Global 3D Printing Construction Market Size, Share, Trends & Growth Forecast Report By Material (Concrete and Mortar, Polymers and Others), Process (Extrusion, Powder Bonding and Others), Construction Form and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global 3D Printing Construction Market Size

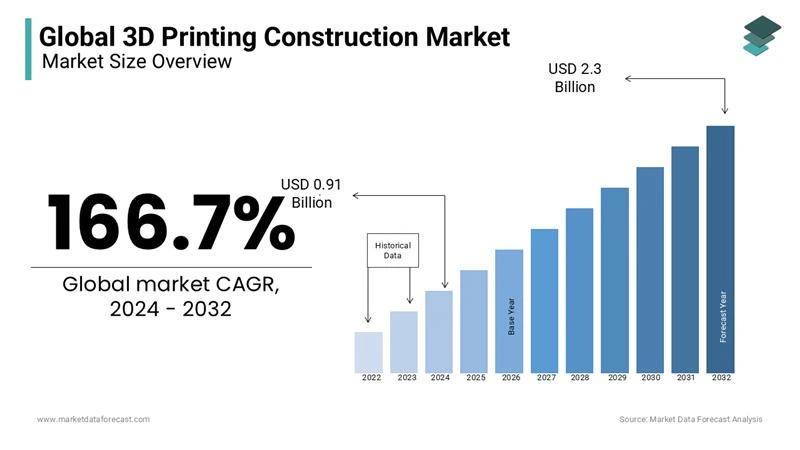

The global 3D printing construction market size was valued at USD 0.34 billion in 2023. The global market is anticipated to grow at a CAGR of 166.7% from 2024 to 2032 and be worth USD 0.91 billion in 2024 and USD 2.3 billion by 2032.

The 3D printing construction market is a growing sector that utilizes additive manufacturing technologies to create complex building structures with precision and efficiency. This innovative approach enables reduced material waste, faster construction timelines, and greater design flexibility compared to traditional methods. Key applications include residential housing, commercial buildings, and infrastructure projects such as bridges and pavilions. The adoption of 3D printing in the construction industry is driven by advancements in large-scale 3D printers capable of working with materials like concrete, metals, and polymers. Notable benefits include reducing construction costs by up to 30% and cutting project completion times by 50-70%. Additionally, 3D printing enables sustainability in construction by optimizing material use and incorporating recycled materials into the process. Several players are pioneering research into structural integrity and scalability, ensuring compliance with building codes and safety standards.

MARKET TRENDS

Rise of Sustainable Construction Practices

3D printing significantly reduces material waste by up to 60% through precise additive processes, allowing for greater material efficiency than traditional construction. Additionally, the technology enables the use of eco-friendly materials, such as recycled concrete and bio-based composites, supporting environmental goals. With the construction industry accounting for nearly 40% of global CO₂ emissions, these sustainable 3D printing practices are increasingly vital. For example, firms are exploring “zero-waste” projects, producing structures with a reduced carbon footprint to align with international sustainability targets.

Accelerated Affordable Housing Solutions

3D printing in construction is becoming integral to addressing global housing shortages. This technology reduces build times by 50-70%, creating homes in just days compared to months with traditional methods. Cost savings of up to 30% make it a viable option for affordable housing developments worldwide. In the U.S. and the Netherlands, companies have completed small, affordable 3D-printed homes, demonstrating feasibility at scale. Given the estimated global shortage of 440 million affordable housing units by 2030, 3D printing offers a scalable, efficient solution to create cost-effective housing options rapidly.

MARKET DRIVERS

Labor Shortages in the Construction Industry

Labor shortages are a significant driver for the adoption of 3D printing in construction. With an aging workforce and a growing gap in skilled labor, construction companies face rising labor costs and project delays. In the U.S., for example, the construction industry needs approximately 500,000 additional workers to meet current demand. 3D printing helps offset these shortages by automating parts of the building process, reducing labor dependency by up to 50%. This automation enables faster project timelines and helps fill the workforce gap, especially for affordable housing and infrastructure projects, where speed and cost-efficiency are crucial.

Growing Demand for Customized Construction

Customization in design is a major factor boosting 3D printing adoption. Unlike conventional methods, 3D printing allows for the creation of complex, customized shapes without significant cost increases. This is beneficial for projects requiring unique architectural designs or structures that adapt to specific environmental or cultural contexts. As urbanization accelerates, cities are seeking innovative designs for sustainable urban living. For instance, Dubai has committed to having 25% of its new buildings 3D printed by 2030, emphasizing customized, eco-friendly architecture to meet modern urban demands and make the city a global hub for construction innovation.

Regulatory Support and Government Initiatives

Government support is a crucial driver for the 3D printing construction market. Countries are implementing policies and pilot projects to encourage the use of 3D printing to address housing shortages and sustainable development goals. In Saudi Arabia, for example, Vision 2030 includes initiatives to promote 3D printing for affordable housing solutions. Additionally, the EU’s Horizon 2020 program has allocated funding to explore additive manufacturing technologies in construction. These initiatives are facilitating faster regulatory approvals, incentivizing investment, and fostering public-private partnerships that support widespread adoption, positioning 3D printing as a transformative solution in modern construction.

MARKET RESTRAINTS

High Initial Capital Investment

The high upfront cost of 3D printing equipment and materials remains a barrier. Large-scale 3D printers for construction can cost between $500,000 and $2 million, requiring significant capital investment that may not be feasible for smaller firms. Additionally, specialized materials like high-performance concrete mixes for 3D printing are more costly than traditional materials. For instance, adapting processes and training staff to operate advanced 3D printers increases initial expenses. These high costs slow adoption as companies weigh potential long-term savings against immediate financial demands.

Limited Skilled Workforce and Technical Knowledge

Adopting 3D printing in construction requires specialized knowledge and skills that are still scarce in the workforce. Engineers, architects, and operators must be trained to handle digital designs, troubleshoot printing hardware, and ensure structural safety. A lack of industry-standard education and certification in 3D construction printing technologies creates operational inefficiencies and limits scalability. According to industry estimates, over 60% of construction companies cite a lack of technical skills as a barrier to adopting advanced technologies, hindering the development of a skilled workforce necessary for widespread 3D printing implementation.

Regulatory and Standardization Challenges

The absence of standardized regulations and building codes for 3D-printed structures poses significant challenges. Many countries lack established safety and quality standards for 3D printing in construction, creating uncertainty for builders and regulators alike. This slows project approvals, as regulatory bodies must evaluate each project individually for compliance. Furthermore, construction safety standards have yet to adapt to unique aspects of additive manufacturing, such as layer-by-layer building and material composition. Until universal guidelines are developed, regulatory complexities will continue to restrict the broader adoption of 3D printing in construction.

MARKET OPPORTUNITIES

Expansion into Disaster-Relief Housing

3D printing presents a unique opportunity to address urgent housing needs in disaster-prone areas. With the ability to construct durable, low-cost homes in a matter of days, 3D printing can provide rapid shelter solutions following natural disasters. For example, prototypes of 3D-printed emergency shelters have shown the potential to withstand high winds and seismic activity, making them ideal for regions facing frequent climate-related crises. As climate change intensifies, the need for resilient housing in vulnerable areas is expected to grow, positioning 3D printing as a viable solution for governments and NGOs focused on emergency preparedness.

Advancements in Material Science for Eco-Friendly Construction

Material innovation is opening new doors in 3D printing, with researchers developing eco-friendly materials like geopolymer concrete and recycled plastics. These materials not only reduce carbon emissions but also enhance the strength and durability of 3D-printed structures. For instance, geopolymer concrete can produce up to 80% fewer CO₂ emissions compared to traditional Portland cement. As sustainability becomes central to construction goals worldwide, companies that invest in alternative, low-carbon materials for 3D printing can capitalize on the demand for greener building practices and appeal to eco-conscious developers and regulators.

Integration with Smart City Initiatives

The integration of 3D printing with smart city developments offers significant potential, especially as urban planners explore technology-driven infrastructure solutions. With 3D printing, smart cities can adopt modular and customizable construction, reducing disruption during urban expansion. For example, 3D-printed buildings can incorporate sensors and IoT technologies directly into their design, supporting real-time monitoring of structural health, energy usage, and environmental impact. As cities worldwide aim to become more efficient and sustainable, 3D printing can support these goals by providing adaptable and tech-integrated building options, particularly in high-density areas needing rapid and flexible construction solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

166.7% |

|

Segments Covered |

By Material, Process, Construction Form and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

WinSun (Yingchuang Building Technique), Apis Cor, ICON, XtreeE, COBOD International, CyBe Construction, Contour Crafting Corporation, BetAbram, Sika AG and Peri Group |

SEGMENTAL ANALYSIS

By Material Insights

The concrete and mortar segment had the largest share of 71.4% of the global 3D printing construction market share in 2023. The dominance of the segment is majorly driven by the material's strength, durability, and suitability for large-scale construction. Concrete, widely used in traditional construction, is readily adaptable to 3D printing, offering robust load-bearing capabilities essential for creating stable walls, floors, and foundations. Additionally, specialized 3D-printable concrete formulations improve build quality, reduce shrinkage, and enable rapid construction of multi-story buildings. With the global construction industry facing pressure to reduce waste and lower costs, concrete and mortar’s adaptability and resilience make it the primary material in this market.

The polymers segment is estimated to register the fastest CAGR over the forecast period owing to the lightweight, versatile properties of polymers that make them ideal for modular and decorative elements, as well as temporary structures. Polymers are often used in combination with composites to produce resilient, insulated, and lightweight components, appealing to energy-efficient and sustainable design initiatives. As 3D printing enables the incorporation of advanced polymer formulations with high thermal resistance and flexibility, the construction sector increasingly adopts polymers for applications like interior partitions, facades, and insulation, particularly in residential and modular buildings.

By Process Insights

The extrusion segment dominated the market and captured 85.8% of the global market share in 2023. This method is favored for its ability to rapidly produce large-scale structures using materials like concrete and mortar, which are extruded layer by layer to form walls and foundational components. The extrusion process is highly compatible with large 3D printers, which are essential for creating full-sized structures on-site. Due to its efficiency, cost-effectiveness, and adaptability to construction-scale projects, extrusion dominates the market, enabling faster completion of residential, commercial, and infrastructure projects without compromising structural integrity.

The powder bonding segment is anticipated to be the fastest-growing segment in the global market over the forecast period. This process, which binds powder materials like sand or recycled glass through a bonding agent, enables high precision and flexibility in design. Powder bonding is particularly suited for detailed architectural elements and intricate forms, expanding possibilities in custom and luxury construction. Additionally, its compatibility with eco-friendly, recycled materials aligns with the industry's sustainability goals. As demand for unique, customized construction grows, powder bonding is increasingly adopted for projects that prioritize both aesthetic appeal and environmental responsibility.

By Construction Form Insights

The on-site segment accounted for 60.6% of the global market share in 2023. This form of construction allows structures to be printed directly at the project location, eliminating the need for transportation of large components and reducing overall logistics costs. On-site 3D printing is particularly advantageous for large residential and infrastructure projects, as it minimizes construction time and enables rapid scaling of affordable housing and emergency shelters. Its efficiency in resource use and cost savings make on-site 3D printing the preferred choice for large-scale projects that require fast, sustainable construction.

The off-site construction segment is expected to grow rapidly over the forecast period. This form involves fabricating parts or modules in a controlled environment before transporting them to the final site for assembly. Off-site 3D printing is gaining traction due to its ability to produce high-quality, precise components under optimal conditions, which improves structural integrity and reduces construction errors. Additionally, off-site methods enable better material management and waste reduction, aligning with sustainability goals. With increasing interest in modular buildings and prefabricated structures, especially in urban areas, off-site 3D printing is expanding rapidly in sectors that value efficiency and customization.

REGIONAL ANALYSIS

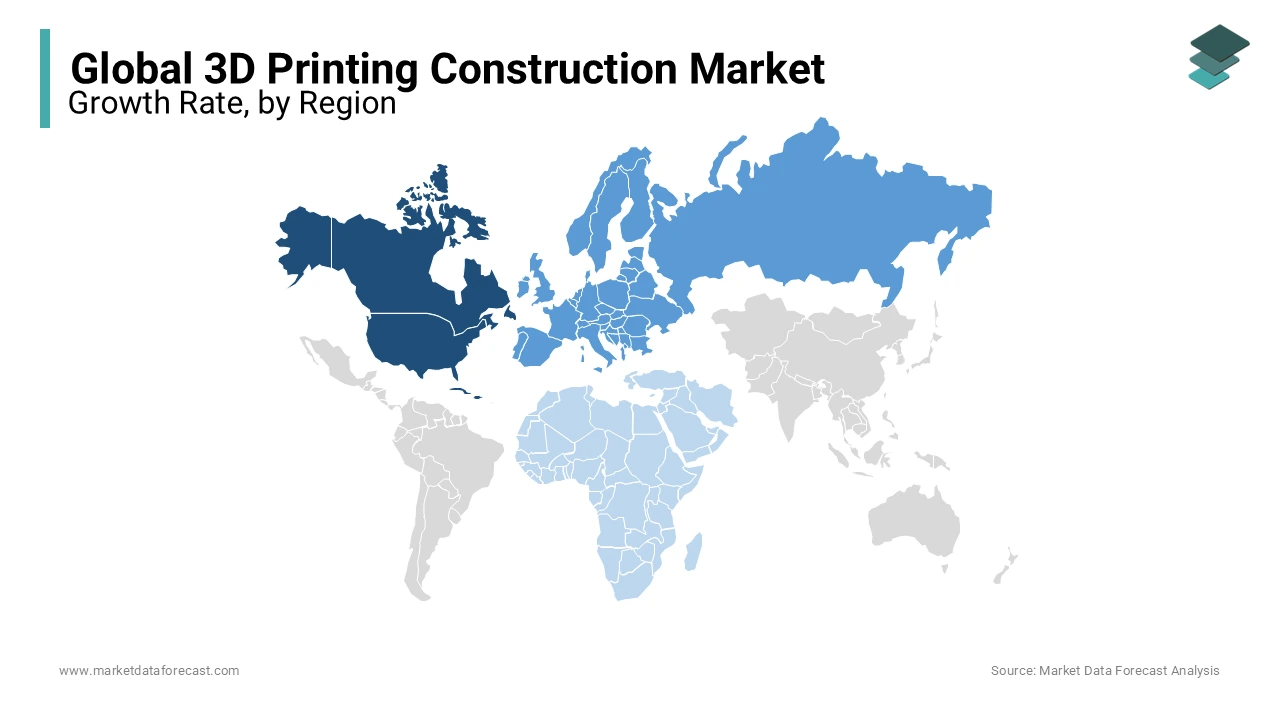

North America led the market and occupied 35.8% of the global market share in 2023. The growth of the North American market is primarily driven by significant investments and the adoption of advanced construction technology. The United States leads the market in North America due to the ongoing projects focusing on residential housing and infrastructure innovation. Government initiatives, such as the promotion of sustainable construction, further support market growth. As costs decrease and new projects are launched, North America is expected to remain one of the top regions in the market for the foreseeable future.

Europe captured a notable share of the global market share in 2023 and is expected to witness a healthy CAGR over the forecast period. The growth of the European market is primarily driven by sustainability goals and advancements in material science. The Netherlands, Germany, and the UK are leading countries in the European market, with numerous projects utilizing 3D printing to produce eco-friendly, affordable housing. Europe is focused on meeting stringent environmental regulations, which support the use of recycled materials and eco-friendly 3D printing methods. With countries like the Netherlands actively integrating 3D printing in public and private construction, Europe is expected to maintain a strong market position.

Asia-Pacific is the fastest-growing region in the worldwide market. Rapid urbanization and high demand for affordable housing drive this growth, particularly in China, Japan, and Singapore. China is a frontrunner, leveraging 3D printing to address large-scale housing shortages and meet environmental targets. Singapore is also investing in 3D printing to create efficient, modular building solutions for its dense urban areas. With a growing interest in sustainable construction, Asia-Pacific is likely to increase its global share in the coming years.

Latin America currently represents a considerable share of the global 3D printing construction market. Brazil and Mexico are leading the regional market, with increasing demand for cost-effective housing solutions and government support for new technologies in construction. The region is exploring 3D printing as a solution for affordable housing and infrastructure needs, particularly in rural and disaster-prone areas. Although it holds a smaller market share, Latin America’s adoption of 3D printing in construction is expected to expand steadily, supported by partnerships with international firms.

The market in the Middle East and Africa is predicted to account for a moderate share of the worldwide market during the forecast period. The UAE and Saudi Arabia are key players, with ambitious plans to incorporate 3D printing in infrastructure and residential projects. Dubai, for example, aims to have 25% of its new buildings constructed through 3D printing by 2030 as part of its smart city initiatives. In Africa, South Africa is exploring 3D printing to address housing shortages and improve building resilience. With supportive government policies, the Middle East and Africa are anticipated to gradually increase their market presence.

KEY MARKET PLAYERS

Companies playing a dominating role in the global 3D printing construction market include WinSun (Yingchuang Building Technique), Apis Cor, ICON, XtreeE, COBOD International, CyBe Construction, Contour Crafting Corporation, BetAbram, Sika AG and Peri Group.

RECENT HAPPENINGS IN THE MARKET

- In 2023, Apis Cor, a construction technology company, developed robotic printers named Frank, Gary, and Mary to enhance consistency and efficiency in building processes. This development aims to improve scalability and reliability for large-scale 3D-printed construction projects.

- In 2022, CyBe Construction, a 3D concrete printing company, collaborated with local partners in the Middle East to construct affordable housing using its mobile 3D printers. This collaboration seeks to address regional housing shortages and promote sustainable building practices.

- In 2023, Contour Crafting Corporation, a construction automation company, secured a contract with NASA to develop 3D printing technologies for building habitats on the Moon. This contract supports the pioneering of extraterrestrial construction methods and broadens technological applications.

- In 2023, BetAbram, a Slovenian 3D printer manufacturer, launched the P1 printer, capable of constructing residential buildings up to three stories high. This product launch is expected to provide scalable solutions for residential construction and meet varied architectural needs.

- In 2023, Sika AG, a specialty chemicals company, developed a new 3D printing concrete mix that reduces material usage by 30%. This development supports sustainable and cost-effective solutions for 3D-printed construction projects.

- In 2023, Peri Group, a formwork and scaffolding manufacturer, completed the world’s first 3D-printed apartment building in Germany. This project is intended to demonstrate 3D printing’s potential in multi-story residential construction and set industry benchmarks.

- In 2023, WinSun (Yingchuang Building Technique), a Chinese construction company, constructed a 3D-printed office building in Dubai. This construction project showcases large-scale 3D printing capabilities and promotes innovative construction solutions internationally.

MARKET SEGMENTATION

This research report on the global 3D printing construction market is segmented and sub-segmented based on material, process, construction form and region.

By Material

- Concrete and Mortar

- Polymers

- Others

By Process

- Extrusion

- Powder Bonding

- Others

By Construction Form

- On-site

- Off-site

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the 3D printing construction market?

The global 3D printing construction market is expected to be as big as USD 2.3 billion by 2032.

What is the expected CAGR of the global 3D printing construction market?

The global 3D printing construction market is anticipated to grow at a CAGR of 166.7% over the forecast period.

Which segment by material type is leading the 3D printing construction market?

The concrete and mortar segment is currently dominating the 3D printing construction market.

Who are the key players in the 3D printing construction market?

WinSun (Yingchuang Building Technique), Apis Cor, ICON, XtreeE, COBOD International, CyBe Construction, Contour Crafting Corporation, BetAbram, Sika AG and Peri Group are a few of the notable companies in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]