Global Tire Derived Fuel Market Size, Share, Trends & Growth Forecast Report By End Use Industry (Cement Kilns, Pulp and Paper Mills and Utility and Industrial Boilers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis 2024 to 2033

Global Tire Derived Fuel Market Size

The Global Tire Derived Fuel Market was worth USD 459 million in 2024. The global market is anticipated to reach a valuation of USD 818.64 million by 2033 from USD 489.48 million in 2025 and register a CAGR of 6.64% from 2025 to 2033.

MARKET DRIVERS

The growing manufacturing of electric and hybrid vehicles and increasing car sales worldwide are propelling the growth of the tire-derived fuel market.

Tire-derived fuel is made from shredded employed tires. Tires can be mixed with charcoal or other fuels, such as wood or chemical waste, for burning in concrete kilns, power plants, or paper mills, which promotes global market growth. The call for fuel derived from tires is escalating dramatically due to its advantages, such as providing a higher calorific value than coal or wood. The calorific value of fuel derived from tires is about a third greater than that of coal and more than twice that of wood. These advantages of tire-derived fuel are predicted to drive market expansion over the foreseen period. Tire-derived fuels offer several advantages over traditional fuels. Tires produce almost similar energy as oil and around 25% more than coal. TDF ash residues may contain a lower heavy metal content than some coals. TDF is cheaper than fossil fuels. Burning tires for fuel decreases the number of employed tires that are thrown into landfills or inventory. TDF reduces emissions of sulfur oxides (SOx) when employed to replace high-sulfur coal in cement kilns.

Over the years, there has been an increase in calls for electric vehicles in the automotive industry to reduce greenhouse gas emissions and move towards a sustainable ecosystem. Increased sales of electric vehicles and hybrid electric vehicles are predicted to attract more end-of-life tires during the foreseen period, which can be converted into fuel. Therefore, the escalating call for such vehicles will drive the expansion of the tire-derived fuels market during the foreseen period. Fuel prices are continually rising and there are no signs of easing in the future. The call for fossil fuels is escalating and fuel remains the main natural resource employed in cement manufacturing facilities. The growing focus on reducing greenhouse gas emissions and strict regulations to minimize the carbon footprint has driven calls for electric vehicles (EV) and hybrid electric vehicles (HEV) around the world. The governments of several countries, including China and the United States, set targets and offer incentives in the form of monetary and non-monetary benefits to promote the sales of electric vehicles. Increased sales of electric vehicles and electric sports vehicles will increase the number of tires at the end of their useful life. These end-of-life tires can be converted to PTO and employed for various applications. Therefore, the growing call for EVs and HEV will be one of the critical trends in the tire-derived fuel market.

MARKET RESTRAINTS

Environmental issues, strict laws and regulations, and Infrastructure are restricting the expansion of the tire-derived fuel market.

Moreover, huge processing costs are a restraining factor for the expansion of the TDF market. Flaming garbage in cement furnaces is another type of incineration and also wastes resources that emit harmful greenhouse gases (GHG) which affect human health and the environment. In addition, increased support from international environmental protection organizations and bodies coupled with legal and financial backing from prominent industries like the European Union and other countries are a major obstacle to the market growth. As a result, some companies have already and some may start to refrain from using old tires for making fuel. A large quantity of hazardous gases, including NO2, HCI, SO2, CO, fine particulates, and other dangerous compounds, are discharged during waste rubber incineration. This straightaway pollutes the atmosphere and impacts health, especially for those residing close to the rubber recycling factories.

The strict laws and regulations are hurting the growth of the tire-derived fuel market share. This is because of the absence of standardized regulations particularly related to GHG emissions from scrap tire and tire-derived fuel (TDF) combustion. Apart from this, the industry's progress is hindered by the constraints in downstream procedures for managing products made by recycling discarded tires by pyrolysis to make fuel. This also results in compliance issues with environmental laws. Tire pyrolysis oil (TPO) can not be utilised as engine fuel and this significantly reduces its use cases across several industries, having a detrimental effect on the market. It is a dark and heavy fluid with a similar chemical composition to crude oil, so it necessitates extra processing and extraction to become suitable for engine use.

Multiple countries have imposed bans on the import and export of used tires, resulting in the high cost of tire-derived fuel. Economies including Brazil, Australia and India have already prohibited the import and export of used tires making a significant shift in the global industry. Similarly, in February 2024, the European Union Parliament agreed by vote to amend the EU’s Waste Shipment Regulations to correctly handle the waste exports so that it protects the environment and people’s health.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.64% |

|

Segments Covered |

By End-User Industry and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Emanuel Tire, ETR Group, Front Range Tire Recycle, Inc., Globarket Tire Recycling LLC, L & S Tire Company, Lakin Tire West Inc., Liberty Tire Recycling, Ragn-Sells Group, Reliable Tire Disposal, Renelux Cyprus Ltd, ResourceCo Pty Ltd, Scandinavian Enviro Systems AB, Tire Disposal & Recycling, Inc. and West Coast Rubber Recycling Inc., and Others. |

SEGMENTAL ANALYSIS

By End-User Industry Insights

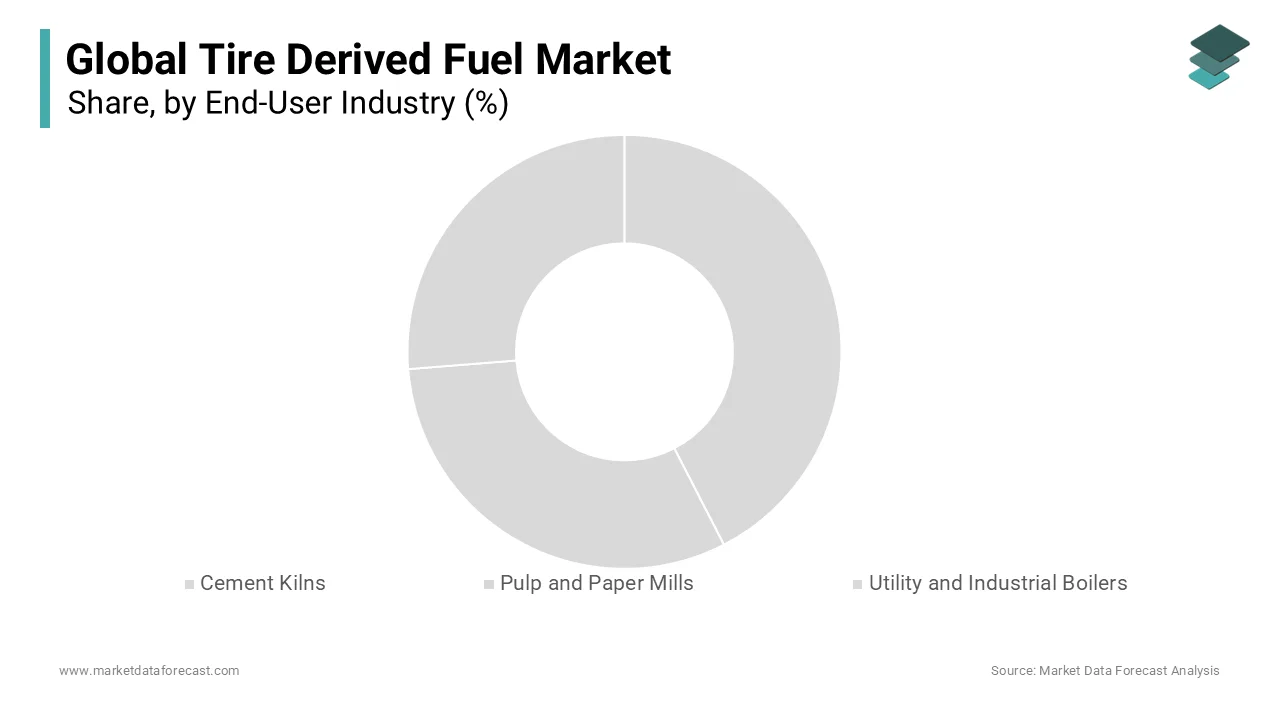

The cement manufacturing sector led the global tire-derived fuel market with a 41% share in 2024. The segment was followed by the pulp and paper mill segment. Additionally, cement manufacturing companies use whole and shredded tires to supplement their primary cement kiln fuel. Several characteristics, like high BTU value, make tires an ideal choice for fuel among cement kilns. Moreover, as the demand for cement surges, so does the necessity of lowering its carbon footprint. There is a huge opportunity for this segment to use fuels made from tires. In the last few years, the dumping of used tires has caused severe ecological problems. A research paper revealed that integrating waste rubber tires in concrete can enhance its mechanical qualities and simultaneously mitigate the environmental effect of garbage rubber disposal. Additionally, the segment will grow further because its application offers a potential solution to the problem of the reduction of natural resources and heightening demand for eco-friendly building materials.

The segment's market size is expected to increase with the full commitment of 80 per cent of cement production outside China towards delivering community with net zero cement by 2025. This is as per the Global Cement and Concrete Association (GCCA).

For instance, in June 2023, Holcim Group opened a cement plant in Alpena, Michigan (US). It is a new whole-tire coprocessing factory which is a state-supported program having the objective to cleanly and securely transform 22K tons of tires annually into energy to assist fuel one of the biggest cement facilities in the United States.

REGIONAL ANALYSIS

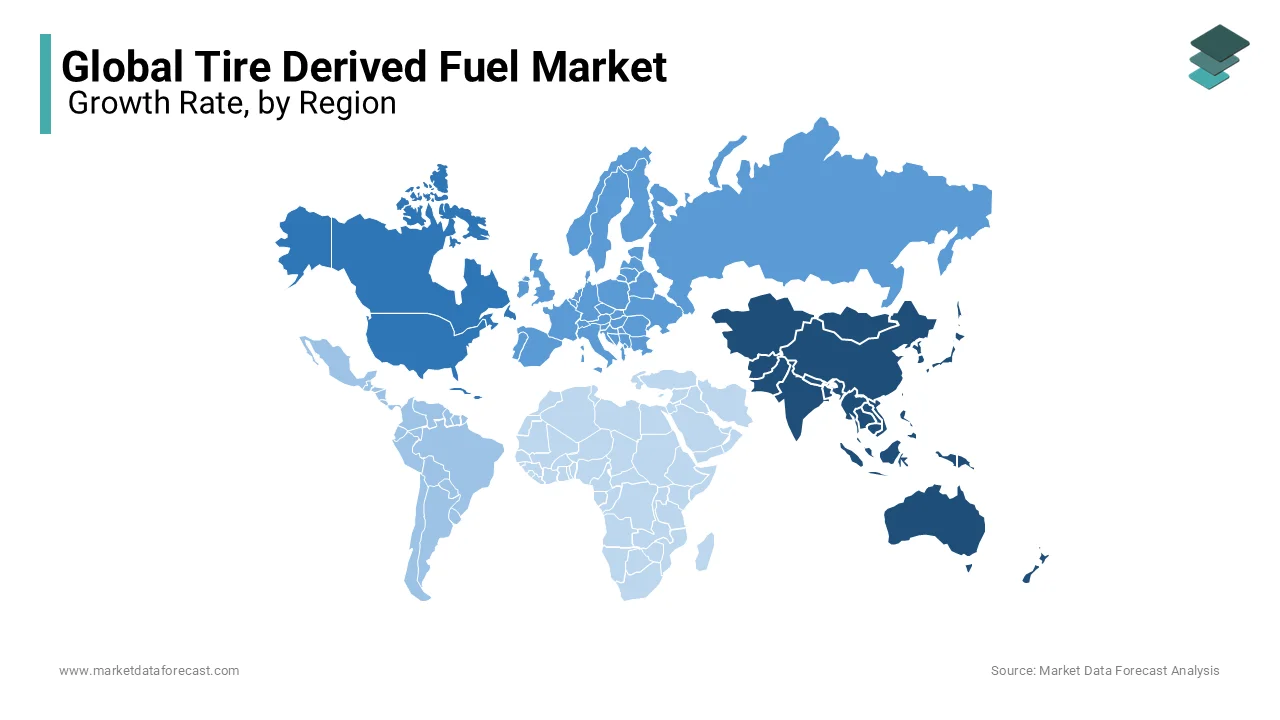

The Asia Pacific region is predicted to have a significant market share during the foreseen period due to the increase in the generation of newer tires as well as waste tires. Japan had a significant market share for tire-derived fuels in the Asia Pacific. More than 80 million units of employed tires are produced in Japan each year. However, the call for tire-derived fuel in India is predicted to increase at a rapid pace during the foreseen period. Asia-Pacific is a key region in the tire-derived fuel market. It is predicted to remain dominant during the foreseen period, driven by a year-over-year increase in the production of new and employed tires. Japan had a significant share of the Asia Pacific tire-derived fuel market in 2023. In India, more than 25 million vehicles were produced in the 2024-2032 fiscal year. Therefore, the production of new tires is very high in the country.

In terms of consumption, the United States is an important country in the market for tire-derived fuels. In the United States, more than 270 million scrap tires were produced in 2032. Of these, 81.4% of scrap tires were recycled and reemployed for various applications. More than 100 million tires have been employed for fuel in pulp and paper mills, cement manufacturing, and utility boilers, among others.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global tire derived fuel market include Emanuel Tire, ETR Group, Front Range Tire Recycle, Inc., Globarket Tire Recycling LLC, L & S Tire Company, Lakin Tire West Inc., Liberty Tire Recycling, Ragn-Sells Group, Reliable Tire Disposal, Renelux Cyprus Ltd, ResourceCo Pty Ltd, Scandinavian Enviro Systems AB, Tire Disposal & Recycling, Inc. and West Coast Rubber Recycling Inc., and Others.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, BP signed an 8-year offtake agreement with Circtec for the year-on-year purchase of 60000 tons of HUPATM renewable marine fuel and circular naphtha petrochemical feedstock of up to 15000 tons. This will be supplied by Circtec's new large-scale factory. Also, the deal obliges BP for eight years after starting factory operations within a take-or-pay arrangement.

- In May 2024, the U.S. Tire Manufacturers Association (USTMA) in collaboration with the Tire Industry Association (TIA) announced the constitution of the Tire Recycling Foundation during its ninth Tire Recycling Conference. The aim is to reprocess 100 per cent of end-of-life tires into circular, durable and tenable markets. This new program will obtain financing and distribute grants for research, intervention, education and demonstration projects.

- In June 2024, Golden Bay announced through a press release that it utilizes old tires and reprocessed timber in its production process to replace 55 to 60 per cent of the coal it consumed in the Portland factory. The organisation is targeting 2030 to completely become coal-free.

MARKET SEGMENTATION

This research report on the global tire derived fuel market has been segmented and sub-segmented based on end-user industry, and region.

By End-User Industry

- Cement Kilns

- Pulp and Paper Mills

- Utility and Industrial Boilers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the definition of Tire Derived Fuel Market ?

Tire-derived fuel is a fuel extracted from all types of employed tires such as whole tires or tires made in uniform flowable parts that meet end-user specifications, Employed tires are an exceptional source of fuel due to their high calorific value.

2. What can be the total Tire Derived Fuel Market value?

The Global Tire Derived Fuels Market was worth USD 459 million in 2024 and is predicted to reach USD 818.64 million in 2033, with a CAGR of 6.64% during the forecast period.

3. Name any three Tire Derived Fuel Market key players?

Lakin Tire West Inc, Liberty Tire Recycling, Ragn-Sells Group are the global Tire Derived Fuel Market Key Players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]