Global Tokenization Market Size, Share, Trends & Growth Forecast Report – Segmented by Component, Application, Technique, Deployment, Enterprise Size, End-User, & Region - Industry Forecast From 2024 to 2032

Global Tokenization Market Size (2024 to 2032)

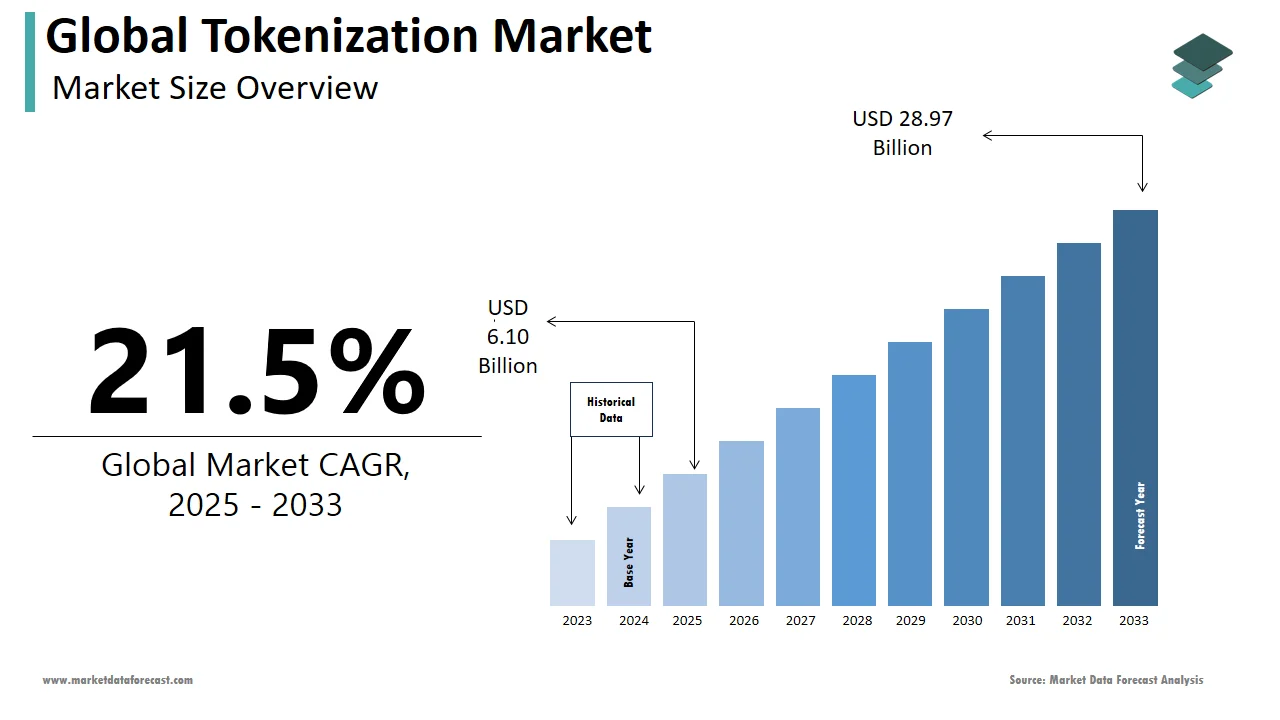

The global tokenization market was worth USD 4.13 billion in 2023. The global market is estimated to reach USD 5.02 billion in 2024 and USD 23.84 billion by 2032, growing at a CAGR of 21.5% during the forecast period.

Tokenization is the process of converting sensitive data into non-sensitive “tokens” that can be used in a database or internal system without being visible to the general public. Tokenization protects sensitive data by replacing it with an irrelevant value of the same length and format as the original. Subsequently, the tokens are delivered to an organization’s internal systems for use, while the original data is kept in a token vault. Tokenized data, unlike encrypted data, is impregnable and irrevocable.

Tokenization is the process of removing sensitive information from your system and replacing it with tokens. Most businesses have sensitive data on their systems, whether credit card information, medical information, Social Security numbers, or anything else that requires security and protection. Tokenization replaces the data in the environment with one-of-a-kind tokens for each piece of data.

Current Scenario of the Global Tokenization Market

In recent years, the tokenization market is gaining traction. In the financial markets, the tokenization of Real-World Assets (RWAs) is picking up speed, which is propelled by technological developments and the rising acknowledgement of its advantages.

- According to a report by McKinsey, tokenized RWAs are expected to experience only 4 trillion dollars even in an ideal situation by 2030 with wider acceptance still far away.

The financial landscape is presently moved by the current measures for quantitative tightening, which resulted in a change in the sentiment of investors to risk aversion. In this market setting, the trendiness of stablecoins has been significant both under budding real-world uses and within decentralized finance (DeFi). Apart from the existing market situations, various key elements are crucial for the tokenization of RWAs to attain essential mass. These consist of the positive macroeconomic accelerators, considerable on-chain liquidity, natural customer demand, and advancement of practical and powerful applications.

The growing requirement to comply with regulations, the growing demand to create a consistent user experience, and the increasing demand to maintain fraud prevention levels due to increased financial crimes drive the tokenization market. Furthermore, rising demand for cloud-based tokenization solutions and services and increased customer alignment towards contactless payments will present attractive prospects for tokenization suppliers.

MARKET DRIVERS

Real-world assets (RWAs) are driving the growth of the tokenization market.

It is bound to transform asset markets by improving liquidity, transparency, and productivity. Enhanced institutional engagement, incorporation with DeFi platforms, better legal guidelines, technological developments, and the extension into new asset categories are notable trends believed to define the future of this technology. Moreover, the market also benefitted from its adoption by the private credit sector which has shown a substantial rise, with the market arriving around 8 billion dollars by early 2024. This progress is mainly fuelled by unique protocols like Credix, Clearpool, Goldfish, Maple, Centrifuge, and Figure. The surging value of loans highlights a strong and positive course for the wider adoption of tokenized assets.

The increased requirement to safeguard sensitive data and information against compromise is the primary driver of the tokenization market’s growth.

Tokenization technology has been widely employed to protect sensitive data against fraud. It offers a variety of benefits, including protection from hackers and thieves, a reduced PCI scope, internet protection, and internal security. Significant factors, such as an increase in data breaches and cyber-attacks around the world, are projected to propel the industry forward.

Contactless payment systems have grown in popularity worldwide due to their convenience, which allows users to make payments without the need for help and eliminates the need to be physically present. Mobile is the most popular contactless payment option among customers. One key driver of the adoption of contactless payment solutions is cost reduction.

MARKET RESTRAINTS

Although tokenization is not a new payment security technology, many end-users still utilize an older payment security method that is more vulnerable than tokenization. A lack of knowledge about sophisticated and cutting-edge payment methods is a concern for organizations. Unlike encryption, tokenization uses ‘tokens’ to substitute critical information rather than transferring it from credit/debit cards. Budget constraints also make it difficult for SMEs to replace outdated technology and combat payment fraud with standard security solutions.

MARKET OPPORTUNITIES

Asia Pacific presents potential opportunities for the expansion of the market. The fast-growing digitalization in the region lays a good foundation for market expansion, with banks and financial institutions progressively exploring the application of blockchain.

- According to a report by Bloomberg, the latest decision of the Philippines Bureau of the Treasury to provide 10 billion pesos, i.e. 179 million dollars, of tokenized treasury bonds signifies a major action in this direction. The Land Bank and the Development Bank of the Philippines will issue these bonds displaying a rising inclination to use blockchain for government securities.

Apart from Asia, major economies of the Middle East and Europe, like the United Arab Emirates and the United Kingdom are also actively widening ground for the expansion of the market.

The alternative asset Management industry is another potential opportunity for the market. It can simplify, automate, and streamline the majority of levels of alternative investments, profiting institutions and individuals alike. Also, it could facilitate portfolio customization, automate capital calls, and enhance liquidity and collateralization. Opening these advantages can give a massive 400 billion dollars in extra yearly revenue for this alternative industry.

MARKET CHALLENGES

The lack of regulatory and legal Certainty is one of the challenges impeding the expansion of the tokenization market. For instance, in the United States, despite breakthroughs in technology and different legislative measures, involving bills tabled in Congress and reports from government agencies under the March 2022 order of the Digital Assets Executive, an extensive legal structure is still absent. This doubt hinders the potential advantages of tokenization of assets, like higher liquidity, improved transparency, and cost reduction.

Moreover, this regulatory ambiguity also affects real-world assets which derail market growth. Builders will find it tough to produce sustainable items which could revolutionise the availability of customary illiquid assets such as art and real estate

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

21.5% |

|

Segments Covered |

By Component, Application, Technique, Deployment, Enterprise Size, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Finserv (US), Visa (US), American Express (US), CipherCloud (US), Tokenex (US), Futurex (US), Symantec (US), Liaison Technologies (US), Thales e-Security (France), PayU (Netherlands), AsiaPay (China) and Others. |

SEMENTAL ANALYSIS

Global Tokenization Market Analysis By Component

The solution category is predicted to gain the largest market share over the forecast years. Many SMEs turn to tokenization to defend themselves from rising payment fraud and identity theft. The segment’s market growth can be attributed to the greater accessibility. It provides the part ownership of assets, making it convenient for a large variety of investors to enter the market which were previously unavailable. Likewise, Visa in 2022 produced over 5 billion tokens, and as of 2024, that figure has exceeded 10 billion tokens.

Global Tokenization Market Analysis By Application

As online purchasing gets more popular, eCommerce companies are devoting more attention to payment security. Even in the event of a data breach, tokenization makes it more difficult to reveal sensitive personal data. While tokenization will not eliminate data breaches, it will assist in reducing the financial damages that may occur. As a result, tokenization simplifies the user experience while maintaining high levels of fraud prevention. As per a report by Cybersource, tokenization can be a win-win-win situation for consumers, merchants, and issuers, i.e. all the parties in the payment ecosystem. Also, due to digital network tokens, enhanced security and an improved customer experience to a large section of eCommerce transactions. About 95 per cent of the volume of Visa card payments in North America is already facilitated to assist tokenization, and a big share of merchants and acquirers service providers drive the service.

- According to a survey performed at the end of 2023, around 2/3rd of online traders surveyed globally were utilising some kind of tokenization in payment management. Just less than 50 per cent of participants stated that they use gateway tokens and those using network tokens account for 43 per cent.

Global Tokenization Market Analysis By Technique

The API-based market led the Global Tokenization Market by Tokenization Technique in 2024, with a predicted CAGR of 19.3 per cent during the forecast period. It is the spine of modern business. These tools enable companies to attain, utilize and augment their current information by linking to varied data sources, presenting new paths for revenue generation, spurring innovation, and improving interoperability.

- In September 2024, WisdomTree introduced an Ethereum-based platform for ‘Wisdom Tree Connect’ which is a tokenized real-world assets (RWA). The statement clarifies that the platform at the beginning supports API and web portal access, with prospective plans to study decentralized application (dApp) exchanges or engagement.

Over the projection period, the Gateway-Based market would grow at a CAGR of 21.7 per cent and is expected to witness significant expansion in the coming years.

Global Tokenization Market Analysis By Deployment

Cloud deployment is developing rapidly in the tokenization industry. SMEs increasingly turn to cloud deployment options because they allow them to focus on their core skills rather than payment infrastructure. Using cloud-based solutions, businesses can dramatically reduce their software, hardware, storage, and technical staffing costs.

Global Tokenization Market Analysis By Enterprise Size

Tokenization products and services are mostly used by SMEs to comply with responsibilities and mitigate fraud risks. These SMEs use tokenization solutions to secure sensitive data from network weaknesses and assaults. One of the main goals of attackers targeting SMEs is to gain access to client information, payment details, and other confidential information through their applications. Cybercriminals use automation to attack thousands of applications at once, taking advantage of SMEs’ lack of security. To save money, time, and resources, SMEs are increasingly turning to cloud-based tokenization solutions. Tokenization as a Service (TaaS) addresses the financial constraints encountered by SMEs, with the segment increasingly implementing cloud-based tokenization solutions, driving the tokenization market for SMEs to grow.

Global Tokenization Market Analysis By End-User

Cybercriminals target the BFSI sector because it deals with money. It displays a large number of financial transactions, which is enticing to thieves. As a result, it is always on the search for advanced payment security solutions and services to protect its employees, customers, assets, offices, branches, and operations; as a result, it owns a significant percentage of the tokenization market by vertical. In the BFSI sector, tokenization solutions are popular and have a high acceptance rate since they help firms manage PCI DSS regulatory compliance. Furthermore, the vertical frequently develop new and enhanced financial goods and services to boost business operations, which attracts fraudsters looking for sensitive client data. The BFSI vertical would have to prioritize payment security with services like smart banking, online banking, and mobile banking.

REGIONAL ANALYSIS

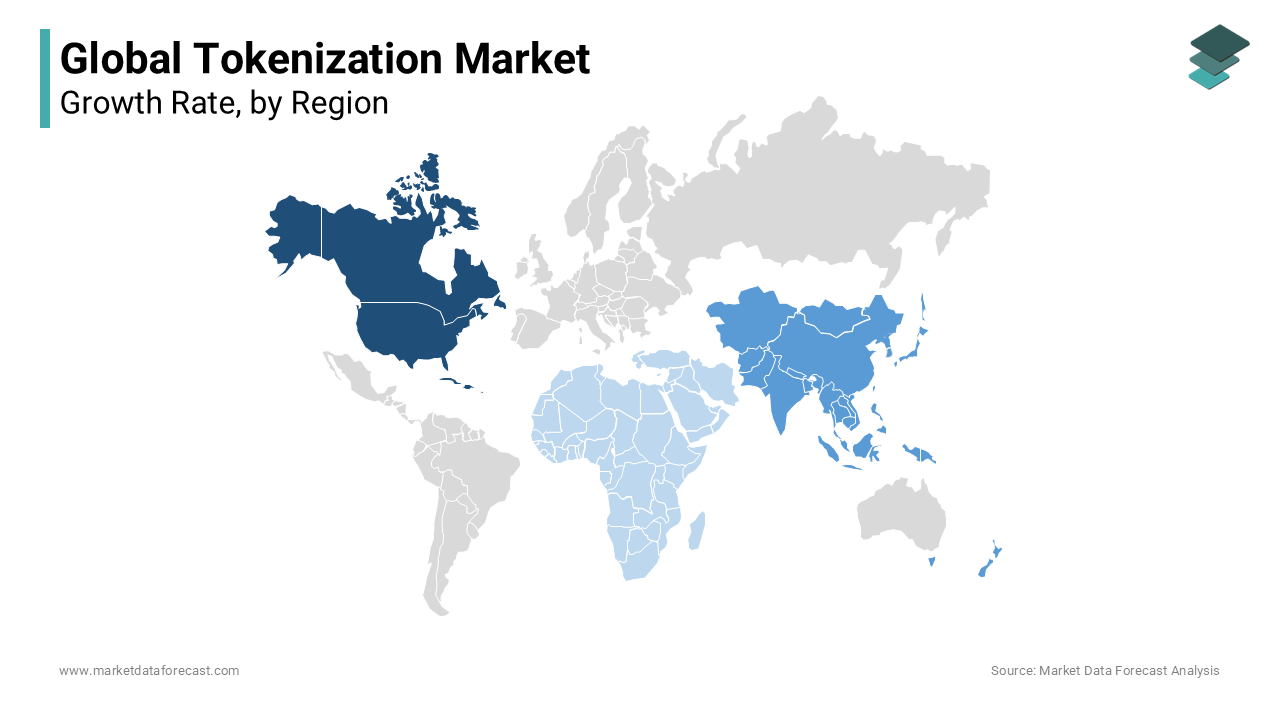

The North American tokenization market was worth USD 591.6 million in 2022 and is estimated to rise to USD 2751.3 million by 2028, with a CAGR of 24.6 per cent. Regulations like the CCPA, as well as an increase in cyberattacks, particularly payment thefts across industries, are projected to fuel demand for tokenization solutions and services in North America. Customer inclinations for contactless cards and digital-first credit cards are projected to aid the growth of tokenization in North America. Growing eCommerce, smartphone usage for online payments, and access to various services, including online streaming, online gaming, and other government services, are all driving market expansion in North America.

- In July 2024, Goldman Sachs to introduce 3 projects on tokenization by the end of 2024. These are aimed at asset diversification and institutional clients. As the three tokenization projects are scheduled, McDermott disclosed that the foremost plans will emphasize on United States market. Especially European debt insurance and the US fund complex will be the main focus, capitalising on private blockchain for legal compliance.

The Asia Pacific Tokenization Market is predicted to develop at a CAGR of 22.3 percent over the forecast period. China dominated the Asia Pacific Cloud Tokenization Market, growing at a CAGR of 21.4 percent over the forecast period.

The demand for effective tokenization solutions in APAC is expected to be uelled by government efforts to combat financial fraud and country-specific compliance laws aimed at boosting cybersecurity. Other factors driving tokenization solution adoption include the increased use of smartphones for online transactions and online shopping and the rapid adoption of online transactions, which has opened the door to a flood of new cyber threats. As a result, the number of customers has increased, necessitating tokenization technologies to protect and reinforce payment processes.

- According to a press release on March 2024, the adoption of Visa Token Services (VTS) has led to an increase of 2 billion US dollars in the digital commerce economy of Asia Pacific

The Japanese market is rising at a rate of 23% during this time. Furthermore, during the forecast period, the Indian market is expected to grow at a CAGR of 24.5 percent. Large Enterprises dominated the Malaysia Tokenization Market by Enterprise Size, with a market value of USD 59.3 million by 2026. Small and Medium Businesses (SMBs) are growing at a rate of 27.4 per cent per year.

During the forecast period, the European Tokenization Market is expected to develop at a CAGR of 19.5 per cent. During the projected period, the German market will continue to dominate the area, rising at a CAGR of 16.7%. The UK market is growing at a rate of 17.1% per year. Furthermore, the French market is expected to grow at an annual rate of 18.9%. By 2026, the API-Based market had dominated the Spanish market, with a market value of $57.6 million.

The African region accounts for only 2% of the global tokenization market. Central banks in the MEA region are discovering digital currency opportunities, which could boost the tokenization market. The UAE is the leading country, with $27 billion and $61 billion invested in credit agencies and private firms, respectively. Egypt is the most promising market in North Africa, with a $6 billion fund dedicated to SMEs and consumer liquidity.

KEY PARTICIPANTS TOKENIZATION MARKET

The major companies operating in the global tokenization market include Finserv (US), Visa (US), American Express (US), CipherCloud (US), Tokenex (US), Futurex (US), Symantec (US), Liaison Technologies (US), Thales e-Security (France), PayU (Netherlands), AsiaPay (China), and others.

RECENT HAPPENINGS IN THE GLOBAL TOKENIZATION MARKET

- In June 2024, a global asset manager company, Investcorp, press released that the signing of a partnership agreement between Securitize and Strategic Capital Group (ISCG). ISCG is part of Investcorp and Securitize is a company specializing in tokenization of assets.

DETAILED SEGMENTATION OF THE GLOBAL TOKENIZATION MARKET INCLUDED IN THIS REPORT

This research report on the global tokenization market has been segmented and sub-segmented based on the component, application, technique, deployment, enterprise size, end user, and region.

By Component

- Solutions

- Services

By Application

- Supermarkets/Hypermarkets

- Convenience Stores

- Pharmacies

- Online

- Others

By Technique

- API-Based

- Gateway-Based

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-User

- BFSI

- Retail & eCommerce

- Government

- Healthcare

- Telecom & IT

- Energy & Utilities

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Frequently Asked Questions

What are the primary drivers fueling the growth of the tokenization market worldwide?

The growth of the tokenization market is primarily driven by increasing concerns regarding data security, stringent regulatory requirements, the rising adoption of digital payment methods, and the growing prominence of blockchain technology across various industries globally.

What are the key industries leveraging tokenization solutions on a global scale?

Industries such as banking and finance, healthcare, e-commerce, retail, and telecommunications are among the key sectors leveraging tokenization solutions globally to enhance security, streamline transactions, and protect sensitive data across various digital platforms.

How do tokenization solutions impact customer experience and trust in global markets?

Tokenization solutions enhance customer experience by offering secure and convenient payment options, reducing the risk of fraud and identity theft. By safeguarding sensitive data and ensuring privacy, tokenization builds trust among consumers, leading to increased confidence in digital transactions and interactions on a global scale.

What are the future prospects and trends expected to shape the tokenization market globally?

Future prospects for the tokenization market include the integration of tokenization with emerging technologies such as artificial intelligence and the Internet of Things, the expansion of tokenized asset classes beyond traditional financial instruments, and the continued evolution of regulatory frameworks to accommodate tokenized assets and transactions on a global scale.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]