Global Thin and Ultra-thin Films Market Research Report – Segmentation By Material Type (Organics, Inorganic, Hybrid, Nanocomposite), By Deposition Techniques (Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), Spray Pyrolysis, Atomic Layer Deposition (ALD), Sol-Gel Processing), By End-User Industry (Electronic, Semiconductor, Energy and Power Generation, Healthcare, Medical and Biomedical Applications, Automotive and Transportation, Defence and Aerospace, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2029).

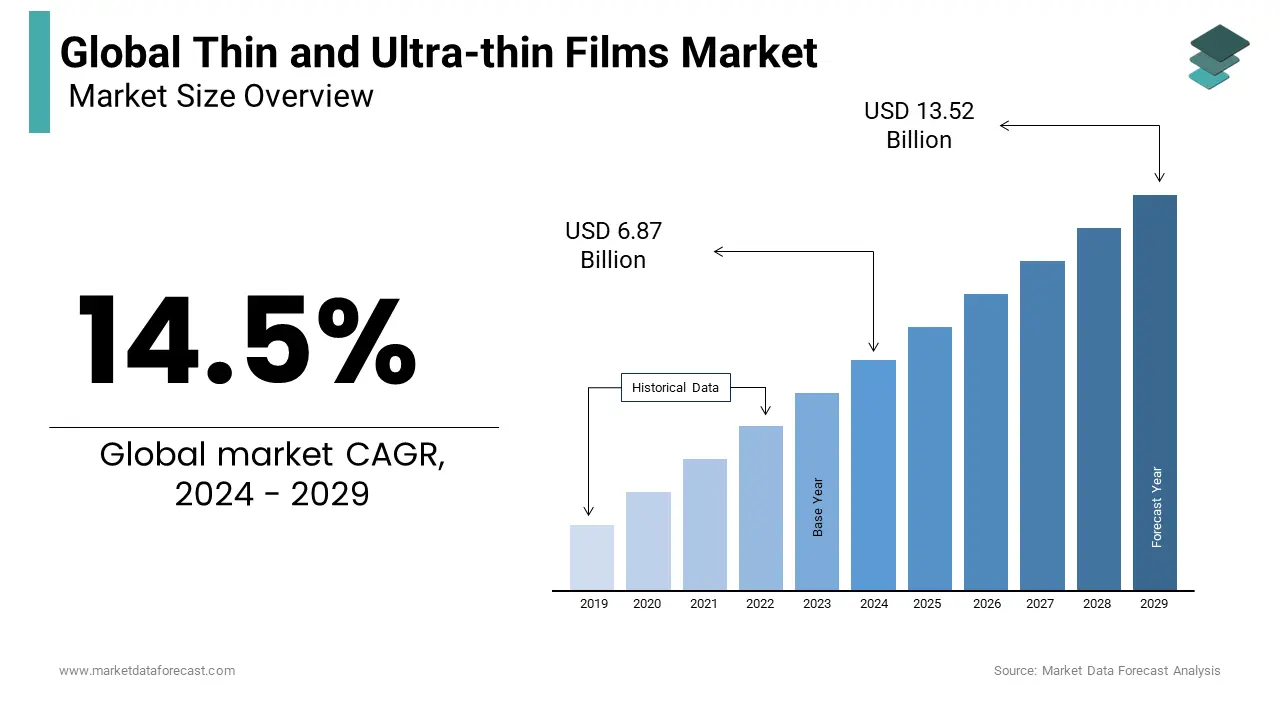

Global Thin and Ultra-thin Films Market Size (2024 to 2029):

The global thin and ultra-thin films market was worth US$ 6 billion in 2023 and is anticipated to reach a valuation of US$ 13.52 billion by 2029 from US$ 6.87 billion in 2024. It is predicted to register a CAGR of 14.5% during the forecast period 2024 to 2029.

Current Scenario of the Global Thin and Ultra-thin Films Market

Presently, the thin and ultra-thin films market is quickly advancing owing to the development of new synthesis techniques, specific optical sensors and use cases in several industries. Another trend pushing the market growth forward is the rising demand for goods that are ecological and sustainable. The industry players are progressively investing to improve the product’s quality and effectiveness leading to the increased pace of technology integration. Also, advanced technologies including blockchain, machine learning and artificial intelligence are put to use to make unique items that outshine traditional choices in both efficiency and overall performance. Apart from this, these have emerged as essential to the aesthetic beauty and performance of modern motorcycles.

MARKET DRIVERS

The growth of the thin and ultra-thin films market is due to the rising consumer inclination towards high-performance bikes, which require sophisticated coverings.

Moreover, personalization has become more prevalent amongst motorbike lovers, propelling the market growth forward. In addition, strict greenhouse gas discharge laws enforced on motorcycles have forced the development and use of these films to fulfil compliance provisions. Further, the persistent breakthroughs in technology and matter employed in the production procedure of thin and ultra-thin films have considerably increased their demand.

The electronics industry is the biggest customer and extensively uses these films which is another factor driving the market expansion. They are extremely vital for the manufacturing of displays, sensors, microchips or integrated circuits. The transition into compact and more effective electronic gadgets and systems has surged the need for ultra-thin coatings which enable high-quality output and functionality in heat removal and conductivity.

The soaring interest in this industry also influences market growth. Hence, the pattern of continued technological developments and unique approaches in its manufacturing is expected in future as well.

MARKET RESTRAINTS

The absence of conversion productivity when provided with silicon cells is likely to hinder the thin and ultra-thin films market growth.

Moreover, a lack of cognizance is expected to obstruct the industry’s progress. The companies and stakeholders are also concerned about the escalating manufacturing costs as it requires substantial initial investment. The expenses related to input materials and maintenance and repairs further increase the manufacturing costs in some situations, making thin-coating player technologies less competitive against traditional choices.

MARKET OPPORTUNITIES

The recent breakthrough in conductors for thin film presents a huge opportunity for market growth in wearable electronics.

Experts and researchers in July 2024 accomplished a series of landmarks in developing a high-quality thin film conductor, as per a new study, the substance or matter is a budding candidate platform for forthcoming wearable electronics and other miniature use cases. This development can be credited to the Army Research Laboratory, MIT, and The Ohio State University, which found the material superior amongst other created films for its electron movement.

Moreover, quantum computing and energy storage are promising areas with immense potential for the thin and ultra-thin films market. Ultrathin films with innovative electronic qualities are poised to contribute significantly to the advancement of quantum computers, which need materials suitable for sustaining quantum integrity.

MARKET CHALLENGES

Regardless of encouraging growth, the thin and ultrathin films market encounters various issues.

The manufacturing techniques for these films are complicated and expensive. Furthermore, ensuring the consistency and balance of ultrathin coverings is a scientific need. Incorporating these modern materials into current production processes smoothly is also a problem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

CAGR |

14.5% |

|

Segments Covered |

By material type, deposition techniques, end-user industry, and region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Orange Thin Films (Netherlands), American Elements (US), ThinFilms Inc. (US), LEW TECHNIQUES LTD (UK), Angstrom Engineering Inc. (Canada), Denton Vacuum (US), Super Conductor Materials, Inc. (US), KANEKA CORPORATION (Japan), Arrow Thin Films, Inc. (US), Umicore (Belgium), Plasma-Therm (UK), Materion Corporation (US), INTEVAC, INC. (US), AIXTRON (Germany), GEOMATEC Co., Ltd. (Japan), Kurt J. Lesker Company (US), PVD Products, Inc. (US), Vital Materials Co., Limited (China), Praxair S.T. Technology, Inc. (US), AJA INTERNATIONAL, Inc. (US), and Others. |

SEGMENTAL ANALYSIS

Global Thin and Ultra-thin Films Market Analysis By Material Type

The inorganic segment continues to lead the category, however the organic and nanocomposite are swiftly growing. These are broadly applied in optics, solar energy and semiconductor industries. The growth of the segment’s market share is credited to its customised electrical qualities, thermal stability and strength which is important for superior operations and output from devices.

Also, another rising material is the hybrid nanocomposite which is expected to witness a significant surge in its market share by the end of 2029. Photovoltaic panels including hybrid nanocomposite coats have, recently, received comprehensive study attention because of the potential to merge the benefits originating from the qualities of both elements: resilience and machining properties from the natural component and balance and optoelectronics characteristics from the inorganic ones.

Global Thin and Ultra-thin Films Market By Deposition Techniques

The physical vapor deposition (PVD) segment is expected to remain the widely employed technique during the forecast period for the thin and ultra-thin films market. This is mainly due to the upward trend in demand for PVD films through a variety of industries, including the aerospace and automobile sectors. In these industries, this deposition technique is used to enhance the matter’s tensile strength, abrasion and rust resistance. Furthermore, the exceptional adherence, low deposition temperature and superior density of PVD films are some advantages that are fuelling the demand for this technology in the thin and ultra-thin film market.

Whereas, the chemical vapor deposition (CVD) segment is projected to grow at a faster rate in the coming years. The expansion of the segment’s market share can be attributed to the semiconductor sector’s heightening use of CVD films. This is because these coatings are commonly used in this sector to make solar cells, integrated circuits and other electronic parts. Besides this, the CVD technique has several benefits such as tremendous unity, greater purity and quick deposition pace, which are elevating the market size of CVD technology.

Global Thin and Ultra-thin Films Market By End-User Industry

The electronic and semiconductor segment holds the maximum portion of the thin and ultra-thin films market. This is because they are regularly utilised, especially in microchips and solar cells, and recent developments in ultra-thin electronics. Moreover, the surging need for customer gadgets such as tablets, laptops and smartphones is also believed to drive upward the segment’s market size. In addition, the development of ultra-thin films with improved electrical and optical qualities, which are extremely popular in the electronics industry. This is caused by the discovery of novel substances and production procedures. The semiconductor segment is the manufacturing of ultra-thin coatings for semiconductor purposes is propelled by the creation of state-of-the-art thin film deposition technology consisting of atomic layer deposition (ALD) and chemical vapor deposition (CVD).

Considering the global shift towards green energy, the energy and power generation segment is quickly gaining traction as solar cells use thin coatings to achieve higher productivity and reduce their expenses. The fabrication of thin-coating solar cells utilising parts such as copper indium gallium selenide (CIGS) and cadmium telluride (CdTe) resulted in the emergence of efficient, adjustable and lightweight solar panels.

REGIONAL ANALYSIS

Asia Pacific is quickly gaining ground in the thin and ultra-thin films market, compared to other regions, owing to the increase in rapid technological adoption across the region. The reason behind this dominance is the acceptance of modern technologies like sustainable methods, blockchain and AI. Similarly, recently it was reported in a study that India is the fastest adopter of AI. Hence, the countrywide trend is driving the growth of the APAC’s market share.

North America commands the thin and ultra-thin films market and is anticipated to experience substantial expansion during the estimation period. This is due to the presence of an intense competitive environment in the region and the increasing application for thin and ultra-thin coatings over a wide range of industries, particularly medical and electronics. Also, there is mounting pressure to lower carbon discharge in the area.

KEY PLAYERS IN THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET

Companies playing a prominent role in the global thin and ultra-thin films market include Orange Thin Films (Netherlands), American Elements (US), ThinFilms Inc. (US), LEW TECHNIQUES LTD (UK), Angstrom Engineering Inc. (Canada), Denton Vacuum (US), Super Conductor Materials, Inc. (US), KANEKA CORPORATION (Japan), Arrow Thin Films, Inc. (US), Umicore (Belgium), Plasma-Therm (UK), Materion Corporation (US), INTEVAC, INC. (US), AIXTRON (Germany), GEOMATEC Co., Ltd. (Japan), Kurt J. Lesker Company (US), PVD Products, Inc. (US), Vital Materials Co., Limited (China), Praxair S.T. Technology, Inc. (US), AJA INTERNATIONAL, Inc. (US), and Others.

RECENT HAPPENINGS IN THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET

- In May 2024, it was reported that the Fraunhofer Institute for Physical Measurement Techniques IPM in collaboration with plasma system specialist Plasma Electronic GmbH developed a Film-Inspect testing system. This is a new kind of sensor to check functional barrier layers on plastic or synthetic goods at the manufacturing pace. The sensor utilises infrared measurement technology to find thin coverings with a width of lower than 10 nm to 200 nm inline.

- In February 2024, experts at Osaka University made an innovative flexible optical sensor that functions even when wrinkled. It is a soft, malleable and wireless optical sensor employing natural transistors and carbon nanotubes on an ultra-thin polymer film. This development is believed to present new avenues in imaging technologies and non-destructive analysis methods.

DETAILED SEGMENTATION OF THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET INCLUDED IN THIS REPORT

This research report on the global thin and ultra-thin films market has been segmented and sub-segmented based on material type, deposition techniques, end-user industry, and region.

By Material Type

- Organics

- Inorganic

- Hybrid

- Nanocomposite

By Deposition Techniques

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Spray Pyrolysis

- Atomic Layer Deposition (ALD)

- Sol-Gel Processing

By End-User Industry

- Electronic

- Semiconductor

- Energy and Power Generation

- Healthcare, Medical and Biomedical Applications

- Automotive and Transportation

- Defence and Aerospace

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com