Global Tomato Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (Sauces, Paste, Canned Tomatoes, Ketchup, Juice, and Others), Type, Category, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Tomato Market Size

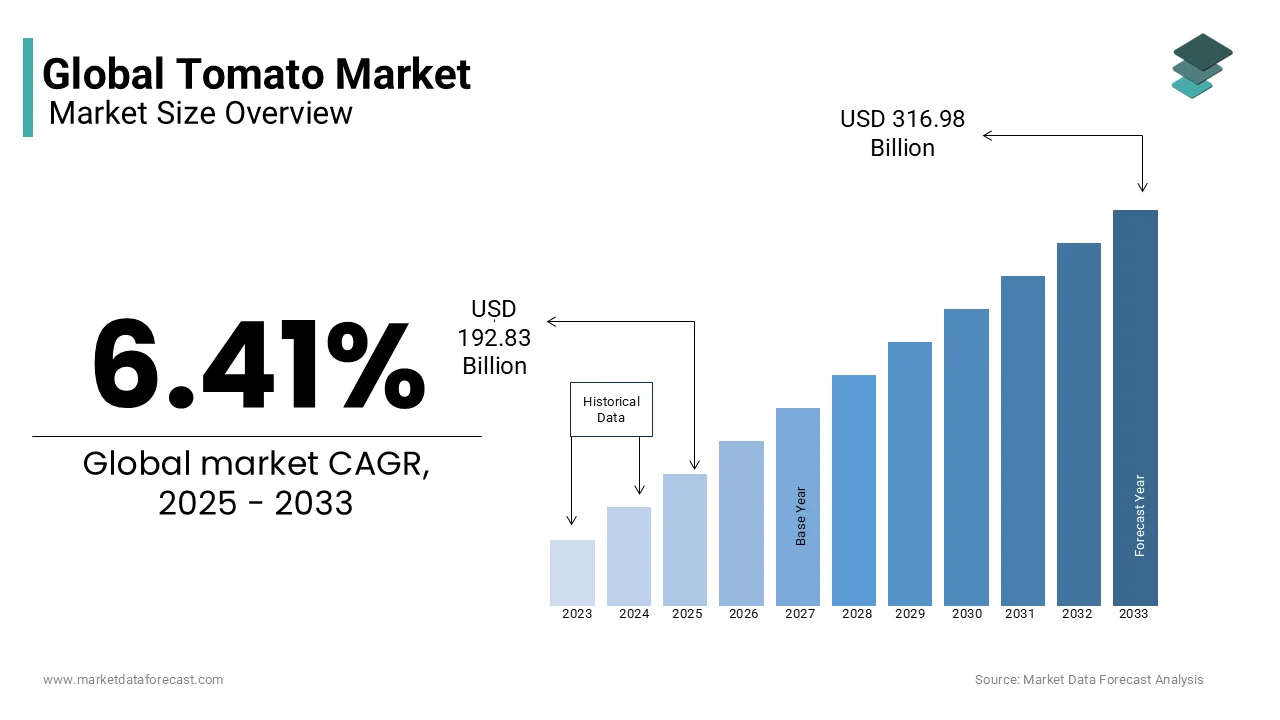

The global tomato market size was valued at USD 181.21 billion in 2024 and is projected to grow from USD 192.83 billion in 2025 to USD 316.98 billion by 2033, the market is expected to grow at a CAGR of 6.41% during the forecast period.

As of 2022, the global tomato production reached approximately 186 million metric tonnes with China leading as the foremost producer and contributing nearly 37% of the total output, as reported by the Food and Agriculture Organization. In 2024, the World Processing Tomato Council estimated that global processing volumes achieved a record 45.7 million tonnes and thereby underscoring the crop's escalating importance in the food industry. China's prominence in tomato production is evident by having a substantial portion of its yield originating from the Xinjiang region. However, this has sparked concerns within the European Union regarding the influx of inexpensive Chinese tomato paste which is perceived as undermining local producers. Francesco Mutti, CEO of the Italian company Mutti, has advocated for protective measures to uphold the integrity of Italian tomato products, as highlighted in the Financial Times. In the United States, California stands as a pivotal contributor to tomato processing. In 2024, the state processed approximately 11 million short tons accounting for a significant share of the nation's output, according to The Morning Star Company. California maintains a crucial role in meeting both domestic and international tomato product demands despite facing challenges such as heatwaves that affects yields.

MARKET DRIVERS

Rising Health and Wellness Trends

The increasing global emphasis on health and wellness has significantly propelled the demand for tomatoes which are renowned for their rich antioxidant properties and essential nutrients. The COVID-19 pandemic further amplified this trend, with consumers prioritizing immunity-boosting foods, leading to heightened consumption of fruits and vegetables, including tomatoes. In Japan, a national survey conducted by the Ministry of Agriculture, Forestry and Fisheries (MAFF) revealed a significant rise in fruit and vegetable purchases following the COVID-19 pandemic. The survey indicated that 16% of consumers increased their vegetable consumption, with tomatoes being among the most commonly increased in intake. The versatility of tomatoes in various culinary applications, coupled with their health benefits, continues to drive their popularity across diverse consumer segments.

Technological Advancements in Agriculture

Innovations in agricultural technology have markedly enhanced tomato production efficiency and yield. For instance, the adoption of AI-equipped agricultural support systems in Japan has led to a 30% increase in tomato crop yield, as reported by NEC Corp. and Kagome Co. Similarly, in Australia, the integration of robotics for tomato pollination has improved productivity with companies like Costa Group utilizing robotic pollinators to boost yields, as detailed in the Financial Times. These technological advancements not only optimize production but also contribute to the sustainability and scalability of tomato farming operations globally.

MARKET RESTRAINTS

Climate-Induced Production Challenges

Climate variability poses significant challenges to tomato cultivation which is leading to production inconsistencies. In India, adverse weather conditions such as excessive rainfall, heatwaves, and pest infestations have been identified as primary factors causing sharp fluctuations in tomato prices. Likewise, the Hindu reported that these climatic adversities can lead to price hikes of up to 100% during certain periods. In the United Kingdom, extreme weather events have caused a 4.9% decrease in vegetable yields and a 12% decrease in fruit yields in 2023, with tomatoes being among the affected crops, according to The Guardian. Such environmental challenges not only disrupt supply chains but also affect the livelihoods of farmers and the affordability of tomatoes for consumers.

Price Volatility Impacting Market Stability

The tomato market is characterized by significant price volatility, which can adversely affect both producers and consumers. The Food and Agriculture Organization (FAO) has noted that large and unexpected price fluctuations in agricultural markets can negatively impact food security and economic stability. For instance, in November 2024, global food prices surged to an 18-month high, driven by increases in staple commodities like vegetable oils, wheat, cheese, and sugar. In response to such volatility, the Indian government has funded 28 innovative projects aimed at stabilizing tomato prices, as reported by The Hindu. These initiatives seek to enhance supply chain efficiency and processing capabilities to mitigate sharp price swings.

MARKET OPPORTUNITIES

Government Initiatives to Stabilize Prices

Government initiatives aimed at stabilizing tomato prices have created significant opportunities for the tomato business worldwide by enhancing supply chain efficiency which is reducing post-harvest losses and promoting value-added processing. In the European Union, the Common Agricultural Policy (CAP) plays a pivotal role in supporting farmers and stabilizing agricultural markets including tomatoes. The CAP allocates approximately €387 billion to support farmers with a focus on small and medium-sized enterprises.

Implementation of Market Intelligence Systems

The establishment of the Market Intelligence and Early Warning System (MIEWS) by the Ministry of Food Processing Industries offers a strategic opportunity to monitor real-time prices of tomatoes, onions, and potatoes. This system aids in generating alerts for timely interventions under the Operation Greens scheme. According to the Research Journal of Agricultural Sciences, the use of market intelligence in agriculture has led to an increase in total income by approximately 26.55% for farmers, highlighting its effectiveness in enhancing profitability The Press Information Bureau highlighted that MIEWS provides advisories to farmers to prevent cyclical production and offers early warnings in situations of surplus. By leveraging such systems, stakeholders can make informed decisions, optimize supply chains, and enhance market stability, thereby capitalizing on data-driven insights to improve profitability and reduce waste.

MARKET CHALLENGES

Biosecurity Threats Impacting Production

The emergence of plant viruses poses significant challenges to tomato cultivation. For instance, the detection of the tomato brown rugose fruit virus in South Australia in August 2024 led to the quarantine of several large tomato farms. This outbreak resulted in the destruction of over a million plants and an estimated economic loss of $20 million, as reported by The Guardian. Such biosecurity threats not only disrupt local production but also have broader implications for trade and market stability.

Post-Harvest Losses Affecting Supply Chains

Post-harvest losses remain a significant challenge in the tomato market. A study by the World Resources Institute India found that approximately 15% of tomatoes are wasted at the farm level, with an additional 12% lost at the retail stage. These losses are attributed to factors such as inadequate storage facilities, poor handling practices, and pest infestations. Such inefficiencies in the supply chain not only reduce the overall availability of tomatoes but also contribute to price volatility and economic losses for producers and retailers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.41% |

|

Segments Covered |

By Product, Type, Category, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Morning Star Company, COFCO Tunhe Tomato Co.LTD., Xinjiang Chalkis Company Ltd, Ingomar Packing Co, ConAgra Brands Inc, Olam International, Los Gatos Tomato Products, China Haohan Group Limited, Campbell Soup Company, Toma-Tek (Neil Jones Food Company), and others. |

SEGMENTAL ANALYSIS

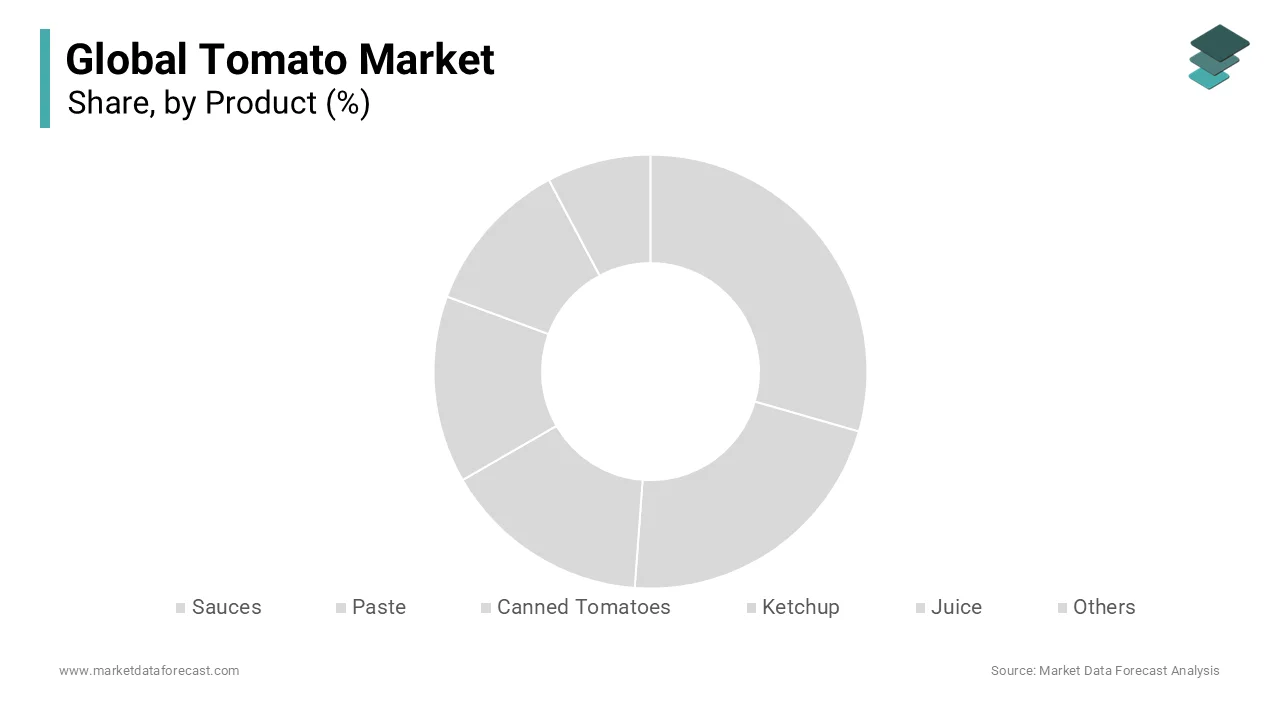

By Product Insights

The sauces segment dominated the market by accounting for 32.5% of the global market share in 2024. The domination of the sauces segment is majorly driven by the widespread use of tomato-based sauces in various cuisines worldwide. This segment's dominance is attributed to the versatility and essential role of sauces in cooking, making them a staple in both household and commercial kitchens. According to the USDA, tomatoes make up about a quarter of the average 1.5 cups of vegetables Americans consume daily, with tomato sauces and mixed foods being a key category. The substantial market share underscores the importance of sauces in the tomato industry and is reflecting their integral position in global food consumption patterns.

The paste segment is projected to grow at a CAGR of 4.65% from 2025 to 2033. This growth is driven by the increasing demand for processed tomato products in the food industry, where tomato paste serves as a fundamental ingredient in various recipes. The versatility and concentrated flavor of tomato paste make it a preferred choice for manufacturers, contributing to its rapid expansion in the market. The rising popularity of ready-to-eat meals and convenience foods further propels the demand for tomato paste, highlighting its significant role in the global tomato market.

By Type Insights

The Roma tomatoes segment ruled the market in 2024 by holding 78.3% of the global market share owing to their widespread use in processing applications such as sauces, pastes, and canned products. Their dense flesh and low moisture content make them ideal for these purposes, leading to their dominance in the market. According to Volza, Roma tomatoes are exported to over 41 countries worldwide. The United States is the largest importer, accounting for approximately 75% of global Roma tomato imports, followed by Lesotho and Costa Rica, each with about 5% market share.

On the other hand, the cherry tomato segment in the recent years have grown rapidly and is expected to witness a CAGR of 3.5% over the forecast period due to the increasing consumer demand for fresh, convenient, and healthy snack options. Cherry tomatoes is known for their small size as well as sweet flavour and cater to this trend and is making them popular among health-conscious consumers. Cherry tomatoes are also a great source of fiber, offering approximately 1.2 grams per 100 grams. The rising preference for ready-to-eat and on-the-go snacks contributes to the expanding market for cherry tomatoes. Additionally, their versatility in culinary applications, from salads to garnishes, further enhances their appeal. The growing health and wellness trend, coupled with the demand for convenient and nutritious food options, positions cherry tomatoes as a key player in the evolving tomato market.

By Category Insights

The conventional segment held a dominant position and accounted for 97.6% of the total cultivated area in 2024. This prevalence is due to conventional farming's established practices, higher yields, and lower production costs compared to organic methods. The extensive adoption of conventional farming techniques has led to economies of scale, making tomatoes more accessible and affordable to consumers worldwide. The global production of conventional tomatoes is significant. In 2022, the total world production of tomatoes was estimated at approximately 186.1 million metric tonnes.

In contrast, the organic tomato segment is gaining traction and is predicted to register a CAGR of 10.1% over the forecast period. The expansion of the organic tomato segment is driven by increasing consumer demand for organic produce. As of March 31, 2023, India reported a total area under organic certification of 101.72 lakh hectares, which includes both cultivated land and wild harvest collection areas. While specific figures for organic tomato cultivation are not detailed, the overall growth in organic farming indicates a rising interest in organic tomato production. This trend reflects a broader shift towards sustainable agriculture and healthier food choices among consumers. The organic food market is projected to reach USD 658.38 billion by 2034 and is highlighting the expanding consumer base for organic products including tomatoes.

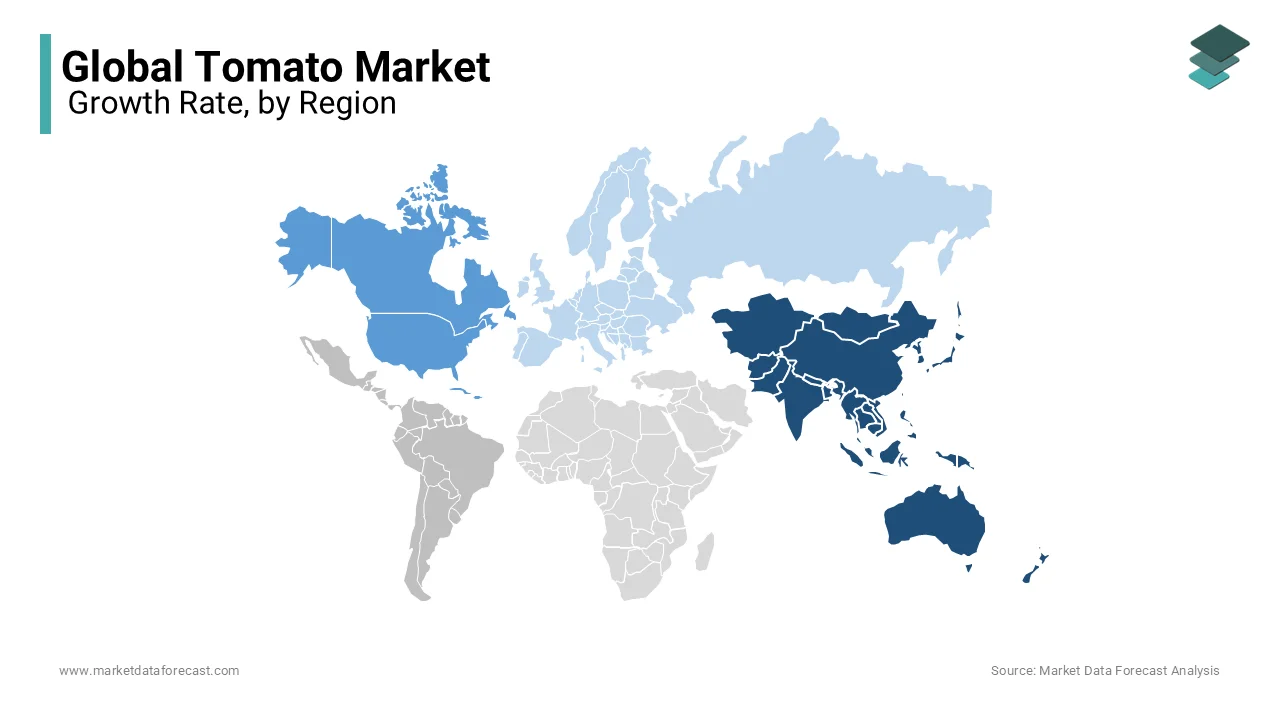

REGIONAL ANALYSIS

The Asia-Pacific region was the largest regional segment for tomatoes worldwide and is also experiencing the fastest growth in the global tomato market and is expected to grow at a CAGR of 4.76% from 2025 to 2033. The Asia-Pacific accounted for 36.09% of global production of tomato. This dominance is primarily driven by China's substantial output, which alone contributes 35.29 thousand metric tons. Factors such as favorable climatic conditions, extensive cultivation areas, and advancements in agricultural practices contribute to the region's leading position. The Asia-Pacific's prominence underscores its critical role in meeting both regional and global tomato demand.

The North American tomato market is anticipated to expand at a CAGR of 3.0% during the forecast period. The United States in the region is a significant player with California leading in production. According to the United States Department of Agriculture (USDA), California accounted for approximately 96% of the processed tomatoes produced in the U.S. in recent years. The region's advanced agricultural practices and favorable climate contribute to its substantial output. The North American tomato market is expected to remain stable, with a focus on both fresh consumption and processed products.

Europe holds a prominent position in the global tomato market with countries like Italy, Spain, and the Netherlands leading in production and export. The European Union's statistical office, Eurostat, reported that in 2020, Spain produced approximately 4.85 million tonnes of tomatoes while Italy produced around 6.06 million tonnes. The region's emphasis on high-quality produce and sustainable farming practices enhances its competitiveness in the global market.

Latin America is a growing region in the tomato market with countries like Mexico and Brazil contributing significantly to production. According to the Food and Agriculture Organization (FAO), Mexico produced approximately 3.54 million tonnes of tomatoes in 2020. The region's favorable climate and increasing investments in agriculture are expected to drive moderate growth in the coming years.

The Middle East and Africa region is anticipated to experience moderate growth in the tomato market. Countries like Egypt and South Africa are notable producers. The FAO reported that Egypt produced approximately 6.73 million tonnes of tomatoes in 2020. Efforts to improve agricultural practices and infrastructure are expected to enhance production and market performance in the coming years.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Morning Star Company, COFCO Tunhe Tomato Co.LTD., Xinjiang Chalkis Company Ltd, Ingomar Packing Co, ConAgra Brands Inc, Olam International, Los Gatos Tomato Products, China Haohan Group Limited, Campbell Soup Company, Toma-Tek (Neil Jones Food Company) are playing dominating role in the global tomato market.

The tomato market is highly competitive, with numerous players spanning across the entire value chain, including production, processing, and retail. Major producers like China, India, and the United States dominate global output, accounting for a significant portion of the total tomato production. Within this competitive landscape, players such as The Morning Star Company, Del Monte Foods, and Mutti S.p.A. stand out, with strong brand recognition and extensive market share.

The competition is driven by several factors, including technological advancements, innovation in product offerings, and the ability to scale operations efficiently. Companies are increasingly investing in vertical integration to control the supply chain and reduce costs, while some are turning to new technologies like AI and robotics to enhance farming and processing capabilities.

Additionally, market players face pressure from price fluctuations, varying climatic conditions, and changing consumer preferences for organic and healthier food options. Trade protection and regulations in key markets, such as the European Union, also shape the competitive dynamics, with some countries advocating for measures to protect domestic tomato farming.

The processed tomato segment, including sauces, pastes, and purees, is particularly competitive, with brands striving to meet growing demand. Companies must navigate these challenges while capitalizing on emerging opportunities in both fresh and processed tomato markets to maintain a strong position.

STRATEGIES USED BY THE MARKET PLAYERS

Vertical Integration

Companies like The Morning Star Company have adopted vertical integration to control multiple stages of production, from cultivation to processing. This approach enhances efficiency and profitability by streamlining operations and reducing reliance on external suppliers. According to Roland Berger, vertical integration in the tomato industry can lead to significant cost savings and improved supply chain coordination.

Advocacy for Trade Protection

Firms such as Mutti S.p.A. actively engage in advocacy to protect domestic production from foreign competition. For instance, Mutti's CEO has called for measures to safeguard Italian tomato farmers from the influx of cheap Chinese tomato paste, emphasizing the importance of maintaining product quality and supporting local agriculture.

Investment in Agricultural Technology

Leading companies are investing in advanced agricultural technologies to enhance productivity and sustainability. The Financial Times reports that innovations such as AI-equipped agricultural support systems and robotics are being utilized to increase efficiency in tomato farming.

TOP PLAYERS IN THE MARKET

The Morning Star Company

The Morning Star Company which is based in processes about 40% of California's processing tomato production, supplying a significant portion of the U.S. industrial tomato paste and diced tomato markets. With an annual processing capacity of approximately 5 million tons of tomatoes, the company accounts for about 10% of the world's ingredient tomato products. Its vertically integrated operations and innovative self-management practices have solidified its leadership position in the industry.

Del Monte Foods

Del Monte Foods, headquartered in Walnut Creek, California, is a prominent player in the processed food industry, with a significant presence in the tomato market. The company's portfolio includes well-known brands such as Del Monte, S&W, and Contadina, offering a variety of tomato-based products like sauces, pastes, and canned tomatoes. Del Monte's extensive distribution network and strong brand recognition contribute to its substantial market share in the global tomato industry.

Mutti S.p.A.

An Italian company, Mutti S.p.A. specializes in tomato products and is renowned for its commitment to quality and authenticity. The company has expressed concerns over the influx of cheap Chinese tomato paste, which poses challenges to Italian tomato farmers. Mutti's advocacy for protective measures underscores its dedication to preserving the integrity of Italian tomato production.

RECENT HAPPENINGS IN THE MARKET

- On November 2024, the Indian government announced funding for 28 innovative ideas aimed at stabilizing tomato prices and enhancing supply chain efficiency. These initiatives, selected from 1,376 proposals, include novel approaches such as producing wine from tomatoes. The Department of Consumer Affairs, in collaboration with the Ministry of Education's Innovation Cell, is facilitating these startups to scale their businesses, with 14 patents already registered.

- On September 2023, Blue Road Capital, an independent investment firm, acquired NatureSweet, a leading snacking tomato brand. NatureSweet, founded in 1990, has grown to become the largest controlled environmental agriculture company globally to earn B Corporation Certification. The acquisition aims to leverage Blue Road Capital's expertise to expand NatureSweet's market reach and operational capabilities.

MARKET SEGMENTATION

This research report on the global tomato market has been segmented and sub-segmented based on, product, type, category, and region.

By Product

- Sauces

- Paste

- Canned Tomatoes

- Ketchup

- Juice

- Others

By Type

- Cherry Tomatoes

- Grape Tomatoes

- Roma Tomatoes

- Beefsteak Tomatoes

- Heirloom Tomatoes

- Tomatoes On The Vine

- Green Tomatoes

- Others

By Category

- Conventional

- Organic

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global tomato market?

The global tomato market was valued at USD 181.21 billion in 2024 and is projected to grow to USD 316.98 billion by 2033, exhibiting a CAGR of 6.41% during the forecast period.

2. What drives the global demand for tomatoes?

Rising consumption in food processing, health awareness, and the popularity of organic produce.

3. Which regions lead in tomato production?

China, India, the U.S., and Italy dominate due to favorable climate and strong agriculture.

4. What are the key challenges in the tomato market?

Climate change, supply chain disruptions, price fluctuations, and crop diseases.

5. Why is the processed tomato segment growing?

Increased demand for sauces, pastes, and canned products in fast food and home cooking.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]