Global Total Lab Automation Market Size, Share, Trends & Growth Forecast Report By Type (Equipment (Automated Liquid Handlers, Automated Plate Handlers, Robotic arms and Automated storage and retrieval systems) and Software (LIMS, LIS, CDS, ELN, SDMS), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Total Lab Automation Market Size

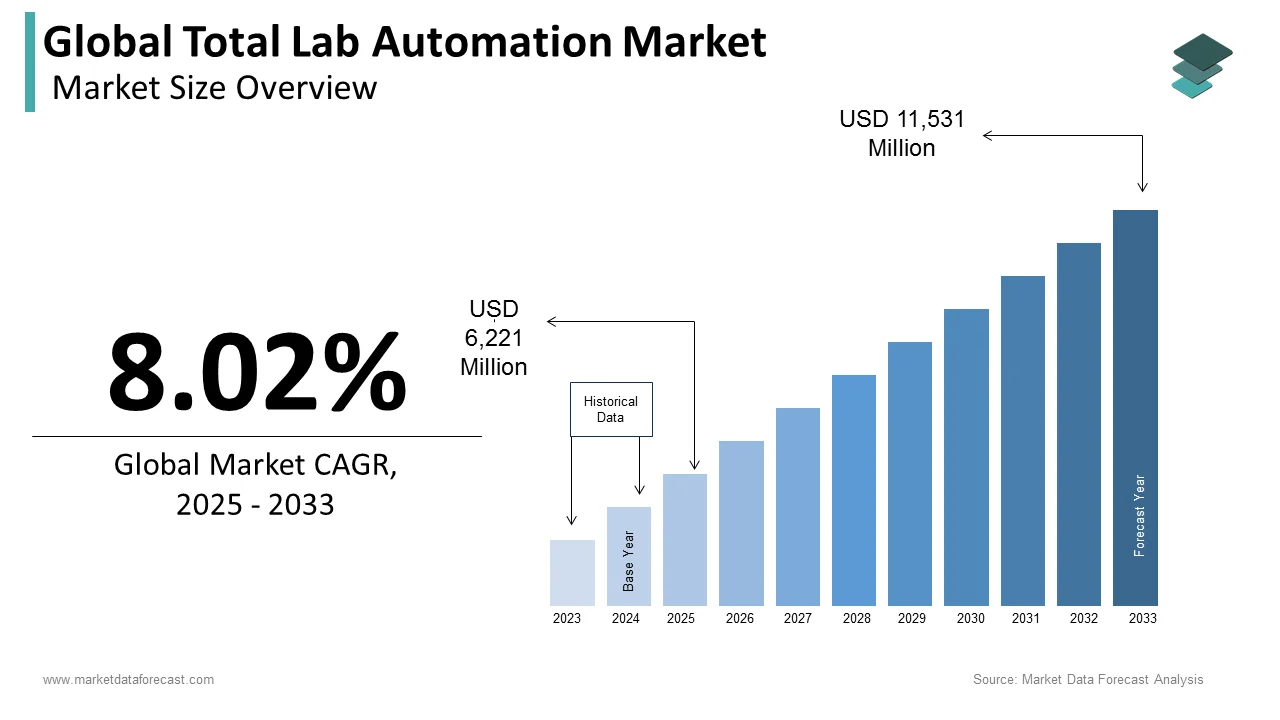

The global total lab automation market was worth US$ 5,759 million in 2024 and is anticipated to reach a valuation of US$ 11,531 million by 2033 from US$ 6,221 million in 2025, and it is predicted to register a CAGR of 8.02% during the forecast period 2025-2033.

Total Lab Automation represents an automation system employed to perform highly repetitive tasks conducted within the library. Total laboratory automation system performs the overall and esoteric laboratory testing throughout the system in a timely and cost-effective fashion. The biotechnology & pharmaceutical industries segment is the major revenue contributor due to the significant presence of pharmaceutical companies worldwide and an increase in robotics & laboratory automation adoption.

MARKET DRIVERS

Rising Demand for Automation in Liquid Handling and Workstations

The high demand for automation in liquid handling and automated workstations offers advantages such as enhanced accuracy and reduced time. The price propels global total lab automation market growth. To meet the rising demands of the healthcare industry, pharmaceutical and biotechnology companies are investing heavily in research and development activities, which is expected to promote the growth rate of the total lab automation market during the forecast period. For instance, pharmaceutical companies such as Sun Pharmaceuticals, Cipla, and Lupin Ltd. spent 8.8% of their revenue on R&D in 2018, according to the India Brand Equity Foundation (IBEF). Furthermore, partnerships between the pharmaceutical industry players for R&D in therapeutics are likely to fuel the global total lab automation market growth. In addition, growing demand for sample results, data integrity, short method development time, increasing healthcare expenditure, rising need for high efficiency, and low regent cost are expected to favor the growth of the total lab automation market.Furthermore, the growing demand for higher accuracy within the testing results wiped out the laboratories, one of the major factors augmenting automation adoption within the laboratories. This is predicted to support the growth rate of the global total lab automation market over the forecast period. In addition, lab automation offers low regent cost, high productivity, reproducibility, and accuracy. These benefits also raise the demand for lab automation in various application sectors.Emerging markets are expected to provide substantial growth opportunities for lab automation device manufacturers and distributors. Increased sales of lab automation products due to increased demand for clinical diagnostic procedures set new growth opportunities for the market. Major product manufacturers are expanding their distribution networks and manufacturing capacities in developing markets to grow their market share. This presents a profitable opportunity for laboratory automation.

MARKET RESTRAINTS

High Initial Costs and Resistance from Small and Medium Laboratories

The high initial costs associated with lab automation and the rigidity of the small and medium laboratories to adapt to lab automation are prominent restraining factors for the global total lab automation market. In addition, the cost of maintaining IT solutions is higher than the cost of the software itself. Furthermore, a lack of risk-taking capacity is limiting the growth of the total lab automation market.In addition, the lack of skilled personnel and acceptance by small and medium-sized laboratories are anticipated to inhibit the market’s growth rate during the forecast period. Furthermore, because of the challenges of sharing data and communication standards between automated instruments from two separate organizations, the evolving nature of laboratory work necessitates automated solutions with greater versatility and interfacing capabilities. These factors are hindering the total lab automation market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Danaher Corporation, Hamilton Company, Honeywell International Inc., Shimadzu Corporation |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the equipment segment is predicted to hold the most dominating share of the global total lab automation market during the forecast period and register the fastest growth owing to increased demand for automated laboratory equipment and technological advancements.The software segment is projected to showcase a healthy CAGR during the forecast period; under the sub-segments, the laboratory information management system (LIMS) segment probably possesses an enormous demand in the future. A Laboratory Information Management System (LIMS) enables the user to automate work processes, integrate instruments, produce reliable outcomes rapidly, and improve effectiveness by sequencing information that runs over time and across experiments.

By Application Insights

The genomics segment is predicted to showcase a healthy CAGR during the forecast period. The advances in genomics that deal with biology concerning the structure, function, evolution, and mapping of genomes create an abnormal amount of knowledge, making it imperative for laboratories to look for solutions that cater to such needs. This is expected to boost the genomic segment in the global market over the forecast period to account for a dominant share.

REGIONAL ANALYSIS

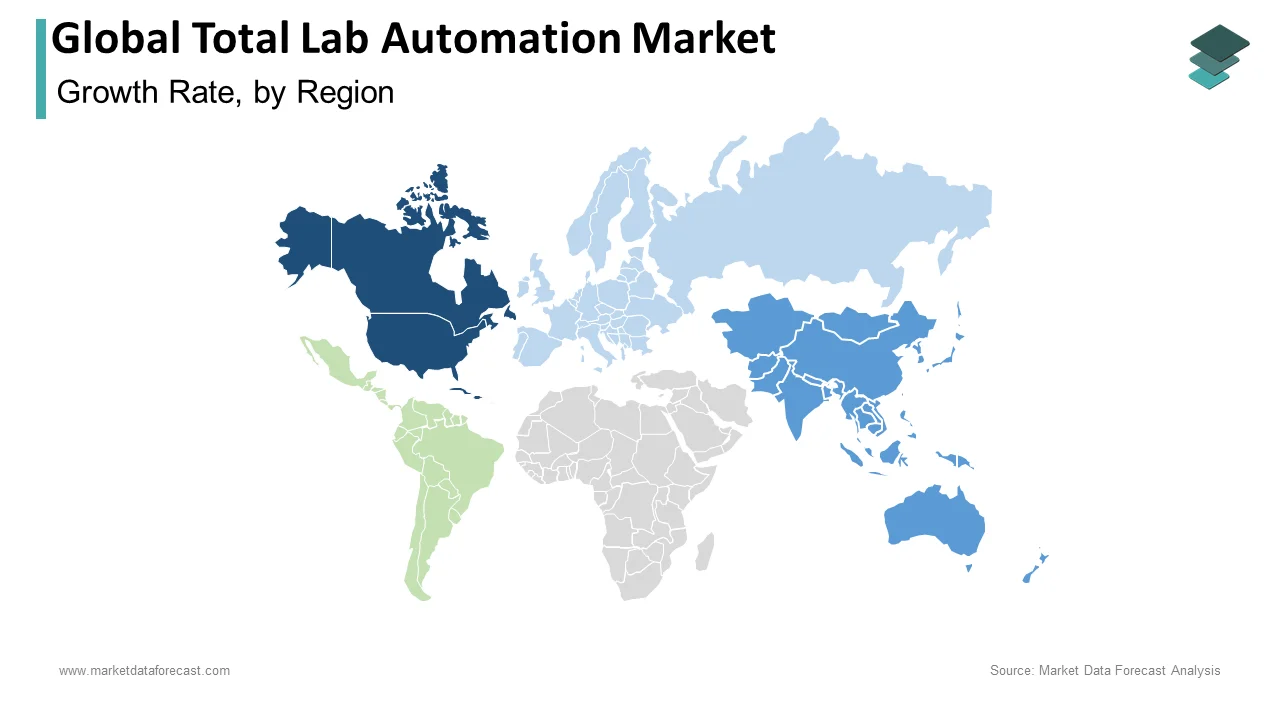

Geographically, the North American total lab automation market led the market in 2024 and is expected to continue the dominating trend throughout the forecast period. The regional dominance can be attributed to increased spending on medicinal services. In addition, the North American regional market is driven by the growing adoption of lab automation in executing the work practices by pharmaceutical companies, including clinical trials, where automation becomes imperative to urge error-free outcomes to achieve greater accuracy. For instance, in January 2019, Shimadzu Medical Systems USA announced ORE Medical Imaging, Inc. Therefore, in this region, the U.S. is forecasted to occupy the most dominating share during the forecast period.

The total lab automation market in the Asia-Pacific region is predicted to project faster growth during the forecast period due to emerging nations such as India, South Korea, Australia, and China, among others. This growth is attributed to the skilled workforce required within lab automation and improving economic conditions within the region.

On the other hand, the European market is expected to grow at a promising CAGR during the forecast period.

KEY MARKET PLAYERS

Danaher Corporation, Hamilton Company, Honeywell International Inc., Shimadzu Corporation, Siemens AG, Thermo Fisher Scientific Roche Ltd, Qiagen Inc., Abbott Laboratories, and Agilent Technologies Inc. are a few companies playing a prominent role in the global total lab automation market and profiled in this report.

RECENT HAPPENINGS IN THIS MARKET

-

In Oct 2019, Danaher Corporation announced that it had signed a deal to sell its label-free biomolecular characterization, chromatography hardware and resins, and microcarriers and particle validation standards businesses Sartorius AG for about $750 million. The company's combined revenue, a part of Danaher's Life Sciences segment, was valued at around US$140 million in 2018. Danaher agreed to sell these businesses to obtain regulatory approval for its pending acquisition of the GE Biopharma business. Therefore, the closing of the Sartorius AG agreement is conditioned upon Danaher's closing of its acquisition of the GE Biopharma business.

-

As a part of a partnership with Airbus, Hamilton developed two new sensors to be used onboard the International space platform. "VisiSpace," a custom version of Hamilton's VisiFerm dissolved oxygen sensor, and "ConduSpace," a custom version of the Conducell conductivity sensor, are incorporated into Airbus' Advanced closed-loop system System (ACLS) experimental life network.

- Hamilton Storage signed a deal with iBio-Gene on May 1, 2019, to distribute its automated sample management products in China. iBio-Gene is based in Beijing, with several staff and technicians located in China, including Shanghai. The company helps its customers augment life sciences research, solve complex analytical challenges, improve diagnostic methods, and increase laboratory productivity. The corporate is committed to providing the leading advanced science equipment and total solutions for patrons in biobanking. Their mission is to support customers in forming research that is accessible, reproducible, and consistent in every experiment.

MARKET SEGMENTATION

This research report on the global total lab automation market has been segmented and sub-segmented based on the type, application, and region.

By Type

- Equipment

- Automated Liquid Handlers

- Automated Plate Handlers

- Robotic arms

- Automated storage and retrieval systems (ASRS)

- Software

- Laboratory information management system (LIMS)

- Laboratory information system (LIS)

- Chromatography data systems (CDS)

- Electronic lab notebook (ELN)

- Scientific data management system (SDMS)

By Application

- Drug discovery

- Genomics

- Protein engineering

- Bio-analysis

- Analytical Chemistry

- Clinical diagnostics

- Proteomics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big s the total lab automation market?

The global total lab automation market was valued at USD 5,759 million in 2024.

Who are the key players in the total lab automation market?

Yes, we have studied and included the COVID-19 impact on the global total lab automation market in this report.

Which region is growing the fastest in the global total lab automation market?

The Asia-Pacific region is anticipated to grow the fastest in the global total lab automation market in the coming future.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]