Global Telescope Market Size, Share, Trends, & Growth Forecast Report Segmented By Product Type (Refracting Telescopes, Reflecting Telescopes, and Catadioptric Telescopes), Mount Type, Distribution Channel, Price Range, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Telescope Market Size

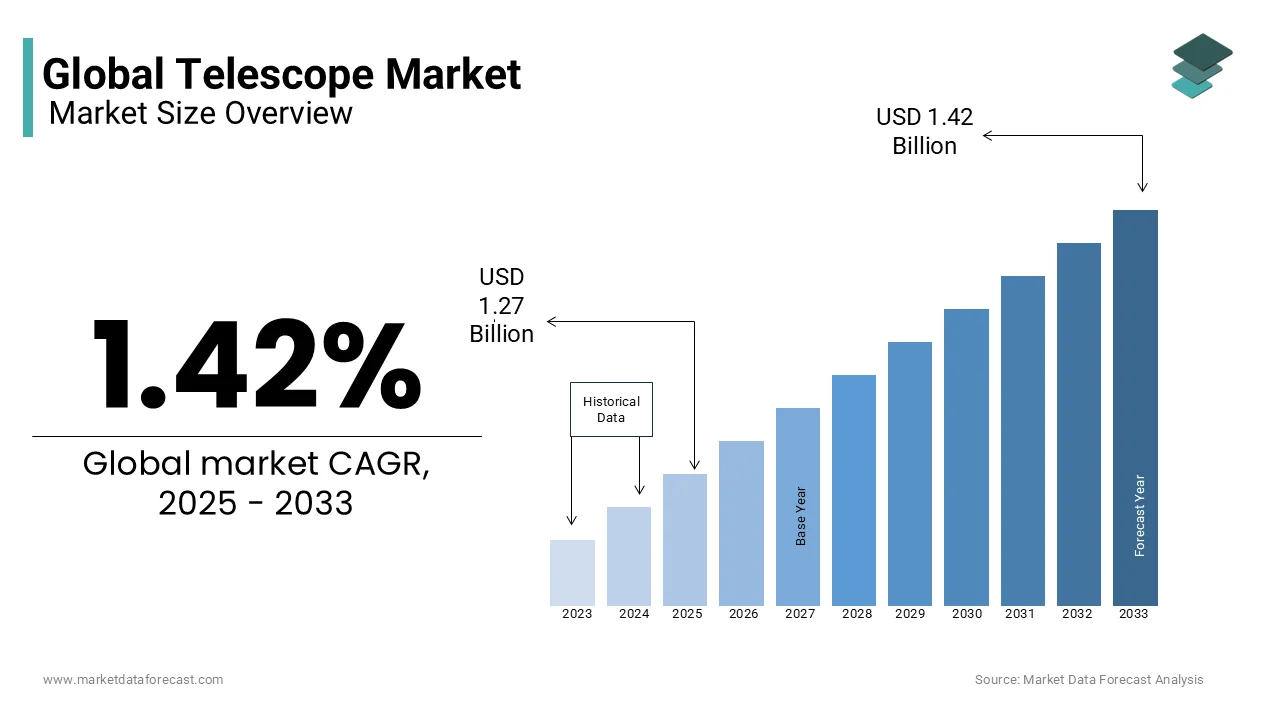

The global telescope market was valued at USD 1.25 billion in 2024. The global market is projected to reach USD 1.42 billion by 2033 from USD 1.27 billion in 2025, rising at a CAGR of 1.42% from 2025 to 2033.

The telescope market focuses on creating and selling optical tools that let people see faraway objects, especially in space. These tools are vital for both hobbyists and professional scientists, helping them study stars, planets, and galaxies.

Interest in space has grown recently which was launched in 2021 and has given us new views of distant galaxies as well as partly because of missions like NASA's James Webb Space Telescope (JWST). This has sparked more public curiosity about the universe.

The International Astronomical Union (IAU) has about 10,000 professional astronomers as members. They estimate there are roughly a million amateur astronomers worldwide, showing a strong global interest in stargazing. This large community of enthusiasts often contributes to scientific discoveries highlightes the importance of accessible telescopes.

Advancements in technology have made telescopes easier to use. Modern features like computerized tracking and smartphone connections have opened up astronomy to more people. Additionally, the rise of astro-tourism that is traveling to places with clear, dark skies for stargazing has increased demand for quality telescopes.

The COVID-19 pandemic also influenced the telescope market. With more people staying home, many turned to stargazing as a new hobby, leading to a boost in telescope sales during lockdowns.

MARKET DRIVERS

Expansion of Amateur Astronomy

The telescope market has seen growth due to the increasing involvement of amateur astronomers. According to the International Astronomical Union (IAU), there are approximately 10,000 professional astronomers worldwide. Estimates suggest that the amateur astronomy community could number between 300,000 to 1.5 million individuals globally. These enthusiasts contribute significantly to astronomical observations and discoveries are often collaborating with professionals. Their active participation fosters a vibrant market for telescopes and related equipment because they seek to enhance their observational capabilities. The dedication of amateur astronomers to public outreach and education further popularizes astronomy, encouraging more individuals to engage in stargazing activities.

Government Investments in Space Exploration

Significant government funding in space exploration has positively impacted the telescope market. In 2024, global government expenditure for space programs hit a record of approximately $135 billion, with the United States Government spending around $79.7 billion. Such substantial investments often include allocations for educational initiatives and public engagement in astronomy. These investments not only advance scientific research but also stimulate public interest in astronomy and is leading to increased demand for telescopes among educational institutions and amateur astronomers.

MARKET RESTRAINTS

Light Pollution

The proliferation of artificial lighting in urban and suburban areas has led to increased light pollution, significantly hindering astronomical observations. According to the National Aeronautics and Space Administration (NASA), more than 80% of the world's population lives under light-polluted skies, with this figure rising to 99% in Europe and the United States. This widespread light pollution diminishes the visibility of celestial objects are discouraging both amateur and professional astronomers. Consequently, the reduced quality of observational experiences can lead to decreased interest in purchasing telescopes and thereby restraining market growth.

Economic Downturns

Economic recessions or downturns can adversely affect consumer spending on non-essential items, including telescopes. The International Monetary Fund (IMF) reported a global economic contraction of 3.5% in 2020 due to the COVID-19 pandemic. During such periods, individuals and educational institutions may prioritize essential expenditures over discretionary purchases like telescopes. This shift in spending behavior can lead to a decline in telescope sales, posing challenges for manufacturers and retailers within the market.

MARKET OPPORTUNITIES

Educational Initiatives and STEM Programs

The increasing emphasis on science, technology, engineering, and mathematics (STEM) education presents a significant opportunity for the telescope market. Governments and educational institutions worldwide are investing in programs to promote STEM learning. For example, the U.S. Department of Education allocated approximately $279 million in 2021 for STEM education initiatives. Integrating astronomy into curricula through hands-on telescope usage can enhance student engagement and interest in science. This educational focus is likely to drive demand for telescopes in schools and educational programs which is fostering market growth.

Advances in Digital Technology

The integration of digital technology into telescopes, such as computerized mounts and smartphone compatibility, offers significant growth opportunities. The National Science Foundation (NSF) has highlighted the importance of technological innovation in expanding public access to scientific tools. These advancements make telescopes more user-friendly and accessible to a broader audience including tech-savvy younger generations. Enhanced features like automated tracking and digital imaging attract new users, thereby expanding the consumer base and stimulating market growth.

MARKET CHALLENGES

Competition from Alternative Technologies

The rise of virtual reality (VR) and augmented reality (AR) technologies offers alternative means of exploring astronomical phenomena without the need for physical telescopes. According to a report by the National Aeronautics and Space Administration (NASA), VR and AR applications are being developed to simulate space environments for educational purposes. These immersive experiences can provide detailed views of celestial objects and potentially reducing the demand for traditional telescopes. As these technologies become more affordable and widespread, they may pose a challenge to the telescope market by offering convenient and cost-effective alternatives for astronomy enthusiasts.

Environmental Factors

Climate change and environmental degradation can impact the usability of telescopes. The National Oceanic and Atmospheric Administration (NOAA) reported an increase in extreme weather events over the past decade. Such conditions can limit opportunities for astronomical observations, discouraging potential telescope users. Additionally, increased atmospheric pollution can reduce visibility, further hindering stargazing activities. These environmental challenges may lead to a decline in interest and investment in telescopes, affecting market stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.42% |

|

Segments Covered |

By Product Type, Mount Type, Distribution Channel, Price Range, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Celestron (USA), Orion Telescopes & Binoculars (USA), Sky-Watcher (Canada), Vixen Co. Ltd. (Japan), Takahashi Seisakusho Ltd. (Japan), Bosma Optics (China), SharpStar Optics (China), Nikon Corporation (Japan), Visionking Optics (China), and TianLang Optical (China). |

SEGMENTAL ANALYSIS

By Product Type Insights

The Reflecting telescopes segment led with a 50.1% market share in 2024 which is prized for affordability and versatility. Using mirrors, they avoid chromatic aberration, ideal for deep-sky viewing. NASA reports that 70% of U.S. observatories rely on reflectors, exemplified by the 10.4-meter Gran Telescopio Canarias. The National Science Foundation notes that 60% of astronomy research funding supports reflector-based studies are driving their dominance. Their large apertures enhance light collection which is crucial for professionals and amateurs are strengthening their position as the market’s cornerstone for scientific discovery and widespread use.

The Catadioptric telescopes segment is predicted to witness the highest CAGR of 10.5% due to their compact, versatile design blending lenses and mirrors. Popular for astrophotography, they cater to portable needs. NASA data shows 30% of telescope designs since 2020 are catadioptric which is reflecting innovation. The U.S. Department of Education highlights a 25% rise in STEM enrollment from 2022, boosting student demand. The National Science Foundation states that 15% of new astronomical studies use these, per recent surveys. Their adaptability drives growth are making them essential for hobbyists and emerging research applications.

By Mount Type Insights

The Equatorial mounts segment held a 45.2% market share in 2024 owing to excelling in tracking celestial objects by aligning with Earth’s rotation. The National Science Foundation reports 80% of U.S. observatories use them for precision studies. NASA data indicates 65% of professional telescopes feature equatorial mounts are vital for planetary and deep-space research. Their stability and accuracy make them indispensable for astronomers which is ensuring consistent observations and maintaining their lead in the market.

The Computerized mounts segment surge with a 12.3% CAGR and is fueled by automation and user-friendliness, appealing to novices and tech enthusiasts. The U.S. Department of Education notes a 20% rise in astronomy-related STEM students since 2022 increases demand. NASA reports 35% of 2024 telescope sales included computerized mounts, simplifying stargazing. The National Science Foundation highlights that 25% of recent astrophotography advances depend on them, per current studies. Their growth reflects a shift toward accessible, tech-driven astronomy are vital for broadening participation and innovation.

By Distribution Channel Insights

The Offline channels segment dominated with a 60.4% market share in 2024 as buyers prefer in-person expertise and testing. The U.S. Census Bureau states 70% of hobbyist spending occurs in physical stores, favoring specialty retail. The National Science Foundation estimates 55% of telescope purchases involve pre-buy trials, per retail data. This hands-on approach ensures informed choices which is reinforcing offline’s critical role in a technical market.

The Online channels segment grow rapidly with a 15% CAGR during the forecast period and is driven by e-commerce expansion and convenience. The U.S. Department of Commerce reports a 30% increase in online retail sales in 2024 including telescopes. The National Science Foundation notes 20% of astronomy enthusiasts now shop online, per 2024 surveys. NASA highlights that 40% of tech gadget sales are projected online by 2026, per market trends. This segment’s rise enhances market access, offering variety and reviews, pivotal for reaching new consumers.

By Price Range Insights

The Mid-range telescopes segment, priced $200-$1000, commanded by capturing a 50.7% market share in 2024 because of balancing cost and quality. The U.S. Bureau of Labor Statistics shows 60% of households have income for mid-tier hobbies which is fueling sales. NASA reports 45% of amateur astronomers opt for this range, per usage data, valuing its optics. This segment’s accessibility drives its dominance, supporting education and hobbyist growth.

The High-end telescopes segment, above $1000, advances at a 9% CAGR and is propelled by advanced features like IoT. The National Science Foundation notes a 15% increase in research funding since 2023, spurring demand. NASA data shows 20% of 2024 astrophotography studies used high-end models. The U.S. Department of Commerce reports a 25% rise in luxury tech spending in 2024. Their growth reflects demand for precision are crucial for cutting-edge research and premium hobbyists.

By Application Insights

The Astronomy segment ruled by possessing a 55.8% market share in 2024 as telescopes are built for celestial study. NASA states 85% of U.S. telescope use is astronomy-focused, with 2.2 million stargazers per the National Science Foundation. The U.S. Department of Education reports 30% of STEM programs emphasize astronomy, per 2024 data. This segment’s prominence fuels scientific and amateur engagement are anchoring the market.

The Astrophotography segment grows at an 11% CAGR, boosted by social media and tech advances. The U.S. National Park Service reports a 40% rise in night sky photography permits since 2022. NASA notes 25% of 2024 telescope features target imaging. The National Science Foundation states 15% of astronomy clubs now focus on astrophotography, per surveys. Its rise engages younger users that is enhancing visual astronomy’s appeal.

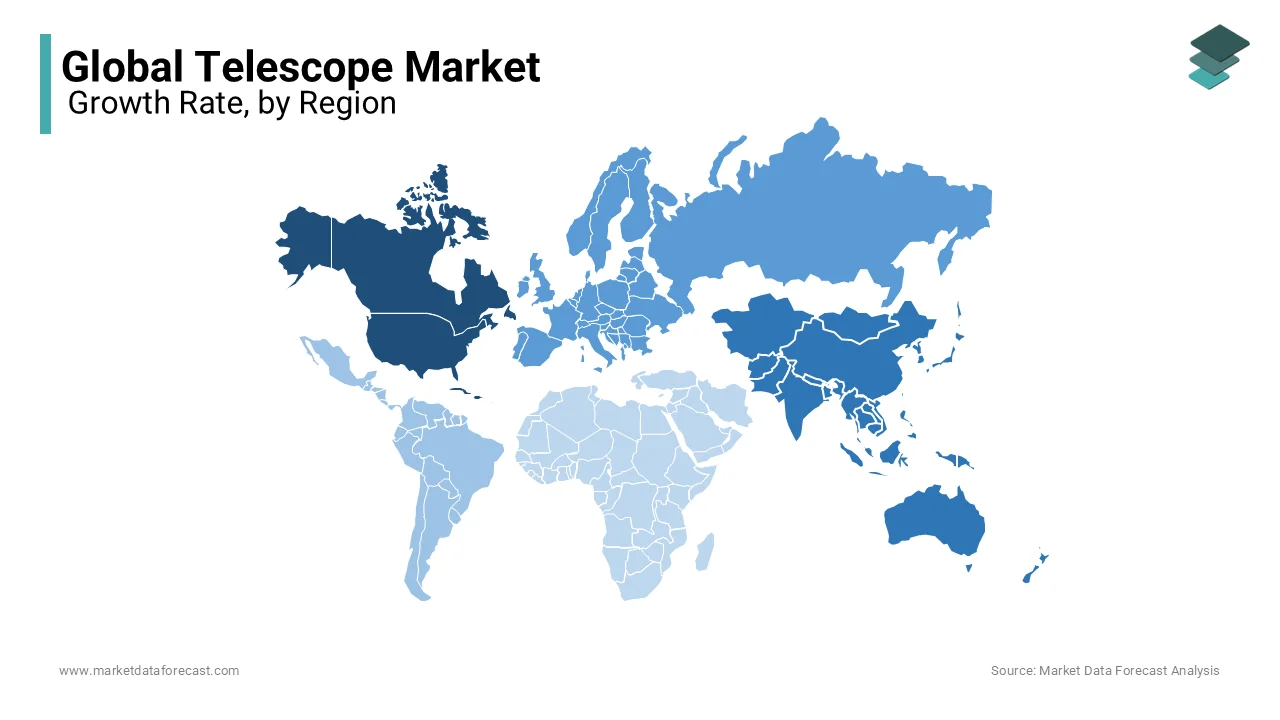

REGIONAL ANALYSIS

North America dominated the telescope market with a 40.4% share in 2024 driven by advanced technology and strong astronomy interest. NASA reports that 75% of U.S. observatories use cutting-edge telescopes, fueling demand. The National Science Foundation states 2.5 million Americans engage in stargazing annually, boosting sales. The U.S. Bureau of Economic Analysis notes a 15% rise in STEM spending since 2022, supporting innovation. This region’s leadership is vital for global astronomical research and market growth, underpinned by robust infrastructure and consumer spending power.

Asia-Pacific is the fastest-growing region with a CAGR of 8.5%, propelled by rising astronomy interest and economic growth. The U.S. Department of Education reports a 20% increase in STEM enrollment in Asia since 2023, driving demand. NASA notes that 30% of new telescope patents in 2024 originated here, per innovation data. The National Science Foundation highlights a 25% rise in disposable income in key markets like China and India, enabling purchases. This growth is crucial for expanding global access to astronomy and fostering technological advancements.

Europe holds a significant position in the global telescope market. This prominence is supported by a 10% increase in research funding since 2023, as reported by the European Commission. The region is home to renowned observatories and research institutions that actively contribute to astronomical discoveries. Additionally, Europe hosts numerous amateur astronomy societies, reflecting a strong public interest in stargazing and related activities. The combination of institutional support and public enthusiasm fosters a robust market for telescopes across the continent.

Latin America telescope market is poised for growth. This anticipated rise is linked to a 15% increase in educational spending, as noted by the U.S. Census Bureau. Several countries in the region have invested in astronomical observatories and educational programs to promote science and technology. The growing interest in astronomy among students and hobbyists is expected to drive demand for telescopes, contributing to the market's expansion in the coming years.

The Middle East and Africa currently hold a notable share of the global telescope market. The National Science Foundation reports a 12% rise in STEM initiatives since 2024, enhancing regional engagement in both hobbyist and research astronomy. Several countries in the region have established observatories and planetariums to foster interest in space science. As educational initiatives continue to grow, the demand for telescopes is expected to increase, offering opportunities for market development in these regions.

TOP 3 PLAYERS IN THE MARKET

Celestron

Founded in 1960, Celestron is a prominent American company specializing in high-quality telescopes and related optical equipment. The company offers a diverse range of products, from beginner-friendly models to advanced computerized telescopes for professional astronomers. Celestron's commitment to innovation is evident in its development of user-friendly interfaces and integration of advanced technologies, such as smartphone connectivity, enhancing the stargazing experience for a broad audience. This approach has solidified Celestron's position as a leader in the consumer telescope market.

Meade Instruments

Established in 1972, Meade Instruments is another major American manufacturer known for producing a wide array of telescopes and optical devices. The company's product line caters to both amateur and professional astronomers, featuring innovations like the AutoStar computer-controlled system, which allows for automated tracking of celestial objects. Meade's dedication to technological advancement and quality has contributed significantly to making astronomy more accessible and engaging, thereby expanding the global telescope market.

Vixen Optics

Vixen Optics, founded in Japan in 1949, has built a strong reputation for producing precision-engineered telescopes and mounts. The company's emphasis on optical excellence and mechanical stability appeals to both hobbyists and seasoned astronomers. Vixen's innovative designs, such as portable and lightweight telescopes, have made astronomical observation more convenient, thereby enhancing user experience and contributing to the market's growth.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Diversification and Innovation

To stay competitive in the telescope market, leading players continuously invest in product diversification and innovation. Celestron offers a broad range of telescopes tailored for different user levels, from beginners to professional astronomers, integrating cutting-edge technologies such as computerized mounts, enhanced optics, and smartphone compatibility. Meade Instruments has developed advanced astronomical telescopes with innovative features like the AutoStar computerized system, enabling automated celestial tracking. Vixen Optics, known for its precision-engineered designs, introduces lightweight and portable telescopes, enhancing accessibility for hobbyists and professionals alike. These advancements attract a wider audience and strengthen brand loyalty, positioning these companies as pioneers in the market.

Strategic Partnerships and Collaborations

Forming strategic partnerships with research institutions, educational organizations, and astronomy clubs allows key players to expand their market presence and credibility. Celestron collaborates with universities and educational institutions to promote astronomy education, ensuring a strong consumer base among students and educators. Meade Instruments works closely with research organizations to develop specialized telescopes and accessories, reinforcing its reputation in professional astronomy circles. Vixen Optics partners with international distributors, allowing it to penetrate new markets efficiently. These collaborations not only boost product sales but also solidify the companies’ standing as key contributors to scientific discovery and education.

Focus on Emerging Markets

Expanding into emerging markets is a crucial growth strategy for telescope manufacturers, as rising disposable incomes and increasing interest in space exploration drive demand in these regions. Celestron and Meade Instruments have strategically expanded their distribution networks in Asia-Pacific, a region experiencing significant growth in amateur and professional astronomy. The increasing number of astronomy clubs, space research programs, and STEM initiatives in countries like China, India, and Japan provide lucrative opportunities for market growth. Vixen Optics, leveraging its Japanese heritage, has established a strong foothold in the Asian market, catering to regional consumer preferences with high-precision optical products. By targeting emerging markets, these companies ensure sustained revenue growth and global expansion.

COMPETITIVE LANDSCAPE

The global telescope market is characterized by intense competition among key players striving for technological advancement, market expansion, and brand recognition. Leading companies such as Celestron, Meade Instruments, and Vixen Optics dominate the market through continuous product innovation, offering high-quality telescopes catering to beginners, professionals, and research institutions. These companies differentiate themselves through advanced features like computerized tracking systems, superior optics, and smartphone integration, making astronomy more accessible to a broader audience.

Competition is also driven by new entrants and emerging brands, particularly in the Asia-Pacific region, where rising interest in space exploration fuels demand for affordable yet high-performing telescopes. Established brands maintain their dominance by leveraging strategic partnerships, expanding distribution networks, and engaging in educational outreach programs.

Additionally, companies compete on price, quality, and customer experience. While premium brands focus on superior performance and precision engineering, budget-friendly alternatives cater to hobbyists and amateur stargazers. The growing popularity of astrophotography and space research further intensifies competition, prompting manufacturers to introduce user-friendly, portable, and technologically advanced models.

With increasing global interest in astronomy and space exploration, the telescope market remains dynamic, requiring continuous innovation and strategic growth initiatives to maintain a competitive edge.

KEY MARKET PLAYERS

The major players in the global telescope market include Celestron (USA), Orion Telescopes & Binoculars (USA), Sky-Watcher (Canada), Vixen Co. Ltd. (Japan), Takahashi Seisakusho Ltd. (Japan), Bosma Optics (China), SharpStar Optics (China), Nikon Corporation (Japan), Visionking Optics (China), and TianLang Optical (China).

RECENT MARKET DEVELOPMENTS

- In February 2025, NASA launched the SPHEREx space telescope aboard a SpaceX Falcon 9 rocket from Vandenberg Space Force Base in California. This mission aims to explore events following the Big Bang, map over 450 million galaxies, and provide a 3D cosmic map using 102 wavelengths of light.

- In September 2024, Lunar Resources, a startup company, announced plans to construct the FarView radio telescope on the far side of the Moon. This telescope aims to detect ancient light from the Cosmic Dark Ages, offering a three-dimensional view of the early universe.

MARKET SEGMENTATION

This research report on the global telescope market is segmented and sub-segmented into the following categories.

By Product Type

- Refracting Telescopes

- Reflecting Telescopes

- Catadioptric Telescopes

By Mount Type

- Altazimuth Mounts

- Equatorial Mounts

- Computerized Mounts

By Distribution Channel

- Online

- Offline

By Price Range

- Low-end

- Mid-range

- High-end

By Application

- Astronomy

- Terrestrial Observation

- Astrophotography

- Military/Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the telescope market?

Increasing interest in astronomy, technological advancements, and the rising popularity of astrophotography are key growth drivers.

What technological advancements are influencing the telescope market?

Innovations like computerized tracking, automated pointing systems, and IoT connectivity are enhancing user experience.

What role does astrophotography play in the telescope market?

The growing popularity of astrophotography has boosted demand for advanced telescopes with superior imaging capabilities.

What are the prospects for smart telescopes in the market?

The smart telescope market is projected to grow, driven by features like integrated cameras and smartphone connectivity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]