Global Tiny Homes Market Size, Share, Trends, & Growth Forecast Report Segmented By Product Type (Mobile Tiny Homes and Stationary Tiny Homes), Area, Application, Distribution Channel, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Tiny Homes Market Size

The global tiny homes market size was valued at USD 5.95 billion in 2024 and is projected to grow from USD 6.17 billion in 2025 to USD 8.20 billion by 2033, the market is expected to grow at a CAGR of 3.62% during the forecast period.

Tiny homes are an evolving sector that caters to individuals seeking affordable, sustainable, and minimalist living solutions. A tiny home is typically defined as a residential structure of less than 500 square feet and designed to maximize space efficiency while reducing material consumption and carbon footprints. The movement is driven by a combination of financial constraints, changing lifestyle preferences, and environmental concerns. One of the key motivators behind the growing interest in tiny homes is housing affordability. According to the U.S. Census Bureau, the median price of a new home in the U.S. reached $417,700 in 2023, making homeownership increasingly unattainable for many. By contrast, the average cost of a tiny home is estimated to be between $30,000 and $80,000, making it a significantly more economical option.

From a demographic perspective, tiny homes are increasingly popular among millennials and retirees. The AARP reports that 40% of people aged 55+ are considering downsizing, and many are opting for tiny homes due to their low maintenance and reduced financial burden. Meanwhile, a 2022 survey by IPX1031 found that 63% of millennials expressed interest in living in a tiny home, citing affordability and lifestyle flexibility as key reasons.

MARKET DRIVERS

Environmental Sustainability

A significant driver of the tiny homes market is the emphasis on environmental sustainability. Tiny homes which is typically under 400 square feet requires fewer building materials and consume less energy which is resulting in a smaller carbon footprint compared to traditional homes. According to the U.S. Department of Energy, residential energy consumption accounts for approximately 21% of total U.S. energy use. By downsizing to a tiny home, individuals can significantly reduce their energy consumption, contributing to environmental conservation efforts. This reduction in resource usage aligns with the growing public awareness and concern for environmental issues, making tiny homes an attractive option for eco-conscious individuals.

Desire for Minimalist and Flexible Living

The increasing desire for minimalist and flexible living arrangements also fuels the tiny homes market. Many individuals are seeking to declutter their lives, focusing on experiences over possessions. Tiny homes facilitate this lifestyle by offering simplified living spaces that encourage minimalism. According to a Zillow survey, 58% of millennials express interest in living in a tiny home due to affordability, sustainability, and the ability to own property without excessive debt. Additionally, the mobility of many tiny homes allows for flexible living locations, appealing to those who prefer a nomadic lifestyle. This trend is particularly prevalent among younger demographics who value flexibility and the ability to relocate easily. The combination of minimalism and mobility offered by tiny homes caters to these evolving lifestyle preferences, further driving market growth

MARKET RESTRAINTS

Zoning Regulations and Building Codes

A primary restraint is the complexity of zoning laws and building codes, which often impose minimum size requirements for residential dwellings. These regulations can prohibit the construction or placement of tiny homes in many areas. For instance, the International Residential Code (IRC) traditionally mandates a minimum floor area for dwellings, making compliance difficult for tiny homes.

Although Appendix Q of the 2018 IRC introduced provisions for tiny houses, its adoption varies by jurisdiction, leading to inconsistent legal standing across regions. Additionally, the National Association of Home Builders (NAHB) reports that 68% of U.S. municipalities have zoning regulations that either limit or entirely exclude tiny homes from residential areas. This patchwork of regulations creates uncertainty for potential tiny home owners and builders, hindering market growth.

Financing and Insurance Challenges

Securing financing and insurance for tiny homes presents another significant obstacle. Traditional mortgage lenders often hesitate to finance tiny homes due to their unconventional nature and concerns about resale value. According to the Federal Deposit Insurance Corporation (FDIC), lenders typically require homes to meet certain standards and be affixed to permanent foundations to qualify for traditional mortgages. According to a 2023 survey by the Tiny House Industry Association (THIA), over 70% of tiny homeowners faced difficulties obtaining traditional financing, leading them to rely on personal loans, RV loans, or cash savings instead. Since many tiny homes are mobile or do not conform to standard housing criteria, obtaining financing becomes challenging. Similarly, insurance companies may be reluctant to provide coverage, or may offer policies with high premiums, due to perceived risks associated with non-traditional structures. These financial hurdles can deter potential buyers, thereby restraining the market's expansion.

MARKET OPPORTUNITIES

Government Incentives and Policy Support

An increasing number of state governments are introducing incentives to encourage the construction of accessory dwelling units (ADUs) which is commonly known as tiny homes to address housing shortages and promote affordable living. For instance, California offers grants of up to $40,000 to low- and moderate-income residents for pre-construction costs associated with building ADUs. Similarly, New York's Plus One ADU Program provides up to $125,000 per grantee, with a total budget of $85 million allocated over five years. Vermont also offers up to $50,000 to homeowners through regional organizations, supported by a $15 million budget. These programs aim to increase housing equity and provide financial assistance to individuals interested in constructing tiny homes.

Innovations in Prefabricated and Modular Construction

Advancements in prefabricated and modular construction techniques present significant opportunities for the tiny homes market. Companies like MyCabin, a Latvian startup, have developed minimalist, Scandinavian-inspired tiny homes that are now available in the U.S. through PrefabPads. MyCabin offers units ranging from a 132-square-foot sauna to a 682-square-foot two-bedroom home with prices between $59,000 and $175,000. These prefabricated units are constructed in factories and delivered fully finished, reducing construction time and costs. The growing popularity of such homes, driven by rising land costs and high mortgage rates, has led many states to pass laws supporting them, facilitating market expansion in regions like California and Colorado.

MARKET CHALLENGES

Security Vulnerabilities

The mobility of tiny homes, especially those on wheels, makes them susceptible to theft. Recent incidents highlight this vulnerability; for example, in November 2024, a tiny home was stolen in Sapulpa, Oklahoma, after thieves cut through locks and towed it away. Similarly, in Spokane, Washington, another tiny home was taken from a storage facility, though it was later recovered. According to the National Insurance Crime Bureau (NICB), vehicle thefts, including trailers, have increased by 20% since 2021, with movable tiny homes being a growing target. These thefts underscore the need for enhanced security measures, such as wheel locks and trailer receiver locks, to protect these movable dwellings. The increasing frequency of such incidents poses a significant concern for current and prospective tiny home owners, potentially deterring adoption.

Limited Awareness and Acceptance

Despite growing interest, tiny homes remain a niche market, and widespread public awareness and acceptance are limited. Many individuals are unfamiliar with the concept, benefits, and practicalities of tiny living. This lack of awareness can lead to misconceptions and hesitations, hindering market expansion. Zillow's 2024 housing market report noted that 80% of home listings cater to homes above 1,500 square feet, reinforcing traditional housing expectations. Moreover, societal norms and expectations around housing often favor traditional, larger homes, making it challenging for tiny homes to gain mainstream acceptance. Efforts to educate the public and promote the advantages of tiny homes are essential to overcome this barrier and foster broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.62% |

|

Segments Covered |

By Product Type, Area, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tumbleweed Tiny House Company, Tiny Heirloom, Tiny House Company, Skyline Champion Corporation, Tiny SMART House, Inc., Cavco Industries, Inc., Berkshire Hathaway Inc., Mustard Seed Tiny Homes, Atlas Vans, Aussie Tiny Houses, and others. |

SEGMENT ANALYSIS

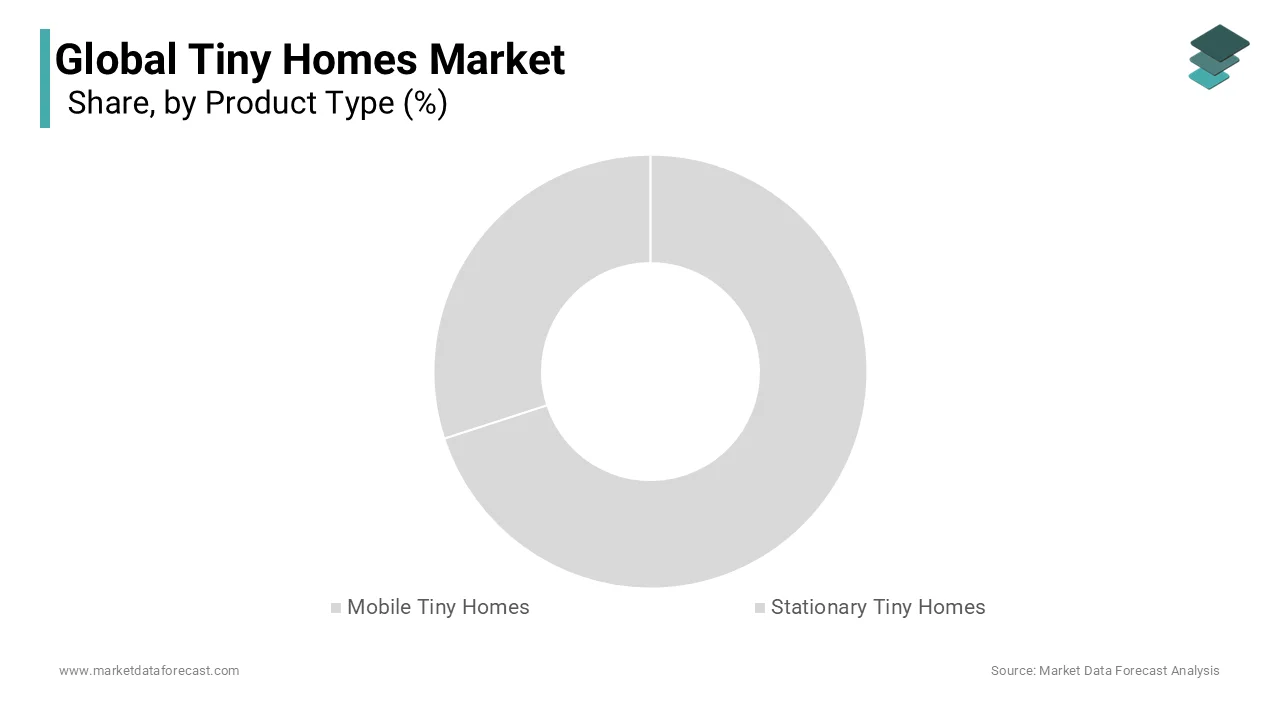

By Product Type Insights

The mobile tiny homes segment had the leading share of 64.7% of the global market in 2024. Their popularity is driven by affordability and flexibility, making them an attractive option for individuals and families seeking cost-effective housing solutions. According to the National Association of Home Builders (NAHB), the median price of a new single-family home in the U.S. increased by over 30% between 2020 and 2023, making traditional homeownership increasingly out of reach for many. The mobility aspect allows owners to relocate as needed, catering to a transient lifestyle. This segment's growth is also supported by rising housing costs, prompting consumers to explore alternative living arrangements.

On the other hand, the stationary tiny homes segment is projected to register the fastest CAGR of 5.37% over the forecast period owing to the increasing urbanization and the need for affordable housing solutions in densely populated areas. Stationary tiny homes offer a permanent housing option that is both cost-effective and space-efficient, appealing to individuals and families seeking affordable housing solutions, particularly in areas where housing costs are high. According to the U.S. Census Bureau, the median home price in urban areas rose by over 40% from 2019 to 2023, making alternative housing solutions like stationary tiny homes increasingly attractive. Their fixed nature allows for the development of tiny home communities, fostering a sense of community among residents.

By Area Insights

The 130-500 Sq. Ft. segment ruled the market in 2024 by accounting for 72.4% of the global market share. The growth of the 130-500 Sq. Ft. segment is driven by its balance between compact living and sufficient space for essential amenities, making it an attractive option for individuals and families seeking affordable housing solutions. In fact, a survey by the American Tiny House Association (ATHA) indicated that 67% of tiny home owners prefer homes in the 200-400 sq. ft. range, citing the need for enough space to accommodate basic living functions while retaining the affordability and simplicity that tiny homes offer. The 130-500 Sq. Ft. range offers a practical compromise, providing enough room for comfortable living while maintaining the cost-effectiveness and sustainability associated with tiny homes.

On the other hand, the Less Than 130 Sq. Ft. segment is projected to experience the fastest CAGR of 8.43% over the forecast period. This rapid expansion is attributed to increasing urbanization and the need for affordable housing solutions in densely populated areas. According to a recent study by the National Association of Home Builders (NAHB), 30% of tiny home buyers expressed interest in even smaller homes for their ability to reduce costs and simplify lifestyles. Tiny homes in this size category offer a cost-effective and space-efficient housing option, appealing to individuals and families seeking affordable housing solutions, particularly in areas where housing costs are high. Their compact size allows for innovative designs and efficient use of space, making them a viable alternative to traditional housing.

By Application Insights

The household segment currently holds the leading share of 63.2% in the global market in 2024. The domination of the household segment is driven by the increasing demand for affordable and sustainable housing solutions. This segment's prominence is attributed to the rising cost of traditional housing and a growing interest in minimalist living. According to the U.S. Census Bureau, the median price of a new home in the U.S. reached $417,700 in 2023, making homeownership increasingly unattainable for many. By contrast, the average cost of a tiny home is estimated to be between $30,000 and $80,000, making it a significantly more economical option.

On the other hand, the Commercial segment is estimated to undergo the rapid expansion over the forecast period and exhibit a CAGR of 8.43% from 2025 to 2033. This growth is driven by the increasing adoption of tiny homes for commercial purposes, such as hospitality and retail. According to the American Hotel & Lodging Association (AHLA), 60% of travelers in the U.S. have expressed interest in staying in non-traditional accommodation types, including tiny homes, with a notable rise in bookings for vacation rentals. The flexibility and cost-effectiveness of tiny homes make them an attractive option for businesses seeking to reduce overhead costs and offer unique experiences to customers. For instance, tiny homes are being utilized as boutique hotels and retail spaces, providing a novel and sustainable alternative to traditional commercial structures.

By Distribution Channel Insights

The direct sales segment led the market by holding 56.4% of the global market share in 2024. This approach allows manufacturers to engage directly with consumers, offering personalized services and fostering stronger customer relationships. Direct sales enable companies to maintain control over pricing and branding, which is crucial in a market where customization and personalization are highly valued. A report from the National Association of Home Builders (NAHB) suggests that nearly 45% of new home buyers in 2023 preferred direct interactions with sellers to understand the full scope of customization options available.

The distributors segment is expected to be the fastest-growing segment and grow at a CAGR of 8.43% from 2025 to 2033. This growth is driven by the increasing adoption of tiny homes across various regions, necessitating efficient distribution channels to meet rising demand. Distributors play a pivotal role in expanding market reach, especially in areas where direct sales channels are limited. Their ability to manage logistics and provide localized support is essential for companies aiming to penetrate new markets and cater to a broader customer base. In 2023, around 30% of tiny home manufacturers reported that their online sales grew by over 20% year-on-year, as consumers increasingly use the internet to browse, compare, and directly purchase tiny homes.

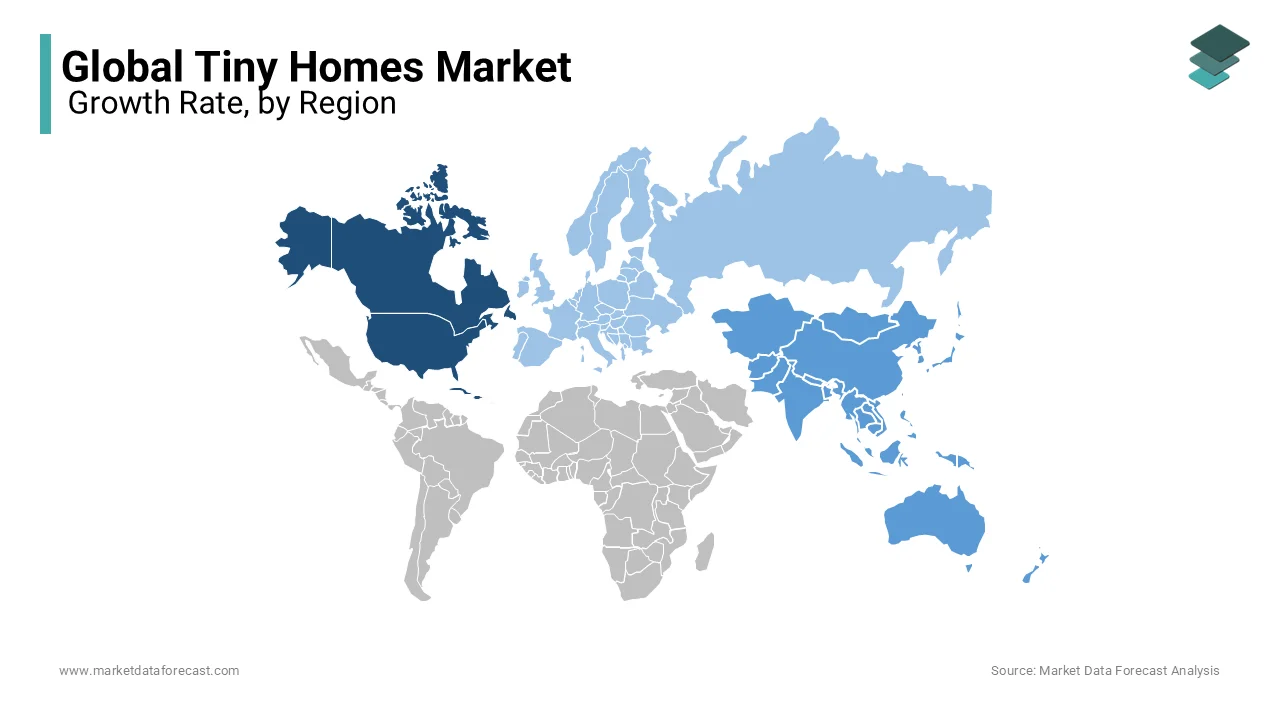

REGIONAL ANALYSIS

North America ruled the tiny homes market worldwide and accounted for 54.3% of the global market share in 2024. This dominance is attributed to factors such as the rising cost of traditional housing and a growing interest in minimalist, sustainable living. For instance, in 2023, the city of Austin, Texas, passed new regulations allowing tiny homes to be used as ADUs (Accessory Dwelling Units), contributing to a 30% increase in tiny home permits in the region. The high cost of conventional homes has led many individuals to seek more affordable alternatives, making tiny homes an attractive option.

The Asia-Pacific region is experiencing the fastest growth in the global tiny homes market. This rapid expansion is driven by increasing urbanization, rising housing costs, and a growing awareness of sustainable living practices. As urban populations swell, the demand for affordable and space-efficient housing solutions becomes more pressing, positioning tiny homes as a viable and appealing alternative. According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), Asia is expected to have 2.5 billion urban residents by 2050, with many facing challenges related to housing affordability.

In Europe, the tiny homes market is gaining momentum, driven by a strong emphasis on sustainability and innovative housing solutions. Countries like Germany and the United Kingdom are witnessing increased interest in minimalist living, with companies such as Tiny Eco Homes UK offering customizable models starting at £26,000. The European market is expected to see moderate growth as environmental consciousness and housing affordability become more prominent concerns.

In Latin America, the tiny homes concept is gradually gaining acceptance, primarily driven by economic factors and the need for affordable housing solutions. Brazil, for instance, has seen the emergence of companies like Tiny Houses Brazil, which develops and builds mini-houses on wheels, with prices starting around R$90,000. As urbanization continues and housing shortages persist, the tiny homes market in Latin America is poised for gradual growth.

In the Middle East and Africa, the tiny homes market is still in its nascent stages. However, there is potential for growth as awareness increases and housing challenges persist. According to the World Bank, the population of urban dwellers in Africa is expected to more than double by 2050, with cities like Lagos, Cairo, and Nairobi facing immense pressure to provide affordable housing. In South Africa, for example, companies like Freedom Tiny Homes are beginning to build and sell tiny houses, and non-profit organizations such as The Tiny House Project are promoting tiny house living through workshops and educational resources. As these initiatives gain traction, the region may experience a gradual adoption of tiny homes as a viable housing alternative.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the global tiny homes are Tumbleweed Tiny House Company, Tiny Heirloom, Tiny House Company, Skyline Champion Corporation, Tiny SMART House, Inc., Cavco Industries, Inc., Berkshire Hathaway Inc., Mustard Seed Tiny Homes, Atlas Vans, Aussie Tiny Houses, and others.

The global tiny homes market is witnessing increasing competition as demand for affordable, sustainable, and minimalist living solutions grows. The market is characterized by a mix of established players, like Skyline Champion Corporation and Tumbleweed Tiny House Company, and newer entrants such as Boxabl and MyCabin. These companies are vying for market share by offering diverse products, including traditional tiny homes on wheels, prefabricated units, and modular homes designed for rapid deployment.

Innovation plays a significant role in this competitive landscape. Companies are investing in research and development to introduce smarter and more efficient designs, incorporating technology like AI and energy-efficient features to appeal to eco-conscious consumers. Strategic partnerships and acquisitions are also common, with many players collaborating with construction firms, landowners, or government bodies to expand their reach and capabilities. For example, Boxabl's partnership with the U.S. military to supply modular homes has opened new market segments.

Despite the growing competition, the market is still fragmented, with no single player commanding a dominant position. This fragmentation presents opportunities for new entrants and innovative companies to carve out a niche. As the market matures, competition will intensify, pushing companies to focus on product differentiation, affordability, and sustainability to stay ahead.

STRATEGIES USED BY THE MARKET PLAYERS

Innovation and Product Diversification

Companies like AC Future are revolutionizing the market with innovative products such as AI-Transformer Homes. These 400-square-foot smart homes, priced at $98,000, feature expandable designs and integrated AI technology for managing heating, lighting, and security systems. Over 300 units have been pre-ordered, with deliveries starting in late 2026.

Strategic Partnerships and Acquisitions

Skyline Champion Corporation has strengthened its market position through strategic acquisitions. In July 2022, the company expanded its retail presence by acquiring Factory Expo Home Center locations across 12 of its U.S. production facilities, enhancing its capacity to meet the growing demand for tiny homes.

Market Expansion and Accessibility

Latvian startup MyCabin has expanded into the U.S. market through a partnership with PrefabPads, offering minimalist, Scandinavian-inspired tiny homes. Their product line includes units ranging from a 132-square-foot sauna to a 682-square-foot two-bedroom home, with prices between $59,000 and $175,000. By January 2024, 43 tiny homes were delivered across several U.S. states, reflecting the company's successful market expansion.

TOP 3 PLAYERS IN THE MARKET

The global tiny homes market has seen significant contributions from key players who have advanced the industry's growth through innovation and strategic initiatives.

Skyline Champion Corporation

Skyline Champion Corporation stands as a prominent entity in the tiny homes sector, offering a diverse range of manufactured and modular homes. The company's extensive distribution network and commitment to quality have solidified its position in the market. In July 2022, Skyline Champion expanded its retail presence by acquiring Factory Expo Home Center locations across 12 of its U.S. production facilities, enhancing its capacity to meet the growing demand for tiny homes.

Tumbleweed Tiny House Company

Established in 1999, Tumbleweed Tiny House Company has been a pioneer in the tiny homes movement. Specializing in designing and building small, timber-framed houses mounted on trailers, Tumbleweed offers both ready-made homes and construction plans for DIY enthusiasts. Their customizable designs cater to a variety of preferences, contributing to the widespread appeal and adoption of tiny living.

Boxabl

Boxabl has introduced innovative solutions in the tiny homes market with its foldable, prefabricated housing units. Their flagship product, the Casita, is a 361-square-foot compact home designed for rapid setup and affordability. In 2020, Boxabl secured a federal contract exceeding $9 million to supply 156 units for military housing, underscoring their growing influence in the sector.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Chase Packaging Corporation announced its intention to acquire assets in the tiny home industry, including Tiny Estates, LLC, Tiny Communities Fund, LLC, and Endeavor Tiny Homes, LLC. This move aims to address affordable housing challenges in the U.S.

- In June 2024, Tiny, backed by Hosking Partners, acquired MediaNet Solutions, an educational software business. This acquisition expands Tiny's portfolio, though its direct impact on the tiny homes market is limited.

MARKET SEGMENTATION

This research report on the global tiny homes market has been segmented and sub-segmented based on product type, area, application, distribution channel, and region.

By Product Type

- Mobile Tiny Homes

- Stationary Tiny Homes

By Area

- Less Than 130 Sq. Ft.

- 130-500 Sq. Ft.

- More Than 500 Sq. Ft.

By Application

- Household

- Commercial

- Industrial

- Others

By Distribution Channel

- Direct Sales

- Distributors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key factors driving the growth of the tiny homes market?

The increasing demand for affordable housing, rising environmental concerns, and the growing trend of minimalistic living are key factors driving the tiny homes market.

2. Which regions are expected to witness the highest growth in the tiny homes market?

North America and Europe are expected to experience significant growth due to high housing costs, government incentives, and a strong preference for sustainable living solutions.

3. What are the major challenges faced by the tiny homes market?

Regulatory barriers, zoning restrictions, and limited financing options are some of the challenges that may hinder market growth.

4. How is the adoption of smart home technology impacting the tiny homes market?

The integration of smart home technologies, such as energy-efficient appliances and automated systems, is enhancing the appeal of tiny homes and making them more convenient for modern living.

5. Who are the major players in the tiny homes market, and what strategies are they adopting?

Leading companies in the tiny homes market focus on sustainable materials, innovative designs, and strategic partnerships to expand their market presence.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]