Global Tulip Market Size, Share, Trends & Growth Forecast Report Segmented By Type( Fresh, Dry), Application, Distribution Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Tulip Market Size

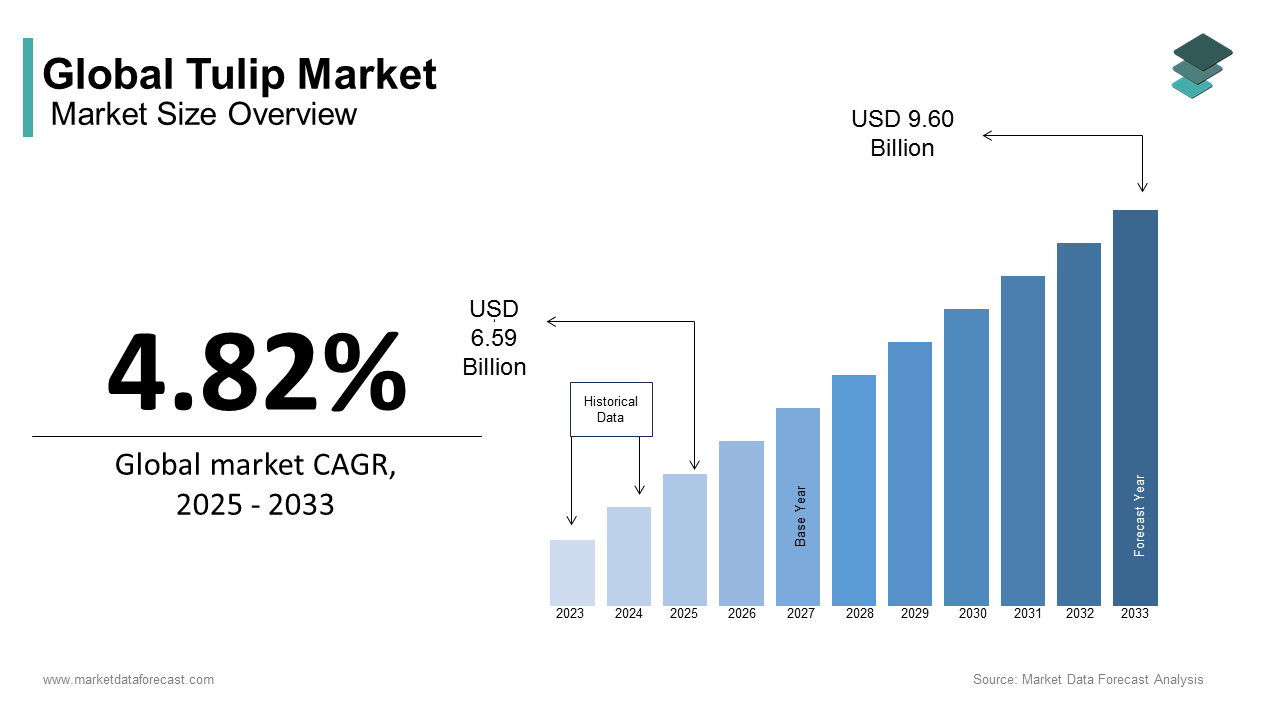

The global tulip market size was calculated to be USD 6.29 billion in 2024 and is anticipated to be worth USD 9.60 billion by 2033 from USD 6.59 billion In 2025, growing at a CAGR of 4.82% during the forecast period.

Tulips gained immense popularity in Europe during the 16th century since its originating from Central Asia and have become emblematic of springtime and ornamental horticulture. The Netherlands stands as the preeminent leader in tulip production. In 2023, approximately 15,000 hectares of Dutch farmland were dedicated to tulip bulb cultivation by marking a 32% increase over the past decade. This extensive cultivation is the country's pivotal role in the marketplace. Beyond their economic impact, tulips contribute significantly to the Netherlands' cultural heritage and tourism by attracting millions of visitors annually to events like the Keukenhof Gardens' spring displays.

Beyond the Netherlands, countries such as Lithuania, Poland, Denmark, and Latvia have also established themselves as notable producers and exporters of tulip bulbs is contributing to the diversity and availability of tulip varieties in the global market. The widespread cultivation and appreciation of tulips reflect their enduring appeal and the robust demand for these flowers in both domestic and international markets.

MARKET DRIVERS

Expansion of Tulip Cultivation Area

The tulip market has experienced significant growth owing to the expansion of cultivation areas. In the Netherlands, the total area dedicated to tulip bulb production increased from approximately 12,000 hectares in 2008 to about 15,000 hectares in 2023 which marks a substantial rise over 15 years. According to the Netherlands' Central Bureau of Statistics (CBS), the area used for flower bulb cultivation has grown by more than 20% since 2013 with tulips dominating production. This increase in cultivation area not only supports higher production volumes but also enhances the availability of diverse tulip varieties to meet consumer preferences.

Tourism and Cultural Significance

Tourism significantly propels the tulip market in regions where tulips hold cultural importance. The Netherlands, renowned for its tulip fields attracts millions of visitors annually during the blooming season. The Keukenhof Gardens, one of the world's largest flower gardens, showcases over seven million flowers each year, many of which are tulips with approximately 1.5 million visitors annually. This influx of tourists not only boosts the local economy but also elevates the global profile of tulips is nurturing increased interest and demand. The Dutch tourism sector's growth is closely linked to such cultural attractions with projections indicating continued expansion in the coming years.

MARKET RESTRAINTS

Declining Number of Tulip Growers

The tulip market faces challenges due to a significant reduction in the number of tulip bulb growers. Between 2000 and 2017, the number of tulip bulb cultivation enterprises in the Netherlands decreased by 46%, from 1,663 to 893. It also raises concerns about reduced genetic diversity and increased vulnerability to market fluctuations while this may lead to economies of scale. Disease outbreaks or economic downturns may even pose challenges for the market players.

Pesticide Usage and Environmental Concerns

Environmental concerns related to pesticide usage present another restraint in the tulip market. In 2020, Dutch farmers applied 5 million kilograms of crop protection products which is a decrease of over 11% compared to 2016. Specifically, tulip cultivation required 25.8 kilograms of active pesticide substances per hectare in 2020 which is slightly down from 28.1 kilograms in 2016. Tulip farming remains one of the more pesticide-intensive agricultural activities. This reliance on chemical treatments raises issues regarding environmental sustainability and may lead to stricter regulations which is potentially increasing production costs and affecting market dynamics.

MARKET OPPORTUNITIES

Expansion of Export Markets

The tulip market presents significant opportunities through the expansion of export destinations. In 2022, the Netherlands exported over one billion euros worth of flower bulbs which is nearly 30% increase compared to five years earlier. Notably, tulip exports experienced a 44% rise in value is reaching 320 million euros, with the volume of exported tulip bulbs increasing by 16% during the same period. This growth indicates a robust international demand for tulips and suggests potential for further market expansion into emerging economies. Diversifying export markets can enhance revenue streams and reduce dependency on traditional markets thereby strengthening the resilience of the tulip market.

Advancements in Cultivation Techniques

Innovations in cultivation methods offer substantial opportunities for the tulip market. The total area dedicated to flower bulb cultivation in the Netherlands expanded by over 20% since 2013 by reaching more than 27,000 hectares in 2023. This increase is partly attributed to the adoption of advanced agricultural practices, such as precision farming and sustainable cultivation techniques, which enhance yield and quality. Implementing these modern methods can lead to more efficient use of resources, reduced environmental impact, and improved profitability for growers. Embracing technological advancements positions the tulip market to meet growing global demand while adhering to environmental and regulatory standards.

MARKET CHALLENGES

Regulatory Challenges Impacting Traditional Tulip Vendors

In July 2024, Amsterdam's traditional tulip vendors faced significant challenges due to new European Union regulations. These rules mandate that permanent permits for flower stands be subjected to a lottery system every ten years by replacing the longstanding practice of automatic renewals. This change threatens the stability of family-run businesses that have operated for generations which is potentially disrupting the continuity of tulip sales in iconic locations. Critics argue that such regulations could erode Dutch cultural heritage and adversely affect the livelihoods of established vendors. The Amsterdam city council acknowledges the necessity to comply with EU directives but faces opposition from those advocating for the preservation of traditional tulip stands.

Environmental Concerns and Pesticide Usage

Environmental concerns related to pesticide usage present another restraint in the tulip market. In 2022, Dutch farmers applied 9 million kilograms of crop protection products, primarily for agricultural use. This represents a 4% decrease compared to 2021 and an 18% reduction since 2011. Despite this overall decline, certain sectors such as flower cultivation is remaining reliant on chemical treatments. This reliance raises issues regarding environmental sustainability and may lead to stricter regulations that potentially increasing production costs and affecting market dynamics.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.82% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dümmen Orange, Syngenta, Finlays, Beekenkamp, Selecta Klemm, Oserian, PitchBook Data, Multiflora, Queens Group, Ball Horticultural Company, Farplants Group Ltd, Dutch Flower Group, Astraflowers, IncCNH Industrial America LLC., SEED HAWK, Bourgault Industries Ltd., Dawn Equipment Company, Zoomlion Heavy Industry Science & Technology Co., Ltd., Visser Horti Systems, Kverneland AS and KUBOTA Corporation |

SEGMENTAL ANALYSIS

By Type Insights

The fresh tulips segment dominated the market by holding the most significant share of the global tulip market in 2024. The domination of the fresh segment is majorly attributed to the widespread usage of fresh tulips in floral arrangement, gifting, and decorative purposes. According to the Food and Agriculture Organization, fresh tulips are favored for their vibrant colors and short shelf life which drives frequent repurchasing. Additionally, countries like the Netherlands export over 2 billion fresh tulip stems annually are catering to both domestic and international markets. This segment's importance lies in its ability to sustain florists, retailers, and growers while maintaining cultural traditions tied to fresh flowers.

The dry tulips segment is more likely to have a prominent CAGR of 8.3% in tulips market during the forecast period. Factors such as increasing demand for long-lasting floral decorations and sustainable products are propelling the growth of the dry segment in the global market. According to the United Nations Environment Programme studies, dry tulips are gaining popularity due to their eco-friendly nature which is requiring no water or refrigeration. Furthermore, the Indian Ministry of Commerce reports a rising trend of using dried tulips in home decor and crafts among millennials. Dry tulips offer an innovative solution is reducing waste while appealing to modern lifestyles as consumers prioritize sustainability and aesthetic versatility.

By Application Insights

The home segment was the largest segment in the global market in 2024 and held a 65.8% of the global market share in 2024. The lead of the home segment in the worldwide market is credited to growing trend of home gardening and interior decoration, particularly in urban areas. As per the Food and Agriculture Organization, tulips are favored for their vibrant colors and ease of maintenance by making them ideal for residential spaces. Additionally, the rise of DIY home improvement projects is fueled by platforms like Pinterest and Instagram which has increased demand for ornamental flowers. As per the European Commission reports, over 70% of tulip purchases in Europe are for personal use, underscoring their cultural significance in home aesthetics. This segment's importance lies in its ability to cater to individual preferences while fostering emotional connections through floral beauty.

The commercial segment is predicted to witness the highest CAGR of 9.7% over the forecast period owing to the rising demand for tulips in hotels, restaurants, corporate events, and public spaces, where they enhance ambiance and customer experience. According to the United Nations Conference on Trade and Development, the global hospitality industry’s recovery post-pandemic has significantly boosted floral spending, with tulips being a top choice due to their versatility and affordability. Furthermore, the Indian Ministry of Tourism reports a 12% annual increase in floral decorations for weddings and festivals is driving commercial demand. Tulips play a pivotal role in creating memorable experiences that is enhancing this segment's rapid expansion.

By Distribution Channel Insights

The specialty stores and florists segment had the leading share of 45.8% of the global market in 2024. The ability of specialty stores to offer fresh and high-quality tulips with personalized services that are critical for gifting and special occasions is majorly contributing to the domination of the segment in the global market. According to the United States Department of Agriculture, florists cater to over 60% of floral purchases during peak seasons like Valentine’s Day and Mother’s Day. Additionally, specialty stores often provide expert advice on flower care is enhancing customer satisfaction. This segment's importance lies in its role as a trusted source for premium tulips is maintaining cultural traditions and supporting local growers while driving steady demand in the global tulip market.

The online retail segment is estimated to register the fastest CAGR of 12.5% during the forecast period. Factors such as the convenience of doorstep delivery, competitive pricing and the rise of digital platforms are fuelling the online retail segment in the global market. According to the U.S. Census Bureau, that online floral sales grew by 20% in 2022 with tulips being a popular choice due to their vibrant appeal and versatility. Furthermore, the Indian Ministry of Electronics and Information Technology reports that mobile commerce accounts for 45% of online flower orders by reflecting shifting consumer preferences. Online retail bridges gaps between producers and consumers is making tulips more accessible globally while fostering innovation in packaging and logistics.

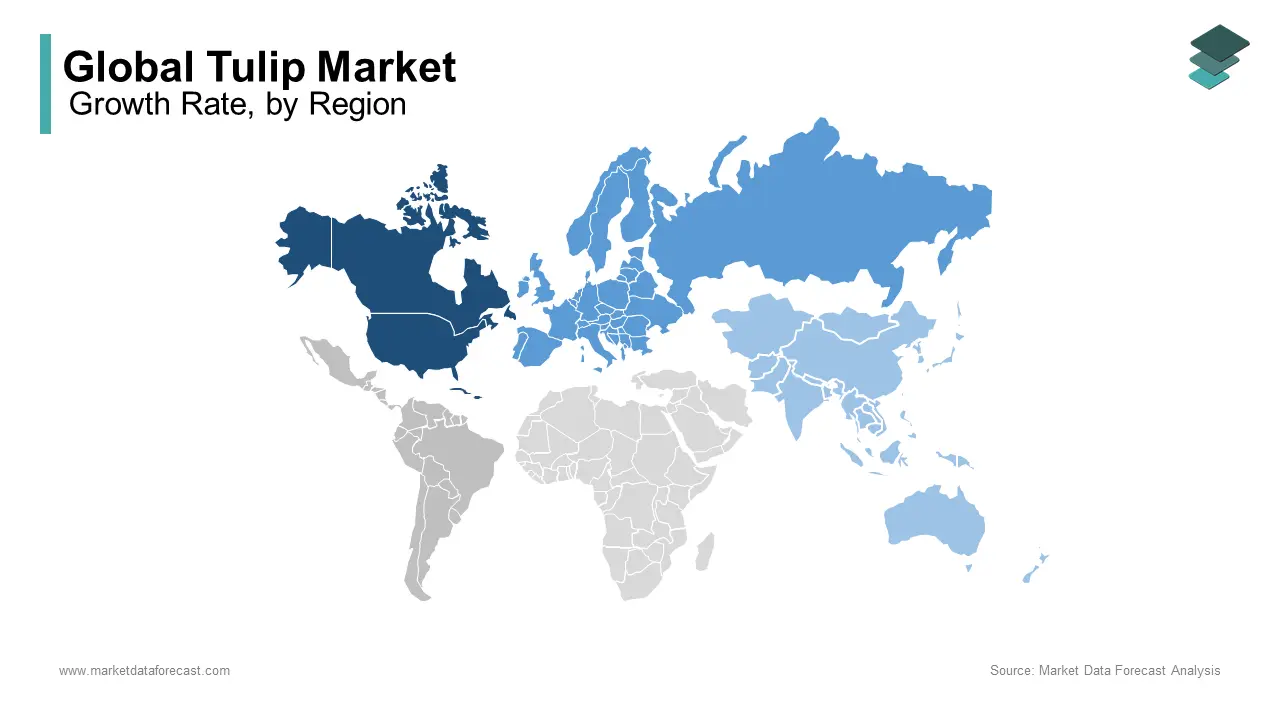

REGIONAL ANALYSIS

Europe was the top performer in the tulip market in 2024 and accounted for a dominating share of the global market. This dominance is driven by the Netherlands, which produces over 2 billion tulip stems annually is accounting for 80% of global exports, according to the Food and Agriculture Organization. The region's leadership stems from its advanced floriculture infrastructure, favorable climate, and strong cultural ties to tulips during spring festivals. The Royal Horticultural Society states that tulips are integral to European traditions is making them a staple in both domestic consumption and international trade. Europe’s prominence ensures it remains a benchmark for quality and innovation in tulip cultivation and distribution.

Asia-Pacific is predicted to be the fastest growing region in the global tulip market and is projected to grow at a CAGR of 9.7% during the forecast period. Rising disposable incomes, urbanization, and increasing adoption of Western gifting traditions are key drivers. The Indian Ministry of Commerce reports a 15% annual rise in tulip imports, while China’s floral sector grew by 18% in 2022 is fueled by online retail expansion. According to the Australian Department of Agriculture, growing demand for tulips in weddings and corporate events across Southeast Asia. This region is poised to become a significant consumer and producer by ensuring rapid market expansion.

North America shows steady growth during the forecast period. Latin America led by Colombia and Ecuador, focuses on exporting cut flowers, including tulips, to North America, with trade volumes rising by 10% annually, according to the International Trade Centre. The Middle East and Africa are expected to grow due to rising tourism and events with Dubai’s flower imports increasing by 12% yearly, as per Dubai Chamber of Commerce reports. These regions benefit from favorable climates and strategic trade routes, positioning them as emerging markets for tulip consumption and production in the coming years.

KEY MARKET PLAYERS

Major Players of the global tulip market include Dümmen Orange, Syngenta, Finlays, Beekenkamp, Selecta Klemm, Oserian, PitchBook Data, Multiflora, Queens Group, Ball Horticultural Company, Farplants Group Ltd, Dutch Flower Group, Astraflowers, IncCNH Industrial America LLC., SEED HAWK, Bourgault Industries Ltd., Dawn Equipment Company, Zoomlion Heavy Industry Science & Technology Co., Ltd., Visser Horti Systems, Kverneland AS and KUBOTA Corporation

The global tulip market is characterized by intense competition, driven by a mix of established players, regional growers, and evolving consumer preferences. Leading companies such as Dümmen Orange, Syngenta, and Dutch Flower Group dominate the industry through innovation, sustainability initiatives, and robust supply chain management. These key players focus on developing unique tulip varieties with vibrant colors, extended vase life, and disease resistance, leveraging advanced biotechnology to maintain their competitive edge. At the same time, smaller regional growers and cooperatives cater to niche markets, emphasizing local cultivation and eco-friendly practices.

Competition is further intensified by the growing influence of online retail platforms, which have lowered entry barriers for smaller brands while enabling larger companies to expand their reach. The rise of e-commerce has also spurred price wars and increased pressure on supply chain efficiency. Additionally, regions like Asia-Pacific and Latin America are emerging as competitive hubs due to rising disposable incomes and increasing adoption of Western gifting traditions, challenging traditional exporters like the Netherlands.

Sustainability has become a critical differentiator, with stringent environmental regulations and eco-conscious consumer preferences shaping market dynamics. Companies that adopt sustainable practices, such as reducing chemical inputs and promoting pest-resistant hybrids, gain a significant advantage. Furthermore, strategic collaborations with florists, retailers, and event planners help players strengthen their market presence. This multifaceted competition enables the need for continuous innovation, adaptability, and differentiation in the ever-evolving tulip market

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation in Breeding and Product Development

Leading companies like Dümmen Orange and Syngenta focus on developing innovative tulip varieties with unique characteristics such as vibrant colors, extended vase life, and disease resistance. By leveraging advanced biotechnology and genetic research, they cater to diverse market demands, from commercial growers to hobbyists, ensuring their products remain competitive.

Sustainability and Eco-Friendly Practices

Sustainability is a cornerstone strategy for key players. Companies emphasize eco-friendly practices, such as reducing chemical inputs and promoting pest-resistant hybrids. This aligns with global environmental trends and enhances brand reputation among environmentally conscious consumers and regulators.

Vertical Integration and Supply Chain Optimization

Players like Dutch Flower Group adopt vertical integration to control the entire supply chain, from breeding and cultivation to logistics and retail. This ensures consistent quality, timely delivery, and cost efficiency, particularly during peak demand seasons like spring festivals.

Expansion into Emerging Markets

To tap into new growth opportunities, companies are expanding their presence in emerging markets like Asia-Pacific and Latin America. By establishing partnerships with local growers and investing in regional distribution networks, they increase accessibility and affordability for consumers in these regions.

Digital Marketing and E-Commerce Integration

With the rise of online retail, key players are embracing digital platforms to reach broader audiences. By leveraging social media, personalized marketing, and e-commerce channels, they enhance customer engagement and drive sales, particularly among younger demographics.

TOP 3 PLAYERS IN THE MARKET

Dümmen Orange

Dümmen Orange is a global leader in the floriculture industry, including the tulip market, with a strong focus on breeding and propagating innovative varieties. The company is known for developing tulips that feature vibrant colors, extended vase life, and disease resistance. Their commitment to sustainability and eco-friendly practices aligns with global trends, ensuring compliance with environmental standards. By combining cutting-edge research with extensive distribution networks, Dümmen Orange has established itself as a key player driving innovation and quality in the tulip market. Their efforts have made them a trusted name among growers and retailers worldwide.

Syngenta

Syngenta is a leading agricultural company that plays a pivotal role in the tulip market through its expertise in seed and bulb technology. The company’s tulip varieties are renowned for their resilience and adaptability to diverse climates, making them ideal for both commercial growers and hobbyists. Syngenta’s focus on sustainable agriculture and pest-resistant hybrids has positioned it as a trusted supplier for large-scale tulip producers. By integrating advanced breeding techniques with global outreach, Syngenta continues to shape the future of tulip cultivation and trade, promoting high-quality and reliable products.

Dutch Flower Group

The Dutch Flower Group (DFG) is a dominant force in the tulip market, particularly in Europe, where it controls a significant share of the supply chain. The group’s strength lies in its vertically integrated operations, from breeding and cultivation to logistics and retail. DFG collaborates with local growers to ensure consistent quality and timely delivery, particularly during peak seasons like spring festivals. Their commitment to sustainability and innovation has made them a preferred partner for retailers and florists globally. By maintaining robust trade networks and promoting Dutch tulips as a premium product, DFG continues to influence global tulip consumption trends and market dynamics.

MARKET SEGMENTATION

This research report on the global tulip market has been segmented and sub-segmented based on type, application, distribution channel, and region.

By Type

- Fresh

- Dry

By Application

- Home

- Commercial

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores/Florists

- Online Retail

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors influence the growth of the tulip market?

Climate conditions, demand for ornamental flowers, technological advancements in floriculture, and trade regulations significantly impact the tulip market.

2. Who are the key players in the global tulip market?

Key players include Royal FloraHolland, Dutch Grown, Fluwel, Kapiteyn, and other major tulip growers and exporters.

3. What is the expected growth trend of the tulip market?

The tulip market is expected to grow due to increasing demand for cut flowers, urban landscaping, and the rising popularity of flower tourism.

4. How can tulip farmers increase production efficiency?

By adopting advanced greenhouse technologies, optimizing irrigation systems, and using pest-resistant tulip varieties, farmers can improve production efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]