Global 3D Printing High Performance Plastics Market Size, Share, Trends & Growth Forecast Report By Type (PA, PEEK & PEKK and Others), Technology, End-users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis, 2024 to 2032

Global 3D Printing High-Performance Plastics Market Size

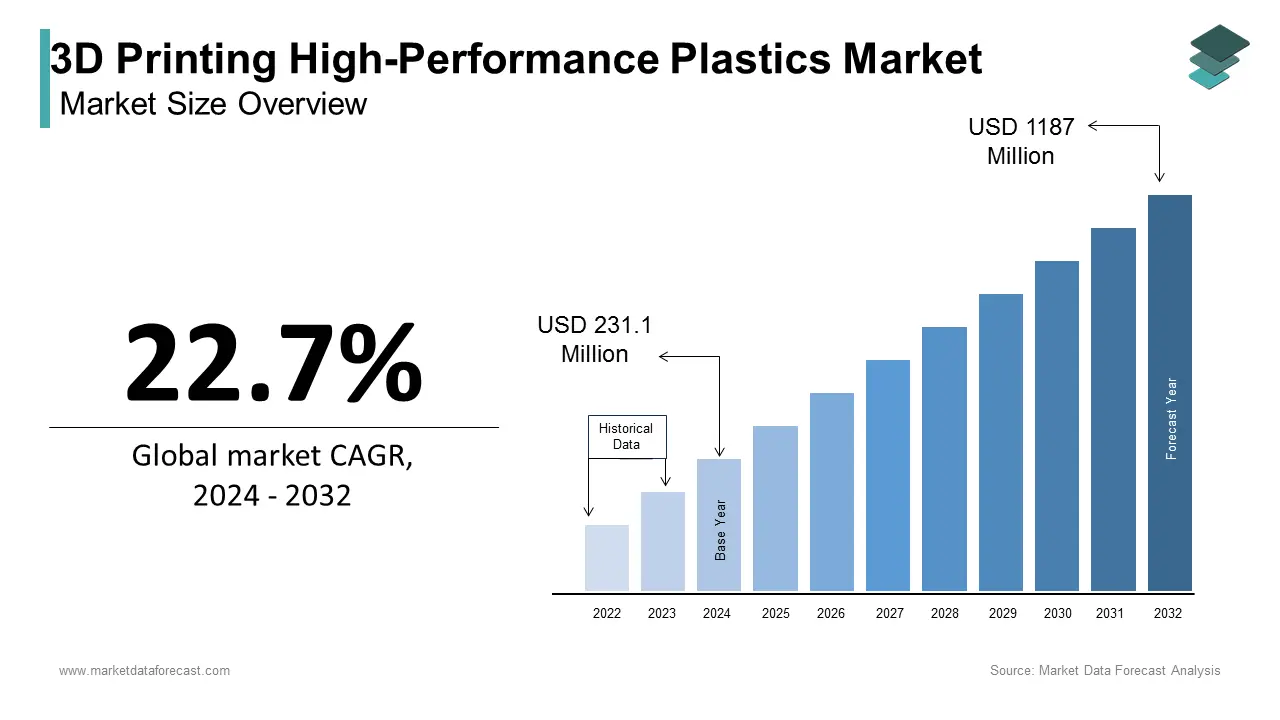

The global 3D Printing high-performance plastics market was valued at USD 188.4 million in 2023. The global market size is expected to grow at a CAGR of 22.7% from 2024 to 2032 and be worth USD 1187 million by 2032 from USD 231.1 million in 2024.

The 3D printing high-performance plastics market is rapidly advancing as industries seek durable, heat-resistant, and lightweight materials for complex applications. This market is driven by demand in sectors such as aerospace, automotive, healthcare, and electronics, where materials like PEEK, PEKK, and polyamides offer high strength-to-weight ratios, chemical resistance, and adaptability for customized solutions.

Globally, North America holds a leading market position, fueled by extensive R&D in high-performance polymers and advanced manufacturing processes, particularly in the U.S. and Canada. The European market follows closely, with significant growth in Germany and the U.K., driven by a strong automotive industry and investments in industrial-grade 3D printing capabilities. The Asia-Pacific region, particularly China and Japan, is experiencing robust growth due to increasing industrialization, expanding manufacturing bases, and government support for innovation. Collaborations between polymer producers and 3D printing companies to create industry-specific materials, such as flame-retardant and biocompatible plastics are some of the notable happenings in the market. In 2023, notable advances emerged in sustainable and recyclable high-performance plastics, aligning with global environmental goals. Increasing R&D investments and production scalability improvements are anticipated to drive market growth further in the coming years.

MARKET TRENDS

Sustainable and Recyclable High-Performance Plastics

As environmental sustainability becomes a core focus across industries, there’s a strong push toward developing recyclable, eco-friendly high-performance plastics for 3D printing. Manufacturers are exploring bio-based alternatives and creating plastics that can be recycled or repurposed, which minimizes waste and aligns with circular economy principles. For instance, companies are investing in research to make traditional high-performance plastics, like PEEK and PEKK, more environmentally friendly without sacrificing performance. This trend is particularly significant as industries aim to meet carbon reduction goals while still leveraging advanced materials for demanding applications.

Industry-Specific Customization of 3D Printing Plastics

Another key trend is the customization of high-performance plastics tailored to specific industry needs, especially in aerospace, healthcare, and electronics. Manufacturers are developing polymers with specialized properties, such as flame retardancy for aerospace or biocompatibility for medical implants. This trend is fueled by partnerships between polymer scientists and 3D printing companies to create materials that meet rigorous industry standards. Customization enables highly specialized applications, like lightweight aircraft parts or patient-specific medical devices, showcasing the potential of high-performance plastics to transform traditional manufacturing and design possibilities.

MARKET DRIVERS

Growing Demand in Aerospace and Defense

The aerospace and defense sectors are increasingly using high-performance plastics like PEEK and PEKK for lightweight and heat-resistant components. For example, reducing weight by 1 kg on an aircraft can save up to 3,000 liters of fuel annually. High-performance plastics used in 3D printing can achieve up to 50% weight reduction compared to metals, which significantly boosts fuel efficiency and reduces carbon emissions. Additionally, Boeing reports that 3D-printed plastic parts can reduce lead time by 60–90%, making production more efficient, especially for complex, custom components needed in aerospace.

Rising Healthcare Applications

In healthcare, the demand for sterilizable and biocompatible high-performance plastics has surged due to their applications in medical implants, surgical tools, and prosthetics. Approximately 83% of 3D-printed medical implants use high-performance plastics, given their strength and compatibility with patient-specific designs. For instance, customized 3D-printed implants made from PEKK reduce surgery times by up to 30%, improving patient recovery rates and lowering healthcare costs. This compatibility with medical-grade sterilization processes makes these materials particularly valuable in the fast-evolving field of personalized healthcare.

Advances in Material Development

Innovations in high-performance plastics are driving adoption in industries requiring properties like flame resistance and electrical insulation. Approximately 70% of the electronics industry’s 3D-printed parts now utilize these advanced materials to improve safety and functionality. For example, new flame-retardant plastics can withstand temperatures over 300°C, which is critical in applications such as circuit boards and battery housings. In the automotive industry, the use of electrically conductive high-performance plastics in sensors and control units has reduced component weights by 40%, contributing to overall vehicle weight reduction, energy efficiency, and improved design flexibility.

MARKET RESTRAINTS

High Material Costs

High-performance plastics like PEEK and PEKK used in 3D printing are significantly more expensive than standard 3D printing materials such as PLA or ABS. For instance, PEEK can cost up to $500 per kilogram, compared to approximately $20 per kilogram for standard PLA. This high cost restricts its use to specialized industries like aerospace and healthcare, where durability and performance justify the price. The material cost increases the overall expense of 3D-printed components, limiting broader adoption in cost-sensitive industries such as consumer goods and general manufacturing.

Complex Processing Requirements

High-performance plastics have demanding processing requirements due to their high melting points and specific cooling needs. For example, PEEK requires extrusion temperatures of over 400°C, which necessitates specialized, high-cost 3D printers. The need for precise temperature control and specialized equipment increases operational costs and requires technical expertise. Approximately 65% of manufacturers cite high-performance plastic processing challenges as a primary barrier to adoption, as it leads to higher maintenance, training, and quality control costs, impacting the cost-effectiveness of 3D printing with these materials.

Limited Material Recyclability

Unlike other 3D printing materials, many high-performance plastics lack recyclability due to their complex chemical structures. Studies show that only about 20% of high-performance plastic waste can be recycled, compared to over 60% for standard thermoplastics. The lack of recyclable options adds disposal challenges and environmental costs, deterring companies focused on sustainability goals. The inability to recycle these materials easily limits their appeal, especially as industries face increasing pressure to adopt circular economy practices and reduce waste, which conflicts with the properties of high-performance 3D-printed plastics.

MARKET OPPORTUNITIES

Expansion in the Medical Device Industry

The use of high-performance plastics in 3D printing offers enormous potential for personalized medical devices. With the rise of custom implants, prosthetics, and surgical guides, demand for biocompatible, sterilizable materials like PEKK has surged. It’s estimated that patient-specific 3D-printed implants reduce complication rates by 25% due to better anatomical fit. Additionally, high-performance 3D-printed plastics allow hospitals to create low-volume, patient-specific devices onsite, reducing lead times by over 60%. As personalized medicine grows, 3D printing can revolutionize healthcare delivery, reducing costs and improving patient outcomes.

Automotive Industry’s Shift Toward Lightweight Materials

With the automotive industry focused on fuel efficiency and emissions reduction, high-performance plastics offer an ideal solution by reducing vehicle weight. A 10% reduction in vehicle weight can enhance fuel efficiency by 6-8%, and high-performance plastics are 30-50% lighter than metals. The growing trend toward electric vehicles (EVs) further amplifies this opportunity, as lighter components improve EV range and battery efficiency. Forecasts indicate a 30% rise in high-performance plastic applications in EVs by 2028, making lightweight 3D-printed components a key differentiator in automotive manufacturing.

Growth in Sustainable Material Innovation

The development of sustainable, recyclable and high-performance plastics for 3D printing presents a significant opportunity as industries adopt greener practices. Research into bio-based alternatives and fully recyclable polymers is gaining momentum, driven by increasing regulatory pressure to minimize plastic waste. According to recent industry studies, sustainable materials could capture up to 15% of the 3D printing plastics market by 2030. Companies are investing in R&D to create eco-friendly, high-performance plastics, positioning them to meet both regulatory standards and consumer demand for sustainable products, which is critical for long-term growth in this market.

MARKET CHALLENGES

Limited Printer Compatibility

High-performance plastics such as PEEK and PEKK require specialized, high-temperature 3D printers capable of maintaining extrusion temperatures above 400°C. This limits compatibility with many standard 3D printers, which typically operate at lower temperatures. According to industry surveys, only about 15% of industrial 3D printers can handle these advanced plastics, which constrains accessibility and raises equipment costs. The expense of acquiring compatible printers, coupled with the need for trained operators, adds a barrier for companies wanting to adopt high-performance materials, particularly in small-to-medium enterprises.

Inconsistent Quality Control

Ensuring consistent quality and structural integrity in 3D-printed high-performance plastic parts can be challenging. Variability in temperature, cooling rates, and environmental conditions can affect layer adhesion and part durability. Studies indicate that up to 25% of high-performance 3D-printed parts may have defects related to warping or inadequate adhesion. This inconsistency is particularly concerning in industries like aerospace and medical, where high reliability is critical. Manufacturers must invest in strict quality control protocols, increasing production costs and limiting high-performance plastic adoption in high-precision applications.

Environmental and Regulatory Pressure

High-performance plastics are often non-recyclable, and disposal poses an environmental challenge. Only around 20% of these plastics are recyclable, and with global waste management regulations tightening, manufacturers face pressure to reduce plastic waste. The European Union, for instance, has imposed stricter recycling targets that impact the use of non-recyclable materials, putting companies at risk of regulatory penalties. Addressing these environmental challenges requires investment in sustainable alternatives or closed-loop systems, but the lack of cost-effective, recyclable options remains a significant hurdle for companies aiming to meet sustainability standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

22.7% |

|

Segments Covered |

Type, Technology, End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Stratasys, 3D Systems, Inc., BASF SE, Victrex plc, Evonik Industries AG, Markforged, Impossible Objects, Solvay, Apium Additive Technologies, Arkema, CRP Technology S.r.l., Lehmann & Voss & Co., PolyOne Corporation, 3dxtech, SABIC, Oxford Performance Materials, Inc., Vexma Technologies PVT LTD and EOS GmbH |

SEGMENTAL ANALYSIS

By Type Insights

The PA (Polyamide) segment dominated the market and accounted for 34.9% of the global market share in 2023. The dominance of the segment is majorly credited to the increasing demand for Polyamide plastics in the automotive and consumer goods sectors. The advancements in PA formulations that offer improved temperature resistance and durability are further boosting the expansion of the polyamide segment in the global market. Polyamide (PA) is a widely used high-performance plastic in 3D printing due to its strength, flexibility, and relatively lower cost compared to other high-performance options. Polyamide’s future in 3D printing is promising, especially as modified versions are developed for industrial applications where cost-efficiency is key. Growth is likely to continue as new PA composites (such as carbon-filled PA) enhance performance, making it an increasingly popular choice for functional prototypes and end-use parts.

The PEEK segment is another promising segment and captured a substantial share of the global market in 2023. The growth of the PEEK segment is primarily driven by the increased demand in customized, durable parts for aerospace and medical implants. PEEK is one of the most valued high-performance plastics due to its exceptional mechanical strength, chemical resistance, and thermal stability, withstanding temperatures up to 250°C. The future of PEEK is bright as industries seek lightweight, durable alternatives to metals, though its high cost may limit broader market penetration. However, advancements in 3D printing technology and reductions in material costs could expand its application across additional sectors.

The PEKK segment is anticipated to be the fastest-growing segment and witness a CAGR of 14.9% in the global market over the forecast period. Similar to PEEK but with slightly different properties, PEKK offers excellent flame retardancy and high thermal stability, making it ideal for aerospace applications. The aerospace sector, which values PEKK’s lightweight and heat-resistant properties, is anticipated to be the main growth driver, especially as aviation manufacturing emphasizes safety and fuel efficiency. PEKK’s future in the 3D printing market is strong as more aerospace and defense companies adopt it for functional parts. Research into more cost-effective PEKK formulations may also make it more accessible for other sectors, such as electronics.

By Technology Insights

The FDM/FFF segment currently dominates the market and held 60.8% of the global market share in 2023. This growth of the FDM/FFF segment is primarily supported by the cost-effectiveness of FDM and expanding material compatibility, particularly with high-performance plastics such as PEEK, PEKK, and advanced polyamides that are crucial for applications in the automotive, aerospace, and medical sectors. The technology enables up to 50% weight reduction in parts, which is highly beneficial in automotive prototyping and aerospace applications. Moreover, the emergence of high-temperature FDM printers and multi-material printing capabilities is enhancing FDM’s versatility, making it an appealing choice for functional prototyping and customized parts production.

On the other hand, the selective laser sintering (SLS) segment is estimated to be the fastest-growing segment and registers a CAGR of 13.3% over the forecast period. SLS is favored for its precision and capacity to create complex, detailed parts without support structures, leading to significant material savings up to 50% over traditional methods. This advantage is particularly valuable in sectors like aerospace, healthcare, and electronics, where intricate and strong components are essential. SLS achieves high dimensional accuracy (within ±0.1 mm) and is increasingly adopted for producing medical implants and lightweight aerospace parts due to its superior mechanical properties and minimal post-processing requirements. The introduction of new high-performance powders, such as PA 11 and PA 12, is further expanding SLS applications, enabling it to compete with injection molding for end-use production in regulated industries.

By End-User Insights

The medical segment led the market and occupied 31.8% of the global market share in 2023 and is predicted to be the fastest growing segment with a CAGR of 14.88% over the forecast period. The demand for high-performance plastics in 3D printing is rapidly increasing in the medical sector, primarily due to the need for biocompatible, durable materials for implants, prosthetics, and surgical tools. For example, materials like PEKK and PPSU are frequently used for custom implants and devices that are both durable and sterilizable. Customized 3D-printed implants can reduce surgery time by up to 30%, improving patient outcomes and recovery. The use of 3D printing for patient-specific applications is projected to rise, with increasing demand for surgical models and custom-fit prosthetics. The growth of 3D printing in healthcare is further supported by its ability to reduce lead times, with devices created onsite in medical facilities.

The aerospace segment is another major end-user of 3D printing high-performance plastics and is expected to register a promising CAGR of 13.4% during the forecast period. Companies that operate in the Aerospace industry rely heavily on high-performance plastics for their lightweight, heat-resistant, and durable properties, which are essential for creating critical components like brackets, fuel systems, and structural parts. A significant advantage of using 3D-printed high-performance plastics is the potential for up to 50% weight savings over traditional metal parts, which translates to improved fuel efficiency. The aerospace sector values the precision of 3D printing and its capacity to produce complex geometries with reduced material waste. As aerospace manufacturers push for higher performance and cost savings, the adoption of high-performance plastics in 3D printing is expected to rise, especially in commercial aviation and defense.

The automotive segment held 19.7% of the worldwide market share in 2023 and is projected to witness a CAGR of 10.4% over the forecast period. High-performance plastics are valuable in the automotive industry for lightweight and durable parts, which contribute to improved fuel efficiency and emissions reduction. A 10% reduction in vehicle weight can lead to a 6-8% improvement in fuel efficiency. PEEK and other high-performance plastics are used for components such as engine parts, fuel systems, and interior components, replacing metals while providing similar strength. With the shift toward electric vehicles, demand for lightweight materials will grow further, making high-performance 3D-printed parts increasingly attractive for prototyping and low-volume production. The versatility of 3D printing also allows automotive manufacturers to test and validate new designs rapidly.

REGIONAL ANALYSIS

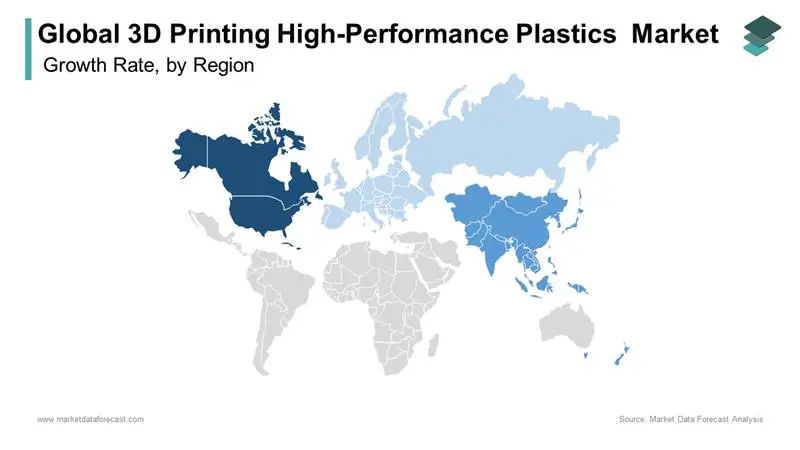

North America had 40.7% of the global market share in 2023 and emerged as the dominating regional segment in the worldwide market. The dominance of North America in the global market is majorly attributed to the strong demand in the aerospace, defense, and healthcare sectors, where high-performance plastics are used for lightweight and durable parts. The U.S. is a global leader in aerospace, and approximately 70% of the aerospace 3D printing applications originate here. Medical applications are also on the rise, with U.S. hospitals increasingly adopting 3D-printed medical implants and tools due to regulatory support and advancements in biocompatible materials. The region’s robust R&D ecosystem, government support, and early adoption of 3D printing technologies contribute to its continued growth.

Europe is a key regional segment in the worldwide market and accounted for a substantial share of the worldwide market in 2023. The growth of the 3D printing high-performance plastics market in Europe is driven by demand for high-performance plastics in the automotive and healthcare sectors, particularly in Germany, the U.K., and France. Germany, a leader in automotive manufacturing, is increasingly using 3D printing to develop lightweight components and prototypes for fuel efficiency. The European Union’s stringent environmental regulations also drive the demand for sustainable and recyclable high-performance plastics. Additionally, about 40% of European medical device manufacturers are exploring 3D printing solutions to create biocompatible implants and medical tools. The emphasis on sustainability and innovation in manufacturing processes is expected to bolster Europe’s position in the market.

Asia-Pacific is predicted to be the fastest-growing region in the global market and is expected to register a CAGR of 14.12% during the forecast period. The Asia-Pacific region is seeing rapid adoption of 3D printing technologies, led by China, Japan, and South Korea. Industrial growth, government investments in advanced manufacturing, and an expanding electronics industry contribute to this upward trajectory. China’s government, for example, has set initiatives to make 3D printing an integral part of its manufacturing sector. The region’s automotive sector, especially in Japan and South Korea, is increasingly using 3D-printed high-performance plastics for prototyping and small-batch production of lightweight parts. In healthcare, Japan is adopting 3D printing for surgical tools and dental implants, with healthcare providers and manufacturers working together to develop cost-effective biocompatible solutions.

Latin America is expected to showcase a CAGR of 8.82% over the forecast period. The market growth in Latin America is slower than in other regions but has been increasing steadily due to rising industrialization and the adoption of 3D printing in the automotive and healthcare sectors. Brazil and Mexico lead the region, with Brazil’s automotive industry increasingly exploring 3D-printed parts to reduce costs and improve efficiency. The region’s focus on economic development, coupled with an emerging interest in additive manufacturing for prototyping and small-batch production, is expected to support market growth. However, limited R&D infrastructure and relatively low investment in advanced manufacturing may constrain the rate of adoption.

The 3D printing performance plastics market in the Middle East and Africa is predicted to grow at a CAGR of 7.12% during the forecast period. In the Middle East, the adoption of 3D printing is growing in the oil and gas and healthcare sectors, where high-performance plastics are used for durable parts and medical tools. The UAE, in particular, has been proactive in adopting 3D printing technologies, especially for healthcare applications. In Africa, South Africa is leading in 3D printing adoption, particularly in medical and dental applications. The overall growth in this region is steady but limited by infrastructure challenges and lower investment in high-performance plastic R&D. As local governments promote technology-driven initiatives, the market is expected to see gradual adoption across the region.

KEY MARKET PLAYERS

Companies playing a notable role in the global 3D printing high-performance plastics market include Stratasys, 3D Systems, Inc., BASF SE, Victrex plc, Evonik Industries AG, Markforged, Impossible Objects, Solvay, Apium Additive Technologies, Arkema, CRP Technology S.r.l., Lehmann & Voss & Co., PolyOne Corporation, 3dxtech, SABIC, Oxford Performance Materials, Inc., Vexma Technologies PVT LTD and EOS GmbH.

RECENT MARKET DEVELOPMENTS

- In January 2024, Stratasys launched a new suite of high-performance materials, including Somos WeatherX 100 and Kimya PC-FR, expanding options for FDM and SLS applications in aerospace and automotive prototyping.

- In February 2024, Evonik introduced an advanced implant-grade PEEK filament under the VESTAKEEP® brand, designed for long-term use in medical implants, further supporting custom surgical solutions.

- In March 2024, BASF announced a collaboration with Impossible Objects to develop new high-strength thermoplastic composites aimed at reducing production costs for aerospace components.

- In April 2024, Arkema launched a high-temperature-resistant PAEK filament for SLS technology, expanding its range for industrial applications in the energy and aerospace sectors.

- In May 2024, Solvay partnered with Ginkgo Bioworks to create bio-based 3D printing polymers, enhancing sustainability in the high-performance plastics market.

- In June 2024, 3D Systems introduced DuraForm® AM 900, a highly durable material for SLS applications, particularly targeting tooling and end-use part production in automotive.

- In July 2024, Markforged released a new FX20 industrial printer capable of printing carbon-fiber-reinforced PEEK, meeting demand for lightweight, durable parts in automotive and aerospace.

- In August 2024, SABIC introduced ULTEM™ 9085 filament with enhanced flame retardancy, ideal for aerospace interiors where safety regulations are strict.

- In September 2024, Oxford Performance Materials acquired patents for next-gen PEKK-based materials, reinforcing its position in the medical and aerospace markets.

- In October 2024, Victrex expanded its PAEK portfolio by launching VICTREX AM 400, a filament with improved wear resistance for use in oil & gas industry applications.

MARKET SEGMENTATION

This research report on the global 3D printing high-performance plastics market is segmented and sub-segmented based on type, technology, end-users, and region.

By Type

- PA

- PEEK

- PEKK

- Others

By Technology

- Fused Deposition Modeling (FDM) or Fused Filament Manufacturing (FFF)

- Selective Laser Sintering (SLS)

By End-Users

- Medical

- Transportation

- Automotive

- Aerospace

- Others

- Oil & Gas

- Energy Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global 3D printing high performance plastics market?

In 2023, the global 3D printing high-performance plastics market was worth USD 188.4 million.

What is the CAGR of the 3D printing high performance plastics market??

The global 3D printing high-performance plastics market is anticipated to grow at a CAGR of 22.7% over the forecast period.

Which region dominated the global 3D printing high performance plastics market in 2023?

With holding 40.7% of the share, North America had the largest share of the worldwide market in 2023.

Who are the key players in the 3D printing high performance plastics market?

Stratasys, 3D Systems, Inc., BASF SE, Victrex plc, Evonik Industries AG, Markforged, Impossible Objects, Solvay, Apium Additive Technologies, Arkema, CRP Technology S.r.l., Lehmann & Voss & Co., PolyOne Corporation, 3dxtech, SABIC, Oxford Performance Materials, Inc., Vexma Technologies PVT LTD and EOS GmbH are a few of the key players in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]