Global Train Battery Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report Segmented By Battery Type (Lead Acid, Nickel Cadmium, And Lithium-Ion), Rolling Stock Type (Locomotive, Metro, Monorail, Tram, Freight Wagons and Passenger Coaches), Application, Train Type and Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Train Battery Market Size

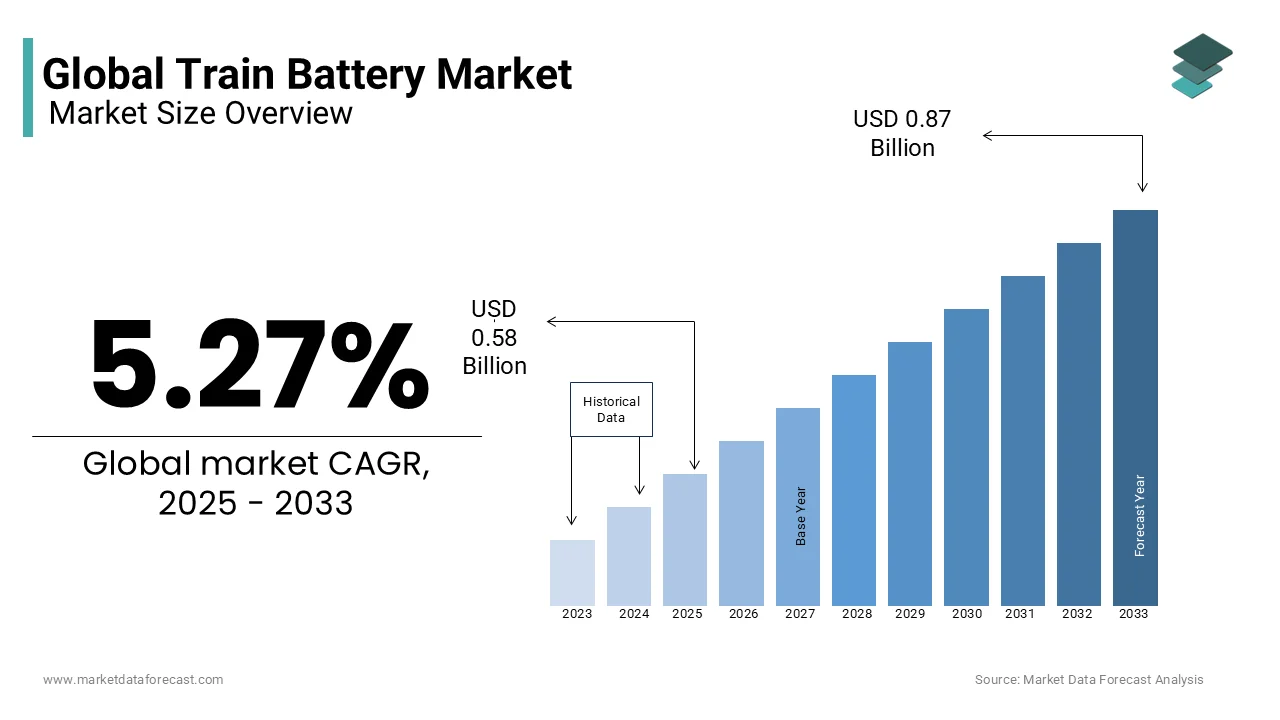

The global train battery market was valued at USD 0.55 billion in 2024 and is anticipated to reach a valuation of USD 0.58 billion in 2025 from USD 0.87 billion by 2033, growing at a CAGR of 5.27% from 2025 to 2033.

Train batteries are critical components in modern railway systems, providing power for starting engines, auxiliary systems, and hybrid propulsion. These batteries are integral to ensuring operational efficiency, safety, and sustainability in rail transport. According to the International Union of Railways (UIC), the global demand for train batteries grew by 8% in 2022, driven by the increasing adoption of hybrid and battery-operated trains. The European Commission's Green Deal initiative emphasizes reducing carbon emissions from transportation, further amplifying demand for advanced battery technologies in railways. Additionally, according to the U.S. Department of Transportation, investments in sustainable rail infrastructure exceeded $50 billion in 2022, creating a favorable environment for train battery adoption.

MARKET DRIVERS

Rising Demand for Hybrid Trains

The escalating demand for hybrid trains is primarily driving the growth of the train battery market. According to the International Energy Agency (IEA), hybrid trains accounted for 15% of new rail vehicle orders in 2022, driven by their ability to reduce fuel consumption and emissions. Train batteries play a pivotal role in hybrid propulsion systems, enabling efficient energy storage and distribution. The European Railway Agency reports that over 60% of hybrid trains in Europe utilize advanced lithium-ion batteries, reflecting their widespread adoption. Additionally, the Asian Development Bank, investments in hybrid rail technologies have grown considerably in the recent years and further amplifying demand for train batteries. This trend positions train batteries as a cornerstone of growth in the hybrid rail sector, particularly for applications requiring compliance with stringent environmental standards.

Stringent Emission Regulations

Stringent emission regulations governing the transportation sector is another major factor fuelling the growth of the train battery market. According to the U.S. Environmental Protection Agency (EPA), over 40% of rail operators in North America have adopted low-emission technologies to comply with federal air quality standards. Train batteries are extensively used in battery-operated and hybrid trains to achieve zero or near-zero emissions. The European Commission's Horizon Europe program emphasizes innovation in sustainable transport, further boosting demand for eco-friendly train batteries. Additionally, the International Union of Railways (UIC) projects that investments in emission-reducing technologies will reach $70 billion by 2030, underscoring the critical role of train batteries in enabling innovative and sustainable rail solutions.

MARKET RESTRAINTS

High Initial Costs

High initial costs associated with advanced train batteries is a significant restraint for the market. According to the International Transport Forum (ITF), the cost of incorporating lithium-ion batteries into hybrid and battery-operated trains is approximately 30-40% higher than traditional lead-acid batteries, limiting their affordability for small-scale operators. The European Railway Agency notes that over 60% of rail operators cite affordability as a primary barrier to adopting advanced train batteries, particularly in developing regions. Additionally, fluctuations in raw material prices, particularly lithium and cobalt, exacerbate this issue. According to the International Energy Agency (IEA), the cost of these materials surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Charging Infrastructure

Limited charging infrastructure for battery-operated trains are further hindering the growth of the train battery market. According to the International Union of Railways (UIC), less than 40% of rail networks in Europe and North America are equipped with adequate charging facilities, creating a significant operational bottleneck. The U.S. Department of Transportation highlights that over 50% of rail operators struggle to adopt battery-operated trains due to insufficient charging infrastructure. Furthermore, the Asian Development Bank reports that investments in rail electrification and charging technologies remain insufficient, with only $10 billion allocated annually across the region. This lack of infrastructure not only slows the adoption of battery-operated trains but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, industry stakeholders, and research institutions to develop comprehensive charging networks.

MARKET OPPORTUNITIES

Advancements in Lithium-Ion Technology

Advancements in lithium-ion technology present a lucrative opportunity for the train battery market. According to the International Energy Agency (IEA), over 30% of new rail vehicles globally are transitioning to lithium-ion batteries, driven by their superior energy density, longevity, and performance. The European Commission's Green Deal initiative emphasizes reducing carbon footprints in transportation, further amplifying demand for advanced lithium-ion train batteries. Additionally, the International Union of Railways (UIC) highlights the increasing use of lithium-ion batteries in high-speed and urban rail systems, further amplifying demand. This opportunity positions lithium-ion train batteries as a critical enabler of global sustainability goals, aligning with the region's commitment to reducing emissions from transportation.

Expansion into Emerging Markets

The growing focus on emerging markets is another promising opportunity for the train battery market. According to the Asian Development Bank, the demand for battery-operated and hybrid trains in Asia-Pacific grew by 12% in 2022, driven by rapid urbanization and government initiatives to modernize rail infrastructure. Train batteries are extensively used in metro and monorail systems, where they provide reliable and eco-friendly power solutions. The African Development Bank projects that investments in rail electrification will reach $20 billion by 2030, further accelerating this trend. Additionally, the International Union of Railways (UIC) supports the development of sustainable rail solutions in emerging economies, amplifying the need for advanced train batteries. This opportunity underscores the immense potential for market expansion in high-growth regions.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions is significant challenge to the train battery market, exacerbated by logistical bottlenecks and geopolitical tensions. According to the International Transport Forum (ITF), shipping delays increased by 25% in 2022, affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as lithium and cobalt, which account for nearly 70% of train battery production expenses. The International Energy Agency (IEA) reports that imports of certain raw materials declined by 40% in 2022, leading to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules, impacting market stability. According to the U.S. Department of Transportation, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges, underscoring the severity of this issue.

Technological Limitations

Technological limitations surrounding battery performance and lifespan is another major challenge to the train battery market. According to the International Union of Railways (UIC), over 40% of train battery projects face delays due to issues such as limited energy density, overheating, and degradation over time. The European Railway Agency reports that compliance costs for advanced battery technologies have risen by 20% over the past three years, limiting affordability for small-scale operators. Additionally, the Asian Development Bank highlights that investments in battery research and development remain insufficient, with only $5 billion allocated annually across the region. These technological hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.27% |

|

Segments Covered |

By Battery Type, Rolling Stock Type, Application, Train Type and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CRRC Corporation Limited, Alstom, Siemens Mobility, Bombardier Transportation, General Electric, Hyundai Rotem, Kawasaki Heavy Industries, Trinity Rail Group, Stadler Rail AG, and Others. |

SEGMENT ANALYSIS

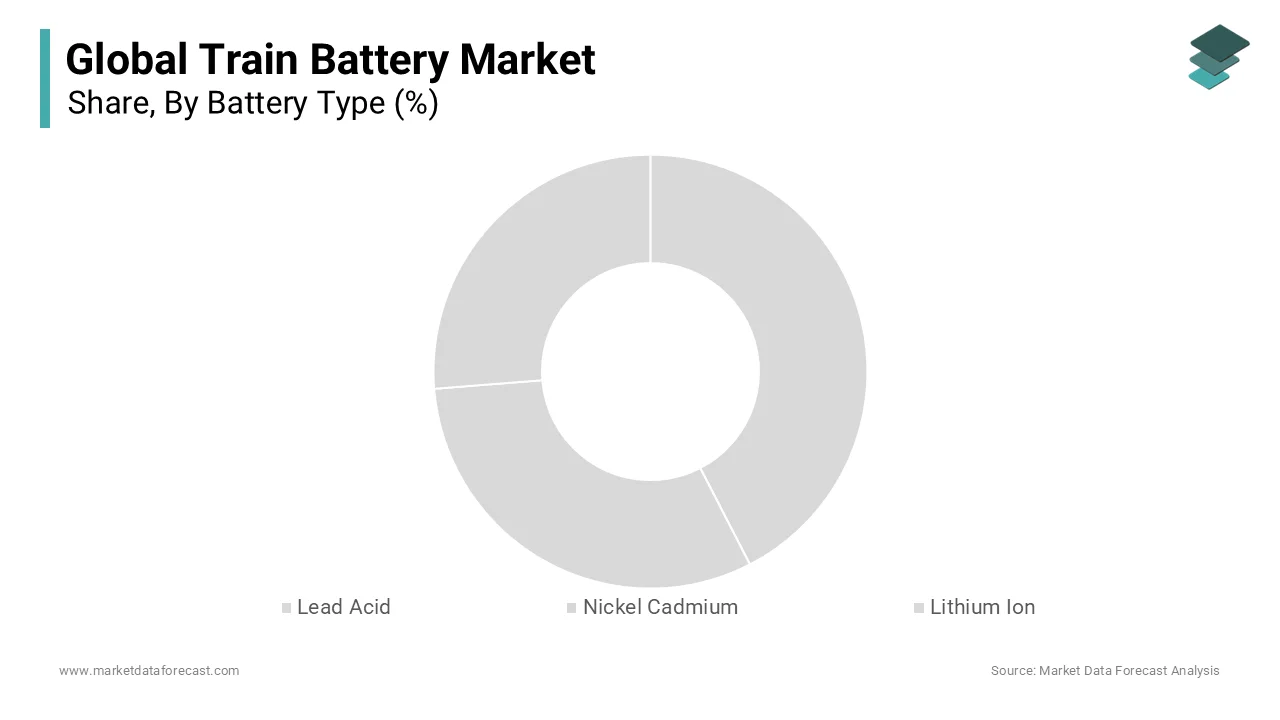

By Battery Type

The lead-acid batteries segment accounted for the largest share of 50.9% in the European market in 2024. The leading position of the lead-acid batteries segment in the global market is attributed to their widespread use in starter and auxiliary applications, where they provide reliable and cost-effective power solutions. The U.S. Department of Transportation reports that over 60% of lead-acid batteries consumed in the rail sector are utilized in freight wagons and passenger coaches, reflecting their widespread adoption. The versatility and reliability of lead-acid batteries ensure their sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards.

The lithium-ion batteries segment is predicted to expand at a CAGR of 12.8% over the forecast period owing to their increasing adoption in hybrid and battery-operated trains, where they provide superior energy density and longevity. The European Commission's Horizon Europe program supports the development of sustainable rail solutions, further amplifying demand for lithium-ion batteries. Additionally, the Asian Development Bank projects that investments in advanced battery technologies will reach $30 billion by 2030, underscoring the critical role of lithium-ion batteries in enabling innovative and eco-friendly rail solutions.

By Rolling Stock Type

The locomotives segment had the major share of 41.8% of the global market in 2024. The extensive use of train batteries in diesel-electric and hybrid locomotives, where they provide efficient energy storage and distribution is one of the key factors boosting the expansion of the locomotive segment in the global market. The U.S. Department of Transportation reports that over 60% of locomotives in North America utilize advanced train batteries, reflecting their widespread adoption. Additionally, the European Railway Agency highlights that investments in locomotive electrification technologies reached $20 billion in 2022, underscoring the critical role of train batteries in supporting this growth. The versatility and reliability of train batteries ensure their sustained dominance in the locomotive sector.

The metro systems segment is anticipated to register a CAGR of 12.8% over the forecast period owing to the increasing demand for urban rail systems, where train batteries provide reliable and eco-friendly power solutions. The European Commission's Green Deal initiative supports the development of sustainable urban transport, further amplifying demand for train batteries in metro systems. Additionally, the International Union of Railways (UIC) projects that investments in metro electrification will reach $25 billion by 2030, underscoring the critical role of train batteries in enabling innovative and sustainable urban rail solutions.

By Application

The starter batteries segment captured the leading share of 55.8% in the global market in 2024. The leading position of starter batteries segment is primarily attributed to the extensive use in locomotives, freight wagons, and passenger coaches, where they provide reliable power for engine ignition and auxiliary systems. The U.S. Department of Transportation reports that over 60% of starter batteries consumed in the rail sector are utilized in freight operations, reflecting their widespread adoption. The versatility and reliability of starter batteries ensure their sustained dominance in the market.

The auxiliary batteries segment is projected to grow at a CAGR of 10.4% over the forecast period owing to the increasing demand for advanced auxiliary systems in hybrid and battery-operated trains, where they provide reliable power for lighting, HVAC, and communication systems. The European Commission's Horizon Europe program supports the development of sustainable rail solutions, further amplifying demand for auxiliary batteries.

By Train Type

The hybrid trains segment dominated the train battery market and accounted for 43.8% of the global market share in 2024. The dominating position of hybrid trains segment in the global market is attributed to their widespread adoption in regions aiming to reduce carbon emissions while maintaining operational efficiency. Hybrid trains utilize advanced train batteries to store energy generated from regenerative braking and diesel engines, providing a balance between performance and sustainability. The European Railway Agency reports that over 60% of hybrid trains in Europe are equipped with lithium-ion batteries, reflecting their critical role in achieving low-emission targets. The versatility and reliability of hybrid trains ensure their sustained dominance in the market, particularly for applications requiring compliance with stringent environmental standards.

The battery-operated trains segment is estimated to progress at a CAGR of 13.5% over the forecast period owing to the increasing urbanization and government initiatives to modernize rail infrastructure in emerging markets. Battery-operated trains rely entirely on advanced train batteries, such as lithium-ion, to provide zero-emission transportation solutions. The European Commission's Green Deal initiative supports the development of sustainable urban transport, further amplifying demand for battery-operated trains. This trend positions battery-operated trains as a key driver of innovation in the global rail sector.

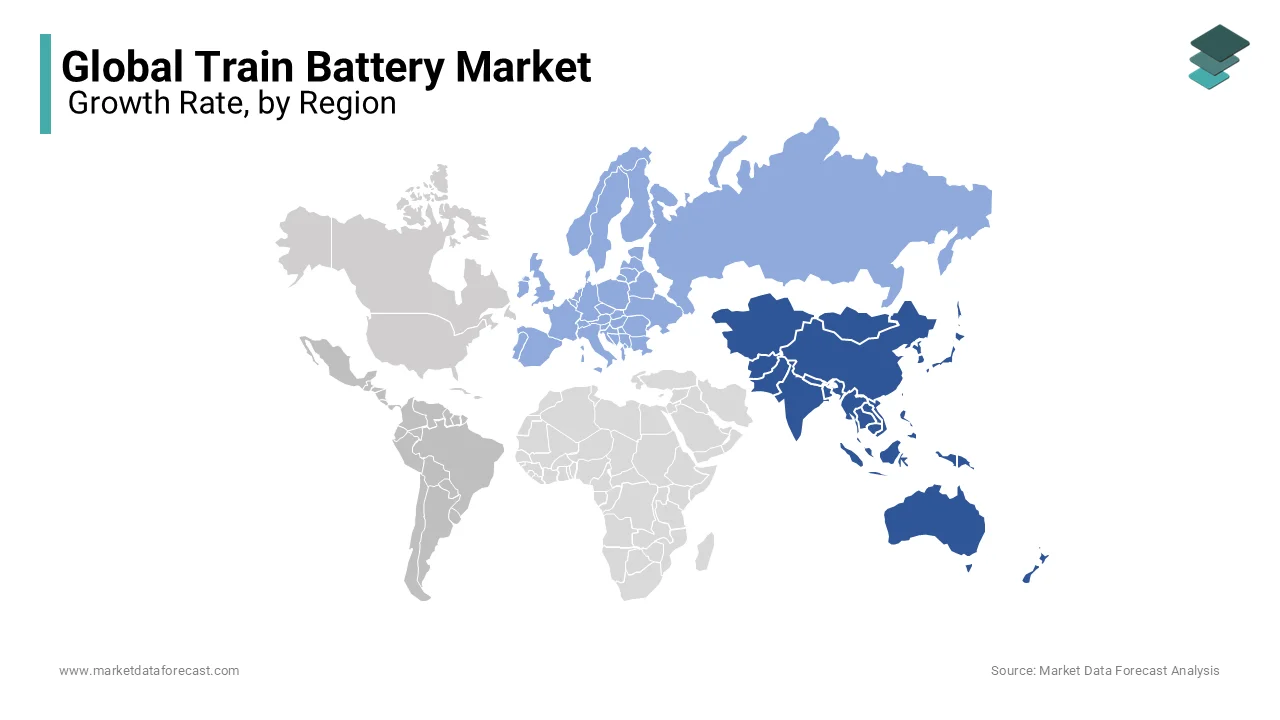

Regional Analysis

Top 5 Leading Regions

Asia-Pacific held the leading share of the global train battery market in 2024 and the dominating position of the Asia-Pacific in the global market is attributed to the region's rapid urbanization and significant investments in rail infrastructure modernization. Countries like China, India, and Japan are at the forefront of adopting hybrid and battery-operated trains, driven by government initiatives to reduce carbon emissions. The International Union of Railways (UIC) reports that over 60% of new rail vehicles in Asia-Pacific utilize advanced train batteries, reflecting their widespread adoption.

Europe accounted for a substantial share of the global train battery market in 2024 and is expected to grow at a notable CAGR over the forecast period. The emphasis of Europe on reducing carbon emissions from transportation drives the adoption of train batteries in hybrid and battery-operated trains. The European Railway Agency reports that over 70% of metro and tram systems in Europe utilize advanced lithium-ion batteries, underscoring their critical role in achieving sustainability goals. Furthermore, the European Investment Bank projects that investments in green rail technologies will reach €30 billion by 2030, further accelerating this trend. Europe's focus on eco-friendly solutions amplifies the importance of train batteries in the regional market.

North America occupied a notable share of the global train battery market in 2024. The thriving freight and passenger rail networks of North America drive demand for train batteries, particularly in hybrid locomotives and metro systems, which is one of the major factors propelling the North American market growth. The U.S. Environmental Protection Agency highlights the growing use of train batteries in emission-reducing technologies, while the Federal Railroad Administration reports a 15% annual increase in their adoption. Additionally, North America's focus on sustainability boosts the use of advanced train batteries, ensuring steady market growth. The region's commitment to reducing carbon footprints aligns with the increasing adoption of eco-friendly rail solutions.

The Middle East and Africa accounts for a moderate share of the worldwide market. The region's extensive rail modernization projects, particularly in countries like Saudi Arabia, the UAE, and South Africa, rely heavily on train batteries for hybrid and battery-operated systems. The Middle East's leadership in sustainable transport amplifies demand for eco-friendly solutions. Furthermore, the African Development Bank emphasizes the growing adoption of advanced train batteries in urban rail systems, further supporting market growth. The region's focus on environmental regulations aligns with the increasing use of train batteries in modern rail infrastructure.

Latin America is predicted to register a healthy CAGR over the forecast period in the global train battery market. The region's rail infrastructure projects, particularly in Brazil, Mexico, and Argentina, drive demand for train batteries in hybrid and battery-operated trains. Latin America's emphasis on sustainable urban transport utilizes train batteries extensively in metro and tram systems. Additionally, the Inter-American Development Bank highlights the region's commitment to circular economy initiatives, driving demand for sustainable materials like lithium-ion train batteries. This focus positions Latin America as a growing hub for eco-friendly rail solutions.

KEY MARKET PLAYERS

CRRC Corporation Limited, Alstom, Siemens Mobility, Bombardier Transportation, General Electric, Hyundai Rotem, Kawasaki Heavy Industries, Trinity Rail Group, Stadler Rail AG. These are the market players that are dominating the global train battery market.

RECENT HAPPENINGS IN THE MARKET

- Alstom reported its first agreement for battery-electric territorial trains in Germany for the Leipzig-Chemnitz course, which needs the train to travel 80 km (50 miles) of the non-electrified track.

- The Danish Ministry of Transport and Housing has reported that it'll start preliminaries of battery-fueled trains on two railroad lines in Denmark one year from now. Battery trains are as of now being tried in Austria and Germany.

- 'Battery trains – a decent option in contrast to diesel trains or electrification of railroad lines

MARKET SEGMENTATION

This research report on the global train battery market is segmented and sub-segmented into the following categories.

By Battery Type

- Lead Acid

- Nickel Cadmium

- Lithium Ion

By Rolling Stock Type

- Locomotive

- Metro

- Monorail

- Tram

- Freight Wagons

- Passenger Coaches

By Application

- Starter Battery

- Auxiliary Battery

By Train Type

- Hybrid

- Battery Operated

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the Train Battery Market growth rate during the projection period?

The Global Train Battery market is expected to grow with a CAGR of 5.27% between 2025 to 2033.

2. What can be the total Train Battery Market value?

The Global Train Battery Market size is expected to reach a revised size of USD 0.87 billion by 2033.

3. Name any three Train Battery Market key players?

CRRC Corporation Limited, Alstom, and Siemens Mobility are the three Train Battery Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]