GmbH, and Exxon Mobil Corporation are the three Turbine Oil Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]