Global Track and Trace Solutions Market Size, Share, Trends & Growth Forecast Report By Product Type (Hardware Systems & Software Solutions), Technology (2D Barcodes, Radiofrequency Identification (RFID) & Linear Barcodes), Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis (2025 to 2033)

Global Track and Trace Solutions Market Size

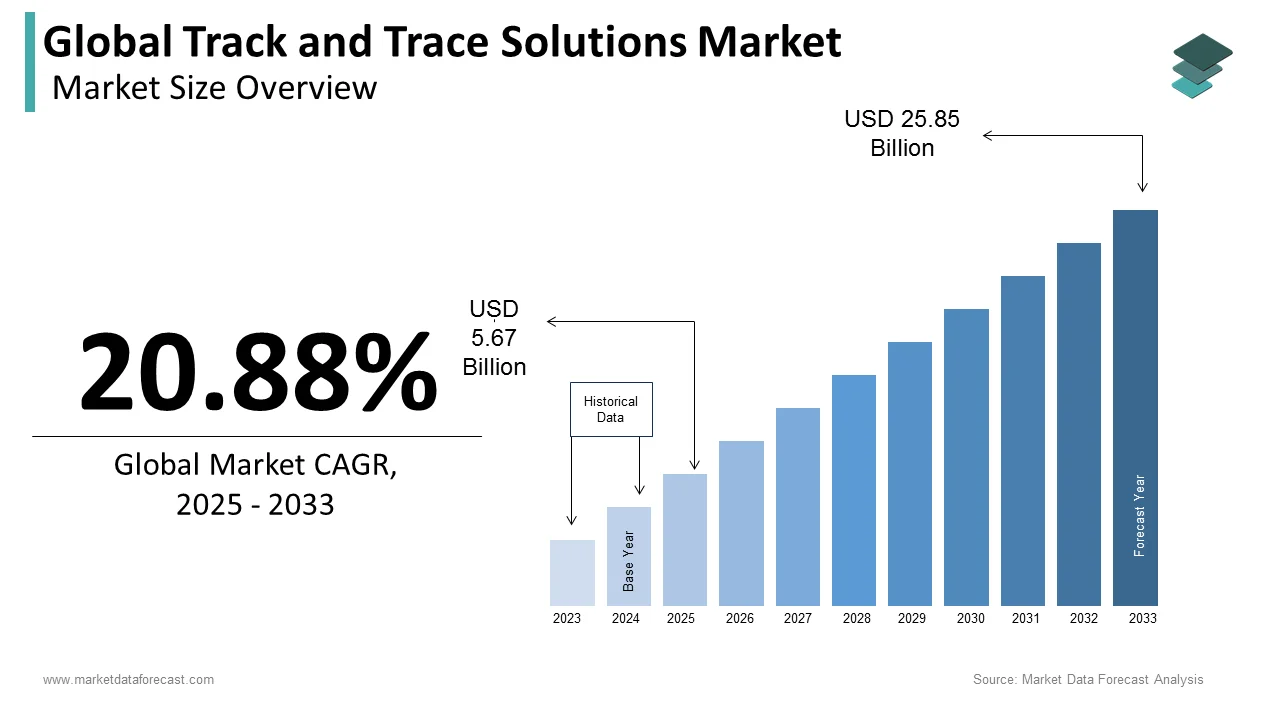

The size of the global track and trace solutions market was valued at USD 4.69 billion in 2024. Between 2025 and 2033, the global market is anticipated to witness a whopping CAGR of 20.88% and be worth USD 25.85 billion by 2033 from USD 5.67 billion in 2025.

Track and Trace solutions are technologies that enable end-to-end visibility of products across the supply chain, ensuring their authenticity, safety, and compliance. These solutions utilize technologies such as RFID, barcodes, QR codes, and GPS tracking to provide real-time monitoring of products. In industries like pharmaceuticals, serialization helps prevent counterfeiting, ensuring that drugs reach consumers safely. For example, the World Health Organization has emphasized the importance of tracking medicines to avoid counterfeit products, which are a significant global concern. Similarly, the food industry uses traceability systems to track products from farm to table, ensuring food safety and compliance with regulatory standards. These solutions not only improve product security but also streamline supply chain operations, reduce errors, and enhance operational efficiency. With increasing concerns about fraud, product recalls, and supply chain transparency, Track and Trace solutions are becoming essential for businesses across various sectors.

MARKET DRIVERS

Regulatory Compliance

One of the key drivers for the Track and Trace solutions market is the increasing pressure for industries, especially pharmaceuticals and food, to comply with stringent regulatory frameworks. For instance, the Drug Supply Chain Security Act (DSCSA) in the U.S. mandates the tracking of pharmaceutical products from manufacturing to dispensing. Similarly, the European Union’s Falsified Medicines Directive requires serial numbers on all medicine packaging for traceability. These regulations aim to curb counterfeit products, which account for up to 10% of global pharmaceuticals. As compliance becomes mandatory, industries adopt track and trace systems to meet these regulatory demands, ensuring product authenticity and safety.

Increasing Consumer Demand for Transparency

Consumers are increasingly prioritizing product transparency, especially in sectors like food and pharmaceuticals, driving the adoption of track-and-trace solutions. According to a 2020 survey, 73% of consumers are more likely to purchase from brands that provide detailed information about product sourcing and production. In the food industry, traceability systems allow consumers to access information on the origin and journey of their food, ensuring quality and safety. This growing consumer awareness pushes companies to adopt real-time tracking systems to meet expectations and build trust, especially in the face of rising concerns over food safety and product authenticity.

MARKET RESTRAINTS

High Implementation and Maintenance Costs

A significant restraint for the Track and Trace Solutions market is the high initial setup and ongoing maintenance costs. The integration of RFID, barcode scanners, and GPS tracking systems requires significant investment in infrastructure, software, and hardware. For instance, implementing RFID technology alone can cost between $0.10 to $1 per tag, depending on the type. Small and medium-sized enterprises (SMEs), particularly in developing markets, find these costs prohibitive. Additionally, regular software updates, system maintenance, and workforce training add to the operational expenses, which can deter businesses from adopting these solutions despite their benefits.

Data Privacy and Security Concerns

The adoption of Track and Trace systems raises concerns over data privacy and security, particularly with sensitive product information and consumer data. As these systems collect vast amounts of real-time data, there is an increased risk of cyberattacks or data breaches. For example, a 2021 study revealed that 60% of companies believe data privacy and cybersecurity threats are among the top barriers to adopting traceability technologies. Stringent data protection regulations, such as GDPR in Europe, also require companies to ensure that consumer data is securely handled, adding complexity to system adoption.

MARKET OPPORTUNITIES

Integration with IoT and AI for Enhanced Analytics

A significant opportunity in the Track and Trace solutions market lies in integrating the Internet of Things (IoT) and Artificial Intelligence (AI) to enhance tracking efficiency and data analytics. IoT devices, such as sensors, can provide real-time tracking of products, while AI can analyze large datasets to predict supply chain disruptions and optimize operations. According to a report by McKinsey, AI-powered systems can improve supply chain forecasting accuracy by 30-50%. This integration can provide actionable insights, reduce inefficiencies, and improve decision-making, offering businesses a competitive edge in streamlining supply chain operations and enhancing customer satisfaction.

Expansion of Track and Trace in Emerging Markets

Emerging markets present a significant growth opportunity for the Track and Trace solutions market. As supply chains in regions like Asia-Pacific, Latin America, and Africa become more complex, there is growing demand for robust traceability systems. For instance, countries in Asia-Pacific are increasing their focus on pharmaceutical traceability due to the rise in counterfeit drugs, which has reached up to 20% in some regions. As regulatory frameworks evolve and consumer awareness grows, businesses in these markets are seeking reliable track-and-trace solutions to enhance product security, ensure compliance, and improve supply chain transparency.

MARKET CHALLENGES

Complexity in System Integration

A major challenge in the Track and Trace solutions market is the complexity of integrating new systems with existing infrastructure. Many companies, especially those in established industries, rely on legacy systems that are not easily compatible with modern tracking technologies like RFID or blockchain. According to a 2021 survey by Gartner, 56% of businesses cite system integration as a key barrier to adopting advanced traceability solutions. The need for seamless integration across various stages of the supply chain, including spanning suppliers, manufacturers, and distributors, adds complexity, which requires substantial time, resources, and expertise to implement and maintain.

Lack of Standardization Across Industries

Another challenge is the lack of standardization in Track and Trace solutions across different industries and regions. While some sectors, like pharmaceuticals, have stringent regulations, others, such as food or consumer goods, often lack universal standards for traceability. This lack of uniformity complicates cross-border trade and data sharing. A report from the World Economic Forum found that inconsistent standards in global supply chains result in 40% of companies facing difficulties in ensuring smooth cross-border traceability. This disparity can hinder the widespread adoption of universal tracking systems and reduce the overall effectiveness of traceability technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analyzed |

By Product Type, Technology, Application, End-user and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analyzed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Axway, Sea Vision SRL, TraceLink Inc., Rfxcel Corporation, Mettler-Toledo International Inc., Optel Group, Systech International, Zebra Technologies Corporation, KUKA AG and Toshiba Tec Corporation |

SEGMENTAL ANALYSIS

By Product Type Insights

The hardware systems segment was the largest segment in the track and trace solutions market and accounted for 37.9% of the global market share in 2023. This dominance can be attributed to the essential role hardware plays in real-time tracking and data collection. Key components such as RFID tags, barcode scanners, and IoT sensors enable seamless supply chain integration, facilitating item identification, verification, and location tracking. The increasing need for real-time visibility across industries like pharmaceuticals, food, and logistics further drives this segment's growth. With continuous advancements in hardware, such as miniaturized sensors and improved connectivity, the segment is poised to maintain its lead as it supports operational efficiency and compliance across industries.

The software solutions segment is growing rapidly and is estimated to register a CAGR of 12.22% from 2024 to 2033. This growth is largely due to the increasing demand for data management and real-time analytics across complex supply chains. Software platforms like plant manager software and bundle tracking software provide businesses with enhanced control and visibility. The increasing integration of artificial intelligence (AI) and cloud technologies in software solutions further boosts their relevance, enabling smarter decision-making and automation. As supply chains become more digitized and complex, the demand for sophisticated software to manage, track, and authenticate goods will continue to rise.

By Technology Insights

The radiofrequency identification (RFID) segment led the market by capturing 36.66% of the global market share in 2023. The dominance of the RFID segment in the global market is majorly due to its ability to provide automated, real-time tracking of products across extensive supply chains. Unlike traditional barcodes, RFID tags don’t require direct line-of-sight to be read, making them highly efficient in environments where high volumes of items need to be tracked. RFID technology is critical for industries like pharmaceuticals, where it ensures compliance with regulatory standards and prevents the circulation of counterfeit products. RFID also enhances inventory management, reduces human error, and increases operational efficiency by providing accurate data on the location and status of goods at any given time. With these capabilities, RFID continues to be the preferred choice for businesses seeking to optimize their tracking systems and improve supply chain transparency.

The 2D barcodes segment is predicted to be the fastest-growing segment and is likely to showcase a CAGR of 16.12% from 2024 to 2033. The rapid growth of 2D barcodes is driven by their ability to store significantly more information than traditional 1D barcodes, making them ideal for inventory management and product authentication in various industries. Additionally, the increasing use of smartphone-enabled scanning and the cost-effectiveness of 2D barcode technology contribute to its widespread adoption, especially among small and medium-sized enterprises (SMEs). The rise of contactless transactions and the demand for digital engagement further accelerate the use of 2D barcodes in applications like QR codes for customer interaction and real-time product tracking. Their growing use in industries such as retail, food safety, and consumer goods underscores their importance in enhancing traceability and consumer confidence in product authenticity.

By Application Insights

The serialization segment dominated the market by occupying 31.9% of the global market share in 2023. Serialization involves assigning unique identifiers (like barcodes or RFID tags) to individual products, making them traceable throughout the supply chain. It is crucial in industries such as pharmaceuticals, where strict regulations, like the Drug Supply Chain Security Act (DSCSA) in the U.S. and the Falsified Medicines Directive (FMD) in Europe, mandate serialization to combat counterfeit drugs and ensure patient safety. Serialization helps enhance product authentication, reduce counterfeiting, and ensure regulatory compliance. It is critical for brand protection, enables precise inventory management, and offers increased operational transparency. This widespread adoption in regulated industries like pharmaceuticals makes serialization the dominant segment, providing significant growth opportunities as more industries embrace this technology to improve supply chain integrity.

The aggregation segment is projected to grow at a CAGR of 15.44% from 2024 to 2033. Aggregation builds on serialization by linking individual items to their packaging units, such as cases, pallets, or cartons. This method improves visibility and traceability across the entire supply chain. It is especially crucial in industries like pharmaceuticals, where aggregated data simplifies regulatory compliance by enabling quicker reporting of entire shipments rather than individual products. The growth in aggregation is driven by the increasing complexity of pharmaceutical distribution, as well as global regulatory requirements for track-and-trace systems. With the need for real-time supply chain visibility and improved anti-counterfeit measures, aggregation is gaining traction due to its ability to improve inventory management, product authenticity, and efficiency in handling large shipments.

By End-Use Insights

The pharmaceutical segment dominated the market by accounting for 45.4% of the global market share in 2023. This dominance is primarily driven by the increasing regulatory pressure to combat counterfeit drugs and improve supply chain transparency. Global regulations, such as the FDA’s Drug Supply Chain Security Act (DSCSA) in the U.S. and the EU Falsified Medicines Directive (FMD), require pharmaceutical companies to implement strict serialization and traceability systems to ensure the safety and authenticity of drugs. Track and trace technologies, particularly serialization and aggregation, are crucial for pharmaceutical companies to meet these regulatory requirements, prevent counterfeit drugs, and maintain operational efficiency. The pharmaceutical sector’s focus on patient safety, compliance with international standards, and anti-counterfeiting efforts make it the largest segment in the market.

The biopharmaceutical segment is predicted to grow at a CAGR of 14.44% from 2024 to 2033. Biopharmaceuticals, which include biologics and biosimilars, are experiencing significant growth due to the increasing demand for advanced therapies like gene therapies, monoclonal antibodies, and vaccines. As the market for biopharmaceuticals expands, regulatory compliance, particularly in serialization and traceability, becomes more critical. The biopharmaceutical industry faces unique challenges, such as managing complex distribution chains, ensuring temperature control, and protecting against counterfeiting. Track and trace solutions are crucial for maintaining product integrity, ensuring regulatory compliance, and managing real-time data throughout the supply chain, making this sector the fastest-growing in the market.

REGIONAL ANALYSIS

North America dominates the track and trace solutions market globally and the United States is the major contributor to this regional market. North America benefits from stringent regulations, particularly in the pharmaceutical and medical device industries, which mandate product serialization and traceability. North America's emphasis on counterfeit prevention and regulatory compliance drives market demand. The United States, in particular, has led in the implementation of advanced technologies like 2D barcodes and RFID, fostering significant demand for software solutions, especially in the pharmaceutical sector.

Europe, led by countries like Germany, the UK, and France, holds the second-largest market share and is also expected to grow at a healthy pace. The region’s regulatory frameworks, especially in the pharmaceutical sector, drive the adoption of track-and-trace solutions. European nations focus heavily on maintaining supply chain integrity, implementing serialization and aggregation for compliance with EU regulations. The presence of key market players in the region, coupled with the growth in medical devices, bolsters the demand for these technologies.

The Asia-Pacific region is witnessing the fastest growth in the track and trace solutions market. This rapid growth is driven by increasing manufacturing activities, especially in countries like China, India, and Japan. The surge in the pharmaceutical and biopharmaceutical industries, alongside rising concerns about counterfeit drugs, propels the demand for efficient tracking and traceability systems. As regulatory bodies in Asia-Pacific countries tighten their standards, the adoption of track-and-trace solutions is expected to intensify, making this region a key growth driver.

Latin America, while smaller in market share, is also showing a steady increase in the adoption of Track and Trace solutions, fueled by the rise in regulatory requirements and awareness about product safety. The growth of the Latin American market is driven by markets such as Brazil and Mexico, where pharmaceuticals and food industries are experiencing rising demand for secure supply chain systems.

The Middle East and Africa region is expected to have moderate growth; the market in MEA is primarily driven by the demand from the pharmaceutical and food sectors. This region's growth is supported by increasing regulatory pressures, particularly in the pharmaceutical sector, to curb the distribution of counterfeit drugs. However, the overall market share remains smaller compared to other regions.

KEY MARKET PLAYERS

Companies playing a leading role in the global track and trace solutions market include Axway, Sea Vision SRL, TraceLink Inc., Rfxcel Corporation, Mettler-Toledo International Inc., Optel Group, Systech International, Zebra Technologies Corporation, KUKA AG and Toshiba Tec Corporation.

The track and trace solutions market is competitive, with many companies offering products to improve supply chain visibility and product tracking. Big names like Axway, TraceLink, Mettler-Toledo, and Rfxcel lead the market, providing technologies such as RFID and barcode solutions. These companies serve industries like pharmaceuticals, biopharmaceuticals, and food and beverages, where traceability is crucial for regulatory compliance and preventing counterfeit products. Smaller players, such as Sea Vision SRL and Systech International, are also gaining ground by focusing on specialized solutions like serialization and aggregation, which help companies meet strict regulations. This is especially important in industries like pharmaceuticals, where safety and authenticity are top priorities.

The competition is growing as companies form partnerships and make acquisitions to expand their offerings. For instance, OPTEL Group teamed up with Bureau Veritas to improve COVID-19 vaccine supply chain management. Many companies are also exploring new technologies like blockchain and IoT to stay ahead of the curve and offer even more secure and transparent solutions for product tracking. This makes the market dynamic and ever-evolving.

MARKET SEGMENTATION

This research report on the global track and trace solutions market is segmented and sub-segmented based on product type, technology, application, end-user and region.

By Product Type

- Hardware Systems

- Software Solutions

By Technology

- 2D Barcodes

- Radiofrequency Identification (RFID)

- Linear Barcodes

By Application

- Serialization

- Aggregation

- Tracking

- Tracing

- Reporting

By End-Use

- Pharmaceutical

- Biopharmaceutical

- Medical Devices

- Food and Beverages

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global track and trace solutions market?

The global track and trace solutions market was worth USD 4.69 billion in 2024 and is expected to be worth USD 5.67 billion in 2025.

What is the expected CAGR of the global track and trace solutions market?

The global track and trace solutions market is predicted to grow at a CAGR of 20.88% from 2025 to 2033.

Which region is likely to dominate the track and trace solutions market over the forecast period?

The Asia-Pacific is growing rapidly and is expected to register domination in the global market over the forecast period.

Who are the key players in the track and trace solutions market?

Axway, Sea Vision SRL, TraceLink Inc., Rfxcel Corporation, Mettler-Toledo International Inc., Optel Group, Systech International, Zebra Technologies Corporation, KUKA AG and Toshiba Tec Corporation are a few of the major companies in the global track and trace solutions market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]